|

시장보고서

상품코드

1774596

철근 시장 : 유형별, 프로세스별, 코팅 유형별, 바 사이즈별, 최종 용도 부문별, 지역별 - 예측(-2030년)Steel Rebar Market by Type (Deformed, Mild), Process (BOS, EAF), Coating Type (Plain, Galvanized, Epoxy Coated), Bar Size (#3, #4, #5, #8), End-use Industry (Infrastructure, Housing & Industrial), and Region - Global Forecast to 2030 |

||||||

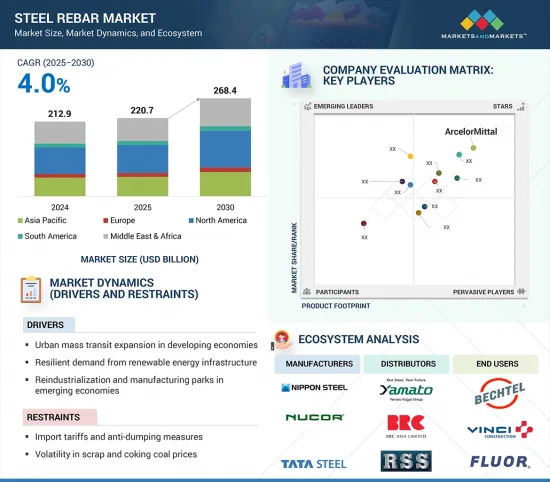

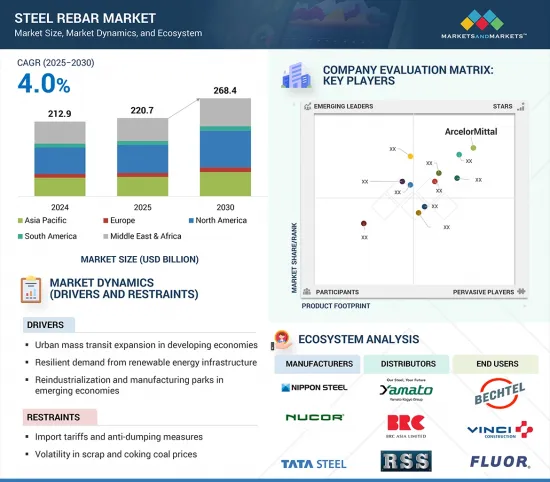

철근 시장 규모는 2024년에 2,129억 달러에 달했습니다.

이 시장은 4.0%의 CAGR로 확대되어 2030년에는 2,684억 달러에 달할 것으로 예상됩니다. 인프라 개발, 도시 주택 프로젝트, 산업용 건설 증가가 전 세계 철근 시장을 지속적으로 견인하고 있습니다. 각국이 새로운 교통 시스템, 스마트 시티 이니셔티브, 재생에너지 인프라에 투자하는 한편, 교량 및 기타 중요한 구조물을 포함한 구조적으로 건전한 건물에 대한 중요한 요구가 남아 있습니다. 지진이 발생하기 쉬운 지역에서는 철근이 콘크리트를 보강하는 데 매우 중요하며, 구조물이 지진의 흔들림을 견딜 수 있도록 도와줍니다. 한편, 신흥국의 인구 증가와 경제 성장은 상업 및 주택 건설의 성장을 가속화하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러)/킬로톤 |

| 부문 | 유형별, 프로세스별, 코팅 유형별, 바 사이즈별, 최종 용도 부문별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미 |

이러한 건축 활동의 급증은 철근과 같은 고성능 건축자재에 대한 수요를 증가시키고 있습니다. 또한, 기술의 발전으로 녹에 강하고 강도가 높은 철근이 만들어지고 있습니다. 이러한 최신 선택은 더 높은 내구성과 낮은 장기 유지보수 비용을 제공하고 더 탄력적이고 비용 효율적인 건설을 제공하기 때문에 엔지니어와 계약자가 점점 더 선호하고 있습니다.

이형 철근은 인장 강도가 우수하고, 응력을 보다 효과적으로 처리하며, 다양한 건설 산업에서 사용하기에 적합하기 때문에 가장 높은 CAGR을 기록할 것으로 예상됩니다. 골판지 철근은 콘크리트와의 결합을 개선하기 위해 표면에 리브와 융기가 있습니다. 이는 콘크리트와 강철 사이의 결합 강도를 향상시켜 약제의 하중 지지력을 향상시킵니다. 따라서 이 재료는 고층 빌딩, 고속도로, 교량, 터널, 내진 건축물에 매우 적합합니다.

전 세계적으로 인프라 투자가 증가하고 도시화가 가속화됨에 따라, 특히 아시아태평양, 중동 및 아프리카 등 빠르게 발전하는 지역에서는 신뢰할 수 있는 고강도 철근 제품에 대한 수요가 증가하고 있습니다. 정부 및 민간 개발업체들은 새로운 안전 기준과 성능 기준을 충족하기 위해 이형 철근을 요구하고 있습니다. 또한, 열처리(TMT) 철근 및 내식성 등급과 같은 고급 제품의 도입은 이 부문의 성장을 더욱 촉진하고 있습니다. 이형 철근은 다양한 직경, 등급, 길이로 제공되며, 배송을 위한 다양한 맞춤형 옵션이 있습니다. 이러한 유연성으로 인해 점점 더 많은 시장에서 사용되고 있습니다. 낮은 비용, 건설상의 이점, 다양한 응용 분야에 적용 가능하기 때문에 이형 철근 부문은 철근 시장에서 가장 빠르게 성장하고 가장 탄력적인 부분이 되었습니다.

전기 아크로(EAF)는 지속가능성, 에너지 효율성, 철강 생산의 탈탄소화에 대한 전 세계적인 관심 증가로 인해 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다. 전기 아크로(EAF)는 특히 금속 스크랩을 쉽게 구할 수 있고 재생에너지가 증가하는 지역에서 현대 제철에 필수적인 요소로 자리 잡고 있습니다. 석탄과 철광석에 크게 의존하는 전통적인 용광로와 달리 EAF는 전기를 사용하여 금속 스크랩을 용해하기 때문에 공정이 더 깨끗하고 유연하며 저탄소 미래에 적합합니다. 대규모 철강 생산에서 페로 티타늄, 망간, 실리콘과 같은 특수 합금 생산에 이르기까지 EAF는 다양한 요구에 적응할 수 있습니다. 경사형 용광로든 고정형 용광로든, 또는 합금철 생산에 사용되는 서브머지드 아크로든, 이 기술은 효율성과 지속가능성의 요구를 모두 충족시키기 위해 계속 진화하고 있습니다. 튀르키예와 같은 국가들은 산업 성장과 환경적 책임의 균형을 맞추기 위해 EAF 기술을 채택하고 있습니다. 탈탄소화 추진이 계속되는 가운데, EAF는 단순한 용해 도구 그 이상임이 입증되고 있습니다.

순환경제의 실천과 산업계의 탄소배출량 감축을 위한 환경정책의 적용이 확대됨에 따라, 제강에서 EAF 기반 생산에 대한 관심이 높아지고 있습니다. 최신 EAF 기술은 더 높은 생산성, 더 낮은 운영 비용, 더 안정적인 철강 품질을 가능하게 하며, 주거용, 상업용, 인프라 프로젝트에 사용되는 다양한 철근 등급의 생산에 적합합니다.

이 공정은 미국, 인도, 유럽 일부 지역 등 저탄소 제철을 위한 정책 및 투자가 이루어지고 있는 다른 국가에서도 확산되고 있습니다. 친환경 건축 기준과 ESG 기준이 계속 영향력을 발휘하는 가운데, EAF 부문은 예측 기간 동안 모든 철근 제조 공정에서 가장 빠른 성장률을 기록할 것으로 예상됩니다.

급속한 도시화, 대규모 인프라 및 신규 건설 활동, 신흥국의 견조한 경제 성장으로 인해 아시아태평양은 예측 기간 동안 철근 시장에서 가장 빠른 CAGR을 보일 것으로 추정 및 예측됩니다. 중국, 인도, 인도네시아, 베트남과 같은 국가에서는 도시 인구 증가에 대응하고 경제 회복력을 자극하기 위해 도로, 교량, 철도, 주택, 산업용 건물과 같은 건설 프로젝트가 증가하고 있습니다.

세계 최대 철강 생산국인 중국은 '일대일로 이니셔티브(Belt and Road Initiative)'와 같은 프로그램을 통해 국내외 인프라에 자금을 공급하고 있습니다. 인도는 직접 환원철(DRI) 생산 능력의 증가뿐만 아니라 정부 주도의 야심찬 프로그램으로 인해 세계 철근 시장의 주요 성장 동력으로 빠르게 부상하고 있습니다. Pradhan Mantri Awas Yojana(PMAY), Smart Cities Mission, PM Gati Shakti와 같은 이니셔티브는 주택 및 인프라 부문 전반에 걸쳐 철근에 대한 대규모 수요를 촉진하고 있습니다. 이러한 국내 건설의 급증은 산업단지, 교통 회랑, 물류 허브에 대한 외국인 투자를 유치하고 있는 동남아시아 전역에 반영되어 철근 소비의 꾸준한 증가를 촉진하고 있습니다. 원자재에 대한 접근성, 상대적으로 낮은 인건비, 철강 생산능력의 확대 등 이 지역의 경쟁 우위는 그 지위를 더욱 강화하고 있습니다. 특히 신흥 경제국에서 내진성 및 고강도 건설 자재에 대한 수요가 증가함에 따라 아시아태평양은 향후 몇 년 동안 가장 높은 성장률로 세계 철근 시장을 주도할 것으로 예상됩니다.

세계의 철근 시장에 대해 조사했으며, 유형별, 공정별, 코팅 유형별, 바 크기별, 최종 용도 부문별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

제6장 업계 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 생성형 AI가 철근 시장에 미치는 영향

- 특허 분석

- 주요 신청자

- 무역 분석

- 2025년의 주요 회의와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 거시경제 분석

- 투자와 자금 조달 시나리오

- 2025년 미국 관세의 영향 : 철근 시장

제7장 철근 시장(유형별)

- 소개

- 이형

- 연강

제8장 철근 시장(프로세스별)

- 소개

- 기본적인 산소 제강

- 전기 아크로

제9장 철근 시장(코팅 유형별)

- 소개

- 일반 탄소강 철근

- 아연도금강 철근

- 에폭시 코팅강 철근

제10장 철근 시장(바 사이즈별)

- 소개

- #3바 사이즈

- #4바 사이즈

- #5바 사이즈

- #8바 사이즈

- 기타

제11장 철근 시장(최종 용도 부문별)

- 소개

- 인프라

- 하우징

- 산업

제12장 철근 시장(지역별)

- 소개

- 북미

- 북미의 철근 시장(국가별)

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 아시아태평양의 철근 시장(국가별)

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 유럽

- 유럽의 철근 시장(국가별)

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 우크라이나

- 튀르키예

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 철근 시장(국가별)

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 남미의 철근 시장(국가별)

- 브라질

- 아르헨티나

- 기타

제13장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 벤치마킹 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 개요

- 주요 진출 기업

- NIPPON STEEL CORPORATION

- ARCELORMITTAL

- GERDAU S/A

- NUCOR CORPORATION

- COMMERCIAL METALS COMPANY

- TATA STEEL

- STEEL AUTHORITY OF INDIA LIMITED

- MECHEL PAO

- STEEL DYNAMICS, INC.

- NLMK GROUP

- JSW

- BAOSTEEL GROUP CO., LTD.

- 기타 기업

- METINVEST

- PAO SEVERSTAL

- BYER STEEL CORPORATION

- DAIDO STEEL CO., LTD.

- ACERINOX

- HYUNDAI STEEL

- JIANGSU SHAGANG GROUP

- HBIS GROUP CO., LTD.

- EVRAZ PLC

- SWISS STEEL GROUP

- SUNFLAG IRON AND STEEL CO. LTD.

- OUTOKUMPU

- 7 STEEL UK

제15장 인접 시장과 관련 시장

제16장 부록

ksm 25.07.29The market for steel rebar was USD 212.9 billion in 2024, and it is projected to reach USD 268.4 billion by 2030, at a CAGR of 4.0%. Increasing infrastructure development, urban housing projects, and construction of industrial applications have continued to drive the steel rebar market across the globe. While countries are investing in new transportation systems, smart city initiatives, and renewable energy infrastructure, there remains a critical need for structurally sound buildings, including bridges and other essential structures. In earthquake-prone areas, steel rebar is crucial in reinforcing concrete, helping structures better withstand seismic shocks. Meanwhile, increasing populations and economic growth in emerging economies are accelerating growth in both commercial and residential construction.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion)/ Volume (Kiloton) |

| Segments | Type, Process, Coating Type, Bar Size, End-Use Sector, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

This surge in building activity boosts demand for high-performance construction materials like rebar. Additionally, technological advancements have led to the creation of rust-resistant, high-strength rebars. These modern options are increasingly favored by engineers and contractors because they provide greater durability and lower long-term maintenance costs, resulting in more resilient and cost-effective construction.

By type, the deformed segment accounted for the highest CAGR during the forecast period

Deformed steel rebar is projected to register the highest CAGR, as it possesses better tensile strength, handles stress more effectively, and is suitable for use in various construction industries. Corrugated rebar has surface ribs or ridges to improve the bond with the concrete. This increases the strength of the bond between the concrete and steel, and hence the load capacity of the agent. So the material is very appropriate for high buildings, high-speed ways, bridges, tunnels, and earthquake-resistant buildings.

The demand for reliable, high-strength reinforcement products is rising as global infrastructure investment increases and urbanization speeds up, especially in rapidly developing regions such as Asia Pacific, the Middle East, and Africa. Governments and private developers are increasingly requiring deformed rebar to meet new safety standards and performance criteria. Moreover, the introduction of premium products such as thermo-mechanically treated (TMT) bars and corrosion-resistant grades has further driven growth in this segment. Deformed rebar comes in various diameters, grades, and lengths, with many customization options for shipping. Its flexibility allows it to be used in a growing number of markets. Lower costs, construction advantages, and applicability for numerous uses have made the deformed rebar segment the fastest-growing and most resilient part of the steel rebar market.

By process, electric arc furnace (EAF) accounted for the highest CAGR during the forecast period

Electric arc furnace (EAF) is projected to record the highest CAGR during the forecast period, because of its sustainability, energy effectiveness, and increasing global focus on decarbonization of steel production. The electric arc furnace (EAF) is becoming an essential part of modern steelmaking, especially in regions where scrap metal is readily available and renewable energy is on the rise. Unlike traditional blast furnaces that rely heavily on coal and iron ore, EAFs use electricity to melt down scrap metal, making the process cleaner, more flexible, and better suited for a low-carbon future. From large-scale steel production to specialized alloy making like ferrotitanium, manganese, or silicon EAFs can be adapted to a wide range of needs. Whether it is a tilting or fixed type furnace, or even a submerged arc furnace used for ferroalloy production, the technology continues to evolve to meet the demands of both efficiency and sustainability. Countries like Turkiye are embracing EAF technology as they balance industrial growth with environmental responsibility. As the global push for decarbonization continues, EAFs are proving to be more than just a melting tool; they are helping shape a smarter, cleaner steel industry for the future.

Growing applications of circular economy practices and environmental policies to reduce industrial carbon footprints have increased interest in EAF-based production in steel-making. Modern EAF technology allows for greater productivity, lower operational costs, and more consistent steel quality, making it well-suited for manufacturing various rebar grades used in residential, commercial, and infrastructure projects.

The process is also catching on in other countries, including the US, India, and parts of Europe, where policies and investments are aimed at low-carbon steelmaking. While green building standards and ESG criteria continue to gain influence, the EAF segment is anticipated to gain more ground, producing the fastest growth rate for all steel rebar producing processes in the forecast period.

Asia Pacific accounted for the highest CAGR during the forecast period.

Among regions, Asia Pacific is estimated to have the fastest CAGR in the steel rebar market during the forecast period, with rapid urbanization, extensive infrastructural and new construction activities, and robust economic growth in emerging economies. Nations like China, India, Indonesia, and Vietnam are seeing an increase in construction projects such as roads, bridges, railways, residential and industrial buildings to accommodate growing urban populations and stimulate economic resilience.

The world's largest steel producer, China, is still financing both domestic and foreign infrastructure with programs such as the Belt and Road Initiative. India is quickly emerging as a major growth engine in the global steel rebar market, not only through its rising Direct Reduced Iron (DRI) capacity but also due to ambitious government-led programs. Initiatives like the Pradhan Mantri Awas Yojana (PMAY), Smart Cities Mission, and PM Gati Shakti are fueling massive demand for steel rebar across housing and infrastructure sectors. This surge in domestic construction is being mirrored across Southeast Asia, where countries are attracting foreign investments in industrial zones, transport corridors, and logistics hubs, all of which are driving steady increases in rebar consumption. The region's competitive advantages, such as access to raw materials, relatively low labor costs, and growing steelmaking capacity, further strengthen its position. As the need for earthquake-resistant and high-strength construction materials rises, particularly in developing economies, Asia Pacific is expected to lead the global steel rebar market with the highest growth rate over the coming years.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%.

Companies Covered:

NIPPON STEEL CORPORATION (Japan), ArcelorMittal (Luxemberg), Gerdau S/A (Brazil), Nucor Corporation (US), Commercial Metals Company (US), TATA Steel (India), Steel Authority of India Limited (India), Mechel PAO (Russia), Steel Dynamics, Inc. (US), NLMK Group (Russia), JSW (India), and Baosteel Group Co., Ltd. (China) are some key players in steel rebar Market.

Research Coverage

The market study covers the steel rebar market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, process, coating type, bar size, end-use sector, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the steel rebar market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall steel rebar market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Urban Mass Transit Expansion in Developing Economies and Resilient Demand from Renewable Energy Infrastructure), restraints (Import Tariffs and Anti-Dumping Measures), opportunities (Green Steel Rebar from Hydrogen-Based DRI and Integration with Precast and Modular Construction), and challenges (Lack of Recycling Infrastructure in Emerging Economies) influencing the growth of the steel rebar market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the steel rebar market

- Market Development: Comprehensive information about profitable markets - the report analyses the steel rebar market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the steel rebar market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Nippon Steel Corporation (Japan), ArcelorMittal (Luxembourg), Gerdau S/A (Brazil), , Nucor Corporation (US), Commercial Metals Company (US), TATA Steel (India), Steel Authority of India Limited (India), Mechel PAO (Russia), Steel Dynamics, Inc. (US), NLMK Group (Russia), JSW (India), and Baosteel Group Co., Ltd. (China) in the steel rebar market. The report also helps stakeholders understand the pulse of the steel rebar market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN STEEL REBAR MARKET

- 4.2 STEEL REBAR MARKET, BY TYPE

- 4.3 STEEL REBAR MARKET, BY END-USE SECTOR

- 4.4 STEEL REBAR MARKET, BY SIZE

- 4.5 STEEL REBAR MARKET, BY COATING TYPE

- 4.6 STEEL REBAR MARKET, BY PROCESS

- 4.7 STEEL REBAR MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Expansion of urban mass transit systems across developing economies

- 5.1.1.2 Resilient demand from renewable energy infrastructure

- 5.1.1.3 Reindustrialization and manufacturing parks in emerging economies

- 5.1.2 RESTRAINTS

- 5.1.2.1 Import tariffs and anti-dumping measures

- 5.1.2.2 Volatility in scrap and coking coal prices

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Green steel rebar from hydrogen-based DRI

- 5.1.3.2 Integration with precast and modular construction

- 5.1.4 CHALLENGES

- 5.1.4.1 Lack of recycling infrastructure in emerging economies

- 5.1.4.2 Untracked informal sector dominance in rural rebar supply

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Corrosion-Resistant Coatings

- 6.5.1.2 Non-Destructive Testing (NDT)

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Rebar Tracking and Tagging

- 6.5.2.2 Rebar Scanning and Detection Tools

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Self-Sensing Rebars

- 6.5.3.2 3D Printing of Rebar Cages

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON STEEL REBAR MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.8 TOP APPLICANTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.9.2 EXPORT DATA RELATED TO HS CODE 7227, BY COUNTRY, 2020-2024 (USD THOUSAND)

- 6.10 KEY CONFERENCES AND EVENTS IN 2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.12 PORTER'S FIVE FORCES' ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 TATA ELXSI - AI-DRIVEN SUSTAINABLE AUTOMATION FOR STEEL INDUSTRY

- 6.14.2 PAN GULF TECHNOLOGIES - REBAR CASE STUDY: COMMERCIAL PROJECT IN KSA

- 6.14.3 HELIX STEEL - REBAR ALTERNATIVES USING MICRO REBAR TECHNOLOGY

- 6.15 MACROECONOMIC ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.15.3 GLOBAL STEEL PRODUCTION AND REBAR DEMAND

- 6.15.4 INFRASTRUCTURE INVESTMENT IMPACT

- 6.16 INVESTMENT AND FUNDING SCENARIO

- 6.17 IMPACT OF 2025 US TARIFF: STEEL REBAR MARKET

- 6.17.1 INTRODUCTION

- 6.17.2 KEY TARIFF RATES

- 6.17.3 PRICE IMPACT ANALYSIS

- 6.17.4 KEY IMPACT ON VARIOUS REGIONS

- 6.17.4.1 US

- 6.17.4.2 Europe

- 6.17.4.3 Asia Pacific

- 6.17.5 END-USE SECTOR IMPACT

7 STEEL REBAR MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DEFORMED

- 7.2.1 WIDE APPLICATIONS FOR STRUCTURAL STABILITY IN HIGH-STRENGTH CONCRETE TO DRIVE MARKET

- 7.3 MILD

- 7.3.1 DEMAND IN SPECIALIZED AND COST-EFFICIENT APPLICATIONS TO DRIVE MARKET

8 STEEL REBAR MARKET, BY PROCESS

- 8.1 INTRODUCTION

- 8.2 BASIC OXYGEN STEELMAKING

- 8.2.1 BASIC OXYGEN STEELMAKING EMPOWERS REBAR PRODUCTION AMIDST RECORD INFRASTRUCTURE INVESTMENT

- 8.3 ELECTRIC ARC FURNACE

- 8.3.1 FLEXIBLE, SUSTAINABLE, AND STRATEGICALLY ALIGNED FOR MODERN REBAR PRODUCTION

9 STEEL REBAR MARKET, BY COATING TYPE

- 9.1 INTRODUCTION

- 9.2 PLAIN CARBON STEEL REBAR

- 9.2.1 COST-EFFECTIVE AND STRUCTURALLY RELIABLE FOR STANDARD CONSTRUCTION ENVIRONMENTS TO DRIVE MARKET

- 9.3 GALVANIZED STEEL REBAR

- 9.3.1 RISING DEMAND FOR CORROSION-RESISTANT INFRASTRUCTURE SOLUTIONS TO DRIVE MARKET

- 9.4 EPOXY-COATED STEEL REBAR

- 9.4.1 STEADY DEMAND IN HIGHWAY AND MARINE INFRASTRUCTURE APPLICATIONS TO INFLUENCE MARKET

10 STEEL REBAR MARKET, BY BAR SIZE

- 10.1 INTRODUCTION

- 10.2 #3 BAR SIZE

- 10.2.1 IDEAL USE IN SWIMMING POOL FRAMES AND ROAD & HIGHWAY PAVING TO DRIVE DEMAND

- 10.3 #4 BAR SIZE

- 10.3.1 COMMON USE IN SLAB-ON-GRADE FOUNDATIONS AND WALL REINFORCEMENT TO DRIVE DEMAND

- 10.4 #5 BAR SIZE

- 10.4.1 WIDE APPLICATIONS IN BRIDGE DECKS, TRANSPORT STRUCTURES, AND MEDIUM TO HEAVY FOUNDATIONS TO DRIVE DEMAND

- 10.5 #8 BAR SIZE

- 10.5.1 SUBSTANTIAL CROSS-SECTIONAL AREA AND HIGH TENSILE STRENGTH TO DRIVE DEMAND IN HEAVY CIVIL CONSTRUCTION AND HIGH-STRENGTH CONCRETE STRUCTURES

- 10.6 OTHER BAR SIZES

11 STEEL REBAR MARKET, BY END-USE SECTOR

- 11.1 INTRODUCTION

- 11.2 INFRASTRUCTURE

- 11.2.1 RISING GLOBAL INVESTMENTS IN INFRASTRUCTURE SIGNIFICANTLY ACCELERATE STEEL REBAR DEMAND ACROSS URBAN AND TRANSPORT PROJECTS

- 11.3 HOUSING

- 11.3.1 GOVERNMENT-BACKED HOUSING INITIATIVES AND URBAN EXPANSION DRIVE CONSISTENT GROWTH IN STEEL REBAR DEMAND GLOBALLY

- 11.4 INDUSTRIAL

- 11.4.1 SURGING INVESTMENTS IN MANUFACTURING AND CLEAN ENERGY DRIVE STRONG STEEL REBAR DEMAND IN INDUSTRIAL CONSTRUCTION

12 STEEL REBAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA STEEL REBAR MARKET, BY COUNTRY

- 12.2.2 US

- 12.2.2.1 Government initiatives to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rise in residential and non-residential construction activities to trigger market

- 12.2.4 MEXICO

- 12.2.4.1 Increase in infrastructure investment to drive market

- 12.3 ASIA PACIFIC

- 12.3.1 ASIA PACIFIC STEEL REBAR MARKET, BY COUNTRY

- 12.3.2 CHINA

- 12.3.2.1 Urban expansion and BRI infrastructure projects to drive demand

- 12.3.3 INDIA

- 12.3.3.1 Steady rise in steel rebar demand amid infrastructure expansion to drive market

- 12.3.4 JAPAN

- 12.3.4.1 Infrastructure resilience and global investments to drive demand

- 12.3.5 SOUTH KOREA

- 12.3.5.1 Industrial expansion and rapid housing and redevelopment projects to drive market

- 12.3.6 AUSTRALIA

- 12.3.6.1 Large-scale infrastructure, housing, and energy projects to drive demand

- 12.3.7 REST OF ASIA PACIFIC

- 12.4 EUROPE

- 12.4.1 EUROPE STEEL REBAR MARKET, BY COUNTRY

- 12.4.2 GERMANY

- 12.4.2.1 Infrastructure investments and population growth to drive market

- 12.4.3 UK

- 12.4.3.1 Rising government commitments to investments for infrastructure and green steel to drive market

- 12.4.4 FRANCE

- 12.4.4.1 Surging infrastructure, urban expansion, and housing recovery to drive market

- 12.4.5 ITALY

- 12.4.5.1 Extensive infrastructure and energy investments to drive market

- 12.4.6 SPAIN

- 12.4.6.1 Rising infrastructure and energy investments to drive demand

- 12.4.7 RUSSIA

- 12.4.7.1 Rising construction and infrastructure investments to drive market

- 12.4.8 UKRAINE

- 12.4.8.1 Reconstruction and infrastructure revitalization efforts to drive demand

- 12.4.9 TURKEY

- 12.4.9.1 Rising construction, infrastructure, and housing investments to drive demand

- 12.4.10 REST OF EUROPE

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA STEEL REBAR MARKET, BY COUNTRY

- 12.5.2 GCC COUNTRIES

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Robust infrastructure and housing investments to drive market

- 12.5.2.2 UAE

- 12.5.2.2.1 Strong infrastructure and real estate expansion to drive demand

- 12.5.2.3 Rest of GCC countries

- 12.5.2.1 Saudi Arabia

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 Robust infrastructure and real estate developments to drive demand

- 12.5.4 REST OF MIDDLE EAST & AFRICA

- 12.6 SOUTH AMERICA

- 12.6.1 SOUTH AMERICA STEEL REBAR MARKET, BY COUNTRY

- 12.6.2 BRAZIL

- 12.6.2.1 Robust infrastructure and housing initiatives to demand

- 12.6.3 ARGENTINA

- 12.6.3.1 Rising infrastructure investments and urban resilience projects to drive market

- 12.6.4 REST OF SOUTH AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS STRATEGIES/ RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.6 FINANCIAL METRICS

- 13.7 BRAND/PRODUCT COMPARISON

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.8.5.1 Company footprint

- 13.8.5.2 Region footprint

- 13.8.5.3 Type footprint

- 13.8.5.4 Process footprint

- 13.8.5.5 Coating Type footprint

- 13.8.5.6 Bar Size footprint

- 13.8.5.7 End-use Industry footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.10 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.10.1 DETAILED LIST OF KEY STARTUPS/SMES

- 13.10.2 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.11 COMPETITIVE SCENARIO

- 13.11.1 DEALS

- 13.11.2 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 NIPPON STEEL CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 ARCELORMITTAL

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 GERDAU S/A

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NUCOR CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 COMMERCIAL METALS COMPANY

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TATA STEEL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.7 STEEL AUTHORITY OF INDIA LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.8 MECHEL PAO

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.9 STEEL DYNAMICS, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.4 MnM view

- 14.1.10 NLMK GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Expansions

- 14.1.10.4 MnM view

- 14.1.11 JSW

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.4 MnM view

- 14.1.12 BAOSTEEL GROUP CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.12.4 MnM view

- 14.1.1 NIPPON STEEL CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 METINVEST

- 14.2.2 PAO SEVERSTAL

- 14.2.3 BYER STEEL CORPORATION

- 14.2.4 DAIDO STEEL CO., LTD.

- 14.2.5 ACERINOX

- 14.2.6 HYUNDAI STEEL

- 14.2.7 JIANGSU SHAGANG GROUP

- 14.2.8 HBIS GROUP CO., LTD.

- 14.2.9 EVRAZ PLC

- 14.2.10 SWISS STEEL GROUP

- 14.2.11 SUNFLAG IRON AND STEEL CO. LTD.

- 14.2.12 OUTOKUMPU

- 14.2.13 7 STEEL UK

15 ADJACENT & RELATED MARKET

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.2.1 LONG STEEL MARKET

- 15.2.1.1 Market definition

- 15.2.1.2 Long steel market, by process

- 15.2.1.3 Long steel market, by product type

- 15.2.1.4 Long steel market, by end-use industry

- 15.2.1.5 Long steel market, by region

- 15.2.1 LONG STEEL MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS