|

시장보고서

상품코드

1801776

메인프레임 현대화 시장 : 제공별, 조직 규모별, 업계별, 지역별 - 예측(-2030년)Mainframe Modernization Market by Offering (Software, Services), Organization Size (Large Enterprises, SMEs), Vertical (BFSI, Telecom, IT & ITES, Retail & Ecommerce, Government, Others), and Region - Global Forecast to 2030 |

||||||

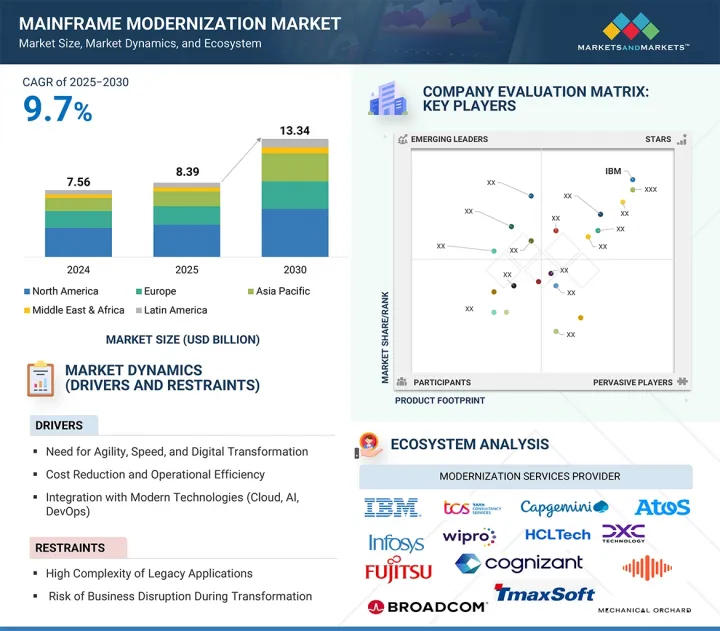

세계의 메인프레임 현대화 시장 규모는 2025년 83억 9,000만 달러에서 2030년까지 133억 4,000만 달러에 이르고, 2025년-2030년 CAGR 9.7%의 성장이 전망됩니다.

주요 메인프레임 현대화 기업들은 AI 기반 자동화, 전략적 파트너십, 특수 프레임워크를 통해 빠르게 변화하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만/10억 달러 |

| 부문 | 서비스, 조직 규모, 업계, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

IBM은 AI로 메인프레임을 현대화하고 은행 업무와 데이터 처리를 강화하기 위해 다른 회사와 협력하고 있습니다. AWS는 Kyndryl을 통해 금융의 클라우드 전환을 가속화하고 있습니다. Capgemini, HCLTech, TCS도 AI와 자동화를 활용하여 규제 부문의 레거시에서 클라우드로의 효율적인 전환과 현대화를 추진하고 있습니다.

그러나 문서화되지 않은 코드와 긴밀하게 결합된 비즈니스 로직을 포함하는 경우가 많은 레거시 코드 기반의 마이그레이션에 따른 번거로움과 복잡성이 시장 성장을 저해하고 있습니다. 마이그레이션을 면밀히 계획하고 실행하지 않으면 데이터 유출과 비즈니스 중단의 위험이 크며, 많은 경우 기업은 자동화와 전문가 주도의 개입을 통해 지원되는 하이브리드 또는 단계적 현대화 전략을 채택하게 됩니다.

"메인프레임 애플리케이션 현대화 서비스 부문이 예측 기간 동안 가장 큰 시장 점유율을 기록할 것으로 보입니다. "

메인프레임 애플리케이션 현대화 서비스는 레거시 용도를 민첩하고 클라우드에 적합한 솔루션으로 전환하는 동시에 업무 연속성과 규제 준수를 보장하기 위한 조직들의 요구가 증가함에 따라 수요가 증가하고 있습니다. 리호스팅, 리플랫폼화, 리아키텍처화, AI를 통한 리팩토링 등을 포함한 이러한 서비스는 대부분의 기업이 복잡한 레거시 용도를 사내에서 현대화할 수 있는 전문 지식이 부족하기 때문에 매우 중요합니다. 서비스 제공업체는 고객이 실시간 분석을 활용할 수 있도록 돕고, API를 통한 통합을 가능하게 하며, 다운타임을 최소화한 원활한 클라우드 마이그레이션을 지원합니다.

예를 들어, 금융기관과 통신사들은 디지털 퍼스트 전략을 채택하면서 비즈니스 크리티컬 워크로드를 유지하기 위해 애플리케이션 현대화 서비스에 크게 의존하고 있습니다. AI를 활용한 자동화 도구의 등장은 코드 변환을 가속화하고, 수작업으로 인한 실수를 줄이며, 프로젝트 타임라인을 단축하여 새로운 디지털 서비스를 신속하게 배포할 수 있게 해줍니다. 컴플라이언스 요구사항과 보안 위험이 증가함에 따라 기업들은 복잡성을 처리하고, 위험 관리형 혁신을 보장하며, 레거시 투자를 최적화하기 위해 이러한 종합적인 현대화 서비스 계약을 선호하고 있습니다.

"예측 기간 동안 BFSI 부문이 가장 큰 시장 점유율을 기록할 것으로 예측됩니다. "

BFSI 부문은 대량의 트랜잭션 처리와 실시간 금융 서비스를 지원하는 안전하고 탄력적인 레거시 시스템에 의존하고 있기 때문에 메인프레임 현대화의 주요 촉진제 역할을 하고 있습니다. 자금세탁방지, 디지털 뱅킹 의무화, 재무보고 등의 규제적 복잡성으로 인해 레거시 인프라를 최신 클라우드 및 AI 생태계와 연계하는 플랫폼의 지속적인 업그레이드가 요구되고 있습니다.

많은 금융기관들은 혁신을 도입하고 컴플라이언스를 준수하면서 중요한 시스템의 안정성을 유지하기 위해 AI 지원 코드 리팩토링, API 인에이블먼트 등의 현대화 기술을 사용하고 있습니다. 일본과 미국의 주요 은행들은 진화하는 고객의 기대와 규제 당국의 감독에 대응하기 위해 단계적인 클라우드 통합 전략을 통해 핵심 결제 플랫폼과 리스크 플랫폼을 현대화하고 있습니다. 이 부문의 신중하고 야심찬 접근 방식은 급변하는 금융 환경에서 비즈니스 연속성, 데이터 무결성 및 신속한 적응력에 대한 요구를 반영합니다.

세계의 메인프레임 현대화(Mainframe Modernization) 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 메인프레임 현대화 시장 주요 기업에 있어서 매력적인 기회

- 메인프레임 현대화 시장 : 제공 별

- 메인프레임 현대화 시장 : 현대화 서비스별

- 메인프레임 현대화 시장 : 조직 규모별

- 메인프레임 현대화 시장 : 업계별

- 북미의 메인프레임 현대화 시장 : 제공, 주요 3개 업계

제5장 시장 개요와 산업 동향

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 메인프레임 현대화 소프트웨어 및 서비스 진화

- 메인프레임 현대화 시장 : 에코시스템 시장 맵

- 사례 연구 분석

- 세계 금융 서비스 제공업체가 레거시 메인프레임 현대화에 Capgemini와 MicrosoftAzure를 활용

- Lumen Technologies, 메인프레임 현대화와 클라우드 마이그레이션을 위해 ATOS와 제휴

- 북미 보험 기업이 Infosys 메인프레임/애플리케이션 현대화 서비스에 의해 TCO를 30% 삭감

- 공급망 분석

- 규제 상황

- 규제기관, 정부기관 및 기타 조직

- 주요 규제

- 가격 결정 분석

- 메인프레임 현대화 소프트웨어 평균 판매 가격 : 주요 기업별

- 메인프레임 현대화 서비스 가격대 : 최종사용자별

- 기술 분석

- 주요 기술

- 인접 기술

- 보완 기술

- 특허 분석

- Porter의 Five Forces 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 주요 이해관계자와 구입 기준

- 주요 컨퍼런스 및 이벤트

- 메인프레임 현대화 시장 기술 로드맵

- 단기 로드맵(2023년-2025년)

- 중기 로드맵(2026년-2028년)

- 장기 로드맵(2029년-2030년)

- 메인프레임 현대화 시장 베스트 프랙티스

- 종합적 평가와 비즈니스 alignment

- 단계적인 모듈식 현대화

- 자동 코드 변환, 시험

- 크로스 기능적 팀과 지식 이전

- 보안 및 컴플라이언스 통합

- 투자 및 자금조달 시나리오

- 메인프레임 현대화 시장에 대한 생성형 AI의 영향

- 주요 이용 사례와 시장 장래성

- 베스트 프랙티스

- 생성형 AI 도입 사례 연구

- 2025년 미국 관세의 영향 - 개요

- 서론

- 주요 관세율

- 가격 영향 분석

- 지역/국가에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 메인프레임 현대화 시장 : 제공별

- 서론

- 소프트웨어

- 메인프레임 애플리케이션 현대화 소프트웨어

- 메인프레임 최적화 소프트웨어

- 현대화 서비스

- 메인프레임 애플리케이션 현대화 서비스

- 메인프레임 최적화 서비스

- 메인프레임 운영

- Mainframe as a Service

제7장 메인프레임 현대화 시장 : 조직 규모별

- 서론

- 대기업

- 중소기업

제8장 메인프레임 현대화 시장 : 업계별

- 서론

- 은행, 금융서비스 및 보험(BFSI)

- IT·ITeS

- 의료

- 미디어 및 엔터테인먼트

- 소매 및 E-Commerce

- 교육

- 제조

- 정부

- 통신

- 기타 업계

제9장 메인프레임 현대화 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점(2023년-2025년)

- 시장 점유율 분석(2024년)

- 매출 분석(2020년-2024년)

- 브랜드/제품 비교

- 기업 평가와 재무 지표

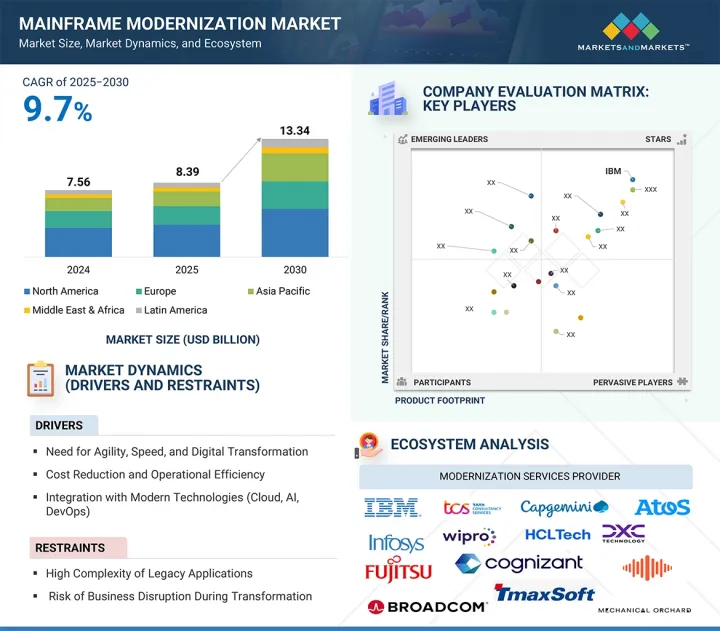

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- IBM

- AWS

- TCS

- CAPGEMINI

- HCLTECH

- ATOS

- MICRO FOCUS(OPENTEXT)

- BMC SOFTWARE

- INFOSYS

- WIPRO

- DXC TECHNOLOGY

- KYNDRYL

- ROCKET SOFTWARE

- FUJITSU

- COGNIZANT

- TECH MAHINDRA

- BROADCOM

- TMAXSOFT

- 스타트업/중소기업

- PALMDIGITALZ

- TSRI

- MECHANICAL ORCHARD

- VIRTUALZ COMPUTING

- CLOUDFRAME

- HEIRLOOM COMPUTING

제12장 인접 시장과 관련 시장

- 서론

- 애플리케이션 현대화 서비스 시장

- 클라우드 전문 서비스 시장

제13장 부록

LSH 25.09.08The mainframe modernization market is projected to grow from USD 8.39 billion in 2025 to USD 13.34 billion by 2030, at a CAGR of 9.7%, from 2025 to 2030. Key players in mainframe modernization are rapidly advancing transformation through AI-driven automation, strategic partnerships, and specialized frameworks.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, organization size, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

IBM is modernizing mainframes with AI and partnering with others to enhance banking and data processing. AWS is accelerating cloud migration for finance with Kyndryl. Capgemini, HCLTech, and TCS are also leveraging AI and automation for efficient legacy-to-cloud transitions and modernization in regulated sectors.

However, the formidable complexity associated with migrating legacy codebases, which often include undocumented code and tightly coupled business logic, restrains market growth. The risk of data loss and business disruption is large unless migration is planned and executed meticulously, often leading organizations to adopt hybrid or gradual modernization strategies supported by both automation and expert-led interventions.

"Mainframe application modernization services segment will register the largest market share during the forecast period"

Mainframe application modernization services are in demand as organizations seek to transform legacy applications into agile and cloud-ready solutions while ensuring operational continuity and regulatory compliance. These services, encompassing re-hosting, re-platforming, re-architecting, and AI-driven refactoring, are critical because most enterprises lack the expertise to modernize complex legacy applications internally. Service providers help clients unlock real-time analytics, enable API-driven integration, and support seamless cloud migration with minimal downtime.

Financial institutions and telecom companies, for example, rely heavily on application modernization services to maintain business-critical workloads while adopting digital-first strategies. The rise of AI-powered automation tools accelerates code conversion, reduces manual errors, and shortens project timelines, enabling faster rollout of new digital services. With compliance demands and security risks rising, enterprises prefer these comprehensive modernization service engagements to handle complexity, ensure risk-managed transformation, and optimize legacy investments.

"BFSI segment is projected to register the largest market share during the forecast period"

The BFSI sector remains the primary driver of mainframe modernization due to its dependence on secure, resilient legacy systems supporting high-volume transaction processing and real-time financial services. Regulatory complexities such as anti-money laundering, digital banking mandates, and financial reporting demand continual platform upgrades that align legacy infrastructure with modern cloud and AI ecosystems.

Many institutions use modernization techniques, such as AI-assisted code refactoring and API enablement, to maintain critical system stability while introducing innovation and ensuring compliance. Leading banks in Japan and the US are modernizing core payment and risk platforms with incremental, cloud-integrated strategies to meet evolving customer expectations and regulatory scrutiny. The sector's cautious yet ambitious approach reflects its need for business continuity, data integrity, and fast adaptability in a rapidly shifting financial landscape.

"Asia Pacific will record the highest growth rate, while North America will hold the largest market share during the forecast period"

Asia Pacific is emerging as a key region for mainframe modernization driven by a unique blend of large, mature mainframe estates and fast-paced digital economy growth. India, Japan, China, and Southeast Asian nations prioritize modernizing legacy systems to support digital banking, mobile payments, public sector digital initiatives, and regulatory compliance. This modernization often involves phased migrations, hybrid cloud deployments, and AI-enabled automation to handle enormous transaction volumes while reducing operational risk.

Regulatory pressures around data sovereignty and open banking accelerate the urgency of modernization. Enterprises in Asia Pacific are embracing cloud-native integration and API-first architectures to transform traditional workflows and enhance real-time processing capabilities. The collaborative innovation ecosystem, combining global technology vendors with strong local IT service providers, further fuels growth of the Asia Pacific market.

North America maintains its dominant share in the mainframe modernization sector, primarily driven by a substantial presence of Fortune 500 companies and government agencies that manage extensive legacy systems. This region's leadership can be attributed to a history of early technology adoption and stringent compliance requirements, particularly in the finance and healthcare industries, and a persistent demand for robust and scalable IT infrastructures. These elements contribute to aggressive digital transformation initiatives focusing on enhancing operational resilience and agility.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 25% , Directors -35%, and Others - 40%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 10%

The major players in the mainframe modernization market are IBM (US), TCS (India), Capgemini (France), Atos (France), AWS (US), Micro Focus (UK), BMC Software (US), Infosys (India), Wipro (India), HCL Tech (India), DXC Technology (US), Kyndryl (US), Rocket Software (US), Fujitsu (Japan), Cognizant (US), Tech Mahindra (India), Broadcom (US), and TmaxSoft (US). These players have adopted various growth strategies, such as partnerships, agreements & collaborations, new product launches, product enhancements, and acquisitions, to expand their footprint in the mainframe modernization market.

Research Coverage

The market study covers the mainframe modernization market size across different segments. It aims to estimate the market size and the growth potential across different segments, including offering (software and modernization services), organization size (large enterprises and SMEs), verticals (BFSI, IT & ITES, healthcare, media & entertainment, retail & ecommerce, education, manufacturing, government, telecom, and other verticals), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global mainframe modernization market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (workforce retirement and legacy skills shortage, increasing regulatory and compliance requirements, rapid adoption of AI and cloud for mission-critical workloads), restraints (complexity and risk of migrating legacy codebases, persistent high costs and budget constraints for large-scale transformations, insufficient documentation of legacy systems), opportunities (emerging SME adoption and mid-market demand, accelerated banking and fintech modernization in Asia Pacific, growth of AI-enabled and modular modernization solutions) and challenges (ensuring uninterrupted business operations during migration, overcoming resistance to organizational change, shortage of skilled modernization and integration talent) influencing the growth of the mainframe modernization market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the mainframe modernization market

Market Development: Comprehensive information about lucrative markets - analysis of mainframe modernization market across various regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the mainframe modernization market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players IBM (US), TCS (India), Capgemini (France), Atos (France), AWS (US), Micro Focus (UK), BMC Software (US), Infosys (India), Wipro (India), HCL Tech (India), DXC Technology (US), Kyndryl (US), Rocket Software (US), Fujitsu (Japan), Cognizant (US), Tech Mahindra (India), Broadcom (US), and TmaxSoft (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 MAINFRAME MODERNIZATION MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN MAINFRAME MODERNIZATION MARKET

- 4.2 MAINFRAME MODERNIZATION MARKET, BY OFFERING

- 4.3 MAINFRAME MODERNIZATION MARKET, BY MODERNIZATION SERVICE

- 4.4 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE

- 4.5 MAINFRAME MODERNIZATION MARKET, BY VERTICAL

- 4.6 NORTH AMERICA: MAINFRAME MODERNIZATION MARKET: OFFERINGS AND TOP THREE VERTICALS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

Unpacking the Forces Shaping Mainframe Modernization & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for agility, speed, and digital transformation

- 5.2.1.2 Cost reduction and operational efficiency

- 5.2.1.3 Integration with modern technologies (cloud, AI, DevOps)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High complexity of legacy applications

- 5.2.2.2 Risk of business disruption during transformation

- 5.2.2.3 Shortage of modernization expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Accelerated innovation with cloud-native and AI tools

- 5.2.3.2 Migration to pay-as-you-go and managed modernization services

- 5.2.3.3 Enhanced business agility through modular architectures

- 5.2.3.4 Modernization demand in highly regulated sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Understanding legacy system architecture and code complexity

- 5.2.4.2 Ensuring data integrity and compliance during migration

- 5.2.4.3 Long modernization timelines and resource management

- 5.2.4.4 Integrating mainframe and non-mainframe workloads smoothly

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF MAINFRAME MODERNIZATION SOFTWARE AND SERVICES

- 5.4 MAINFRAME MODERNIZATION MARKET: ECOSYSTEM MARKET MAP

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 GLOBAL FINANCIAL SERVICES PROVIDER LEVERAGES CAPGEMINI AND MICROSOFT AZURE FOR LEGACY MAINFRAME MODERNIZATION

- 5.5.2 LUMEN TECHNOLOGIES PARTNERS WITH ATOS FOR MAINFRAME MODERNIZATION AND CLOUD MIGRATION

- 5.5.3 NORTH AMERICAN INSURANCE COMPANY REDUCES TCO BY 30% WITH INFOSYS MAINFRAME AND APPLICATION MODERNIZATION SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 General Data Protection Regulation-European Union

- 5.7.1.2 Federal Risk and Authorization Management Program (FedRAMP) - US

- 5.7.1.3 National Institute of Standards and Technology (NIST)-US

- 5.7.2 KEY REGULATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.2 Europe

- 5.7.2.2.1 UK

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 India

- 5.7.2.3.2 Japan

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 Saudi Arabia

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.1 North America

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF MAINFRAME MODERNIZATION SOFTWARE, BY KEY PLAYER

- 5.8.2 PRICING RANGE OF MAINFRAME MODERNIZATION SERVICES, BY END USER

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Automated Code Conversion and Refactoring

- 5.9.1.2 Cloud Hosting and Mainframe-as-a-Service

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Hybrid cloud orchestration platforms

- 5.9.2.2 Low-code and no-code application platforms

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 AI (including Gen AI for Code Transformation)

- 5.9.3.2 Data Migration and Integration Tools

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 TECHNOLOGY ROADMAP FOR MAINFRAME MODERNIZATION MARKET

- 5.15.1 SHORT-TERM ROADMAP (2023-2025)

- 5.15.2 MID-TERM ROADMAP (2026-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN MAINFRAME MODERNIZATION MARKET

- 5.16.1 COMPREHENSIVE ASSESSMENT AND BUSINESS ALIGNMENT

- 5.16.2 INCREMENTAL AND MODULAR MODERNIZATION

- 5.16.3 AUTOMATED CODE TRANSFORMATION AND TESTING

- 5.16.4 CROSS-FUNCTIONAL TEAMS AND KNOWLEDGE TRANSFER

- 5.16.5 SECURITY AND COMPLIANCE INTEGRATION

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF GEN AI ON MAINFRAME MODERNIZATION MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 BEST PRACTICES

- 5.18.2.1 Banking & financial services industry

- 5.18.2.2 Healthcare industry

- 5.18.2.3 Telecom industry

- 5.18.3 CASE STUDIES OF GEN AI IMPLEMENTATION

- 5.18.3.1 Automating Mainframe Testing with AI (Micro Focus)

- 5.18.3.2 Mapping Legacy Dependencies Using AI for Mainframes (Deloitte)

- 5.18.3.3 Detecting Fraud on IBM Z Mainframes with AI/ML

- 5.18.3.4 Optimizing Mainframe Workloads through AI Analytics (BMC)

- 5.18.3.5 Enhancing Mainframe Code Security with AI Scanning (Veracode)

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19 IMPACT OF 2025 US TARIFFS-OVERVIEW

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON REGION/COUNTRY

- 5.19.4.1 North America

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 MAINFRAME MODERNIZATION MARKET, BY OFFERING

Detailed breakdown of market share and growth across Mainframe Modernization Software and Services

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: MAINFRAME MODERNIZATION MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 MAINFRAME APPLICATION MODERNIZATION SOFTWARE

- 6.2.1.1 Gen-AI code analysis/refactoring and microservices adoption to propel rapid portfolio upgrades, signaling strong expansion ahead

- 6.2.2 MAINFRAME OPTIMIZATION SOFTWARE

- 6.2.2.1 Cost pressure and performance SLAs to push AI/ML tuning and MIPS reduction, underpinning steady, efficiency led growth

- 6.2.1 MAINFRAME APPLICATION MODERNIZATION SOFTWARE

- 6.3 MODERNIZATION SERVICES

- 6.3.1 MAINFRAME APPLICATION MODERNIZATION SERVICES

- 6.3.1.1 AI/DevOps led refactoring and CI/CD demand to accelerate migrations, pointing to robust multi year growth

- 6.3.1.2 Rehosting

- 6.3.1.2.1 Rapid migration of legacy workloads to modern infrastructure with minimal code change to reduce costs and preserve business continuity

- 6.3.1.3 Replatforming

- 6.3.1.3.1 Cloud adoption, containerization, and DevOps agility to drive lift and shift modernization, supporting steady, scalable growth

- 6.3.1.4 Refactoring

- 6.3.1.4.1 AI assisted code modularization to reduce technical debt and downtime, accelerating phased upgrades and multi year expansion

- 6.3.1.5 Rewriting

- 6.3.1.5.1 Strategic rebuilds for compliance and innovation to unlock long term capability gains, forecasting selective but high value growth

- 6.3.1.6 Replacing

- 6.3.1.6.1 COTS/SaaS substitution to cut cost and meet regulations speeds time to value, enabling broad, rapid adoption

- 6.3.2 MAINFRAME OPTIMIZATION SERVICES

- 6.3.2.1 Compliance and cost pressure to drive AMI, MIPS reduction, and license tuning, supporting steady efficiency led expansion

- 6.3.3 MAINFRAME OPERATIONS

- 6.3.3.1 24X7 resilience, security, and hybrid complexity to sustain managed operations demand, forecasting durable recurring growth

- 6.3.4 MAINFRAME-AS-A-SERVICE

- 6.3.4.1 Skills gaps and pay as you go economics to spur outsourced, consumption based mainframe management, signaling rapid, scalable adoption

- 6.3.1 MAINFRAME APPLICATION MODERNIZATION SERVICES

7 MAINFRAME MODERNIZATION MARKET, BY ORGANIZATION SIZE

Detailed breakdown of market share and growth across Mainframe Modernization Organization Size

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: MAINFRAME MODERNIZATION MARKET DRIVERS

- 7.2 LARGE ENTERPRISES

- 7.2.1 AI DRIVEN, COMPLIANCE FIRST MODERNIZATION IN LARGE ENTERPRISES TO PROPEL MULTI YEAR GROWTH

- 7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.3.1 SME MODERNIZATION TO ACCELERATE THROUGH AI ENABLED, SAAS FIRST, MFAAS SUPPORTED APPROACHES WITH PREDICTABLE COSTS

8 MAINFRAME MODERNIZATION MARKET, BY VERTICAL

Detailed breakdown of market share and growth across Mainframe Modernization Verticals

- 8.1 INTRODUCTION

- 8.1.1 VERTICALS: MAINFRAME MODERNIZATION MARKET DRIVERS

- 8.2 BANKING, FINANCIAL SERVICES, & INSURANCE

- 8.2.1 COMPLIANCE AND AI DRIVEN CORE MODERNIZATION TO SCALE VIA PHASED REFACTORING, SUSTAINING MULTI YEAR GROWTH

- 8.3 IT & ITES

- 8.3.1 AI/DEVOPS MODERNIZATION TO BOOST PROVIDER AGILITY AND CLIENT DEMAND, DRIVING STEADY EXPANSION

- 8.4 HEALTHCARE

- 8.4.1 HIPAA/GDPR LED, AI ASSISTED CLOUD MODERNIZATION TO ADVANCE CAUTIOUSLY, UNDERPINNING DURABLE GROWTH

- 8.5 MEDIA & ENTERTAINMENT

- 8.5.1 CX AND RIGHTS COMPLIANCE TO DRIVE AI-ENABLED DEVOPS PIPELINES FOR RAPID RELEASES AND SUSTAINED GROWTH

- 8.6 RETAIL & E-COMMERCE

- 8.6.1 OMNICHANNEL DEMAND AND PEAK EVENTS TO DRIVE AI AND AUTOMATION LED MODERNIZATION FOR REAL TIME AGILITY AND SCALABLE GROWTH

- 8.7 EDUCATION

- 8.7.1 PRIVACY DRIVEN (FERPA/GDPR) CLOUD AND AI UPGRADES TO MODERNIZE STUDENT SYSTEMS, SUPPORTING STEADY ADOPTION AND INCLUSIVE EXPANSION

- 8.8 MANUFACTURING

- 8.8.1 INDUSTRY 4.0, ERP INTEGRATION, AND COMPLIANCE NEEDS TO PROPEL HYBRID REFACTORING AND DATA DRIVEN PLATFORMS FOR SUSTAINED COMPETITIVENESS

- 8.9 GOVERNMENT

- 8.9.1 COMPLIANCE, COST REDUCTION, AND CITIZEN SERVICE GOALS TO PUSH HYBRID CLOUD AND MFAAS MODERNIZATION, YIELDING GRADUAL BUT DURABLE PROGRESS

- 8.10 TELECOM

- 8.10.1 5G ROLLOUT, REAL-TIME BILLING, AND CUSTOMER EXPERIENCE PRESSURES TO DRIVE AI/DEVOPS MODERNIZATION TOWARD MICROSERVICES AND HYBRID CLOUD, ENABLING SUSTAINABLE GROWTH

- 8.11 OTHER VERTICALS

9 MAINFRAME MODERNIZATION MARKET, BY REGION

Regional market sizing, forecasts, and regulatory landscapes

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Focus on transforming legacy systems with AI, automation, and cloud technologies to drive market

- 9.2.3 CANADA

- 9.2.3.1 Emphasis on hybrid cloud integration, compliance, workforce upskilling, and data accessibility in financial and public sectors to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 GERMANY

- 9.3.2.1 Focus on industrial resilience, compliance, and secure stepwise mainframe-to-cloud integration to drive market

- 9.3.3 UK

- 9.3.3.1 Regulatory-driven banking transformation, public sector digitalization, and adoption of phased, risk-managed modernization to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Public sector and banking initiatives, regulatory compliance, and high-profile AI adoption to drive market

- 9.3.5 SPAIN

- 9.3.5.1 Banking, insurance, and public sector transformation via cloud integration and modular migration strategies to drive market

- 9.3.6 ITALY

- 9.3.6.1 Focus on banking, insurance, and public sector modernization to drive market

- 9.3.7 NORDIC COUNTRIES

- 9.3.7.1 Public sector digital transformation and open banking to drive market

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Data sovereignty, strong public sector involvement, and modernization of banking and government platforms to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Regulatory-driven transformation with stepwise upgrades and automation-led migration to drive market

- 9.4.4 INDIA

- 9.4.4.1 Public sector digital transformation and large-scale banking modernization to propel market

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Regulatory-driven banking and public sector modernization with strong vendor partnerships to drive market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Leveraging local technology leaders for modular migration in banking and telecom to drive market

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Digital banking, public sector upgrading, and greater cloud adoption to drive market

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.2.1.1 State-led digital transformation and mandated banking and public sector upgrades to drive market

- 9.5.2.2 UAE

- 9.5.2.2.1 Government-led digital initiatives, banking innovation, and widespread use of hybrid cloud and containerized mainframe models to fuel modernization

- 9.5.2.3 Rest of Middle East

- 9.5.2.1 Kingdom of Saudi Arabia

- 9.5.3 AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Strategic public-private investments, regulatory reforms, and landmark banking sector projects to drive market

- 9.6.3 MEXICO

- 9.6.3.1 Cloud migration, talent upskilling, and system integration for financial and governmental sectors to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Organization size footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 11.1 KEY PLAYERS

- 11.1.1 IBM

- 11.1.1.1 Business overview

- 11.1.1.2 Software/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 AWS

- 11.1.2.1 Business overview

- 11.1.2.2 Software/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 TCS

- 11.1.3.1 Business overview

- 11.1.3.2 Software/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CAPGEMINI

- 11.1.4.1 Business overview

- 11.1.4.2 Software/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 HCLTECH

- 11.1.5.1 Business overview

- 11.1.5.2 Software/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 ATOS

- 11.1.6.1 Business overview

- 11.1.6.2 Software/Services offered

- 11.1.7 MICRO FOCUS (OPENTEXT)

- 11.1.7.1 Business overview

- 11.1.7.2 Software/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 BMC SOFTWARE

- 11.1.8.1 Business overview

- 11.1.8.2 Software/Services offered

- 11.1.9 INFOSYS

- 11.1.9.1 Business overview

- 11.1.9.2 Software/Services offered

- 11.1.10 WIPRO

- 11.1.10.1 Business overview

- 11.1.10.2 Software/Services offered

- 11.1.11 DXC TECHNOLOGY

- 11.1.12 KYNDRYL

- 11.1.13 ROCKET SOFTWARE

- 11.1.14 FUJITSU

- 11.1.15 COGNIZANT

- 11.1.16 TECH MAHINDRA

- 11.1.17 BROADCOM

- 11.1.18 TMAXSOFT

- 11.1.1 IBM

- 11.2 STARTUPS/SMES

- 11.2.1 PALMDIGITALZ

- 11.2.2 TSRI

- 11.2.3 MECHANICAL ORCHARD

- 11.2.4 VIRTUALZ COMPUTING

- 11.2.5 CLOUDFRAME

- 11.2.6 HEIRLOOM COMPUTING

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 APPLICATION MODERNIZATION SERVICES MARKET

- 12.2.1 MARKET DEFINITION

- 12.3 CLOUD PROFESSIONAL SERVICES MARKET

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS