|

시장보고서

상품코드

1904934

합성 윤활유 시장 : 시장 분석 및 기회Global Synthetic Lubricants: Market Analysis and Opportunities |

||||||

※ 본 상품은 영문 자료로 한글과 영문 목차에 불일치하는 내용이 있을 경우 영문을 우선합니다. 정확한 검토를 위해 영문 목차를 참고해주시기 바랍니다.

이 보고서는 세계의 합성 윤활유 시장에 대한 조사 분석을 통해 주요 성장국 시장의 사업 기회, 각 부문 수요 촉진요인, 주요 공급업체경쟁 구도 등에 대한 정보를 제공합니다.

세계의 합성 윤활유 산업을 형성하는 주요 주제

상품화와 프리미엄화

- 모든 자동차 및 산업용 제품 유형을 순위화 및 평가하여 상품화 및 프리미엄화의 수준, 주시해야 할 촉진요인과 동향을 평가합니다.

- 양 부문에서의 성장 기회를 평가합니다.

전기화, 효율화, 기술, 규제

- 분석은 산업용 오일 및 유체와 합성유의 침투 가능성이 가장 높은 부문/제품 카테고리가 중심이지만, 이것들에 한정되는 것은 아닙니다.

- 인더스트리 4.0, IoT, 로봇 공학, 합성유에의 파급 효과의 가능성에 대해서 순위 매수를 실시합니다.

- 해당 부문에서 성공할 가능성이 가장 높거나 역량을 갖춘 공급업체를 평가하여 그 이유를 밝혀냅니다.

OEM의 영향력과 영향

- OEM의 영향력, 기술, 권장 사항(공장 출하 시 및 서비스 충전 시), 그리고 공급망과 최종 사용자의 의사 결정 프로세스에 대한 영향을 파악을 이해합니다.

채널/부문 역학

- 합성수지의 각 채널/부문의 현상과 장래의 침투율을 검증합니다.

- 성장 기회와 잠재적인 디스 랩터/동향을 순위 매기고 평가합니다.

경쟁 활동과 압력

- 가격 설정, 브랜딩, 제품의 특징과 이점, 유통 집중도, 원료 조달, 장기적인 성공 등의 요인에 대한 활동과 압력을 평가합니다

공급업체 포지셔닝 - 시장 점유율

- 세계의 주요, 지역 독립 기업, 개인 브랜드, OEM 정품 및 전문 공급업체의 자동차 및 산업용 합성유 제품 포트폴리오를 비교 검토하고 PCMO/HDMO내 계측화(가치, 플래그쉽, 프리미엄), 가격 설정, 효과성, 가치 제안, 전략, 장기적인 성공을 분석합니다

Global Synthetic Lubricants: Market Analysis and Opportunities

- Provides a comprehensive analysis of trends in synthetic lubricants, along with opportunities, challenges and trends in select countries across consumer, commercial and industrial segments.

- Synthetics outperform other categories providing opportunities for suppliers to grow both volume and value.

This report will deliver to subscribers:

- Business opportunities in synthetic lubricants for key growth country markets around the world

- Demand drivers and outlook for synthetic and semi-synthetic lubricants by product, segment and country

- Competitive landscape by key suppliers with estimated market shares and marketing activities by segment

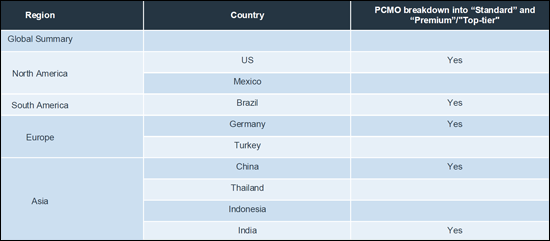

Regional coverage: Global -with focus on 9key country markets across the world

New - more granular market view: Full synthetic PCMO will be split into "Flagship" (Standard) and "Premium" in 5 key markets to evaluate different trends and opportunities for those market segments

Leading themes to be covered that are shaping the Global Synthetic Lubricants industry

Commoditization and Premiumization

- Rank and rate all automotive and industrial product types to assess levels of commoditization and premiumization and what are the driving forces and trends to monitor?

- Assess opportunities in both spaces for growth

Electrification, Efficiency, Technology, Regulation

- Analysis skewed but not exclusive to industrial oils, fluids and sectors/product categories with the greatest potential for synthetics penetration

- Rank and rate Industry 4.0, IoT, Robotics and the potential pull through effect for synthetics

- Assess suppliers most likely/capable to win in the space and why

OEM Influence & Impact

- Understand OEM influence, technology and recommendations (factory and service fill) and how it impacts the supply chain and end users' decision process

Channel/sector dynamics

- Examine synthetics' current/future penetration by channel/sector

- Rank and rate growth opportunities and potential disruptors/trends

Competitive Activity and Pressure

- Assess activity and pressure against factors such as pricing, branding, product features and benefits, distribution focus, feedstock sourcing and long-term success

Supplier Positioning -Market Share

- Review-compare-contrast global majors, regional independents, private label, OEM genuine and specialty suppliers' automotive and industrial synthetics product portfolio, tiering in PCMO/HDMO (value, flagship, premium), pricing, effectiveness, value proposition, strategies and long-term success

NEW for the 9th edition of the report will be an assessment and examination of the tiering of full synthetic PCMO in 5 key country markets

- Suppliers have been observed extending their full synthetic PCMO offer into two distinct tiers or categories: Flagship and Premium

- Objectives behind this trend can be viewed as (1) a means to maintain existing end user awareness and loyalty; (2) a hedge against growing competition from peers, private label, distributor house and OEM genuine oil brands among others; (3) protection against revenue and margins erosion as the full synthetic PCMO market skews towards commoditization

- Flagship can be viewed as a supplier existing or standard product offering featuring leading viscosity grades targeted to the specific needs of the vehicle parc and consumers, while meeting all OEM and industry specifications

- Premium aims to elevate the flagship offer through additional features and benefits such as extended performance and protection claims tied to higher mileage, e.g., 15K-20K miles / 24K-32K km, cleanliness, improved mileage/fuel economy, reduced friction, and sludge protection

- To convey Premium to end users, suppliers will use for example, distinct pac type graphics/colors/designs, elevated advertising, marketing and promotional efforts, and a price premium over their flagship offer

- The aim of this NEW content is to qualitatively and quantitatively explore the success of this tactic across 5 similar yet different country markets, identify which suppliers are currently active, how receptive are B2B participants and specifically, which trade classes (Installed / Retail) offer the most potential and opportunity for success and why

샘플 요청 목록