|

시장보고서

상품코드

1808970

치과용 소모품 시장 : 제품별, 최종 사용자별 세계 예측(-2030년)Dental Consumables Market by Product (Implants, Prosthetics, Orthodontics, Endodontics, Infection Control, Periodontics, Whitening Products, Finishing Products, Sealants), End User (Dental Hospital & Clinics, Dental Labs) - Global Forecast to 2030 |

||||||

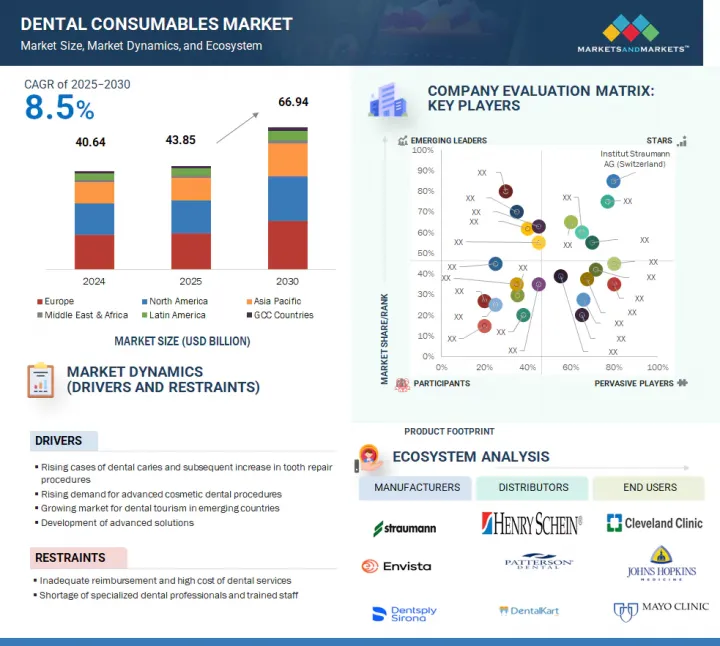

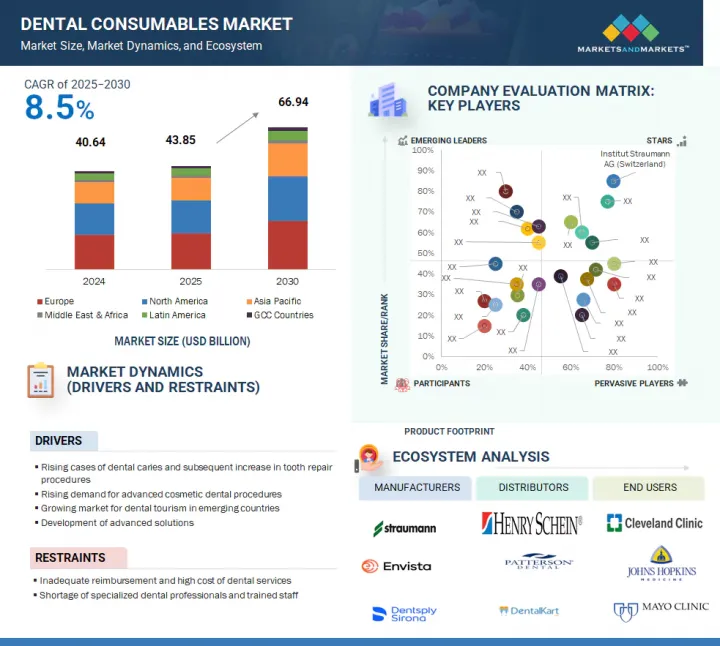

세계의 치과용 소모품 시장 규모는 2025년 438억 5,000만 달러에서 2030년까지 669억 4,000만 달러에 이를 것으로 예상되며, 예측 기간에 CAGR는 8.5%를 나타낼 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 유형, 최종 사용자, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

치과용 소모품 시장은 인구 역학, 임상 및 기술의 복합적인 영향으로 인한 강력한 성장이 예상됩니다. 수리 및 보철 솔루션을 필요로 하는 노인들의 확대에 의해 지원되는 치과 질환의 이환율 증가는 치과용 소모품의 세계 수요를 지속적으로 촉진하고 있습니다.

디지털 덴티스트리, 생체적합성 컴포지트 레진, CAD/CAM 시스템 등의 치과 재료·기술의 진보는 이미 치료 결과를 대폭 향상시키고 있어 제품의 채용을 추진하고 있습니다. 게다가 구강 관리에 대한 관심 증가와 치과 치료에 대한 접근성, 심미 치과에 대한 수요 증가가 시장을 뒷받침하고 있습니다. 이러한 요인은 앞으로 수년간 선진국 시장과 신흥국 시장 모두에서 기세를 유지할 가능성이 높습니다.

제품 유형별로는 치과 교정 부문이 치과용 소모품 시장에서 가장 높은 CAGR을 나타낼 것으로 예상됩니다.

치과 교정 부문은 부정 교합과 치열을 치료하는 기존의 브레이스와 클리어 얼라이너의 사용 증가를 중심으로 심미 치과 치료 및 교정 치과 치료 수요 증가 등의 이유로 가장 높은 CAGR를 나타낼 것으로 예상됩니다. 셀프 라이게이션 브레이스 및 세라믹 브레이스와 같은 치열 교정 재료의 기술적 진보는 환자의 편안함과 치료 효과를 향상시킵니다. 게다가 이 부문의 성장은 신흥 시장에서의 접근성 향상과 청소년과 성인의 치열 교정 치료에 대한 의식 증가에 의해 촉진되고 있습니다.

최종 사용자별로 치과 진료소 및 클리닉 부문이 치과용 소모품 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다.

치과의원·진료소는 환자의 유입이 많고, 제공되는 수술이 다양하고, 최신의 치과 기술을 이용할 수 있기 때문에 2024년의 치과용 소모품 시장에서 최대의 점유율을 차지했습니다. 이러한 시설은 치내 치료, 수리 및 수술의 경우를 대량으로 관리하는 경향이 있으며, 필연적으로 소모품에 대한 높은 수요가 발생합니다. 또한 숙련된 치과 의사의 존재와 공립 및 사립 진료소에서 인프라에 대한 투자가 증가함에 따라 부문 우위가 더욱 높아지고 있습니다. 클리닉에서 심미 치과 치료와 예방 치과 치료에 대한 관심 증가도이 부문의 이점을 지원합니다.

유럽이 예측 기간에 치과용 소모품 시장에서 가장 큰 점유율을 차지할 전망입니다.

유럽이 가장 큰 시장이 될 것으로 예측됩니다. 이는 이 지역의 첨단 의료 인프라, 치과 치료 요구 증가와 함께 노인 증가, 치과 질환의 높은 유병률에 기인합니다. 또한, 주요 시장 기업의 존재, 치과 제품의 지속적인 혁신, 정부의 지원은 이 시장에서 유럽의 주도적 지위를 더욱 강화하고 있습니다. 구강 위생에 대한 의식이 증가하고 유럽인의 가처분 소득이 증가함에 따라이 지역 시장 성장이 크게 증가했습니다.

본 보고서는 세계의 치과용 소모품 시장에 대한 조사 분석을 통해 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 치과용 소모품 시장 기업에게 매력적인 기회

- 유럽의 치과용 소모품 시장 : 최종 사용자별, 국가별

- 치과용 소모품 시장 : 지리적 성장 기회

- 치과용 소모품 시장 : 지역별

- 치과용 소모품 시장 : 선진국 시장과 신흥국 시장

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 인접 기술

- 인접 기술

- 산업 동향

- 치과 진료에의 다액 투자

- 저침습치과치료 증가

- 시장 통합

- 제품 개발에 주력

- 치과 제품의 그레이/블랙 마켓

- 상환 시나리오

- 가격 설정 분석

- 평균 판매 가격 동향 : 유형별

- 평균 판매 가격 동향 : 국가별

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 규제 상황

- 미국

- 유럽연합

- 중국

- 라틴아메리카

- 중동

- 아프리카

- 규제기관, 정부기관, 기타 조직

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 특허 분석

- 치과용 소모품 시장에 있어서 특허 공보의 동향

- 관할분석 : 치과용 소모품 시장에서의 상위 특허 출원자

- 무역 분석

- 치과 제품(HS 코드 : 9021)의 수입 데이터(2020-2024년)

- 치과 제품(HS 코드 : 9021)의 수출 데이터(2020-2024년)

- 관련 보고서

- 사례 연구

- 치과용 소모품 시장에 있어서 암멧 니즈/최종 사용자의 기대

- 치과용 소모품 시장에 대한 AI의 영향

- 투자 및 자금조달 시나리오

- 치과용 소모품 시장에 대한 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

제6장 치과용 소모품 시장 : 제품별

- 서론

- 치과 임플란트

- 티타늄 임플란트

- 지르코늄 임플란트

- 치과 수복 재료

- 직접 수복 재료

- 간접 수복 재료

- 치과용 생체재료

- 교정 소모품

- 투명 교정기/탈착식 교정 장치

- 고정식 교정 장치

- 액세서리

- 치주 소모품

- 치과용 마취제

- 치과용 지혈제

- 치과용 봉합사

- 감염 관리 소모품

- 살균 젤

- 개인 보호 장비

- 소독제

- 근관 치료용 소모품

- 성형 및 세척 소모품

- 충전 소모품

- 접근 준비 소모품

- 미백 소모품

- 진료실 내 미백 소모품

- 가정용 미백 소모품

- 마무리 및 연마 소모품

- 예방 제품

- 불소제

- 기타 치과용 소모품

- 치과용 스플린트

- 치과용 실란트

- 치과용 인상재

- 접착제

- 기타 소모품

제7장 치과용 소모품 시장 : 최종 사용자별

- 서론

- 치과 병원 및 진료소

- 치과 기공소

- 치과 서비스 기관

- 기타 최종 사용자

제8장 치과용 소모품 시장 : 지역별

- 서론

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 이탈리아

- 스페인

- 프랑스

- 영국

- 기타 유럽

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 일본

- 호주

- 한국

- 중국

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

제9장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 주요 기업의 연구 개발비

- 경쟁 시나리오

제10장 기업 프로파일

- 주요 기업

- INSTITUT STRAUMANN AG

- ENVISTA

- DENTSPLY SIRONA

- SOLVENTUM

- ZIMVIE INC.

- HENRY SCHEIN

- KURARAY CO., LTD.

- MITSUI CHEMICALS, INC.

- SHOFU

- IVOCLAR VIVADENT AG

- 기타 기업

- GC CORPORATION

- KEYSTONE DENTAL GROUP

- BEGO GMBH & CO. KG

- SEPTODONT HOLDING

- ULTRADENT PRODUCTS

- VOCO GMBH

- COLTENE GROUP

- SDI LIMITED

- YOUNG INNOVATIONS, INC.

- DMG CHEMISCH-PHARMAZEUTISCHE FABRIK GMBH

- BRASSELER USA

- GEISTLICH PHARMA AG

- SHOFU INC.

- GLIDEWELL

- BISCO INC.

- DENTAL TECHNOLOGIES INC.

제11장 부록

KTH 25.09.17The global dental consumables market is projected to reach USD 66.94 billion by 2030 from USD 43.85 billion in 2025 at a CAGR of 8.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa, and GCC Countries |

The market for dental consumables is expected to grow vigorously, fueled by a combination of demographic, clinical, and technological influences. A greater incidence of dental diseases, supported by an expanding geriatric population in need of restorative and prosthetic solutions, continues to fuel global demand for dental consumables.

Progress in dental materials and technologies, including digital dentistry, biocompatible composites, and CAD/CAM systems, has already enhanced treatment outcomes considerably, thus fueling the adoption of products. Moreover, increased focus on oral care, easier access to dental procedures, and increasing demand for cosmetic dentistry are also fueling the market. These factors are likely to maintain momentum in both developed and emerging markets in the coming years.

Based on product type, the orthodontics segment is projected to have the highest CAGR in the dental consumables market.

The dental consumables market is segmented by product type into dental restoration, orthodontics, periodontics, infection control, endodontics, whitening products, finishing & polishing products, and others.

The orthodontics segment is projected to grow at the highest CAGR, due to reasons such as the increasing demand for cosmetic and corrective dental treatment, particularly the increasing use of conventional braces and clear aligners for treating malocclusion and misalignment. Patient comfort and treatment efficacy are being enhanced by technological advancements in orthodontic materials, including self-ligating and ceramic braces. In addition, the segmental growth is fueled by enhanced access in emerging markets as well as increased awareness about orthodontic treatment among adolescents and adults.

Based on end user, the dental hospitals and clinics segment is expected to account for the largest share of the dental consumables market.

The dental consumables market is segmented into dental hospitals and clinics, dental laboratories, dental service organizations (DSOs), and other end users, which include dental academic & research institutes and forensic dentistry. Dental hospitals and clinics accounted for the largest share of the dental consumables market in 2024 based on their high inflow of patients, extensive assortment of procedures offered, and availability of the latest dental technology. These institutions tend to manage a large volume of endodontic, restorative, and surgical cases, necessitating a high demand for consumables. Also, the presence of experienced dental practitioners and increasing investments in infrastructure at public and private clinics have augmented segment dominance further. The growing focus on cosmetic and preventive dental care in clinics also supports the segment's leadership.

Europe is projected to account for the largest share of the dental consumables market during the forecast period.

Europe is projected to be the largest market, and this is attributed to the region's advanced healthcare infrastructure, a growing aging population with increased dental care needs, and the high prevalence of dental disorders. Additionally, the presence of leading market players, continuous innovation in dental products, and supportive government initiatives further bolster Europe's leading position in this market. Enhanced awareness of oral health and increased disposable income among Europeans also contribute to the substantial market growth in this region.

A breakdown of the primary participants (supply side) for the dental consumables market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Directors (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), Middle East & Africa (2%), GCC Countries (3%)

Prominent players in the dental consumables market include Institut Straumann AG (Switzerland), Envista Holdings Corporation (US), Dentsply Sirona (US), ZimVie Inc. (US), Solventum (US), Henry Schein, Inc. (US), Kuraray Co., Ltd. (Japan), Mitsui Chemicals, Inc. (Japan), Geistlich Pharma AG (Switzerland), Ivoclar Vivadent (Liechtenstein), GC Corporation (Japan), Keystone Dental Inc. (US), BEGO GmbH & Co. KG (Germany), Septodont Holding (France), Ultradent Products (US), VOCO GmbH (Germany), COLTENE Group (Switzerland), SDI Limited (Australia), Young Innovations, Inc. (US), DMG Chemisch-Pharmazeutische Fabrik (Germany), Brasseler USA (US), SHOFU INC. (Japan), Zhermack SpA (Italy), BISCO, Inc. (US), and Dental Technologies Inc. (US).

Research Coverage

The report provides an analysis of the dental consumables market, focusing on estimating the market size and potential for future growth across various segments, including product types, regions, and end users. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product & service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report provides valuable insights for both market leaders and new entrants in the dental consumables industry, offering approximate revenue figures for the overall market and its subsegments. It assists stakeholders in understanding the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, helping stakeholders gauge the current state of the market.

This report provides insights into the following pointers:

- Analysis of key drivers (rising cases of dental caries and subsequent increase in tooth repair procedures, rising demand for advanced cosmetic dental procedures, growing market for dental tourism in emerging countries, and development of advanced solutions), restraints (inadequate reimbursement and high cost of dental services), opportunities (increasing investments in CAD/CAM technologies, growing focus on emerging markets and rising disposable income levels, and increasing demand for same day dentistry) and challenges (pricing pressure faced by prominent market players and dearth of skilled lab professionals)

- Market Penetration: Provides detailed information on the product portfolios offered by major players in the global dental consumables market (the report covers various segments, including product types, end users, and regions)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global dental consumables market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product types, end users, and regions

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global dental consumables market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global dental consumables market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 MARKETS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DENTAL CONSUMABLES MARKET

- 4.2 EUROPE: DENTAL CONSUMABLES MARKET, BY END USER AND COUNTRY

- 4.3 DENTAL CONSUMABLES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 DENTAL CONSUMABLES MARKET, BY REGION

- 4.5 DENTAL CONSUMABLES MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of dental caries leading to higher demand for tooth restoration procedures

- 5.2.1.2 Growing preference for advanced cosmetic dental treatments

- 5.2.1.3 Expanding dental tourism market in developing nations

- 5.2.1.4 Introduction of innovative and advanced dental solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited reimbursement policies and high cost associated with dental treatments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising funding and adoption of CAD/CAM dental technologies

- 5.2.3.2 Expanding opportunities in emerging markets supported by rising disposable incomes

- 5.2.3.3 Growing popularity of same-day dental treatment services

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense pricing competition among leading market players

- 5.2.4.2 Shortage of qualified and experienced dental laboratory professionals

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 CAD/CAM technology

- 5.3.1.2 Caries detection technology

- 5.3.2 ADJACENT TECHNOLOGIES

- 5.3.2.1 Robot dentists and AI

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Novel biocompatible materials

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 HIGH INVESTMENTS IN DENTAL PRACTICES

- 5.4.2 RISING NUMBER OF MINIMALLY INVASIVE DENTAL PROCEDURES

- 5.4.3 MARKET CONSOLIDATION

- 5.4.4 FOCUS ON PRODUCT DEVELOPMENT

- 5.4.5 GRAY AND BLACK MARKET FOR DENTAL PRODUCTS

- 5.5 REIMBURSEMENT SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.6.2 AVERAGE SELLING PRICE TREND, BY COUNTRY

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 US

- 5.10.2 EUROPEAN UNION

- 5.10.3 CHINA

- 5.10.4 LATIN AMERICA

- 5.10.5 MIDDLE EAST

- 5.10.6 AFRICA

- 5.10.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 INFLUENCE OF KEY STAKEHOLDERS

- 5.12.2 BUYING CRITERIA FOR PRODUCTS

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 PATENT ANALYSIS

- 5.15.1 PATENT PUBLICATION TRENDS FOR DENTAL CONSUMABLES MARKET

- 5.15.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DENTAL CONSUMABLES MARKET

- 5.16 TRADE ANALYSIS

- 5.16.1 IMPORT DATA FOR DENTAL PRODUCTS (HS CODE: 9021), 2020-2024

- 5.16.2 EXPORT DATA FOR DENTAL PRODUCTS (HS CODE: 9021), 2020-2024

- 5.17 ADJACENT REPORTS

- 5.18 CASE STUDIES

- 5.19 UNMET NEEDS/END-USER EXPECTATIONS IN DENTAL CONSUMABLES MARKET

- 5.20 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON DENTAL CONSUMABLES MARKET

- 5.21 INVESTMENT AND FUNDING SCENARIO

- 5.22 IMPACT OF US TARIFF ON DENTAL CONSUMABLES MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON REGION

- 5.22.4.1 US

- 5.22.4.2 Europe

- 5.22.4.3 Asia Pacific

- 5.22.5 IMPACT ON END-USER INDUSTRIES

6 DENTAL CONSUMABLES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 DENTAL IMPLANTS

- 6.2.1 TITANIUM IMPLANTS

- 6.2.1.1 High biocompatibility and cost-effectiveness to drive usage in implants

- 6.2.2 ZIRCONIUM IMPLANTS

- 6.2.2.1 Superior esthetics to drive preference for zirconium over titanium implants

- 6.2.1 TITANIUM IMPLANTS

- 6.3 DENTAL RESTORATION MATERIALS

- 6.3.1 DIRECT RESTORATIVE MATERIALS

- 6.3.1.1 Amalgams

- 6.3.1.1.1 Presence of mercury in amalgams to restrain market growth

- 6.3.1.2 Composites

- 6.3.1.2.1 Need for minimal tooth preparation and effective bonding to propel growth

- 6.3.1.3 Glass ionomers

- 6.3.1.3.1 Low load-bearing strength to restrain growth

- 6.3.1.4 Other direct restorative materials

- 6.3.1.1 Amalgams

- 6.3.2 INDIRECT RESTORATIVE MATERIALS

- 6.3.2.1 Metals

- 6.3.2.1.1 High durability and fracture resistance to drive demand

- 6.3.2.2 Ceramics

- 6.3.2.2.1 Appeal and translucency to propel adoption

- 6.3.2.3 Other indirect materials

- 6.3.2.1 Metals

- 6.3.3 DENTAL BIOMATERIALS

- 6.3.3.1 Dental bone grafts

- 6.3.3.1.1 Growing number of dental implant procedures to drive market

- 6.3.3.2 Dental membranes

- 6.3.3.2.1 Growing procedural volumes to drive market

- 6.3.3.3 Tissue regenerative materials

- 6.3.3.3.1 Rising number of cosmetic dentistry procedures to support segment growth

- 6.3.3.1 Dental bone grafts

- 6.3.1 DIRECT RESTORATIVE MATERIALS

- 6.4 ORTHODONTIC CONSUMABLES

- 6.4.1 CLEAR ALIGNERS/REMOVABLE BRACES

- 6.4.1.1 Esthetic concerns among teens and adults to drive adoption

- 6.4.2 FIXED BRACES

- 6.4.2.1 Brackets

- 6.4.2.1.1 Advancements in orthodontic brackets to support market growth

- 6.4.2.2 Archwires

- 6.4.2.2.1 Increasing number of orthodontic procedures to drive growth

- 6.4.2.3 Anchorage appliances

- 6.4.2.3.1 Huge patient population base with malocclusions and jaw diseases to propel market growth

- 6.4.2.4 Ligatures

- 6.4.2.4.1 Advantages such as low cost, ease of use, and comfort to increase adoption of ligatures

- 6.4.2.1 Brackets

- 6.4.3 ACCESSORIES

- 6.4.3.1 Increasing number of orthodontic procedures to support demand for accessories

- 6.4.1 CLEAR ALIGNERS/REMOVABLE BRACES

- 6.5 PERIODONTIC CONSUMABLES

- 6.5.1 DENTAL ANESTHETICS

- 6.5.1.1 Injectable anesthetics

- 6.5.1.1.1 Safety and efficacy to drive market

- 6.5.1.2 Topical anesthetics

- 6.5.1.2.1 Rising volume of pediatric dental procedures to boost usage

- 6.5.1.1 Injectable anesthetics

- 6.5.2 DENTAL HEMOSTATS

- 6.5.2.1 Oxidized regenerated cellulose-based hemostats

- 6.5.2.1.1 Superior hemostasis and bactericidal effectiveness during surgical procedures to propel demand

- 6.5.2.2 Gelatin-based hemostats

- 6.5.2.2.1 Innovations in gelatin-based hemostats to support market growth

- 6.5.2.3 Collagen-based hemostats

- 6.5.2.3.1 Reduced blood loss and effectiveness to support adoption

- 6.5.2.1 Oxidized regenerated cellulose-based hemostats

- 6.5.3 DENTAL SUTURES

- 6.5.3.1 Non-absorbable dental sutures

- 6.5.3.1.1 Possibility of discomfort during removal to restrain adoption

- 6.5.3.2 Absorbable dental sutures

- 6.5.3.2.1 Great tensile strength and high comfort for patients to promote growth

- 6.5.3.1 Non-absorbable dental sutures

- 6.5.1 DENTAL ANESTHETICS

- 6.6 INFECTION CONTROL CONSUMABLES

- 6.6.1 SANITIZING GELS

- 6.6.1.1 Sanitizing gels to hold largest market share

- 6.6.2 PERSONAL PROTECTIVE WEAR

- 6.6.2.1 Government mandates for using personal protective wear to support segment growth

- 6.6.3 DISINFECTANTS

- 6.6.3.1 Emphasis on environmental disinfection in dental settings to support growth

- 6.6.1 SANITIZING GELS

- 6.7 ENDODONTIC CONSUMABLES

- 6.7.1 SHAPING & CLEANING CONSUMABLES

- 6.7.1.1 Importance of shaping & cleaning consumables in root canal treatment to propel adoption

- 6.7.2 OBTURATION CONSUMABLES

- 6.7.2.1 Increasing root canal procedures to drive demand

- 6.7.3 ACCESS PREPARATION CONSUMABLES

- 6.7.3.1 Growing demand for access preparation consumables in endodontic treatment to drive market

- 6.7.1 SHAPING & CLEANING CONSUMABLES

- 6.8 WHITENING CONSUMABLES

- 6.8.1 IN-OFFICE WHITENING CONSUMABLES

- 6.8.1.1 Gels

- 6.8.1.1.1 Safety and effectiveness of gels to drive market growth

- 6.8.1.2 Resin barriers

- 6.8.1.2.1 Easy application and no patient discomfort to propel usage

- 6.8.1.3 Other in-office whitening consumables

- 6.8.1.1 Gels

- 6.8.2 TAKE-HOME WHITENING CONSUMABLES

- 6.8.2.1 Whitening trays

- 6.8.2.1.1 Lower effectiveness than other modes to restrain market growth

- 6.8.2.2 Pens

- 6.8.2.2.1 Convenience to support adoption

- 6.8.2.3 Pocket trays

- 6.8.2.3.1 Regular intake of tobacco and tannin-containing products to boost adoption

- 6.8.2.4 Other take-home whitening consumables

- 6.8.2.1 Whitening trays

- 6.8.1 IN-OFFICE WHITENING CONSUMABLES

- 6.9 FINISHING & POLISHING CONSUMABLES

- 6.9.1 PROPHYLAXIS PRODUCTS

- 6.9.1.1 Pastes

- 6.9.1.1.1 High dental polishing procedure volumes to drive demand for pastes

- 6.9.1.2 Disposable agents

- 6.9.1.2.1 Greater flexibility in polishing and finishing to boost usage

- 6.9.1.3 Cups

- 6.9.1.3.1 High flexibility and stability to drive adoption

- 6.9.1.4 Brushes

- 6.9.1.4.1 Durability and ease of use to propel market

- 6.9.1.1 Pastes

- 6.9.2 FLUORIDES

- 6.9.2.1 Varnishes

- 6.9.2.1.1 Effective protection against tooth decay to boost adoption

- 6.9.2.2 Rinses

- 6.9.2.2.1 Product development efforts to drive launch of innovative offerings

- 6.9.2.3 Topical gels/oral solutions

- 6.9.2.3.1 Highly acidic nature of fluoride gels to hinder growth

- 6.9.2.4 Foams

- 6.9.2.4.1 Reduced risk of dulling and etching of restorations to propel growth

- 6.9.2.5 Trays

- 6.9.2.5.1 Rising awareness on reducing risk of caries to drive market

- 6.9.2.1 Varnishes

- 6.9.1 PROPHYLAXIS PRODUCTS

- 6.10 OTHER DENTAL CONSUMABLES

- 6.10.1 DENTAL SPLINTS

- 6.10.1.1 Rising treatment of occlusion-related disorders to propel market

- 6.10.2 DENTAL SEALANTS

- 6.10.2.1 Growing popularity and usage to support segment growth

- 6.10.3 DENTAL IMPRESSION MATERIALS

- 6.10.3.1 Frequent, repetitive usage in dental hospitals & clinics to ensure sustained demand

- 6.10.4 BONDING AGENTS/ADHESIVES

- 6.10.4.1 Applications in bonding direct and indirect restorative materials to drive market

- 6.10.5 OTHER CONSUMABLES

- 6.10.1 DENTAL SPLINTS

7 DENTAL CONSUMABLES MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 DENTAL HOSPITALS & CLINICS

- 7.2.1 RISING NUMBER OF DENTAL HOSPITALS & CLINICS IN EMERGING MARKETS TO DRIVE MARKET GROWTH

- 7.3 DENTAL LABORATORIES

- 7.3.1 INCREASING INTEREST IN COSMETIC DENTISTRY TO PROPEL MARKET GROWTH

- 7.4 DENTAL SERVICE ORGANIZATIONS

- 7.5 OTHER END USERS

8 DENTAL CONSUMABLES MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 EUROPE

- 8.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 8.2.2 GERMANY

- 8.2.2.1 Favorable government policies to drive demand for dental consumables

- 8.2.3 ITALY

- 8.2.3.1 Low-cost treatment and growing penetration of dental products to drive market

- 8.2.4 SPAIN

- 8.2.4.1 Increasing demand for cosmetic dentistry and growing medical tourism to drive demand

- 8.2.5 FRANCE

- 8.2.5.1 Favorable government healthcare strategies to fuel market growth

- 8.2.6 UK

- 8.2.6.1 Increasing incidence of dental disorders to drive demand for dental consumables

- 8.2.7 REST OF EUROPE

- 8.3 NORTH AMERICA

- 8.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 8.3.2 US

- 8.3.2.1 US to dominate North American dental consumables market

- 8.3.3 CANADA

- 8.3.3.1 Rising incidence of dental caries to drive demand for dental consumables

- 8.4 ASIA PACIFIC

- 8.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 8.4.2 JAPAN

- 8.4.2.1 Rising geriatric population and favorable reimbursement to support market growth

- 8.4.3 AUSTRALIA

- 8.4.3.1 Increasing incidence of dental disorders to drive demand for dental consumables

- 8.4.4 SOUTH KOREA

- 8.4.4.1 High penetration of dental implants to drive market in South Korea

- 8.4.5 CHINA

- 8.4.5.1 Growing prevalence of dental diseases to drive market

- 8.4.6 INDIA

- 8.4.6.1 India to offer lucrative growth opportunities for market players

- 8.4.7 REST OF ASIA PACIFIC

- 8.5 LATIN AMERICA

- 8.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 8.5.2 BRAZIL

- 8.5.2.1 Rising investments in R&D and growing popularity of 3D dental printing to promote market growth

- 8.5.3 MEXICO

- 8.5.3.1 Focus on improving healthcare infrastructure and availability of skilled dentists to drive market

- 8.5.4 ARGENTINA

- 8.5.4.1 Growing demand for personalized dentistry to drive market

- 8.5.5 REST OF LATIN AMERICA

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 GROWING AWARENESS ABOUT DENTAL HYGIENE TO DRIVE MARKET GROWTH

- 8.6.2 MACROECONOMIC OUTLOOK FOR THE MIDDLE EAST & AFRICA

- 8.7 GCC COUNTRIES

- 8.7.1 RISING NUMBER OF CONFERENCES, SUMMITS AND TRAINING COURSES

- 8.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.2.1 OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DENTAL CONSUMABLES MARKET

- 9.3 REVENUE ANALYSIS

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- 9.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.5.5.1 Company footprint

- 9.5.5.2 Region footprint

- 9.5.5.3 Product footprint

- 9.5.5.4 End user footprint

- 9.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- 9.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.6.5.1 Detailed list of key startups/SMEs

- 9.7 COMPANY VALUATION & FINANCIAL METRICS

- 9.7.1 FINANCIAL METRICS

- 9.7.2 COMPANY VALUATION

- 9.8 BRAND/PRODUCT COMPARISON

- 9.9 R&D EXPENDITURE OF KEY PLAYERS

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 PRODUCT LAUNCHES AND APPROVALS

- 9.10.2 DEALS

- 9.10.3 EXPANSIONS

- 9.10.4 OTHER DEVELOPMENTS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 INSTITUT STRAUMANN AG

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses & competitive threats

- 10.1.2 ENVISTA

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches & approvals

- 10.1.2.3.2 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses & competitive threats

- 10.1.3 DENTSPLY SIRONA

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Product launches

- 10.1.3.3.2 Deals

- 10.1.3.4 MnM view

- 10.1.3.4.1 Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses & competitive threats

- 10.1.4 SOLVENTUM

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches

- 10.1.4.3.2 Deals

- 10.1.4.4 MnM view

- 10.1.4.4.1 Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses & competitive threats

- 10.1.5 ZIMVIE INC.

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Product launches

- 10.1.5.3.2 Deals

- 10.1.5.3.3 Expansions

- 10.1.6 HENRY SCHEIN

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches

- 10.1.6.3.2 Deals

- 10.1.6.3.3 Expansions

- 10.1.6.3.4 Other developments

- 10.1.7 KURARAY CO., LTD.

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.7.3.2 Expansions

- 10.1.8 MITSUI CHEMICALS, INC.

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 DEALS

- 10.1.9 SHOFU

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.10 IVOCLAR VIVADENT AG

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Product launches

- 10.1.10.3.2 Deals

- 10.1.1 INSTITUT STRAUMANN AG

- 10.2 OTHER PLAYERS

- 10.2.1 GC CORPORATION

- 10.2.2 KEYSTONE DENTAL GROUP

- 10.2.3 BEGO GMBH & CO. KG

- 10.2.4 SEPTODONT HOLDING

- 10.2.5 ULTRADENT PRODUCTS

- 10.2.6 VOCO GMBH

- 10.2.7 COLTENE GROUP

- 10.2.8 SDI LIMITED

- 10.2.9 YOUNG INNOVATIONS, INC.

- 10.2.10 DMG CHEMISCH-PHARMAZEUTISCHE FABRIK GMBH

- 10.2.11 BRASSELER USA

- 10.2.12 GEISTLICH PHARMA AG

- 10.2.13 SHOFU INC.

- 10.2.14 GLIDEWELL

- 10.2.15 BISCO INC.

- 10.2.16 DENTAL TECHNOLOGIES INC.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS