|

시장보고서

상품코드

1901398

멤브레인 바이오리액터 시장 : 멤브레인 유형별, 시스템 구성별, 용량별, 용도별, 지역별 예측Membrane Bioreactor Market by Membrane Type, System Configuration, Capacity, Application, And Region - Global Forecast to 2030 |

||||||

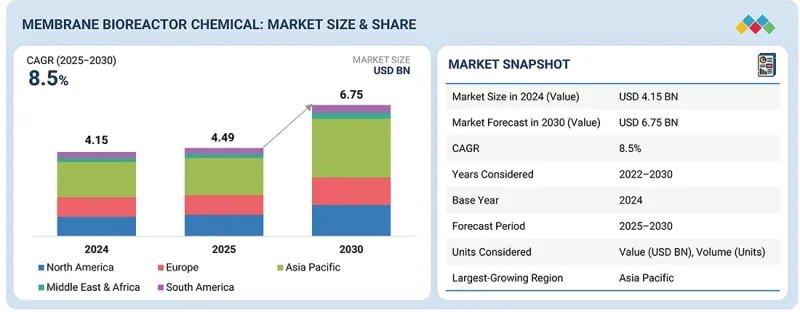

세계의 멤브레인 바이오리액터 시장의 규모는 2025년 44억 9,000만 달러에서 2030년까지 67억 5,000만 달러에 이를 것으로 예측되며, 예측기간 동안 CAGR 8.5%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2022-2030년 |

| 기준연도 | 2024년 |

| 예측기간 | 2025-2030년 |

| 단위 | 100만 달러, 대 |

| 부문 | 멤브레인 유형, 시스템 구성, 용량, 용도, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동, 아프리카, 남미 |

중공사막은 폐수처리 용도에서의 수많은 이점으로 인해 멤브레인 바이오리액터 시장에서 두 번째로 성장이 빠른 유형이 되고 있습니다. 중공사막은 높은 표면적 대 체적비를 가지고 여과 효율을 높여 컴팩트한 시스템 설계를 가능하게 하므로 공간 제약이 있는 환경에 이상적입니다. 또한, 설계 구조는 효과적인 바이오매스의 유지를 촉진하고 투과액의 품질 향상을 실현하기 때문에 멤브레인 바이오리액터 시스템 전체의 성능 향상에 기여합니다. 중공사막은 오염(파울링)의 발생률이 낮아, 장기적으로 유지보수의 필요성과 운용 비용을 절감합니다.

중공사막 기술의 지속적인 진보 중에서도 특히 내구성과 내약품성이 우수한 재료의 개발이 채용을 더욱 촉진하고 있습니다. 산업에서 효율적이고 비용 효율적이며 지속 가능한 폐수 처리 솔루션에 대한 수요가 증가함에 따라 중공사막의 매력은 계속 증가하고 있으며 멤브레인 바이오리액터 시장에서 중요한 존재로서의 지위를 확립하고 있습니다.

"시스템 구성별로는 침지형 멤브레인 바이오리액터 시스템이 예측기간 동안 금액 기준으로 2위 성장률을 나타낼 전망입니다."

침지형 멤브레인 바이오리액터 시스템은 막 여과와 생물학적 처리 공정을 효율적으로 통합하여 멤브레인 바이오리액터 시장에서 성장률이 두 번째로 높은 부문이 되었습니다. 이 설계는 멤브레인을 폭기조에 직접 침지시켜 바이오매스의 유지성을 향상시키고 미생물 및 폐수의 접촉을 촉진합니다. 침지 구성은 처리 시설에 필요한 설치 면적을 크게 줄이기 때문에 공간에 제약이 있는 도시 환경에 특히 적합합니다. 또한, 침지형 멤브레인 바이오리액터 시스템은 수중 막이 공기에 노출될 기회가 적고 역세척이 필요하지 않으므로 오염률이 낮고 운영 비용을 절감할 수 있습니다. 효율적이고 공간 절약적인 폐수 처리 솔루션에 대한 수요가 높아지는 가운데 침지형 멤브레인 바이오리액터 시스템은 도시 폐수 처리부터 산업 공정까지 다양한 용도로 채용이 진행되고 있어 시장 성장이 더욱 촉진되고 있습니다.

"용도별로는 산업 폐수 처리가 예측기간 동안 금액 기준으로 2위의 시장 규모를 차지할 전망입니다."

멤브레인 바이오리액터 시장에서 산업 폐수 처리가 제2위의 용도인 요인은 제약, 식품 및 음료, 섬유 등의 산업에서 발생하는 배수의 양과 복잡성 증가에 있습니다. 이 부문은 환경 규제 준수를 위해 엄격한 수질 기준을 충족해야 하며, 오염물질을 효과적으로 제거하고 고품질의 배수를 공급할 수 있는 멤브레인 바이오리액터 등의 첨단 처리 솔루션에 대한 수요가 촉진되고 있습니다. 멤브레인 바이오리액터 기술은 기존의 처리 방법에 비해 컴팩트한 설계, 설치 면적 축소, 운영 비용 절감 등의 이점도 제공합니다. 이는 폐수 관리에서 지속 가능성과 효율성 향상을 목표로 하는 업계에 매력적인 선택이 되었습니다. 게다가 물 재사용과 자원 회수에 대한 관심이 높아짐에 따라 산업용 분야에서 멤브레인 바이오리액터 시스템의 채용이 촉진되고 따라서 큰 시장 점유율이 예상되고 있습니다.

지역별로는 북미가 2023년 멤브레인 바이오리액터 시장에서 금액 기준으로 2위의 규모를 차지하였습니다.

여러 요인들로 인해 북미는 멤브레인 바이오리액터 부문에서 두 번째로 큰 시장이 되었습니다. 이 지역은 견고한 산업 및 공공 인프라를 보유하고 있으며, 제약, 화학, 식품 및 음료, 자동차 제조 등 중요한 부문이 선진 폐수 처리 솔루션 수요를 촉진하고 있습니다. 특히 미국 환경보호청(EPA)에 의한 엄격한 환경규제는 폐수 배출 기준을 높게 설정하고 있으며, 멤브레인 바이오리액터 기술이 규제 준수를 위한 효과적인 선택지가 되고 있습니다. 게다가 물 부족에 대한 우려 증가와 지속 가능한 물 관리 기술의 필요성으로 인해 물 재사용을 지원하는 멤브레인 바이오리액터 시스템에 대한 투자가 증가하고 있습니다. 이 지역의 지속적인 기술 진보와 연구개발 노력도 멤브레인 바이오리액터의 효율성을 높이고 있으며, 북미는 세계의 멤브레인 바이오리액터 시장에서 주요 국가로서의 지위를 강화하고 있습니다.

이 보고서는 세계의 멤브레인 바이오리액터 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 제품 개발 및 혁신, 경쟁 구도에 대한 인사이트를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 멤브레인 바이오리액터 시장의 기업에게 매력적인 기회

- 멤브레인 바이오리액터 시장 : 막 유형별

- 멤브레인 바이오리액터 시장 : 시스템 구성별

- 멤브레인 바이오리액터 시장 : 용도별

- 멤브레인 바이오리액터 시장 : 국가별

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구 및 사업 기회

- MBR 시장에서의 미충족 요구

- 사업 기회

- 연관 시장 및 부문 간 기회

- 연관 시장

- 부문 간 기회

- 신규 비즈니스 모델 및 생태계 변화

- 신규 비즈니스 모델

- 생태계 변화

- Tier 1, 2, 3 기업의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 밸류체인 분석

- 원재료 공급자

- 제조자

- 판매자

- 최종 소비자

- 생태계 분석

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별(2024년)

- 평균 판매 가격 : 지역별(2022-2024년)

- 무역 분석

- 수입 시나리오(HS코드 841989)

- 수출 시나리오(HS코드 841989)

- 주요 회의 및 이벤트(2026년)

- 고객 사업에 영향을 끼치는 동향 및 혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 멤브레인 바이오리액터 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 사용 산업에 대한 영향

제7장 기술, 특허, 디지털, AI의 채용에 의한 전략적 파괴

- 주요 신기술

- MBR 및 폐수 처리 플랜트의 AI 디지털 트윈(DT)

- 바이오차 이용 MBR

- 보완 기술

- 기술 및 제품 로드맵

- 단기 : 기반 구축과 조기 상업화(2025-2027년)

- 중기 : 확장과 표준화(2027-2030년)

- 장기 : 대규모 상업화와 파괴적 변화(2030-2035년 이후)

- 특허 분석

- 조사 방법

- 문서 유형

- 고찰

- 특허의 법적 지위

- 관할 분석

- 주요 출원인

- 과거 10년간의 주요 10개 특허 보유사

- 미래 용도

- 무방류 시스템(ZLD)

- 고독성 및 미량오염물질 제거

- 극한 환경 처리

- 음용수 재사용

- 분산형 시스템 패키지

- MBR 시장에 대한 AI 및 생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- MBR 처리 모범 사례

- MBR 시장에서의 AI 도입 사례 연구

- 연관 인접 생태계와 시장 기업에 미치는 영향

- MBR 시장에서의 생성형 AI 채용에 대한 클라이언트의 준비 상황

제8장 지속 가능성과 규제 정세

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속 가능성에 대한 노력

- 지속 가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 사용 산업에서의 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용 역학

- 주요 최종 사용 산업에서의 사업 기회

제10장 멤브레인 바이오리액터 시장 : 시스템 구성별

- 침지형 MBR

- 외부가압식 MBR

제11장 멤브레인 바이오리액터 시장 : 막 유형별

- 중공사막

- 플랫 시트

- 다중 관

제12장 멤브레인 바이오리액터 시장 : 용량별

- 소

- 중

- 대

제13장 멤브레인 바이오리액터 시장 : 용도별

- 도시 하수 처리

- 산업 폐수 처리

- 식품 및 음료

- 석유 및 가스

- 펄프 및 제지

- 의약품

- 기타 산업 폐수 처리 용도

제14장 멤브레인 바이오리액터 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 튀르키예

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제15장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무지표(2024년)

- 브랜드 및 제품 비교 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 기업

- VEOLIA

- KUBOTA CORPORATION.

- XYLEM

- TORAY INDUSTRIES, INC.

- MANN HUMMEL

- MITSUBISHI CHEMICAL CORPORATION

- KOVALUS SEPARATION SOLUTIONS

- DUPONT

- ALFA LAVAL

- PENTAIR

- CITIC ENVIRONMENTAL TECHNOLOGIES CO., LTD.

- AQUATECH

- MEMBION GMBH

- 기타 기업

- B&P WATER TECHNOLOGIES SRL

- BERGHOF MEMBRANE TECHNOLOGY GMBH

- HUBER SE

- LENNTECH BV

- TRIQUA INTERNATIONAL

- WEHRLE-WERK AG

- EUROPE MEMBRANE

- SIGMADAF

- AQUAMATCH

- HITACHI, LTD.

- CLEAR AQUA TECHNOLOGIES P. LTD.

- HYDROTECH

- HINADA

제17장 부록

CSM 26.01.16The membrane bioreactor market is projected to grow from USD 4.49 billion in 2025 to USD 6.75 billion by 2030, at a CAGR of 8.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Unit) |

| Segments | By Membrane Type, System Configuration, Capacity Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Hollow fiber membranes are the second fastest-growing type in the membrane bioreactor market due to their numerous advantages in wastewater treatment applications. These membranes offer a high surface area-to-volume ratio, which enhances filtration efficiency and allows for compact system designs, making them ideal for space-constrained environments. Their design also facilitates effective biomass retention and provides improved permeate quality, contributing to the overall performance of membrane bioreactor systems. Hollow fiber membranes exhibit lower fouling rates, which reduces maintenance needs and operational costs over time.

The continuous advancements in hollow fiber membrane technology, including the development of more durable and chemically resistant materials, have further boosted their adoption. As industries increasingly seek efficient, cost-effective, and sustainable wastewater treatment solutions, the appeal of hollow fiber membranes continues to grow, positioning them as a key player in the membrane bioreactor market.

''Based on system configuration, submerged membrane bioreactor system is the second fastest-growing market during the forecast period, in terms of value.''

The submerged membrane bioreactor system is the second fastest-growing segment in the membrane bioreactor market due to its efficient integration of membrane filtration and biological treatment processes. This design allows the membranes to be submerged directly in the aeration tank, enhancing the retention of biomass and promoting better contact between microorganisms and wastewater. The submerged configuration significantly reduces the footprint required for treatment facilities, making it particularly suitable for urban environments with space constraints. Additionally, the submerged membrane bioreactor system tends to experience lower fouling rates and reduced operational costs, as the submerged membranes are less exposed to air and do not require backwashing. With increasing demand for effective and space-saving wastewater treatment solutions, the submerged membrane bioreactor system is gaining traction in various applications, from municipal wastewater treatment to industrial processes, further driving its market growth.

"Based on application, industrial wastewater treatment is projected to be the second-largest market during the forecast period, in terms of value."

Industrial wastewater treatment is the second-largest application in the membrane bioreactor market, primarily due to the increasing volume and complexity of wastewater produced by industries such as pharmaceuticals, food and beverage, and textiles. These sectors are subject to stringent water quality standards that must be met to comply with environmental regulations, driving the demand for advanced treatment solutions, such as membrane bioreactors, that can effectively remove contaminants and deliver high-quality effluent. Membrane bioreactor technology also offers benefits, including a compact design, a smaller footprint, and lower operational costs compared to traditional treatment methods, making it an appealing choice for industries seeking to enhance sustainability and efficiency in wastewater management. Furthermore, the growing focus on water reuse and resource recovery is enhancing the adoption of membrane bioreactor systems in industrial applications, thereby reinforcing their significant market share.

"Based on region, North America is the second-largest market for membrane bioreactor in 2023, in terms of value."

North America is the second-largest market for membrane bioreactors due to several key factors. The region boasts a robust industrial and municipal infrastructure, with significant sectors such as pharmaceuticals, chemicals, food and beverage, and automotive manufacturing driving the demand for advanced wastewater treatment solutions. Stringent environmental regulations, particularly from the U.S. Environmental Protection Agency (EPA), mandate high standards for wastewater discharge, making membrane bioreactor technology an effective option for compliance. Furthermore, growing concerns over water scarcity and the need for sustainable water management practices are leading to increased investments in membrane bioreactor systems that support water reuse. Ongoing technological advancements and research and development efforts in the region also enhance the efficiency and effectiveness of membrane bioreactors, reinforcing North America's position as a major player in the global membrane bioreactor market.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Managers- 34%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, Middle East & Africa- 15%, and Latin America- 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Veolia (France), KUBOTA Corporation (Japan), Mitsubishi Chemical Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Kovalus Separation Solutions (US), Dupont (US), Xylem (US), Pentair (UK), Mann+Hummel (Germany), ALFA LAVAL (Sweden), CITIC Envirotech (China), and Aquatech (Canada).

Research Coverage

This research report categorizes the membrane bioreactor market by membrane type (hollow fiber, flat sheet, multi-tubular), system configuration (submerged membrane bioreactor system, external membrane bioreactor system), capacity (small capacity, medium capacity, large capacity), application, and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the membrane bioreactor market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the membrane bioreactor market are all covered. This report includes a competitive analysis of upcoming startups in the membrane bioreactor market ecosystem.

Reasons to buy this report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall membrane bioreactor market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing demand for effective wastewater treatment, rising stringent environmental regulations standards, growing concern over water scarcity), restraints (membrane fouling, high initial capital investment), opportunities (Increasing focus on sustainability, integration of membrane bioreactor technology with other advanced treatment processes), and challenges (technical complexity of membrane bioreactor systems, high energy consumption).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the membrane bioreactor market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the membrane bioreactor market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the membrane bioreactor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Veolia (France), KUBOTA Corporation (Japan), Mitsubishi Chemical Corporation (Japan), TORAY INDUSTRIES, INC. (Japan), Kovalus Separation Solutions (US), Dupont (US), Xylem (US), Pentair (UK), Mann+Hummel (Germany), ALFA LAVAL (Sweden), CITIC Envirotech (China), and Aquatech (Canada) in the membrane bioreactor market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants-demand and supply sides

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MEMBRANE BIOREACTOR (MBR) MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEMBRANE BIOREACTOR MARKET

- 4.2 MEMBRANE BIOREACTOR MARKET, BY MEMBRANE TYPE

- 4.3 MEMBRANE BIOREACTOR MARKET, BY SYSTEM CONFIGURATION

- 4.4 MEMBRANE BIOREACTOR MARKET, BY APPLICATION

- 4.5 MEMBRANE BIOREACTOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent environmental regulations and standards

- 5.2.1.2 Depleting water reserves and limited availability of freshwater

- 5.2.1.3 Shift from chemical to membrane treatment of water

- 5.2.1.4 Increasing number of water supply & irrigation projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher cost-intensive technology than conventional systems

- 5.2.2.2 Membrane fouling resulting in operational burden in MBR systems

- 5.2.2.3 High initial capital investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for high-quality effluents

- 5.2.3.2 Integration of MBR systems with advanced treatment technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Operational difficulties and process sensitivity in MBR technology

- 5.2.4.2 High energy consumption impacting MBR feasibility

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN MBR MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.5.1 EMERGING BUSINESS MODELS

- 5.5.2 ECOSYSTEM SHIFTS

- 5.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMICS INDICATORS

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END CONSUMERS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS, 2024

- 6.5.2 AVERAGE SELLING PRICE, BY REGION, 2022-2024

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT SCENARIO (HS CODE 841989)

- 6.6.2 EXPORT SCENARIO (HS CODE 841989)

- 6.7 KEY CONFERENCES AND EVENTS, 2026

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 ADI MBR SOLVES WASTEWATER CHALLENGES AT AGP'S EXPANDED BIODIESEL PLANT

- 6.10.2 KSS DELIVERS HIGH-QUALITY REUSE WATER FOR SAO PAULO'S PETROCHEMICAL HUB

- 6.10.3 BIO-CEL L+480 UPGRADE TRANSFORMS CASINO WASTEWATER TREATMENT

- 6.11 IMPACT OF 2025 US TARIFFS ON MEMBRANE BIOREACTOR MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRIES/REGIONS

- 6.11.4.1 US

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENT, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 AI-ENABLED DIGITAL TWIN (DT) OF MBR / WASTEWATER PLANTS

- 7.1.2 BIOCHAR ASSISTED MBR

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 ANAEROBIC MEMBRANE BIOREACTOR (ANMBR) AND RESOURCE-RECOVERY BIOREACTORS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 INSIGHTS

- 7.4.5 LEGAL STATUS OF PATENTS

- 7.4.6 JURISDICTION ANALYSIS

- 7.4.7 TOP APPLICANTS

- 7.4.8 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 7.5 FUTURE APPLICATIONS

- 7.5.1 INDUSTRIAL REUSE & ZERO LIQUID DISCHARGE (ZLD)

- 7.5.2 HIGH TOXICITY & MICROPOLLUTANT REMOVAL

- 7.5.3 EXTREME ENVIRONMENT TREATMENT

- 7.5.4 POTABLE WATER REUSE

- 7.5.5 DECENTRALIZED AND PACKAGED SYSTEMS

- 7.6 IMPACT OF AI/GEN AI ON MBR MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN MBR PROCESSING

- 7.6.3 CASE STUDIES OF AI IMPLEMENTATION IN MBR MARKET

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN MBR MARKET

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY END-USE INDUSTRIES

10 MEMBRANE BIOREACTOR MARKET, BY SYSTEM CONFIGURATION

- 10.1 INTRODUCTION

- 10.2 SUBMERGED MBR

- 10.2.1 ELIMINATES NEED FOR EXTERNAL RECYCLE PUMPS, REDUCES ENERGY CONSUMPTION, AND OFFERS COMPACT FOOTPRINT

- 10.3 EXTERNAL MBR

- 10.3.1 EASE OF INSTALLATION, SMALLER FOOTPRINT, EFFICIENT TAG REMOVAL, AND SHORTER MEMBRANE REPLACEMENT TIME

11 MEMBRANE BIOREACTOR MARKET, BY MEMBRANE TYPE

- 11.1 INTRODUCTION

- 11.2 HOLLOW FIBER

- 11.2.1 HIGH SURFACE-AREA-TO-VOLUME RATIO PROVIDES LARGE FILTRATION AREA IN A SMALL FOOTPRINT

- 11.3 FLAT SHEET

- 11.3.1 SIMPLE DESIGN ENABLES EASY INSTALLATION, MAINTENANCE, AND CLEANING

- 11.4 MULTI-TUBULAR

- 11.4.1 HIGH MECHANICAL STRENGTH, OPERATIONAL FLEXIBILITY, AND RESISTANCE TO FOULING

12 MEMBRANE BIOREACTOR MARKET, BY CAPACITY

- 12.1 INTRODUCTION

- 12.2 SMALL

- 12.2.1 SUSTAINABLE OPTIONS FOR LOW-VOLUME WASTEWATER TREATMENT

- 12.3 MEDIUM

- 12.3.1 EFFECTIVELY REMOVE SUSPENDED SOLIDS, PATHOGENS, AND NUTRIENTS

- 12.4 LARGE

- 12.4.1 LARGE-CAPACITY MBR PLANTS DELIVERING SUPERIOR EFFLUENT QUALITY

13 MEMBRANE BIOREACTOR MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 MUNICIPAL WASTEWATER TREATMENT

- 13.2.1 FOCUS ON SUSTAINABLE WATER MANAGEMENT TO ADDRESS WATER SCARCITY PROBLEMS TO DRIVE MARKET

- 13.3 INDUSTRIAL WASTEWATER TREATMENT

- 13.3.1 FOOD & BEVERAGE

- 13.3.1.1 Rising use to control wastewater generated in beverage processing to fuel market

- 13.3.2 OIL & GAS

- 13.3.2.1 Capability to eliminate toxic substances and provide treated water for reuse to drive demand

- 13.3.3 PULP & PAPER

- 13.3.3.1 Production of less sludge during reaction process to drive demand

- 13.3.4 PHARMACEUTICALS

- 13.3.4.1 Ability to provide excellent disinfection and high-quality effluent to fuel demand

- 13.3.5 OTHER INDUSTRIAL WASTEWATER TREATMENT APPLICATIONS

- 13.3.1 FOOD & BEVERAGE

14 MEMBRANE BIOREACTOR MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Presence of major manufacturers and suppliers to drive demand

- 14.2.2 CANADA

- 14.2.2.1 Food & beverage, pharmaceuticals, and chemical processing to drive demand

- 14.2.3 MEXICO

- 14.2.3.1 Emergence as a strategic oil & gas hub to drive market

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Heavy investment in modern sewage networks to drive market

- 14.3.2 UK

- 14.3.2.1 Shift toward advanced wastewater treatment and high-quality reuse solutions to propel market

- 14.3.3 FRANCE

- 14.3.3.1 Government's plan to increase spending on decontamination facilities by 20% by 2030 to propel market

- 14.3.4 ITALY

- 14.3.4.1 Wastewater reuse, desalination, and advanced biological treatment due to aging supply networks to fuel market

- 14.3.5 SPAIN

- 14.3.5.1 Investment to upgrade wastewater treatment and reuse infrastructure to fuel market

- 14.3.6 RUSSIA

- 14.3.6.1 Regulatory pressure on petrochemicals, mining, and manufacturing industries to reduce pollutant loads to drive market

- 14.3.7 TURKEY

- 14.3.7.1 Rising emphasis on circular water schemes to fuel market growth

- 14.3.8 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Government incentives for green technologies and foreign investment to drive market

- 14.4.2 JAPAN

- 14.4.2.1 Emphasis on improvements in municipal sewerage systems to expand treatment capacity and promote water reuse to drive market

- 14.4.3 INDIA

- 14.4.3.1 Rising adoption of wastewater treatment technologies and growing urban population demanding clean water to drive market

- 14.4.4 SOUTH KOREA

- 14.4.4.1 Rising investment in smart water management systems to boost market

- 14.4.5 AUSTRALIA

- 14.4.5.1 Rising environmental awareness, stringent wastewater regulations, and increasing urbanization to boost market

- 14.4.6 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Rising investment in wastewater treatment for industrial and sewage applications to contribute to market growth

- 14.5.1.2 Rest of GCC countries

- 14.5.1.1 Saudi Arabia

- 14.5.2 EGYPT

- 14.5.2.1 Need to improve wastewater treatment capacity and address severe water scarcity to drive market

- 14.5.3 SOUTH AFRICA

- 14.5.3.1 Need for sustainable water management to propel market

- 14.5.4 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Expansion of industrial base to boost market

- 14.6.2 ARGENTINA

- 14.6.2.1 Modernization of existing water treatment plants to drive market

- 14.6.3 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 COMPANY VALUATION AND FINANCIAL METRIC, 2024

- 15.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Membrane type footprint

- 15.7.5.4 System configuration footprint

- 15.7.5.5 Application footprint

- 15.7.5.6 Capacity footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 15.8.5.1 List of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 VEOLIA

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 KUBOTA CORPORATION.

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 XYLEM

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 TORAY INDUSTRIES, INC.

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 MANN+HUMMEL

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Key strengths

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 MITSUBISHI CHEMICAL CORPORATION

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 MnM view

- 16.1.6.3.1 Key strengths

- 16.1.6.3.2 Strategic choices

- 16.1.6.3.3 Weaknesses and competitive threats

- 16.1.7 KOVALUS SEPARATION SOLUTIONS

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.4 MnM view

- 16.1.8 DUPONT

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.4 MnM view

- 16.1.9 ALFA LAVAL

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 MnM view

- 16.1.10 PENTAIR

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 MnM view

- 16.1.11 CITIC ENVIRONMENTAL TECHNOLOGIES CO., LTD.

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Deals

- 16.1.11.4 MnM view

- 16.1.12 AQUATECH

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Expansions

- 16.1.12.4 MnM view

- 16.1.13 MEMBION GMBH

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Deals

- 16.1.13.4 MnM view

- 16.1.1 VEOLIA

- 16.2 OTHER PLAYERS

- 16.2.1 B&P WATER TECHNOLOGIES S.R.L.

- 16.2.2 BERGHOF MEMBRANE TECHNOLOGY GMBH

- 16.2.3 HUBER SE

- 16.2.4 LENNTECH B.V.

- 16.2.5 TRIQUA INTERNATIONAL

- 16.2.6 WEHRLE-WERK AG

- 16.2.7 EUROPE MEMBRANE

- 16.2.8 SIGMADAF

- 16.2.9 AQUAMATCH

- 16.2.10 HITACHI, LTD.

- 16.2.11 CLEAR AQUA TECHNOLOGIES P. LTD.

- 16.2.12 HYDROTECH

- 16.2.13 HINADA

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS