|

시장보고서

상품코드

1800736

접선유동여과 시장 : 제품별, 막 재료별, 기술별, 용도별, 운전 규모별, 최종사용자별, 지역별 - 예측(-2030년)Tangential Flow Filtration Market by Product (Single Use Systems, Cassettes, Capsules), Material (PES, PVDF), Technique (Ultrafiltration), Application (Protein, Vaccine, API, Cell Separation), Scale of Operation (R&D), End User - Global Forecast to 2030 |

||||||

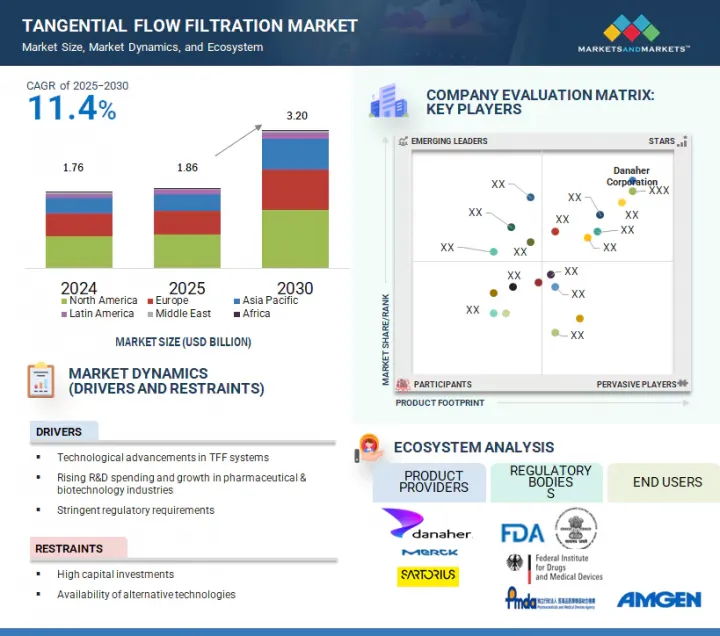

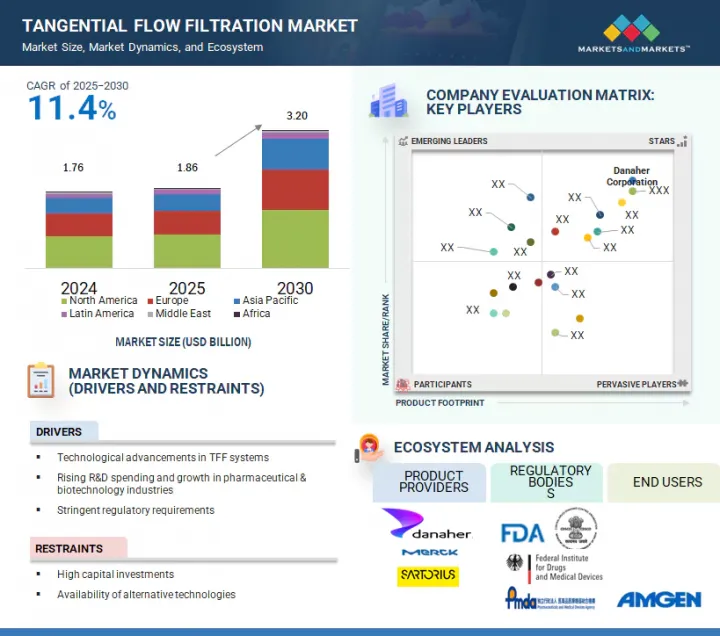

접선유동여과 시장 규모는 예측 기간 동안 11.4%의 CAGR로 확대되어 2025년 18억 6,000만 달러에서 2030년에는 32억 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 막 재료별, 기술별, 용도별, 운전 규모별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 시장의 성장은 R&D 활동에 대한 지출 증가에 기인합니다. TFF 기술은 크게 발전하여 효율적이고 신뢰할 수 있으며 비용 효율적인 공정을 실현하고 있습니다. 이러한 추세는 향후 몇 년 동안 접선유동여과 시장의 성장을 촉진할 것으로 예상됩니다.

멤브레인 소재별로 접선유동여과 시장은 폴리에테르설폰(PES), 폴리불화비닐리덴(PVDF), 나일론, 폴리테트라플루오로에틸렌(PTFE), 혼합 셀룰로오스 에스테르 및 셀룰로오스 아세테이트(MCE & CA), 폴리카보네이트 트랙에치(PCTE), 재생 셀룰로오스, 기타 멤브레인 재료로 구분됩니다. 2024년 PES 분야는 높은 유속, 낮은 단백질 결합성, 광범위한 화학적 호환성 등의 유리한 특성으로 인해 시장에서 가장 큰 점유율을 차지했습니다. 이러한 특성으로 인해 PES 멤브레인은 단백질 농축, 완충액 교환, 세포 채취와 같은 중요한 바이오의약품 용도에 적합합니다.

접선유동여과 시장은 운전 규모에 따라 제조 스케일 운전, 파일럿 스케일 운전, R&D 스케일 운전으로 구분됩니다. 2024년에는 대규모 바이오의약품 생산에 TFF 시스템이 널리 사용됨에 따라 제조 규모 운영 부문이 세계 접선유동여과 시장에서 가장 큰 점유율을 차지했습니다. 이 단계에서는 안정적인 제품 수율, 공정 효율성, 규제 준수가 중요합니다. TFF는 특히 한외 여과, 투석 여과, 생물학적 제제 농축에서 이러한 목적을 달성하는 데 핵심적인 역할을 합니다. 상업용 생물학적 제제의 증가와 연속 공정의 채택 증가도 제조 규모의 TFF 시스템에 대한 높은 수요를 촉진하고 있습니다.

2024년 북미 접선유동여과 시장은 미국이 주도했습니다. 미국은 세계 최대 바이오의약품 시장으로 중요한 위치를 차지하고 있으며, 바이오의약품 연구와 투자에 집중하고 있습니다. 또한, 이 나라에는 유력한 시장 기업이 존재하며, 생물학적 제제 및 첨단 치료법에 대한 연구개발 투자가 활발합니다. 특히 단클론항체, 유전자 치료제, 백신 등 기술 혁신, 규제 준수, 대규모 제조 능력에 중점을 두고 있는 이 나라는 TFF 시스템, 멤브레인, 일회용 기술의 보급에 박차를 가하고 있습니다.

세계의 접선유동여과 시장에 대해 조사했으며, 제품별, 막 재료별, 기술별, 용도별, 가동 규모별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- Porter's Five Forces 분석

- 기술 분석

- 밸류체인 분석

- 생태계 분석

- 특허 분석

- 2025-2026년의 주요 회의와 이벤트

- 규제 상황

- 무역 데이터

- 주요 이해관계자와 구입 기준

- 투자와 자금 조달 시나리오

- AI/생성형 AI가 접선유동여과 제품 시장에 미치는 영향

- 트럼프 관세가 접선유동여과 시장에 미치는 영향

제6장 접선유동여과 시장(제품별)

- 소개

- 멤브레인 필터 장비

- 시스템

- 기타

제7장 접선유동여과 시장(막 재료별)

- 소개

- PES

- 재생 셀룰로오스

- PVDF

- PTFE

- MCE &CA

- PCTE

- 나일론

- 기타

제8장 접선유동여과 시장(기술별)

- 소개

- 한외여과

- 정밀여과

- 나노여과

- 기타

제9장 접선유동여과 시장(용도별)

- 소개

- 최종 제품 가공

- 원료 여과

- 세포 분리

- 물 정화

제10장 접선유동여과 시장(운전 규모별)

- 소개

- 제조 규모 오퍼레이션

- 파일럿 스케일 오퍼레이션

- R&D 스케일 오퍼레이션

제11장 접선유동여과 시장(최종사용자별)

- 소개

- 제약·바이오테크놀러지 기업

- CRO

- 학술연구기관

제12장 접선유동여과 시장(지역별)

- 소개

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 중동 : 거시경제 전망

- GCC 국가

- 기타

- 아프리카

- 시장 성장을 지지하는 의약품 연구개발에 대한 주력 강화

- 아프리카 : 거시경제 전망

제13장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제14장 기업 개요

- 주요 진출 기업

- DANAHER CORPORATION

- MERCK KGAA

- SARTORIUS AG

- REPLIGEN CORPORATION

- PARKER-HANNIFIN CORPORATION

- ALFA LAVAL CORPORATE AB

- ANDRITZ

- DONALDSON COMPANY

- MEISSNER FILTRATION PRODUCTS, INC.

- ANTYLIA SCIENTIFIC

- KOVALUS SEPARATION SOLUTIONS

- SYNDER FILTRATION, INC.

- ABEC, INC.

- FORMULATRIX, INC.

- VERDOT

- 기타 기업

- STERLITECH CORPORATION

- APPLEXION

- PENDOTECH

- MICROFILT INDIA PVT. LTD.

- BIONET

- HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.

- SMARTFLOW TECHNOLOGIES, INC.

- TAMI INDUSTRIES

- ZETA BIOSYSTEM

- JIANGSU HANBON SCIENCE & TECHNOLOGY CO., LTD.

- TECNIC BIOPROCESS EQUIPMENT MANUFACTURING

제15장 부록

KSM 25.09.04The tangential flow filtration market is projected to reach USD 3.20 billion by 2030 from USD 1.86 billion in 2025, at a CAGR of 11.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Membrane Material, Technique, Application, Scale of Operation, and End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

The growth of this market can be attributed to increasing spending on R&D activities. TFF technology has advanced significantly, leading to efficient, reliable, and cost-effective processes. This trend is expected to drive the growth of the tangential flow filtration market in the coming years.

The Polyethersulfone (PES) segment accounted for the largest share of the membrane material segment in 2024.

Based on membrane material, the tangential flow filtration market is segmented into polyethersulfone (PES), polyvinylidene difluoride (PVDF), nylon, polytetrafluoroethylene (PTFE), mixed cellulose ester & cellulose acetate (MCE & CA), polycarbonate track-etched (PCTE), regenerated cellulose, and other membrane materials. In 2024, the PES segment accounted for the largest share of the market owing to its favorable characteristics, such as high flow rates, low protein-binding properties, and broad chemical compatibility. These features make PES membranes ideal for critical biopharmaceutical applications like protein concentration, buffer exchange, and cell harvesting.

By scale of operation, the manufacturing scale operation segment accounted for the largest share of the market in 2024.

Based on the scale of operation, the tangential flow filtration market is segmented into manufacturing scale operations, pilot scale operations, and R&D scale operations. In 2024, the manufacturing scale operation segment accounted for the largest share of the global tangential flow filtration market, owing to the widespread use of TFF systems in large-scale biopharmaceutical production. Consistent product yield, process efficiency, and regulatory compliance are critical at this stage. TFF plays a central role in achieving these objectives, particularly in ultrafiltration, diafiltration, and concentration of biologics. The growing number of commercial biologics and the increasing adoption of continuous processing further contribute to the high demand for TFF systems at the manufacturing scale.

The US dominated the tangential flow filtration market in 2024.

In 2024, the US led the tangential flow filtration market in North America. The US holds a prominent position as the world's largest biopharmaceutical market with a strong emphasis on research and investment in biopharmaceuticals. Moreover, the country has a strong presence of leading market players and high R&D investment in biologics and advanced therapies. The country's focus on innovation, regulatory compliance, and large-scale manufacturing capacity, especially for monoclonal antibodies, gene therapies, and vaccines, continues to fuel the widespread adoption of TFF systems, membranes, and single-use technologies.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply-side- 70% and Demand-side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, the Asia Pacific -25%, Latin America -5% and the Middle East & Africa- 5%

List of Companies Profiled in the Report:

- Danaher Corporation (US)

- Merck KGaA (Germany)

- Sartorius AG (Germany)

- Repligen Corporation (US)

- Parker Hannifin Corporation (US)

- ANDRITZ (Austria)

- Alfa Laval Corporate AB (Sweden)

- Solaris Biotechnology Srl (Italy)

- Kovalus Separation Solutions (US)

- Synder Filtration, Inc. (US)

- Antylia Scientific (US)

- FORMULATRIX (US)

- ABEC, Inc. (US)

- VERDOT (France)

- Meissner Filtration Products, Inc. (US)

- Sterlitech Corporation (US)

- APPLEXION (France)

- ZETA BIOSYSTEM (India)

- Smartflow Technologies (US)

- Tecnic Bioprocess Solutions (Spain)

- Bionet (Spain)

- TAMI Industries (France)

- Jiangsu Hanbon Science&Technology Co., Ltd. (China)

- Pendotech (US)

- Microfilt India Pvt. Ltd. (India)

- Cobetter Filtration Equipment Co., Ltd. (China)

Research Coverage

This research report categorizes the tangential flow filtration market by product [membrane filtration devices (cassettes and capsules & cartridges), systems (single-use systems and reusable systems), and other TFF products], membrane material (PES, regenerated cellulose, PVDF, PTFE, MCE & CA, nylon, PCTE, and other membrane materials), technique (ultrafiltration, microfiltration, nanofiltration, and other techniques), application [final product processing (API filtration, protein purification, vaccine and antibody processing, formulation & filling solutions, and viral clearance), raw material filtration (media & buffer filtration, prefiltration, and bioburden testing), cell separation, and water purification], scale of operation (manufacturing scale operations, pilot scale operations, and R&D scale operations), end user (pharmaceutical & biotechnology companies, CMOs & CROs, and academic & research institutes), and by region (North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the tangential flow filtration market. A thorough analysis of the key industry players has provided insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are the recent developments associated with the tangential flow filtration market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the overall tangential flow filtration market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (technological advancements in TFF systems, rising R&D spending and growing pharmaceutical & biotechnology industries, and stringent regulatory requirements), restraints (high capital investments to limit the entry of small players and competition from alternative technologies), opportunities (growing opportunities in emerging economies, increasing demand for biologics, and increasing focus on developing and manufacturing cell & gene therapies), and challenges (complexities introduced by excipient-protein interaction) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly launched products of the tangential flow filtration market

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the tangential flow filtration market

- Competitive Assessment: Danaher Corporation (US), Merck KGaA (Germany), Sartorius AG (Germany), Repligen Corporation (US), Parker Hannifin Corporation (US), ANDRITZ (Austria), Alfa Laval Corporate AB (Sweden), Solaris Biotechnology Srl (Italy), Kovalus Separation Solutions (US), Synder Filtration, Inc. (US), Antylia Scientific (US), FORMULATRIX (US), ABEC, Inc. (US), VERDOT (France), Meissner Filtration Products, Inc. (US), Sterlitech Corporation (US), APPLEXION (France), ZETA BIOSYSTEM (India), Smartflow Technologies (US), Tecnic Bioprocess Solutions (Spain), Bionet (Spain), TAMI Industries (France), Jiangsu Hanbon Science&Technology Co., Ltd. (China), Pendotech (US), Microfilt India Pvt. Ltd. (India), and Cobetter Filtration Equipment Co., Ltd. (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS & REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Insights from primary sources

- 2.2.2 SEGMENTAL MARKET ASSESSMENT (TOP-DOWN APPROACH)

- 2.2.1 MARKET SIZE ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE FORECAST

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS

- 3.3 DISRUPTIVE TRENDS

4 PREMIUM INSIGHTS

- 4.1 TANGENTIAL FLOW FILTRATION MARKET SNAPSHOT

- 4.2 NORTH AMERICA: TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT & COUNTRY (2024)

- 4.3 TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION (2024)

- 4.4 TANGENTIAL FLOW FILTRATION MARKET, BY END USER (2024)

- 4.5 TANGENTIAL FLOW FILTRATION MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising technological advancements in TFF systems

- 5.2.1.2 Rising R&D spending and growth in pharmaceutical & biotechnology industries

- 5.2.1.3 Increasing adoption of single-use technologies

- 5.2.1.4 Stringent regulatory requirements for biopharmaceutical products

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments to limit entry of small players

- 5.2.2.2 Issues associated with membrane fouling

- 5.2.2.3 Competition from alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- 5.2.3.2 Expansion of biologics & biosimilars pipelines

- 5.2.3.3 Integration of TFF in continuous bioprocessing workflows

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of PFAS restrictions

- 5.2.4.2 Complexities introduced by excipient-protein interaction

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYERS, 2022-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF TFF PRODUCTS, 2022-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY REGION, 2022-2024

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Ultrafiltration

- 5.6.1.2 Microfiltration

- 5.6.1.3 Nanofiltration

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Single-use technology

- 5.6.2.2 Automation & control software

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Chromatography

- 5.6.3.2 Centrifugation

- 5.6.3.3 Microfluidics

- 5.6.1 KEY TECHNOLOGIES

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 ROLE IN ECOSYSTEM

- 5.8.2 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 5.9 PATENT ANALYSIS

- 5.9.1 TOP APPLICANTS/OWNERS (COMPANIES) FOR TANGENTIAL FLOW FILTRATION PATENTS, 2014-2024

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.4 Latin America

- 5.11.2.5 Middle East & Africa

- 5.11.3 REGULATORY CHALLENGES IN TANGENTIAL FLOW FILTRATION MARKET

- 5.11.4 SUSTAINABILITY IMPACT ON TANGENTIAL FLOW FILTRATION MARKET

- 5.12 TRADE DATA

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA FOR END USERS

- 5.13.3 UNMET NEEDS OF END USERS

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.14.1 VC/PRIVATE EQUITY INVESTMENT TRENDS & STARTUP LANDSCAPE, 2024

- 5.15 IMPACT OF AI/GENERATIVE AI ON TANGENTIAL FLOW FILTRATION PRODUCTS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 MARKET POTENTIAL OF AI IN TANGENTIAL FLOW FILTRATION APPLICATIONS

- 5.15.3 AI-USE CASES

- 5.15.4 KEY COMPANIES IMPLEMENTING AI

- 5.15.5 FUTURE OF GENERATIVE AI IN TANGENTIAL FLOW FILTRATION ECOSYSTEM

- 5.16 TRUMP TARIFF IMPACT ON TANGENTIAL FLOW FILTRATION MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON END-USE INDUSTRIES

- 5.16.5.1 Pharmaceutical & biotech companies

- 5.16.5.2 Academic & research institutes

- 5.16.5.3 Contract research organizations

6 TANGENTIAL FLOW FILTRATION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 MEMBRANE FILTER DEVICES

- 6.2.1 CASSETTES

- 6.2.1.1 Reduction of downtime and elimination of cleaning validation to fuel uptake

- 6.2.2 CAPSULES & CARTRIDGES

- 6.2.2.1 Increased flow path and higher efficiency of hollow-fiber filters to boost demand

- 6.2.1 CASSETTES

- 6.3 SYSTEMS

- 6.3.1 SINGLE-USE SYSTEMS

- 6.3.1.1 Reduced need for product validation and minimized cross-contamination risks to boost usage

- 6.3.2 REUSABLE SYSTEMS

- 6.3.2.1 Availability of automated & semi-automated varieties to fuel uptake

- 6.3.1 SINGLE-USE SYSTEMS

- 6.4 OTHER PRODUCTS

7 TANGENTIAL FLOW FILTRATION MARKET, BY MEMBRANE MATERIAL

- 7.1 INTRODUCTION

- 7.2 PES

- 7.2.1 HIGH RELIABILITY AND BROAD APPLICATIONS TO DRIVE MARKET

- 7.3 REGENERATED CELLULOSE

- 7.3.1 LOW PROTEIN BINDING & BIOCOMPATIBILITY FEATURES TO FUEL UPTAKE

- 7.4 PVDF

- 7.4.1 HIGH DURABILITY AND ENHANCED PERFORMANCE IN INTENSIVE PROCESSES T0 BOOST DEMAND

- 7.5 PTFE

- 7.5.1 HIGH CHEMICAL RESISTANCE IN HARSH FILTRATION ENVIRONMENTS TO FUEL UPTAKE

- 7.6 MCE & CA

- 7.6.1 COST-EFFECTIVENESS AND FAST FLOW FOR BASIC FILTRATION REQUIREMENTS TO SUPPORT MARKET GROWTH

- 7.7 PCTE

- 7.7.1 USAGE IN CELL BIOLOGY & ANALYTICAL TESTING APPLICATIONS TO AID ADOPTION

- 7.8 NYLON

- 7.8.1 INCREASED ENDOTOXIN ADSORPTION CAPACITY OF NYLON FILTERS TO DRIVE DEMAND

- 7.9 OTHER MEMBRANE MATERIALS

8 TANGENTIAL FLOW FILTRATION MARKET, TECHNIQUE

- 8.1 INTRODUCTION

- 8.2 ULTRAFILTRATION

- 8.2.1 EXPANDING APPLICATIONS IN BIOPHARMACEUTICAL INDUSTRY FOR POST-FERMENTATION CELL HARVESTING TO DRIVE MARKET

- 8.3 MICROFILTRATION

- 8.3.1 ABILITY FOR BIOMASS RECOVERY & PURIFICATION DURING ANTIBIOTIC PRODUCTION TO BOOST DEMAND

- 8.4 NANOFILTRATION

- 8.4.1 INCREASING APPLICATIONS IN PHARMA & BIOTECH INDUSTRY TO PROPEL MARKET

- 8.5 OTHER TECHNIQUES

9 TANGENTIAL FLOW FILTRATION MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FINAL PRODUCT PROCESSING

- 9.2.1 API FILTRATION

- 9.2.1.1 Need for continuous filtration of APIs to drive market

- 9.2.2 PROTEIN PURIFICATION

- 9.2.2.1 Recent advancements in protein therapeutic drugs to fuel uptake

- 9.2.3 VACCINE & ANTIBODY PROCESSING

- 9.2.3.1 Development of vaccines for viral diseases to boost demand

- 9.2.4 FORMULATION & FILLING SOLUTIONS

- 9.2.4.1 Rising need for aseptic filling and bioburden reduction to support market growth

- 9.2.5 VIRAL CLEARANCE

- 9.2.5.1 Increasing development of therapeutic monoclonal antibodies to boost usage

- 9.2.1 API FILTRATION

- 9.3 RAW MATERIAL FILTRATION

- 9.3.1 MEDIA & BUFFER FILTRATION

- 9.3.1.1 Growth in biopharmaceutical manufacturing to drive market

- 9.3.2 PREFILTRATION

- 9.3.2.1 Issues associated with membrane fouling to boost demand

- 9.3.3 BIOBURDEN TESTING

- 9.3.3.1 Stringent quality control of biopharmaceuticals to support market growth

- 9.3.1 MEDIA & BUFFER FILTRATION

- 9.4 CELL SEPARATION

- 9.4.1 RISING DEMAND FOR PERSONALIZED MEDICINE TO SUPPORT MARKET GROWTH

- 9.5 WATER PURIFICATION

- 9.5.1 GROWING FOCUS ON PURIFIED WATER FOR BIOPHARMACEUTICAL PROCESSES TO FUEL UPTAKE

10 TANGENTIAL FLOW FILTRATION MARKET, BY SCALE OF OPERATION

- 10.1 INTRODUCTION

- 10.2 MANUFACTURING SCALE OPERATIONS

- 10.2.1 GROWING FOCUS ON LARGE VOLUME BIOPRODUCTION AND HIGH-THROUGHPUT TFF SOLUTIONS TO DRIVE MARKET

- 10.3 PILOT SCALE OPERATIONS

- 10.3.1 RISING OUTSOURCING OF SERVICES TO BOOST DEMAND

- 10.4 R&D SCALE OPERATIONS

- 10.4.1 INCREASING INVESTMENTS IN R&D OF BIOLOGICS TO SUPPORT MARKET GROWTH

11 TANGENTIAL FLOW FILTRATION MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.2.1 DEVELOPMENT & PRODUCTION OF BIOLOGICS, BIOSIMILARS, AND ADVANCED THERAPIES TO PROPEL MARKET

- 11.3 CONTRACT RESEARCH ORGANIZATIONS

- 11.3.1 RISING DEMAND FOR OUTSOURCING OF CLINICAL ACTIVITIES TO FUEL MARKET

- 11.4 ACADEMIC & RESEARCH INSTITUTES

- 11.4.1 INCREASING PHARMA-ACADEMIA COLLABORATIONS TO SUPPORT MARKET GROWTH

12 TANGENTIAL FLOW FILTRATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 High healthcare expenditure and presence of stringent regulatory guidelines for product approvals to drive market

- 12.2.3 CANADA

- 12.2.3.1 Favorable government support for expansion of biologics manufacturing facilities to fuel market

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Expansion in biologics & biosimilar production to fuel market

- 12.3.3 UK

- 12.3.3.1 Rising demand for high-quality drugs and increasing uptake of filtration processes to boost market

- 12.3.4 FRANCE

- 12.3.4.1 Government investments in pharmaceutical industry to drive market

- 12.3.5 ITALY

- 12.3.5.1 Availability of funding for NME development to support market growth

- 12.3.6 SPAIN

- 12.3.6.1 Rising focus on development of targeted therapeutics to drive market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Rising incidence of infectious diseases to propel market

- 12.4.3 JAPAN

- 12.4.3.1 Growing focus on pharmaceutical research and potential hub for CRO services to drive market

- 12.4.4 INDIA

- 12.4.4.1 Favorable scenario for foreign direct investments to favor market growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Growth in biotechnology industry to fuel market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Rising demand for innovative filtration solutions to support market growth

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Expansion of clinical research activities to support market growth

- 12.5.3 MEXICO

- 12.5.3.1 Increasing demand for chronic disease management treatment to fuel uptake

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 MIDDLE EAST: MACROECONOMIC OUTLOOK

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Kingdom of Saudi Arabia (KSA)

- 12.6.2.1.1 Growth in healthcare sector to drive market

- 12.6.2.2 United Arab Emirates (UAE)

- 12.6.2.2.1 Adoption of efficient & precise filtration processes to drive market

- 12.6.2.3 Other GCC Countries

- 12.6.2.1 Kingdom of Saudi Arabia (KSA)

- 12.6.3 REST OF MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 INCREASING FOCUS ON PHARMACEUTICAL R&D TO SUPPORT MARKET GROWTH

- 12.7.2 AFRICA: MACROECONOMIC OUTLOOK

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TANGENTIAL FLOW FILTRATION MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Product footprint

- 13.5.5.4 Application footprint

- 13.5.5.5 Scale of operation footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISON

- 13.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DANAHER CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices made

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 MERCK KGAA

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 SARTORIUS AG

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 REPLIGEN CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.3.4 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses & competitive threats

- 14.1.5 PARKER-HANNIFIN CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 ALFA LAVAL CORPORATE AB

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.7 ANDRITZ

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.8 DONALDSON COMPANY

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 MEISSNER FILTRATION PRODUCTS, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.10 ANTYLIA SCIENTIFIC

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Other developments

- 14.1.11 KOVALUS SEPARATION SOLUTIONS

- 14.1.11.1 Products offered

- 14.1.11.2 Recent developments

- 14.1.11.2.1 Deals

- 14.1.12 SYNDER FILTRATION, INC.

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 ABEC, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.14 FORMULATRIX, INC.

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 VERDOT

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.1 DANAHER CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 STERLITECH CORPORATION

- 14.2.2 APPLEXION

- 14.2.3 PENDOTECH

- 14.2.4 MICROFILT INDIA PVT. LTD.

- 14.2.5 BIONET

- 14.2.6 HANGZHOU COBETTER FILTRATION EQUIPMENT CO., LTD.

- 14.2.7 SMARTFLOW TECHNOLOGIES, INC.

- 14.2.8 TAMI INDUSTRIES

- 14.2.9 ZETA BIOSYSTEM

- 14.2.10 JIANGSU HANBON SCIENCE & TECHNOLOGY CO., LTD.

- 14.2.11 TECNIC BIOPROCESS EQUIPMENT MANUFACTURING

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS