|

시장보고서

상품코드

1795412

디지털 저작권 관리 시장(-2030년) : 구성요소별(솔루션, 서비스), 용도별(오디오 컨텐츠, 이미지, 비디오 컨텐츠, 기밀 문서, 소프트웨어 및 게임), 산업별(BFSI, 교육 및 트레이닝, 미디어 및 엔터테인먼트)Digital Rights Management Market by Component (Solutions and Services), Application (Audio Content, Images, Video Content, Confidential Documents, Software & Games), Vertical (BFSI, Education & Training, Media & Entertainment) - Global Forecast to 2030 |

||||||

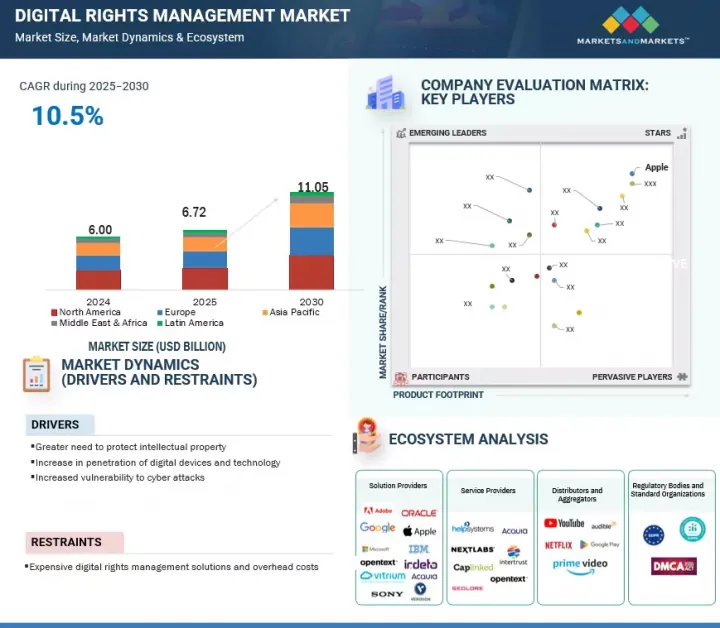

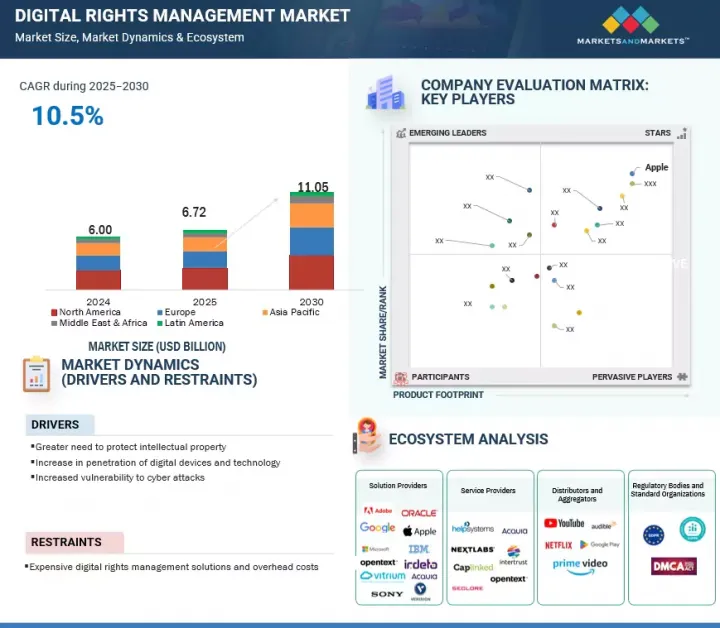

디지털 저작권 관리 시장 규모는 2025년 67억 2,000만 달러에서 예측 기간 동안 CAGR 10.5%로 성장하여 2030년에는 110억 5,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문별 | 구성요소별, 용도별, 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

AI와 클라우드 네이티브 배포로의 전환은 기업이 디지털 컨텐츠를 보호하고 플랫폼 간 사용권을 행사하는 방식에 큰 변화를 가져오고 있습니다. 이러한 최신 DRM(디지털 저작권 관리) 기술을 통해 조직은 스트리밍 플랫폼, 전자책, 기업 문서, 소프트웨어 등 디지털 자산에 대한 액세스를 실시간으로 제어하고, 클라우드 환경 및 컨텐츠 전송 네트워크(CDN)와 원활하게 통합할 수 있습니다. 클라우드 기반 DRM은 미디어, 출판, 기업 생태계에서 분산형 소비 모델을 지원하는 데 필수적인 확장성, 원격 정책 시행, 중앙 집중식 라이선스 관리 기능을 제공합니다. 또한, AI와 머신러닝은 이상 감지, 예측적 불법복제 감시, 불법 공유 및 유출을 방지하는 지능형 접근 제어를 실현하며 DRM에서 그 역할이 커지고 있습니다.

"예측 기간 동안 교육 및 훈련 부문이 예측 기간 동안 가장 큰 성장을 이룰 것으로 예상됩니다."

E-Learning 플랫폼과 디지털 학습 리소스의 급속한 확장이 이 부문의 성장을 주도하고 있습니다. 대규모 공개 온라인 강좌(MOOC)와 디지털 출판물의 보급으로 지적 재산을 보호하고, 교재의 무단 복제를 방지하기 위해 DRM이 필요하게 되었습니다. Digify와 같은 솔루션은 기밀 문서를 보호하고 라이선스 계약 준수를 보장합니다. 원격 학습의 확대는 안전한 디지털 컨텐츠 전송에 대한 수요를 더욱 증가시키고 있습니다.

"예측 기간 동안 아시아태평양이 가장 높은 성장률을 기록할 것으로 예상됩니다."

아시아태평양은 DRM 기술 개발에 대한 투자와 참여로 인해 DRM 산업의 핫스팟이 되고 있습니다. 이 지역은 급속한 디지털화와 인터넷 보급의 발전에 힘입어 성장하고 있습니다. 중국, 인도, 일본과 같은 국가들이 엔터테인먼트 및 게임 산업의 확장으로 이 지역을 주도하고 있습니다. 인도 정보 기술부의 워터마크 기술 프로젝트와 같은 정부의 노력도 DRM 채택을 촉진하고 있습니다.

세계의 디지털 저작권 관리 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 디지털 저작권 관리 시장 : 간단한 역사

- 공급망 분석

- 생태계 분석

- 가격 분석

- 기술 분석

- 사례 연구 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 특허 분석

- Porter's Five Forces 분석

- 규제 상황

- 주요 이해관계자와 구입 기준

- 2025-2026년의 주요 회의와 이벤트

- 디지털 저작권 관리 시장의 베스트 프랙티스

- 디지털 저작권 관리 시장 기술 로드맵

- 투자와 자금 조달 시나리오

- 디지털 저작권 관리 비즈니스 모델

- AI/생성형 AI가 디지털 저작권 관리 시장에 미치는 영향

- 2025년 미국 관세의 영향

제6장 디지털 저작권 관리 시장 : 구성요소별

- 솔루션

- 서비스

- 컨설팅

- 통합

- 운영과 유지보수

제7장 디지털 저작권 관리 시장 : 용도별

- 오디오 컨텐츠

- 이미지

- 비디오 컨텐츠

- 기밀 문서, 스프레드시트, 프리젠테이션

- 소프트웨어와 게임

- 전자책

- 기타

제8장 디지털 저작권 관리 시장 : 산업별

- 은행·금융 서비스·보험

- 교육·훈련

- 연구·출판

- 미디어 및 엔터테인먼트

- IT·ITES

- 헬스케어

- 법률

- 기타

제9장 디지털 저작권 관리 시장 : 지역별

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 전망

- 영국

- 독일

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 중국

- 인도

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- 중동

- 아프리카

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제10장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

- 브랜드/제품 비교

- 기업 평가와 재무 지표

제11장 기업 개요

- 주요 기업

- ADOBE SYSTEMS

- GOOGLE LLC

- MICROSOFT CORPORATION

- APPLE

- ORACLE

- IBM

- IRDETO

- OPENTEXT

- KUDELSKI GROUP

- SONY CORPORATION

- VERISIGN INC

- ACQUIA

- OVHCLOUD

- FORTRA

- SME/스타트업

- VITRIUM SYSTEMS

- NEXTLABS

- VERIMATRIX

- SECLORE

- VAULTIZE

- BITMOVIN

- EDITIONGUARD

- EZDRM

- INTERTRUST TECHNOLOGIES

- ARTISTSCOPE

- CAPLINKED

- BYNDER

- DIGIFY

제12장 인접 시장/관련 시장

제13장 부록

KSM 25.08.29The digital rights management market is estimated at USD 6.72 billion in 2025 and is expected to reach USD 11.05 billion by 2030 at a CAGR of 10.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Component, Application, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The shift toward AI, cloud-native deployment, is revolutionizing how enterprises secure digital content and enforce usage rights across platforms. These modern DRM technologies enable organizations to control access to digital assets in real time across streaming platforms, eBooks, enterprise documents, and software, while integrating seamlessly with cloud environments and content delivery networks (CDNs). Cloud-based DRM offers scalability, remote policy enforcement, and centralized license management, which is essential for supporting distributed consumption models in media, publishing, and corporate ecosystems. AI and machine learning play a growing role in DRM, powering anomaly detection, predictive piracy monitoring, and intelligent access control to prevent unauthorized sharing or leaks.

As data privacy regulations intensify and digital assets grow more valuable, businesses are prioritizing flexible DRM platforms that support compliance, geo-blocking, offline access, and watermarking. These innovations are shifting DRM from static access tools to dynamic security frameworks, enabling content owners to deliver protected experiences with speed, adaptability, and data-informed control, driving the next wave of secure digital content consumption.

"The education and training vertical segment will witness the fastest growth during the forecast period."

The rapid expansion of e-learning platforms and digital learning resources drives the education and training vertical. The proliferation of massive open online courses (MOOCs) and digital publications necessitates DRM to protect intellectual property and prevent unauthorized duplication of course materials. Solutions such as Digify protect sensitive documents and ensure compliance with licensing agreements. The rise of remote learning has increased demand for secure digital content distribution.

"Integration service segment is expected to have the largest market size during the forecast period."

Integration services are a critical component of the DRM market, driven by the need to seamlessly incorporate DRM solutions into existing IT ecosystems. Its demand is further propelled by the complexity of integrating DRM with platforms like OTT, IPTV, and enterprise systems, ensuring secure content delivery without disrupting workflows. The rise of cloud-based DRM, such as Microsoft's PlayReady integration with Azure Media Services, requires expert integration to support multi-device streaming and compliance with licensing agreements. Industries like media and entertainment, with growing digital content repositories, rely on integration services to manage large-scale deployments.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The investment and participation of Asia Pacific in the development of DRM technology have made the region a hotspot for this industry. The region is driven by rapid digitalization and increasing internet penetration. Countries like China, India, and Japan lead due to their expanding entertainment and gaming industries. Government initiatives, such as India's watermarking projects by the Department of Information Technology, enhance DRM adoption. The rise of OTT platforms like Mola.tv, secured by Verimatrix, reflects the region's focus on secure content delivery. High population density and growing cyber threats, as reported by the Data Security Council of India, further necessitate robust DRM solutions to safeguard digital assets and ensure compliance with copyright regulations.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C-level - 35%, D-level - 30%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, Middle East & Africa - 5%, Latin America - 5%

The major players in the digital rights management market include Adobe Systems (US), Google LLC (US), Microsoft Corporation (US), Apple (US), Oracle (US), IBM (US), Irdeto (Netherlands), OpenText (Canada), Kudelski Group (Switzerland), Sony Corporation (Japan), Verisign Inc (US), Acquia (US), OVH Cloud (France), Fortra (US), Vitrium Systems (Canada), NextLabs (US), Verimatrix (France), Seclore (US), Digify (US), Bitmovin (US), EditionGuard (US), EZDRM (US), Intertrust Technologies (Us), ArtistScope (Australia), CapLinked (US), Vaultize (India), and Bynder (Netherlands). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, enhancements, and acquisitions, to expand their digital rights management market footprint.

Research Coverage

- The market study covers the digital rights management market size and the growth potential across different segments, including components, applications, verticals, and regions. The offerings are sub-segmented into solutions and services. The services studied under the digital rights management market include consulting, integration, operation & maintenance. The application segment includes audio content, images, video content, confidential documents, spreadsheets & presentations, software & games, eBooks, and other applications. The vertical segment includes BFSI, education & training, research & publications, media & entertainment, IT & ITeS, healthcare, legal, and other verticals. The regional analysis of the digital rights management market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global digital rights management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain insights, and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

1. Analysis of key drivers (Greater need to protect intellectual property, increase in penetration of digital devices and technology, Increased vulnerability to cyber-attacks), restraints (Expensive digital rights management solutions and overhead costs), opportunities (Expansion of OTT platforms, Rise in corporate need to protect data), and challenges (Unclear legal precedents) influencing the growth of the digital rights management market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital rights management market

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the digital rights management market across various regions.

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the digital rights management market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Adobe Systems (US), Google LLC (US), Microsoft Corporation (US), Apple (US), Oracle (US), IBM (US), Irdeto (Netherlands), OpenText (Canada), Kudelski Group (Switzerland), Sony Corporation (Japan), Verisign Inc (US), Acquia (US), OVH Cloud (France), Fortra (US), Vitrium Systems (Canada), NextLabs (US), Verimatrix (France), Seclore (US), Digify (US), Bitmovin (US), EditionGuard (US), EZDRM (US), Intertrust Technologies (Us), ArtistScope (Australia), CapLinked (US), Vaultize (India), and Bynder (Netherlands).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DIGITAL RIGHTS MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.2.4 DIGITAL RIGHTS MANAGEMENT MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL RIGHTS MANAGEMENT MARKET

- 4.2 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT

- 4.3 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION

- 4.4 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL

- 4.5 NORTH AMERICA: DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION AND VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Greater need to protect intellectual property

- 5.2.1.2 Increase in penetration of digital devices and technology

- 5.2.1.3 Increased vulnerability to cyberattacks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expensive digital rights management solutions and overhead costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of OTT platforms

- 5.2.3.2 Rise in corporate need to protect data

- 5.2.4 CHALLENGES

- 5.2.4.1 Unclear legal precedents

- 5.2.1 DRIVERS

- 5.3 DIGITAL RIGHTS MANAGEMENT MARKET: BRIEF HISTORY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- 5.6.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY PRICING MODEL

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Encryption

- 5.7.1.2 Digital watermarking

- 5.7.1.3 Content fingerprinting

- 5.7.1.4 Conditional access system (CAS)

- 5.7.1.5 Artificial intelligence (AI) and machine learning (ML)

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 High-bandwidth digital content protection (HDCP)

- 5.7.2.2 Content delivery network (CDN)

- 5.7.2.3 Augmented/virtual reality

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Blockchain

- 5.7.3.2 Multi-factor authentication (MFA)

- 5.7.3.3 Cloud computing

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: TATA SKY CHOSE IRTEDO AS A STRATEGIC PARTNER TO SECURE OTT CONTENT

- 5.8.2 CASE STUDY 2: WOHLERS ASSOCIATES DEPLOYED DRM SOLUTIONS PROVIDED BY VITRIUM

- 5.8.3 CASE STUDY 3: CITY ONLINE MEDIA USED PALLYCON'S MULTI-DRM SOLUTION

- 5.8.4 CASE STUDY 4: FLUTTERWAVE USES DIGIFY TO SECURELY SHARE FUNDRAISING DOCUMENTS

- 5.8.5 CASE STUDY 5: DIGIFY PROTECTS RTD LEARNING'S COURSE MATERIALS FROM UNAUTHORIZED ACCESS

- 5.8.6 CASE STUDY 6: PALLYCON DELIVERED A MULTI-DRM SOLUTION TO VIDIO.COM

- 5.8.7 CASE STUDY 7: FTI CONSULTING DEPLOYS ROBUST WATERMARKING TECHNIQUE OF CAPLINKED

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.1.2 Canada

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 China

- 5.12.2.3.2 India

- 5.12.2.3.3 Australia

- 5.12.2.3.4 Japan

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 Middle East

- 5.12.2.4.2 South Africa

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazil

- 5.12.2.5.2 Mexico

- 5.12.2.1 North America

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 BEST PRACTICES IN DIGITAL RIGHTS MANAGEMENT MARKET

- 5.16 TECHNOLOGY ROADMAP FOR DIGITAL RIGHTS MANAGEMENT MARKET

- 5.16.1 SHORT-TERM ROADMAP (2025-2026)

- 5.16.2 MID-TERM ROADMAP (2026-2028)

- 5.16.3 LONG-TERM ROADMAP (2028-2030)

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 BUSINESS MODELS OF DIGITAL RIGHTS MANAGEMENT

- 5.18.1 CURRENT BUSINESS MODELS

- 5.18.2 EMERGING BUSINESS MODELS

- 5.19 IMPACT OF AI/GENERATIVE AI ON DIGITAL RIGHTS MANAGEMENT MARKET

- 5.19.1 USE CASES OF GENERATIVE AI IN DIGITAL RIGHTS MANAGEMENT

- 5.20 IMPACT OF 2025 US TARIFF - DIGITAL RIGHTS MANAGEMENT MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 DIGITAL RIGHTS MANAGEMENT MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 GROWING NEED TO PROTECT CRITICAL BUSINESS-RELATED INFORMATION

- 6.3 SERVICES

- 6.3.1 CONTINUAL SERVICE RESPONSE DEMAND FROM CONSULTANTS

- 6.3.2 CONSULTING

- 6.3.3 INTEGRATION

- 6.3.4 OPERATION AND MAINTENANCE

7 DIGITAL RIGHTS MANAGEMENT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 7.2 AUDIO CONTENT

- 7.2.1 USE OF MP4 FORMAT TO INTEGRATE MULTI-DRM IN AUDIO CONTENT

- 7.3 IMAGES

- 7.3.1 NEED TO PREVENT DOWNLOADING, SHARING, AND MODIFICATION OF IMAGES

- 7.4 VIDEO CONTENT

- 7.4.1 GROWTH OF SECURE STREAMING OF DIGITAL VIDEO CONTENT

- 7.5 CONFIDENTIAL DOCUMENTS, SPREADSHEETS, AND PRESENTATION

- 7.5.1 GREATER NEED TO PROTECT SENSITIVE DOCUMENTS FROM UNAUTHORIZED ACCESS

- 7.6 SOFTWARE AND GAMES

- 7.6.1 GROWTH OF CONTENT SECURITY THREATS IN GAMING INDUSTRY

- 7.7 EBOOKS

- 7.7.1 DEMAND TO KEEP UNAUTHORIZED DISTRIBUTION OF EBOOKS IN CHECK

- 7.8 OTHER APPLICATIONS

8 DIGITAL RIGHTS MANAGEMENT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: DIGITAL RIGHTS MANAGEMENT MARKET DRIVERS

- 8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.2.1 HIGHER THREAT OF CYBER ATTACKS IN BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.3 EDUCATION AND TRAINING

- 8.3.1 INCREASE IN DIGITAL TRANSFORMATION AND E-LEARNING PLATFORMS

- 8.4 RESEARCH AND PUBLICATIONS

- 8.4.1 NEED TO MAINTAIN AUTHENTICITY AND CREDIBILITY OF PUBLICATIONS

- 8.5 MEDIA AND ENTERTAINMENT

- 8.5.1 RISE IN NEED TO PROTECT DATA FROM ALARMING PIRACY STATISTICS

- 8.6 IT AND ITES

- 8.6.1 NEED TO ENHANCE SECURITY OF CONFIDENTIAL DOCUMENTS

- 8.7 HEALTHCARE

- 8.7.1 PROTECTION OF SENSITIVE HEALTHCARE INFORMATION

- 8.8 LEGAL

- 8.8.1 NEED BY FIRMS TO STAY LEGALLY COMPLIANT AND KEEP DOCUMENTS SECURE

- 8.9 OTHER VERTICALS

9 DIGITAL RIGHTS MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Need for efficient data protection solutions to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increase in cyber solutions to protect businesses from data loss

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Rising need to reduce data breaches

- 9.3.3 GERMANY

- 9.3.3.1 High demand for data protection solutions

- 9.3.4 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Increase in data breaches to drive demand

- 9.4.3 INDIA

- 9.4.3.1 Higher demand for strong content protection systems

- 9.4.4 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Increasing adoption of DRM solutions due to rising cybercrimes

- 9.5.3 AFRICA

- 9.5.3.1 Greater cloud adoption to increase demand

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Increasing investment in digital infrastructure

- 9.6.3 MEXICO

- 9.6.3.1 Growth in innovations to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2021-2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Vertical footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/ SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.7.2 DEALS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPANY VALUATION AND FINANCIAL METRICS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 ADOBE SYSTEMS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MNM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 GOOGLE LLC

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.3.2 Deals

- 11.1.2.4 MNM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 MICROSOFT CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 APPLE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MNM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ORACLE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MNM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 IBM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 IRDETO

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 OPENTEXT

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 KUDELSKI GROUP

- 11.1.10 SONY CORPORATION

- 11.1.11 VERISIGN INC

- 11.1.12 ACQUIA

- 11.1.13 OVHCLOUD

- 11.1.14 FORTRA

- 11.1.1 ADOBE SYSTEMS

- 11.2 SMES/STARTUPS

- 11.2.1 VITRIUM SYSTEMS

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches and enhancements

- 11.2.2 NEXTLABS

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches and enhancements

- 11.2.3 VERIMATRIX

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches and enhancements

- 11.2.3.3.2 Deals

- 11.2.4 SECLORE

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches and enhancements

- 11.2.4.3.2 Deals

- 11.2.5 VAULTIZE

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.6 BITMOVIN

- 11.2.7 EDITIONGUARD

- 11.2.8 EZDRM

- 11.2.9 INTERTRUST TECHNOLOGIES

- 11.2.10 ARTISTSCOPE

- 11.2.11 CAPLINKED

- 11.2.12 BYNDER

- 11.2.13 DIGIFY

- 11.2.1 VITRIUM SYSTEMS

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 DIGITAL ASSET MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 DIGITAL ASSET MANAGEMENT MARKET, BY OFFERING

- 12.2.3 DIGITAL ASSET MANAGEMENT MARKET, BY BUSINESS FUNCTION

- 12.2.4 DIGITAL ASSET MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.2.5 DIGITAL ASSET MANAGEMENT MARKET, BY VERTICAL

- 12.2.6 DIGITAL ASSET MANAGEMENT MARKET, BY REGION

- 12.3 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY OFFERING

- 12.3.3 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY BUSINESS FUNCTION

- 12.3.4 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY APPLICATION

- 12.3.5 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY VERTICAL

- 12.3.6 ENTERPRISE FILE SYNCHRONIZATION AND SHARING (EFSS) MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS