|

시장보고서

상품코드

1811762

유리섬유 시장 : 제품 유형별, 용도별, 지역별 예측(-2030년)Fiberglass Market by Glass Type (E-Glass, ECR Glass, S-Glass, Others), by Product Type (Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strands, Milled Fibers), Application (Composites, Insulation), and Region - Global Forecast to 2030 |

||||||

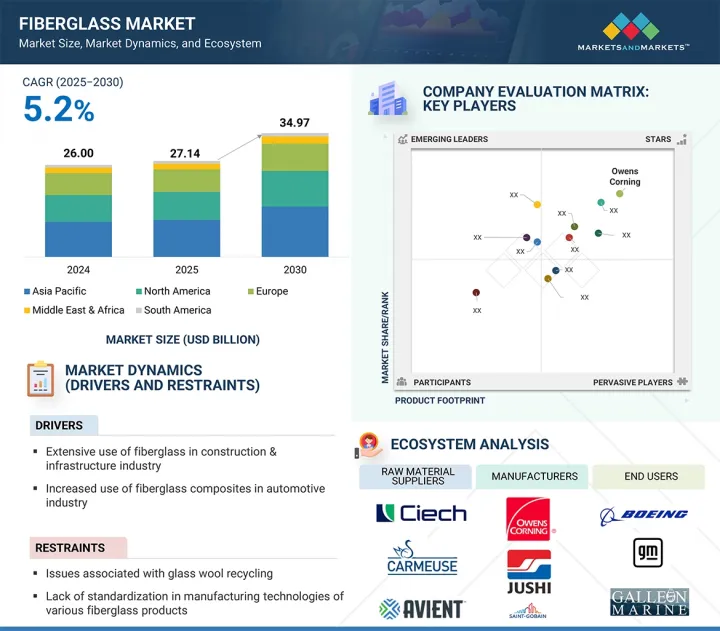

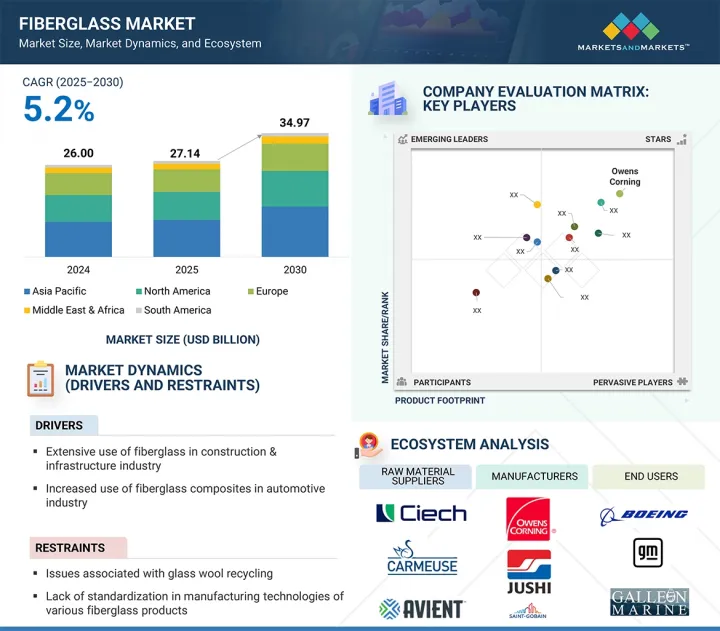

유리섬유 시장 규모는 2025년 271억 4,000만 달러에서 2030년에는 349억 7,000만 달러로 성장하며, 예측 기간 동안 CAGR은 5.2%를 나타낼 것으로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러) 및 킬로톤(KT) |

| 부문 | 유리 유형별, 제품 유형별, 용도별, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동, 아프리카, 남미 |

S-글라스는 뛰어난 강도와 강성으로 알려진 고성능 유리섬유입니다. 섬유화에 의해 용융 유리 풀에서 유리섬유를 꺼내서 제조됩니다. S-글라스는 실리카와 산화마그네슘을 많이 포함하고 있으며, 다른 유리섬유에 비해 우수한 특성을 갖추고 있습니다. 이 고급 소재는 강도와 강성이 중요한 용도로 사용됩니다.

항공우주, 방위, 자동차 등의 산업이 보다 정교한 소재를 요구함에 따라 S-글라스 수요는 증가할 것으로 예측됩니다. S-글라스는 가볍고 강도와 내구성이 뛰어난 복합재료의 제조에 사용됩니다. 이러한 산업이 연비를 향상시키고 배출가스를 줄이기 위해 경량화에 힘을 쏟아 가면서 S-글라스의 사용이 증가할 것으로 보입니다.

유리섬유는 강도와 내구성을 높이기 위해 콘크리트 보강재로 사용됩니다. 유리섬유 보강재는 경량이며 부식에 강하기 때문에 강철보다 선호되는 경우가 많습니다. 또한, 유리섬유 단열재는 일반적으로 단열재를 제공하고 에너지 효율을 높이기 위해 건설에 채택됩니다. 이것은 벽, 바닥, 천장에 쉽게 설치할 수있는 비용 효율적인 옵션입니다. 유리섬유는 상하수도처리시설, 화학처리시설, 석유 및 가스사업 등 다양한 용도의 파이프나 탱크의 제조에도 사용되고 있습니다. 이 유리섬유 파이프 및 탱크는 가볍고 내식성이 뛰어나 수명도 깁니다. 건설 및 인프라 분야에서 유리섬유는 경량, 내구성, 내식성 등 많은 이점을 제공합니다. 이러한 산업이 계속 성장하고 새로운 문제에 직면함에 따라 유리섬유의 사용이 증가할 것으로 예측됩니다.

아시아태평양은 예측 기간 동안 유리섬유 시장에서 가장 빠르게 성장하는 지역으로 예측됩니다. 중국, 인도 및 기타 동남아시아 국가와 같은 국가들은 급속한 산업 성장과 도시 확대를 경험하고 있습니다. 인구 증가와 경제 확대는 다양한 용도에서 유리섬유 복합재 수요 증가를 뒷받침하고 있습니다. 지속 가능한 건축 관행을 지원하기 위한 노력, 새로운 인프라 프로젝트(중국의 '새로운 인프라 계획', 인도의 '스마트 시티 미션' 등), 국내 제조를 우월한 정책이 이 지역 수요를 밀어 올려 생산 능력을 증대시키고 있습니다.

풍력에너지 및 기타 재생 가능 섹터의 성장은 터빈 블레이드 및 기타 부품에 사용되는 유리섬유 복합재 수요를 촉진합니다. 제조 공정을 개선하면 제품 품질이 향상되고 비용이 절감되므로 시장 확대가 더욱 가능해집니다. 건설과 자동차뿐만 아니라 항공우주, 전자, 해양, 스포츠 용품 등의 분야도이 지역의 유리섬유 시장 성장에 기여하고 있습니다.

본 보고서에서는 세계의 유리섬유 시장에 대해 조사했으며, 제품 유형별, 유리 유형별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 공급망 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 기술 분석

- AI/생성형 AI가 유리섬유 시장에 미치는 영향

- 거시경제 전망

- 특허 분석

- 규제 상황

- 주요 컨퍼런스 및 행사(2025-2026년)

- 사례 연구 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 미국 관세의 영향(2025년) - 유리섬유 시장

제6장 유리섬유 시장(제품 유형별)

- 서론

- 유리솜

- 직접 및 조립 로빙

- 원사

- 절단 스트랜드

- 밀링 섬유

제7장 유리섬유 시장(유리 유형별)

- 서론

- E-글라스

- ECR-글라스

- S-글라스

- 기타

제8장 유리섬유 시장(용도별)

- 서론

- 복합재료

- 단열재

제9장 유리섬유 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 러시아

- 스페인

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 인도네시아

- 말레이시아

- 호주

- 기타

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타

- 중동 및 아프리카

- GCC 국가

- 이집트

- 기타

제10장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 수익 분석(2019-2023년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- CHINA JUSHI CO., LTD.

- OWENS CORNING

- SAINT-GOBAIN

- TAISHAN FIBERGLASS INC.(CTG GROUP)

- CHONGQING POLYCOMP INTERNATIONAL CORP.(CPIC)

- NIPPON ELECTRIC GLASS CO., LTD.

- 3B-THE FIBREGLASS COMPANY

- TAIWAN GLASS IND. CORP.

- PFG FIBER GLASS CORPORATION

- JOHNS MANVILLE(A BERKSHIRE HATHWAY COMPANY)

- AGY

- ASAHI FIBERGLASS CO., LTD.

- KNAUF INSULATION

- KCC CORPORATION

- SISECAM

- 기타 기업

- FIBTEX PRODUCTS

- DARSHAN SAFETY ZONE

- JIANGSU CHANGHAI COMPOSITE MATERIALS HOLDING CO., LTD.

- BGF INDUSTRIES

- ARABIAN FIBERGLASS INSULATION CO., LTD.(AFICO)

- SHREE LAXMI UDYOG

- CHONGQING DUJIANG COMPOSITES CO., LTD.(CQFIBERGLASS)

- ENVALIOR

- MONTEX GLASS FIBRE INDUSTRIES PVT. LTD.

제12장 부록

KTH 25.09.19The fiberglass market is expected to grow from USD 27.14 billion in 2025 to USD 34.97 billion by 2030, at a CAGR of 5.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) and volume (kiloton) |

| Segments | Glass Type, Product Type, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

S-glass is a high-performance type of fiberglass known for its exceptional strength and stiffness. It is produced by drawing glass fibers from a molten glass pool through fiberization. S-glass contains a high percentage of silica and magnesium oxide, which gives it superior properties compared to other fiberglass types. This advanced material is used in applications where strength and stiffness are crucial.

As industries like aerospace, defense, and automotive demand more sophisticated materials, the demand for S-glass is expected to increase. S-glass is lightweight and used to create composite materials that are strong and durable. As these industries focus more on lightweighting to boost fuel efficiency and reduce emissions, the use of S-glass is likely to grow.

"In terms of value, the construction & infrastructure end-use industry accounted for the largest share of the overall composite applications segment."

Fiberglass is used as a reinforcement material in concrete to enhance its strength and durability. Fiberglass reinforcement is often favored over steel because it is lightweight and resistant to corrosion. Additionally, fiberglass insulation is commonly employed in construction to provide thermal insulation and boost energy efficiency. It is a cost-effective option that can be easily installed in walls, floors, and ceilings. Fiberglass is also used to manufacture pipes and tanks for various applications, such as water and wastewater treatment plants, chemical processing facilities, and oil and gas operations. These fiberglass pipes and tanks are lightweight, corrosion-resistant, and have a long service life. In the construction and infrastructure sectors, fiberglass offers many advantages, including light weight, durability, and corrosion resistance. As these industries continue to grow and face new challenges, the use of fiberglass is expected to rise.

"The Asia Pacific region is projected to register the highest growth rate in the fiberglass market during the forecast period."

The Asia Pacific is projected to be the fastest-growing region in the fiberglass market during the forecast period. Countries like China, India, and other Southeast Asian nations are experiencing rapid industrial growth and urban expansion. Growing populations and expanding economies drive higher demand for fiberglass composites in various applications. Initiatives supporting sustainable building practices, new infrastructure projects (e.g., China's "New Infrastructure Plan" and India's "Smart Cities Mission"), and policies favoring domestic manufacturing boost demand and increase production capacity in the region.

Growth in wind energy and other renewable sectors fuels demand for fiberglass composites used in turbine blades and other components. Improvements in manufacturing processes enhance product quality and reduce costs, further enabling market expansion. Beyond construction and automotive, sectors like aerospace, electronics, marine, and sports goods also contribute to fiberglass market growth in the region.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group, China), Chongqing Polycomp International Corp. (CPIC, China), Nippon Electric Glass Co., Ltd. (Japan), 3B- The Fiberglass Company (Belgium), Taiwan Glass Ind. Corp. (Taiwan), PFG Fiber Glass Corporation (China), Johns Manville (US), AGY (US), Asahi Fiber Glass Co., Ltd. (Japan), Knauf Insulation (Belgium), KCC Corporation (South Korea), and Sisecam (Turkey).

Research coverage

This research report categorizes the fiberglass market by glass type (E Glass, ECR Glass, S Glass, other glasses), product type (glass wool, direct & assembled roving, yarn, chopped strand, milled fibers), application (composites, insulation), and region. The scope of the report includes detailed information about the major factors influencing the growth of the fiberglass market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the fiberglass market are all covered. This report includes a competitive analysis of upcoming startups in the fiberglass market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall fiberglass market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (extensive use of fiberglass in construction & infrastructure industry and increased use of fiberglass composites in automotive industry), restraints (issues associated with glass wool recycling and lack of standardization in manufacturing technologies), opportunities (increasing number of wind energy capacity installations and increasing demand for composite materials in construction & infrastructure industry in Middle East & Africa), and challenges (capital-intensive production and complex manufacturing process of fiberglass and competition from alternative materials) influencing the growth of the fiberglass market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the fiberglass market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the fiberglass market across several regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the fiberglass market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group, China), Chongqing Polycomp International Corp. (CPIC, China), Nippon Electric Glass Co., Ltd. (Japan), 3B- The Fiberglass Company (Belgium), Taiwan Glass Ind. Corp. (Taiwan), PFG Fiber Glass Corporation (China), Johns Manville (US), AGY (US), Asahi Fiber Glass Co., Ltd. (Japan), Knauf Insulation (Belgium), KCC Corporation (South Korea), and Sisecam (Turkey) in the fiberglass market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN FIBERGLASS MARKET

- 4.2 FIBERGLASS MARKET, BY PRODUCT TYPE AND REGION

- 4.3 FIBERGLASS MARKET, BY GLASS TYPE

- 4.4 FIBERGLASS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Extensive use of fiberglass in construction & infrastructure

- 5.2.1.2 Rising use of fiberglass composites in automotive applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues associated with glass wool recycling

- 5.2.2.2 Lack of standardization in fiberglass manufacturing technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased number of wind energy capacity installations

- 5.2.3.2 Rising demand for composite materials in MEA construction & infrastructure sector

- 5.2.4 CHALLENGES

- 5.2.4.1 Capital-intensive production and complex manufacturing process

- 5.2.4.2 Competition from alternative materials

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 7019)

- 5.8.2 EXPORT SCENARIO (HS CODE 7019)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES (FIBERGLASS MANUFACTURING)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES (FIBERGLASS MANUFACTURING)

- 5.9.2.1 Hand Lay-up and Spray Lay-Up

- 5.10 IMPACT OF AI/GEN AI ON FIBERGLASS MARKET

- 5.10.1 TOP USE CASES AND MARKET POTENTIAL

- 5.10.2 CASE STUDIES OF AI IMPLEMENTATION IN FIBERGLASS MARKET

- 5.11 MACROECONOMIC OUTLOOK

- 5.11.1 INTRODUCTION

- 5.11.2 GDP TRENDS AND FORECAST

- 5.11.3 TRENDS IN AEROSPACE & DEFENSE INDUSTRY

- 5.11.4 TRENDS IN WIND ENERGY INDUSTRY

- 5.11.5 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.11.6 TRENDS IN CONSTRUCTION INDUSTRY

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 PATENT TYPES

- 5.12.3 INSIGHTS

- 5.12.4 LEGAL STATUS

- 5.12.5 JURISDICTION ANALYSIS

- 5.12.6 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1L CHINA JUSHI AIMED TO EXTEND FIBERGLASS PRODUCT OFFERINGS FOR MULTIPLE END-USE INDUSTRIES

- 5.15.2 CASE STUDY 2: OWENS CORNING AND PULTRON COMPOSITES SIGNED AN AGREEMENT TO MANUFACTURE FIBERGLASS REBAR

- 5.15.3 CASE STUDY 3: SAINT-GOBAIN ACQUIRED U.P. TWIGA FIBERGLASS LTD.

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFFS-FIBERGLASS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USER INDUSTRIES

6 FIBERGLASS MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 GLASS WOOL

- 6.2.1 THERMAL INSULATION PROPERTIES DRIVING DEMAND IN RESIDENTIAL CONSTRUCTION

- 6.3 DIRECT & ASSEMBLED ROVINGS

- 6.3.1 HIGH DEMAND FROM CONSTRUCTION, INFRASTRUCTURE, AND WIND ENERGY SEGMENTS

- 6.4 YARNS

- 6.4.1 RISING DEMAND FOR ELECTRONICS AND CONSTRUCTION

- 6.5 CHOPPED STRANDS

- 6.5.1 RISING AUTOMOBILE PRODUCTION IN ASIA PACIFIC AND EUROPE FUELING GROWTH

- 6.6 MILLED FIBERS

- 6.6.1 RISING DEMAND FOR COMPOSITES PROPELLING MARKET GROWTH

7 FIBERGLASS MARKET, BY GLASS TYPE

- 7.1 INTRODUCTION

- 7.2 E-GLASS

- 7.2.1 MOST WIDELY USED GLASS TYPE IN FIBERGLASS MARKET

- 7.3 ECR-GLASS

- 7.3.1 ENHANCED CORROSION RESISTANCE PROPERTIES DRIVING DEMAND

- 7.4 S-GLASS

- 7.4.1 HIGH PERFORMANCE AT ELEVATED TEMPERATURES DRIVES GROWTH IN ADVERSE APPLICATIONS

- 7.5 OTHER GLASSES

8 FIBERGLASS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 COMPOSITES

- 8.2.1 FIBERGLASS COMPOSITES MARKET, BY REGION

- 8.2.2 FIBERGLASS COMPOSITES MARKET, BY END-USE INDUSTRY

- 8.2.2.1 Construction & infrastructure

- 8.2.2.1.1 Tensile strength and strength-to-weight ratio of fiberglass drives adoption

- 8.2.2.2 Automotive

- 8.2.2.2.1 Weight reduction, increased processing speed, and low VOC emissions encourage fiberglass adoption

- 8.2.2.3 Wind energy

- 8.2.2.3.1 High tensile strength of fiberglass composites driving demand in wind turbine blade manufacturing

- 8.2.2.4 Electronics

- 8.2.2.4.1 High thermal resistance and electrical conductivity of fiberglass fueling adoption in electronics applications

- 8.2.2.5 Aerospace

- 8.2.2.5.1 Aerodynamic design flexibility fueling demand in aerospace applications

- 8.2.2.6 Other end-use industries

- 8.2.2.1 Construction & infrastructure

- 8.3 INSULATION

- 8.3.1 FIBERGLASS INSULATION MARKET, BY REGION

- 8.3.2 FIBERGLASS INSULATION MARKET, BY END-USE INDUSTRY

- 8.3.2.1 Residential construction

- 8.3.2.1.1 Rapid urbanization in developing countries is creating demand

- 8.3.2.2 Non-residential construction

- 8.3.2.2.1 Urbanization and rising infrastructural development to drive market

- 8.3.2.3 Industrial applications

- 8.3.2.3.1 High demand for glass wool fiber to manufacture industrial pipes, power plant boilers, and smoke flues

- 8.3.2.4 Other end-use industries

- 8.3.2.1 Residential construction

9 FIBERGLASS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Presence of aerospace and automotive companies driving demand

- 9.2.2 CANADA

- 9.2.2.1 Growing energy sector to support market growth

- 9.2.3 MEXICO

- 9.2.3.1 Rising demand for fiberglass from automotive industry driving growth

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Growth of automotive and aerospace sectors driving demand

- 9.3.2 FRANCE

- 9.3.2.1 France boasts second-largest market for fiberglass due to strong presence of automobile manufacturers

- 9.3.3 UK

- 9.3.3.1 Rising demand for lightweight & high-performance materials

- 9.3.4 ITALY

- 9.3.4.1 Shift towards sustainability propelling demand

- 9.3.5 RUSSIA

- 9.3.5.1 Innovation in fiber-reinforced technologies driving growth

- 9.3.6 SPAIN

- 9.3.6.1 Demand from wind energy sector driving market

- 9.3.7 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Presence of major fiberglass manufacturers fueling market

- 9.4.2 INDIA

- 9.4.2.1 Construction industry fueling demand for fiberglass products

- 9.4.3 JAPAN

- 9.4.3.1 Demand for lightweight composites from automotive industry drives market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of key electronics companies drives demand for fiberglass

- 9.4.5 INDONESIA

- 9.4.5.1 Growing urban population and rising disposable income to drive construction industry and fiberglass demand

- 9.4.6 MALAYSIA

- 9.4.6.1 Growing demand from transportation and aerospace industries

- 9.4.7 AUSTRALIA

- 9.4.7.1 Renewable energy expansion propelling fiberglass demand

- 9.4.8 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growth in automotive industry to fuel fiberglass demand

- 9.5.2 ARGENTINA

- 9.5.2.1 Increased public spending on construction activities to support market growth

- 9.5.3 COLOMBIA

- 9.5.3.1 Rapid urbanization fueling demand

- 9.5.4 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 UAE

- 9.6.1.1.1 Stringent regulations for energy efficiency to propel demand for fiberglass across end-use industries

- 9.6.1.2 Saudi Arabia

- 9.6.1.2.1 Increased investment in infrastructural development driving fiberglass market

- 9.6.1.3 Rest of GCC Countries

- 9.6.1.1 UAE

- 9.6.2 EGYPT

- 9.6.2.1 Increased spending on infrastructure projects driving growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 KEY STRATEGIES ADOPTED BY PLAYERS IN FIBERGLASS MARKET

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 CASICO (BOREALIS GMBH)

- 10.5.2 ACCUREL (EVONIK INDUSTRIES)

- 10.5.3 MULTIBASE (DUPONT)

- 10.5.4 SYNCURE (AVIENT CORPORATION)

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Glass Type footprint

- 10.6.5.4 Product Type footprint

- 10.6.5.5 Application footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CHINA JUSHI CO., LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 OWENS CORNING

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 SAINT-GOBAIN

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TAISHAN FIBERGLASS INC. (CTG GROUP)

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Expansions

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 CHONGQING POLYCOMP INTERNATIONAL CORP. (CPIC)

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 NIPPON ELECTRIC GLASS CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Expansions

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 3B-THE FIBREGLASS COMPANY

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 MnM view

- 11.1.7.3.1 Key strengths

- 11.1.7.3.2 Strategic choices

- 11.1.7.3.3 Weaknesses and competitive threats

- 11.1.8 TAIWAN GLASS IND. CORP.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 MnM view

- 11.1.8.3.1 Key strengths

- 11.1.8.3.2 Strategic choices

- 11.1.8.3.3 Weaknesses and competitive threats

- 11.1.9 PFG FIBER GLASS CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.9.4.1 Key strengths

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 JOHNS MANVILLE (A BERKSHIRE HATHWAY COMPANY)

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.10.4 MnM view

- 11.1.10.4.1 Key strengths

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.11 AGY

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Expansions

- 11.1.11.4 MnM view

- 11.1.11.4.1 Key strengths

- 11.1.11.4.2 Strategic choices

- 11.1.11.4.3 Weaknesses and competitive threats

- 11.1.12 ASAHI FIBERGLASS CO., LTD.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.12.4 MnM view

- 11.1.12.4.1 Key strengths

- 11.1.12.4.2 Strategic choices

- 11.1.12.4.3 Weaknesses and competitive threats

- 11.1.13 KNAUF INSULATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Expansions

- 11.1.13.4 MnM view

- 11.1.13.4.1 Key strengths

- 11.1.13.4.2 Strategic choices

- 11.1.13.4.3 Weaknesses and competitive threats

- 11.1.14 KCC CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 MnM view

- 11.1.14.3.1 Key strengths

- 11.1.14.3.2 Strategic choices

- 11.1.14.3.3 Weaknesses and competitive threats

- 11.1.15 SISECAM

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 MnM view

- 11.1.15.3.1 Key strengths

- 11.1.15.3.2 Strategic choices

- 11.1.15.3.3 Weaknesses and competitive threats

- 11.1.1 CHINA JUSHI CO., LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 FIBTEX PRODUCTS

- 11.2.2 DARSHAN SAFETY ZONE

- 11.2.3 JIANGSU CHANGHAI COMPOSITE MATERIALS HOLDING CO., LTD.

- 11.2.4 BGF INDUSTRIES

- 11.2.5 ARABIAN FIBERGLASS INSULATION CO., LTD. (AFICO)

- 11.2.6 SHREE LAXMI UDYOG

- 11.2.7 CHONGQING DUJIANG COMPOSITES CO., LTD. (CQFIBERGLASS)

- 11.2.8 ENVALIOR

- 11.2.9 MONTEX GLASS FIBRE INDUSTRIES PVT. LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS