|

시장보고서

상품코드

1796403

세컨드 라이프 EV 배터리 시장 예측(-2030년) : 용도, EV 판매 역학, EV 배터리 수요와 잠재 전환율, 밸류체인, 에코시스템과 비즈니스 모델 분석, 지역별Second Life EV Battery Market by Application (Utility Scale, Commercial/Industrial, Residential), EV Sales Dynamics, EV Battery Demand & Potential Conversion Rate, Value Chain, Ecosystem & Business Model Analysis, and Region - Forecast to 2030 |

||||||

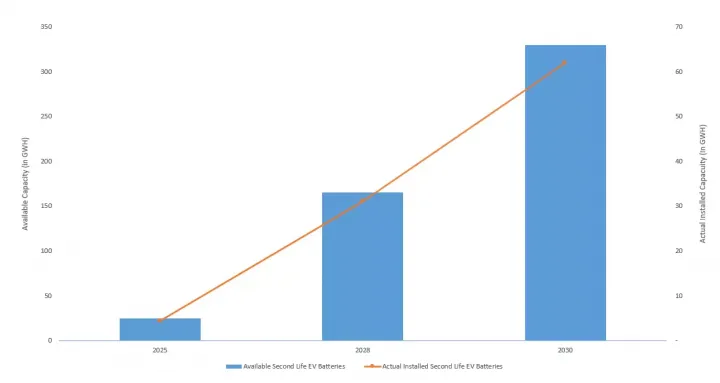

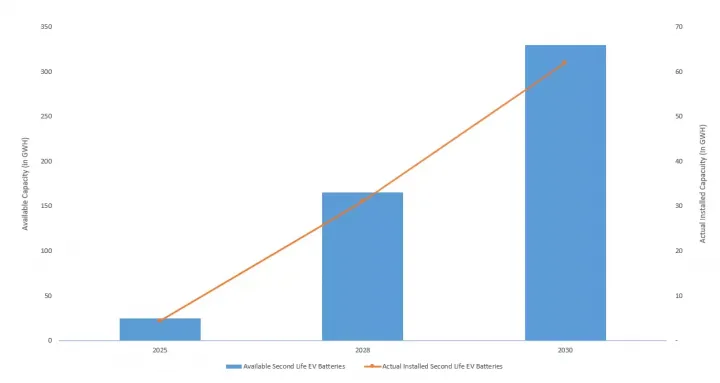

세계의 세컨드 라이프 EV 배터리 시장 규모는 2025년에 추정 25-30GWH이며, 2030년까지 330-350GWH에 달할 것으로 예측되며, 예측 기간에 CAGR로 약 65%의 성장이 전망됩니다.

시장의 급격한 성장은 순환 경제 원칙과 에너지 안보를 촉진하는 적극적이고 지지적인 규제 프레임워크, 산업 전략, 기술 자금에 의해 크게 촉진되고 있습니다. EU Battery Directive 및 Horizon Europe과 같은 자금 지원 프로그램은 유럽의 배터리 전환 인프라를 강화하고 명확한 사용 후 기준을 설정하는 것을 목표로 합니다. 인플레이션 감소법(Inflation Reduction Act)에 따른 세액 공제 및 DOE가 지원하는 파일럿 프로젝트(미국)와 같은 연방 정부의 인센티브, 아시아 국가들의 보조금과 야심찬 배터리 재활용 및 재사용 목표를 통한 민관 파트너십의 확대는 에너지 전환 목표를 지원하는 한편, 세컨드 라이프 EV 배터리 시장 수요를 촉진하고 있습니다. 에너지 전환 목표를 지원하는 동시에 세컨드 라이프 EV 배터리 시장 수요를 가속화하고 있습니다.

상업 및 산업 부문은 세컨드 라이프 EV 배터리의 두 번째로 큰 용도입니다.

상업용 및 산업 용도 부문은 백업 전원, 수요 충전 감소, EV 충전소, 모바일 모듈형 스토리지, 창고 및 데이터센터의 태양광 에너지 최적화 등 수요가 증가함에 따라 세컨드 라이프 EV 배터리의 활용에 탄력을 받을 것으로 예측됩니다. 그 중에서도 EV 충전소는 이 부문에서 유망 이용 사례로 꼽힙니다. EV 배터리는 70-80%의 잔여 용량을 가지고 있으며, 무정전 전원장치(UPS) 및 마이크로그리드 안정화에 사용되는 연간 50-150 사이클과 같은 중주기 수요에 적응할 수 있으며, 이는 백업 전원 및 피크 부하 관리에 활용될 수 있도록 지원합니다. Nissan, Renault, Tesla, Connected Energy(영국), Enel X(이탈리아) 등 주요 기업은 전력 회사 및 기술 파트너와 협력하여 C&I 부문에서 세컨드 라이프 배터리를 개발하고 있습니다. 예를 들어 Connected Energy는 영국의 EV 충전 허브에 시스템을 도입했고, Enel X는 이탈리아 공항에서 에너지 저장 솔루션을 시범적으로 도입하고 있습니다. Daimler의 15MW급 산업용 전기 저장 시스템이나 아마존의 물류 센터에 세컨드 라이프 EV 배터리를 배치하는 것과 같은 다른 프로젝트들은 기업의 지속가능성 목표를 달성하는 데 기여할 것으로 보입니다. 또한 이러한 배터리를 현장 태양광 및 풍력발전과 통합하면 그리드 전력에 대한 의존도를 줄이고 탄소발자국을 연간 10-20%까지 최소화하여 지속가능성과 비용 효율성을 높일 수 있습니다. 전략적으로 기업은 전력 수요가 많은 곳에 전력 저장 및 재사용 시설을 설치하여 경제적 이익을 극대화하고, 최적화된 에너지 관리와 비용 절감을 할 수 있습니다.

유럽이 세컨드 라이프 EV 배터리의 큰 점유율을 차지합니다.

유럽은 순환 경제에 대한 강한 관심과 우호적인 규제 환경을 갖춘 세컨드라이프 전기자동차 배터리의 주요 시장 중 하나입니다. 이 지역에는 세계적인 자동차 OEM 및 EV 배터리 전환 기업이 있습니다. 재생에너지 발전의 42% 가량을 재생에너지로 충당하겠다는 목표를 세우면서, 유틸리티 그리드 스케일의 축전지 및 산업용 백업에 대한 수요가 증가하고 있습니다. 이에 따라 Renault는 2018년 신규 및 중고 EV 배터리를 결합한 Advanced Battery Storage 프로그램을 시작했습니다. 이는 60MWh의 에너지를 가진 배터리로 프랑스와 독일 각지에 설치되어 재생에너지로 생산된 전력을 저장할 수 있는 설비를 갖추고 있습니다. Nissan, BMW, Audi와 같은 다른 OEM의 유사한 프로젝트는 2030년까지 유럽의 넷 제로 목표에 부합합니다.

세계의 세컨드 라이프 EV 배터리에 대해 조사분석했으며, 시장의 에코시스템, 기술 로드맵, 밸류체인, 다양한 비즈니스 모델과 수입원 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 개요

제3장 시장의 평가

- 서론

- 시장 규모와 성장 궤도

- 배터리 EV 판매와 예측

- EV 배터리 시장의 수요와 예측

- 배터리 화학 포트폴리오 전략

- 비용 퍼포먼스 매트릭스 : 화학별

- 세컨드 라이프 EV 배터리 : 기술 로드맵

- 배터리 평가 기술

- 배터리 매니지먼트 시스템의 혁신

- 시스템 통합 혁신

- 소프트웨어 플랫폼 전략

- 세컨드 라이프 전환율에 대한 EV 시장 침투율

제4장 밸류체인 분석

- 밸류체인

- 세컨드 라이프 EV 배터리 : 각 단계의 부가가치

- 수집·물류

- 테스트·평가

- 리퍼브·전용

- 애플리케이션 개발·통합

- 유통·시장 배포

- 사용 종료 제품 재활용

제5장 EV 배터리 재사용 시장 : 용도별

- 서론

- 유틸리티 스케일 그리드 서비스

- 상산업

- 주택 용도

제6장 지역 시장 분석

- 서론

- 북미

- 개요

- 주요 투자 촉진요인과 정부 구상

- 성장 전망과 결론

- 유럽

- 개요

- 2030년까지의 전략적 제휴, 스케일러블응용, 시장 준비도

- 전망과 결론

- 아시아태평양

- 개요

- 제조 리더십 탁월성

- 전망과 결론

제7장 경쟁 구도

- 경쟁 포지셔닝

- 비즈니스 모델

- 소유 모델

- 수입원

- 고객 획득 전략

- 수익성의 분석

- 세계 OEM의 세컨드 라이프 EV 배터리 설치 프로젝트와 용량

- 주요 배터리 전용 업자와 현재 용량, 예측되는 향후 용량

제8장 전략적 제안

제9장 주요 기업의 전략적 개요

- 자동차 OEM

- TESLA

- TOYOTA MOTOR CORPORATION

- NISSAN MOTOR CO., LTD.

- AB VOLVO

- VOLKSWAGEN GROUP

- BMW AG

- 에너지 저장·세컨드 라이프 배터리 전문가

- CONNECTED ENERGY

- B2U STORAGE SOLUTIONS, INC.

- REJOULE

- EATON

- E.BATTERY SYSTEMS AG

제10장 부록

KSA 25.09.01The second life EV battery market is estimated at ~25-30 GWH in 2025 and is projected to reach ~330-350 GWH in 2030 at a CAGR of ~65% during the forecast period. The rapid growth of the second life EV battery market is significantly driven by proactive, supportive regulatory frameworks, industrial strategies, and technology funding to promote circular economy principles and energy security. Initiatives like the EU Battery Directive and funding programs like Horizon Europe are aimed at boosting battery repurposing infrastructure and setting clear end-of-life standards in Europe. Federal incentives, including tax credits under the Inflation Reduction Act and DOE-funded pilot projects (US) and scaling public-private partnerships, with subsidies and ambitious battery recycling & reuse targets in Asian countries, support energy transition targets while accelerating the second life EV battery market demand.

The commercial & industrial segment is the second prominent application of second Life EV batteries.

The commercial & industrial application segment is expected to gain momentum for second life EV battery usage with the growing demand for backup power, demand charge reduction, EV charging stations, mobile & modular storage, and solar energy optimization in warehouses or data centers. Among these, EV charging stations represent this segment's promising use case. EV batteries are left with 70-80% residual capacity and adaptability to medium-cycle demands, such as 50-150 cycles annually for uninterruptible power supply (UPS) and microgrid stabilization, which support their usage for backup power and peak load management. Leading companies like Nissan, Renault, Tesla, Connected Energy (UK), and Enel X (Italy) are advancing second-life battery deployments in the C&I sector, often collaborating with utilities and technology partners. For example, Connected Energy has implemented systems at UK EV charging hubs, while Enel X pilots energy storage solutions at Italian airports. Other projects like Daimler's 15 MW industrial storage system and Amazon's deployment of second life EV batteries into logistics centers will contribute to the commitment toward their corporate sustainability goals. Furthermore, integrating these batteries with on-site solar or wind generation improves sustainability and cost-effectiveness by reducing reliance on grid power and minimizing the carbon footprint by 10-20% annually. Strategically, businesses can maximize economic benefits by co-locating storage and reuse facilities at high-power demand sites, enabling optimized energy management and cost savings.

Europe accounts for a significant market share of second life EV batteries.

Europe is one of the prominent markets for second-life EV batteries with a strong focus on the circular economy and a supportive regulatory environment. The region is home to global automotive OEMs and repurposing companies for EV batteries. Regional efforts such as integration of advanced renewable energy with a target to generate nearly 42% of electricity from these sources will drive demand for utility & grid-scale storage and industrial backups. In line with this, Renault launched an "advanced battery storage program" in 2018 using a combination of new and used EV batteries. It has an energy of 60 MWh battery and is installed in various parts across France and Germany, and is equipped to store electricity generated from renewable sources. Similar projects from other OEMs like Nissan, BMW, and Audi are aligned with Europe's net-zero target by 2030. In addition, some of the promising European EV battery repurposers include Connected Energy (UK), Allye Energy (UK), Zenobe (UK), Voltfang (Germany), BeePlanet Factory (Spain), Libattion (Switzerland), and The Mobility House (Germany). These players are responsible for developing large-scale stationary storage using batteries from passenger cars, trucks & buses, and commercial fleets. Government support, such as USD 1.97 billion allocated through Horizon Europe for battery innovation, combined with corporate initiatives like Volkswagen's plan to reuse 40 GWh of second-life batteries, is helping reduce entry barriers. Additionally, the region's well-established recycling ecosystem, spearheaded by companies like Northvolt, contributes to the scalability of the market. In line with the strong pipeline of new entrants in the repurposed arena and the high-end project activity in Europe, this regional leadership is expected to remain instrumental in the long run.

Research Coverage:

The report provides an in-depth analysis of the second-life EV battery market, focusing on the market ecosystem, technology roadmap, value chain analysis, various business model & their revenue streams, and potential installation demand by application (utility-scale grid services, commercial & industrial, and residential) and region (Asia Pacific, Europe, and North America). It examines EV sales trends (passenger cars & commercial vehicles), current & futuristic EV battery demand (lithium-ion, nickel-metal hydride, solid-state, and other battery chemistries), and performance/cost matrix by different battery chemistries, and EV market penetration to second life conversion rates.

Additionally, the report assesses the effects of the rising EV stocks and presents a future outlook based on industry-wise consumption patterns. It includes detailed information about the significant factors boosting the global demand and key growth impetuses. A thorough analysis of key industry players provides insights into their business overviews, product offerings, key strategies, contracts, partnerships, agreements, product launches, mergers, and acquisitions.

Key Benefits of Buying this Report:

The report provides valuable information for current vs. projected second-life EV battery installation capabilities across key global markets. It will assist stakeholders in understanding the competitive landscape, positioning their businesses more effectively, and planning appropriate go-to-market strategies. Additionally, the report will offer insights into the current market conditions and highlight different ownership models & their revenue profit streams within the industry.

The report provides insights into the following points:

- Analysis of critical technology roadmap parameters such as battery assessment & testing approaches, cell-level & algorithm-based battery management system, various system integration techniques, and software platform strategies

- Market Development: Comprehensive market information (the report analyzes & recommends the most dominant application demand across the considered regions under the scope)

- Market Diversification: Exhaustive information about strategic collaborations, potential geography expansion, recent projections & their capacity, and investments in the second-life EV battery industry

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/technology offerings of leading OEMs & battery storage specialists such as Tesla, Volvo, Toyota Motor Corporation, BMW Group, Nissan Motor Corporation, Connected Energy, B2U Storage solutions, and Rejoule

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 GLOBAL SECOND LIFE EV BATTERY INDUSTRY OVERVIEW

- 1.1.1 MAJOR DEMAND ZONES AND APPLICATIONS FOR SECOND LIFE EV BATTERIES

- 1.2 SECOND LIFE EV BATTERY MARKET DEFINITION & CONCEPT

- 1.3 INDUSTRY ECOSYSTEM

2 EXECUTIVE SUMMARY

- 2.1 REPORT SUMMARY

3 MARKET ASSESSMENT

- 3.1 INTRODUCTION

- 3.2 MARKET SIZING & GROWTH TRAJECTORY

- 3.2.1 BATTERY EV SALES & FORECASTS

- 3.2.1.1 Electric passenger car sales & forecast

- 3.2.1.2 Electric commercial vehicle sales & forecast

- 3.2.2 EV BATTERY MARKET DEMAND & FORECAST

- 3.2.2.1 EV battery market, by battery chemistry, 2024 vs. 2035 (Thousand Units)

- 3.2.2.2 Upcoming EV models and their battery chemistries, 2025-2026

- 3.2.2.3 Regional demand patterns for EV batteries

- 3.2.2.3.1 Asia Pacific

- 3.2.2.3.1.1 Asia Pacific: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.2 Europe

- 3.2.2.3.2.1 Europe: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.3 North America

- 3.2.2.3.3.1 North America: Cell supplier-wise battery demand, 2022-2024 (Megawatt-hour)

- 3.2.2.3.1 Asia Pacific

- 3.2.3 BATTERY CHEMISTRY PORTFOLIO STRATEGY

- 3.2.3.1 Lithium-ion categories (NMC, LFP, NCA, LTO)

- 3.2.3.1.1 Lithium-ion battery cell specifications

- 3.2.3.1.2 Lithium iron phosphate

- 3.2.3.1.3 Nickel manganese cobalt

- 3.2.3.1.4 Lithium iron manganese phosphate

- 3.2.3.2 Nickel-metal hydride

- 3.2.3.3 Solid-state batteries

- 3.2.3.4 Other battery types

- 3.2.3.1 Lithium-ion categories (NMC, LFP, NCA, LTO)

- 3.2.4 PERFORMANCE/COST MATRIX, BY CHEMISTRY

- 3.2.1 BATTERY EV SALES & FORECASTS

- 3.3 SECOND LIFE EV BATTERY: TECHNOLOGY ROADMAP

- 3.3.1 BATTERY ASSESSMENT TECHNOLOGIES

- 3.3.1.1 Non-invasive testing methods

- 3.3.1.2 AI-based degradation prediction

- 3.3.2 BATTERY MANAGEMENT SYSTEM INNOVATIONS

- 3.3.2.1 Adaptive control algorithm

- 3.3.2.2 Cell-level management system

- 3.3.3 SYSTEM INTEGRATION INNOVATIONS

- 3.3.3.1 Modular architecture development

- 3.3.3.2 Thermal management innovation

- 3.3.3.3 Advancements in power electronics

- 3.3.4 SOFTWARE PLATFORM STRATEGY

- 3.3.4.1 Energy management system

- 3.3.4.2 Market participation software

- 3.3.1 BATTERY ASSESSMENT TECHNOLOGIES

- 3.4 EV MARKET PENETRATION INTO SECOND LIFE CONVERSION RATES

4 VALUE CHAIN ANALYSIS

- 4.1 VALUE CHAIN

- 4.1.1 SECOND LIFE EV BATTERY: VALUE ADDITION BY STAGE

- 4.1.2 COLLECTION & LOGISTICS

- 4.1.2.1 Key players and their recent developments in collection & logistics

- 4.1.3 TESTING & ASSESSMENT

- 4.1.3.1 Key players and their recent developments in testing capabilities

- 4.1.4 REFURBISHMENT & REPURPOSING

- 4.1.4.1 Major specialists and their recent developments in repurposing

- 4.1.5 APPLICATION DEVELOPMENT & INTEGRATION

- 4.1.5.1 Prominent application developers & integration providers and their recent developments

- 4.1.6 DISTRIBUTION & MARKET DEPLOYMENT

- 4.1.6.1 Key market deployment players and their recent developments

- 4.1.7 END-OF-LIFE RECYCLING

- 4.1.7.1 Key end-of-life recyclers and their recent developments

5 SECOND LIFE EV BATTERY MARKET, BY APPLICATION

- 5.1 INTRODUCTION

- 5.2 UTILITY-SCALE GRID SERVICES

- 5.2.1 PROMINENT UTILITY-SCALE PROVIDERS & THEIR CAPACITIES

- 5.2.2 RENEWABLE ENERGY

- 5.2.2.1 Solar power

- 5.2.2.2 Wind energy

- 5.3 COMMERCIAL & INDUSTRIAL

- 5.3.1 EV CHARGING STATIONS

- 5.3.2 EV CHARGING STATION SITES EQUIPPED WITH SECOND LIFE EV BATTERIES, BY REGION

- 5.4 RESIDENTIAL APPLICATION

6 REGIONAL MARKET ANALYSIS

- 6.1 INTRODUCTION

- 6.2 NORTH AMERICA

- 6.2.1 OVERVIEW

- 6.2.1.1 Key players and their second life EV battery installation projects

- 6.2.2 MAJOR INVESTMENT DRIVERS & GOVERNMENT INITIATIVES

- 6.2.3 GROWTH OUTLOOK & CONCLUSION

- 6.2.1 OVERVIEW

- 6.3 EUROPE

- 6.3.1 OVERVIEW

- 6.3.1.1 Key players and their second life EV battery installation projects

- 6.3.2 STRATEGIC ALIGNMENT, SCALABLE APPLICATIONS, AND MARKET READINESS BY 2030

- 6.3.3 OUTLOOK & CONCLUSION

- 6.3.1 OVERVIEW

- 6.4 ASIA PACIFIC

- 6.4.1 OVERVIEW

- 6.4.1.1 Key players and their second life EV battery installation projects

- 6.4.2 MANUFACTURING LEADERSHIP EXCELLENCE

- 6.4.3 OUTLOOK & CONCLUSION

- 6.4.1 OVERVIEW

7 COMPETITIVE LANDSCAPE

- 7.1 COMPETITIVE POSITIONING

- 7.2 BUSINESS MODELS

- 7.2.1 OWNERSHIP MODELS

- 7.2.1.1 Battery leasing & rentals

- 7.2.1.2 Battery-as-a-service (BaaS)

- 7.2.1.3 Mobile BESS for temporary power supply

- 7.2.1.4 Energy-as-a-service (EaaS)

- 7.2.2 REVENUE STREAMS

- 7.2.3 CUSTOMER ACQUISITION STRATEGIES

- 7.2.4 PROFITABILITY ANALYSIS

- 7.2.1 OWNERSHIP MODELS

- 7.3 GLOBAL OEMS' SECOND LIFE EV BATTERY INSTALLATION PROJECTS & THEIR CAPACITIES

- 7.4 KEY BATTERY REPURPOSERS AND THEIR CURRENT VS. PROJECTED CAPACITY

8 STRATEGIC RECOMMENDATIONS

9 KEY PLAYERS' STRATEGIC PROFILES

- 9.1 AUTOMOTIVE OEMS

- 9.1.1 TESLA

- 9.1.1.1 Overview

- 9.1.1.2 Recent financials

- 9.1.1.3 Tesla: Global EV sales, by key model

- 9.1.1.4 Strategic approach toward second life EV batteries

- 9.1.1.5 Recent developments, 2019-2025

- 9.1.2 TOYOTA MOTOR CORPORATION

- 9.1.2.1 Overview

- 9.1.2.2 Recent financials

- 9.1.2.3 Toyota Motor Corporation: Global EV sales, by key model

- 9.1.2.4 Strategic approach toward second life EV batteries

- 9.1.2.5 Recent developments, 2019-2025

- 9.1.3 NISSAN MOTOR CO., LTD.

- 9.1.3.1 Overview

- 9.1.3.2 Recent financials

- 9.1.3.3 Nissan Motors Co., Ltd.: Global EV sales, by key model

- 9.1.3.4 Continued investment in global network expansion for battery collection and repurposing technologies

- 9.1.3.5 Recent developments, 2010-2025

- 9.1.4 AB VOLVO

- 9.1.4.1 Overview

- 9.1.4.2 Recent financials

- 9.1.4.3 Strategic approach toward second life EV batteries

- 9.1.4.4 Recent developments, 2022-2023

- 9.1.5 VOLKSWAGEN GROUP

- 9.1.5.1 Overview

- 9.1.5.2 Recent financials

- 9.1.5.3 Volkswagen Group: Global EV sales, by key model

- 9.1.5.4 Strategic approach toward second life EV batteries

- 9.1.5.5 Recent developments, 2021-2025

- 9.1.6 BMW AG

- 9.1.6.1 Overview

- 9.1.6.2 Recent financials

- 9.1.6.3 BMW AG: Global EV sales, by key model

- 9.1.6.4 Strategic approach toward second life EV batteries

- 9.1.6.5 Recent developments, 2020-2025

- 9.1.1 TESLA

- 9.2 ENERGY STORAGE & SECOND LIFE BATTERY SPECIALISTS

- 9.2.1 CONNECTED ENERGY

- 9.2.1.1 Overview

- 9.2.1.2 Products, capacity, and applications

- 9.2.1.3 Recent developments, 2021-2025

- 9.2.2 B2U STORAGE SOLUTIONS, INC.

- 9.2.2.1 Overview

- 9.2.2.2 Products, capacity, and application

- 9.2.2.3 Recent developments, 2021-2024

- 9.2.3 REJOULE

- 9.2.3.1 Overview

- 9.2.3.2 Products, capacity, and application

- 9.2.3.3 Projects

- 9.2.3.4 Recent developments, 2023-2025

- 9.2.4 EATON

- 9.2.4.1 Overview

- 9.2.4.2 Recent financials

- 9.2.4.3 Products, capacity, and application

- 9.2.4.4 Recent developments, 2024

- 9.2.5 E.BATTERY SYSTEMS AG

- 9.2.5.1 Overview

- 9.2.5.2 Products, capacity, and application

- 9.2.5.3 Recent developments, 2021-2025

- 9.2.1 CONNECTED ENERGY

10 APPENDIX

- 10.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 10.2 AUTHOR DETAILS