|

시장보고서

상품코드

1807085

LiDAR 시장 : 기술별, 설치 장소별, 유형별, 거리별, 서비스별, 최종 용도별, 지역별 예측(-2030년)LiDAR Market by Installation (Airborne, Ground-based), Type (Mechanical, Solid-state), Range (Short, Medium, Long), Service (Aerial Surveying, Asset Management, GIS Services, Ground-based Surveying), Region - Global Forecast to 2030 |

||||||

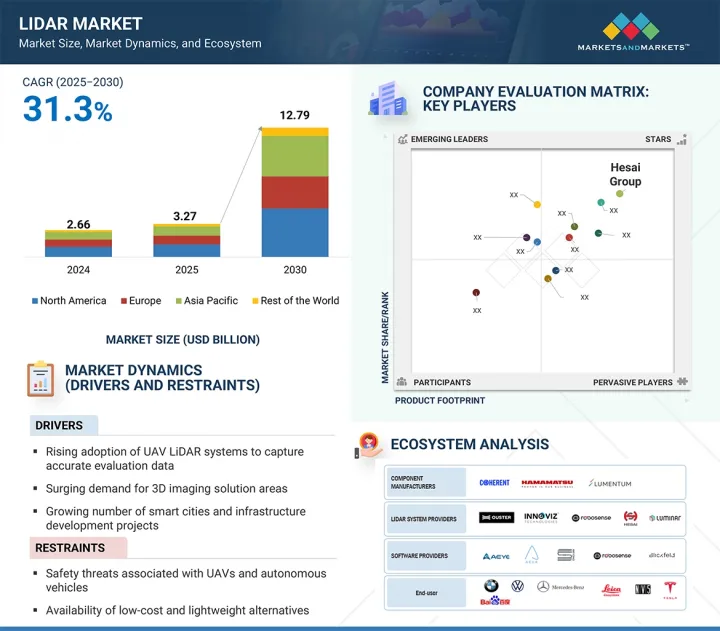

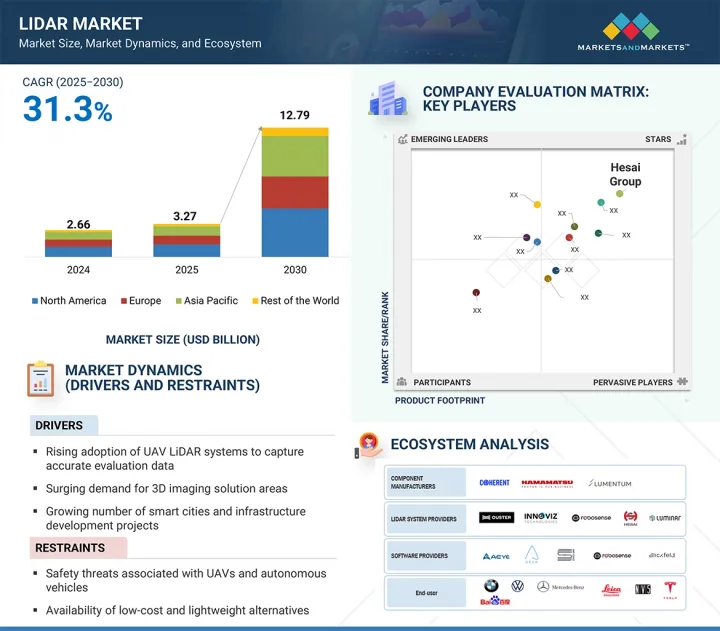

세계의 LiDAR 시장 규모는 예측 기간 동안 31.3%의 연평균 복합 성장률(CAGR)로 확대되어, 2025년 32억 7,000만 달러에서 2030년까지 127억 9,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 기술별, 설치 장소별, 유형별, 거리별, 서비스별, 최종 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

자율주행차의 보급이 LiDAR 시장을 견인해, 고정밀 3D 매핑 수요가 높아지고, 스마트 시티나 인프라 개발 프로젝트에 대한 투자가 증가하고 있습니다. 비용 효율성과 내구성을 제공하는 솔리드 스테이트 LiDAR 기술의 발전은 자동차, 환경 및 산업 분야에서의 채택을 더욱 가속화하고 있습니다. 또한 디지털 매핑과 지능형 교통 시스템을 지원하는 정부의 이니셔티브가 시장 성장을 가속하고 있습니다. 그러나 LiDAR 시스템의 초기 비용이 높고 카메라 및 레이더 기반 시스템과 같은 대체 감지 기술을 사용할 수 있다는 것이 주요 억제 요인이 되었습니다. 또한 자율 내비게이션의 제한된 표준화와 규제상의 과제도 대규모의 전개를 방해하고 있습니다.

LiDAR 시장의 GIS 서비스 부문은 원시 LiDAR 데이터를 실용적인 지리공간 통찰력으로 변환하는 데 중요한 역할을 하기 때문에 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. 교통, 도시 개발, 환경 모니터링 등의 분야에서 정확한 매핑, 공간 분석, 인프라 계획에 대한 수요 증가가 채택을 촉진하고 있습니다. 첨단 GIS 플랫폼과 LiDAR을 통합하면 실시간 의사결정이 가능해지고 재난 관리, 농업, 공공시설 자산 관리 등의 효율성이 향상됩니다. 정부와 민간 조직은 스마트 시티 프로젝트와 인프라 현대화를 위해 GIS 기반 LiDAR 솔루션에 대한 투자를 늘리고 있습니다. 또한 클라우드 기반 GIS와 AI 주도의 공간 분석의 발전으로 이러한 서비스의 접근성과 확장성이 확대되고 있습니다. 이러한 기술 혁신과 광범위한 산업 횡단적 적용성의 강력한 조합으로 GIS 서비스는 LiDAR 시장에서 가장 빠르게 성장하는 부문으로 자리매김하고 있습니다.

지상 설치형 LiDAR은 통로 매핑, 건설, 광업, 임업, 환경 모니터링 등의 용도로 널리 사용되고 있기 때문에 최대 시장 점유율을 차지할 것으로 예측됩니다. 고정밀도, 고밀도의 점군 데이터를 취득 가능, 단거리 및 중거리 스캔에 적합하므로, 상세한 지형이나 구조 분석에 최적입니다. 이 기술은 정확도가 중요한 도시 계획, 고고학, 인프라 검사에서 측량 및 매핑에 널리 채택되었습니다. 게다가 지상형 LiDAR 시스템은 소규모에서 중간 규모의 프로젝트에서 공중형에 비해 비용 효율적입니다. 빌딩 정보 모델링(BIM) 및 산업 플랜트 유지보수에서 지상 레이저 스캐닝에 대한 수요가 증가함에 따라 시장 우위가 더욱 높아지고 있습니다. 휴대성, 자동화, GIS 플랫폼과의 통합에 대한 지속적인 발전은 여러 분야에서의 채택을 강화하고 있습니다.

북미는 이 지역의 주요 LiDAR 제조업체, 기술 공급자, 자율주행차 개발자의 강한 존재감으로 인해 LiDAR 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 자율주행차 연구, 스마트 인프라 프로젝트, 첨단 매핑 이니셔티브에 대한 많은 투자가 수요를 이끌고 있습니다. 이 지역은 환경 모니터링, 방어 용도 및 운송 안전 프로그램에 대한 정부의 강력한 지원으로부터 혜택을 누리고 있습니다. 광업, 임업, 건설, 석유 및 가스와 같은 분야에서 LiDAR의 높은 채택이 시장 성장을 더욱 강화하고 있습니다. 또한, LiDAR과 AI, IoT, 클라우드 기반 플랫폼과의 조기 통합은 그 응용 가능성을 높이고 있습니다. 기술적 리더십, 높은 R&D 비용, 다양한 최종 용도 채택의 조합으로 북미는 세계적으로 지배적인 LiDAR 시장에 자리잡고 있습니다.

본 보고서에서는 세계의 LiDAR 시장에 대해 조사했으며, 기술별, 설치 장소별, 유형별, 거리별, 서비스별, 최종 용도별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 밸류체인 분석

- 에코시스템 및 시장지도

- 가격 분석

- 고객사업에 영향을 주는 동향/혼란

- 기술 분석

- Porter's Five Forces 분석

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- 무역 분석

- 특허 분석

- 2025-2026년의 주된 회의와 이벤트

- 주요 이해관계자와 구매 프로세스

- AI가 LiDAR 시장에 미치는 영향

- 트럼프 관세가 라이더 시장에 미치는 영향

- 주요 관세율

- 가격 영향 분석

- 다양한 지역에 미치는 영향

- 최종 이용 산업 수준에 미치는 영향

제6장 LiDAR 시장(기술별)

- 소개

- 2D

- 3D

- 4D

제7장 LiDAR 시장(설치 장소별)

- 소개

- 공중

- 지상

제8장 LiDAR 시장(유형별)

- 소개

- 기계

- 솔리드 스테이트

제9장 LiDAR 시장(거리별)

- 소개

- 단거리(0-200미터)

- 중거리(200-500미터)

- 장거리(500미터 이상)

제10장 라이더 시장(서비스별)

- 소개

- 항공측량

- 자산운용관리

- 지리 정보 시스템(GIS) 서비스

- 지상측량

- 기타

제11장 라이더 시장(최종 용도)

- 소개

- 코리더 매핑

- 엔지니어링

- 환경

- ADAS 및 자율주행차

- 탐험

- 도시계획

- 지도 작성

- 기상학

- 기타

제12장 LiDAR 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 북유럽

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타

- 기타 지역

- 거시경제 전망은 연속

- 남미

- 중동

- 아프리카

제13장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석, 2021-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 및 재무지표

- 브랜드 및 제품 비교

- 기업 평가 매트릭스: 주요 진입기업, 2024년

- 기업 평가 매트릭스: 스타트업 및 중소기업, 2024년

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- ROBOSENSE

- HESAI GROUP

- LUMINAR TECHNOLOGIES, INC.

- OUSTER, INC.

- SICK AG

- LEICA GEOSYSTEMS AG

- TRIMBLE INC.

- TELEDYNE OPTECH

- FARO

- RIEGL LASER MEASUREMENT SYSTEMS GMBH

- NV5GEOSPATIA

- SURESTAR

- YELLOWSCAN

- 기타 기업

- PREACT TECHNOLOGIES

- OPSYS TECHNOLOGIES

- GEOKNO

- PHOENIX LiDAR SYSTEMS

- QUANERGY SYSTEMS, INC.

- INNOVIZ TECHNOLOGIES LTD

- LEOSPHERE

- WAYMO LLC

- VALEO

- NEPTEC TECHNOLOGIES CORP.

- ZX LiDARS

- LIVOX

- ROUTESCENE

- BLICKFELD GMBH

- SABRE ADVANCED 3D SURVEYING SYSTEMS LTD

- LEISHEN INTELLIGENT SYSTEM

제15장 부록

JHS 25.09.16The LiDAR market is projected to reach USD 12.79 billion by 2030 from USD 3.27 billion in 2025, at a CAGR of 31.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Installation, Type, Range, Service, End-Use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising adoption of autonomous vehicles drives the LiDAR market, growing demand for high-precision 3D mapping, and increasing investments in smart city and infrastructure development projects. Advancements in solid-state LiDAR technology, offering cost efficiency and durability, are further accelerating adoption across automotive, environmental, and industrial applications. Additionally, government initiatives that support digital mapping and intelligent transportation systems are driving market growth. However, the high initial cost of LiDAR systems and the availability of alternative sensing technologies, such as camera and radar-based systems, act as key restraints. Limited standardization and regulatory challenges in autonomous navigation also hinder large-scale deployment.

"GIS service to witness the highest growth during the forecast period."

The GIS services segment in the LiDAR market is expected to grow at the highest CAGR during the forecast period due to its critical role in transforming raw LiDAR data into actionable geospatial insights. Increasing demand for accurate mapping, spatial analysis, and infrastructure planning in sectors such as transportation, urban development, and environmental monitoring is driving adoption. The integration of LiDAR with advanced GIS platforms enables real-time decision-making, improving efficiency in disaster management, agriculture, and utility asset management. Governments and private organizations are increasingly investing in GIS-based LiDAR solutions for smart city projects and infrastructure modernization. Furthermore, advancements in cloud-based GIS and AI-driven spatial analytics are expanding the accessibility and scalability of these services. This strong combination of technological innovation and broad cross-industry applicability positions GIS services as the fastest-growing segment in the LiDAR market.

"Ground-based installation segment to dominate the market during the forecast period."

Ground-based LiDAR is expected to hold the largest market share due to its extensive use in applications such as corridor mapping, construction, mining, forestry, and environmental monitoring. Its high accuracy, ability to capture dense point clouds, and suitability for short- to medium-range scanning make it ideal for detailed terrain and structural analysis. The technology is widely adopted for surveying and mapping in urban planning, archaeology, and infrastructure inspection, where precision is critical. Additionally, ground-based LiDAR systems are cost-effective compared to airborne counterparts for small- to mid-scale projects. The growing demand for terrestrial laser scanning in building information modeling (BIM) and industrial plant maintenance further fuels market dominance. Continuous advancements in portability, automation, and integration with GIS platforms are strengthening its adoption across multiple sectors.

"North America to hold the largest share of the LiDAR market during the forecast period."

North America is expected to hold the largest share in the LiDAR market due to the strong presence of leading LiDAR manufacturers, technology providers, and autonomous vehicle developers in the region. Significant investments in self-driving car research, smart infrastructure projects, and advanced mapping initiatives are driving demand. The region benefits from robust government support for environmental monitoring, defense applications, and transportation safety programs. High adoption of LiDAR in sectors such as mining, forestry, construction, and oil & gas further strengthens market growth. Additionally, the early integration of LiDAR with AI, IoT, and cloud-based platforms enhances its application potential. The combination of technological leadership, high R&D spending, and diverse end-use adoption positions North America as the dominant LiDAR market globally.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

The report profiles key LiDAR market players and their respective market ranking analyses. Prominent players profiled in this report include Hesai Group (China), RoboSense Technology Co., Ltd. (China), Sick AG (Germany), Ouster, Inc. (US), Luminar Technologies (US), Leica Geosystems AG (Sweden), Trimble Inc. (US), Teledyne Optech (Canada), FARO Technologies, Inc. (US), RIEGL Laser Measurement Systems GmbH (Austria), NV5 Geospatial (US), Beijing SureStar Technology Co., Ltd. (China), YellowScan (France) SABRE Advanced 3D Surveying Systems (Scotland), Geokno (India), Phoenix LiDAR Systems (US), Quanergy Systems, Inc. (US), Innoviz Technologies Ltd (Israel), Leosphere (France), Waymo LLC (US), Valeo (France), ZX Lidars (UK), Livox (China), Routescene (Scotland), and Blickfeld GmbH (Germany).

Research Coverage

The report defines, describes, and forecasts the LiDAR market based on installation, type, range, services, end-use application, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as product launches, acquisitions, expansions, and actions carried out by the key players to grow in the market.

Reason to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall LiDAR market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising adoption of UAV LIDAR systems to capture accurate evaluation data), restraints (Availability of low-cost and lightweight alternatives), opportunities (Increasing development of quantum dot detectors), and challenges (High cost of post-processing LIDAR software) of the LiDAR market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the LiDAR market

- Market Development: Comprehensive information about lucrative markets by analyzing the LiDAR market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the LiDAR market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and offerings of leading players in the LiDAR market, such as Hesai Group (China), RoboSense Technology Co., Ltd. (China), Sick AG (Germany), Ouster, Inc. (US), and Luminar Technologies (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIDAR MARKET

- 4.2 LIDAR MARKET, BY TYPE

- 4.3 LIDAR MARKET, BY END-USE APPLICATION

- 4.4 LIDAR MARKET IN ASIA PACIFIC, BY INSTALLATION AND COUNTRY

- 4.5 LIDAR MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of UAV LiDAR systems to capture accurate evaluation data

- 5.2.1.2 Surging demand for 3D imaging solutions

- 5.2.1.3 Growing number of smart cities and infrastructure development projects

- 5.2.1.4 Rising deployment of 4D LiDAR technology in autonomous vehicles

- 5.2.1.5 Increasing enforcement of regulations related to commercial drone adoption in highway construction applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety threats associated with UAVs and autonomous vehicles

- 5.2.2.2 Availability of low-cost and lightweight alternatives

- 5.2.2.3 High testing, engineering, and calibration costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments in ADAS systems by automotive giants

- 5.2.3.2 Increasing development of quantum dot detectors

- 5.2.3.3 Rising popularity of compact and cost-effective flash LiDAR

- 5.2.3.4 Developing advanced geospatial solutions

- 5.2.3.5 Increasing reliance on drones to gather key analytic data

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of post-processing LiDAR software

- 5.2.4.2 Complexities related to miniaturized LiDAR sensing

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH, DESIGN, AND DEVELOPMENT

- 5.3.2 RAW MATERIAL SUPPLY

- 5.3.3 LIDAR COMPONENT MANUFACTURING

- 5.3.4 SYSTEM INTEGRATION

- 5.3.5 SUPPLY AND DISTRIBUTION

- 5.3.6 END-USE APPLICATION

- 5.4 ECOSYSTEM/MARKET MAP

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYER, 2024

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 Frequency-modulated continuous-wave LiDAR

- 5.7.1.2 Photon-counting LiDAR

- 5.7.1.3 Multi-wavelength LiDAR

- 5.7.2 ADJACENT TECHNOLOGY

- 5.7.2.1 Metamaterials

- 5.7.2.2 In-car LiDAR

- 5.7.2.3 Artificial intelligence (AI) and machine learning (ML)

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Sensor suite

- 5.7.3.2 Flash LiDAR technology

- 5.7.1 KEY TECHNOLOGY

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 VISIMIND PARTNERS WITH VELODYNE LIDAR TO INCREASE SAFETY AND SECURE DATA RELATED TO ENERGY DISTRIBUTION

- 5.9.2 DRONE TECHNOLOGIES ADOPTS TRIMBLE INC.'S LIDAR SENSORS FOR TERRAIN MAPPING

- 5.9.3 TS ENGINEERING PERFORMS HIGHWAY AERIAL MAPPING WITH TRUEVIEW 535 AND LP360 PROCESSING SOFTWARE

- 5.9.4 CSX TRANSPORTATION UTILIZES PHOENIX LIDAR SCOUT SYSTEMS FOR RAILROAD SURVEYING

- 5.9.5 MEASUREMENT SCIENCES INC. IMPLEMENTS LIDAR IN PIPELINE SURVEYS TO MAP LARGE VEGETATED AREAS EFFICIENTLY

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATIONS

- 5.11.1.1 Restriction of Hazardous Substances (RoHs) Directive

- 5.11.1.2 General Data Protection Regulation (GDPR)

- 5.11.1.3 Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)

- 5.11.1.4 Import-export laws

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 901320)

- 5.12.2 EXPORT SCENARIO (HS CODE 901320)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON LIDAR MARKET

- 5.17 TRUMP TARIFF IMPACT ON LIDAR MARKET

- 5.17.1 INTRODUCTION

- 5.18 KEY TARIFF RATES

- 5.19 PRICE IMPACT ANALYSIS

- 5.20 IMPACT ON VARIOUS REGIONS

- 5.20.1 US

- 5.20.2 EUROPE

- 5.20.3 ASIA PACIFIC

- 5.21 END-USE INDUSTRY-LEVEL IMPACT

6 LIDAR MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 2D

- 6.3 3D

- 6.4 4D

7 LIDAR MARKET, BY INSTALLATION

- 7.1 INTRODUCTION

- 7.2 AIRBORNE

- 7.2.1 TOPOGRAPHIC

- 7.2.1.1 Topographic LiDAR unlocks precision terrain intelligence, fueling market expansion

- 7.2.2 BATHYMETRIC LIDAR

- 7.2.2.1 Development of airborne bathymetric LiDAR systems to map coastal zones to contribute to market growth

- 7.2.1 TOPOGRAPHIC

- 7.3 GROUND-BASED

- 7.3.1 MOBILE

- 7.3.1.1 Deployment of mobile LiDAR technology in corridor mapping and meteorology applications to fuel segmental growth

- 7.3.2 STATIC

- 7.3.2.1 Utilization of static LiDAR in engineering and exploration to accelerate segmental growth

- 7.3.1 MOBILE

8 LIDAR MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 MECHANICAL

- 8.2.1 MECHANICAL LIDAR-ENABLED ENVIRONMENTAL MAPPING TO ACCELERATE MARKET EXPANSION

- 8.3 SOLID STATE

- 8.3.1 SOLID-STATE LIDAR GAINS TRACTION WITH SUPERIOR SHOCK AND VIBRATION RESISTANCE

9 LIDAR MARKET, BY RANGE

- 9.1 INTRODUCTION

- 9.2 SHORT (0-200 M)

- 9.2.1 ADOPTION OF SHORT-RANGE LIDAR TO AUTOMATE INDUSTRIAL OBJECT PROXIMITY SENSING TO BOOST SEGMENTAL GROWTH

- 9.3 MEDIUM (200-500 M)

- 9.3.1 IMPLEMENTATION OF MEDIUM-RANGE LIDAR TO NAVIGATE AUTOMATED GUIDED VEHICLES TO ACCELERATE SEGMENTAL GROWTH

- 9.4 LONG (ABOVE 500 M)

- 9.4.1 EMPLOYMENT OF LONG-RANGE LIDAR COMPONENTS FOR WIDE-AREA MAPPING TO FOSTER SEGMENTAL GROWTH

10 LIDAR MARKET, BY SERVICE

- 10.1 INTRODUCTION

- 10.2 AERIAL SURVEYING

- 10.2.1 RELIANCE ON AERIAL LIDAR SURVEYS TO PROVIDE ACCURATE 3D MAPPING OF TERRAINS AND LANDSCAPES TO PROPEL MARKET

- 10.3 ASSET MANAGEMENT

- 10.3.1 ADOPTION OF LIDAR IN TRANSMISSION LINE AND ROAD MAPPING PROJECTS TO FUEL SEGMENTAL GROWTH

- 10.4 GEOGRAPHIC INFORMATION SYSTEM (GIS) SERVICES

- 10.4.1 CAPABILITY TO INTEGRATE LIDAR WITH GEOSPATIAL DATA TO AUGMENT DEMAND

- 10.5 GROUND-BASED SURVEYING

- 10.5.1 USE OF GROUND-BASED MONITORING SYSTEMS IN HIGH-VOLUME TRAFFIC STUDIES TO DRIVE SEGMENTAL GROWTH

- 10.6 OTHER SERVICES

11 LIDAR MARKET, BY END-USE APPLICATION

- 11.1 INTRODUCTION

- 11.2 CORRIDOR MAPPING

- 11.2.1 ROADWAYS

- 11.2.1.1 Reliance on LiDAR technology to determine length of roads and terrain structure to foster segmental growth

- 11.2.2 RAILWAYS

- 11.2.2.1 Use of LiDAR systems as cost-effective solution to map complete railway networks to propel market

- 11.2.3 OTHER CORRIDOR MAPPING TYPES

- 11.2.1 ROADWAYS

- 11.3 ENGINEERING

- 11.3.1 RELIANCE ON LIDAR-BASED SURVEY TO EXTRACT DATA RELATED TO GROUND ELEVATION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.4 ENVIRONMENT

- 11.4.1 FOREST MANAGEMENT

- 11.4.1.1 Adoption of LiDAR technology to detect deforestation and forest loss to fuel segmental growth

- 11.4.2 COASTLINE MANAGEMENT

- 11.4.2.1 Utilization of LiDAR systems to create accurate topographic maps of coastal areas to accelerate segmental growth

- 11.4.3 POLLUTION MODELING

- 11.4.3.1 Implementation of LiDAR systems to determine carbon absorption in forests to drive market

- 11.4.4 AGRICULTURE MAPPING

- 11.4.4.1 Use of LiDAR systems to increase crop viability and mapping to fuel segmental growth

- 11.4.5 WIND FARM

- 11.4.5.1 Deployment of LiDAR technology to detect wind direction to accelerate segmental growth

- 11.4.6 PRECISION FORESTRY

- 11.4.6.1 Utilization of LiDAR systems to make data-driven decisions related to forest dynamics to boost segmental growth

- 11.4.1 FOREST MANAGEMENT

- 11.5 ADAS & DRIVERLESS CARS

- 11.5.1 RELIANCE ON LIDAR TO ENSURE ACCURATE OBJECT DETECTION AND RECOGNITION BY ADAS & DRIVERLESS CARS TO PROPEL MARKET

- 11.6 EXPLORATION

- 11.6.1 OIL & GAS

- 11.6.1.1 Adoption of LiDAR photography solutions to identify threats along oil & gas pipelines to augment segmental growth

- 11.6.2 MINING

- 11.6.2.1 Utilization of LiDAR solutions to provide exact mining location to drive market

- 11.6.1 OIL & GAS

- 11.7 URBAN PLANNING

- 11.7.1 ADOPTION OF LIDAR TO OBTAIN DIGITAL MODELS OF CITIES AND DIGITAL SURFACE TO FUEL SEGMENTAL GROWTH

- 11.8 CARTOGRAPHY

- 11.8.1 UTILIZATION OF LIDAR COMPONENTS TO PRODUCE HIGH-RESOLUTION CONTOUR MAPS TO FOSTER SEGMENTAL GROWTH

- 11.9 METEOROLOGY

- 11.9.1 IMPLEMENTATION OF LIDAR TECHNOLOGY TO GAIN ACCURATE DATA ON ATMOSPHERIC GASES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 11.10 OTHER END-USE APPLICATIONS

12 LIDAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Surging demand for drones for corridor mapping applications to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rising development of spatial data infrastructure to contribute to market growth

- 12.2.4 MEXICO

- 12.2.4.1 Increasing emphasis on examining ancient archeological sites to foster market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK IN EUROPE

- 12.3.2 UK

- 12.3.2.1 Rising production of cost-effective terrain maps to assess flood risks to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Increasing R&D of advanced automotive technologies to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Rising demand for innovative technologies for corridor mapping to boost market growth

- 12.3.5 ITALY

- 12.3.5.1 Growing need for infrastructure monitoring and coastline protection to augment demand for LiDAR components

- 12.3.6 SPAIN

- 12.3.6.1 Regulatory backing and cross-industry adoption to propel LiDAR market growth in Spain

- 12.3.7 POLAND

- 12.3.7.1 Government modernization initiatives and industrial automation to boost LiDAR market in Poland

- 12.3.8 NORDICS

- 12.3.8.1 Sustainability goals and advanced mobility projects fuel LiDAR growth in Nordic region

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK IN ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Increasing development of advanced drone technologies to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Growing demand for autonomous vehicles to fuel market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Rising emphasis on optimizing factory to accelerate market growth

- 12.4.5 INDIA

- 12.4.5.1 Increasing formulation of mandates on LiDAR adoption during highway construction to contribute to market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Government-backed mapping and climate efforts to advance LiDAR adoption in Australia

- 12.4.7 INDONESIA

- 12.4.7.1 Infrastructure growth and urban planning to spur LiDAR demand in Indonesia

- 12.4.8 MALAYSIA

- 12.4.8.1 Smart nation ambitions and environmental policies to drive LiDAR growth in Malaysia

- 12.4.9 THAILAND

- 12.4.9.1 Tourism and urban expansion initiatives to encourage LiDAR usage in Thailand

- 12.4.10 VIETNAM

- 12.4.10.1 Disaster management and coastal planning to propel LiDAR market in Vietnam

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK IN ROW

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Topographic mapping and environmental monitoring to accelerate LiDAR growth in South America

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Smart infrastructure and sustainability goals to drive LiDAR demand in Middle East

- 12.5.3.2 Bahrain

- 12.5.3.2.1 Urban digitization and land management to boost LiDAR market in Bahrain

- 12.5.3.3 Kuwait

- 12.5.3.3.1 Geospatial intelligence and environmental security to drive demand

- 12.5.3.4 Oman

- 12.5.3.4.1 LiDAR adoption in Oman driven by geological and coastal applications

- 12.5.3.5 Qatar

- 12.5.3.5.1 Infrastructure vision and smart city push to fuel LiDAR in Qatar

- 12.5.3.6 Saudi Arabia

- 12.5.3.6.1 Desert terrain mapping and autonomous mobility to expand LiDAR market in Saudi Arabia

- 12.5.3.7 United Arab Emirates (UAE)

- 12.5.3.7.1 LiDAR deployment in UAE accelerated by megaprojects and automation demand

- 12.5.3.8 Rest of Middle East

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 South Africa leads regional LiDAR market with advanced applications in mining and conservation

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.4.1 Company footprint

- 13.7.4.2 Company overall footprint

- 13.7.4.3 Company region footprint

- 13.7.4.4 Company end-use application footprint

- 13.7.4.5 Company installation footprint

- 13.8 START-UP/SME EVALUATION MATRIX, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ROBOSENSE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.4 Deals

- 14.1.1.5 MnM view

- 14.1.1.5.1 Key strengths

- 14.1.1.5.2 Strategic choices

- 14.1.1.5.3 Weaknesses and competitive threats

- 14.1.2 HESAI GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LUMINAR TECHNOLOGIES, INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 OUSTER, INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 SICK AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 LEICA GEOSYSTEMS AG

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.4 Recent developments

- 14.1.6.4.1 Deals

- 14.1.7 TRIMBLE INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 TELEDYNE OPTECH

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 FARO

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.10 RIEGL LASER MEASUREMENT SYSTEMS GMBH

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 NV5 GEOSPATIA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 SURESTAR

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.13 YELLOWSCAN

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.1 ROBOSENSE

- 14.2 OTHER PLAYERS

- 14.2.1 PREACT TECHNOLOGIES

- 14.2.2 OPSYS TECHNOLOGIES

- 14.2.3 GEOKNO

- 14.2.4 PHOENIX LIDAR SYSTEMS

- 14.2.5 QUANERGY SYSTEMS, INC.

- 14.2.6 INNOVIZ TECHNOLOGIES LTD

- 14.2.7 LEOSPHERE

- 14.2.8 WAYMO LLC

- 14.2.9 VALEO

- 14.2.10 NEPTEC TECHNOLOGIES CORP.

- 14.2.11 ZX LIDARS

- 14.2.12 LIVOX

- 14.2.13 ROUTESCENE

- 14.2.14 BLICKFELD GMBH

- 14.2.15 SABRE ADVANCED 3D SURVEYING SYSTEMS LTD

- 14.2.16 LEISHEN INTELLIGENT SYSTEM

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS