|

시장보고서

상품코드

1816004

농업 IoT 시장 : 자동화 및 제어 시스템, 센싱 및 모니터링 디바이스, 가변 레이트 컨트롤러, RFID 태그 및 리더, LED 재배 조명, HVAC 시스템, 관개 시스템, 예측(-2030년)Agriculture IoT Market by Automation & Control Systems (Drones/UAVs, Guidance & Steering), Sensing & Monitoring Devices, Variable Rate Controllers, RFID Tags & Readers, LED Grow Lights, HVAC Systems, Irrigation Systems Global Forecast to 2030 |

||||||

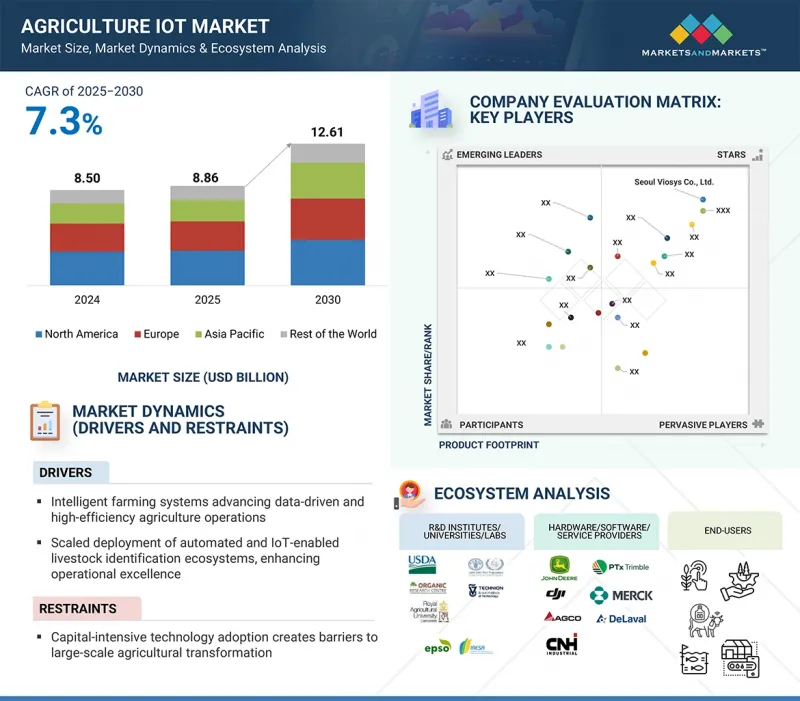

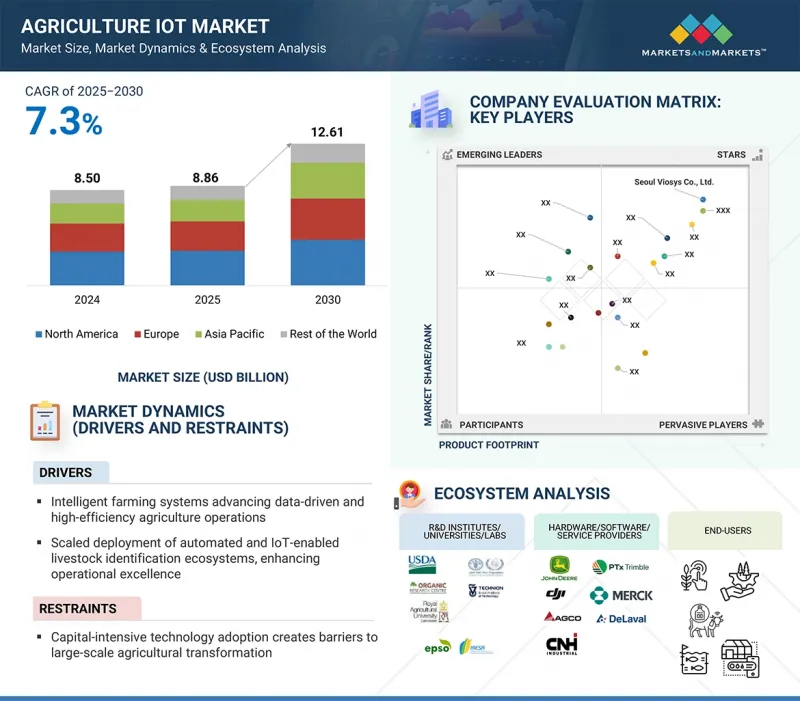

세계의 농업 IoT 시장 규모는 2025년에 88억 6,000만 달러, 2030년까지 126억 1,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR은 7.3%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 하드웨어, 농장 규모, 농장 생산 계획, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

농업 IoT의 성장은 정밀 농업, 실시간 모니터링, 자동화에 대한 수요 증가, 정부의 이니셔티브, 무선 연결의 발전, 식량 수요 증가에 지속적으로 대응하기 위한 자원 최적화에 대한 요구가 뒷받침하고 있습니다.

"자동화 및 제어 시스템 부문은 예측 기간 동안 더 높은 CAGR로 성장할 것으로 예측됩니다. "

자동화 및 제어 시스템은 드론/UAV, 스마트 관개 컨트롤러, GPS 기반 가이던스, 조향 시스템 등 첨단 자동화 도구의 채택이 증가함에 따라 예측 기간 동안 농업 IoT 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 지속 가능한 농업과 효율적인 자원 관리에 대한 관심이 높아지면서 이러한 기술의 통합이 가속화되고 있습니다. 또한, 정부의 강력한 지원과 주요 기업의 지속적인 연구개발 및 혁신이 시장 확대를 촉진하고 있습니다. 주요 농업 기술 제조업체의 존재와 커넥티드 기계의 사용 확대는 농업 IoT를 전 세계 농업 혁신의 주요 촉진요인으로 만들고 있습니다.

"RFID 태그 및 리더기 부문은 예측 기간 동안 농업 IoT 시장에서 큰 비중을 차지할 것으로 예측됩니다. "

RFID 태그 및 리더기 부문은 실시간 가축 추적 기능, 효율적인 가축 관리에 대한 수요 증가, 목초지 모니터링 및 자동 사료 공급 시스템에서의 채택 확대로 인해 예측 기간 동안 농업 IoT 시장에서 큰 비중을 차지할 것으로 예측됩니다. RFID 태그 리더를 통해 농가는 가축의 건강 상태, 행동, 위치를 모니터링하여 최적의 생산성과 질병 관리를 보장할 수 있습니다. 정확하고 화학물질을 사용하지 않는 가축 식별에 대한 수요는 이러한 솔루션이 기존의 수작업에 대한 보다 안전하고 지속 가능한 대안을 제공한다는 점에서 채택을 가속화하고 있습니다. 또한, GPS, IoT 플랫폼, 자동 계량 시스템과의 통합은 컴팩트한 크기, 데이터 정확도, 사용 편의성으로 인해 증가하고 있습니다. 이러한 특징은 신뢰할 수 있고 효율적인 가축 관리를 보장하며, 다양한 농업 분야에서 RFID 기술의 채택을 확대하는 데 기여하고 있습니다.

"중국이 예측 기간 동안 농업 IoT 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

중국의 이러한 성장은 농업을 현대화하고 식량 안보를 향상시키기 위한 정부의 이니셔티브에 힘입어 스마트 농업 솔루션의 빠른 채택에 기인합니다. 최적화된 비료, 농약, 물 관리에 대한 수요 증가와 더불어 정밀 농법의 사용 증가가 IoT의 도입을 촉진하고 있습니다. 센서, 드론, GPS 등의 첨단 기술은 작물 수확량을 향상시키고, 환경에 미치는 영향을 줄이며, 현장에 맞는 투입물 활용을 가능하게 합니다. 이러한 요인과 중국의 지속 가능한 자원 관리 및 디지털 농업 정책에 대한 집중은 채택을 크게 가속화하여 중국의 강력한 시장 성장에 기여하고 있습니다.

세계의 농업 IoT 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 농업 IoT 시장 기업에 있어서 매력적인 기회

- 정밀농업용 농업 IoT 시장 : 하드웨어 유형별

- 정밀농업용 농업 IoT 시장 : 지역별

- 가축 모니터링 하드웨어용 농업 IoT 시장 : 유형별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 결정 분석

- 농업 IoT 드론/UAV 가격 동향 : 주요 기업별(2024년)

- 드론/UAV 평균 판매 가격 동향 : 지역별(2021년-2024년)

- 드론/UAV 평균 판매 가격 동향 : 지역별(2021년-2024년)

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 무역 분석

- 수입 데이터(HS코드 843280)

- 수출 데이터(HS코드 843280)

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- 관세 분석

- 규제기관, 정부기관 및 기타 조직

- 규제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 농업 IoT 시장에 대한 AI/생성형 AI의 영향

- 농업 IoT 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 대한 영향

- 용도에 대한 영향

제6장 농업 IoT 시장 : 하드웨어별

- 서론

- 정밀농업 하드웨어

- 가축 모니터링 하드웨어

- 정밀 임업 하드웨어

- 정밀 양식 하드웨어

- 스마트 온실 하드웨어

- 기타 하드웨어

제7장 농업 IoT 시장 : 용도별

- 서론

- 정밀 농업

- 가축 모니터링

- 정밀 임업

- 정밀 양식

- 스마트 그린 하우스

- 기타 용도

제8장 농업 IoT 시장 : 농장 생산 계획별

- 서론

- 생산 전

- 생산

- 생산 후

제9장 농업 IoT 시장 : 농장 규모별

- 서론

- 소

- 중

- 대

제10장 농업 IoT 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 네덜란드

- 폴란드

- 북유럽

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 호주

- 인도

- 한국

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 남미

- 중동

- 아프리카

제11장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점(2020년-2025년)

- 시장 점유율 분석(2024년)

- 매출 분석(2021년-2024년)

- 기업 평가와 재무 지표(2025년)

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- DEERE & COMPANY

- AGCO CORPORATION

- RAVEN INDUSTRIES, INC.

- DELAVAL

- MERCK & CO., INC.

- AKVA GROUP

- KUBOTA CORPORATION

- INNOVASEA SYSTEMS INC.

- TOPCON

- SCALEAQ

- 기타 기업

- TEEJET TECHNOLOGIES

- DICKEY-JOHN

- DJI

- AGEAGLE AERIAL SYSTEMS INC

- HEXAGON AGRICULTURE

- FARMERS EDGE

- ARGUS CONTROL SYSTEMS LIMITED

- EC2CE

- AGRI SPRAY DRONES

- CROPX INC.

- ERUVAKA TECHNOLOGIES

- TEKTELIC COMMUNICATIONS INC.

- ORBCOMM

- GROWFLUX

- PRIVA

제13장 부록

LSH 25.09.25The agriculture IoT market is expected to be valued at USD 8.86 billion in 2025 and is projected to reach USD 12.61 billion by 2030; it is expected to register a CAGR of 7.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By hardware, farm size, farm production planning, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of agriculture IoT is driven by rising demand for precision farming, real-time monitoring, and automation, supported by government initiatives, wireless connectivity advancements, and the need for resource optimization to meet increasing food demand sustainably.

"Automation & control systems segment is expected to grow at a higher CAGR during the forecast period."

The automation & control systems are expected to witness the highest CAGR in the agriculture IoT market during the forecast period due to rising adoption of advanced automation tools such as drones/UAVs, smart irrigation controllers, GPS-based guidance, and steering systems. Increasing focus on sustainable farming and efficient resource management has accelerated the integration of these technologies. Additionally, strong government support, coupled with ongoing R&D and innovations by key players, is boosting market expansion. The presence of leading agri-tech manufacturers and the growing use of connected machinery are positioning agriculture IoT as a major driver of global farming transformation.

"RFID tags & readers segment is expected to hold a significant share of the agriculture IoT market during the forecast period."

RFID tags & readers segment is expected to hold a significant share of the agriculture IoT market during the forecast period due to their ability to enable real-time livestock tracking, rising demand for efficient herd management, and growing adoption in pasture monitoring and automated feeding systems. RFID tags & readers allow farmers to monitor animal health, behavior, and location, ensuring optimal productivity and disease control. The demand for accurate and chemical-free livestock identification is accelerating adoption, as these solutions offer a safer and more sustainable alternative to traditional manual methods. Furthermore, integration with GPS, IoT platforms, and automated weighing systems is increasing due to their compact size, data accuracy, and ease of use. These features ensure reliable and efficient livestock management, contributing to the growing adoption of RFID technology in diverse agricultural applications.

"China is expected to register the highest CAGR in the agriculture IoT market during the forecast period."

China is expected to register the highest CAGR in the agriculture IoT market during the forecast period. This growth in China is driven by the rapid adoption of smart farming solutions, supported by government initiatives to modernize agriculture and improve food security. Increasing use of precision farming practices, coupled with strong demand for optimized fertilizer, pesticide, and water management, is fueling IoT adoption. Advanced technologies such as sensors, drones, and GPS are enabling site-specific input applications that enhance crop yield and reduce environmental impact. These factors, along with China's focus on sustainable resource management and digital agriculture policies, are significantly accelerating adoption and contributing to the country's strong market growth.

Extensive primary interviews were conducted with key industry experts in the agriculture IoT market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type- Tier 1 - 20%, Tier 2 - 35%, Tier 3 - 45%

- By Designation- C-level Executives - 35%, Directors - 25%, Others - 40%

- By Reion- North America- 45%, Europe - 25%, Asia Pacific - 20%, and RoW - 10%

The agriculture IoT market is dominated by a few globally established players, such as Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), DeLaval (Sweden), Merck & Co., Inc. (US).

The study includes an in-depth competitive analysis of these key players in the agriculture IoT market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the agriculture IoT market and forecasts its size by application (Precision farming, precision forestry, smart greenhouse, livestock monitoring, precision aquaculture, other applications), hardware (Precision farming hardware, precision forestry hardware, livestock monitoring hardware, precision aquaculture hardware, smart greenhouse hardware, other agriculture hardware), farm size (Small farms, medium- sized farms, large farms), Farm Production Planning (Pre-production planning, production planning, post-production planning). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across Region (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the agriculture IoT ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Intelligent Farming Systems Advancing Data-Driven and High-Efficiency Agriculture Operations, Scaled Deployment of Automated and IoT-Enabled Livestock Identification Ecosystems Enhancing Operational Excellence, Robust Policy Frameworks and Regulatory Tailwinds Catalyzing AgriTech Expansion), restraint (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations), opportunities (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations), challenges (Capital-Intensive Technology Adoption Creating Barriers to Large-Scale Agricultural Transformation, Talent and Capability Gaps Hindering Advanced Farming Technology Deployment at Scale, Sustainability Risks Arising from Environmental Durability Limitations in Agricultural Innovations)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the agriculture IoT market

- Market Development: Comprehensive information about lucrative markets - the report analyses the agriculture IoT market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the agriculture IoT market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the agriculture IoT market, such as Deere & Company (US), AGCO Corporation (US), Raven Industries, Inc. (US), DeLaval (Sweden), and Merck & Co., Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH DATA

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Breakdown of primaries

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURE IOT MARKET

- 4.2 AGRICULTURE IOT MARKET FOR PRECISION FARMING, BY HARDWARE TYPE

- 4.3 AGRICULTURE IOT MARKET FOR PRECISION FARMING APPLICATION, BY REGION

- 4.4 AGRICULTURE IOT MARKET FOR LIVESTOCK MONITORING HARDWARE, BY TYPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advances in digital technologies, automation, and data analytics

