|

시장보고서

상품코드

1858525

원료의약품(API) 시장 예측(-2030년) : 유형별, 역가별, 합성 유형별, 약제 유형별, 치료 용도별, 최종사용자별, 지역별Active Pharmaceutical Ingredients (API) Market by type (Innovative, Generic), Synthesis (synthetic, biotech), Potency (HPAPI), Product (mAbs, hormones), Drug (OTC, Rx), Application (Diabetes, Oncology), Competitive landscape - Global forecast to 2030 |

||||||

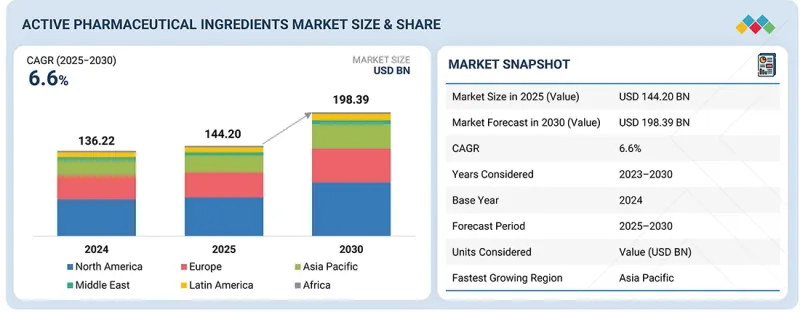

세계의 원료의약품(API) 시장 규모는 2025년 추정 1,442억 달러에서 2030년에는 1,983억 9,000만 달러에 달할 것으로 예측되며, 2025-2030년 CAGR은 6.6%입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 유형별, 역가별, 합성 유형별, 약제 유형별, 치료 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

원료의약품 시장 확대는 암-희귀질환 및 당뇨 제품 파이프라인의 확대가 주요 요인으로 작용하고 있습니다. 지난 수년간 2형 당뇨병과 비만 치료는 세마글루티드, 틸제파타이드, 리라글루티드, 둘라글루티드로 대표되는 펩티드 계열의 신약에 의해 재구성되었습니다. 이러한 치료법은 환자의 결과를 바꾸고 API 공급망 전체에 큰 기회를 가져다주고 있습니다.

최종사용자별로 시장은 제약 및 생명공학 산업, 위탁연구기관(CRO), 수탁제조기관(CMO), 기타 최종사용자로 분류됩니다. 제약 및 바이오 산업은 의약품 개발 및 제조에 필수적인 원료의약품(API)의 주요 최종사용자를 차지하고 있습니다. 지난 5년간 제약업계에서는 특히 고가의약품, ADC 등 의약품 및 생물제제의 개발 및 제조에 있으며, CMO에 대한 제조 아웃소싱이 증가하고 있습니다. 그러나 제약회사와 생명공학 기업은 여전히 고부가가치 블록버스터 의약품과 생물제제의 자체 제조를 유지함으로써 최종사용자 부문을 지배하고 있습니다. 또한 혁신적인 치료법에 대한 수요 증가로 연구개발에 대한 지속적인 투자가 이루어지고 있으며, 각 제약사들은 신약 및 첨단 제제 개발에 우선순위를 두고 있습니다. 이러한 추세는 제약 및 바이오테크놀러지 최종사용자 부문의 성장을 더욱 강화할 것으로 예측됩니다.

유형별로 살펴보면, 세계 원료의약품(API) 시장은 혁신형 API와 제네릭 API로 구분됩니다. 2024년에는 신약 및 첨단 의약품의 규제 승인 증가에 힘입어 혁신적인 API가 시장을 주도하고 있으며, 이는 예측 기간 중 성장을 지속할 것으로 예측됩니다. 예를 들어 미국 FDA는 2024년에 50개 이상의 신약(NME)을 승인했는데, 이는 신약 개발 속도가 빨라지고 있음을 반영합니다. 혁신신약은 특허로 보호되므로 일반적으로 제네릭 원료의약품보다 가격이 높아 시장 점유율 확대에 기여하고 있습니다. 이 부문의 성장은 암, 희귀질환, 생물제제 등 복잡하고 미충족 의료 수요가 높은 신약개발에 집중하는 제약 및 바이오테크 기업에 의해 더욱 강화되고 있습니다. 또한 R&D 투자, 첨단 제조 능력, 규제 우대조치로 인해 혁신적인 원료의약품의 도입이 지속적으로 촉진되고 있습니다. 이러한 요인으로 인해 혁신적인 API는 높은 가치와 강력한 수요를 반영하여 세계 API 시장의 주요 부문으로 자리매김하고 있습니다.

지역별로는 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카로 나뉩니다. 아시아태평양은 예측 기간 중 가장 높은 CAGR로 성장할 것으로 예측됩니다. 시장 성장에 기여하는 주요 요인으로는 고부가가치 치료제의 채택과 수요 증가, 세계 및 지역 기업의 제조 확장을 촉진하는 것을 들 수 있습니다. 또한 합성치료제와 생물학적 치료제에 집중하는 이 지역 CDMO의 확대도 원료의약품 수요 촉진에 기여하고 있습니다. 중국, 일본, 한국, 한국, 인도, 호주에서 혁신적인 제네릭 의약품의 채택이 증가하고 있으며, 아시아태평양의 제조 시설 확장이 이를 지원하고 있습니다. 또한 비용 효율적인 제조, 제네릭 의약품 및 바이오시밀러 생산 확대, 수입 의존도를 낮추기 위한 현지 원료의약품 생산에 대한 정부의 강력한 지원이 결합되어 있습니다. 인도와 중국은 대규모 생산 능력, 숙련된 노동력, 유리한 규제 구상로 인해 세계 허브로 부상하고 있으며, 이 지역의 원료의약품 시장의 성장을 지원하고 있습니다.

세계의 원료의약품(API) 시장에 대해 조사했으며, 유형별, 역가별, 합성 유형별, 약제 유형별, 치료 용도별, 최종사용자별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 기술 분석

- 공급망 분석

- 밸류체인 분석

- 에코시스템 분석

- 주요 컨퍼런스와 이벤트

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 거시경제 지표

- 특허 분석

- 미충족 요구와 공백

- 무역 데이터

- 투자와 자금조달 시나리오

- 주요 API 공급업체의 제조 사이트와 생산능력 확대

- AI/생성형 AI가 원료의약품(API) 시장에 미치는 영향

- 미국 관세가 원료의약품(API) 시장에 미치는 영향

제6장 원료의약품(API) 시장, 유형별

- 서론

- 원료의약품(API)(유형별, 자사 및 판매원)

- 혁신적 API

- 범용 API

제7장 원료의약품(API) 시장, 역가별

- 서론

- 원료의약품(API)(역가별, 자사 및 판매원)

- 기존 API

- 강력 API

제8장 원료의약품(API) 시장, 합성 유형별

- 서론

- 원료의약품(API)(합성 유형별, 자사 및 판매원별)

- 합성 API

- 바이오테크놀러지 API

제9장 원료의약품(API) 시장, 약제 유형별

- 서론

- 원료의약품(API)(약제 유형별, 자사 및 판매원)

- 처방약

- 시판약

제10장 원료의약품(API) 시장, 치료 용도별

- 서론

- 원료의약품(API)(치료 용도별, 자사 및 판매원)

- 전염병

- 종양학

- 당뇨병

- 심혈관질환

- 호흡기질환

- 통증 관리

- 기타

제11장 원료의약품(API) 시장, 최종사용자별

- 서론

- 원료의약품(API)(최종사용자별, 자사 및 판매원)

- 제약·바이오테크놀러지 업계

- CRO

- CMO

- 기타

제12장 원료의약품(API) 시장, 지역별

- 서론

- 원료의약품(API) 시장(지역별, 자사 및 판매원)

- 북미

- 북미의 거시경제 분석

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 분석

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 헝가리

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 분석

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카 : 거시경제 분석

- 브라질

- 멕시코

- 기타

- 중동

- 중동의 거시경제 분석

- 이스라엘

- GCC 국가

- 기타

- 아프리카

- 의약품의 수요 증가가 시장을 촉진

- 아프리카의 거시경제 전망

제13장 경쟁 구도

- 서론

- 원료의약품(API) 시장에서 주요 기업이 채택하고 있는 전략의 개요

- 매출 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 개요

- 주요 참여 기업

- PFIZER INC.

- DIVI'S LABORATORIES LIMITED

- ASYMCHEM INC.

- CIPLA

- EVONIK

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- SANDOZ GROUP AG

- SK INC.

- MERCK KGAA

- DR. REDDY'S LABORATORIES LTD.

- SUN PHARMACEUTICAL INDUSTRIES LTD.

- AUROBINDO PHARMA LIMITED

- HIKMA PHARMACEUTICALS PLC

- BASF

- ALEMBIC PHARMACEUTICALS LIMITED

- SIEGFRIED HOLDING AG

- EUROAPI

- BACHEM

- ZHEJIANG HUAHAI PHARMACEUTICAL CO., LTD.

- ZHEJIANG HISUN PHARMACEUTICAL CO., LTD.

- 기타 기업

- POLYPEPTIDE GROUP

- GRANULES INDIA

- CORDEN PHARMA

- RECIPHARM

- ABURAIHAN PHARMACEUTICAL COMPANY

- CURIA GLOBAL, INC.

- CAMBREX CORPORATION

- API PHARMA TECH

- SREEPATHI PHARMACEUTICALS LIMITED

- SHILPA MEDICARE LIMITED

- NANJING JIANYOU BIOCHEMICAL PHARMACEUTICAL CO., LTD.

- HOVIONE

- CHEMCON GMBH

- PHARCO PHARMACEUTICALS

- SAMBI PHARMA PVT. LTD.

제15장 디스커션 가이드

KSA 25.11.14The global active pharmaceutical ingredients market is projected to reach USD 198.39 billion by 2030 from an estimated USD 144.20 billion in 2025, at a CAGR of 6.6% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Type, Potency, Synthesis, Type of Drug, Therapeutic Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

The expansion of the active pharmaceutical ingredients market has been predominantly fueled by the expanding oncology & rare disease and diabetes product pipeline. Over the past few years, type 2 diabetes and obesity care have been reshaped by a new class of peptide-based drugs, most notably Semaglutide, Tirzepatide, Liraglutide, and Dulaglutide. These therapies are transforming patient outcomes and creating significant opportunities across the API supply chain.

The pharmaceutical & biotechnology industry segment accounted for the largest share by end user in 2024.

Based on end users, the market is categorized into the pharmaceutical & biotechnology industry, contract research organizations (CROs), contract manufacturing organizations (CMOs), and other end users. The pharmaceutical & biotechnology industry accounted for the major end-user of active pharmaceutical ingredients (APIs), which are essential for drug development and manufacturing. The pharmaceutical industry has seen increasing manufacturing outsourcing to CMOs in the last 5 years, especially for developing and manufacturing drugs & biologics, such as high-potency drugs, ADCs, among others. However, pharmaceutical and biotechnology companies still dominate the end-user segment by retaining in-house manufacturing for high-value blockbuster drugs and biologics. Additionally, the rising demand for innovative therapies has encouraged continuous investment in research and development, with companies prioritizing the creation of novel drugs and advanced formulations. Together, these trends are expected to further strengthen the growth of the pharmaceutical and biotechnology end-user segment.

The innovative APIs segment accounted for the largest market share in the active pharmaceutical ingredients market by type.

Based on type, the global active pharmaceutical ingredients (API) market is divided into innovative APIs and generic APIs. In 2024, innovative APIs dominated the market, driven by the increasing number of regulatory approvals for new and advanced drugs, which is expected to continue supporting growth over the forecast period. For instance, the US FDA approved more than 50 new molecular entities (NMEs) in 2024, reflecting the rising pace of novel drug development. Innovative APIs, being protected by patents, are typically priced higher than generic APIs, contributing to their larger market share. The segment's growth is further reinforced by the focus of pharmaceutical and biotechnology companies on developing novel therapies for complex and unmet medical needs, including oncology, rare diseases, and biologics. Additionally, investments in research and development, advanced manufacturing capabilities, and regulatory incentives continue to promote the introduction of innovative APIs. These factors position innovative APIs as the leading segment of the global API market, reflecting higher value and strong demand.

The Asia Pacific region is expected to grow at the highest CAGR in the global active pharmaceutical ingredients market during the forecast period.

The market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The Asia Pacific region is projected to grow at the highest CAGR during the forecast period. The key factors contributing to market growth include the increasing adoption and demand for high-value therapies, driving manufacturing expansion by global & regional players. In addition, the expansion of CDMOs in the region, which is focused on synthetic and biological therapies, is also helping drive demand for APIs. China, Japan, South Korea, India, and Australia are witnessing the growing adoption of innovative and generic medicine, which is supported by expanding manufacturing facilities in the Asia Pacific region. Furthermore, a combination of cost-efficient manufacturing, expanding generics and biosimilars production, and strong government support for local API manufacturing to reduce dependency on imports. India and China are emerging as global hubs owing to their large-scale production capacity, skilled workforce, and favorable regulatory initiatives, which support the growth of the active pharmaceutical ingredients market in the region.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side- 30%

- By Designation: Managers- 45%, CXOs and Directors- 30%, and Executives- 25%

- By Region: North America- 30%, Europe- 30%, Asia Pacific- 30%, Latin America- 5%, and the Middle East & Africa- 5%

Key Companies

Key players in the active pharmaceutical ingredients market include Pfizer (CentreOne) (US), Teva Pharmaceutical Industries Ltd. (Israel), Divi's Laboratories Limited (India), Sandoz Group AG (Switzerland), SK Inc. (South Korea), Merck KGaA (Germany), Dr. Reddy's Laboratories Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Cipla (India), Aurobindo Pharma (India), Evonik Industries AG (Germany), Hikma Pharmaceuticals plc (UK), BASF SE (Germany), Alembic Pharmaceuticals Limited (India), Siegfried Holding AG (Switzerland), EUROAPI (France), Asymchem (China), Bachem (Switzerland), Zhejiang Huahai Pharmaceutical Co., Ltd. (China), and Zhejiang Hisun (China).

Research Coverage

This research report categorizes the active pharmaceutical ingredients market, Active Pharmaceutical Ingredient Market by type (Innovative, generic), potency (traditional API, highly potent API (synthetic, biologics), synthesis ((synthetic, biotech), products (mAb, hormones, cytokines) expression system), type of drug (OTC, Rx), therapeutics application (diabetes, oncology, CVD), end user (pharma & biotech, CROs CMOs) and region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the active pharmaceutical ingredients market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New approvals/launches, collaborations, acquisitions, and recent developments associated with the active pharmaceutical ingredients market.

Reasons to buy this report

The report will help market leaders and new entrants by providing them with the closest approximations of the revenue numbers for the overall active pharmaceutical ingredients market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their businesses and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Surge in Demand for Complex APIs, Government Incentives & Supply Chain Reshoring, Adoption of Continuous Manufacturing & Digital Process Controls, Expanding Oncology & Rare Disease Pipeline Driving Outsourcing), restraints (Tightening regulatory requirements, high production costs in Western facilities and price pressure from generic tenders and single-winner procurement policies), opportunities (Critical medicines are commanding premium pricing through dual-sourcing and local manufacturing, China-Plus-One Strategy Boosting India, US, & EU Manufacturing Bases, and Integrated API-to-FDF CDMO Service Models Gaining Traction), and challenges (Supply Chain Concentration Risk, Quality Failures & Site Shutdowns Leading to Global Supply Disruptions, Capital-intensive Investments Needed for High-containment & Advanced Facilities and Geopolitical Tensions & Trade Restrictions Impacting API Flow)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the active pharmaceutical ingredients market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the active pharmaceutical ingredients market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/ approvals, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the active pharmaceutical ingredients market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 SEGMENTS CONSIDERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries (supply- and demand-side participants)

- 2.1.2.2 Key objective of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (Bottom-up approach)

- 2.2.1.1.1 Revenue share analysis of Pfizer, Inc.

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.1.1 Company revenue analysis (Bottom-up approach)

- 2.2.2 INSIGHTS OF PRIMARY EXPERTS

- 2.2.3 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET ESTIMATION

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

- 3.3 STRATEGIC IMPERATIVES FOR KEY STAKEHOLDERS

- 3.3.1 PHARMACEUTICAL CONTRACT MANUFACTURERS

- 3.3.2 STARTUPS AND INNOVATIVE BIOTECH FIRMS

- 3.3.3 CDMOS/CROS

4 PREMIUM INSIGHTS

- 4.1 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET OVERVIEW

- 4.2 NORTH AMERICA: ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE AND COUNTRY, 2025

- 4.3 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET FOR HIGHLY POTENT APIS, BY TYPE

- 4.4 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET FOR BIOTECH APIS, BY PRODUCT

- 4.5 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.6 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET: EMERGING VS. DEVELOPED MARKETS, 2025 VS. 2030

- 4.7 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.8 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.9 VC/PRIVATE EQUITY INVESTMENT TRENDS AND STARTUP LANDSCAPE

- 4.10 REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for complex APIs

- 5.2.1.2 Favorable government incentives and supply chain reshoring

- 5.2.1.3 Increasing adoption of continuous manufacturing and digital process controls

- 5.2.1.4 Rapid growth of oncology and rare disease pipelines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Tightening regulatory requirements for nitrosamine and impurity controls

- 5.2.2.2 High production costs in US and Europe-based facilities

- 5.2.2.3 Price pressure from generic tenders and single-winner procurement policies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on supply resilience and security of critical medicine manufacturing

- 5.2.3.2 China-Plus-One strategy

- 5.2.3.3 Increasing adoption of integrated CDMO service models

- 5.2.4 CHALLENGES

- 5.2.4.1 Capital-intensive investments for high containment and advanced facilities

- 5.2.4.2 Quality failures and site shutdowns

- 5.2.4.3 Supply chain concentration risk

- 5.2.4.4 Geopolitical tensions and trade restrictions

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER, 2024

- 5.4.2 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Continuous manufacturing

- 5.5.1.2 Advanced analytical techniques

- 5.5.1.3 Biocatalysis

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Data analytics and digitalization

- 5.5.2.2 Personalized medicines and custom synthesis

- 5.5.2.3 Supercritical fluid technology

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Supply chain visibility and blockchain

- 5.5.3.2 3D printing

- 5.5.3.3 Nanotechnology

- 5.5.1 KEY TECHNOLOGIES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RESEARCH & DEVELOPMENT (VALUE ADDITION: 30-35%)

- 5.7.2 CLINICAL TRIALS & REGULATORY APPROVALS (VALUE ADDITION: 50-70%)

- 5.7.3 MANUFACTURING (VALUE ADDITION: 70-80%)

- 5.7.4 MARKETING & COMMERCIALIZATION (VALUE ADDITION: 80-100%)

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 KEY CONFERENCES & EVENTS

- 5.10 REGULATORY ANALYSIS

- 5.10.1 REGULATORY SCENARIO

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.2.1 Germany

- 5.10.1.2.2 UK

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 Japan

- 5.10.1.4 Latin America

- 5.10.1.4.1 Brazil

- 5.10.1.5 Middle East & Africa

- 5.10.1.5.1 Saudi Arabia

- 5.10.1.1 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY SCENARIO

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 KEY BUYING CRITERIA

- 5.13 CASE STUDY ANALYSIS

- 5.14 MACROECONOMICS INDICATORS

- 5.14.1 HEALTHCARE EXPENDITURE TRENDS

- 5.14.2 GLOBAL CANCER BURDEN

- 5.15 PATENT ANALYSIS

- 5.15.1 LIST OF PATENTS

- 5.16 UNMET NEEDS AND WHITE SPACES

- 5.17 TRADE DATA

- 5.17.1 IMPORT DATA FOR HS CODE-2941

- 5.17.2 EXPORT DATA FOR HS CODE-2941

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 MANUFACTURING SITES AND CAPACITY EXPANSION OF KEY API SUPPLIERS

- 5.20 IMPACT OF AI/GEN AI ON ACTIVE PHARMACEUTICAL INGREDIENTS MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 IMPACT AND MARKET POTENTIAL OF ARTIFICIAL INTELLIGENCE IN ACTIVE PHARMACEUTICAL INGREDIENTS MARKET

- 5.20.3 AI USE CASES

- 5.20.4 FUTURE OF GENERATIVE AI IN ACTIVE PHARMACEUTICAL INGREDIENTS MARKET ECOSYSTEM

- 5.21 IMPACT OF US TARIFF ON ACTIVE PHARMACEUTICAL INGREDIENTS MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 North America

- 5.21.4.1.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.4.1 North America

- 5.21.5 IMPACT ON END-USE INDUSTRIES

- 5.21.5.1 Pharmaceutical & biotechnology industry

- 5.21.5.2 Contract research organizations (CROs)

- 5.21.5.3 Contract manufacturing organizations (CMOs)

6 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY TYPE (CAPTIVE AND MERCHANT)

- 6.3 INNOVATIVE APIS

- 6.3.1 INCREASING REGULATORY APPROVALS FOR INNOVATIVE DRUGS TO FACILITATE GROWTH

- 6.4 GENERIC APIS

- 6.4.1 GROWING FOCUS ON GENERIC DRUGS AND LOW MANUFACTURING COSTS TO FUEL MARKET

7 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY POTENCY

- 7.1 INTRODUCTION

- 7.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY POTENCY (CAPTIVE AND MERCHANT)

- 7.3 TRADITIONAL APIS

- 7.3.1 INCREASING NUMBER OF APPLICATIONS IN THERAPEUTIC AREAS TO AUGMENT GROWTH

- 7.4 HIGHLY POTENT APIS

- 7.4.1 SYNTHETIC

- 7.4.1.1 Evolving targeted oncology therapies to stimulate growth

- 7.4.2 BIOLOGICS

- 7.4.2.1 Robust product pipeline to encourage growth

- 7.4.1 SYNTHETIC

8 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE OF SYNTHESIS

- 8.1 INTRODUCTION

- 8.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY TYPE OF SYNTHESIS (CAPTIVE AND MERCHANT)

- 8.3 SYNTHETIC APIS

- 8.3.1 INNOVATIVE SYNTHETIC APIS

- 8.3.1.1 High value of innovative APIs to drive market

- 8.3.2 GENERIC SYNTHETIC APIS

- 8.3.2.1 Increasing need for generic medicines to contribute to growth

- 8.3.1 INNOVATIVE SYNTHETIC APIS

- 8.4 BIOTECH APIS

- 8.4.1 BIOTECH ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE

- 8.4.1.1 Innovative biotech APIs

- 8.4.1.1.1 Growing demand for innovative biopharmaceuticals to drive market

- 8.4.1.2 Generic biotech APIs

- 8.4.1.2.1 Cost-effectiveness and favorable government efforts to fuel market

- 8.4.1.1 Innovative biotech APIs

- 8.4.2 BIOTECH ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY PRODUCT

- 8.4.2.1 Monoclonal antibodies

- 8.4.2.1.1 Growing applications of antibody-drug conjugates in treating cancer to drive market

- 8.4.2.2 Hormones and growth factors

- 8.4.2.2.1 Growing incidence of hormonal disorders to drive market

- 8.4.2.3 Fusion proteins

- 8.4.2.3.1 Increasing applications of fusion proteins in biopharmaceuticals to aid growth

- 8.4.2.4 Cytokines

- 8.4.2.4.1 Rising use of cytokines in cell signaling, inflammation, and cell growth to spur growth

- 8.4.2.5 Therapeutic enzymes

- 8.4.2.5.1 Growing significance of enzymes in therapies for cancer and pain management to propel market

- 8.4.2.6 Blood factors and anti-coagulants

- 8.4.2.6.1 Growing incidence of hemophilia to fuel market

- 8.4.2.7 Recombinant vaccines

- 8.4.2.7.1 Growing prevalence of infectious diseases to fuel market

- 8.4.2.1 Monoclonal antibodies

- 8.4.3 BIOTECH ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY EXPRESSION SYSTEM

- 8.4.3.1 Mammalian expression systems

- 8.4.3.1.1 Ability to carry post-translational modifications to drive adoption

- 8.4.3.2 Microbial expression systems

- 8.4.3.2.1 High expression levels of proteins at low costs to aid growth

- 8.4.3.3 Yeast expression systems

- 8.4.3.3.1 Efficient protein secretion and simple purification to contribute to growth

- 8.4.3.4 Insect expression systems

- 8.4.3.4.1 Scalability, cost-effectiveness, and favorable safety profile to boost market

- 8.4.3.5 Other expression systems

- 8.4.3.1 Mammalian expression systems

- 8.4.1 BIOTECH ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE

9 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY TYPE OF DRUG

- 9.1 INTRODUCTION

- 9.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY TYPE OF DRUG (CAPTIVE AND MERCHANT)

- 9.3 PRESCRIPTION DRUGS

- 9.3.1 INCREASED ADOPTION OF SPECIALTY DRUGS TO SUPPORT GROWTH

- 9.4 OVER-THE-COUNTER DRUGS

- 9.4.1 RISING AWARENESS OF PRECAUTIONARY CARE AND HEALTH CONCERNS TO SPUR GROWTH

10 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY THERAPEUTIC APPLICATION

- 10.1 INTRODUCTION

- 10.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY THERAPEUTIC APPLICATION (CAPTIVE AND MERCHANT)

- 10.3 COMMUNICABLE DISEASES

- 10.3.1 INCREASING INVESTMENTS IN DEVELOPING NEW ANTIBIOTICS, ANTIVIRALS, ANTIFUNGALS, AND VACCINES TO AID GROWTH

- 10.4 ONCOLOGY

- 10.4.1 GROWING NUMBER OF FDA APPROVALS TO DRIVE MARKET

- 10.5 DIABETES

- 10.5.1 RISING ADVANCEMENTS IN TREATMENT OPTIONS TO EXPEDITE GROWTH

- 10.6 CARDIOVASCULAR DISEASES

- 10.6.1 INCREASING ADOPTION OF GROWTH STRATEGIES BY KEY PLAYERS TO PROMOTE GROWTH

- 10.7 RESPIRATORY DISEASES

- 10.7.1 INCREASING BURDEN OF RESPIRATORY DISORDERS TO BOLSTER GROWTH

- 10.8 PAIN MANAGEMENT

- 10.8.1 RISING DEMAND FOR INNOVATIVE AND ADVANCED PAIN MEDICATIONS TO BOLSTER GROWTH

- 10.9 OTHER THERAPEUTIC APPLICATIONS

11 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 ACTIVE PHARMACEUTICAL INGREDIENTS, BY END USER (CAPTIVE AND MERCHANT)

- 11.3 PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRY

- 11.3.1 RISE IN NEED OF NOVEL TREATMENTS TO EXPEDITE GROWTH

- 11.4 CONTRACT RESEARCH ORGANIZATIONS

- 11.4.1 INCREASING OUTSOURCING OF DRUG R&D ACTIVITIES TO SUPPORT GROWTH

- 11.5 CONTRACT MANUFACTURING ORGANIZATIONS

- 11.5.1 GROWING FOCUS ON BETTER QUALITY AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 11.6 OTHER END USERS

12 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ACTIVE PHARMACEUTICAL INGREDIENTS MARKET, BY REGION (CAPTIVE AND MERCHANT)

- 12.3 NORTH AMERICA

- 12.3.1 MACROECONOMIC ANALYSIS OF NORTH AMERICA

- 12.3.2 US

- 12.3.2.1 High clinical trial & drug discovery activity and efficient regulatory environment to expedite growth

- 12.3.3 CANADA

- 12.3.3.1 Favorable government support and strong product pipeline to sustain growth

- 12.4 EUROPE

- 12.4.1 MACROECONOMIC ANALYSIS OF EUROPE

- 12.4.2 GERMANY

- 12.4.2.1 High healthcare expenditure and advanced R&D facilities to drive market

- 12.4.3 UK

- 12.4.3.1 Rising government investments and growing focus on personalized treatment to fuel market

- 12.4.4 FRANCE

- 12.4.4.1 Increased focus on domestic manufacturing to promote growth

- 12.4.5 ITALY

- 12.4.5.1 Rising commercial drug development to favor growth

- 12.4.6 SPAIN

- 12.4.6.1 Increase in generic drug manufacturing capacity to propel market

- 12.4.7 HUNGARY

- 12.4.7.1 Increasing manufacturing activities in pharmaceutical sector to drive market

- 12.4.8 REST OF EUROPE

- 12.5 ASIA PACIFIC

- 12.5.1 MACROECONOMIC ANALYSIS OF ASIA PACIFIC

- 12.5.2 CHINA

- 12.5.2.1 Rise in government policies to increase medicine access and affordability to support growth

- 12.5.3 JAPAN

- 12.5.3.1 Growing geriatric population to boost market

- 12.5.4 INDIA

- 12.5.4.1 Increasing R&D activities and rising government funding initiatives to favor growth

- 12.5.5 SOUTH KOREA

- 12.5.5.1 Rising annual drug exports to drive market

- 12.5.6 AUSTRALIA

- 12.5.6.1 Increasing demand for innovative APIs to propel market

- 12.5.7 REST OF ASIA PACIFIC

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: MACROECONOMIC ANALYSIS

- 12.6.2 BRAZIL

- 12.6.2.1 Increased government investments in pharmaceutical R&D to drive market

- 12.6.3 MEXICO

- 12.6.3.1 Rising investments by foreign firms to support market growth

- 12.6.4 REST OF LATIN AMERICA

- 12.7 MIDDLE EAST

- 12.7.1 MACROECONOMIC ANALYSIS OF MIDDLE EAST

- 12.7.2 ISRAEL

- 12.7.2.1 Highly educated workforce and strong culture of innovations to support growth

- 12.7.3 GCC COUNTRIES

- 12.7.3.1 Saudi Arabia

- 12.7.3.1.1 Growing healthcare expenditure to boost market

- 12.7.3.2 UAE

- 12.7.3.2.1 Rising demand for technologically advanced manufacturing processes to aid growth

- 12.7.3.3 Rest of GCC Countries

- 12.7.3.1 Saudi Arabia

- 12.7.4 REST OF MIDDLE EAST

- 12.8 AFRICA

- 12.8.1 GROWING DEMAND FOR PHARMACEUTICAL PRODUCTS TO PROPEL MARKET

- 12.8.2 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ACTIVE PHARMACEUTICAL INGREDIENTS MARKET

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPETITIVE BENCHMARKING, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region Footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Potency footprint

- 13.7.5.5 Therapeutic application footprint

- 13.8 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT APPROVALS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 PFIZER INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 DIVI'S LABORATORIES LIMITED

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 ASYMCHEM INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 CIPLA

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 EVONIK

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Other developments

- 14.1.7 SANDOZ GROUP AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Expansions

- 14.1.8 SK INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Expansions

- 14.1.9 MERCK KGAA

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.10 DR. REDDY'S LABORATORIES LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Expansions

- 14.1.10.3.2 Other developments

- 14.1.11 SUN PHARMACEUTICAL INDUSTRIES LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.12 AUROBINDO PHARMA LIMITED

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.13 HIKMA PHARMACEUTICALS PLC

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Expansions

- 14.1.14 BASF

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.15 ALEMBIC PHARMACEUTICALS LIMITED

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches and approvals

- 14.1.16 SIEGFRIED HOLDING AG

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Expansions

- 14.1.17 EUROAPI

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Expansions

- 14.1.18 BACHEM

- 14.1.18.1 Business overview

- 14.1.18.2 Products offered

- 14.1.19 ZHEJIANG HUAHAI PHARMACEUTICAL CO., LTD.

- 14.1.19.1 Business overview

- 14.1.19.2 Products offered

- 14.1.20 ZHEJIANG HISUN PHARMACEUTICAL CO., LTD.

- 14.1.20.1 Business overview

- 14.1.20.2 Products offered

- 14.1.1 PFIZER INC.

- 14.2 OTHER PLAYERS

- 14.2.1 POLYPEPTIDE GROUP

- 14.2.2 GRANULES INDIA

- 14.2.3 CORDEN PHARMA

- 14.2.4 RECIPHARM

- 14.2.5 ABURAIHAN PHARMACEUTICAL COMPANY

- 14.2.6 CURIA GLOBAL, INC.

- 14.2.7 CAMBREX CORPORATION

- 14.2.8 API PHARMA TECH

- 14.2.9 SREEPATHI PHARMACEUTICALS LIMITED

- 14.2.10 SHILPA MEDICARE LIMITED

- 14.2.11 NANJING JIANYOU BIOCHEMICAL PHARMACEUTICAL CO., LTD.

- 14.2.12 HOVIONE

- 14.2.13 CHEMCON GMBH

- 14.2.14 PHARCO PHARMACEUTICALS

- 14.2.15 SAMBI PHARMA PVT. LTD.

15 DISCUSSION GUIDE

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS