|

시장보고서

상품코드

1800733

전기자전거 시장 : 클래스별, 배터리별, 모터별, 모드별, 사용 용도별, 속도별, 배터리 용량별, 부품 및 지역별 분석 - 예측(-2032년)E-bike Market by Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region - Global Forecast to 2032 |

||||||

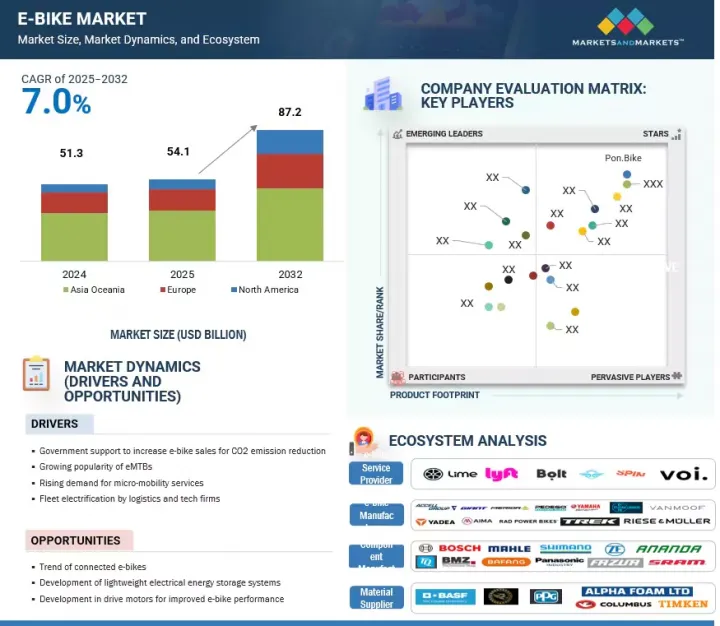

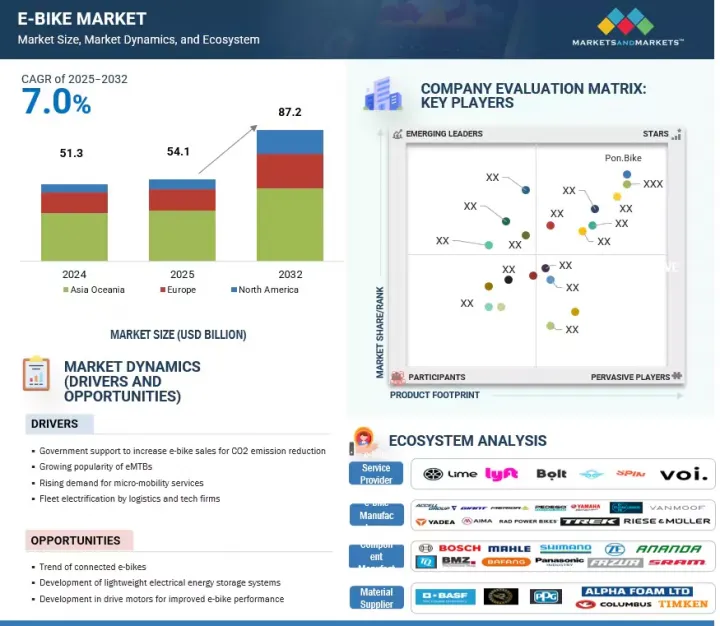

전기자전거 시장 규모는 7.0%의 CAGR로 확대되어 2025년 541억 달러에서 2032년에는 872억 달러로 성장할 것으로 예측됩니다.

환경 인식의 증가와 팬데믹 기간 동안 대체 모빌리티에 대한 수요 증가로 인해 2019-2021년까지 강력한 성장세를 보였습니다. 그러나 2023년에는 경기 침체와 재고 조정으로 인해 일부 지역, 특히 유럽에서 판매량이 감소했습니다. 2024년부터는 아시아, 오세아니아와 북미 지역을 중심으로 지원 정책과 개선된 인프라 덕분에 시장이 회복세를 보였습니다. 클래스 I 전기자전거가 계속 우세했지만, 특히 북미에서는 더 빠른 주행이 가능한 클래스 III 모델이 인기를 끌고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2025-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 클래스별, 구성요소별, 구동 시스템별, 모드별, 소유권별, 속도별, 배터리 용량별, 배터리 통합 유형별, 배터리 유형별, 배터리 전압별, 모터 출력별, 모터 중량별, 모터 유형별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아·오세아니아 |

e-MTB와 화물용 전기자전거의 수요는 오프로드 사용과 도심의 라스트 마일 배송 수요로 인해 빠르게 증가하고 있습니다. 강화된 배터리 기술, 라이더 어시스트 기능, 통근자의 선호도 변화가 장기적으로 시장 확대를 견인할 것으로 예상됩니다.

높은 모터 토크는 특히 오프로드, 산악자전거, 화물용 자전거에서 진화하는 전기자전거를 특징짓는 요소입니다. 70NM 이상의 토크를 가진 E-bike는 가혹한 지형과 고부하 작업에 견고한 성능을 제공하며, 기어 어시스트 시스템은 극한의 오프로드 조건에서 800-1,000N*m의 토크 출력에 도달할 수 있습니다. 이 파워는 도시 물류에서 최대 200kg의 화물을 취급하는 화물용 전기자전거에 필수적이며, 안정성과 효율성은 라스트 마일 배송에 필수적입니다. 유럽은 여전히 고토크 전기자전거의 최대 시장으로, 도시 물류의 성장과 프리미엄 레저용의 성장에 힘입어 최대 시장으로 자리매김하고 있습니다. 보쉬의 Performance Line CX와 같은 미드 드라이브 모터의 발전은 기어 증폭으로 최대 85N*m을 제공하여 핸들링과 배터리 성능을 유지하면서 효율적인 전력 공급을 가능하게 합니다. 또한, Ariel Rider와 Juiced Bikes와 같은 브랜드는 85-110N*m 모델로 토크의 한계치를 더욱 높이고 있으며, 이는 업계가 파워 중심의 솔루션으로 전환하고 있음을 보여줍니다. 그러나 이러한 추세는 주로 북미와 유럽에 집중되어 있으며, 인프라 및 소비자 지출이 3,000달러 이상의 가격대를 뒷받침할 수 있습니다. 많은 지역에서 시속 25-32km의 속도 제한이 있는 등 규제상의 제약이 주류로의 도입을 제한하고 있기 때문에 고토크 전기자전거는 세계 시장에서 특수하지만 성장하고 있는 부문이 되고 있습니다.

시티/어반 전기자전거는 사용 편의성, 편안함, 일상적인 도시 생활에서의 실용성으로 인해 빠르게 주목과 인기를 얻고 있습니다. 도시화가 진행됨에 따라 전기자전거 및 기타 친환경 교통수단에 대한 수요도 확대될 것으로 예상됩니다. 도시/도시형 전기자전거의 성장을 촉진하는 주요 요인은 전력 소비가 적고, 유지보수가 간편하고 경제적이라는 점입니다. 도심형 전기자전거의 가격은 1,000달러에서 3,000달러 사이로, 도시 주택 소유자가 단거리 출퇴근을 위해 사용하기에 적합합니다. 대부분의 도심형 전기자전거는 250W-500W의 허브 또는 미드드라이브 모터를 장착하여 도심의 평탄한 지형에서 효율적인 성능을 발휘합니다. 배터리 용량은 일반적으로 360Wh에서 500Wh 사이이며, 1회 충전으로 40-80km의 실용적인 주행거리를 실현할 수 있어 매일 출퇴근하기에 충분합니다.

아시아-오세아니아아시아-오세아니아는 2025년 도시 및 도시용 전기자전거 판매액이 가장 큰 지역입니다. 교통이 혼잡한 도시에서는 초소형 모빌리티 서비스로 전환하고 있으며, Hellobike(중국), Anywheel(싱가포르), Coo Rides(인도)와 같이 대부분의 시티/어반 바이크가 초소형 모빌리티로 활용되고 있습니다. 도심형 전기자전거를 제조하는 주요 업체로는 Giant Manufacturing Ltd.(대만), Yadea Group Holdings Ltd.(중국), Emotorad(인도), Trek Bicycle Corporation(미국) 등이 있습니다. 도심형 전기자전거의 예로는 Rad Power Bikes RadCity 5 Plus, Tenways CGO600 Pro, Giant Escape+E+3, Trek Verve+, Specialized Turbo Vado 4.0 등이 있습니다.

러시아-우크라이나 전쟁, 세계 경기 둔화, 인플레이션, 높은 수준의 재고, 개인 소비 감소 등 여러 거시 경제 및 지정학적 요인으로 인해 2023년과 2024년 유럽의 전기자전거 판매량이 감소했습니다. 이 지역 최대 시장인 독일에서는 구매자들이 새로운 자전거를 구입하는 것보다 기존 자전거를 유지하는 것을 선택함에 따라 2023년 210만 대에서 2024년 205만 대로 약 2.4% 감소했습니다. 그러나 유럽 각국 정부는 보조금, 인프라 업그레이드, 그린 모빌리티 프로그램을 통해 전기자전거 도입을 적극적으로 추진하고 있습니다. 예를 들어, 구매자는 전기자전거 구매 가격의 최대 25%, 최대 1,100달러를 리베이트로 청구할 수 있습니다. 또한, Eurobike 2022에 전시된 전용차선, 충전소, 소형 표준 충전 커넥터 등의 인프라 개척은 시장 회복의 기반을 강화하고 있습니다.

2024년에는 독일, 오스트리아, 벨기에 등 국가의 전기자전거 판매량이 기존 자전거 판매량을 넘어설 것이며, 독일의 전기자전거는 전체 자전거 판매량의 -53%를 차지할 것입니다. 특히 영국에서는 라스트 마일 배송을 위한 전자화물 자전거의 부상도 상업적 용도의 확장을 반영하여 시장의 장기적인 성장을 뒷받침하고 있습니다.

본 보고서는 시장 선도 기업 및 신규 진입 기업에게 전기 자전거 시장 및 하위 부문의 매출 추정치에 대한 가장 정확한 정보를 제공합니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학, 동향, OEM 분석, 비용 내역 등을 포함한 전기자전거 시장 시장 개요

- 소개

- 시장 역학

- 주요 이해관계자와 구입 기준

- 공급망 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 생태계 분석

- 기술 분석

- 가격 분석

- 세계 유수의 전기자전거 OEM-생산 거점, 생산능력, 제품 중점

- 무역 분석

- 특허 분석

- 규제 상황

- 2025-2026년의 주요 회의와 이벤트

- 사례 연구 분석

- 국가별 전기자전거 판매 상위 모델과 가격대

- OEM별 전기자전거 브랜드 리스트

- OEM 분석 : 전기자전거 부품 공급업체 X 모터 파워

- OEM 분석 : OEM X 제공되는 제품 숨결

- OEM 분석 : OEM X 모터 유형

- OEM 분석 : OEM X 배터리 전압

- 용도별 주행거리

- 투자와 자금 조달 시나리오

- 부품표

- 총소유비용

- AI/생성형 AI가 전기자전거 시장에 미치는 영향

- 전기자전거 배터리 재활용 프로세스, 폴리시, 기준

제6장 전기자전거 시장(사용법별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 마운틴/트레킹

- 시티/어번

- 화물

- 기타

- 주요 인사이트

제7장 전기자전거 시장(클래스별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 클래스 I

- 클래스 II

- 클래스 III

- 주요 인사이트

제8장 전기자전거 시장(구성요소별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 배터리

- 전동 모터

- 포크 탑재 프레임

- 차륜

- 크랭크 기어

- 브레이크 시스템

- 모터 컨트롤러

- 주요 인사이트

제9장 전기자전거 시장(구동 시스템별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 수량(1,000대)

- 소개

- 전기자전거 모델과 그 구동 시스템

- 체인 드라이브

- 벨트 드라이브

제10장 전기자전거 시장(모드별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 페달 어시스트

- 스로틀

- 주요 인사이트

제11장 전기자전거 시장(소유권별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 수량(1,000대)

- 소개

- 공유

- 개인

- 주요 인사이트

제12장 전기자전거 시장(속도별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 최고 시속 25킬로미터

- 시속 25-45킬로미터

- 주요 인사이트

제13장 전기자전거 시장(배터리 용량별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 250W 미만

- 250W-450W

- 450W-650W

- 650W 이상

제14장 전기자전거 시장(배터리 통합 유형별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 수량(1,000대)

- 소개

- 전기자전거 모델과 배터리 통합 종류

- 통합형

- 외부형

제15장 전기자전거 시장(배터리 유형별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 리튬이온

- 리튬이온 폴리머

- 납축배터리

- 기타

- 주요 인사이트

제16장 전기자전거 시장(배터리 전압별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 수량(1,000대)

- 소개

- 전기자전거 모델과 배터리 전압

- 39V 미만

- 39V-45V

- 45V-51V

제17장 전기자전거 시장(모터 출력(NM)별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 전기자전거 모델과 모터 출력(NM)

- 40NM 미만

- 40-70NM

- 70NM 이상

제18장 전기자전거 시장(모터 중량별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 운영 데이터

- 2kg 미만

- 2kg-2.4kg

- 2.4kg 이상

제19장 전기자전거 시장(모터 출력(와트)별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 수량(1,000대)

- 소개

- 전기자전거 모델과 그 모터 파워

- 250W 미만

- 251-350W

- 351-500W

- 501-600W

- 600W 이상

제20장 전기자전거 시장(모터 유형별)

- 2032년까지 시장 규모 잠재성과 기회 평가 - 가치와 수량(1,000대)

- 소개

- 허브 모터

- 미드 드라이브 모터

- 주요 인사이트

제21장 전기자전거 시장(지역별)

- 국가 레벨 분석, 2032년까지 시장 규모 잠재성과 기회 평가, 용도별 및 클래스별 - 금액 및 수량(천 단위)

- 소개

- 전기자전거 시장 : 용도별

- 전기자전거 시장 : 클래스별

- 아시아·오세아니아

- 거시경제 전망

- 아시아·오세아니아 : 국가 레벨 전기자전거 OEM 제조 공장

- 아시아·오세아니아의 전기자전거 시장(용도별)

- 아시아·오세아니아의 전기자전거 시장(클래스별)

- 중국

- 일본

- 인도

- 한국

- 대만

- 호주

- 북미

- 거시경제 전망

- 북미 : 국가 레벨 전기자전거 OEM 제조 공장

- 북미 : 전기자전거 시장(용도별)

- 북미 : 전기자전거 시장(클래스별)

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 유럽 : 국가 레벨 전기자전거 OEM 제조 공장

- 유럽 : 전기자전거 시장(용도별)

- 유럽 : 전기자전거 시장(클래스별)

- 독일

- 네덜란드

- 프랑스

- 영국

- 오스트리아

- 이탈리아

- 벨기에

- 스페인

- 스위스

제22장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점, 2023년 5월-2025년 3월

- 전기자전거 시장 점유율 분석(2024년)

- 공급업체 분석

- 상위 상장 기업/공개 기업 매출 분석

- 기업 평가 매트릭스 : 전기자전거 제조업체, 2024년

- 기업 평가 매트릭스 : 전기자전거 부품 공급업체, 2024년

- 스타트업/중소기업 평가 매트릭스 : 전기자전거 제조업체, 2024년

- 경쟁 시나리오

- 브랜드 비교

- 2025년 기업 평가

- 2025년 기업 재무 지표

제23장 기업 개요

- 주요 진출 기업(전기자전거 제조업체)

- GIANT BICYCLES

- ACCELL GROUP N.V.

- YADEA TECHNOLOGY GROUP CO., LTD.

- YAMAHA MOTOR CO., LTD.

- PEDEGO

- PON.BIKE

- AIMA TECHNOLOGY GROUP CO., LTD.

- MERIDA INDUSTRY CO. LTD.

- TREK BICYCLE CORPORATION

- SPECIALIZED BICYCLE COMPONENTS, INC.

- 전기자전거 컴포넌트 공급업체

- ROBERT BOSCH GMBH

- SAMSUNG SDI CO. LTD.

- PANASONIC HOLDINGS CORPORATION

- BAFANG ELECTRIC(SUZHOU) CO., LTD.

- BROSE FAHRZEUGTEILE

- SHIMANO INC.

- JOHNSON MATTHEY

- PROMOVEC A/S

- BMZ GROUP

- WUXI TRUCKRUN MOTOR CO., LTD

- ANANDA DRIVE TECHNIQUES(SHANGHAI) CO., LTD.

- MAHLE GMBH

- ZF FRIEDRICHSHAFEN AG

- SRAM LLC

- TQ GROUP

- 기타 기업

- HERO LECTRO E-CYCLES

- CUBE

- FUJI-TA BICYCLE CO., LTD.

- ELECTRIC BIKE COMPANY

- RAD POWER BIKES LLC

- VANMOOF

- BH BIKES

- BROMPTON BICYCLE LIMITED

- RIESE & MULLER GMBH

- MYSTROMER AG

- COWBOY

제24장 제안

제25장 부록

KSM 25.09.04The e-bike market is projected to grow from USD 54.1 billion in 2025 to USD 87.2 billion by 2032 at a CAGR of 7.0%. The market witnessed strong growth between 2019 and 2021 due to increased environmental awareness and demand for alternative mobility during the pandemic. However, 2023 saw a decline in sales across some regions, particularly Europe, due to economic slowdowns and inventory corrections. Recovery began in 2024, led by Asia Oceania and North America, where supportive regulations and improved infrastructure fueled adoption. Class-I e-bikes continued to dominate, but Class-III models were gaining traction, especially in North America, due to their higher speed capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | Class, Battery, Motor, Mode, Usage, Speed, Battery Capacity, Component, and Region |

| Regions covered | North America, Europe, Asia Oceania |

The demand for e-MTBs and cargo e-bikes is rising rapidly, driven by off-road applications and urban last-mile delivery needs. Enhanced battery technology, rider assist features, and shifting commuter preferences are expected to support long-term market expansion.

">70 NM motor-powered e-bikes are projected to be the fastest-growing segment over the forecast period."

High motor torque is a defining feature in the evolving e-bike landscape, particularly for off-road, mountain biking, and cargo applications. E-bikes with >70 NM torque offer robust performance for demanding terrains and heavy-duty tasks, with gear-assisted systems reaching torque outputs of 800-1,000 N*m in extreme off-road conditions. This power is essential in urban logistics for cargo e-bikes handling loads of up to 200 kg, where stability and efficiency are critical for last-mile delivery. Europe remains the largest market for high-torque e-bikes, supported by urban logistics growth and premium recreational use. Advancements in mid-drive motors, like Bosch's Performance Line CX offering up to 85 N*m with gear amplification, have enabled efficient power delivery while maintaining handling and battery performance. Additionally, brands such as Ariel Rider and Juiced Bikes are pushing torque thresholds further with 85-110 N*m models, signaling an industry shift toward power-centric solutions. However, this trend is mainly concentrated in North America and Europe, where infrastructure and consumer spending can support the USD 3,000+ price range. Regulatory constraints, such as 25-32 km/h speed limits in many regions, continue to restrict mainstream adoption, making high-torque e-bikes a specialized but growing segment in the global market.

"City/urban bikes are projected to be the largest segment during the forecast period."

City or urban e-bikes have quickly gained attention and popularity due to their ease of use, comfort, and practicality for daily city life. As urbanization increases, the demand for e-bikes and other eco-friendly forms of transport is also expected to grow. The main factor driving the growth of city/urban e-bikes is their low electricity consumption, and they are easy to maintain, making them economical. City/urban e-bikes are priced between USD 1,000 and USD 3,000, and they are more suitable for city homeowners for short-distance commutes. Most urban e-bikes are equipped with 250W to 500W hub or mid-drive motors, providing efficient performance across flat urban terrain. Battery capacities generally range between 360Wh and 500Wh, delivering practical ranges of 40-80 km per charge, sufficient for daily commutes.

Asia Oceania is the region with the most significant city/urban e-bike sales in terms of value in 2025. Cities with traffic congestion are shifting towards micro-mobility services, and most city/urban bikes are used for micro-mobility, like Hellobike (China), Anywheel (Singapore), and Coo Rides (India). Prominent players who manufacture city/urban e-bikes are Giant Manufacturing Ltd. (Taiwan), Yadea Group Holdings Ltd. (China), Emotorad (India), and Trek Bicycle Corporation (US). Examples of city/urban e-bikes include Rad Power Bikes RadCity 5 Plus, Tenways CGO600 Pro, Giant Escape+ E+ 3, Trek Verve+, and Specialized Turbo Vado 4.0.

"Europe is estimated to be the second-largest e-bike market in 2025 due to the rising demand for e-bikes."

E-bike sales in Europe declined in 2023 and 2024 due to several macroeconomic and geopolitical factors, including the Russia-Ukraine war, global economic slowdown, inflation, high inventory levels, and reduced consumer spending. Germany, the region's largest market, saw a decline from 2.1 million units in 2023 to 2.05 million in 2024, a ~2.4% drop, as buyers opted to maintain existing bikes rather than purchase new ones. However, governments across Europe are actively promoting e-bike adoption through subsidies, infrastructure upgrades, and green mobility programs. For example, buyers can claim up to 25% of an e-bike's purchase price, with a rebate cap of USD 1,100. Additionally, infrastructure development such as dedicated lanes, charging stations, and compact standardized charging connectors showcased at Eurobike 2022 is reinforcing the market foundation for a rebound.

In 2024, e-bike sales in countries like Germany, Austria, and Belgium surpassed traditional bicycles, with Germany's e-bikes accounting for ~53% of total bike sales. The rise of e-cargo bikes for last-mile delivery, particularly in the UK, also reflects a growing commercial application, supporting the market's long-term growth.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

Here's the breakdown of the interviews conducted:

- By Company Type: OEM - 80%, Tier I - 20%

- By Designation: D Level - 30%, C Level - 60%, and Others - 10%

- By Region: North America - 10%, Europe - 60%, Asia Oceania - 30%,

The key players in the e-bike market are Giant Manufacturing Co., Ltd. (Taiwan), Yamaha Motor Company (Japan), Accell Group NV (Netherlands), Yadea Group Holdings, Ltd. (China), and Pedego (US). Major companies' key strategies to maintain their position in the global e-bike market are strong global networking, mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the e-bike market and the sub-segments. The report discusses ups and downs in e-bike sales, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities. It will help in understanding the drive unit supplier market share, e-bike display system market share by key suppliers, and OEM analysis.

The report further provides insights into the following points:

- Market Dynamics: Analysis of key drivers (government support to increase e-bike sales to reduce CO2 emissions, growing popularity of e-MTBs, rising demand for micro-mobility services), restraints (high stagnant inventory of e-bikes, government regulations, and lack of infrastructure, e-bike conversion kits), opportunities (trend toward connected e-bikes, development of lightweight electrical energy storage systems, development in drive motors for increased e-bike performance), and challenges (challenges in importing to EU and US from China, high cost of e-bikes) influencing the growth of the e-Bike market

- Product Development/Innovation: Detailed insights on upcoming technologies and product & service launches in the e-bike market

- Market Development: Comprehensive market information (the report analyses the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the e-bike market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Pon. Bike (Netherlands), Accell Group N.V. (Netherlands), Giant Manufacturing Co., Ltd. (Taiwan), Yadea Group Holdings, Ltd. (China), and Merida Bicycle (Taiwan) in the e-bike market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for eBike sales/market sizing

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH: BY REGION, CLASS, AND USAGE

- 2.2.2 TOP-DOWN APPROACH: BY BATTERY TYPE AND MOTOR TYPE

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EBIKE MARKET

- 4.2 EBIKE MARKET, BY MODE

- 4.3 EBIKE MARKET, BY MOTOR TYPE

- 4.4 EBIKE MARKET, BY CLASS

- 4.5 EBIKE MARKET, BY USAGE

- 4.6 EBIKE MARKET, BY BATTERY TYPE

- 4.7 EBIKE MARKET, BY SPEED

- 4.8 EBIKE MARKET, BY OWNERSHIP

- 4.9 EBIKE MARKET, BY COMPONENT

- 4.10 EBIKE MARKET, BY MOTOR WEIGHT

- 4.11 EBIKE MARKET, BY BATTERY CAPACITY

- 4.12 EBIKE MARKET, BY MOTOR POWER

- 4.13 EBIKE MARKET, BY MOTOR POWER (WATT)

- 4.14 EBIKE MARKET, BY BATTERY VOLTAGE

- 4.15 EBIKE MARKET, BY BATTERY INTEGRATION

- 4.16 EBIKE MARKET, BY DRIVE SYSTEM

- 4.17 EBIKE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 Market overview of eBike market with market dynamics, trends, OEM Analysis, Cost Breakdown, and others

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.1.1.1 Europe

- 5.2.1.1.2 North America

- 5.2.1.1.3 Asia Oceania

- 5.2.1.2 Growing popularity of electric mountain and cargo bikes

- 5.2.1.2.1 Electric mountain and cargo bike models and their technical specifications

- 5.2.1.3 Growth of micro mobility services and Mobility-as-a-Service (MaaS)

- 5.2.1.1 Government support to increase eBike sales for CO2 emission reduction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited charging infrastructure for eBikes

- 5.2.2.2 Varied government regulations and lack of proper infrastructure

- 5.2.2.3 eBike conversion kits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Trend of connected eBikes

- 5.2.3.2 Development of lightweight electrical energy storage systems

- 5.2.3.3 Developments in drive motors for improved performance of eBikes

- 5.2.4 CHALLENGES

- 5.2.4.1 High price of eBikes

- 5.2.4.2 Challenges in importing to European Union and US from China

- 5.2.4.2.1 China to European Union: Import requirements

- 5.2.4.2.2 China to US: Import requirements

- 5.2.1 DRIVERS

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 FOOD DELIVERY

- 5.3.2 POSTAL SERVICES

- 5.3.3 MUNICIPAL SERVICES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 All-wheel drive

- 5.7.1.2 Motor drive

- 5.7.1.3 Battery technology

- 5.7.1.4 Electric mountain bikes

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Swappable batteries

- 5.7.2.2 Integration of intelligent features

- 5.7.2.3 Folding eBikes for urban mobility

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Aftermarket eBike kit

- 5.7.3.2 Subscription and sharing services

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 BY OEM AND TYPE, 2025

- 5.8.2 BY REGION

- 5.8.3 BY KEY COUNTRY

- 5.9 LEADING GLOBAL E-BIKE OEMS - PRODUCTION FOOTPRINT, CAPACITY, AND PRODUCT FOCUS

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORTS

- 5.10.1.1 China

- 5.10.1.2 Germany

- 5.10.1.3 Netherlands

- 5.10.1.4 Taipei, Chinese

- 5.10.2 IMPORTS

- 5.10.2.1 Germany

- 5.10.2.2 US

- 5.10.2.3 Netherlands

- 5.10.2.4 France

- 5.10.2.5 Belgium

- 5.10.1 EXPORTS

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY ANALYSIS OF EBIKE MARKET, BY REGION/COUNTRY

- 5.12.2.1 European Union

- 5.12.2.2 China

- 5.12.2.3 India

- 5.12.2.4 Japan

- 5.12.2.5 US

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 COMODULE CONNECTIVITY: THEFT-PROOF URBAN ARROW CARGO EBIKES

- 5.14.2 NYE SOLUTION: REQUIREMENT OF LUBRICANTS FOR ROTARY MOTOR GEAR OF EBIKES

- 5.14.3 COMODULE: LAUNCH OF IOT INTEGRATIONS FOR SHIMANO DRIVETRAINS

- 5.14.4 BINOVA DRIVE UNIT: CONTACTLESS TORQUE SENSORS

- 5.14.5 MAHLE GROUP: NEW GENERATION OF DRIVE SYSTEM FOR EBIKES

- 5.14.6 REVONTE ONE DRIVE SYSTEM: DEVELOPMENT OF NEW DRIVE SYSTEM FOR EBIKES WITH AUTOMATIC TRANSMISSION

- 5.15 TOP-SELLING EBIKE MODELS VS. PRICE RANGE BY COUNTRY

- 5.15.1 US

- 5.15.2 CANADA

- 5.15.3 GERMANY

- 5.15.4 NETHERLANDS

- 5.15.5 UK

- 5.15.6 JAPAN

- 5.15.7 CHINA

- 5.16 LIST OF EBIKE BRANDS PER OEM

- 5.17 OEM ANALYSIS: EBIKE COMPONENT SUPPLIERS X MOTOR POWER

- 5.17.1 EBIKE MOTOR SUPPLIERS VS MOTOR POWER

- 5.18 OEM ANALYSIS: OEM X BREATH OF THE PRODUCT OFFERED

- 5.18.1 OEM X BREATH OF THE PRODUCT OFFERED

- 5.19 OEM ANALYSIS: OEM X MOTOR TYPE

- 5.19.1 EBIKE OEM VS MOTOR TYPE

- 5.20 OEM ANALYSIS: OEM X BATTERY VOLTAGE

- 5.20.1 EBIKE OEM VS BATTERY VOLTAGE

- 5.21 DISTANCE DRIVEN PER APPLICATION

- 5.21.1 EMTB: DISTANCE VS. RIDING TIME

- 5.21.2 EBIKE: DISTANCE VS. SYSTEM WEIGHT

- 5.21.3 EBIKE: BATTERY VOLTAGE VS. MILES

- 5.22 INVESTMENT AND FUNDING SCENARIO

- 5.23 BILL OF MATERIALS

- 5.24 TOTAL COST OF OWNERSHIP

- 5.24.1 TOTAL COST OF OWNERSHIP (GLOBAL)

- 5.24.2 TOTAL COST OF OWNERSHIP FOR EBIKES IN INDIA, EBIKE VS. E2W VS. ICE 2W

- 5.24.2.1 Total cost of ownership (India)

- 5.24.3 COST BREAKDOWN

- 5.25 IMPACT OF AI/GEN AI ON EBIKE MARKET

- 5.25.1 IMPACT AND RECOMMENDATIONS

- 5.26 EBIKE BATTERY RECYCLING PROCESS, POLICIES, AND STANDARDS

- 5.26.1 RECYCLING PROCESS OVERVIEW

- 5.26.2 POLICIES AND STANDARDS, BY REGION

- 5.26.3 RECENT DEVELOPMENTS (2024-2025)

- 5.26.4 KEY PLAYERS IN EBIKE BATTERY RECYCLING

6 EBIKE MARKET, BY USAGE

- 6.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 6.1 INTRODUCTION

- 6.2 MOUNTAIN/TREKKING

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.2.1.1 Mountain eBike, model-wise motor power and battery weight

- 6.2.1 AGILE FRAME STRUCTURE FOR EASY OFF-ROAD CYCLING TO DRIVE GROWTH

- 6.3 CITY/URBAN

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.3.1.1 City/Urban eBike, model-wise motor power and battery weight

- 6.3.1 DESIGNED FOR FREQUENT, SHORT, AND MODERATE-PACE RIDES

- 6.4 CARGO

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.4.1.1 Cargo eBike, model-wise motor power and battery weight

- 6.4.1 RISE IN E-COMMERCE INDUSTRY TO DRIVE MARKET

- 6.5 OTHER USAGES

- 6.5.1 OTHER EBIKE USAGES, MODEL-WISE MOTOR POWER AND BATTERY WEIGHT

- 6.6 PRIMARY INSIGHTS

7 EBIKE MARKET, BY CLASS

- 7.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 7.1 INTRODUCTION

- 7.2 CLASS I

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.2.1.1 Production and model insights for Class I eBike OEMs

- 7.2.1 RAPIDLY GROWING SEGMENT OF EBIKE MARKET

- 7.3 CLASS II

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.3.1.1 Production and model insights for Class II eBike OEMs

- 7.3.1 REGULATORY SUPPORT IN NORTH AMERICA TO DRIVE MARKET

- 7.4 CLASS III

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.4.1.1 Production and model insights for Class III eBike OEMs

- 7.4.1 MOST REGULATED CLASS OF EBIKES

- 7.5 PRIMARY INSIGHTS

8 EBIKE MARKET, BY COMPONENT

- 8.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 8.1 INTRODUCTION

- 8.2 BATTERY

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.2.1.1 Comprehensive overview of leading eBike battery manufacturers

- 8.2.1 ADVANCEMENT IN BATTERY TECHNOLOGIES FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.3 ELECTRIC MOTOR

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.3.1.1 Comprehensive overview of leading eBike motor manufacturers

- 8.3.1 CONSTANT DEVELOPMENTS IN EBIKE MOTORS AND GROWING DEMAND FOR HIGH PERFORMANCE TO DRIVE MARKET

- 8.4 FRAME WITH FORK

- 8.4.1 INCREASING DEMAND FOR TITANIUM AND CARBON FIBER FOR LIGHTWEIGHT FRAMES TO DRIVE MARKET

- 8.4.1.1 Comprehensive overview of eBike frame with fork manufacturers

- 8.4.1 INCREASING DEMAND FOR TITANIUM AND CARBON FIBER FOR LIGHTWEIGHT FRAMES TO DRIVE MARKET

- 8.5 WHEEL

- 8.5.1 RISING DEMAND FOR PERFORMANCE EBIKES TO BOOST NEED FOR DURABLE, HIGH-QUALITY WHEEL SYSTEMS

- 8.5.1.1 Comprehensive overview of eBike wheel manufacturers

- 8.5.1 RISING DEMAND FOR PERFORMANCE EBIKES TO BOOST NEED FOR DURABLE, HIGH-QUALITY WHEEL SYSTEMS

- 8.6 CRANK GEAR

- 8.6.1 NORTH AMERICA TO DOMINATE MARKET

- 8.6.1.1 Comprehensive overview of eBike crank gear manufacturers

- 8.6.1 NORTH AMERICA TO DOMINATE MARKET

- 8.7 BRAKE SYSTEM

- 8.7.1 INCREASE IN SPEED LIMIT REGULATIONS TO DRIVE MARKET

- 8.7.1.1 Comprehensive overview of eBike brake system manufacturers

- 8.7.1 INCREASE IN SPEED LIMIT REGULATIONS TO DRIVE MARKET

- 8.8 MOTOR CONTROLLER

- 8.8.1 ADVANCEMENT IN MOTOR CONTROLLERS FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.8.1.1 Comprehensive overview of eBike motor controller manufacturers

- 8.8.1 ADVANCEMENT IN MOTOR CONTROLLERS FOR HIGH-PERFORMANCE EBIKES TO DRIVE MARKET

- 8.9 PRIMARY INSIGHTS

9 EBIKE MARKET, BY DRIVE SYSTEM

- 9.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 9.1 INTRODUCTION

- 9.2 EBIKE MODELS AND THEIR DRIVE SYSTEMS

- 9.3 CHAIN DRIVE

- 9.3.1 COMPATIBLE WITH VARIOUS GEAR SYSTEMS

- 9.4 BELT DRIVE

- 9.4.1 RISING FOCUS TOWARD URBAN RIDING

10 EBIKE MARKET, BY MODE

- 10.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 10.1 INTRODUCTION

- 10.2 PEDAL ASSIST

- 10.2.1 IDEAL FOR COMMUTING AND LIGHT CARGO TRANSPORT

- 10.3 THROTTLE

- 10.3.1 GROWING DEMAND FOR LAST-MILE DELIVERIES TO DRIVE GROWTH

- 10.4 PRIMARY INSIGHTS

11 EBIKE MARKET, BY OWNERSHIP

- 11.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 11.1 INTRODUCTION

- 11.2 SHARED

- 11.2.1 COST-EFFECTIVENESS OF SHARED OWNERSHIP TO DRIVE MARKET

- 11.3 PERSONAL

- 11.3.1 MINIMAL MAINTENANCE COSTS OF PERSONAL EBIKES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 EBIKE MARKET, BY SPEED

- 12.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 12.1 INTRODUCTION

- 12.2 UP TO 25 KM/H

- 12.2.1 EUROPE AND ASIA OCEANIA TO DRIVE MARKET

- 12.3 25-45 KM/H

- 12.3.1 NORTH AMERICA TO DRIVE MARKET

- 12.4 PRIMARY INSIGHTS

13 EBIKE MARKET, BY BATTERY CAPACITY

- 13.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 13.1 INTRODUCTION

- 13.2 <250W

- 13.2.1 IDEAL FOR ENTRY-LEVEL CITY EBIKES, COMPACT FOLDING BIKES, AND LOW-SPEED ELECTRIC CYCLES

- 13.2.1.1 Model-wise motor power and battery capacity, <250W

- 13.2.1 IDEAL FOR ENTRY-LEVEL CITY EBIKES, COMPACT FOLDING BIKES, AND LOW-SPEED ELECTRIC CYCLES

- 13.3 >250W-<450W

- 13.3.1 GROWING DEMAND FOR LONG-RANGE EBIKES IN EUROPE AND NORTH AMERICA TO DRIVE GROWTH

- 13.3.1.1 Model-wise motor power and battery capacity, >250W-<450W

- 13.3.1 GROWING DEMAND FOR LONG-RANGE EBIKES IN EUROPE AND NORTH AMERICA TO DRIVE GROWTH

- 13.4 >450W-<650W

- 13.4.1 NEED FOR COST-EFFECTIVE AND EFFICIENT OPTIONS TO DRIVE MARKET

- 13.4.1.1 Model-wise motor power and battery capacity,>450W-<650W

- 13.4.1 NEED FOR COST-EFFECTIVE AND EFFICIENT OPTIONS TO DRIVE MARKET

- 13.5 >650W

- 13.5.1 INCREASING DEMAND FOR HIGH-POWERED EBIKES TO DRIVE MARKET

- 13.5.1.1 Model-wise Motor Power and Battery Capacity,>650W

- 13.5.1 INCREASING DEMAND FOR HIGH-POWERED EBIKES TO DRIVE MARKET

14 EBIKE MARKET, BY TYPE OF BATTERY INTEGRATION

- 14.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 14.1 INTRODUCTION

- 14.2 EBIKE MODELS AND THEIR TYPES OF BATTERY INTEGRATION

- 14.3 INTEGRATED

- 14.3.1 OFFERS CLEAN AESTHETICS AND BETTER WEIGHT DISTRIBUTION

- 14.4 EXTERNAL

- 14.4.1 EASY BATTERY SWAPPING AND CHARGING PROVIDING FLEXIBILITY ACROSS VEHICLE MODELS

15 EBIKE MARKET, BY BATTERY TYPE

- 15.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 15.1 INTRODUCTION

- 15.2 LITHIUM-ION

- 15.2.1 RANGE, WEIGHT, AND LONGEVITY OF LITHIUM-ION BATTERIES IDEAL FOR EBIKES

- 15.3 LITHIUM-ION POLYMER

- 15.3.1 BETTER RANGE AND LESSER WEIGHT THAN LITHIUM-ION BATTERIES

- 15.4 LEAD-ACID

- 15.4.1 CHEAPEST OF ALL EBIKE BATTERIES

- 15.5 OTHER BATTERY TYPES

- 15.6 PRIMARY INSIGHTS

16 EBIKE MARKET, BY BATTERY VOLTAGE

- 16.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 16.1 INTRODUCTION

- 16.2 EBIKE MODELS AND THEIR BATTERY VOLTAGES

- 16.3 LESS THAN 39V

- 16.3.1 WELL-SUITED FOR FOLDING EBIKES

- 16.3.1.1 Key market insights, less than 39V batteries

- 16.3.1 WELL-SUITED FOR FOLDING EBIKES

- 16.4 39V TO 45V

- 16.4.1 CUSTOMIZABLE BATTERY PREFERRED BY EBIKE ENTHUSIASTS

- 16.4.1.1 Key market insights, 39V to 45V batteries

- 16.4.1 CUSTOMIZABLE BATTERY PREFERRED BY EBIKE ENTHUSIASTS

- 16.5 45V TO 51V

- 16.5.1 IDEAL FOR PERFORMANCE-ORIENTED BIKES IN DEMANDING CONDITIONS

- 16.5.1.1 Key market insights, 45V to 51V batteries

- 16.5.1 IDEAL FOR PERFORMANCE-ORIENTED BIKES IN DEMANDING CONDITIONS

17 EBIKE MARKET, BY MOTOR POWER (NM)

- 17.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 17.1 INTRODUCTION

- 17.2 EBIKE MODEL VS. MOTOR POWER (NM)

- 17.3 <40 NM

- 17.3.1 GROWING SALES OF AFFORDABLE EBIKES REQUIRING LESS MOTOR POWER TO DRIVE GROWTH

- 17.4 >40-<70 NM

- 17.4.1 HIGH DEMAND FOR CITY AND MULTI-PURPOSE EBIKES TO DRIVE GROWTH

- 17.5 >70 NM

- 17.5.1 RISING DEMAND FOR MOUNTAIN AND TREKKING BIKES TO DRIVE GROWTH

18 EBIKE MARKET, BY MOTOR WEIGHT

- 18.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 18.1 INTRODUCTION

- 18.2 OPERATIONAL DATA

- 18.3 < 2 KG

- 18.3.1 RISING DEMAND FOR CITY EBIKES TO DRIVE MARKET

- 18.4 > 2 KG -< 2.4 KG

- 18.4.1 SIGNIFICANT INVESTMENTS IN MICRO-MOBILITY PROJECTS TO DRIVE MARKET

- 18.5 > 2.4 KG

- 18.5.1 INCREASING USE OF HIGH-POWER MOTORS TO DRIVE MARKET

19 EBIKE MARKET, BY MOTOR POWER (WATT)

- 19.1 Market Size Potential and Opportunity Assessment To 2032 - Volume (Thousand Units)

- 19.1 INTRODUCTION

- 19.2 EBIKE MODELS AND THEIR MOTOR POWERS

- 19.3 <250W

- 19.3.1 LOW POWERED AND COST-EFFECTIVE

- 19.4 251-350W

- 19.4.1 OFFER HIGHER ASSISTANCE LEVELS

- 19.5 351-500W

- 19.5.1 OFFERS BALANCED PERFORMANCE AND ENERGY EFFICIENCY

- 19.6 501-600W

- 19.6.1 GOOD OPTION FOR RIDERS FREQUENTLY NAVIGATING INCLINES

- 19.7 >600W

- 19.7.1 RISE IN DEMAND FOR MOUNTAIN EBIKES

20 EBIKE MARKET, BY MOTOR TYPE

- 20.1 Market Size Potential and Opportunity Assessment To 2032 - Value (USD Million) & Volume (Thousand Units)

- 20.1 INTRODUCTION

- 20.2 HUB MOTOR

- 20.2.1 EXTRA TRACTION PROVIDED BY ALL-WHEEL DRIVE-LIKE SYSTEMS TO DRIVE MARKET

- 20.3 MID-DRIVE MOTOR

- 20.3.1 GEAR RATIO TO KEEP MID MOTOR SEGMENT AHEAD OF HUB MOTOR SEGMENT

- 20.4 PRIMARY INSIGHTS

21 EBIKE MARKET, BY REGION

- 21.1 Country-level Analysis, Market Size Potential and Opportunity Assessment to 2032, By Usage and By Class - Value (USD Million) & Volume (Thousand Units)

- 21.1 INTRODUCTION

- 21.1.1 EBIKE MARKET: BY USAGE

- 21.1.2 EBIKE MARKET: BY CLASS

- 21.2 ASIA OCEANIA

- 21.2.1 MACROECONOMIC OUTLOOK

- 21.2.2 ASIA OCEANIA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.2.3 ASIA OCEANIA EBIKE MARKET, BY USAGE

- 21.2.4 ASIA OCEANIA EBIKE MARKET, BY CLASS

- 21.2.5 CHINA

- 21.2.5.1 Traffic congestion in urban cities to drive market

- 21.2.6 JAPAN

- 21.2.6.1 Presence of major eBike component innovators to drive market

- 21.2.7 INDIA

- 21.2.7.1 Growing fuel prices to drive market

- 21.2.8 SOUTH KOREA

- 21.2.8.1 Government initiatives to reduce carbon emissions to drive market

- 21.2.9 TAIWAN

- 21.2.9.1 Growing eBike exports to drive market

- 21.2.10 AUSTRALIA

- 21.2.10.1 eBike tourism to drive market

- 21.3 NORTH AMERICA

- 21.3.1 MACROECONOMIC OUTLOOK

- 21.3.2 NORTH AMERICA: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.3.3 NORTH AMERICA: EBIKE MARKET, BY USAGE

- 21.3.4 NORTH AMERICA: EBIKE MARKET, BY CLASS

- 21.3.5 US

- 21.3.5.1 Increasing awareness about sustainable transportation solutions to drive market

- 21.3.6 CANADA

- 21.3.6.1 Investment in shared mobility infrastructure to drive market

- 21.4 EUROPE

- 21.4.1 MACROECONOMIC OUTLOOK

- 21.4.2 EUROPE: COUNTRY-LEVEL EBIKE OEM MANUFACTURING PLANT

- 21.4.3 EUROPE: EBIKE MARKET, BY USAGE

- 21.4.4 EUROPE: EBIKE MARKET, BY CLASS

- 21.4.5 GERMANY

- 21.4.5.1 Rising demand for trekking eBikes to drive market

- 21.4.6 NETHERLANDS

- 21.4.6.1 Incentives offered by government to promote eBike adoption to drive market

- 21.4.7 FRANCE

- 21.4.7.1 Government incentives for purchase of cargo eBikes to drive market

- 21.4.8 UK

- 21.4.8.1 Cycle-to-Work scheme to drive market

- 21.4.9 AUSTRIA

- 21.4.9.1 Shift toward electric mobility to drive market

- 21.4.10 ITALY

- 21.4.10.1 Mobility Bonus for higher eBike sales to drive market

- 21.4.11 BELGIUM

- 21.4.11.1 Government initiatives toward infrastructural development to drive market

- 21.4.12 SPAIN

- 21.4.12.1 Bike-sharing schemes to drive market

- 21.4.13 SWITZERLAND

- 21.4.13.1 Growing demand for cargo eBikes to drive market

22 COMPETITIVE LANDSCAPE

- 22.1 OVERVIEW

- 22.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, MAY 2023-MARCH 2025

- 22.3 EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.1 NORTH AMERICA: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.2 EUROPE: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.3 ASIA OCEANIA: EBIKE MARKET SHARE ANALYSIS, 2024

- 22.3.4 EBIKE DISPLAY MARKET SHARE ANALYSIS, 2024

- 22.3.5 EBIKE BATTERY MARKET SHARE ANALYSIS, 2024

- 22.3.6 OEM-LEVEL EBIKE MARKET SHARE ANALYSIS, 2023-2024

- 22.3.7 EBIKE DRIVE UNIT MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2023-2024

- 22.3.8 EBIKE BATTERY MANAGEMENT SYSTEM MARKET: LIST OF MAJOR BATTERY MANAGEMENT SYSTEM SUPPLIERS

- 22.3.9 EBIKE CONNECTIVITY ECU MARKET: LIST OF MAJOR CONNECTIVITY ECU SUPPLIERS

- 22.3.10 EBIKE INVERTER MARKET: LIST OF MAJOR INVERTER SUPPLIERS

- 22.3.11 LIST OF EBIKE MANUFACTURERS IN CHINA

- 22.3.12 LIST OF PLAYERS WITH GRAVEL EBIKE PRODUCT OFFERINGS

- 22.4 SUPPLIER ANALYSIS

- 22.4.1 MOTOR SUPPLIERS TO KEY OEMS

- 22.4.2 INVERTER SUPPLIERS TO KEY OEMS

- 22.4.3 BATTERY AND BATTERY MANAGEMENT SYSTEM SUPPLIERS TO KEY OEMS

- 22.4.4 COMPONENTS AS A PACKAGE TO OEMS

- 22.4.5 IOT SERVICES BY TOP PLAYERS

- 22.4.5.1 Robert Bosch GmbH

- 22.4.5.1.1 eBike Connect

- 22.4.5.1.2 eBike Flow App

- 22.4.5.2 Specialized Bicycle Components, Inc.

- 22.4.5.2.1 Mission Control App

- 22.4.5.2.2 The Specialized App

- 22.4.5.3 Shimano Inc.

- 22.4.5.3.1 E-Tube

- 22.4.5.4 Yamaha Motor Co., Ltd.

- 22.4.5.4.1 Yamaha My Ride App

- 22.4.5.5 Giant Bicycles

- 22.4.5.5.1 RideControl App

- 22.4.5.6 Fazua GmbH

- 22.4.5.6.1 FAZUA Rider App

- 22.4.5.7 MAHLE GmbH

- 22.4.5.7.1 MySmart Bike App

- 22.4.5.7.2 SmartBike Lab App

- 22.4.5.8 Velco

- 22.4.5.8.1 Velco Rider App

- 22.4.5.9 Powunity GmbH

- 22.4.5.9.1 PowUnity App

- 22.4.5.10 FIT

- 22.4.5.10.1 FIT eBike Control App

- 22.4.5.11 Porsche digital

- 22.4.5.11.1 Cyklaer App

- 22.4.5.12 ESB

- 22.4.5.12.1 ESB.APP

- 22.4.5.13 Haibike

- 22.4.5.13.1 eConnect App

- 22.4.5.14 Hyena Inc

- 22.4.5.14.1 Rider App

- 22.4.5.15 Strava

- 22.4.5.15.1 Strava App

- 22.4.5.16 Brose

- 22.4.5.16.1 Brose eBike App

- 22.4.5.17 Garmin Ltd

- 22.4.5.17.1 Garmin Connect App

- 22.4.5.18 Komoot

- 22.4.5.18.1 Komoot App

- 22.4.5.19 Ride with GPS

- 22.4.5.19.1 Ride with GPS app

- 22.4.5.20 TrainerRoad

- 22.4.5.20.1 TrainerRoad App

- 22.4.5.21 Epic Ride Weather

- 22.4.5.21.1 Epic Ride Weather App

- 22.4.5.1 Robert Bosch GmbH

- 22.5 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 22.6 COMPANY EVALUATION MATRIX: EBIKE MANUFACTURERS, 2024

- 22.6.1 STARS

- 22.6.2 EMERGING LEADERS

- 22.6.3 PERVASIVE PLAYERS

- 22.6.4 PARTICIPANTS

- 22.6.5 COMPANY FOOTPRINT

- 22.7 COMPANY EVALUATION MATRIX: EBIKE COMPONENT SUPPLIERS, 2024

- 22.7.1 STARS

- 22.7.2 EMERGING LEADERS

- 22.7.3 PERVASIVE PLAYERS

- 22.7.4 PARTICIPANTS

- 22.7.5 COMPANY FOOTPRINT

- 22.8 STARTUP/SME EVALUATION MATRIX: EBIKE MANUFACTURERS, 2024

- 22.8.1 PROGRESSIVE COMPANIES

- 22.8.2 RESPONSIVE COMPANIES

- 22.8.3 DYNAMIC COMPANIES

- 22.8.4 STARTING BLOCKS

- 22.8.5 COMPETITIVE BENCHMARKING

- 22.9 COMPETITIVE SCENARIO

- 22.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 22.9.2 DEALS

- 22.9.3 EXPANSIONS

- 22.9.4 OTHER DEVELOPMENTS

- 22.10 BRAND COMPARISON

- 22.11 COMPANY VALUATION, 2025

- 22.12 COMPANY FINANCIAL METRICS, 2025

23 COMPANY PROFILES

- 23.1 KEY PLAYERS (EBIKE MANUFACTURERS)

- 23.1.1 GIANT BICYCLES

- 23.1.1.1 Business overview

- 23.1.1.2 Products offered

- 23.1.1.3 Recent developments

- 23.1.1.3.1 Product launches

- 23.1.1.3.2 Deals

- 23.1.1.3.3 Expansions

- 23.1.1.3.4 Other developments

- 23.1.1.4 MnM view

- 23.1.1.4.1 Key strengths

- 23.1.1.4.2 Strategic choices

- 23.1.1.4.3 Weaknesses and competitive threats

- 23.1.2 ACCELL GROUP N.V.

- 23.1.2.1 Business overview

- 23.1.2.2 Products offered

- 23.1.2.3 Recent developments

- 23.1.2.3.1 Product launches

- 23.1.2.3.2 Deals

- 23.1.2.3.3 Expansions

- 23.1.2.3.4 Other developments

- 23.1.2.4 MnM view

- 23.1.2.4.1 Key strengths

- 23.1.2.4.2 Strategic choices

- 23.1.2.4.3 Weaknesses and competitive threats

- 23.1.3 YADEA TECHNOLOGY GROUP CO., LTD.

- 23.1.3.1 Business overview

- 23.1.3.2 Products offered

- 23.1.3.3 Recent developments

- 23.1.3.3.1 Product launches

- 23.1.3.3.2 Expansions

- 23.1.3.4 MnM View

- 23.1.3.4.1 Key strengths

- 23.1.3.4.2 Strategic choices

- 23.1.3.4.3 Weaknesses and competitive threats

- 23.1.4 YAMAHA MOTOR CO., LTD.

- 23.1.4.1 Business overview

- 23.1.4.2 Products offered

- 23.1.4.3 Recent developments

- 23.1.4.3.1 Product launches

- 23.1.4.3.2 Deals

- 23.1.4.3.3 Expansions

- 23.1.4.4 MnM view

- 23.1.4.4.1 Key strengths

- 23.1.4.4.2 Strategic choices

- 23.1.4.4.3 Weaknesses and competitive threats

- 23.1.5 PEDEGO

- 23.1.5.1 Business overview

- 23.1.5.2 Products offered

- 23.1.5.3 Recent developments

- 23.1.5.3.1 Product launches

- 23.1.5.3.2 Deals

- 23.1.5.3.3 Expansions

- 23.1.5.4 MnM view

- 23.1.5.4.1 Key strengths

- 23.1.5.4.2 Strategic choices

- 23.1.5.4.3 Weaknesses and competitive threats

- 23.1.6 PON.BIKE

- 23.1.6.1 Business overview

- 23.1.6.2 Products offered

- 23.1.6.3 Recent developments

- 23.1.6.3.1 Deals

- 23.1.6.3.2 Other developments

- 23.1.7 AIMA TECHNOLOGY GROUP CO., LTD.

- 23.1.7.1 Business overview

- 23.1.7.2 Products offered

- 23.1.7.3 Recent developments

- 23.1.7.3.1 Product launches

- 23.1.7.3.2 Deals

- 23.1.8 MERIDA INDUSTRY CO. LTD.

- 23.1.8.1 Business overview

- 23.1.8.2 Products offered

- 23.1.8.3 Recent developments

- 23.1.8.3.1 Product launches

- 23.1.8.3.2 Deals

- 23.1.9 TREK BICYCLE CORPORATION

- 23.1.9.1 Business overview

- 23.1.9.2 Products offered

- 23.1.9.3 Recent developments

- 23.1.9.3.1 Product launches

- 23.1.9.3.2 Deals

- 23.1.10 SPECIALIZED BICYCLE COMPONENTS, INC.

- 23.1.10.1 Business overview

- 23.1.10.2 Products offered

- 23.1.10.3 Recent developments

- 23.1.10.3.1 Deals

- 23.1.1 GIANT BICYCLES

- 23.2 EBIKE COMPONENT SUPPLIERS

- 23.2.1 ROBERT BOSCH GMBH

- 23.2.1.1 Business overview

- 23.2.1.2 Products offered

- 23.2.1.3 Recent developments

- 23.2.1.3.1 Product launches/developments/enhancements

- 23.2.1.3.2 Deals

- 23.2.2 SAMSUNG SDI CO. LTD.

- 23.2.2.1 Business overview

- 23.2.2.2 Products offered

- 23.2.2.3 Recent developments

- 23.2.2.3.1 Product launches

- 23.2.3 PANASONIC HOLDINGS CORPORATION

- 23.2.3.1 Business overview

- 23.2.3.2 Products offered

- 23.2.3.2.1 Deals

- 23.2.4 BAFANG ELECTRIC (SUZHOU) CO., LTD.

- 23.2.4.1 Business overview

- 23.2.4.2 Products offered

- 23.2.4.3 Recent developments

- 23.2.4.3.1 Product launches/developments

- 23.2.4.3.2 Deals

- 23.2.4.3.3 Expansions

- 23.2.5 BROSE FAHRZEUGTEILE

- 23.2.5.1 Business overview

- 23.2.5.2 Products offered

- 23.2.5.3 Recent developments

- 23.2.5.3.1 Product enhancements

- 23.2.5.3.2 Deals

- 23.2.5.3.3 Other developments

- 23.2.6 SHIMANO INC.

- 23.2.6.1 Business overview

- 23.2.6.2 Products offered

- 23.2.6.3 Recent developments

- 23.2.6.3.1 Product launches

- 23.2.7 JOHNSON MATTHEY

- 23.2.7.1 Business overview

- 23.2.7.2 Products offered

- 23.2.7.3 Recent developments

- 23.2.7.3.1 Deals

- 23.2.8 PROMOVEC A/S

- 23.2.8.1 Business overview

- 23.2.8.2 Products offered

- 23.2.8.3 Recent developments

- 23.2.8.3.1 Deals

- 23.2.9 BMZ GROUP

- 23.2.9.1 Business overview

- 23.2.9.2 Products offered

- 23.2.9.3 Recent developments

- 23.2.9.3.1 Deals

- 23.2.9.3.2 Expansions

- 23.2.10 WUXI TRUCKRUN MOTOR CO., LTD

- 23.2.10.1 Business overview

- 23.2.10.2 Products offered

- 23.2.11 ANANDA DRIVE TECHNIQUES (SHANGHAI) CO., LTD.

- 23.2.11.1 Business overview

- 23.2.11.2 Products offered

- 23.2.11.3 Recent developments

- 23.2.11.3.1 Product launches

- 23.2.11.3.2 Deals

- 23.2.11.3.3 Expansions

- 23.2.11.3.4 Other developments

- 23.2.12 MAHLE GMBH

- 23.2.12.1 Business overview

- 23.2.12.2 Products offered

- 23.2.12.3 Recent developments

- 23.2.12.3.1 Product Launches/developments

- 23.2.12.3.2 Deals

- 23.2.12.3.3 Other developments

- 23.2.13 ZF FRIEDRICHSHAFEN AG

- 23.2.13.1 Business overview

- 23.2.13.2 Products offered

- 23.2.13.3 Recent developments

- 23.2.13.3.1 Product launches/developments

- 23.2.14 SRAM LLC

- 23.2.14.1 Business overview

- 23.2.14.2 Products offered

- 23.2.14.3 Recent developments

- 23.2.14.3.1 Deals

- 23.2.15 TQ GROUP

- 23.2.15.1 Business overview

- 23.2.15.2 Products offered

- 23.2.15.3 Recent developments

- 23.2.15.3.1 Product launches

- 23.2.1 ROBERT BOSCH GMBH

- 23.3 OTHER PLAYERS

- 23.3.1 HERO LECTRO E-CYCLES

- 23.3.2 CUBE

- 23.3.3 FUJI-TA BICYCLE CO., LTD.

- 23.3.4 ELECTRIC BIKE COMPANY

- 23.3.5 RAD POWER BIKES LLC

- 23.3.6 VANMOOF

- 23.3.7 BH BIKES

- 23.3.8 BROMPTON BICYCLE LIMITED

- 23.3.9 RIESE & MULLER GMBH

- 23.3.10 MYSTROMER AG

- 23.3.11 COWBOY

24 RECOMMENDATIONS

- 24.1 ASIA OCEANIA TO BE MAJOR MARKET FOR EBIKES

- 24.2 CITY/URBAN EBIKES AND DEVELOPMENTS IN DRIVE MOTORS TO BE KEY FOCUS FOR MANUFACTURERS

- 24.3 RISING DEMAND FOR MID MOTOR COMPARED TO HUB MOTOR

- 24.4 RISING DEMAND FOR >250 W AND <450 W BATTERY CAPACITY IN EBIKES

- 24.5 CONCLUSION

25 APPENDIX

- 25.1 KEY INSIGHTS OF INDUSTRY EXPERTS

- 25.2 DISCUSSION GUIDE

- 25.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 25.4 CUSTOMIZATION OPTIONS

- 25.4.1 BY DESIGN

- 25.4.1.1 Foldable

- 25.4.1.2 Unfoldable

- 25.4.2 BY FRAME MATERIAL

- 25.4.2.1 Carbon fiber

- 25.4.2.2 Carbon steel

- 25.4.2.3 Aluminum

- 25.4.2.4 Aluminum alloy

- 25.4.3 EMTB MARKET, BY TYPE

- 25.4.3.1 Light

- 25.4.3.2 Trekking

- 25.4.3.3 Enduro

- 25.4.4 CITY E-BIKE MARKET, BY TYPE

- 25.4.4.1 Speed

- 25.4.4.2 Foldable

- 25.4.5 MARKET SHARE ANALYSIS, BY CLASS

- 25.4.6 TECHNICAL SPECIFICATIONS OF EBIKES, BY OEM AND COUNTRY

- 25.4.6.1 US

- 25.4.6.2 Canada

- 25.4.6.3 Germany

- 25.4.6.4 Netherlands

- 25.4.6.5 UK

- 25.4.6.6 France

- 25.4.6.7 China

- 25.4.6.8 Japan

- 25.4.1 BY DESIGN

- 25.5 RELATED REPORTS

- 25.6 AUTHOR DETAILS