- 5.2.1.2 Adoption of automation technology and IoT-enabled devices

- 5.2.1.3 Regulations focusing on agriculture digitization, building data infrastructure, and adopting climate-responsive budgeting

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront capital expenditure

- 5.2.2.2 Lack of technical expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of VRA technology

- 5.2.3.2 Shift toward hyper-localized and data-validated decision making

- 5.2.3.3 Advent of nanotechnology in precision agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns regarding agricultural data privacy

- 5.2.4.2 Limited digital infrastructure in rural areas

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING TREND OF AGRICULTURE IOT DRONES/UAVS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF DRONES/UAVS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Satellite imaging & GPS

- 5.7.1.2 Agricultural drones

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Blockchain technology

- 5.7.2.2 Digital twin

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Climate tech & agri-climate modeling

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA (HS CODE 843280)

- 5.9.2 EXPORT DATA (HS CODE 843280)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SYNGENTA ADVANCES PRECISION FARMING WITH SATELLITE INSIGHTS VIA PLANET LABS PBC PARTNERSHIP

- 5.11.2 TELNYX IOT SENSORS OPTIMIZE FRUIT YIELD AND MINIMIZE WASTE THROUGH REAL-TIME DATA IN AGRICULTURE

- 5.11.3 FARMONAUT TECHNOLOGIES PVT. LTD. EMPOWERS CALIFORNIA AGRICULTURE WITH DRONE-ENABLED PRECISION FARMING FOR ENHANCED CROP HEALTH AND EFFICIENCY

- 5.11.4 PRECISION AGRICULTURE ENHANCES COTTON YIELDS IN PARBHANI THROUGH DIGITAL INNOVATION

- 5.11.5 DJI AGRAS T40 TRANSFORMS SUGARCANE WEED MANAGEMENT

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON AGRICULTURE IOT MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF ON AGRICULTURE IOT MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 AGRICULTURE IOT MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- 6.2 PRECISION FARMING HARDWARE

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.2.1.1 Drones/UAVs

- 6.2.1.1.1 Ability to offer aerial data for crop health assessment to boost demand

- 6.2.1.2 Irrigation controllers

- 6.2.1.2.1 Limited water availability and depleted aquifers to foster segmental growth

- 6.2.1.3 GPS/GNSS trackers

- 6.2.1.3.1 Increasing demand for precise navigation and positioning for farming equipment to fuel market growth

- 6.2.1.4 Guidance & steering

- 6.2.1.4.1 Growing pressure to cut fuel and input costs to boost demand

- 6.2.1.5 Other automation & control systems

- 6.2.1.1 Drones/UAVs

- 6.2.2 SENSING & MONITORING DEVICES

- 6.2.2.1 Yield monitors

- 6.2.2.1.1 Rising demand for real-time data on crop yields and moisture content during harvest to boost demand

- 6.2.2.2 Soil sensors

- 6.2.2.2.1 Increasing need to monitor moisture, temperature, and pH to foster market growth

- 6.2.2.3 Climate sensors

- 6.2.2.3.1 Rising frequency of extreme weather events to fuel market growth

- 6.2.2.4 Water sensors

- 6.2.2.4.1 Need for efficient water management and reduced water waste to boost demand

- 6.2.2.1 Yield monitors

- 6.2.1 AUTOMATION & CONTROL SYSTEMS

- 6.3 LIVESTOCK MONITORING HARDWARE

- 6.3.1 RFID TAGS & READERS

- 6.3.1.1 Need to monitor livestock behavior and health to boost demand

- 6.3.2 SENSORS

- 6.3.2.1 Growing need to track animals' location, temperature, and blood pressure to drive market

- 6.3.3 CAMERAS

- 6.3.3.1 Integration with AI to offer lucrative growth opportunities

- 6.3.4 GPS TRACKERS

- 6.3.4.1 Ability to track spatial movements and activities to fuel market growth

- 6.3.1 RFID TAGS & READERS

- 6.4 PRECISION FORESTRY HARDWARE

- 6.4.1 HARVESTERS & FORWARDERS

- 6.4.1.1 Increasing demand for efficient harvesting and transportation of trees to fuel market growth

- 6.4.2 UAVS/DRONES

- 6.4.2.1 Government-led initiatives for reforestation to support segmental growth

- 6.4.3 GPS TRACKERS

- 6.4.3.1 Ability to provide real-time sub-meter or centimeter-level positioning to boost demand

- 6.4.4 CAMERAS

- 6.4.4.1 Advancements and reduced costs of imaging sensors to support market growth

- 6.4.5 RFID SENSORS

- 6.4.5.1 Increasing demand for growth and health data of trees and environmental conditions to drive market

- 6.4.6 VARIABLE RATE CONTROLLERS

- 6.4.6.1 Integration with advanced ground-based machinery to offer lucrative growth opportunities

- 6.4.7 OTHER PRECISION FORESTRY HARDWARE

- 6.4.1 HARVESTERS & FORWARDERS

- 6.5 PRECISION AQUACULTURE HARDWARE

- 6.5.1 SENSORS

- 6.5.1.1 Enhanced fish health and optimized production processes to drive market

- 6.5.1.2 Temperature & environmental monitoring devices

- 6.5.1.3 pH & dissolved oxygen sensors

- 6.5.1.4 Electricity conductivity sensors

- 6.5.2 CAMERAS

- 6.5.2.1 Need to monitor feeding response, feeding rates, and fish behavior to boost demand

- 6.5.3 CONTROL SYSTEMS

- 6.5.3.1 Streamlined management of camera operations to drive market

- 6.5.4 OTHER PRECISION FORESTRY HARDWARE

- 6.5.1 SENSORS

- 6.6 SMART GREENHOUSE HARDWARE

- 6.6.1 HVAC SYSTEMS

- 6.6.1.1 Rising demand for sustainable and cost-effective agricultural practices to fuel market growth

- 6.6.2 LED GROW LIGHTS

- 6.6.2.1 Ability to offer enhanced crop yields to foster market growth

- 6.6.3 IRRIGATION SYSTEMS

- 6.6.3.1 Growing emphasis on sustainable water management to drive market

- 6.6.4 CONTROL SYSTEMS

- 6.6.4.1 Minimized environmental fluctuations and reduced crop damage risks to boost demand

- 6.6.5 SENSORS & CAMERAS

- 6.6.5.1 Reduced farming costs and time to boost demand

- 6.6.1 HVAC SYSTEMS

- 6.7 OTHER HARDWARE

7 AGRICULTURE IOT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PRECISION FARMING

- 7.2.1 GROWING NEED TO OPTIMIZE AGRICULTURAL PRODUCTION TO DRIVE MARKET

- 7.2.2 YIELD MONITORING

- 7.2.2.1 On-farm yield monitoring

- 7.2.2.2 Off-farm yield monitoring

- 7.2.3 CROP SCOUTING

- 7.2.4 FIELD MAPPING

- 7.2.4.1 Boundary mapping

- 7.2.4.2 Drainage mapping

- 7.2.5 VARIABLE RATE APPLICATION

- 7.2.5.1 Precision irrigation

- 7.2.5.2 Precision seeding

- 7.2.5.3 Precision fertilization

- 7.2.5.4 Pesticide VRA

- 7.2.6 WEATHER TRACKING & FORECASTING

- 7.2.6.1 Inventory management

- 7.2.6.2 Farm labor management

- 7.2.6.3 Financial management

- 7.2.7 OTHER PRECISION FARMING APPLICATIONS

- 7.3 LIVESTOCK MONITORING

- 7.3.1 RISING EMPHASIS ON ENHANCING FARM ANIMALS' HEALTH AND PRODUCTIVITY TO FUEL MARKET GROWTH

- 7.3.2 MILK HARVESTING MANAGEMENT

- 7.3.3 FEEDING MANAGEMENT

- 7.3.4 BEHAVIOR MONITORING & CONTROL

- 7.3.5 OTHER LIVESTOCK MONITORING APPLICATIONS

- 7.4 PRECISION FORESTRY

- 7.4.1 INTEGRATION WITH REMOTE SENSING DATA TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.4.2 GENETICS & NURSERIES

- 7.4.3 SILVICULTURE & FIRE MANAGEMENT

- 7.4.4 HARVESTING MANAGEMENT

- 7.4.5 INVENTORY & LOGISTICS MANAGEMENT

- 7.5 PRECISION AQUACULTURE

- 7.5.1 GROWING APPLICATION OF ADVANCED TECHNOLOGY AND DATA ANALYTICS TO DRIVE MARKET

- 7.5.2 FEEDING MANAGEMENT

- 7.5.3 MONITORING, CONTROL, & SURVEILLANCE

- 7.5.4 OTHER PRECISION AQUACULTURE APPLICATIONS

- 7.6 SMART GREENHOUSE

- 7.6.1 RISING NEED TO REGULATE CRITICAL ENVIRONMENTAL FACTORS TO FUEL SEGMENTAL GROWTH

- 7.6.2 HVAC MANAGEMENT

- 7.6.3 YIELD MONITORING & HARVESTING

- 7.6.4 WATER & FERTILIZER MANAGEMENT

- 7.6.5 OTHER SMART GREENHOUSE APPLICATIONS

- 7.7 OTHER APPLICATIONS

8 AGRICULTURE IOT MARKET, BY FARM PRODUCTION PLANNING

- 8.1 INTRODUCTION

- 8.2 PRE-PRODUCTION

- 8.2.1 NEED TO ANALYZE SOIL MOISTURE AND NUTRIENT LEVELS TO BOOST DEMAND

- 8.3 PRODUCTION

- 8.3.1 REDUCED DOWNTIME DURING HARVESTING PERIOD TO FOSTER MARKET GROWTH

- 8.4 POST-PRODUCTION

- 8.4.1 RISING DEMAND FOR ON-TIME DELIVERY WHILE REDUCING FUEL COSTS TO DRIVE MARKET

9 AGRICULTURE IOT MARKET, BY FARM SIZE

- 9.1 INTRODUCTION

- 9.2 SMALL

- 9.2.1 RISE OF PLUG-AND-PLAY IOT KITS AND PAY-AS-YOU-GO SERVICE MODELS TO DRIVE MARKET

- 9.3 MEDIUM

- 9.3.1 INCREASING ADOPTION OF PREDICTIVE ANALYTICS TO MANAGE CROP CYCLES TO FUEL MARKET GROWTH

- 9.4 LARGE

- 9.4.1 DEPLOYMENT OF COMPREHENSIVE SENSOR NETWORKS FOR SOIL, WEATHER, AND CROP HEALTH MONITORING TO FOSTER MARKET GROWTH

10 AGRICULTURE IOT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Emphasis on advancing engineering and agronomy practices to boost demand

- 10.2.2.2 Canada

- 10.2.2.2.1 Growing demand for advanced livestock identification and monitoring solutions to foster market growth

- 10.2.2.3 Mexico

- 10.2.2.3.1 Government-backed financial support to encourage adoption of agriculture IoT technologies to fuel market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing funding to improve livestock farming practices to drive market

- 10.3.3 UK

- 10.3.3.1 Strong political and commercial support for precision farming to fuel market growth

- 10.3.4 FRANCE

- 10.3.4.1 Growing need for environmental conservation to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Financial aid for farmers to invest in modern technologies to fuel market growth

- 10.3.6 NETHERLANDS

- 10.3.6.1 Emphasis on standardizing agricultural practices across different technologies to drive market

- 10.3.7 POLAND

- 10.3.7.1 Focus on complying with EU standards and offering cost-effective solutions to drive market

- 10.3.8 NORDICS

- 10.3.8.1 Strong commitment to environmental sustainability to drive market

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Shift from subsistence farming to market-oriented model to offer lucrative growth opportunities

- 10.4.3 JAPAN

- 10.4.3.1 Expanding aging population to boost demand

- 10.4.4 AUSTRALIA

- 10.4.4.1 Emphasis on obtaining data-driven decisions to improve field productivity to fuel market growth

- 10.4.5 INDIA

- 10.4.5.1 Emergence of startups that support site-specific management of agriculture and livestock to drive market

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing investments in aquaculture industry to support market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Rising popularity of agritech platforms with affordable and IoT-driven services to fuel market growth

- 10.4.8 MALAYSIA

- 10.4.8.1 Growing adoption of smart farming technologies to foster market growth

- 10.4.9 THAILAND

- 10.4.9.1 Increasing application of drones for crop monitoring and precision spraying to drive market

- 10.4.10 VIETNAM

- 10.4.10.1 Deployment of sensor networks to monitor water quality to support market growth

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Brazil

- 10.5.2.1.1 Presence of fertile soil and skilled labor to favor market growth

- 10.5.2.2 Argentina

- 10.5.2.2.1 Relaxed government export regulations and production innovations to boost demand

- 10.5.2.3 Rest of South America

- 10.5.2.1 Brazil

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Bahrain

- 10.5.3.1.1 Growing popularity of vertical farming and hydroponics to drive market

- 10.5.3.2 Kuwait

- 10.5.3.2.1 Increasing investment in plant and protein production to boost demand

- 10.5.3.3 Oman

- 10.5.3.3.1 Emphasis on achieving long-term food security and sustainability to offer lucrative growth opportunities

- 10.5.3.4 Qatar

- 10.5.3.4.1 Adoption of smart agriculture technologies to drive market

- 10.5.3.5 Saudi Arabia

- 10.5.3.5.1 Increasing investments to boost sustainable food production to drive market

- 10.5.3.6 UAE

- 10.5.3.6.1 Growing focus on commercializing technologies for arid climates to fuel market growth

- 10.5.3.7 Rest of Middle East

- 10.5.3.1 Bahrain

- 10.5.4 AFRICA

- 10.5.4.1 South Africa

- 10.5.4.1.1 Rising need to optimize irrigation and manage crop health to drive market

- 10.5.4.2 Rest of Africa

- 10.5.4.1 South Africa

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2021-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Farm production planning footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 Farm size footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DEERE & COMPANY

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 AGCO CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 RAVEN INDUSTRIES, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 DELAVAL

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 MERCK & CO., INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 AKVA GROUP

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.6.3.3 Other developments

- 12.1.7 KUBOTA CORPORATION

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 INNOVASEA SYSTEMS INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.9 TOPCON

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 SCALEAQ

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 DEERE & COMPANY

- 12.2 OTHER PLAYERS

- 12.2.1 TEEJET TECHNOLOGIES

- 12.2.2 DICKEY-JOHN

- 12.2.3 DJI

- 12.2.4 AGEAGLE AERIAL SYSTEMS INC

- 12.2.5 HEXAGON AGRICULTURE

- 12.2.6 FARMERS EDGE

- 12.2.7 ARGUS CONTROL SYSTEMS LIMITED

- 12.2.8 EC2CE

- 12.2.9 AGRI SPRAY DRONES

- 12.2.10 CROPX INC.

- 12.2.11 ERUVAKA TECHNOLOGIES

- 12.2.12 TEKTELIC COMMUNICATIONS INC.

- 12.2.13 ORBCOMM

- 12.2.14 GROWFLUX

- 12.2.15 PRIVA

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS