|

시장보고서

상품코드

1808089

네트워크 API 시장 : API 유형별, 용도별, 업계별 - 예측(-2030년)Network API Market by API Type (Device Status, Identity, Location, Network Performance), Application (IoT, Priority Communication, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Autonomous Vehicles), Vertical - Global Forecast to 2030 |

||||||

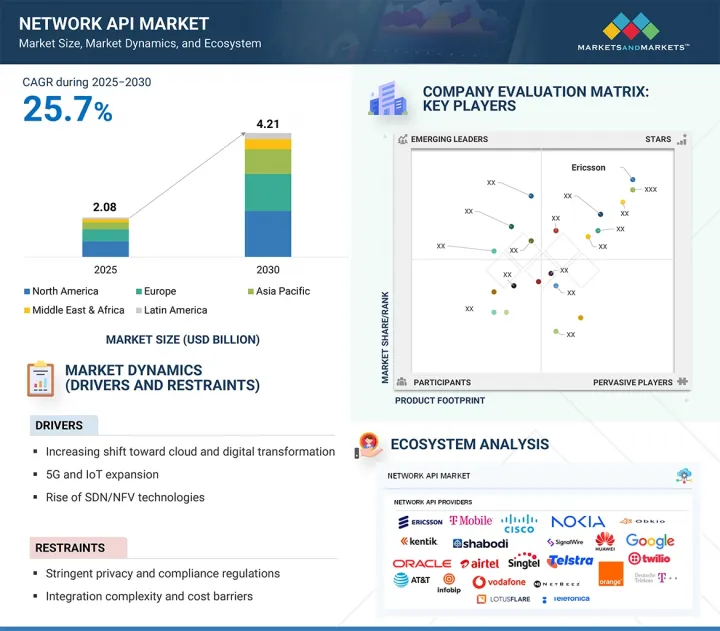

세계의 네트워크 API 시장 규모는 2025년에 19억 6,000만 달러로 추정되고, 2030년까지 61억 3,000만 달러에 이를 것으로 예측되며, 2025-2030년 CAGR 25.7%로 성장이 전망됩니다.

시장은 프로그래머블하고 온디맨드 연결성을 추진함으로써 빠르게 실험에서 상업화로 전환하고 있습니다. 기존의 통합 모델과는 달리, 네트워크 API는 디바이스 상태, 위치 정보, 엣지 컴퓨팅, 정책 제어 등의 실시간 기능을 표준화된 개발자를 위한 형식으로 게시합니다. 이러한 변화로 인해 기업은 클라우드 인프라와 같이 네트워크 서비스를 쉽게 이용할 수 있어 IoT, 자율적 이동성, XR, 보안 디지털 트랜잭션 등의 새로운 용도를 확보하면서 복잡성을 줄일 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2025-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만/10억 달러 |

| 부문 | API 유형별, 용도별, 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

CAMARA와 Open Gateway와 같은 이니셔티브의 대두는 사업자 간의 상호 운용성을 보장하며, 기업은 사일로화된 전개가 아니라 세계적인 프로그래머빌리티를 실현하고 있습니다. 네트워크의 소프트웨어 정의화가 진행됨에 따라 API는 선택 사양의 애드온에서 비즈니스를 실현하는 필수 요소로 진화하고 있습니다. 향후 5년간은 민첩성을 요구하는 기업 수요, 사업자의 새로운 수익화 모델, AI에 의한 자동화 및 네트워크 프로그래머빌리티의 융합에 의해 성장이 촉진될 것으로 보입니다.

강력한 성장 가능성에도 불구하고 네트워크 API 시장은 통합 복잡성, 운영자 간의 제한된 표준화, 높은 구현 비용 등의 억제요인에 직면하고 있습니다. 기업들은 API를 쉽게 이용할 수 없는 레거시 시스템을 고민하는 경우가 많으며, API의 보안, 지연 보증, 수익화 모델에 대한 우려가 채용의 확대를 늦추고 있습니다.

용도별로 IoT 부문이 예측 기간에 가장 큰 시장 규모를 차지할 것으로 예측됩니다.

IoT는 네트워크 API 시장의 가장 큰 용도이며 기업은 수십억 개의 장치에 대한 확장 가능하고 안전한 실시간 연결성을 요구하고 있습니다. 디바이스 상태, 정책 제어 및 분석에 사용되는 API는 기업이 타의 추종을 불허하는 정확도로 IoT 에코시스템을 관리할 수 있도록 합니다. 2024년 11월 NTT Docomo가 CAMARA 호환 API를 일본의 5G IoT 플랫폼에 통합하여 기업이 장치 성능을 동적으로 모니터링하고 대규모 IoT 배포 전반에 걸쳐 네트워크 정책을 구현할 수 있게 되었다는 획기적인 변화가 발생했습니다. 이는 지연과 신뢰성이 업무에 직접 영향을 미치는 스마트 매뉴팩처링, 물류, 유틸리티 등의 산업에 매우 중요합니다. API를 IoT 솔루션에 통합함으로써 사업자는 새로운 수익화의 길을 열어 기업이 규모에 맞는 제어와 가시성을 확보하고 있습니다.

API 유형별로는 엣지 부문이 예측 기간에 가장 빠른 성장률을 나타낼 것으로 예측됩니다.

Edge API는 네트워크 API 시장의 중요한 전장으로 부상하며 기업이 초저지연의 로컬 연산 능력을 필요로 하는 경험을 제공할 수 있도록 합니다. Edge API를 통해 개발자는 통신에 대한 깊은 전문 지식 없이 분산 인프라를 원활하게 활용하고 워크로드를 오케스트레이션하며 성능을 최적화할 수 있습니다. 2024년 10월, Singtel과 Bridge Alliance는 제휴하여 API Exchange를 아시아태평양 전역으로 확장하여 표준화된 엣지 API를 기업 및 개발자에게 제공했습니다. 이러한 확장으로 스마트 시티 및 물류 애플리케이션 제공업체는 자율적인 무인 항공기 및 교통 관리와 같은 지연에 민감한 이용 사례를 위해 엣지 인프라에 직접 액세스할 수 있습니다. 네트워크 리소스의 복잡성을 추상화함으로써 이 배포는 엣지 기능을 프로그래밍 가능하고 확장 가능하게 사용할 수 있도록 합니다. 기업이 워크로드를 가장자리로 밀어 가면서 API는 교통에서 엔터테인먼트에 이르기까지 모든 부서에서 수익화, 효율화 및 혁신을 실현하는 핵심이 될 것입니다.

이 보고서는 세계의 네트워크 API 시장에 대한 조사 분석을 통해 주요 추진 요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 네트워크 API 시장의 기업에게 매력적인 기회

- 북미의 네트워크 API 시장 : API 유형별, 국가별

- 네트워크 API 시장 : API 유형별

- 네트워크 API 시장 : 업계별

- 네트워크 API 시장 : 용도별

제5장 시장 개요 및 산업 동향(정량적인 의미를 가지는 전략적 촉진요인)

- 서문

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 밸류체인 분석

- 생태계 분석

- 사례 연구

- NOKIA와 DEUTSCHE TELEKOM(DT), NETWORK AS CODE의 5G 기능을 활용하여 드론 운용의 한계 확장

- CHINA TELECOM, QOD API와 CNOS 아키텍처로 기업 지원

- ORANGE, DIDIT의 OTP 의존성을 제거하고 CAMARA API를 통해 디지털 ID 보안 강화

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 특허 분석

- 고객 사업에 영향을 주는 동향 및 혼란

- 가격 설정 분석

- 주요 기업의 평균 판매 가격 : API 유형별(2024년)

- 주요 기업의 참고 가격 분석(2024년)

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 네트워크 API 시장의 기술 로드맵

- 단기 로드맵(2025-2026년)

- 중기 로드맵(2027-2028년)

- 장기 로드맵(2028-2030년)

- 네트워크 API 시장의 모범 사례

- 데이터 교환에 JSON 채용

- URL에 동사를 사용하지 않는

- API 버전 관리 구현

- 안전한 인증 및 승인 실시

- 모든 데이터 전송을 암호화

- 속도 제한 및 스로틀

- 로깅, 모니터링, 감사

- 정기적인 보안 테스트 실시

- GSMA 오픈 게이트웨이와 CAMARA의 노력

- 현재의 비즈니스 모델 및 신흥 비즈니스 모델

- 네트워크 API 시장에서 사용되는 툴, 프레임워크, 테크닉

- 투자 및 자금조달 시나리오

- 네트워크 API 시장에 대한 AI 및 생성형 AI의 영향

- 미국 관세의 영향-네트워크 API 시장(2025년)

- 서문

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 네트워크 API 시장 : API 유형별-시장 규모 및 예측(-2030년)

- 서문

- 디바이스 상태

- 엣지

- 식별

- 위치

- 네트워크 성능

- 기타 API 유형

제7장 네트워크 API 시장 : 용도별-시장 규모 및 예측(-2030년)

- 서문

- IoT

- 우선 통신

- 자율주행차

- 부정 행위 방지

- 엔터테인먼트 및 컨텐츠 전달

- 엔터프라이즈 IT

- 기타 용도

제8장 네트워크 API 시장 : 업계별-시장 규모 및 예측(-2030년)

- 서문

- BFSI

- IT 및 ITeS

- 통신

- 정부 및 공공 부문

- 제조

- 의료 및 생명과학

- 소매 및 전자상거래

- 미디어 및 엔터테인먼트

- 기타 산업

제9장 네트워크 API 시장 : 지역별-시장 규모 및 예측(-2030년)

- 서문

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 스페인

- 러시아

- 이탈리아

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제10장 경쟁 구도

- 서문

- 주요 참가 기업의 전략 및 강점(2023-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2024년)

- 브랜드 및 제품 비교

- 기업 평가 및 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- ERICSSON

- CISCO

- NOKIA

- MICROSOFT

- T-MOBILE

- AT&T

- ORANGE

- DEUTSCHE TELEKOM

- VODAFONE

- TELEFONICA

- 기타 기업

- SINGTEL

- TELSTRA

- BHARTI AIRTEL

- HUAWEI

- ORACLE

- INFOBIP

- 스타트업 및 중소기업

- KENTIK

- OBKIO

- NETBEEZ

- GRAPHIANT

- ALKIRA

- SHABODI

- LOTUSFLARE

- PHOENIXNAP

제12장 인접 시장 및 관련 시장

- 서문

- API 관리 시장

- 시장의 정의

- 시장 개요

- API 관리 시장 : 제공별

- API 관리 시장 : 플랫폼별

- API 관리 시장 : 조직 규모별

- API 관리 시장 : 개발 유형별

- API 관리 시장 : 업계별

- API 관리 시장 : 지역별

- iPaaS(Integration Platform as a Service) 시장

- 시장의 정의

- 시장 개요

- iPaaS(Integration Platform as a Service) 시장 : 서비스 유형별

- iPaaS(Integration Platform as a Service) 시장 : 전개 모델별

- iPaaS(Integration Platform as a Service) 시장 : 조직 규모별

- iPaaS(Integration Platform as a Service) 시장 : 업계별

- iPaaS(Integration Platform as a Service) 시장 : 지역별

제13장 부록

AJY 25.09.16The network API market is estimated to be USD 1.96 billion in 2025 and is projected to reach USD 6.13 billion by 2030, at a CAGR of 25.7% from 2025 to 2030. The market is rapidly moving from experimentation to commercialization, driven by the push for programmable, on-demand connectivity across industries. Unlike traditional integration models, network APIs expose real-time capabilities such as device status, location, edge computing, and policy control in a standardized, developer-friendly format. This shift is enabling enterprises to consume network services as easily as cloud infrastructure, reducing complexity while unlocking new applications in IoT, autonomous mobility, extended reality, and secure digital transactions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | API type, application, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rise of initiatives like CAMARA and Open Gateway is ensuring interoperability across operators, giving enterprises global-scale programmability instead of siloed deployments. As networks become increasingly software-defined, APIs are evolving from optional add-ons to essential business enablers. Over the next five years, growth will be fueled by enterprise demand for agility, new monetization models for operators, and the convergence of AI-driven automation with network programmability.

Despite strong growth potential, the network API market faces constraints such as integration complexity, limited standardization across operators, and high implementation costs. Enterprises often struggle with legacy systems that cannot easily consume APIs, while concerns around API security, latency guarantees, and monetization models slow adoption at scale.

By application, the IoT segment is estimated to account for the largest market size during the forecast period

The Internet of Things (IoT) is the largest application of the network API market, as enterprises demand scalable, secure, and real-time connectivity for billions of devices. APIs for device status, policy control, and analytics are enabling enterprises to manage IoT ecosystems with unmatched precision. A breakthrough came in November 2024, when NTT Docomo integrated CAMARA-compliant APIs into its 5G IoT platform in Japan, allowing enterprises to dynamically monitor device performance and enforce network policies across massive IoT deployments. This is critical for industries like smart manufacturing, logistics, and utilities, where latency and reliability directly impact operations. By embedding APIs into IoT solutions, operators are unlocking new monetization pathways while enterprises gain control and visibility at scale.

By API type, the edge segment is expected to register the fastest growth rate during the forecast period

The edge API is emerging as a critical battleground in the network API market, enabling enterprises to deliver experiences that demand ultra-low latency and local compute power. Edge APIs allow developers to seamlessly tap into distributed infrastructure, orchestrate workloads, and optimize performance without needing deep telecom expertise. In October 2024, Singtel and Bridge Alliance partnered to expand their API Exchange across the Asia Pacific, providing standardized edge APIs to enterprises and developers. This expansion gave application providers in smart cities and logistics direct access to edge infrastructure for latency-sensitive use cases such as autonomous drones and traffic management. By abstracting the complexity of network resources, this rollout makes edge capabilities programmable and consumable at scale. As enterprises push workloads to the edge, APIs will be the key to unlocking monetization, efficiency, and innovation across sectors from transportation to entertainment.

North America leads in market share, while Asia Pacific is expected to be the fastest-growing regional market during the forecast period

The Network API market in North America and the Asia Pacific is dynamically shaping the global digital landscape through rapid adoption, innovation, and infrastructure advancements. North America, with its mature telecommunications ecosystem and extensive 5G rollout, spearheads enterprise adoption of programmable networks, enabling scalable IoT, edge computing, and secure API integration across industries such as healthcare, finance, and smart cities. At the same time, Asia Pacific stands out as the fastest-growing market, driven by aggressive government initiatives, massive 5G deployments, and expanding private network ecosystems. The Asia Pacific region leverages network APIs extensively across manufacturing, autonomous vehicles, and smart urban infrastructure, fueling digital transformation at an unprecedented pace. Together, these regions exemplify a complementary growth narrative: North America leads in technological maturity and use case diversity, while Asia Pacific delivers scale and acceleration through innovative, large-scale deployments. This synergistic growth positions both markets as critical pillars in the worldwide expansion of network API ecosystems, setting a robust foundation for next-generation connectivity and digital services.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 39%, Tier 2 - 26%, and Tier 3 - 35%

- By Designation: C-level - 27%, Directors - 39%, and Others - 34%

- By Region: North America - 39%, Europe - 25%, Asia Pacific - 19%, Rest of the World - 17%

The major players in the network API market are Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, product enhancements, and acquisitions, to expand their footprint in the network API market.

Research Coverage

The market study covers the network API market size and the growth potential across different segments, including API Type (Device Status, Edge, Identity, Location, Network Performance, Other API Types), Application (IoT, Priority Communication, Autonomous Vehicles, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Other Applications), Vertical (BFSI, IT & ITeS, Telecom, Government & Public Sector, Manufacturing, Healthcare & Life Sciences, Retail & E-commerce, Media & Entertainment, Other Verticals), and Region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global network API market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increasing shift toward cloud and digital transformation, 5G and IoT expansion, rise of SDN/NFV technologies), restraints (stringent privacy and compliance regulations, integration complexity and cost barriers), opportunities (growing demand for real-time data and services, monetization of network-as-a-service), challenges (scalability and SLA assurance, rising complexity of API security and cyber threats).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the network API market

- Market Development: Comprehensive information about lucrative markets - analyzing the network API market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the network API market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NETWORK API MARKET

- 4.2 NORTH AMERICA: NETWORK API MARKET, BY API TYPE AND COUNTRY

- 4.3 NETWORK API MARKET, BY API TYPE

- 4.4 NETWORK API MARKET, BY VERTICAL

- 4.5 NETWORK API MARKET, BY APPLICATION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping network API Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing shift toward cloud and digital transformation

- 5.2.1.2 5G and IoT expansion

- 5.2.1.3 Rise of SDN/NFV technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent privacy and compliance regulations

- 5.2.2.2 Integration complexity and cost barriers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for real-time data and services

- 5.2.3.2 Monetization of Network-as-a-Service

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalability & SLA assurance

- 5.2.4.2 Rising complexity of API security and cyber threats

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDIES

- 5.5.1 NOKIA AND DEUTSCHE TELEKOM (DT) PUSH BOUNDARIES OF DRONE OPERATIONS USING NETWORK AS CODE'S 5G CAPABILITIES

- 5.5.2 CHINA TELECOM EMPOWERS ENTERPRISES WITH QOD APIS AND CNOS ARCHITECTURE

- 5.5.3 ORANGE ENABLES DIDIT ELIMINATE OTP DEPENDENCY AND STRENGTHEN DIGITAL IDENTITY SECURITY VIA CAMARA APIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 BARGAINING POWER OF SUPPLIERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, 2024

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 OpenAPI/Swagger

- 5.11.1.2 gRPC with Protocol Buffers

- 5.11.1.3 NETCONF/RESTCONF

- 5.11.1.4 YANG data models

- 5.11.1.5 gNMI (gRPC network management interface)

- 5.11.1.6 API gateways (e.g., Kong, Apigee Edge)

- 5.11.1.7 OAuth 2.0/OpenID Connect

- 5.11.1.8 Event-driven Webhooks/Kafka Topics

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Service mesh (Istio, Linkerd)

- 5.11.2.2 API lifecycle management platforms

- 5.11.2.3 Network function virtualization (NFV) orchestration

- 5.11.2.4 SDN controllers (OpenDaylight, ONOS)

- 5.11.2.5 Telemetry analytics engines (Prometheus, InfluxDB)

- 5.11.2.6 Policy-control engines (PCRF/PCF)

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 OSS/BSS integration platforms

- 5.11.3.2 Edge orchestration frameworks (KubeEdge, OpenNESS)

- 5.11.3.3 IoT device management platforms

- 5.11.3.4 Zero-trust network access (ZTNA) gateways

- 5.11.3.5 Intent-based networking engines

- 5.11.3.6 Network assurance & digital twin tools

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 India

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 UAE

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazil

- 5.12.2.5.2 Mexico

- 5.12.2.1 North America

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TECHNOLOGY ROADMAP FOR NETWORK API MARKET

- 5.14.1 SHORT-TERM ROADMAP (2025-2026)

- 5.14.2 MID-TERM ROADMAP (2027-2028)

- 5.14.3 LONG-TERM ROADMAP (2028-2030)

- 5.15 BEST PRACTICES IN NETWORK API MARKET

- 5.15.1 ADOPT JSON FOR DATA EXCHANGE

- 5.15.2 AVOID VERBS IN URLS

- 5.15.3 IMPLEMENT API VERSIONING

- 5.15.4 ENFORCE SECURE AUTHENTICATION AND AUTHORIZATION

- 5.15.5 ENCRYPT ALL DATA TRANSMISSION

- 5.15.6 RATE LIMITING AND THROTTLING

- 5.15.7 LOGGING, MONITORING, AND AUDITING

- 5.15.8 CONDUCT REGULAR SECURITY TESTING

- 5.16 GSMA OPEN GATEWAY AND CAMARA INITIATIVES

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN NETWORK API MARKET

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF AI/GENERATIVE AI ON NETWORK API MARKET

- 5.20.1 IMPACT OF GENERATIVE AI IN NETWORK API

- 5.21 IMPACT OF 2025 US TARIFF - NETWORK API MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 NETWORK API MARKET, BY API TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API device status, edge, identity, location, network performance, other API types

- 6.1 INTRODUCTION

- 6.1.1 API TYPE: MARKET DRIVERS

- 6.2 DEVICE STATUS

- 6.2.1 NEED FOR REAL-TIME VISIBILITY AND MANAGEMENT CAPABILITIES TO DRIVE DEMAND

- 6.3 EDGE

- 6.3.1 ULTRA-LOW LATENCY WORKFLOWS TO SPUR EDGE API ADOPTION

- 6.4 IDENTITY

- 6.4.1 INTEGRATION OF REAL-TIME NUMBER VERIFICATION TO DRIVE DEMAND FOR IDENTITY APIS

- 6.5 LOCATION

- 6.5.1 NETWORK-BASED GEOFENCING TO DRIVE DEMAND

- 6.6 NETWORK PERFORMANCE

- 6.6.1 ON-DEMAND QUALITY OF SERVICE TO INCREASE ADOPTION

- 6.7 OTHER API TYPES

7 NETWORK API MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API applications

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: MARKET DRIVERS

- 7.2 IOT

- 7.2.1 AUTOMATING SIM ACTIVATION AND CONFIGURATION VIA SINGLE API ACCELERATES LARGE-SCALE IOT ROLLOUTS

- 7.3 PRIORITY COMMUNICATION

- 7.3.1 EMBEDDING AUTOMATED PRIORITY-CHANNEL RESERVATION TO DRIVE DEMAND FOR PRIORITY COMMUNICATION

- 7.4 AUTONOMOUS VEHICLES

- 7.4.1 ON-THE-FLY ALLOCATION OF DEDICATED NETWORK SLICES VIA API ENABLES RELIABLE TELEOPERATION AND REMOTE CONTROL

- 7.5 ANTI-FRAUD

- 7.5.1 INCORPORATING NETWORK-SIDE IDENTITY VALIDATION INTO TRANSACTION FLOWS VIA API DRAMATICALLY CUTS FRAUD RATES

- 7.6 ENTERTAINMENT & CONTENT DISTRIBUTION

- 7.6.1 EDGE-POWERED ADAPTIVE STREAMING TO DRIVE MARKET

- 7.7 ENTERPRISE IT

- 7.7.1 SINGLE API GATEWAY TO UNIFY MULTI-NETWORK CONNECTIVITY

- 7.8 OTHER APPLICATIONS

8 NETWORK API MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API vertical

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 MANDATORY API-DRIVEN TRANSACTION AUTHENTICATION TO DRIVE MARKET

- 8.3 IT & ITES

- 8.3.1 ACCELERATION OF APP-TO-NETWORK INTEGRATION TO DRIVE DEMAND

- 8.4 TELECOM

- 8.4.1 MONETIZED NETWORK SLICES THROUGH SELF-SERVICE APIS TO SPUR MARKET

- 8.5 GOVERNMENT & PUBLIC SECTOR

- 8.5.1 STANDARDIZATION OF APIS TO DRIVE MARKET

- 8.6 MANUFACTURING

- 8.6.1 INTEGRATION OF PRECISION INDOOR POSITIONING APIS TO DRIVE SEGMENT

- 8.7 HEALTHCARE & LIFESCIENCES

- 8.7.1 DEMAND FOR NETWORK PERFORMANCE APIS IN TELEHEALTH APPLICATIONS TO DRIVE MARKET

- 8.8 RETAIL & E-COMMERCE

- 8.8.1 DEMAND FOR REAL-TIME LOCATION-BASED PERSONALIZATION TO DRIVE MARKET

- 8.9 MEDIA & ENTERTAINMENT

- 8.9.1 NEED FOR SEAMLESS STREAMING EXPERIENCES TO INCREASE NETWORK API ADOPTION

- 8.10 OTHER VERTICALS

9 NETWORK API MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing focus on 5G-driven API innovation to drive market

- 9.2.3 CANADA

- 9.2.3.1 Accelerating IoT and digital transformation to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Focus on network API leadership with developer-centric innovation to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Open Gateway to fuel market with identity & QoS APIs

- 9.3.4 FRANCE

- 9.3.4.1 GSMA Open Gateway initiative and Aduna alliance to expand network API ecosystem

- 9.3.5 SPAIN

- 9.3.5.1 Focus on smart city innovations via API integration to drive market

- 9.3.6 RUSSIA

- 9.3.6.1 Emergence of network API landscape with gradual 5G expansion to drive market

- 9.3.7 ITALY

- 9.3.7.1 Advancements in 5G infrastructure and government-led digitization programs to drive market

- 9.3.8 NORDIC COUNTRIES

- 9.3.8.1 Maturing 5G infrastructure to enable API-driven smart applications

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Focus on OTP API commercialization for digital security to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Accelerating network API revolution with Aduna partnerships

- 9.4.4 INDIA

- 9.4.4.1 Widespread 4G/5G adoption and initiatives by Reliance Jio and Bharti Airtel to drive market

- 9.4.5 AUSTRALIA AND NEW ZEALAND

- 9.4.5.1 High smartphone penetration and thriving digital economy to fuel market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Proactive involvement in global collaborations for unified open API framework to drive market

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Advancements in digital infrastructure to accelerate network API integration

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 KSA

- 9.5.2.1.1 Vision 2030 to spur leadership in network API innovation

- 9.5.2.2 UAE

- 9.5.2.2.1 Global standards adoption to fuel API-driven innovation

- 9.5.2.3 KUWAIT

- 9.5.2.3.1 Expanding digital services to accelerate API adoption

- 9.5.2.4 BAHRAIN

- 9.5.2.4.1 Progressive digital agenda and rising demand for enterprise-grade connectivity to drive market

- 9.5.2.5 Rest of Middle East

- 9.5.2.1 KSA

- 9.5.3 AFRICA

- 9.5.3.1 Increasing focus on fintech and e-health to drive market

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Strong market momentum to drive network API innovations

- 9.6.3 MEXICO

- 9.6.3.1 Growing digital economy and global collaborations to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 API type footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 11.1 KEY PLAYERS

- 11.1.1 ERICSSON

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NOKIA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MICROSOFT

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 T-MOBILE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 AT&T

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.7 ORANGE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 DEUTSCHE TELEKOM

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 VODAFONE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 TELEFONICA

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 ERICSSON

- 11.2 OTHER PLAYERS

- 11.2.1 SINGTEL

- 11.2.2 TELSTRA

- 11.2.3 BHARTI AIRTEL

- 11.2.4 HUAWEI

- 11.2.5 ORACLE

- 11.2.6 INFOBIP

- 11.3 STARTUPS/SMES

- 11.3.1 KENTIK

- 11.3.2 OBKIO

- 11.3.3 NETBEEZ

- 11.3.4 GRAPHIANT

- 11.3.5 ALKIRA

- 11.3.6 SHABODI

- 11.3.7 LOTUSFLARE

- 11.3.8 PHOENIXNAP

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 API MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 API MANAGEMENT MARKET, BY OFFERING

- 12.2.4 API MANAGEMENT MARKET, BY PLATFORM

- 12.2.5 API MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.2.6 API MANAGEMENT MARKET, BY DEVELOPMENT TYPE

- 12.2.7 API MANAGEMENT MARKET, BY VERTICAL

- 12.2.8 API MANAGEMENT MARKET, BY REGION

- 12.3 INTEGRATION PLATFORM AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE

- 12.3.4 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL

- 12.3.5 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.6 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL

- 12.3.7 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS