|

시장보고서

상품코드

1787264

국소 약물전달 시장 : 제품별, 용도별, 최종 사용자별, 지역별 예측(-2030년)Topical Drug Delivery Market by Product (Formulation (Semi-solid, Emulsion), Transdermal Patch, Microneedle Patch, Drug-in-adhesive, Matrix Patch), Application (Dermal, Ophthalmic, Nasal, Vaginal, Rectal), End User, Region - Global Forecast to 2030 |

||||||

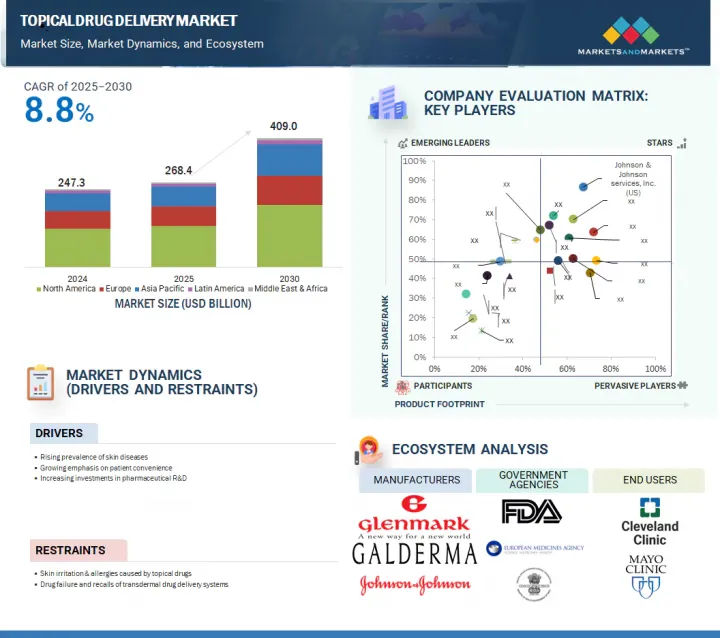

세계의 국소 약물전달 시장은 2025년 2,684억 달러에서 2030년까지 4,090억 달러에 이를 것으로 예상되며, CAGR로 8.8% 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 적용 사이트, 최종 사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 시장 성장의 주요 원인은 안구건조증에 대한 국소 처방 요법의 보급, 제약 기업에 의한 혁신적인 경피 약물 전달 시스템의 연구 개발에 대한 주목 증가, 피부 감염의 유병률 증가, 비침습적인 약물 전달 방법에 대한 선호 증가로 생각됩니다.

제품별로 반고형 제제는 2024년 최대 시장 점유율을 차지했습니다.

반고형 제제의 높은 점유율은 부작용이 적고 환자의 복약 준수가 높고 흡수성이 높고 약물 방출이 효율적이기 때문입니다. 이러한 투여 형태는 비탈수성이며 피부 기능을 변화시키지 않기 때문에 시장 성장이 촉진되고 있습니다.

적용 부위별로, 경피 약물 전달 부문은 2024년에 가장 큰 시장 점유율을 차지했습니다.

경피 약물전달 부문의 큰 점유율은 시장에서 제품 시장이 증가한 것으로 간주됩니다. 규제 요건이 적고, 비강이나 경안의 약물전달보다 자극이 적은 것도 시장 성장에 기여하고 있습니다. 나노에멀젼을 통한 경피 약물 전달은 건선과 백반증과 같은 만성 질환과자가 면역 질환에도 적합합니다.

지역별로 북미는 2024년 최대 시장 점유율을 차지했습니다.

이 지역의 큰 점유율은 피부 질환의 높은 위험, 만성 질환(당뇨병 등)의 유병률 증가, 피임약 사용 증가, 노년 인구 증가, 제약 기업의 혁신적인 경피 약물 전달 시스템의 연구 개발에 주력 등에 기인하고 있습니다.

이 보고서는 세계 국소 약물 전달 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 국소 약물전달 시장 개요

- 아시아태평양의 국소 약물전달 시장 : 제품별, 국가별(2024년)

- 국소 약물전달 시장 : 지역의 구성

- 국소 약물전달 시장 : 지리적 성장 기회

- 국소 약물전달 시장 : 선진국 시장과 신흥국 시장

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 산업 동향

- 경피 약물 전달 시스템의 진보

- 마이크로니들 패치 기술의 등장

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter's Five Forces 분석

- 규제 상황

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 특허 분석

- 국소 약물전달에 관한 특허 공보의 동향

- 고찰 : 관할 구역과 주요 신청자의 분석

- 무역 분석

- 가격 설정 분석

- 평균 판매 가격 동향 : 제품별(2022-2024년)

- 연고의 평균 판매 가격 : 주요 기업별(2024년)

- 젤의 평균 판매 가격 : 주요 기업별(2024년)

- 평균 판매 가격 : 지역별

- 반고형 제제의 평균 판매 가격 : 지역별(2024년)

- 상환 분석

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 주요 이해관계자와 구매 기준

- 미충족 요구/최종사용자의 기대

- 국소 약물전달 시장에서의 AI의 영향

- 파이프라인 분석

- 에코시스템 시장 맵

- 밸류체인 분석

- 투자 및 자금조달 시나리오

- 국소 약물전달 시장에 대한 트럼프 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 다양한 지역에 중요한 영향

- 최종 이용 산업에 미치는 영향

제6장 국소 약물전달 시장 : 제품별

- 소개

- 반고형 제제

- 연고

- 크림

- 로션

- 젤

- 페이스트

- 액체 제형

- 현탁제

- 에멀젼

- 액제

- 고형 제제

- 분말

- 좌약

- 필름

- 경피제품

- 경피 패치

- 경피 겔

- 경피 스프레이

- 기타 제품

제7장 국소 약물전달 시장 : 적용 부위별

- 소개

- 피부 약물전달

- 안약물전달

- 질 약물전달

- 직장 약물전달

- 비강 약물전달

제8장 국소 약물전달 시장 : 최종 사용자별

- 소개

- 재택 케어 환경

- 병원 및 진료소

- 외래수술센터(ASC)

- 열상 케어 센터

- 기타 최종 사용자

제9장 국소 약물전달 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 태국

- 베트남

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석

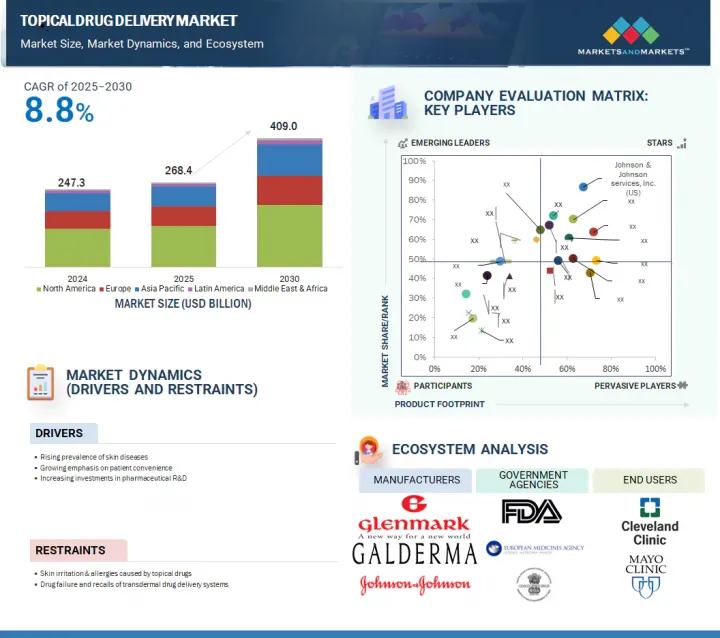

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드/제품 비교

- 주요 기업의 연구 개발비

- 기업 평가 및 재무 지표

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- JOHNSON & JOHNSON SERVICES, INC.

- GALDERMA

- BAYER AG

- NOVARTIS AG

- ABBVIE INC.

- GLENMARK PHARMACEUTICALS LIMITED

- GSK PLC.

- BAUSCH HEALTH COMPANIES INC.

- HISAMITSU PHARMACEUTICAL CO., INC.

- CIPLA

- VIATRIS INC.

- ORGANON GROUP OF COMPANIES

- PFIZER, INC.

- CRESCITA THERAPEUTICS INC.

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- SOLVENTUM

- LUYE PHARMA GROUP

- LEAD CHEMICAL CO., LTD.

- PURDUE PHARMA LP

- LAVIPHARM

- 기타 기업

- CMP PHARMA, INC.

- ENCORE DERMATOLOGY, INC.

- RUSAN PHARMA LTD.

- ADHEXPHARMA

제12장 부록

JHS 25.08.14The global topical drug delivery market is expected to reach USD 409.0 billion by 2030 from USD 268.4 billion in 2025, at a CAGR of 8.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Site of Application, and End User |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

The growth of this market can largely be attributed to the uptake of topical prescription therapy for dry eye diseases, the growing focus of pharmaceutical companies on the R&D of innovative transdermal drug delivery systems, the increasing prevalence of skin infections, and the rising preference for non-invasive drug delivery methods.

By product, the semi-solid formulations segment accounted for the largest market share in 2024.

By product, the topical drug delivery market is segmented into semi-solid formulations, liquid formulations, solid formulations, transdermal products, and other products. The large share of the semi-solid formulations segment is attributed to enhanced patient adherence with limited side effects, high absorption, and efficient provision of drug release. These dosage forms are non-dehydrating and do not modify skin functioning, fueling market growth.

By site of application, the dermal drug delivery segment accounted for the largest market share in 2024.

By site of application, the market is segmented into dermal drug delivery, ophthalmic drug delivery, rectal drug delivery, vaginal drug delivery, and nasal drug delivery. The large share of the dermal drug delivery segment can be attributed to the increasing product launches in the market. Fewer regulatory requirements and lower irritation than nasal or ophthalmic drug delivery also contribute to market growth. Dermal drug delivery through nanoemulsions is also suitable for chronic and autoimmune diseases, such as psoriasis and vitiligo.

By region, North America accounted for the largest market share in 2024.

By region, North America accounted for the largest share of the market in 2024. The large share of this region is attributed to the high risk of skin disorders, the rising prevalence of chronic diseases (such as diabetes), increasing use of contraceptives, the increasing geriatric population, and the growing focus of pharmaceutical companies on the R&D of innovative transdermal drug delivery systems.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By Company Type: Hospitals & Clinics (60%), Ambulatory Surgery Centers (25%), and Home Care Settings (15%)

- By Designation: Directors (35%), Vice Presidents (27%), Managers (22%), and Other Designations (16%)

- By Region: North America (40%), Europe (25%), the Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Key players in the Topical Drug Delivery Market

The prominent players in the topical drug delivery market are Johnson & Johnson Private Limited (US), Galderma (Switzerland), Bayer AG (Germany), Novartis International AG (Switzerland), AbbVie Inc. (US), GSK Plc. (UK), Bausch Health Companies Inc. (Canada), Glenmark Pharmaceuticals Ltd. (India), Hisamitsu Pharmaceuticals Inc. (Japan), Cipla (India), Boehringer Ingelheim International GmbH (Germany), Pfizer Inc. (US), Teva Pharmaceuticals Industries Ltd. (Israel), Viatris Inc. (US), Organon group of companies (US), Solventum (US), Crescita Therapeutics Inc. (Canada), Luye Pharma Group (China), Lead Chemical Co., Ltd. (Japan), Purdue Pharma L.P. (US), Lavipharm (Greece), CMP Pharma, Inc. (Germany), Encore Dermatology, Inc. (US), Rusan Pharma Ltd. (India), and AdhexPharma (France).

Research Coverage:

The report analyzes the topical drug delivery market. It aims to estimate the market size and future growth potential of this market based on various segments such as product, site of application, end user, and region. The report also includes a product portfolio matrix of various topical drug delivery products available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which in turn would help them garner a more significant share of the market. Firms purchasing the report could use one or any combination of the following strategies to strengthen their position in the market.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the topical drug delivery market. The report analyzes this market by product, site of application, and end users.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the topical drug delivery market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various topical drug delivery products across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the topical drug delivery market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the topical drug delivery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 MARKETS & REGIONS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.2.4 CURRENCY CONSIDERED

- 1.3 MARKET STAKEHOLDERS

- 1.4 LIMITATIONS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 APPROACH 1: REVENUE SHARE ANALYSIS

- 2.3.2 APPROACH 2: PHARMACEUTICAL SALES ANALYSIS

- 2.3.3 APPROACH 3: TOP-DOWN APPROACH

- 2.3.4 APPROACH 4: BOTTOM-UP APPROACH

- 2.3.5 APPROACH 4: PRIMARY INTERVIEWS

- 2.3.6 APPROACH 5: DEMAND-SIDE APPROACH

- 2.3.7 APPROACH 6: VOLUME DATA ANALYSIS

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.6.1 GROWTH RATE ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 TOPICAL DRUG DELIVERY MARKET OVERVIEW

- 4.2 ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT & COUNTRY (2024)

- 4.3 TOPICAL DRUG DELIVERY MARKET: REGIONAL MIX

- 4.4 TOPICAL DRUG DELIVERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 TOPICAL DRUG DELIVERY MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of skin disorders

- 5.2.1.2 High incidence of burn injuries

- 5.2.1.3 Growing emphasis on patient convenience

- 5.2.1.4 Increasing investments in pharmaceutical R&D

- 5.2.1.5 Rising incidence of chronic diseases

- 5.2.2 RESTRAINTS

- 5.2.2.1 Adverse skin reactions & allergies

- 5.2.2.2 Drug failure & recalls of TDD systems

- 5.2.2.3 High development costs of topical drug delivery products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing preference for self-administration and home care

- 5.2.3.2 High growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical barriers related to skin irritation & permeability

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCES IN TRANSDERMAL DRUG DELIVERY SYSTEMS

- 5.3.2 EMERGENCE OF MICRONEEDLE PATCH TECHNOLOGIES

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Nanocarrier-based delivery systems

- 5.4.1.2 Microemulsions & nanoemulsion

- 5.4.1.3 Thermosensitive & pH-sensitive hydrogels & hydrocolloids

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Microneedle-enhanced delivery

- 5.4.2.2 AI-assisted formulations & prediction models

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Wearable sensor-integrated topical patches

- 5.4.3.2 3D testing skin models

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY ANALYSIS

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR TOPICAL DRUG DELIVERY

- 5.7.2 INSIGHTS: JURISDICTION & TOP APPLICANT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE DATA FOR HS CODE 300490

- 5.8.1.1 Import data for HS Code 300490

- 5.8.1.2 Export data for HS Code 300490

- 5.8.1 TRADE DATA FOR HS CODE 300490

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2022-2024

- 5.9.2 AVERAGE SELLING PRICE OF OINTMENTS, BY KEY PLAYER, 2024

- 5.9.3 AVERAGE SELLING PRICE OF GELS, BY KEY PLAYER, 2024

- 5.9.4 AVERAGE SELLING PRICE, BY REGION

- 5.9.5 AVERAGE SELLING PRICE OF SEMI-SOLID FORMULATIONS, BY REGION, 2024

- 5.9.5.1 Average selling price trend of ointments, by region, 2022-2024

- 5.9.5.2 Average selling price trend of creams, by region, 2022-2024

- 5.9.5.3 Average selling price trend of gels, by region, 2022-2024

- 5.10 REIMBURSEMENT ANALYSIS

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 UNMET NEEDS/END-USER EXPECTATIONS

- 5.14 IMPACT OF AI ON TOPICAL DRUG DELIVERY MARKET

- 5.14.1 AI-USE CASES

- 5.15 PIPELINE ANALYSIS

- 5.16 ECOSYSTEM MARKET MAP

- 5.17 VALUE CHAIN ANALYSIS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 TRUMP TARIFF IMPACT ON TOPICAL DRUG DELIVERY MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 KEY IMPACT ON VARIOUS REGIONS

- 5.19.5 END-USE INDUSTRY IMPACT

6 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SEMI-SOLID FORMULATIONS

- 6.2.1 OINTMENTS

- 6.2.1.1 Wide applications in analgesic indications to drive market

- 6.2.2 CREAMS

- 6.2.2.1 High absorption capabilities to boost demand

- 6.2.3 LOTIONS

- 6.2.3.1 Convenient application to fuel uptake

- 6.2.4 GELS

- 6.2.4.1 Enhanced patient compliance and aesthetic appeal to drive market

- 6.2.5 PASTES

- 6.2.5.1 Prevention of skin irritation to fuel uptake

- 6.2.1 OINTMENTS

- 6.3 LIQUID FORMULATIONS

- 6.3.1 SUSPENSIONS

- 6.3.1.1 Higher rate of bioavailability and controlled onset of action to drive market

- 6.3.2 EMULSIONS

- 6.3.2.1 Versatile carriers for enhanced drug delivery to fuel uptake

- 6.3.3 SOLUTIONS

- 6.3.3.1 Uniform & rapid drug delivery to boost demand

- 6.3.1 SUSPENSIONS

- 6.4 SOLID FORMULATIONS

- 6.4.1 POWDERS

- 6.4.1.1 Inexpensive manufacturing and effectiveness against antifungal infections to propel market

- 6.4.2 SUPPOSITORIES

- 6.4.2.1 Ability to ensure drug compatibility to fuel market

- 6.4.3 FILM

- 6.4.3.1 Next-generation advancements to boost demand

- 6.4.1 POWDERS

- 6.5 TRANSDERMAL PRODUCTS

- 6.5.1 TRANSDERMAL PATCHES

- 6.5.1.1 Drug-in-adhesive patches

- 6.5.1.1.1 Enhanced drug release to fuel uptake

- 6.5.1.2 Matrix patches

- 6.5.1.2.1 Rising technological advancements to boost demand

- 6.5.1.3 Reservoir membrane patches

- 6.5.1.3.1 Prolonged drug delivery to fuel market

- 6.5.1.4 Microneedle patches

- 6.5.1.4.1 Ability to deliver APIs to support market growth

- 6.5.1.5 Iontophoresis patches

- 6.5.1.5.1 Low molecular weight patches to support market growth

- 6.5.1.6 Vapor patches

- 6.5.1.6.1 Ability to release essential oils to support market growth

- 6.5.1.1 Drug-in-adhesive patches

- 6.5.2 TRANSDERMAL GELS

- 6.5.2.1 Rapid release of drugs to fuel uptake

- 6.5.3 TRANSDERMAL SPRAYS

- 6.5.3.1 Targeted approach to boost demand

- 6.5.1 TRANSDERMAL PATCHES

- 6.6 OTHER PRODUCTS

7 TOPICAL DRUG DELIVERY MARKET, BY SITE OF APPLICATION

- 7.1 INTRODUCTION

- 7.2 DERMAL DRUG DELIVERY

- 7.2.1 STANDARD MEDIUM WITH HIGH DRUG ABSORPTION TO PROPEL MARKET

- 7.3 OPHTHALMIC DRUG DELIVERY

- 7.3.1 FOCUS ON MICROEMULSION-BASED FORMULATIONS TO BOOST DEMAND

- 7.4 VAGINAL DRUG DELIVERY

- 7.4.1 LIMITED INTERVENTION BY MEDICAL PERSONNEL TO DRIVE MARKET

- 7.5 RECTAL DRUG DELIVERY

- 7.5.1 COMBINATION OF LOCAL & SYSTEMIC THERAPY OF DRUGS TO FUEL UPTAKE

- 7.6 NASAL DRUG DELIVERY

- 7.6.1 QUICK ONSET OF DRUG ACTION & CONVENIENCE TO SUPPORT MARKET UPTAKE

8 TOPICAL DRUG DELIVERY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOME CARE SETTINGS

- 8.2.1 HIGH PREFERENCE, AFFORDABILITY, AND CONVENIENCE TO PROPEL MARKET

- 8.3 HOSPITALS & CLINICS

- 8.3.1 ADOPTION OF TOPICAL ANAESTHETICS FOR MEDICAL & SURGICAL SUB-SPECIALTIES TO DRIVE MARKET

- 8.4 AMBULATORY SURGERY CENTERS

- 8.4.1 UTILIZATION OF ANTIMICROBIAL TOPICAL DRUGS FOR TRAUMA CASES TO BOOST DEMAND

- 8.5 BURN CARE CENTERS

- 8.5.1 HIGH INCIDENCE OF BURN INJURIES AND UPTAKE OF OINTMENTS TO SUPPORT MARKET GROWTH

- 8.6 OTHER END USERS

9 TOPICAL DRUG DELIVERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising prevalence of skin diseases to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising prevalence of hypertension and funding for topical drugs research to drive market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Growing focus of R&D for pharmaceutical API development to boost demand

- 9.3.3 UK

- 9.3.3.1 Rising demand for painless treatment alternatives to fuel market

- 9.3.4 FRANCE

- 9.3.4.1 Rising incidence of diabetes and subsequent increase in skin lesions to drive market

- 9.3.5 ITALY

- 9.3.5.1 Rising demand for transdermal patches to propel market

- 9.3.6 SPAIN

- 9.3.6.1 Expanding research hub to fuel market

- 9.3.7 NETHERLANDS

- 9.3.7.1 Public awareness initiatives for preventive care to fuel uptake

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rising cases of communicable diseases to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Increasing number of product approvals to drive market

- 9.4.4 INDIA

- 9.4.4.1 Growing focus on adoption of non-invasive drug delivery methods to drive market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increasing number of smokers to fuel uptake

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Favorable government focus on expanding clinical trials to boost demand

- 9.4.7 THAILAND

- 9.4.7.1 Regulatory reforms and supportive healthcare initiatives to support market growth

- 9.4.8 VIETNAM

- 9.4.8.1 Increasing investments and regulatory reforms to fuel uptake

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 High prevalence of diabetes to propel market growth

- 9.5.3 MEXICO

- 9.5.3.1 Increasing prevalence of glaucoma to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Kingdom of Saudi Arabia (KSA)

- 9.6.2.1.1 Expanding healthcare infrastructure to boost demand

- 9.6.2.2 United Arab Emirates (UAE)

- 9.6.2.2.1 Increasing prevalence of diabetes to fuel uptake

- 9.6.2.3 Other GCC Countries

- 9.6.2.1 Kingdom of Saudi Arabia (KSA)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TOPICAL DRUG DELIVERY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 RANKING OF KEY MARKET PLAYERS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Site of application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SME players

- 10.6.5.2 Competitive benchmarking of key emerging players/startups

- 10.7 BRAND/PRODUCT COMPARISON

- 10.7.1 TOPICAL DRUG DELIVERY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.8 R&D EXPENDITURE OF KEY PLAYERS

- 10.8.1 R&D EXPENDITURE OF KEY PLAYERS IN TOPICAL DRUG DELIVERY MARKET

- 10.9 COMPANY VALUATION & FINANCIAL METRICS

- 10.9.1 FINANCIAL METRICS

- 10.9.2 COMPANY VALUATION

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 GALDERMA

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 BAYER AG

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 NOVARTIS AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.3.2 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 ABBVIE INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Expansions

- 11.1.5.3.3 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 GLENMARK PHARMACEUTICALS LIMITED

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product approvals

- 11.1.6.3.2 Deals

- 11.1.7 GSK PLC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Other developments

- 11.1.8 BAUSCH HEALTH COMPANIES INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.9 HISAMITSU PHARMACEUTICAL CO., INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches, enhancements, and approvals

- 11.1.9.3.2 Deals

- 11.1.9.3.3 Expansions

- 11.1.10 CIPLA

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 VIATRIS INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.11.3.3 Other developments

- 11.1.12 ORGANON GROUP OF COMPANIES

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product approvals

- 11.1.12.3.2 Deals

- 11.1.13 PFIZER, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product approvals

- 11.1.13.3.2 Deals

- 11.1.14 CRESCITA THERAPEUTICS INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Deals

- 11.1.14.3.2 Other developments

- 11.1.15 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.15.3.2 Expansions

- 11.1.16 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Deals

- 11.1.17 SOLVENTUM

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Deals

- 11.1.18 LUYE PHARMA GROUP

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product approvals

- 11.1.18.3.2 Deals

- 11.1.19 LEAD CHEMICAL CO., LTD.

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.20 PURDUE PHARMA L.P.

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.21 LAVIPHARM

- 11.1.21.1 Business overview

- 11.1.21.2 Products offered

- 11.1.1 JOHNSON & JOHNSON SERVICES, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 CMP PHARMA, INC.

- 11.2.2 ENCORE DERMATOLOGY, INC.

- 11.2.3 RUSAN PHARMA LTD.

- 11.2.4 ADHEXPHARMA

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS