|

시장보고서

상품코드

1795419

코코아 및 초콜릿 시장 : 코코아 유형별, 초콜릿 유형별, 성질별, 용도별, 제품 형태별, 유통 채널별, 지역별 예측(-2030년)Cocoa and Chocolate Market by Cocoa Type (Butter, Powder, Liquor), Chocolate Type (Dark, Milk, White, Filled), Nature (Conventional, Organic), Application, Product Form, Distribution Channel, and Region - Global Forecast to 2030 |

||||||

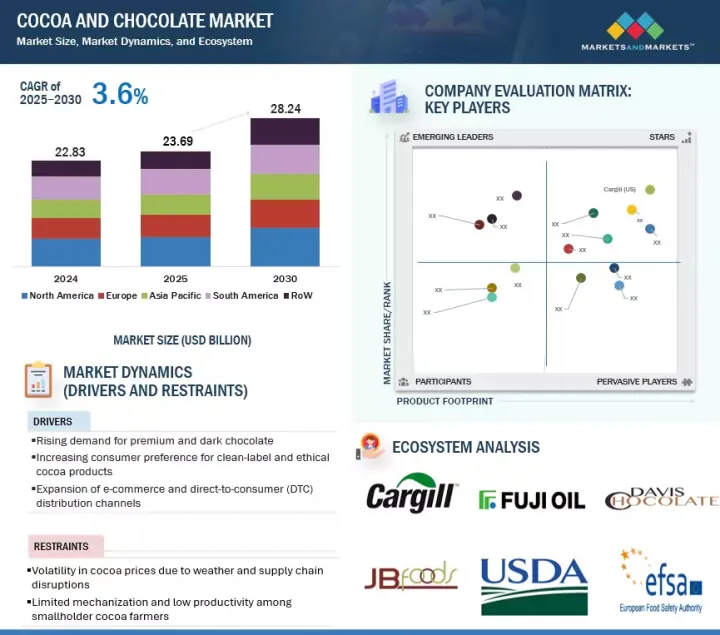

세계의 코코아 및 초콜릿 시장 규모는 2025년 추정 236억 9,000만 달러에서 2030년까지 282억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR 3.6%의 성장이 예상됩니다. 코코아 초콜릿은 과자류, 베이커리 제품, 음료, 유제품, 건강 용도 등에서 이용되고 있으며, 세계 소비 패턴에서 중요한 역할을 하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2025-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러 |

| 부문 | 코코아 유형, 용도, 성질, 초콜릿 유형, 유통 채널, 제품 형태, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

시장 성장의 주요 촉진요인은 건강 효과와 호화로운 경험의 조합에 대한 수요 증가와 윤리적 조달에 대한 관심입니다. 또한 다양한 맛과 형태에 대한 선호도가 높아집니다.

소비자층의 변화 외에도 도시화와 디지털 상거래의 확대로 시장은 소비자에게 더 친숙해지고 있습니다. 지속가능성이 중요한 관심사가 되고, 제조업체 각사는 추적 가능성가 있는 조달과 환경친화적인 활동을 우선하게 되어 있습니다. 이러한 동향을 받아 기업은 경쟁력을 유지하기 위해 연구개발, 제품의 커스터마이즈, 고급품에 대한 투자를 늘리고 있습니다.

이 산업의 성장 가능성은 가처분 소득 증가와 소매 인프라 개선이 코코아 초콜릿 소비에 긍정적인 영향을 미치는 신흥 경제 지역에서 특히 높습니다.

"전통적인 코코아는 비용 효율성, 확립된 공급망 및 대량 시장 용도의 지속적인 수요로 인해 크게 성장하고 있습니다."

전통적인 코코아는 초콜릿 제조, 베이커리 제품, 유제품 및 음료에 널리 사용되기 때문에 세계 시장을 독점하고 있습니다. 유기농 코코아나 스페셜티 코코아에 비해 경쟁력 있는 가격 설정은 저비용 대량 판매에 중점을 둔 선도적인 제조업체에게 특히 매력적입니다. 코트디부아르, 가나, 나이지리아와 같은 주요 카카오 생산국은 기존의 카카오 공급에 크게 기여하고 안정적이고 충분한 시장을 확보하고 있습니다.

또한 구매력과 가격 고려가 소비자의 의사결정에 영향을 미치는 신흥경제권에서는 전통적인 카카오에 대한 강한 수요가 발생하고 있습니다. 주요 제조업체로서 다국적 초콜릿 기업은 벌크 조달과 장기 계약을 통해 주력 제품을 위한 기존의 카카오를 조달하고 있습니다. 오가닉 코코아나 페어 트레이드 코코아 등의 부문은 점차 받아들여지고 있습니다만, 기존 카카오의 주류의 소구력에 비하면 틈새 시장에 머물고 있습니다. 전반적으로 전통적인 코코아는 확장성, 다목적 및 가격 경쟁력으로 산업의 주요 성장 부문이되었습니다.

"다크 초콜릿 부문이 코코아 초콜릿 시장의 초콜릿 유형 부문에서 큰 점유율을 차지했습니다."

소비자는 카카오 함량이 높은 다크 초콜릿을 선호합니다. 카카오 비율이 높을수록 우유 초콜릿에 비해 심장 건강 상태 향상, 항산화 작용, 낮은 당도 등 건강상의 이점으로 이어지는 경우가 많습니다. 이 추세는 저당도 식물 유래의 선택을 요구하는 수요 증가와 일치합니다. National Confectioners Association(NCA)에 따르면 2024년 설문조사는 소비자의 61%가 건강상의 이점에서 어두운 초콜릿을 선호한다고 답했습니다.

이 시프트는 최근 몇 년 동안 주요 초콜릿 제조업체의 주목을 받고 있습니다. 예를 들어 2023년 3월, Lindt & Sprungli는 고강도 카카오 프로파일 수요에 부응하기 위해 카카오 95%의 다크 초콜릿을 더해 EXCELLENCE 포트폴리오를 확대했습니다. 2024년 4월 Nestle은 KitKat을 특징으로 하는 Mindful Chocolate 시리즈를 유럽에서 출시하여 마그네슘과 카모마일 추출물 등 기능적 효과를 제공하는 다크 초콜릿을 두드러지게 했습니다.

소비자가 적은 원료, 유기농 인증 및 윤리적 조달을 뒷받침하는 라벨이있는 어두운 초콜릿을 선호하기 때문에 깨끗한 라벨 제품에 대한 동향은 더욱 성장을 가속합니다. 이러한 선호도는 북미와 유럽에서 현저하게 확대되어 초콜릿 시장에서 가장 급성장하고 있는 부문 중 하나가 되고 있습니다.

이 보고서는 세계의 코코아 초콜릿 시장에 대해 조사 분석하여 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 코코아 시장에서의 매력적인 기회

- 초콜릿 시장에서의 매력적인 기회

- 코코아 시장 : 주요 지역 서브마켓의 성장률

- 초콜릿 시장 : 주요 지역 서브 마켓의 성장률

- 아시아태평양의 코코아 시장 : 유형별, 국가별

- 유럽 초콜릿 시장 : 유형별, 국가별

- 코코아 시장 : 유형별

- 코코아 시장 : 용도별

- 코코아 시장 : 지역별

- 초콜릿 시장 : 유형별

- 초콜릿 시장 : 지역별

제5장 시장 개요

- 소개

- 거시경제지표

- 세계의 GDP 성장률

- 1인당 소득 증가(신흥 시장 확대)

- 무역의 자유화와 자유무역협정

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 코코아 및 초콜릿에 대한 생성형 AI의 영향

- 소개

- 코코아 초콜릿에서 생성형 AI의 사용

- 사례 연구 분석

- 코코아 및 초콜릿 시장에 대한 영향

- 생성형 AI에 임하는 인접 에코시스템

제6장 산업 동향

- 소개

- 공급망 분석

- 밸류체인 분석

- 무역 분석

- HS코드 18 수출 데이터(2020-2024년)

- HS코드 18 수입 데이터(2020-2024년)

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별

- 평균 판매 가격의 동향 : 제품 유형별

- 평균 판매 가격 : 지역별

- 생태계 분석

- 재배자

- 중개업자

- 코코아 가공업자

- 초콜릿 제조업체

- 소매업체

- 고객사업에 영향을 주는 동향/혼란

- 특허 분석

- 주요 회의 및 이벤트

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 틀

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 사례 연구 1 : 초콜릿 제조업체에 영향을 주는 코코아 부족 위기(2024-2025년)

- 사례 연구 2 : BARRY CALLEBAUT의 2세대 초콜릿

- 사례 연구 3 : 인도네시아에서 CARGILL과 NESTLE의 코코아 계획

- 투자 및 자금조달 시나리오

- 2025년 미국 관세의 영향 - 코코아 및 초콜릿 시장

- 소개

- 주요 관세율

- 코코아 및 초콜릿의 혼란

- 가격의 영향 분석

- 국가 및 지역에 대한 영향

- 최종 이용 산업에 미치는 영향

제7장 코코아 시장 : 유형별

- 소개

- 코코아 버터

- 코코아 파우더

- 코코아 리큐어

제8장 코코아 시장 : 용도별

- 소개

- 식음료

- 과자류

- 베이커리

- 기타 식품 및 음료 용도

- 화장품

- 의약품

제9장 코코아 시장 : 성질별

- 소개

- 기존 코코아

- 유기농 코코아

제10장 초콜릿 시장 : 유형별

- 소개

- 다크 초콜릿

- 밀크 초콜릿

- 화이트 초콜릿

- 필드 초콜릿

제11장 초콜릿 시장 : 유통 채널별

- 소개

- 오프라인

- 전자상거래

제12장 초콜릿 시장 : 용도별

- 소개

- 식품 및 음료(B2C 및 푸드서비스)

- 베이커리 및 과자류 제품

- 기능성 및 영양제품

- 퍼스널케어 및 화장품

- 의약품

- 프리미엄 초콜릿 및 선물 초콜릿

제13장 초콜릿 시장 : 제품 형태별

- 소개

- 블록, 슬래브, 바

- 파우더

- 칩스 및 드롭스

- 액체(시럽 및 코팅)

- 페이스트 및 스프레드

- 카카오콩(생 또는 볶음)

- 과립/셰이빙

제14장 코코아 초콜릿 시장 : 프로세스별

- 소개

- 콩 조달

- 로스팅 및 선별

- 분쇄 및 프레스

- 혼합 및 콘칭

- 성형 및 코팅

- 품질 체크

- 알레르겐 컨트롤

- 배치 추적 가능성

- 지속가능한 프로세스

제15장 코코아 및 초콜릿 시장 : 기술별

- 소개

- 발효제어

- 콘칭 시스템

- 로스팅 기술

- 맛 캡슐화

- 품질 모니터링 AI

- IoT 통합

- 3D 프린팅의 응용

- 스마트 포장

- 콜드체인 기술

제16장 코코아 및 초콜릿 시장 : 지역별

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 독일

- 영국

- 스페인

- 이탈리아

- 벨기에

- 스위스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 기타 지역

- 아프리카

- 중동

제17장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2024년)

- 수익 분석, 2022-2024년

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제18장 기업 프로파일

- 주요 기업

- CARGILL, INCORPORATED

- BARRY CALLEBAUT

- OLAM GROUP

- FUJI OIL CO., LTD.

- GUAN CHONG BERHAD(GCB)

- JB COCOA, A SUBSIDIARY OF JB FOODS LIMITED

- ECOM AGROINDUSTRIAL CORP. LIMITED.

- NATRA

- KRUGER GROUP

- MAX FELCHLIN AG

- VALRHONA

- SUCESORES DE JOSE JESUS RESTREPO & CIA. SA

- PURATOS GROUP

- UNITED COCOA PROCESSOR, INC.

- COCOA PROCESSING COMPANY LIMITED(CPC)

- 기타 기업

- SIERRA NATURALS

- CHOCOLATERIE DE L'OPERA

- COCOA FAMILY

- REPUBLICA DEL CACAO

- CAMPCO CHOCOLATES

- JINDAL COCOA

- GENCAU.BR

- FRIIS-HOLM CHOKOLADE

- DAVIS CHOCOLATE

- LOTUS CHOCOLATE COMPANY LTD

제19장 부록

JHS 25.08.28The cocoa and chocolate market is projected to reach USD 28.24 billion by 2030 from an estimated USD 23.69 billion in 2025, registering a CAGR of 3.6% during the forecast period. Cocoa and chocolate play a significant role in global consumption patterns, finding use in confectionery, bakery products, beverages, dairy items, and health applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | By Cocoa Type, Application, Nature, Chocolate Type, Distribution Channel, Product Form, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The primary driver of market growth is the rising demand for a combination of health benefits and indulgent experiences, along with a focus on ethical sourcing. Additionally, there is a rising preference for diverse flavors and formats.

Shifting consumer demographics, coupled with urbanization and the expansion of digital commerce, are making the market more accessible to consumers. Sustainability has become a critical concern, prompting manufacturers to prioritize traceable sourcing and environmentally friendly practices. In response to these trends, companies are increasingly investing in research and development, product customization, and premium offerings to remain competitive.

The growth potential in this industry is particularly strong in emerging economies, where rising disposable incomes and improved retail infrastructure are positively impacting cocoa and chocolate consumption.

"Conventional cocoa is experiencing significant growth due to its cost-efficiency, established supply chains, and sustained demand from mass-market applications."

Conventional cocoa dominates the global market due to its widespread use in chocolate manufacturing, bakery products, dairy items, and beverages. Its competitive pricing compared to organic or specialty cocoa makes it particularly attractive to large manufacturers focused on low-cost, high-volume sales. The primary cocoa-producing countries, like Cote d'Ivoire, Ghana, and Nigeria, contribute significantly to the supply of conventional cocoa, ensuring a stable and adequate market.

Additionally, strong demand for conventional cocoa arises in emerging economies, where purchasing power and price considerations influence consumer decisions. As major producers, multinational chocolate companies source conventional cocoa for their mainstream products through bulk procurement and long-term contracts. While segments such as organic or fair trade cocoa are gradually gaining acceptance, they remain niche markets compared to the mainstream appeal of conventional cocoa. Overall, the scalability, versatility, and price competitiveness of conventional cocoa make it the primary growth segment in the industry.

"The dark chocolate segment holds a significant share in the chocolate type segment of the cocoa and chocolate market."

Consumers are increasingly favoring dark chocolates with higher cocoa content. Higher cocoa percentages are often linked to health benefits such as improved heart health, antioxidant properties, and lower sugar levels compared to milk chocolate. This trend aligns with the growing demand for low-sugar and plant-based options. According to the National Confectioners Association (NCA), 61% of consumers surveyed in 2024 expressed a preference for dark chocolate due to its perceived health benefits.

This shift has captured the attention of major chocolate manufacturers in recent years. For example, in March 2023, Lindt & Sprungli expanded its EXCELLENCE portfolio with a 95% cocoa dark chocolate to cater to the demand for high-intensity cocoa profiles. In April 2024, Nestle launched its "Mindful Chocolate" range featuring KitKat in Europe, highlighting dark chocolate that offers functional benefits, such as magnesium and chamomile extract.

The trend towards clean-label products further drives growth, as consumers prefer dark chocolate with fewer ingredients, organic certifications, and labels that support ethical sourcing. This preference is notably growing in North America and Europe, making it one of the fastest-growing segments in the chocolate market.

Europe holds a significant share of the global cocoa and chocolate market.

Europe holds a significant market share in the global cocoa and chocolate industry due to its long-standing tradition of manufacturing, strong consumer preferences, and robust regulatory frameworks. In countries like Switzerland, Belgium, France, and Germany, major companies such as Lindt & Sprungli, Barry Callebaut, and Ferrero continuously innovate in product development, ethical sourcing, and high-quality formulations. European consumers are presented with an abundance of premium chocolate options, including dark, organic, and sugar-free varieties, which cater to health-conscious trends.

In January 2025, the Bean-to-Bar Sustainability Line of Lindt & Sprungli (Switzerland) was inaugurated in Olten, Switzerland, enhancing traceability and ethical sourcing with the help of blockchain validation for cocoa sourced from Ghana and Ecuador. The investment highlights the region's commitment to sustainability and production-level transparency. Europe's advanced retail setup, strong export capability, and regional authority in sustainability together counterpoise its superior share in the global cocoa and chocolate market to keep itself abreast of trends in ethical and premium chocolate-making.

In-depth interviews were conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the cocoa and chocolate market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

In the cocoa and chocolate industry, the major players are Barry Callebaut (Switzerland), Cargill (US), Olam International (Singapore), Nestle (Switzerland), Mondelez International (US), and Ferrero Group (Italy). These companies maintain great market positions because of their global status, integrated supply chains, and diversified product portfolios that sell across industrial and consumer segments.

The other important ones include Lindt & Sprungli (Switzerland), Mars, Incorporated (US), Blommer Chocolate Company (US), Guan Chong Berhad (Malaysia), JB Foods Limited (Singapore), and ECOM Agroindustrial Corp. (Switzerland). These companies are given credit for their strategic emphasis on sustainable sourcing and product innovation, investing heavily in traceability and ethical supply chain practices.

Additionally, mid-sized and emerging competitors like Natra (Spain), Luker Chocolate (Colombia), Cocoa Family (Dominican Republic), and GENCAU.BR (Brazil) serve as demand generators for their single-origin and artisanal chocolates in niche markets throughout Europe and the Americas. These companies are fostering market competition, product differentiation, and innovation to meet the growing global demand for ethically sourced, high-end, and health-conscious chocolate products.

Research Coverage:

This research report categorizes the cocoa and chocolate market by Cocoa Type (Cocoa Butter, Cocoa Powder, Cocoa Liquor), Application (Food & Beverages, Cosmetics, Pharmaceuticals), Nature (Conventional, Organic), Chocolate Type (Dark Chocolate, Milk Chocolate, White Chocolate, Filled Chocolates), Distribution Channel (Offline, E-commerce), Product Form (Blocks/Slabs/Bars, Powder, Chips & Drops, Liquid (Syrup/Coating), Paste/Spread, Beans (Raw or Roasted), Granules/Shavings), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the cocoa and chocolate market. A detailed analysis of the key industry players was carried out to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the cocoa and chocolate market. This report covers a competitive analysis of upcoming start-ups in the cocoa and chocolate market ecosystem. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to Buy this Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cocoa and chocolate market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Health benefits of chocolates), restraints (Highly unstable economies in cocoa-producing countries), opportunities (Low penetration rate in developing countries), and challenges (Increase in counterfeit products) influencing the growth of the cocoa and chocolate market.

- New Launches/Innovation: Detailed insights on research & development activities and new service launches in the cocoa and chocolate market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the cocoa and chocolate market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the cocoa and chocolate market.

- Competitive Assessment: The cocoa and chocolate market features an in-depth evaluation of competitive positioning based on market share, product portfolios, innovation capabilities, and strategic initiatives. Leading players such as Cargill (US), Barry Callebaut (Switzerland), Olam Group (Singapore), Lindt & Sprungli (Switzerland), and Mondelez International (US) are analyzed for their sourcing practices, processing capabilities, and branded offerings. The assessment includes a comparison of product footprints across cocoa derivatives and finished chocolate goods, with a focus on sustainability certifications, origin traceability, and premium product lines. Additionally, market strategies such as vertical integration, origin partnerships, and investments in ethical sourcing are reviewed to gauge competitive differentiation and long-term positioning.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.3.1 SUPPLY-SIDE

- 2.3.2 DEMAND-SIDE

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN COCOA MARKET

- 4.2 ATTRACTIVE OPPORTUNITIES IN CHOCOLATE MARKET

- 4.3 COCOA MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- 4.4 CHOCOLATE MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- 4.5 ASIA PACIFIC: COCOA MARKET, BY TYPE AND COUNTRY

- 4.6 EUROPE: CHOCOLATE MARKET, BY TYPE AND COUNTRY

- 4.7 COCOA MARKET, BY TYPE

- 4.8 COCOA MARKET, BY APPLICATION

- 4.9 COCOA MARKET, BY REGION

- 4.10 CHOCOLATE MARKET, BY TYPE

- 4.11 CHOCOLATE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL GDP GROWTH

- 5.2.2 PER CAPITA INCOME GROWTH (EMERGING MARKET EXPANSION)

- 5.2.3 TRADE LIBERALIZATION & FREE TRADE AGREEMENTS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Health benefits of chocolate

- 5.3.1.2 Rising demand for premium and dark chocolate

- 5.3.1.3 Seasonal and festive sales

- 5.3.2 RESTRAINTS

- 5.3.2.1 Unstable economies in cocoa-producing countries

- 5.3.2.2 High volatility in cocoa prices

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Low penetration rate in developing countries

- 5.3.3.2 Cocoa derivatives in adjacent sectors

- 5.3.3.3 E-commerce & DTC expansion in chocolate

- 5.3.4 CHALLENGES

- 5.3.4.1 Increase in counterfeit products

- 5.3.4.2 Fragmented smallholder farming system

- 5.3.4.3 Sustainability concerns in cocoa industry

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON COCOA AND CHOCOLATE

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN COCOA AND CHOCOLATE

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Mars Inc.: Gen AI for Recipe Innovation

- 5.4.3.2 Barry Callebaut: AI-Powered Traceability Platform

- 5.4.4 IMPACT ON COCOA AND CHOCOLATE MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT DATA FOR HS CODE 18 (2020-2024)

- 6.4.2 IMPORT DATA FOR HS CODE 18 (2020-2024)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Fermentation optimization

- 6.5.1.2 Conching automation

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Cocoa bean roasting control systems

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Flavor encapsulation technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.6.1.1 Cocoa market

- 6.6.1.2 Chocolate market

- 6.6.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE

- 6.6.2.1 Cocoa market

- 6.6.2.2 Chocolate market

- 6.6.3 AVERAGE SELLING PRICE, BY REGION

- 6.6.3.1 Cocoa market

- 6.6.3.2 Chocolate market

- 6.6.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 GROWERS

- 6.7.2 INTERMEDIARIES

- 6.7.3 COCOA PROCESSORS

- 6.7.4 CHOCOLATE MANUFACTURERS

- 6.7.5 RETAILERS

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 PATENT ANALYSIS

- 6.9.1 LIST OF MAJOR PATENTS

- 6.10 KEY CONFERENCES & EVENTS

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 Codex Alimentarius Commission (CAC)

- 6.11.2.2 North America

- 6.11.2.3 Europe

- 6.11.2.4 Asia Pacific

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 CASE STUDY 1: COCOA SHORTAGE CRISIS IMPACTING CHOCOLATE MAKERS (2024-2025)

- 6.14.2 CASE STUDY 2: BARRY CALLEBAUT'S 2ND GENERATION CHOCOLATE

- 6.14.3 CASE STUDY 3: CARGILL AND NESTLE COCOA PLAN IN INDONESIA

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFFS-COCOA AND CHOCOLATE MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 DISRUPTION IN COCOA AND CHOCOLATE

- 6.16.4 PRICE IMPACT ANALYSIS

- 6.16.5 IMPACT ON COUNTRIES/REGIONS

- 6.16.5.1 Cote d'Ivoire

- 6.16.5.2 Ghana

- 6.16.5.3 United States

- 6.16.5.4 Canada and Europe

- 6.16.6 IMPACT ON END-USE INDUSTRY

7 COCOA MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 COCOA BUTTER

- 7.2.1 RISING DEMAND FOR NATURAL INGREDIENTS AND PREMIUM CHOCOLATE APPLICATIONS GLOBALLY

- 7.3 COCOA POWDER

- 7.3.1 RISING DEMAND FOR FUNCTIONAL FOODS AND CLEAN-LABEL COCOA-BASED PRODUCTS

- 7.4 COCOA LIQUOR

- 7.4.1 RISING DEMAND FOR PREMIUM CHOCOLATE AND CLEAN-LABEL INGREDIENTS GLOBALLY

8 COCOA MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FOOD & BEVERAGES

- 8.2.1 CONFECTIONERY

- 8.2.1.1 Rising demand for premium and functional cocoa-based confectionery products

- 8.2.2 BAKERY

- 8.2.2.1 Rising demand for premium cocoa in artisanal and industrial bakery

- 8.2.3 OTHER FOOD & BEVERAGE APPLICATIONS

- 8.2.1 CONFECTIONERY

- 8.3 COSMETICS

- 8.3.1 RISING INTEREST IN COCOA-BASED COSMETICS AND GROWING AWARENESS PROPELS MARKET

- 8.4 PHARMACEUTICALS

- 8.4.1 INCREASING CONSUMER DEMAND FOR NATURAL INGREDIENTS AND BENEFITS OF COCOA SUPPORTS GROWTH

9 COCOA MARKET, BY NATURE

- 9.1 INTRODUCTION

- 9.2 CONVENTIONAL COCOA

- 9.2.1 RISING GLOBAL DEMAND FOR AFFORDABLE COCOA-BASED MASS MARKET PRODUCTS

- 9.3 ORGANIC COCOA

- 9.3.1 RISING DEMAND FOR ETHICAL, CLEAN-LABEL, AND SUSTAINABLE COCOA PRODUCTS

10 CHOCOLATE MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 DARK CHOCOLATE

- 10.2.1 RISING HEALTH AWARENESS AND DEMAND FOR ANTIOXIDANT-RICH PRODUCTS

- 10.3 MILK CHOCOLATE

- 10.3.1 EXPANDING CONSUMER BASE AND INNOVATION FUEL MILK CHOCOLATE GROWTH

- 10.4 WHITE CHOCOLATE

- 10.4.1 GROWING DEMAND FOR PREMIUM, UNIQUE FLAVORS AND CLEAN-LABEL INGREDIENTS TO DRIVE DEMAND

- 10.5 FILLED CHOCOLATE

- 10.5.1 GROWING DEMAND FOR INDULGENT AND INNOVATIVE TEXTURES TO DRIVE MARKET

11 CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL

- 11.1 INTRODUCTION

- 11.2 OFFLINE

- 11.3 E-COMMERCE

12 CHOCOLATE MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD & BEVERAGES (B2C & FOODSERVICE)

- 12.3 BAKERY & CONFECTIONERY PRODUCTS

- 12.4 FUNCTIONAL & NUTRITIONAL PRODUCTS

- 12.5 PERSONAL CARE & COSMETICS

- 12.6 PHARMACEUTICALS

- 12.7 PREMIUM & GIFT CHOCOLATES

13 CHOCOLATE MARKET, BY PRODUCT FORM

- 13.1 INTRODUCTION

- 13.2 BLOCKS/SLABS/BARS

- 13.3 POWDERS

- 13.4 CHIPS & DROPS

- 13.5 LIQUIDS (SYRUPS/COATINGS)

- 13.6 PASTES/SPREADS

- 13.7 COCOA BEANS (RAW OR ROASTED)

- 13.8 GRANULES/SHAVINGS

14 COCOA AND CHOCOLATE MARKET, BY PROCESS

- 14.1 INTRODUCTION

- 14.2 BEAN SOURCING

- 14.3 ROASTING & WINNOWING

- 14.4 GRINDING & PRESSING

- 14.5 MIXING & CONCHING

- 14.6 MOLDING & COATING

- 14.7 QUALITY CHECKS

- 14.8 ALLERGEN CONTROL

- 14.9 BATCH TRACEABILITY

- 14.10 SUSTAINABLE PROCESSING

15 COCOA AND CHOCOLATE MARKET, BY TECHNOLOGY

- 15.1 INTRODUCTION

- 15.2 FERMENTATION CONTROL

- 15.3 CONCHING SYSTEMS

- 15.4 ROASTING TECHNOLOGIES

- 15.5 FLAVOR ENCAPSULATION

- 15.6 AI IN QUALITY MONITORING

- 15.7 IOT INTEGRATION

- 15.8 3D PRINTING APPLICATIONS

- 15.9 SMART PACKAGING

- 15.10 COLD CHAIN TECHNOLOGIES

16 COCOA AND CHOCOLATE MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Rising seasonal demand and premiumization trends driving market growth

- 16.2.2 CANADA

- 16.2.2.1 Rising demand for premium and ethical chocolate products driving cocoa imports

- 16.2.3 MEXICO

- 16.2.3.1 Rising chocolate consumption and artisan trends drive cocoa processing demand

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 FRANCE

- 16.3.1.1 Growing artisan chocolate demand and ethical sourcing preferences propel cocoa imports

- 16.3.2 GERMANY

- 16.3.2.1 Premiumization, ethical sourcing, and vegan product innovations make Germany a prominent market

- 16.3.3 UK

- 16.3.3.1 Rising demand for premium, ethical, and sustainable chocolate products

- 16.3.4 SPAIN

- 16.3.4.1 Rising artisan chocolate culture and sustainable cocoa sourcing drive market demand

- 16.3.5 ITALY

- 16.3.5.1 Growing premium chocolate demand and cocoa bean imports drive market expansion

- 16.3.6 BELGIUM

- 16.3.6.1 High-quality exports and artisanal legacy drive cocoa and chocolate leadership

- 16.3.7 SWITZERLAND

- 16.3.7.1 Strong domestic consumption, premium exports, and sustainable sourcing drive chocolate industry's growth

- 16.3.8 REST OF EUROPE

- 16.3.1 FRANCE

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Rising premium chocolate demand and e-commerce expansion fuel cocoa market growth

- 16.4.2 JAPAN

- 16.4.2.1 Growing demand for premium, plant-based, and travel-retail chocolates drives Japan's market.

- 16.4.3 INDIA

- 16.4.3.1 Rising urbanization and local sourcing bolster India's cocoa and chocolate demand

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Growing premium chocolate demand and tech-driven product innovation fuel South Korea's market expansion

- 16.4.5 AUSTRALIA & NEW ZEALAND

- 16.4.5.1 Rising premium chocolate demand and ethical sourcing drive regional cocoa market growth

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Rising domestic consumption and strategic imports drive Brazil's cocoa market

- 16.5.2 ARGENTINA

- 16.5.2.1 Rising cocoa imports and export growth driving Argentina's chocolate industry

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Strong cocoa production, export dominance, and sustainability push drive market growth

- 16.6.2 MIDDLE EAST

- 16.6.2.1 Rising premium chocolate demand and import dependency drive market expansion

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 17.3 REVENUE ANALYSIS, 2022-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6 BRAND/PRODUCT COMPARISON

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.7.5.1 Company footprint

- 17.7.5.2 Regional footprint

- 17.7.5.3 Type footprint

- 17.7.5.4 Application footprint

- 17.7.5.5 Nature footprint

- 17.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 17.8.5.1 Detailed list of key startups/SMEs

- 17.8.5.2 Competitive benchmarking of key startups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 CARGILL, INCORPORATED

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 BARRY CALLEBAUT

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions/Services offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Expansions

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 OLAM GROUP

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 MnM view

- 18.1.3.3.1 Key strengths

- 18.1.3.3.2 Strategic choices

- 18.1.3.3.3 Weaknesses and competitive threats

- 18.1.4 FUJI OIL CO., LTD.

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 MnM view

- 18.1.4.3.1 Key strengths

- 18.1.4.3.2 Strategic choices

- 18.1.4.3.3 Weaknesses and competitive threats

- 18.1.5 GUAN CHONG BERHAD (GCB)

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 Recent developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 JB COCOA, A SUBSIDIARY OF JB FOODS LIMITED

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions/Services offered

- 18.1.6.3 MnM view

- 18.1.7 ECOM AGROINDUSTRIAL CORP. LIMITED.

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.7.3 MnM view

- 18.1.8 NATRA

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.8.3 MnM view

- 18.1.9 KRUGER GROUP

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.9.3 MnM view

- 18.1.10 MAX FELCHLIN AG

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.10.3 MnM view

- 18.1.11 VALRHONA

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions/Services offered

- 18.1.11.3 MnM view

- 18.1.12 SUCESORES DE JOSE JESUS RESTREPO & CIA. S.A.

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions/Services offered

- 18.1.12.3 MnM view

- 18.1.13 PURATOS GROUP

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions/Services offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Deals

- 18.1.13.4 MnM view

- 18.1.14 UNITED COCOA PROCESSOR, INC.

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Solutions/Services offered

- 18.1.14.3 MnM view

- 18.1.15 COCOA PROCESSING COMPANY LIMITED (CPC)

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Solutions/Services offered

- 18.1.15.3 MnM view

- 18.1.1 CARGILL, INCORPORATED

- 18.2 OTHER PLAYERS

- 18.2.1 SIERRA NATURALS

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Solutions/Services offered

- 18.2.1.3 MnM view

- 18.2.2 CHOCOLATERIE DE L'OPERA

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Solutions/Services offered

- 18.2.2.3 MnM view

- 18.2.3 COCOA FAMILY

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Solutions/Services offered

- 18.2.3.3 MnM view

- 18.2.4 REPUBLICA DEL CACAO

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Solutions/Services offered

- 18.2.4.3 MnM view

- 18.2.5 CAMPCO CHOCOLATES

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Solutions/Services offered

- 18.2.5.3 MnM view

- 18.2.6 JINDAL COCOA

- 18.2.7 GENCAU.BR

- 18.2.8 FRIIS-HOLM CHOKOLADE

- 18.2.9 DAVIS CHOCOLATE

- 18.2.10 LOTUS CHOCOLATE COMPANY LTD

- 18.2.1 SIERRA NATURALS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS