|

시장보고서

상품코드

1808083

연성 내시경 시장 : 유형별, 용도별, 최종 사용자별, 지역별 - 예측(-2030년)Flexible Endoscopes Market by Type, Application, End User, and Region - Global Forecast to 2030 |

||||||

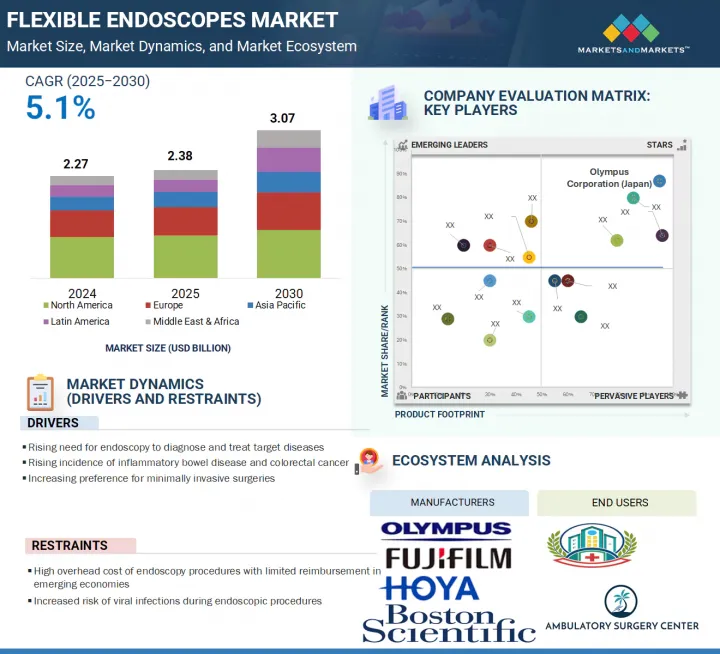

세계의 연성 내시경 시장 규모는 2025년 23억 8,000만 달러로 추정되고, 2030년까지 30억 7,000만 달러에 이를 것으로 예측되며, 예측 기간 CAGR 5.1%로 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 유형별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

연성 내시경 시장의 성장은 대장암 및 염증성 장 질환과 같은 대상 질환을 진단하고 관리하는 내시경 수술에 대한 수요가 증가하고 조기 저침습 개입에 대한 요구에 의해 견인되고 있습니다. 게다가 예방 의료에 대한 의식의 고조가 수술 건수를 밀어 올리고 있습니다.

감염 관리 우려에 대응하는 일회용 연성 내시경의 채용 증가 및 신흥 경제권 의료 인프라의 급속한 확대가 시장 기업에 대한 기회가 되고 있습니다. 이 지역은 투자 증가, 의료 접근성 향상 및 환자 관리 기준의 진화로 시장 기업에 미개발 가능성을 제공합니다.

대장 내시경 부문은 2024년 연성 내시경 시장에서 2위의 점유율을 차지했습니다.

세계적인 대장암 이환율의 상승과 조기 검진 및 진단에 대한 의식이 높아짐에 따라 대장 내시경이 2024년 2위 시장 점유율을 차지했습니다. 대장 내시경 검사는 결장이나 직장 내 전암 폴립, 궤양, 염증 조직 등의 이상을 발견하는데 매우 중요하며 의사들 사이에서 선호되는 진단 도구가 되고 있습니다. CDC에 의하면, 미국에서는 연간 약 1억 4,200만 건의 대장 내시경 검사가 실시되고 있어, 그 보급이 부각되고 있습니다. 또한, 2023년에 15만 3,000명이 넘는 새로운 대장암 환자와 5만 2,550명을 넘는 관련 사망이 발생해, 젊은층에서 이 질환 증가가 우려된다고 American Cancer Society는 보고하고 있습니다. 이러한 우려적인 통계는 검진 가이드라인의 확대 및 검사 건수 증가로 이어지고 있습니다. 대장 내시경은 조직 샘플을 채취하고 실시간 시각적으로 평가할 수 있으므로 진단 정확도를 향상시킵니다. 따라서 수요는 더욱 높아지고 있습니다. 고해상도 영상 및 환자의 편안함에 대한 지속적인 기술 진보와 의료 제공업체 및 정부의 강력한 지원이 이 부문의 성장을 더욱 촉진하고 있습니다.

기관지경 부문은 2024년 연성 내시경 시장에서 2위 점유율을 차지했습니다.

이것은 호흡기 질환, 특히 폐암의 세계적인 부담 증가로 인한 것입니다. American Cancer Society에 따르면 미국에서는 2025년에 약 22만 6,650명의 폐암 환자가 새롭게 발생할 것으로 예측되고 있으며 조기 및 정확한 진단 도구의 긴급성이 강조되고 있습니다. 연성 기관지경은 기도의 직접 시각화, 조직 생검, 치료 개입을 가능하게 하며 폐 치료에 필수적입니다. 저 침습성, 우수한 이미징 능력, 입원 환경과 외래 환경에서의 사용이 광범위한 임상 채용에 기여하고 있습니다. 또한, 인지도 향상, 조기 검진 프로그램 및 호흡기 진단에 대한 투자 증가가 이 부문의 성장을 더욱 향상시킵니다.

아시아태평양이 예측 기간에 연성 내시경 시장에서 가장 높은 CAGR을 나타낼 전망입니다.

이는 주로 의료 인프라 개발, 의료비 증가, 중국과 인도와 같은 인구 강대국에서 질병의 조기 발견에 대한 사람들의 의식 증가로 인한 것입니다. 이들 국가는 특히 암이나 심혈관 장애와 같은 만성 질환 환자 증가를 다루기 위해 진단 능력과 수술 능력 강화에 많은 투자를 하고 있습니다. 일본은 국민 모두 보험의 의료 제도가 확립되어 있기 때문에 선진의 내시경 수술에의 폭넓은 액세스가 확보되고 있습니다. 메디컬 투어리즘 증가, 유리한 정부의 대처, 저침습 기술의 채용 증가가 이 지역에서 시장 침투를 가속화하고 있어, 세계의 연성 내시경 시장에서의 고성장 지역이 되고 있습니다.

이 보고서는 세계의 연성 내시경 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 연성 내시경 시장 개요

- 북미의 연성 내시경 시장 : 최종 사용자별

- 연성 내시경 시장의 지리적 스냅샷(2024년)

- 지역의 구성 : 연성 내시경 시장(2025-2030년)

- 연성 내시경 시장 : 신흥 경제권 및 선진국 시장(2025년, 2030년)

제5장 시장 개요

- 서문

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 산업 동향

- 첨단 가치 기반 기술로의 전환 증가

- 내시경의 기술적 진보

- 밸류체인 분석

- 생태계 분석

- 공급망 분석

- 무역 분석

- HS코드 9018의 수입 데이터

- HS코드 9018의 수출 데이터

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 규제 상황

- 규제기관, 정부기관 및 기타 조직

- 규제 분석

- 특허 분석

- 가격 설정 분석

- 연성 내시경의 평균 가격 동향 : 주요 제조업체별

- 연성 내시경의 평균 가격 동향 : 지역별

- 주된 회의 및 이벤트(2024-2025년)

- 인접 시장 분석

- 언멧 니즈 및 최종 사용자의 기대

- 고객 사업에 영향을 주는 동향 및 혼란

- 투자 및 자금조달 시나리오

- 연성 내시경 시장에서의 AI의 영향

- 미국 관세의 영향-연성 내시경 시장(2025년)

- 서문

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 연성 내시경 시장 : 유형별

- 서문

- 상부 소화관 내시경

- 비디오 상부 소화관 내시경

- 섬유 상부 소화관 내시경

- 대장 내시경

- 비디오 대장 내시경

- 섬유 대장 내시경

- 기관지경

- 비디오 기관지경

- 섬유 기관지경

- S형 결장경

- 비디오 S형 결장경

- 섬유 S형 결장경

- 후두경

- 비디오 후두경

- 섬유 후두경

- 인두경

- 비디오 인두경

- 섬유 인두경

- 십이지장경

- 비디오 십이지장경

- 섬유 십이지장경

- 비인두경

- 비디오 비인두경

- 섬유 비인두경

- 비경

- 비디오 코경

- 섬유 비경

- 기타 연성 내시경

- 기타 비디오 내시경

- 기타 섬유 내시경

제7장 연성 내시경 시장 : 용도별

- 서문

- 위장 내시경 검사

- 기관지경 검사

- 이비인후과 내시경 검사

- 비뇨기과 내시경 검사

- 산부인과 내시경 검사

- 기타 용도

제8장 연성 내시경 시장 : 최종 사용자별

- 서문

- 병원

- 외래수술센터(ASC)

- 진료소

- 기타 최종 사용자

제9장 연성 내시경 시장 : 지역별

- 서문

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제10장 경쟁 구도

- 서문

- 주요 진입 기업의 전략 및 강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드 및 제품 비교

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- OLYMPUS CORPORATION

- KARL STORZ SE & CO. KG

- BOSTON SCIENTIFIC CORPORATION

- FUJIFILM CORPORATION

- HOYA CORPORATION

- NIPRO

- STERIS

- ENDOMED SYSTEMS GMBH

- RICHARD WOLF GMBH

- AMBU A/S

- 기타 기업

- HUGER MEDICAL INSTRUMENT CO., LTD

- SONOSCAPE MEDICAL CORP.

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

- LABORIE

- HUNAN VATHIN MEDICAL INSTRUMENT CO., LTD.

- OTU MEDICAL

- ZHUHAI PUSEN MEDICAL TECHNOLOGY CO., LTD.

- UROVIU CORPORATION

- VERATHON INC.

- GI-VIEW

- OTTOMED(MITRA INDUSTRIES PRIVATE LIMITED)

- GUANGZHOU REDPINE MEDICAL EQUIPMENT CO., LTD

- TSC LIFE

- OUJIAHUA GROUP

- FOSHAN JIALIANDA MEDICAL APPARATUS CO., LTD

제12장 부록

AJY 25.09.16The global flexible endoscopes market is projected to reach USD 3.07 billion by 2030, growing from USD 2.38 billion in 2025, at a CAGR of 5.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Application, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa, and GCC Countries |

The growth of the flexible endoscopes market is driven by the rising demand for endoscopic procedures to diagnose and manage target conditions, such as colorectal cancer and inflammatory bowel diseases, and the need for early, minimally invasive interventions. Additionally, growing awareness regarding preventive healthcare is boosting procedural volumes.

Opportunities for players in the market emerge from the rising adoption of single-use flexible endoscopes, which address infection control concerns, and the rapidly expanding healthcare infrastructure in emerging economies. These areas offer untapped potential to market players due to increasing investments, better access to healthcare, and evolving patient care standards.

The colonoscopes segment accounted for the second-largest share of the flexible endoscopes market in 2024.

By type, the flexible endoscopes market is segmented into upper gastrointestinal endoscopes, colonoscopes, broncoscopes, sigmoidoscopes, laryngoscopes, pharyngoscopes, duodenoscopes, nasopharyngoscopes, rhinoscopes, and other types. Among these, the colonoscopes segment accounted for the second-largest market share in 2024, owing to the rising global incidence of colorectal cancer and increased awareness around early screening and diagnosis. Colonoscopies are critical in detecting precancerous polyps, ulcers, inflamed tissues, and other abnormalities within the colon and rectum, which makes them a preferred diagnostic tool among physicians. According to the CDC, approximately 142 million colonoscopies are performed annually in the US, highlighting their widespread adoption. Furthermore, in 2023, the American Cancer Society reported over 153,000 new colorectal cancer cases and 52,550 related deaths, as well as a concerning rise of this disease in younger populations. These alarming statistics have led to expanded screening guidelines and increased procedural volumes. The ability of colonoscopes to obtain tissue samples and provide real-time visual assessment enhances diagnostic precision, further supporting their demand. Ongoing technological advancements in high-definition imaging and patient comfort, along with strong support from healthcare providers and governments, further drive growth in this segment.

The bronchoscopy segment accounted for the second-largest share of the flexible endoscopes market in 2024.

By application, the flexible endoscopes market has been divided into gastrointestinal endoscopy, bronchoscopy, ENT endoscopy, urology endoscopy (cystoscopy), laparoscopy, obstetrics/gynecology endoscopy, arthroscopy, mediastinoscopy, and other applications. Among these, the bronchoscopy segment accounted for the second-largest share of the market in 2024. This is due to the rising global burden of respiratory disorders, particularly lung cancer. As per the American Cancer Society, approximately 226,650 new cases of lung cancer are projected in the US in 2025, underscoring the urgent need for early and accurate diagnostic tools. Flexible bronchoscopes enable direct visualization of the airways, tissue biopsy, and therapeutic interventions, which makes them indispensable in pulmonary care. Their minimally invasive nature, improved imaging capabilities, and use in inpatient and outpatient settings contribute to widespread clinical adoption. Moreover, increased awareness, early screening programs, and rising investments in respiratory diagnostics further drive segment growth.

Asia Pacific is projected to grow at the highest CAGR in the flexible endoscopes market during the forecast period.

The global flexible endoscopes market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these, the Asia Pacific region is projected to grow at the highest rate during the forecast period. This is primarily due to the development of healthcare infrastructure, increasing healthcare expenditure, and rising awareness of people regarding early disease detection across populous nations, such as China and India. These countries are investing heavily in enhancing diagnostic and surgical capabilities, particularly in managing the rising cases of chronic diseases, such as cancer and cardiovascular disorders. Japan's well-established healthcare system with universal insurance coverage ensures wide accessibility to advanced endoscopic procedures. The increasing medical tourism, favorable government initiatives, and the rising adoption of minimally invasive technologies are accelerating market penetration in the region, making it a high-growth region in the global flexible endoscopes market.

A breakdown of the primary participants referred to in this report is provided below:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 50%, Director-level - 30%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 20%, Latin America - 15%, and Middle East & Africa - 10%

Notes:

Companies are classified into tiers based on their total revenue. The tiers are as follows:

Tier 1 = > USD 10.0 billion, tier 2 = USD 1.0 billion to USD 10.0 billion, and tier 3 = < USD 1.0 billion

- C-level Primaries include CEOs, CFOs, COOs, and VPs.

- Others include Sales Managers, Marketing Managers, Business Development Managers, Product Managers, Distributors, and Suppliers.

Key players operating in the flexible endoscopes market include Olympus Corporation (Japan), Karl STORZ SE & Co. KG (Germany), Boston Scientific Corporation (US), FUJIFILM Corporation (Japan), HOYA Corporation (Japan), Nipro (Japan), EndoMed Systems GmbH (Germany), Richard Wolf GmbH. (Germany), Ambu A/S (Denmark), Huger Medical Instrument Co., Ltd. (China), SonoScape Medical Corp (China), ATMOS MedizinTechnik GmbH & Co. KG (Germany), Stryker (US), Laborie (US), Endoscan Ltd. (UK), MGB BERLIN (Germany), Hunan Vathin Medical Instrument Co., Ltd. (China), OTU Medical (US), Zhuhai Pusen Medical Technology Co., Ltd. (China), Uroviu Corporation (US), ROPER TECHNOLOGIES, INC. (US), Optim LLC. (US), Clarus Medical LLC. (US), GI-View (Israel), Mitra Industries Private Limited (Ottomed), and Myelotec Co., Ltd (South Korea).

Research Coverage

This report studies the flexible endoscopes market based on type, application, end user, and region. The report also studies factors (drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and their respective countries).

Reasons to Buy the Report

The report will enable established and entrants/smaller firms to gauge the market's pulse, which, in turn, would help them gain a larger market share.

This report provides insights on the following pointers:

- Analysis of key drivers (Increasing requirement for endoscopy to diagnose and treat target diseases, rising incidence of inflammatory bowel diseases and colorectal cancer), restraints (High overhead cost of endoscopy procedures with limited reimbursement in emerging economies, increasing risk of infections during endoscopic procedures), opportunities (Rapidly developing healthcare sector in emerging economies, increasing adoption of single-use flexible endoscopes), challenges (Increasing number of product recalls, lack of proper sterilization and reprocessing, shortage of trained physicians and endoscopists)

- Market Penetration: Complete knowledge of the spectrum of products offered by major companies in the flexible endoscopes market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the flexible endoscopes market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the flexible endoscope industry

- Competitive Assessment: In-depth assessment of market share; growth strategies and product offerings of leading players like Olympus Corporation (Japan), Karl Storz SE & CO. Kg (Germany), Boston (US), FUJIFILM Corporation (Japan), HOYA Corporation (Japan), Stryker (US), Nipro (Japan), EndoMed Systems GmbH (Germany), Richard Wolf GmbH. (Germany), and Ambu A/S (Denmark).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 FLEXIBLE ENDOSCOPES MARKET OVERVIEW

- 4.2 NORTH AMERICA: FLEXIBLE ENDOSCOPES MARKET, BY END USER

- 4.3 GEOGRAPHIC SNAPSHOT OF FLEXIBLE ENDOSCOPES MARKET (2024)

- 4.4 GEOGRAPHIC MIX: FLEXIBLE ENDOSCOPES MARKET, 2025-2030 (USD MILLION)

- 4.5 FLEXIBLE ENDOSCOPES MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS, 2025 VS. 2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising requirement for endoscopy to diagnose and treat target diseases

- 5.2.1.2 Increasing preference for minimally invasive surgeries

- 5.2.1.3 Rising incidence of inflammatory bowel disease and colorectal cancer

- 5.2.2 RESTRAINTS

- 5.2.2.1 High overhead costs of endoscopy procedures with limited reimbursement in emerging economies

- 5.2.2.2 Increased risk of getting viral infections during endoscopic procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapidly developing healthcare sector in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing number of product recalls

- 5.2.4.2 Lack of proper sterilization and reprocessing

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Imaging systems

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Artificial Intelligence (AI) and Image Processing

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Robotic-assisted Endoscopy

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 INCREASING SHIFT TOWARD ADVANCED, VALUE-BASED TECHNOLOGIES

- 5.4.2 TECHNOLOGICAL ADVANCEMENTS IN ENDOSCOPES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9018

- 5.8.2 EXPORT DATA FOR HS CODE 9018

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY ANALYSIS

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 Japan

- 5.11.2.3.2 China

- 5.11.2.3.3 India

- 5.11.2.4 Latin America

- 5.11.2.5 Middle East & Africa and GCC Countries

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE PRICING TREND OF FLEXIBLE ENDOSCOPES BY KEY PLAYER

- 5.13.2 AVERAGE PRICING TREND OF FLEXIBLE ENDOSCOPES, BY REGION

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 ENDOSCOPY EQUIPMENT MARKET

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF AI ON FLEXIBLE ENDOSCOPES MARKET

- 5.20 IMPACT OF 2025 US TARIFFS-FLEXIBLE ENDOSCOPES MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRIES/REGIONS

- 5.20.4.1 North America

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 FLEXIBLE ENDOSCOPES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 UPPER GI ENDOSCOPES

- 6.2.1 UPPER GI VIDEOCOPES

- 6.2.1.1 Easy biopsy of tissues in upper GI tract to support segment growth

- 6.2.2 UPPER GI FIBERSCOPES

- 6.2.2.1 Effective treatment of bleeding ulcers and removal of objects stuck in intestine to propel segment growth

- 6.2.1 UPPER GI VIDEOCOPES

- 6.3 COLONOSCOPES

- 6.3.1 VIDEO COLONOSCOPES

- 6.3.1.1 Effective determination of gastrointestinal abnormalities to drive segment

- 6.3.2 FIBER COLONOSCOPES

- 6.3.2.1 Easy visual examination of large intestine and rectum to support segment growth

- 6.3.1 VIDEO COLONOSCOPES

- 6.4 BRONCHOSCOPES

- 6.4.1 VIDEO BRONCHOSCOPES

- 6.4.1.1 Effective examination of abnormalities in airways to propel segment growth

- 6.4.2 FIBER BRONCHOSCOPES

- 6.4.2.1 Effective examination of bronchi for diagnostic and therapeutic purposes to aid market growth

- 6.4.1 VIDEO BRONCHOSCOPES

- 6.5 SIGMOIDOSCOPES

- 6.5.1 VIDEO SIGMOIDOSCOPES

- 6.5.1.1 Easy viewing of internal organ images on monitor to drive segment growth

- 6.5.2 FIBER SIGMOIDOSCOPES

- 6.5.2.1 Increasing focus on medical examination of the large intestine to boost segment growth

- 6.5.1 VIDEO SIGMOIDOSCOPES

- 6.6 LARYNGOSCOPES

- 6.6.1 VIDEO LARYNGOSCOPES

- 6.6.1.1 Effectiveness of endotracheal intubation with general anesthesia to aid segment growth

- 6.6.2 FIBER LARYNGOSCOPES

- 6.6.2.1 Easy detection of voice problems and ear and throat infections to drive segment

- 6.6.1 VIDEO LARYNGOSCOPES

- 6.7 PHARYNGOSCOPES

- 6.7.1 VIDEO PHARYNGOSCOPES

- 6.7.1.1 Effective throat examination using five-inch hollow tube to drive segment

- 6.7.2 FIBER PHARYNGOSCOPES

- 6.7.2.1 Easy viewing of the esophagus and trachea through camera-mounted endoscopes to aid segment growth

- 6.7.1 VIDEO PHARYNGOSCOPES

- 6.8 DUODENOSCOPES

- 6.8.1 VIDEO DUODENOSCOPES

- 6.8.1.1 Better inspection of digestive tract anatomy to support market growth

- 6.8.2 FIBER DUODENOSCOPES

- 6.8.2.1 Increasing focus on better diagnosis and treatment of gastrointestinal disorders to drive segment

- 6.8.1 VIDEO DUODENOSCOPES

- 6.9 NASOPHARYNGOSCOPES

- 6.9.1 VIDEO NASOPHARYNGOSCOPES

- 6.9.1.1 Easy detection of blockages in upper airways to support segment growth

- 6.9.2 FIBER NASOPHARYNGOSCOPES

- 6.9.2.1 Better diagnosis of deviated septum and nasal polyps to propel segment growth

- 6.9.1 VIDEO NASOPHARYNGOSCOPES

- 6.10 RHINOSCOPES

- 6.10.1 VIDEO RHINOSCOPES

- 6.10.1.1 Easy viewing of nasal cavity through video and image transmission to augment segment growth

- 6.10.2 FIBER RHINOSCOPES

- 6.10.2.1 Rising focus on diagnosis of inflammation, foreign bodies, tumors, and fungal infections to drive segment

- 6.10.1 VIDEO RHINOSCOPES

- 6.11 OTHER FLEXIBLE ENDOSCOPES

- 6.11.1 OTHER VIDEO ENDOSCOPES

- 6.11.2 OTHER FIBER ENDOSCOPES

7 FLEXIBLE ENDOSCOPES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 GASTROINTESTINAL ENDOSCOPY

- 7.2.1 INCREASING INCIDENCE OF COLORECTAL CANCER IN YOUNGER ADULTS TO PROPEL MARKET GROWTH

- 7.3 BRONCHOSCOPY

- 7.3.1 RISING NUMBER OF LUNG CANCER CASES TO AID MARKET GROWTH

- 7.4 ENT ENDOSCOPY

- 7.4.1 INCREASING NUMBER OF PATIENTS WITH EAR AND THROAT INFECTIONS TO BOOST MARKET GROWTH

- 7.5 UROLOGY ENDOSCOPY

- 7.5.1 INCREASING RISK OF DEVELOPING BLADDER CANCER TO SUPPORT MARKET GROWTH

- 7.6 OBSTETRICS/GYNECOLOGICAL ENDOSCOPY

- 7.6.1 INCREASING PREVALENCE OF CERVICAL CANCER TO DRIVE SEGMENTAL GROWTH

- 7.7 OTHER APPLICATIONS

8 FLEXIBLE ENDOSCOPES MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 AVAILABILITY OF SKILLED PROFESSIONALS AND TECHNOLOGICALLY DEVELOPED SURGICAL FACILITIES TO DRIVE GROWTH

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 GROWING PATIENT PREFERENCE FOR QUICKER DISCHARGE AND LOWER COSTS BOOSTS DEMAND FOR AMBULATORY CARE

- 8.4 CLINICS

- 8.4.1 ACCESSIBLE, COST-EFFECTIVE, AND SPECIALIZED DIAGNOSTIC AND THERAPEUTIC PROCEDURES TO DRIVE GROWTH

- 8.5 OTHER END USERS

9 FLEXIBLE ENDOSCOPES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Growing cancer and IBD prevalence, advanced healthcare access, and supportive reimbursement policies to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Germany dominated European flexible endoscopes market in 2024

- 9.3.3 UK

- 9.3.3.1 Aging population, high cancer prevalence, and strong healthcare infrastructure stimulating market growth

- 9.3.4 FRANCE

- 9.3.4.1 Rising health expenditure and high prevalence of cancer to stimulate market growth

- 9.3.5 ITALY

- 9.3.5.1 Aging population and rising prevalence of chronic diseases are boosting adoption

- 9.3.6 SPAIN

- 9.3.6.1 Rising aging population to drive market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 China to account for largest market share in Asia Pacific

- 9.4.3 INDIA

- 9.4.3.1 India's large aging population to drive market growth

- 9.4.4 JAPAN

- 9.4.4.1 Aging population and cancer prevalence to drive demand for endoscopy procedures in Japan

- 9.4.5 SOUTH KOREA

- 9.4.5.1 High aging population, advanced healthcare infrastructure, and technological adoption to drive market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 High cancer incidence, advanced healthcare infrastructure, and widespread adoption of screening programs fuel market expansion

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Brazil accounted for largest share of LATAM market in 2024

- 9.5.3 MEXICO

- 9.5.3.1 Expanding healthcare infrastructure and increasing adoption of screening programs to drive Mexico's market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Increasing healthcare investments, hospital expansions, and adoption of advanced medical technologies to drive market growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN FLEXIBLE ENDOSCOPES MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 OLYMPUS CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 KARL STORZ SE & CO. KG

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 BOSTON SCIENTIFIC CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 FUJIFILM CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses & competitive threats

- 11.1.5 HOYA CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 NIPRO

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 STERIS

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 ENDOMED SYSTEMS GMBH

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 RICHARD WOLF GMBH

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 AMBU A/S

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.10.3.2 Expansions

- 11.1.1 OLYMPUS CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 HUGER MEDICAL INSTRUMENT CO., LTD

- 11.2.2 SONOSCAPE MEDICAL CORP.

- 11.2.3 ATMOS MEDIZINTECHNIK GMBH & CO. KG

- 11.2.4 LABORIE

- 11.2.5 HUNAN VATHIN MEDICAL INSTRUMENT CO., LTD.

- 11.2.6 OTU MEDICAL

- 11.2.7 ZHUHAI PUSEN MEDICAL TECHNOLOGY CO., LTD.

- 11.2.8 UROVIU CORPORATION

- 11.2.9 VERATHON INC.

- 11.2.10 GI-VIEW

- 11.2.11 OTTOMED (MITRA INDUSTRIES PRIVATE LIMITED)

- 11.2.12 GUANGZHOU REDPINE MEDICAL EQUIPMENT CO., LTD

- 11.2.13 TSC LIFE

- 11.2.14 OUJIAHUA GROUP

- 11.2.15 FOSHAN JIALIANDA MEDICAL APPARATUS CO., LTD

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS