|

시장보고서

상품코드

1790684

마우스 모델 시장(-2030년) : 모델 유형별(근교계, 비근교계, 하이브리드), 서비스별(번식, 재생), 용도별(맞춤형 의료), 기술별(마이크로인젝션, CRISPR/Cas9), 치료 분야별(종양, 신경), 최종사용자별(CRO)Mice Model Market by Model Type (Inbred, Outbred, Hybrid), Service (Breeding, Rederivation), Application (Personalized Medicine), Technology (Microinjection, CRISPR/Cas9), Therapeutic Area (Oncology, Neurology), End User (CROs) - Global Forecast to 2030 |

||||||

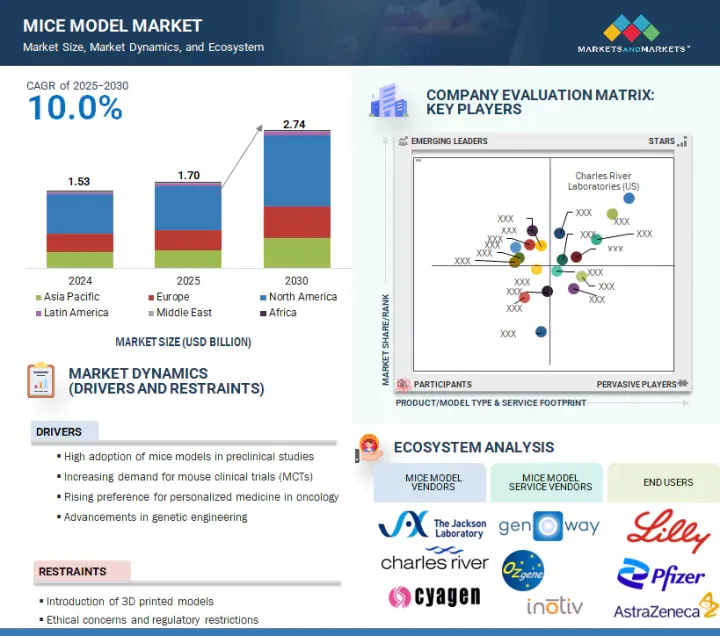

마우스 모델 시장 규모는 2025년 17억 달러에서 예측 기간 동안 CAGR 10.0%로 성장하여 2030년에는 27억 4,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 모델 유형, 서비스, 기술, 치료 분야, 용도, 제품 최종사용자, 서비스 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 시장의 성장은 유전적 및 생리적 다양성으로 인한 전임상시험에서 마우스 모델의 채택 증가, 마우스 임상시험(MCT) 수요 증가, 암 분야에서의 맞춤의료 수요 증가, 유전공학의 발전 등 여러 가지 요인에 의해 촉진되고 있습니다. 또한, 바이오 의료 연구에서의 CRISPR 활용과 질병 특이적 모델에 대한 수요 증가도 예측 기간 동안 시장 성장에 기여할 것으로 예측됩니다.

모델 유형별로는 근교계 마우스 부문이 2024년 시장에서 가장 큰 점유율을 차지했습니다.

근교계 마우스 부문의 큰 점유율은 전임상시험에서 유전적 균일성을 제공할 수 있다는 점, 확장 가능한 생산을 가능하게 하는 표준화된 번식 프로토콜이 존재한다는 점, 지속적인 공급을 뒷받침하는 공급망의 존재에 기인합니다. 국내 및 국제적인 규제 체계에서도 근교계 마우스는 유효성 및 안전성 평가를 위한 참조 모델로 인정받고 있으며, 중앙집중식 사육시설에서는 계통의 무결성을 유지하기 위한 품질 관리가 이루어지고 있습니다. 근교계 마우스의 채택은 제약회사, 생명공학 기업뿐만 아니라 학계와 정부 연구기관으로 확산되고 있으며, 통제된 유전적 배경이 실험의 편차를 줄여주고 있습니다.

용도별로는 2024년 Drug Discovery & Development 부문이 가장 큰 비중을 차지했습니다.

마우스 모델은 분자 표적의 연관성을 확인하는 표적 검증 시험, 약력학적 프로파일을 비교하는 리드 최적화 연구, 그리고 대조군 조건에서 치료 반응을 측정하는 유효성 평가에 활용되고 있습니다. 안전성 약리 프로토콜(심혈관계, 호흡기, 중추신경계 평가)은 마우스에서 수행되는 원격 측정 기록 및 행동 시험에 의존하고 있습니다. 동시에, 생식 및 발생 독성 평가에서 배아의 생존성과 기형 발생 위험을 판단하기 위해 타이밍 제어 임신 프로토콜이 사용됩니다. 조직 샘플의 병리조직학적 검사 및 임상화학 분석은 규제 당국에 제출하는 데 도움을 주며, 오믹스 분석(트랜스criptomics, proteomics, metabolomics)은 용량 선택 및 작용기전 연구에 도움을 주고 있습니다. 서비스 제공업체는 이러한 용도를 최종사용자를 위한 엔드투엔드 워크플로우에 통합하고 있습니다. 이러한 통합된 용도의 조합은 마우스 모델 시장에서 Drug Discovery & Development 분야의 우위를 확고히 하고 있습니다.

세계의 마우스 모델 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 마우스 모델 시장 상황

- 밸류체인 분석

- 가격 분석

- 생태계 분석

- 기술 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 특허 분석

- 무역 데이터 분석

- 주요 회의와 이벤트

- 관세와 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자와 자금 조달 시나리오

- 마우스 모델 시장에서 생성형 AI의 영향

- 사례 연구

- 트럼프 관세가 마우스 모델 시장에 미치는 영향

제6장 마우스 모델 시장 : 모델 유형 및 서비스별

- 모델 유형

- 근교계 마우스

- 유전자 변형 마우스

- 잡종/동종 마우스

- 비근교계 마우스

- 서비스

- 번식 서비스

- 동결보존 서비스

- 재생 서비스

- 검역 서비스

- 기타

제7장 마우스 모델 시장 : 기술별

- CRISPR/CAS9

- 마이크로인젝션

- 배아줄기세포 주사

- 핵이식 기술

- 기타

제8장 마우스 모델 시장 : 용도별

- Drug Discovery & Development

- 연구

- 맞춤형 의료

제9장 마우스 모델 시장 : 치료 분야별

- 종양

- 대사성 질환

- 면역

- 신경

- 심혈관질환

- 기타

제10장 마우스 모델 유형 시장 : 최종사용자별

- 제약·바이오테크놀러지 기업

- CRO·CDMO

- 학술연구기관

제11장 마우스 모델 서비스 시장 : 최종사용자별

- 제약·바이오테크놀러지 기업

- CDMO

- 정부 및 바이오 의료 연구기관

제12장 마우스 모델 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 거시경제 전망

- GCC 국가

- 기타

- 아프리카

- 거시경제 전망

제13장 경쟁 구도

- 개요

- 주요 기업의 전략/유력 기업

- 매출 점유율 분석

- 시장 점유율 분석

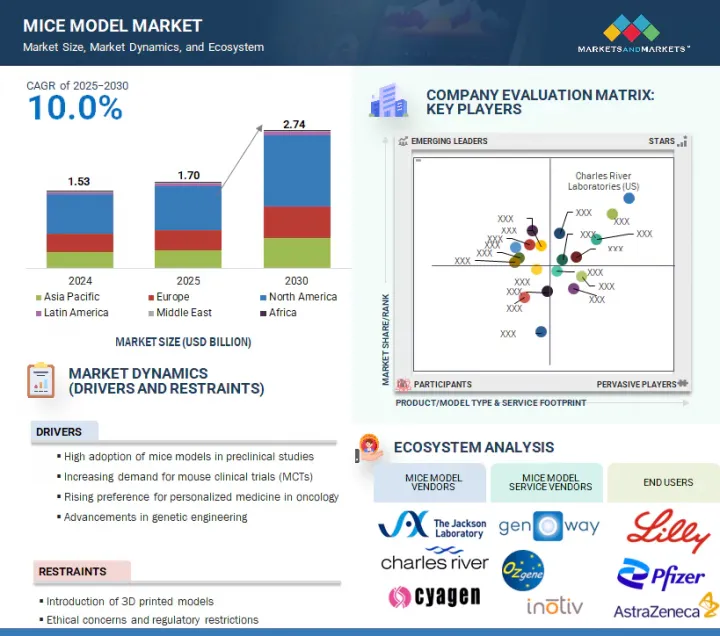

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- CHARLES RIVER LABORATORIES

- THE JACKSON LABORATORY

- INOTIV

- JSR CORPORATION

- BIOCYTOGEN

- SHANGHAI MODEL ORGANISMS CENTER, INC.

- TRANS GENIC INC.

- HARBOUR BIOMED

- GENOWAY

- GEMPHARMATECH

- CYAGEN

- OZGENE PTY LTD.

- TACONIC BIOSCIENCES, INC.

- TRANSCURE BIOSERVICES

- VIVO BIO TECH LTD.

- INGENIOUS TARGETING LABORATORY

- JANVIER LABS

- CHAMPIONS ONCOLOGY, INC.

- VITALSTAR BIOTECHNOLOGY CO., LTD.

- 기타 기업

- ONCODESIGN SERVICES

- CLEA JAPAN, INC.

- APPLIED STEMCELL

- CREATIVE ANIMODEL

- JOINN LABORATORIES(CHINA) CO., LTD.

- CREATIVE BIOLABS

- CRESCENDO BIOLOGICS LIMITED

- ARAGEN LIFE SCIENCES LTD.

- POLYGENE

- PHARMTEST SERVICES

- MARSHALL BIORESOURCES

제15장 부록

KSM 25.08.22The mice model market is projected to reach USD 2.74 billion by 2030 from USD 1.70 billion in 2025, at a CAGR of 10.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Model Type & Service, Technology, Therapeutic Area, Application, Product End User, Services End User, and Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

The growth of this market is driven by several factors, such as rising adoption of mice models in preclinical studies due to genetic & physiological versatility; the increasing demand for mouse clinical trials (MCTs); the rising demand for personalized medicine in oncology; and advancements in genetic engineering. Utilization of CRISPR in biomedical research and the increasing demand for disease-specific models are also expected to contribute to market growth during the forecast period.

By model type, the inbred mice segment accounted for the largest share of the market in 2024.

The market is segmented by model type into inbred mice, genetically engineered mice, hybrid/congenic mice, and outbred mice. In 2024, the inbred mice segment accounted for the largest share of the mice model market. The large share of the inbred mice segment is attributed to the ability of inbred strains to provide genetic uniformity for preclinical studies, standardized breeding protocols that enable scalable production, and supply chains that support continuous availability. Regulatory frameworks at national and international levels recognize inbred strains as reference models for efficacy and safety assessment, and centralized breeding facilities implement quality control measures to maintain strain integrity. Adoption of inbred mice spans pharmaceutical and biotechnology companies and academic and government research institutions, where controlled genetic backgrounds reduce experimental variability.

By application, the drug discovery & development segment accounted for the largest share of the market in 2024.

The mice model market is segmented into drug discovery & development, research applications, and personalized medicine. In 2024, the drug discovery & development segment accounted for the largest share of the market. Mouse models are deployed in target validation assays to confirm the relevance of molecular targets, in lead optimization studies to compare pharmacodynamic profiles, and in efficacy evaluations to measure treatment responses under controlled conditions. Safety pharmacology protocols-cardiovascular, respiratory, and central nervous system endpoints-rely on telemetry recordings and behavioral assays conducted in mice. At the same time, reproductive and developmental toxicity assessments use timed-pregnancy protocols to determine embryonic viability and teratogenic risk. Histopathological examinations and clinical chemistry analyses of tissue samples support regulatory submissions, and omics profiling (transcriptomics, proteomics, metabolomics) informs dose selection and mechanism-of-action studies. Service providers integrate these applications into end-to-end workflows for end users. Combined, these integrated applications ensure the dominance of drug discovery & development applications in the mice model market.

By region, North America accounted for the largest share of the mice model market in 2024.

In 2024, North America accounted for the largest share of the mice model market due to the concentration of major contract research organizations and breeding suppliers, government and private funding mechanisms, and a regulatory environment emphasizing standardized preclinical practices. The key market players, such as Charles River Laboratories (US), The Jackson Laboratory (US), and Inotiv (US), have their presence in the region, thus ensuring regional supply and technical support. Public funding agencies such as the National Institutes of Health (NIH) allocate substantial budgets to basic & translational research, while pharmaceutical & biotechnology companies commit a significant portion of R&D expenditure to preclinical in vivo models. Academic research institutions and specialized contract research organizations leverage this infrastructure and funding landscape to conduct target validation, toxicology, and efficacy studies, reinforcing North America's large share in the global mice model market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Tier 1-25%, Tier 2-35%, and Tier 3- 40%

- By Designation: C-level Executives - 55%, Directors- 20%, and Others- 25%

- By Region: North America -45%, Europe - 20%, the Asia Pacific -20%, Latin America -10%, the Middle East- 3%, and Africa-2%

Charles River Laboratories (US), Inotiv (US), THE JACKSON LABORATORY (US), JSR Corporation (Japan), Biocytogen (China), TRANS GENIC INC. (Japan) Harbour BioMed (China), genOway (France), GemPharmatech (China), Cyagen (US), Ozgene Pty Ltd (Australia), Taconic Biosciences, Inc. (US), TransCure bioServices (France), Vivo Bio Tech Ltd (India), ingenious targeting laboratory (US), Janvier Labs (France), Champions Oncology, Inc (US), and Vitalstar Biotechnology Co., Ltd. (China) are some of the key companies offering mice model products & services.

Research Coverage:

This research report categorizes the mice model market by model type & service [model types (inbred mice, genetically engineered mice, hybrid/congenic mice, and outbred mice, breeding services, cryopreservation services, rederivation services, quarantine services, and other services)], by application (drug discovery & development, research applications, and personalized medicine), by technology (CRISPR/Cas9, microinjection, embryonic stem cell injection, nuclear transfer, and other technologies), by therapeutic area (oncology, neurology, immunology, metabolic diseases, cardiovascular diseases, and other therapeutic areas), by product end user (pharmaceutical & biotechnology companies, academic & research Institutes, and CROs & CDMOs), by services end user (pharmaceutical & biotechnology companies, government & biomedical research institutes, and CDMOs), and by region (North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa).

The report's scope covers detailed information regarding the primary factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the mice model market. A thorough analysis of the key industry players has been conducted to provide insights into their business overview, solutions, and services; key strategies; new product & service launches, acquisitions, and recent developments associated with the mice model market. This report covers the competitive analysis of upcoming startups in the mice model market ecosystem.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the mice model market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide information on the key market drivers, restraints, challenges, trends, and opportunities.

The report provides insights on the following :

- Analysis of key drivers (high adoption of mice models in preclinical studies, the increasing demand for mouse clinical trials, the rising demand for personalized medicine in oncology, technological advancements in genetic engineering), restrains (the introduction of 3D printed models, ethical concerns, and regulatory restrictions), opportunities (Utilization of CRISPR in biomedical research, and the rising demand for disease-specific models), and challenges (development of alternative animal testing methods and genetic & phenotypic variability).

- Product approvals: Detailed insights into newly approved products of the mice models market.

- Market development: Comprehensive information about lucrative markets - the report analyses the mice model market across varied regions.

- Market diversification: Exhaustive information about new products, recent developments, and investments in the mice model market.

- Pipeline analysis: Comprehensive information about products under clinical trials.

- Competitive assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Charles River Laboratories (US), Inotiv (US), THE JACKSON LABORATORY (US), JSR Corporation (Japan), and Biocytogen (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 MARKETS & REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.3 TOP-DOWN APPROACH

- 2.4 GROWTH FORECAST

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 MARKET FORECAST

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 MICE MODEL MARKET OVERVIEW

- 4.2 NORTH AMERICA: MICE MODEL MARKET, BY MODEL TYPE & SERVICE (2024)

- 4.3 MICE MODEL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 MICE MODEL MARKET, BY MODEL TYPE (END USER), 2025 VS. 2030

- 4.5 MICE MODEL MARKET SHARE, BY SERVICES (END USER)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High adoption of mice models in preclinical studies

- 5.2.1.2 Increasing demand for Mouse Clinical Trials (MCTs)

- 5.2.1.3 Growing preference for personalized medicine in oncology

- 5.2.1.4 Advancements in genetic engineering

- 5.2.2 RESTRAINTS

- 5.2.2.1 Introduction of 3D printed models

- 5.2.2.2 Ethical concerns and regulatory restrictions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Utilization of CRISPR in biomedical research

- 5.2.3.2 Rising demand for disease-specific models

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of alternative animal testing methods

- 5.2.4.2 Genetic & phenotypic variability

- 5.2.1 DRIVERS

- 5.3 MICE MODEL MARKET LANDSCAPE

- 5.3.1 HISTORY OF MICE MODELS

- 5.3.2 MICE MODEL GENERATION PROCESS

- 5.3.3 TECHNIQUES FOR MICE MODEL DEVELOPMENT

- 5.3.4 TECHNOLOGICAL ADVANCEMENTS

- 5.3.5 CONSIDERATIONS FOR MICE MODEL DEVELOPMENT

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE OF MODEL TYPES, BY REGION, 2024

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 MICE MODEL VENDORS

- 5.6.2 MICE MODEL SERVICE VENDORS

- 5.6.3 MICE MODEL END USERS

- 5.6.4 REGULATORY ORGANIZATIONS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 CRISPR/CAS9 gene editing

- 5.7.1.2 Pronuclear Microinjection (PNI)

- 5.7.1.3 Embryo cryopreservation & assisted reproduction

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Multimodal preclinical imaging

- 5.7.2.2 Automated behavioural phenotyping

- 5.7.2.3 Integrated physiological monitoring

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Ex vivo CRISPR screening in cell culture

- 5.7.3.2 High-content bioinformatics pipeline

- 5.7.3.3 Mass spectroscopy-based tissue profiling

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 PATENTS FILED, BY DOCUMENT TYPE, 2014-2024

- 5.10 TRADE DATA ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 IMPORT DATA

- 5.11 KEY CONFERENCES & EVENTS

- 5.11.1 KEY CONFERENCES & EVENTS (2025-2026)

- 5.12 TARIFF & REGULATORY LANDSCAPE

- 5.12.1 TARIFF DATA (HS CODE 106.19.90)

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 REGULATORY FRAMEWORK

- 5.12.3.1 North America

- 5.12.3.2 Europe

- 5.12.3.3 China

- 5.12.3.4 Japan

- 5.12.3.5 India

- 5.12.3.6 Australia

- 5.12.3.7 Brazil

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 ROLE OF STAKEHOLDERS IN BUYING PROCESS

- 5.14.3 BUYING CRITERIA FOR MICE MODEL MARKET

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF GENERATIVE AI ON MICE MODEL MARKET

- 5.16.1 AI-USE CASES

- 5.16.2 KEY COMPANIES IMPLEMENTING AI

- 5.17 CASE STUDIES

- 5.17.1 CASE STUDY 1: AAV GENE EDITING IN CYAGEN LDLR MUTANT MICE AMELIORATES ATHEROSCLEROSIS

- 5.17.2 CASE STUDY 2: METABOLIC EFFECTS OF SEMAGLUTIDE & TIRZEPATIDE IN DIET-INDUCED OBESE (DIO) MICEBAC

- 5.17.3 CASE STUDY 3: TARGETING NATURAL KILLER CELL ACTIVITY WITH HUMANIZED NSG-IL15 MOUSE MODEL

- 5.18 TRUMP TARIFF IMPACT ON MICE MODEL MARKET

- 5.18.1 KEY TARIFF RATES

- 5.18.2 PRICE IMPACT ANALYSIS

- 5.18.3 KEY IMPACT ON VARIOUS REGIONS

- 5.18.3.1 US

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.3.4 Rest of the World

- 5.18.4 END-USE INDUSTRY IMPACT

- 5.18.4.1 Pharmaceutical & biotechnology companies

- 5.18.4.2 CROs & CDMOs

- 5.18.4.3 Academic & research institutes

6 MICE MODEL MARKET, BY MODEL TYPE & SERVICE

- 6.1 INTRODUCTION

- 6.2 MODEL TYPE

- 6.2.1 INBRED MICE

- 6.2.1.1 High utilization across research applications to propel market

- 6.2.2 GENETICALLY ENGINEERED MICE

- 6.2.2.1 Ability to induce mutations for CVD & cancer research to drive market

- 6.2.3 HYBRID/CONGENIC MICE

- 6.2.3.1 Growing focus on biomedical research to boost demand

- 6.2.4 OUTBRED MICE

- 6.2.4.1 Genetic diversity benefits to support market growth

- 6.2.1 INBRED MICE

- 6.3 SERVICES

- 6.3.1 BREEDING SERVICES

- 6.3.1.1 Customization of models for specific research applications to boost demand

- 6.3.2 CRYOPRESERVATION SERVICES

- 6.3.2.1 Rising focus on preservation of novel mice models to propel market

- 6.3.3 REDERIVATION SERVICES

- 6.3.3.1 Stringent quality assurance standards to fuel market

- 6.3.4 QUARANTINE SERVICES

- 6.3.4.1 Rising demand for germ-free mice to support market growth

- 6.3.5 OTHER SERVICES

- 6.3.1 BREEDING SERVICES

7 MICE MODEL MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 CRISPR/CAS9

- 7.2.1 ADVANTAGES SUCH AS SIMPLIFIED DESIGN AND COST EFFICIENCY TO PROPEL MARKET

- 7.3 MICROINJECTIONS

- 7.3.1 LOW TOXICITY AND HIGH SUCCESS RATE TO DRIVE MARKET

- 7.4 EMBRYONIC STEM CELL INJECTIONS

- 7.4.1 INCREASING DEMAND FOR TARGETED MICE MODELS IN IMMUNOLOGICAL RESEARCH TO FUEL MARKET

- 7.5 NUCLEAR TRANSFER TECHNIQUE

- 7.5.1 POTENTIAL TO PRODUCE IDENTICAL MICE TO DRIVE MARKET

- 7.6 OTHER TECHNOLOGIES

8 MICE MODEL MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 DRUG DISCOVERY & DEVELOPMENT

- 8.2.1 INCREASING NUMBER OF CLINICAL TRIALS TO PROPEL MARKET

- 8.3 RESEARCH APPLICATIONS

- 8.3.1 INCREASING FUNDING INVESTMENTS FOR CANCER RESEARCH TO DRIVE MARKET

- 8.4 PERSONALIZED MEDICINE

- 8.4.1 INCREASING PREFERENCE FOR ONCOLOGY THERAPEUTICS TO SUPPORT MARKET GROWTH

9 MICE MODEL MARKET, BY THERAPEUTIC AREA

- 9.1 INTRODUCTION

- 9.2 ONCOLOGY

- 9.2.1 GROWING FOCUS ON THERAPEUTIC DEVELOPMENT TO PROPEL MARKET

- 9.3 METABOLIC DISEASES

- 9.3.1 INCREASING PREVALENCE OF ENDOCRINE DISORDERS TO DRIVE MARKET

- 9.4 IMMUNOLOGY

- 9.4.1 RISING CLINICAL RESEARCH ACTIVITIES FOR IMMUNOLOGICAL DISORDERS TO FUEL MARKET

- 9.5 NEUROLOGY

- 9.5.1 INCREASING INVESTMENTS IN R&D FOR CNS DISEASES TO BOOST DEMAND

- 9.6 CARDIOVASCULAR DISEASES

- 9.6.1 GROWING FOCUS ON TARGETED TREATMENTS FOR CVD TO BOOST DEMAND

- 9.7 OTHER THERAPEUTIC AREAS

10 MICE MODEL TYPE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 RISING EXPENDITURE ON R&D FOR DRUG DEVELOPMENT TO FUEL MARKET

- 10.3 CONTRACT RESEARCH ORGANIZATIONS AND CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS (CROS & CDMOS)

- 10.3.1 INCREASING OUTSOURCING OF DRUG DISCOVERY SERVICES TO DRIVE MARKET

- 10.4 ACADEMIC & RESEARCH INSTITUTES

- 10.4.1 INCREASING FUNDING INITIATIVES FOR LIFE SCIENCES R&D TO SUPPORT MARKET GROWTH

11 MICE MODEL SERVICES MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.2.1 RISING OUTSOURCING OF PRECLINICAL SERVICES TO PROPEL MARKET

- 11.3 CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS (CDMOS)

- 11.3.1 DEVELOPMENT OF INTEGRATED MODELS AND GROWTH IN BIOLOGICS TO BOOST DEMAND

- 11.4 GOVERNMENT & BIOMEDICAL RESEARCH INSTITUTES

- 11.4.1 FOCUS ON TRANSLATIONAL RESEARCH SERVICES TO SUPPORT MARKET GROWTH

12 MICE MODEL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Rising production of monoclonal antibodies to fuel market

- 12.2.3 CANADA

- 12.2.3.1 Growth in stem cell research activities to fuel market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Growth in biotechnology industry to drive market

- 12.3.3 UK

- 12.3.3.1 Increasing focus on cancer research to propel market

- 12.3.4 FRANCE

- 12.3.4.1 Rising investments in proteomics & genomics research to boost demand

- 12.3.5 ITALY

- 12.3.5.1 Growth in pharmaceutical & biotechnology industry to drive market

- 12.3.6 SPAIN

- 12.3.6.1 Extensive R&D pipeline to fuel uptake

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Favorable investments in life sciences research to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Increasing focus on personalized diagnostics products to drive market

- 12.4.4 INDIA

- 12.4.4.1 Favorable initiatives for drug discovery & development to boost market

- 12.4.5 AUSTRALIA

- 12.4.5.1 High number of research institutes to favor market growth

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Innovation in health & biotech sectors to support market uptake

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Increasing investments in biopharmaceutical research to fuel uptake

- 12.5.3 MEXICO

- 12.5.3.1 Expanding healthcare ecosystem to support market growth

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 MACROECONOMIC OUTLOOK IN MIDDLE EAST

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Kingdom of Saudi Arabia (KSA)

- 12.6.2.1.1 Growing focus on advancement of healthcare sector to boost market

- 12.6.2.2 United Arab Emirates

- 12.6.2.2.1 Increasing R&D activities and growing demand for personalized medicine to propel market

- 12.6.2.3 Other GCC Countries

- 12.6.2.1 Kingdom of Saudi Arabia (KSA)

- 12.6.3 REST OF MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 RISING PRECISION MEDICINE INITIATIVES TO SUPPORT MARKET GROWTH

- 12.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 13.2.1 STRATEGIES ADOPTED BY KEY PLAYERS IN MICE MODEL MARKET, 2022-2025

- 13.3 REVENUE SHARE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Model type & service footprint

- 13.5.5.4 Application footprint

- 13.5.5.5 Technology footprint

- 13.5.5.6 Therapeutic area footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SME players

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS FOR MICE MODEL MARKET

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT/SERVICE LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 CHARLES RIVER LABORATORIES

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 THE JACKSON LABORATORY

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 INOTIV

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 JSR CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Product/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 BIOCYTOGEN

- 14.1.5.1 Business overview

- 14.1.5.2 Product/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product/Service launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 SHANGHAI MODEL ORGANISMS CENTER, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Product/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 TRANS GENIC INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 HARBOUR BIOMED

- 14.1.8.1 Business overview

- 14.1.8.2 Product/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Other developments

- 14.1.9 GENOWAY

- 14.1.9.1 Business overview

- 14.1.9.2 Product/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 GEMPHARMATECH

- 14.1.10.1 Business overview

- 14.1.10.2 Product/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product/Service launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.11 CYAGEN

- 14.1.11.1 Business overview

- 14.1.11.2 Product/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 OZGENE PTY LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 TACONIC BIOSCIENCES, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product/Service launches

- 14.1.13.3.2 Deals

- 14.1.13.3.3 Expansions

- 14.1.14 TRANSCURE BIOSERVICES

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.15 VIVO BIO TECH LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Product/Services offered

- 14.1.16 INGENIOUS TARGETING LABORATORY

- 14.1.16.1 Business overview

- 14.1.16.2 Product/Services offered

- 14.1.17 JANVIER LABS

- 14.1.17.1 Business overview

- 14.1.17.2 Product/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.18 CHAMPIONS ONCOLOGY, INC.

- 14.1.18.1 Business overview

- 14.1.18.2 Products offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Deals

- 14.1.19 VITALSTAR BIOTECHNOLOGY CO., LTD.

- 14.1.19.1 Business overview

- 14.1.19.2 Products offered

- 14.1.1 CHARLES RIVER LABORATORIES

- 14.2 OTHER PLAYERS

- 14.2.1 ONCODESIGN SERVICES

- 14.2.2 CLEA JAPAN, INC.

- 14.2.3 APPLIED STEMCELL

- 14.2.4 CREATIVE ANIMODEL

- 14.2.5 JOINN LABORATORIES (CHINA) CO., LTD.

- 14.2.6 CREATIVE BIOLABS

- 14.2.7 CRESCENDO BIOLOGICS LIMITED

- 14.2.8 ARAGEN LIFE SCIENCES LTD.

- 14.2.9 POLYGENE

- 14.2.10 PHARMTEST SERVICES

- 14.2.11 MARSHALL BIORESOURCES

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS