|

시장보고서

상품코드

1804838

Fill-Finish 제조 시장(-2030년) : 제품(소모품(PFS, 플런저 스톱퍼), 바이알, 바이아르스툽파, 카트리지, 세포치료 백), 기구), Fill-Finish 서비스, 최종사용자별Fill Finish Manufacturing Market by Product ((Consumables (PFS, Plunger Stopper), Vial, Vial Stoppers, Cartridge, Cell Therapy Bags), Instruments ), Fill Finish Service, End User - Global Forecast to 2030 |

||||||

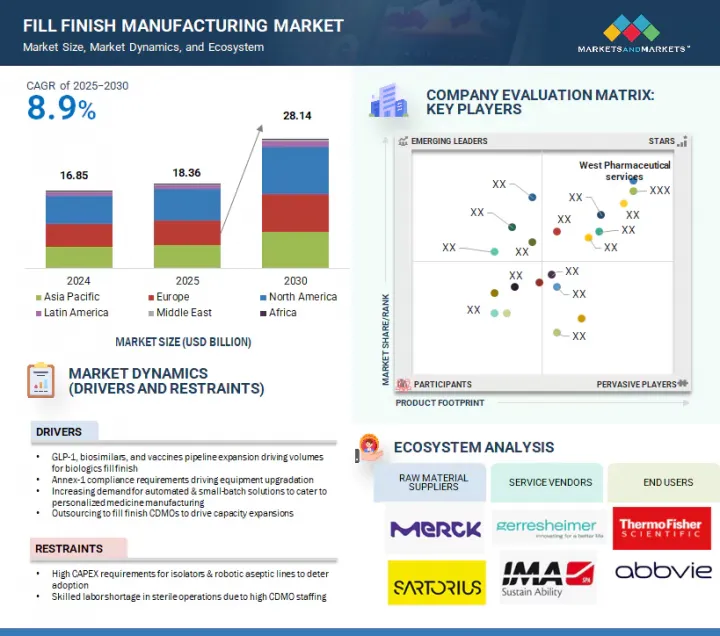

세계의 Fill-Finish 시장 규모는 2025년 183억 6,000만 달러에서 예측 기간 중 CAGR 8.9%로 성장을 지속하여, 2030년에는 281억 4,000만 달러에 이를 것으로 예측됩니다.

이 시장의 확대는 주로 Annex-1 준수 요건에 의해 주도되고 있으며, 이로 인해 장비 업그레이드, 자동화 및 소량 생산 솔루션에 대한 수요가 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제품 유형, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

그러나 아이솔레이터와 로봇에 의한 무균라인 도입에 많은 설비투자가 필요하다는 점, CDMO의 인력 부족으로 인해 무균 작업에 숙련된 인력이 부족하다는 점이 시장 성장을 저해할 것으로 예측됩니다.

"제품 유형별로는 소모품 부문이 가장 큰 점유율을 차지했습니다."

소모품은 의약품의 충전 및 포장 공정에서 무균성, 안전성, 효율성을 보장하는 데 필수적인 역할을 하기 때문에 시장에서 가장 큰 점유율을 차지하고 있습니다. 여기에는 바이알, 주사기, 카트리지, 마개, 마개, 씰, 튜브, 필터, 커넥터와 같은 일회용 시스템이 포함됩니다. 프리필드시린지 및 일회용 기술의 채택이 증가함에 따라 고품질 소모품에 대한 수요가 급증하고 있으며, 특히 엄격한 무균 조건이 요구되는 바이오 의약품 및 백신에 대한 수요가 급증하고 있습니다.

또한, 사전 세척 및 멸균된 용기와 마개는 네스트 또는 트레이 형태로 제공되는 즉시 사용(RTU) 구성품으로 전환되어 오염 위험을 줄이고 작업 효율을 향상시켜 소모품의 우위를 더욱 강화하고 있습니다. 또한, 제약사들은 세계 공급 수요에 대응하기 위해 유연성과 속도를 중시하고 있으며, 다운타임과 교차 오염을 최소화할 수 있는 일회용 소모품을 선호하고 있습니다. CDMO와 바이오 제약사들도 필피니쉬 공정을 외주화하는 경향이 강화되고 있어, 표준화된 규제 준수 소모품에 대한 수요가 더욱 증가하고 있습니다.

단일클론항체, 세포-유전자치료제, mRNA 제품 등 주사제 개발 파이프라인이 확대되고 있는 점도 고성능 소모품 수요를 더욱 촉진하고 있습니다. 그 결과, 소모품은 필피니쉬 워크플로우에 필수적일 뿐만 아니라 진화하는 제약 제조 환경에서 혁신과 가치 창출을 위한 중요한 기회를 제공합니다.

세계의 필피니쉬(Fill Finish) 제조 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 고객 사업에 영향을 미치는 동향/혼란

- Fill-Finish 아웃소싱 동향

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 특허 분석

- 규제 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 충전, 마감제조 시장에 미치는 영향

- 무역 데이터 분석

- 트럼프 관세가 Fill-Finish 시장에 미치는 영향

제6장 Fill-Finish 시장 : 제품별

- 소모품

- 프리필드 시린지

- 바이알

- 바이알 스툽파

- 카트리지

- 세포치료 Fill-Finish 백

- 기타

- 기기

- 시스템 유형별

- 유형별

- Fill-Finish CDMO 서비스 시장 세계의

제7장 Fill-Finish 시장 : 최종사용자별

- CMO

- 제약회사 및 바이오의약품 기업

- 기타

제8장 Fill-Finish 시장 : 지역별

- 북미

- 북미 : 거시경제 분석

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 분석

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 스위스

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 분석

- 중국

- 일본

- 인도

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 분석

- 브라질

- 멕시코

- 기타

- 중동

- 중동 : 거시경제 분석

- GCC 국가

- 기타

- 아프리카

제9장 경쟁 구도

- 개요

- 주요 기업의 전략 개요

- 매출 분석

- 시장 점유율 분석

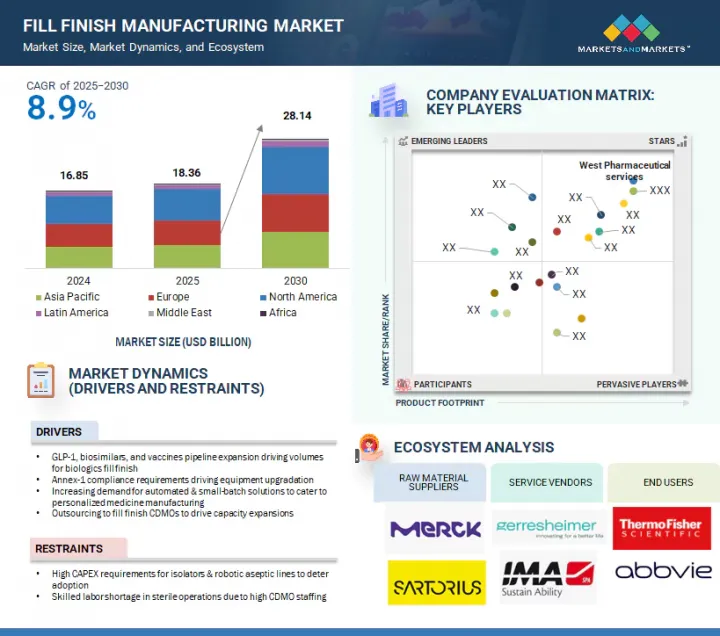

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- Fill-Finish 시장 벤더 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제10장 기업 개요

- 주요 기업

- SYNTEGON TECHNOLOGY GMBH

- I.M.A. S.P.A.

- BD & CO

- WEST PHARMACEUTICAL SERVICES, INC.

- GERRESHEIMER AG

- APTARGROUP, INC.

- DATWYLER HOLDING INC.

- DANAHER CORPORATION

- STEVANATO GROUP S.P.A.

- OPTIMA

- BAUSCH+STROBEL

- GRONINGER & CO. GMBH

- SGD PHARMA

- SCHOTT

- NIPRO CORPORATION

- BAUSCH ADVANCED TECHNOLOGY GROUP

- MAQUINARIA INDUSTRIAL DARA, SL

- 기타 기업

- STERILINE S.R.L.

- AUTOMATED SYSTEMS OF TACOMA, LLC

- SIO2 MATERIALS SCIENCE

- WEILER ENGINEERING, INC.

- FEDEGARI AUTOCLAVI S.P.A.

- SHANDONG PHARMACEUTICAL GLASS

- MITSUBISHI GAS CHEMICAL

- TERUMO CORPORATION

- SKAN AG

- ATS LIFE SCIENCE SYSTEMS

- CORNING INC.

- CREDENCE MEDSYSTEMS

- 3P INNOVATION LTD.

- COLANAR AG.

제11장 부록

LSH 25.09.11The global fill finish manufacturing market is projected to reach USD 28.14 billion by 2030 from an estimated USD 18.36 billion in 2025, at a CAGR of 8.9% from 2025 to 2030. The expansion of the fill finish manufacturing market has been predominantly fueled by Annex-1 compliance requirements, driving equipment upgradation and increasing demand for automated & small-batch solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Product type, End users, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

However, the need for high capex for adoption of isolators and robotic aseptic lines, as well as skilled labor shortage in sterile operations due to high CDMO staffing, is expected to restrain market growth.

"The consumables segment held the highest share in the fill finish manufacturing market by product type."

The fill finish manufacturing market is segmented by product type into consumables and instruments. Consumables held the largest share in the fill finish manufacturing market due to their essential role in ensuring sterility, safety, and efficiency throughout the drug filling and packaging process. These include vials, syringes, cartridges, stoppers, seals, and disposable systems such as tubing, filters, and connectors. With the increasing adoption of prefilled syringes and single-use technologies, the demand for high-quality consumables has surged, particularly for biologics and vaccines that require stringent aseptic conditions. The shift toward ready-to-use (RTU) components, such as pre-washed and sterilized containers and closures in nested & tray formats, further drives the dominance of consumables, as they help reduce contamination risks and streamline operations. Moreover, pharmaceutical manufacturers are prioritizing flexibility and speed to meet global supply demands, making single-use consumables a preferred choice for reducing downtime and cross-contamination. CDMOs and biopharma companies are also increasingly outsourcing fill-finish operations, amplifying the need for standardized and regulatory-compliant consumable products. The growing pipeline of injectable therapies, including monoclonal antibodies, cell and gene therapies, and mRNA-based products, will continue to elevate the demand for high-performance consumables. As a result, consumables are not only indispensable to fill finish workflows but also represent a critical opportunity for innovation and value creation in the evolving pharmaceutical manufacturing landscape.

"CMO segment reported for the highest share of the end user segment in 2024."

The Contract Manufacturing Organizations (CMOs) segment accounted for the largest share of the global fill finish manufacturing market. Based on end users, the market is categorized into CMOs, pharmaceutical and biopharmaceutical companies, and other end users such as Contract Research Organizations (CROs) and academic research institutions. CMOs have gained a strong foothold due to the growing trend of outsourcing fill finish operations, driven by the need for cost-effective and efficient manufacturing solutions. As drug development becomes more complex and time-sensitive, pharmaceutical and biopharmaceutical companies increasingly rely on CMOs to access specialized expertise, reduce capital investment, and accelerate time-to-market while simultaneously reducing costs & freeing up in-house capacity for non-core drugs. CMOs offer advanced capabilities, including aseptic processing, flexibility in batch sizes, and compliance with evolving regulatory standards, making them attractive partners in the highly competitive pharmaceutical landscape. The demand for high-quality, scalable, and reliable manufacturing services continues to rise, particularly for biologics and injectable drugs. As a result, the dominance of CMOs in the fill-finish space is expected to strengthen further, supported by ongoing investment in infrastructure, technology, and global supply chain integration.

"Europe accounted for the highest market share in the global fill finish manufacturing market from 2025 to 2030."

Europe holds the highest market share in the global fill-finish manufacturing market, driven by its strong pharmaceutical and biotechnology infrastructure, well-established regulatory framework, and presence of leading industry players. Countries such as Germany, Switzerland, France, and the UK are home to several top pharmaceutical companies and contract manufacturing organizations (CMOs) that offer advanced fill finish capabilities. The region benefits from significant investments in research and development, high adoption of innovative drug delivery systems, and a growing demand for biologics and personalized medicines. Additionally, Europe's strict regulatory standards promote the use of high-quality, sterile, and compliant fill-finish processes, further boosting the demand for specialized manufacturing solutions. The increasing focus on vaccine production and pandemic preparedness has also enhanced fill finish capacity across the region. Furthermore, government support for pharmaceutical innovation and public-private partnerships continues to strengthen the region's manufacturing capabilities. As a result, Europe remains a dominant force in the fill finish manufacturing landscape, offering growth opportunities for companies with advanced technologies, scalable solutions, and strong quality assurance systems.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side-70% and Demand Side-30%

- By Designation: Managers-45%, CXO and Directors-30%, and Executives-25%

- By Region: North America-30%, Europe-30%, the Asia Pacific-30%, Latin America-5%, and the Middle East & Africa-5%

List of Key Companies Profiled in the Report:

Key players in the fill finish manufacturing market include Syntegon Technology GmbH (Germany), I.M.A. S.P.A. (Italy), BD & Co.(US), West Pharmaceutical Services Inc. (US), Gerresheimer AG (Germany), AptarGroup Inc. (US), Datwyler Holding Inc. (Belgium), Danaher (US), Stevanato Group S.p.A. (Italy), OPTIMA (Germany), Bausch+Strobel (Germany), Groninger & Co. GmbH (Germany), SGD PHARMA (France), SCHOTT (Germany), Nipro Corporation (Japan), Bausch Advanced Technology Group (US), and Maquinaria Industrial Dara SI (Spain).

Research Coverage:

This research report categorizes the fill finish manufacturing market, By Product (Consumables (Pre-fillable Syringes (By components (Pre-fillable Syringe Systems & Components, Plunger Stopper)) By Material (Glass Pre-filled Syringes, Polymer Pre-filled Syringes)), Vial (By Material (Glass Vials, Polymer Vials), By Format (Bulk Vials, RTU Vials)), Vial stoppers (By Type (RTS/RFS Vial Stoppers, RTU Vial Stoppers)), Cartridge, Cell Therapy Fill Finish Bags and other consumables), Instruments (By System Type (Integrated Systems, Standalone Systems), By Machine Type (Automated Machines, Semi-Automated & Manual Machines), End User (Contract Manufacturing Organization (CMOs), Pharmaceutical & Biopharmaceutical Companies and Other end users) and by Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the fill finish manufacturing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New approvals/launches, collaborations, acquisitions, and recent developments associated with the fill finish manufacturing market.

Key Benefits of Buying the Report:

The report will help market leaders and new entrants by providing them with the closest approximations of the revenue numbers for the overall fill finish manufacturing market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (GLP-1, biosimilars and vaccines pipeline expansion driving volumes for biologics fill finish, Annex-1 compliance requirements driving equipment upgradation, increasing demand for automated & small-batch solutions to cater to personalized medicine manufacturing, outsourcing to fill finish CDMOs to drive capacity expansions) restraints (High CAPEX requirements for isolators & robotic aseptic lines to deter adoption, skilled labor shortage in sterile operations due to high CDMO staffing.), opportunities (Demand for cell & gene therapy/ mRNA small batch manufacturing, onshoring/ nearshoring for North America & Europe and integration of predictive analytics.), and challenges (Need for sustainable & PFAS-free consumables for fill finish) influencing the growth of the market.

- Service Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the fill finish manufacturing market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the market across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the fill finish manufacturing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/ approvals, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the fill finish manufacturing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 SEGMENTS CONSIDERED

- 1.4.2 YEARS CONSIDERED

- 1.4.3 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries (supply- and demand-side participants)

- 2.1.2.2 Key objective of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.1.1 Revenue share analysis of BD& Co.

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.2 INSIGHTS OF PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 STRATEGIC IMPERATIVES FOR KEY STAKEHOLDERS

- 3.1.1 FILL FINISH CONSUMABLE MANUFACTURERS

- 3.1.1.1 Shift to RTU & COP containers

- 3.1.1.2 Annex-1 compliance support for customers

- 3.1.1.3 PFAS-free, PPWR-ready portfolio to become table-stakes for customers

- 3.1.2 FILL FINISH EQUIPMENT MANUFACTURERS

- 3.1.2.1 Shift to robotic processes with nested RTU vials, PFS, and cartridges

- 3.1.2.2 Integration of predictive maintenance

- 3.1.3 FILL FINISH CDMOS

- 3.1.3.1 Biologics play vs. growth in niche segments of CGT, ADC, and radiopharma

- 3.1.3.2 Integration of predictive maintenance

- 3.1.1 FILL FINISH CONSUMABLE MANUFACTURERS

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FILL FINISH MANUFACTURING MARKET

- 4.2 EUROPE: FILL FINISH MANUFACTURING MARKET, BY PRODUCT AND COUNTRY (2025)

- 4.3 FILL FINISH MANUFACTURING MARKET, BY PRODUCT

- 4.4 FILL FINISH MANUFACTURING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 GLP-1, biosimilars, and vaccines pipeline expansion driving volumes for biologics fill-finish

- 5.2.1.2 Annex-1 compliance requirements driving equipment upgradation

- 5.2.1.3 Increasing demand for automated & small-batch solutions to cater to personalized medicine manufacturing

- 5.2.1.4 Outsourcing to fill-finish CDMOs driving capacity expansions

- 5.2.2 RESTRAINTS

- 5.2.2.1 High CAPEX requirements for isolators & robotic aseptic lines to deter adoption

- 5.2.2.2 Skilled labor shortage in sterile operations due to high CDMO staffing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for cell & gene therapy/mRNA small-batch manufacturing

- 5.2.3.2 Onshoring/Nearshoring for North America and Europe

- 5.2.3.3 Integration of predictive analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Need for sustainable & PFAS-free consumables for fill finish

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Aseptic processing

- 5.3.1.2 Sterilization

- 5.3.2 COMPLIMENTARY TECHNOLOGIES

- 5.3.2.1 Automation and robotics

- 5.3.2.2 Isolator technology

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Single use systems

- 5.3.3.2 Inspection and quality control

- 5.3.1 KEY TECHNOLOGIES

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4.1 KEY LAUNCHES AND PIPELINE OF BIOSIMILARS, GLP-1, CGT, ADC & RADIOPHARMACEUTICALS

- 5.4.2 US FDA APPROVAL TREND OF DRUG APPROVALS BY DOSAGE FORM

- 5.4.2.1 Injectable vs. other dosage forms

- 5.4.2.2 Subcutaneous vs. intramuscular biologics

- 5.5 FILL FINISH OUTSOURCING TRENDS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY PRODUCT

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- 5.9.1 CONSUMABLES

- 5.9.2 INSTRUMENTS

- 5.9.3 END USERS

- 5.9.4 MANUFACTURING SITES, EXPANSIONS, AND CAPEX TRENDS OF KEY FILL FINISH CDMOS, 2022-2025

- 5.10 PATENT ANALYSIS

- 5.10.1 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE, 2014-2024

- 5.10.2 LIST OF KEY PATENTS, 2023-2024

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.2.1 Germany

- 5.11.2.2.2 France

- 5.11.2.2.3 UK

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China

- 5.11.2.3.2 Japan

- 5.11.2.3.3 India

- 5.11.2.4 Rest of the World

- 5.11.2.4.1 Brazil

- 5.11.2.4.2 Argentina

- 5.11.2.4.3 Saudi Arabia

- 5.11.2.1 North America

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.14.2.1 Key unmet needs of end users

- 5.14.2.1.1 Truly flexible, multi-format lines

- 5.14.2.1.2 Low-MOQ custom packs for clinical CGT

- 5.14.2.1 Key unmet needs of end users

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON FILL FINISH MANUFACTURING MARKET

- 5.17 TRADE DATA ANALYSIS

- 5.17.1 GLASS AMPOULES

- 5.17.2 ARTICLES FOR CONVEYANCE OR PACKAGING OF PLASTIC GOODS, STOPPERS, LIDS, CAPS, AND OTHER CLOSURES

- 5.17.3 LABORATORY, HYGIENIC, OR PHARMACEUTICAL GLASSWARE, WHETHER OR NOT GRADUATED OR CALIBRATED

- 5.17.4 HYGIENIC OR PHARMACEUTICAL ARTICLES, INCLUDING TEATS OF VULCANIZED RUBBER (EXCL. HARD RUBBER), WITH OR WITHOUT FITTINGS OF HARD RUBBER

- 5.18 TRUMP TARIFF IMPACT ON FILL FINISH MANUFACTURING MARKET

- 5.18.1 KEY TARIFF RATES

- 5.18.2 PRICE IMPACT ANALYSIS

- 5.18.3 KEY IMPACT ON VARIOUS REGIONS

- 5.18.3.1 US

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.3.4 Rest of the World

- 5.18.4 END-USE INDUSTRY IMPACT

- 5.18.4.1 Contract manufacturing organizations

- 5.18.4.2 Pharmaceutical & biopharmaceutical companies

- 5.18.4.3 Other end users

6 FILL FINISH MANUFACTURING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 PREFILLABLE SYRINGES

- 6.2.1.1 Rising need for high-quality drug delivery systems to boost market

- 6.2.1.2 Prefillable syringes, by component

- 6.2.1.2.1 Prefillable syringe systems and components

- 6.2.1.3 Plunger stoppers

- 6.2.1.3.1 Rising prevalence of chronic diseases to positively impact pre-fillable syringes plunger stopper growth

- 6.2.1.4 Prefillable syringes, by material

- 6.2.1.4.1 Glass pre filled syringes

- 6.2.1.4.2 Polymer prefilled syringes

- 6.2.2 VIALS

- 6.2.2.1 Increased vaccination and treatment applications to drive growth

- 6.2.2.2 Vials, by material

- 6.2.2.2.1 Glass vials

- 6.2.2.2.2 Polymer vials

- 6.2.2.3 Vials, by format

- 6.2.2.3.1 Bulk vials

- 6.2.2.3.2 RTU vials

- 6.2.3 VIAL STOPPERS

- 6.2.3.1 Vial stoppers, by type

- 6.2.3.1.1 RTS/RFS vial stoppers

- 6.2.3.1.2 RTU vials stopper

- 6.2.3.1 Vial stoppers, by type

- 6.2.4 CARTRIDGES

- 6.2.4.1 Rising cases of diabetes and autoimmune disorders to drive growth of cartridges

- 6.2.5 CELL THERAPY FILL FINISH BAGS

- 6.2.5.1 Specialized fill-finish bags enable safe and sterile cell therapy delivery

- 6.2.6 OTHER CONSUMABLES

- 6.2.1 PREFILLABLE SYRINGES

- 6.3 INSTRUMENTS

- 6.3.1 INSTRUMENTS, BY SYSTEM TYPE

- 6.3.1.1 Rise in applications to drive market growth

- 6.3.1.2 Integrated systems

- 6.3.1.2.1 Higher product yield and automation to drive market growth

- 6.3.1.3 Standalone systems

- 6.3.1.3.1 Customization-a key factor driving growth

- 6.3.2 INSTRUMENTS, BY MACHINE TYPE

- 6.3.2.1 Increased technological advancements to drive growth of machines market

- 6.3.2.2 Automated machines

- 6.3.2.2.1 Technological advancements attributed to market growth

- 6.3.2.3 Semi-automated and manual machines

- 6.3.2.3.1 Popularity of benchtop equipment to drive market growth

- 6.3.3 FILL FINISH CDMO SERVICES MARKET

- 6.3.1 INSTRUMENTS, BY SYSTEM TYPE

7 FILL FINISH MANUFACTURING MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 CONTRACT MANUFACTURING ORGANIZATIONS (CMOS)

- 7.2.1 GROWING PACE OF OUTSOURCING TO BENEFIT CMO SECTOR

- 7.3 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- 7.3.1 INVESTMENTS IN NEW BIOLOGICS PRODUCTION FACILITIES TO DRIVE MARKET

- 7.4 OTHERS

8 FILL FINISH MANUFACTURING MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: MACROECONOMIC ANALYSIS

- 8.2.2 US

- 8.2.2.1 Rising number of pipeline products for fill finish manufacturing to drive market

- 8.2.3 CANADA

- 8.2.3.1 Competitive business environment to boost market

- 8.3 EUROPE

- 8.3.1 EUROPE: MACROECONOMIC ANALYSIS

- 8.3.2 GERMANY

- 8.3.2.1 Rising focus on clinical research and patent approvals to drive market

- 8.3.3 UK

- 8.3.3.1 Growth in biopharmaceutical industry to support market growth

- 8.3.4 FRANCE

- 8.3.4.1 Increasing focus on developing biologics to drive demand for fill-finish technologies

- 8.3.5 ITALY

- 8.3.5.1 Investments and advancements to drive market

- 8.3.6 SPAIN

- 8.3.6.1 Innovations in fill finish manufacturing market to drive growth

- 8.3.7 SWITZERLAND

- 8.3.7.1 Outsourcing trends and collaboration with contract manufacturing organizations to drive growth

- 8.3.8 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: MACROECONOMIC ANALYSIS

- 8.4.2 CHINA

- 8.4.2.1 Increased investments in biologics and biosimilar drug research to drive market

- 8.4.3 JAPAN

- 8.4.3.1 Rise in aging population to drive demand for medications

- 8.4.4 INDIA

- 8.4.4.1 Large domestic consumption and export of generic drugs to drive market

- 8.4.5 SOUTH KOREA

- 8.4.5.1 Well-developed healthcare industry and presence of major pharmaceutical manufacturers to drive market

- 8.4.6 REST OF ASIA PACIFIC

- 8.5 LATIN AMERICA

- 8.5.1 LATIN AMERICA: MACROECONOMIC ANALYSIS

- 8.5.2 BRAZIL

- 8.5.2.1 Free and universal healthcare services to boost market

- 8.5.3 MEXICO

- 8.5.3.1 Government initiatives in healthcare industry to fuel demand for pharmaceutical products

- 8.5.4 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST

- 8.6.1 MIDDLE EAST: MACROECONOMIC ANALYSIS

- 8.6.2 GCC COUNTRIES

- 8.6.2.1 Saudi Arabia (KSA)

- 8.6.2.1.1 More comprehensive access to healthcare services to fuel demand for pharmaceuticals

- 8.6.2.2 United Arab Emirates (UAE)

- 8.6.2.2.1 Increasing initiatives for domestic pharmaceutical production to drive market

- 8.6.2.3 Rest of GCC

- 8.6.2.1 Saudi Arabia (KSA)

- 8.6.3 REST OF MIDDLE EAST

- 8.7 AFRICA

- 8.7.1 GROWING COLLABORATIONS TO SUPPORT GROWTH

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN FILL FINISH MANUFACTURING MARKET, 2022-2024

- 9.3 REVENUE ANALYSIS, 2022-2024

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPETITIVE BENCHMARKING OF TOP PLAYERS

- 9.5.6 COMPANY FOOTPRINT

- 9.5.6.1 Region footprint

- 9.5.6.2 Product footprint

- 9.5.6.3 End user footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.7 VALUATION AND FINANCIAL METRICS OF FILL FINISH MANUFACTURING MARKET VENDORS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/PRODUCT COMPARISON

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT APPROVALS

- 9.9.2 DEALS

- 9.9.3 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 SYNTEGON TECHNOLOGY GMBH

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Services/Solutions offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches and approvals

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Expansions

- 10.1.1.3.4 Other developments

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 I.M.A. S.P.A.

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Services/Solutions offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths/Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 BD & CO

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Services/Solutions offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Product launches and approvals

- 10.1.3.3.2 Deals

- 10.1.3.3.3 Expansions

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths/Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses & competitive threats

- 10.1.4 WEST PHARMACEUTICAL SERVICES, INC.

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Services/Solutions offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches and approvals

- 10.1.4.3.2 Deals

- 10.1.4.3.3 Expansions

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths/Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 GERRESHEIMER AG

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Services/Solutions offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product launches and approvals

- 10.1.5.3.2 Deals

- 10.1.5.3.3 Expansions

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths/Right to win

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses & competitive threats

- 10.1.6 APTARGROUP, INC.

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Services/Solutions offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches and approvals

- 10.1.6.3.2 Deals

- 10.1.6.3.3 Expansions

- 10.1.7 DATWYLER HOLDING INC.

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Services/Solutions offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Product launches and approvals

- 10.1.7.3.2 Deals

- 10.1.7.3.3 Expansions

- 10.1.8 DANAHER CORPORATION

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Services/Solutions offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Deals

- 10.1.9 STEVANATO GROUP S.P.A.

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Services/Solutions offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Product launches and approvals

- 10.1.9.3.2 Deals

- 10.1.9.3.3 Expansions

- 10.1.10 OPTIMA

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Services/Solutions offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Deals

- 10.1.10.3.2 Expansions

- 10.1.11 BAUSCH+STROBEL

- 10.1.11.1 Business overview

- 10.1.11.2 Products/Services/Solutions offered

- 10.1.11.3 Recent developments

- 10.1.11.3.1 Product launches and approvals

- 10.1.12 GRONINGER & CO. GMBH

- 10.1.12.1 Business overview

- 10.1.12.2 Products/Services/Solutions offered

- 10.1.12.3 Recent developments

- 10.1.12.3.1 Expansions

- 10.1.13 SGD PHARMA

- 10.1.13.1 Business overview

- 10.1.13.2 Products/Services/Solutions offered

- 10.1.13.3 Recent developments

- 10.1.13.3.1 Product launches and approvals

- 10.1.13.3.2 Deals

- 10.1.13.3.3 Expansions

- 10.1.14 SCHOTT

- 10.1.14.1 Business overview

- 10.1.14.2 Products/Services/Solutions offered

- 10.1.14.3 Recent developments

- 10.1.14.3.1 Product launches and approvals

- 10.1.14.3.2 Deals

- 10.1.14.3.3 Expansions

- 10.1.14.3.4 Other developments

- 10.1.15 NIPRO CORPORATION

- 10.1.15.1 Business overview

- 10.1.15.2 Products/Services/Solutions offered

- 10.1.15.3 Recent developments

- 10.1.15.3.1 Product launches and approvals

- 10.1.15.3.2 Expansions

- 10.1.16 BAUSCH ADVANCED TECHNOLOGY GROUP

- 10.1.16.1 Business overview

- 10.1.16.2 Products/Services/Solutions offered

- 10.1.17 MAQUINARIA INDUSTRIAL DARA, SL

- 10.1.17.1 Business overview

- 10.1.17.2 Products/Services/Solutions offered

- 10.1.17.3 Recent developments

- 10.1.17.3.1 Product launches and approvals

- 10.1.17.3.2 Deals

- 10.1.1 SYNTEGON TECHNOLOGY GMBH

- 10.2 OTHER PLAYERS

- 10.2.1 STERILINE S.R.L.

- 10.2.2 AUTOMATED SYSTEMS OF TACOMA, LLC

- 10.2.3 SIO2 MATERIALS SCIENCE

- 10.2.4 WEILER ENGINEERING, INC.

- 10.2.5 FEDEGARI AUTOCLAVI S.P.A.

- 10.2.6 SHANDONG PHARMACEUTICAL GLASS

- 10.2.7 MITSUBISHI GAS CHEMICAL

- 10.2.8 TERUMO CORPORATION

- 10.2.9 SKAN AG

- 10.2.10 ATS LIFE SCIENCE SYSTEMS

- 10.2.11 CORNING INC.

- 10.2.12 CREDENCE MEDSYSTEMS

- 10.2.13 3P INNOVATION LTD.

- 10.2.14 COLANAR AG.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS