|

시장보고서

상품코드

1819098

불화알루미늄(AlF3) 시장 : 제품 유형별, 벌크 밀도별, 형상별, 등급별, 용도별, 최종 이용 산업별 - 예측(-2030년)Aluminum Fluoride Market by Product Type, Bulk Density, Form, Grade, Application, End-use Industry - Global Forecast to 2030 |

||||||

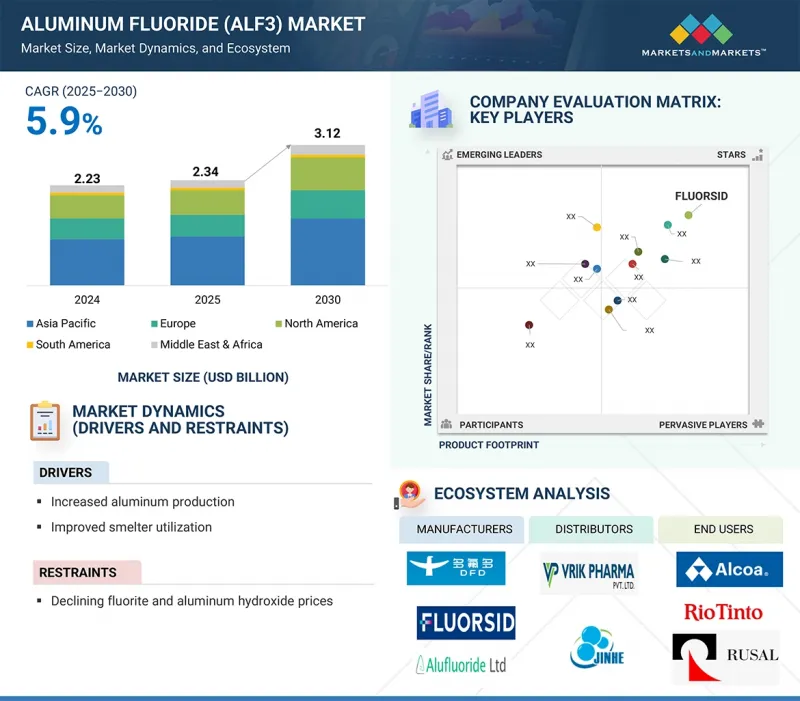

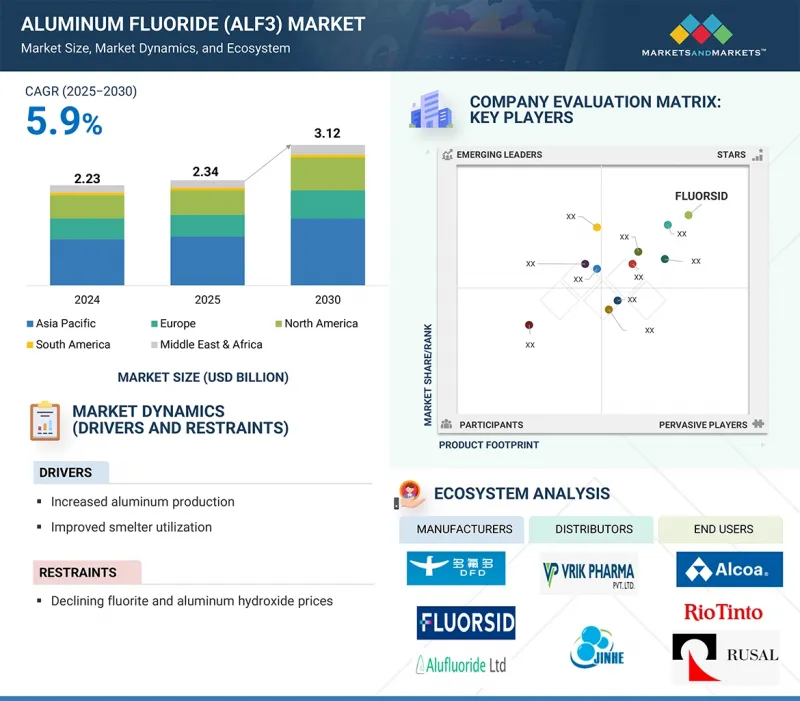

세계의 불화알루미늄(AlF3) 시장 규모는 2025년 23억 4,000만 달러에서 2030년까지 31억 2,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 5.9%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러, 킬로톤 |

| 부문 | 제품 유형, 벌크 밀도, 형상, 등급, 용도, 최종 이용 산업, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

AlF3는 안정적인 전해 공정을 유지하는 데 필수적인 역할로 인해 전 세계 알루미늄 생산량이 계속 증가함에 따라 수요가 증가하고 있습니다. 제련업체들은 자동차, 건설, 대량 생산 부문의 알루미늄 수요 증가에 대응하기 위해 생산능력을 확대하고 있습니다.

각각의 새로운 전해조 열과 생산시설이 효율적으로 가동되기 위해서는 AlF3의 안정적인 공급이 필요하며, AlF3의 소비는 알루미늄 생산과 직결됩니다. 또한, 구식 제련소의 현대화로 인해 공정의 신뢰성을 향상시키고 경영 중단을 줄이기 위해 고성능 AlF3 등급의 사용이 증가하고 있습니다. 특히 신흥 경제권에서 알루미늄 생산의 지리적 분포가 확대됨에 따라 새로운 시설이 대량의 안정적인 AlF3 공급에 크게 의존하기 때문에 수요를 더욱 증가시키고 있습니다.

"무수 불화 알루미늄(AlF3) 시장은 예측 기간 동안 금액 기준으로 가장 빠르게 성장하는 제품 유형이 될 것입니다."

무수 AlF3가 가장 빠르게 성장하는 제품 유형으로 부상하고 있는 것은 청정 투입과 환경 부하 감소를 중시하는 최신 제련 작업의 변화하는 요구에 부응하기 때문입니다. 수화 형태와 달리 무수 AlF3는 셀의 안정성을 약화시키고 에너지 소비를 증가시키는 수분 방출과 관련된 문제를 피할 수 있습니다. 건조된 형태는 고농도, 경량으로 보다 정확한 투약, 더 나은 핸들링, 운송 비용 절감을 가능하게 합니다. 또한, 고급 제련소에서는 자동 공급 시스템의 사용이 증가하고 있으며, 안정적인 흐름과 균일한 분배를 제공하는 무수 재료가 선호되고 있습니다. 이러한 경영상의 이점 외에도 대규모 제련소에서는 투입물 관리를 강화하는 추세에 따라 무수 AlF3는 선호되는 선택이며, 전 세계적으로 빠르게 채택되고 있습니다.

"부피 밀도(HBD)는 예측 기간 동안 불화알루미늄(AlF3) 시장에서 금액 기준으로 가장 빠르게 성장하는 부문이 될 것입니다."

고밀도 AlF3가 가장 빠르게 성장하고 있는 이유는 알루미늄 산업의 대규모 에너지 집약적 제련 작업으로의 전환에 부합하기 때문입니다. 전해조가 대형화되고 더 엄격한 효율 기준에 따라 운영됨에 따라 제련업체들은 안정적인 전력 공급을 보장하고 성능의 편차를 최소화하는 재료를 점점 더 선호하고 있습니다. 부피 밀도가 높은 AlF3는 우수한 유동 특성을 제공하므로 자동 공급 시스템이 더 높은 정확도로 작동하여 막힘이나 일관성 없는 투약의 위험을 줄입니다. 이를 통해 전류 효율이 향상되고, 제조업체의 중요한 비용 요소인 전해조 수명을 연장할 수 있습니다. 또한, 운송량 감소 및 컨테이너 가동률 향상과 같은 물류상의 이점을 통해 세계 공급망에서 경쟁력을 강화할 수 있습니다. 이러한 기술적, 경제적 시너지 효과가 급속한 보급을 촉진하고 있습니다.

"분말은 예측 기간 동안 불화알루미늄(AlF3) 시장에서 금액 기준으로 가장 빠르게 성장하는 형태 부문이 될 것입니다."

AlF3의 분말 형태는 다재다능하고 최신 알루미늄 제련 공정에 쉽게 통합할 수 있어 벌크 밀도에서 가장 빠르게 성장하고 있는 분야입니다. 미립자이기 때문에 용해가 빠르고 전해조 내 분포가 균일하여 제련소의 안정적 가동과 전류 효율 향상에 기여합니다. 또한, 분말 AlF3는 입상보다 고급 취급 장비가 덜 필요하기 때문에 소규모 또는 중간 규모의 제련 장비가 일반적인 지역에서 점점 더 선호되고 있습니다. 또한, 분말을 가방이나 벌크 용기에 효율적으로 포장할 수 있고 취급 비용이 저렴하다는 점에서 연포장 및 운송 솔루션에 대한 중요성이 강조되고 있는 것도 그 사용을 촉진하고 있습니다. 분말 AlF3는 다양한 제련 환경에 대응할 수 있는 범용성과 기존 기술 및 신기술과의 호환성으로 인해 최근 가장 빠르게 성장하고 있는 분야입니다.

세계의 불화알루미늄(AlF3) 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 불화알루미늄(AlF3) 시장의 매력적인 기회

- 불화알루미늄(AlF3) 시장 : 제품 유형별

- 불화알루미늄(AlF3) 시장 : 벌크 밀도별

- 불화알루미늄(AlF3) 시장 : 형상별

- 불화알루미늄(AlF3) 시장 : 등급별

- 불화알루미늄(AlF3) 시장 : 용도별

- 불화알루미늄(AlF3) 시장 : 최종 이용 산업별

- 불화알루미늄(AlF3) 시장 : 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 생성형 AI

- 소개

- 불화알루미늄(AlF3) 시장에 대한 영향

제6장 산업 동향

- 소개

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 투자 상황과 자금 조달 시나리오

- 가격 책정 분석

- 불화알루미늄(AlF3) 평균판매가격 : 지역별(2021-2024년)

- 불화알루미늄(AlF3) 평균판매가격 : 등급별(2021-2024년)

- 불화알루미늄(AlF3) 평균판매가격 : 등급별(2024년)

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 조사 방법

- 세계에서 취득된 특허(2015-2024년)

- 인사이트

- 특허 법적 지위

- 관할 분석

- 주요 출원자

- 주요 특허 리스트

- 무역 분석

- 수입 시나리오(HS 코드 282612)

- 수출 시나리오(HS 코드 282612)

- 주요 회의와 이벤트(2025-2026년)

- 관세와 규제 상황

- 관세 분석

- 기준과 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 불화알루미늄(AlF3) 시장

- 소개

- 주요 관세율

- 가격의 영향 분석

- 지역에 대한 영향

- 제품 유형에 대한 영향

제7장 불화알루미늄(AlF3) 시장 : 등급별

- 소개

- 제련 등급

- 촉매 등급

- 테크니컬 등급

- 실험실 등급

- 고순도 등급

제8장 불화알루미늄(AlF3) 시장 : 제품 유형별

- 소개

- 무수

- 건조

- 습윤

제9장 불화알루미늄(AlF3) 시장 : 형상별

- 소개

- 분말

- 입상

- 펠릿

제10장 불화알루미늄(AlF3) 시장 : 벌크 밀도별

- 소개

- 저벌크 밀도

- 고벌크 밀도

제11장 불화알루미늄(AlF3) 시장 : 용도별

- 소개

- 전해 첨가제

- 플럭스

- 촉매/촉매 담체

- 기능성 첨가제

- 광학 코팅 재료

- 불소 중간체

- 기타 용도

- 부식 방지제

- 에칭/표면 처리

제12장 불화알루미늄(AlF3) 시장 : 최종 이용 산업별

- 소개

- 알루미늄

- 세라믹·유리

- 화학·석유화학

- 전자·광학

- 자동차

- 항공우주

- 건설

- 기타 최종 이용 산업

- 금속 가공·용접

- 의료·제약

제13장 불화알루미늄(AlF3) 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 러시아

- 기타 유럽

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 아르헨티나

- 브라질

- 기타 남미

제14장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드/제품의 비교

- 기업 평가와 재무 지표

- 경쟁 시나리오

제15장 기업 개요

- 주요 기업

- FLUORSID

- INDUSTRIES CHIMIQUES DU FLUOR

- ALUFLUOR

- GULF FLUOR

- ALUFLUORIDE LIMITED

- ORBIA FLUOR & ENERGY MATERIALS

- PHOSAGRO GROUP

- DO-FLUORIDE NEW MATERIALS CO., LTD.

- HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.

- AB LIFOSA

- 기타 기업

- SHANDONG HAIRUN NEW MATERIAL TECHNOLOGY CO., LTD.

- HENAN JINHE INDUSTRY CO., LTD.

- ELIXIRGROUP

- HENAN WEILAI ALUMINUM(GROUP) CO., LTD

- NAVIN FLUORINE INTERNATIONAL LIMITED

- DERIVADOS DEL FLUOR

- TANFAC INDUSTRIES LTD.

- YINGKE NEW MATERIALS CO., LTD.

- LICHE OPTO GROUP CO., LTD

- JIAOZUO JINHONGLI ALUMINUM CO., LTD.

- VRIK PHARMA

- FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD

- HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- PARTH INDUSTRIES

- S B CHEMICALS

제16장 부록

KSM 25.09.29The aluminum fluoride (AlF3) market is projected to grow from USD 2.34 billion in 2025 to USD 3.12 billion by 2030, registering a CAGR of 5.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Product Type, Bulk Density, Form, Grade, Application, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The demand for AlF3 is rising as global aluminum production continues to increase, driven by its essential role in maintaining stable electrolytic processes. Smelters are expanding their capacity to meet the growing needs for aluminum in automotive, construction, and high-volume manufacturing sectors.

Each new potline and production facility requires a reliable supply of AlF3 to operate efficiently, making its consumption directly linked to aluminum output. Modernizing older smelters has also led to increased use of high-performance AlF3 grades to improve process reliability and reduce operational disruptions. The expanding geographic distribution of aluminum production, especially in emerging economies, further boosts demand, as new facilities depend heavily on large volumes of secure AlF3 supplies.

"Anhydrous to be fastest-growing product type segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Anhydrous AlF3 has emerged as the fastest-growing product type because it meets the changing needs of modern smelting operations that focus on cleaner inputs and lower environmental impact. Unlike hydrated forms, anhydrous AlF3 avoids issues related to moisture release, which can weaken cell stability and increase energy consumption. Its dry form allows for more accurate dosing, better handling, and lower transportation costs due to higher concentration and lighter weight. Additionally, the increased use of automated feeding systems in advanced smelters favors anhydrous material, as it provides consistent flow and even distribution. These operational benefits, along with the trend of large-capacity smelters seeking greater control over input materials, make anhydrous AlF3 the preferred choice and boost its rapid adoption worldwide.

"High-bulk density (HBD) to be fastest-growing segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

High bulk density AlF3 is experiencing the fastest growth because it aligns with the shift of the aluminum industry toward larger and more energy-intensive smelting operations. As electrolytic cells become bigger and operate under stricter efficiency standards, smelters increasingly favor materials that ensure stable feeding and minimize variability in performance. High bulk density AlF3 provides superior flow properties, allowing automated feeding systems to work with greater precision, reducing the risk of blockages or inconsistent dosing. This improves current efficiency and extends cell life, which is a critical cost factor for producers. Moreover, its logistical advantages, such as reduced transport volume and better container utilization, make it more competitive in global supply chains. These technological and economic synergies are fueling its rapid adoption.

"Powder to be fastest-growing form segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

The powder form of AlF3 has become the fastest-growing segment in bulk density due to its versatility and easy integration into modern aluminum smelting processes. Its fine particles ensure quicker dissolution and more uniform distribution within electrolytic cells, helping smelters maintain stable operation and improved current efficiency. Powder AlF3 is also increasingly preferred in regions where smaller or mid-scale smelting units are common, as it needs less advanced handling equipment than granular forms. Additionally, the growing emphasis on flexible packaging and transportation solutions supports its use since powder can be efficiently packed in bags or bulk containers at lower handling costs. The versatility of powder AlF3 across various smelting setups and its compatibility with both traditional and new technologies have made it the fastest-growing segment in recent years.

"Smelter to be fastest-growing grade segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Smelter-grade AlF3 is the fastest-growing segment because its adoption is linked to the shift in global aluminum production to regions with abundant energy resources and integrated industrial clusters. Emerging markets are focusing on large-scale smelters designed to use standardized inputs, where smelter-grade AlF3 is the most compatible choice. Unlike specialty grades that serve niche applications, smelter-grade AlF3 addresses the core demand for primary aluminum, which continues to grow due to urbanization, renewable energy projects, and electric mobility. The ability to secure stable supply contracts with aluminum producers and lower production complexity compared to advanced grades has driven its rapid growth. This structural alignment with the expansion of base metal industries makes smelter-grade AlF3 the fastest-growing segment in the market.

"Electrolyte additive to be fastest-growing application segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

Electrolyte additive has emerged as the fastest-growing application in the AlF3 market due to their role in enabling process flexibility in the evolving smelter technologies. Maintaining an optimal bath ratio has become more challenging as the industry shifts toward larger reduction cells and higher current intensities. When added as an electrolyte, AlF3 provides precise control over these parameters, making it essential for next-generation cell designs. Additionally, as producers increasingly incorporate renewable energy into smelting operations, fluctuations in power supply demand tighter bath management to prevent efficiency losses. The ability of electrolyte additives to adapt bath chemistry under variable operating conditions has opened new opportunities for adoption. This adaptability and support for modern, high-capacity smelting facilities make electrolyte additives the fastest-growing segment in the AlF3 market.

"Aluminum to be fastest-growing end-use industry segment of aluminum fluoride (AlF3) market in terms of value during forecast period"

The aluminum industry is the fastest-growing end-use sector for AlF3 due to rising global demand for aluminum products in high-tech and industrial applications. Rapid urbanization and infrastructure development, especially in emerging economies, are increasing aluminum use in construction, transportation, and machinery. As smelters expand production to meet this demand, the need for AlF3 also grows, as it is vital for achieving higher purity aluminum and consistent output. Additionally, industry players are investing in specialized alloys and advanced processing techniques that depend on precise AlF3 formulations. Regulatory requirements for process efficiency and product quality in aluminum manufacturing further strengthen the reliance on AlF3. These factors position the aluminum sector as the leading and fastest-growing driver of AlF3 consumption worldwide.

"Asia Pacific to be fastest-growing market for aluminum fluoride (AlF3) during forecast period"

The Asia Pacific region is the fastest-growing market for AlF3 because of the rapid growth of its aluminum industry, fueled by rising demand from automotive, aerospace, electronics, and construction sectors. China and India, as the largest aluminum producers in the area, are investing heavily in smelting capacity and upgrading existing facilities, which need high-quality AlF3 to improve electrolytic efficiency and boost production. Additionally, industrial growth in Southeast Asia, including Malaysia, Vietnam, and Thailand, is further increasing the use of aluminum and related chemicals. Technological advances, such as better production methods and digital monitoring in smelters, are encouraging the use of premium AlF3 grades. With raw material availability and competitive regional manufacturing, Asia Pacific is the fastest-growing AlF3 market worldwide.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations in the aluminum fluoride (AlF3) market. Additionally, secondary research was used to gather information to identify and confirm the market size of different segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers - 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, Middle East & Africa - 5%, and South America - 5%

The aluminum fluoride (AlF3) market comprises Fluorsid (Italy), Industries Chimiques du Fluor (Tunisia), Do-Fluoride New Materials Co., Ltd. (China), Alufluor (Sweden), Alufluoride Limited (India), Orbia Fluor & Energy Materials (US), Gulf Fluor (UAE), Hunan Nonferrous Fluoride Chemical Group Co., Ltd. (China), AB LIFOSA (Lithuania), and PhosAgro Group (Russia). The study includes an in-depth competitive analysis of these key players in the aluminum fluoride (AlF3) market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report examines the market for aluminum fluoride (AlF3) based on product type, bulk density, form, grade, application, end-use industry, and region, and provides estimates of the overall market value across various regions. It includes a comprehensive review of key industry players, offering insights into their business overviews, products and services, key strategies, and market expansion activities.

Key benefits of buying this report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the aluminum fluoride (AlF3) market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Increased aluminum production), restraints (Declining fluorite and aluminum hydroxide prices), opportunities (Shift toward fluorosilicic acid (FSA)-based AlF3 production), and challenges (Regulatory pressure on hydrofluoric acid (HF) use) influencing the growth of the aluminum fluoride (AlF3) market.

- Market Penetration: Comprehensive information on the AlF3 market offered by top global aluminum fluoride (AlF3) market players.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, expansions, and partnerships in the aluminum fluoride (AlF3) market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for aluminum fluoride (AlF3) across regions.

- Market Capacity: Recycling capacity of the companies is provided wherever available, with upcoming capacities for the aluminum fluoride (AlF3) market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the aluminum fluoride (AlF3) market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants from primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM FLUORIDE MARKET

- 4.2 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE

- 4.3 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY

- 4.4 ALUMINUM FLUORIDE MARKET, BY FORM

- 4.5 ALUMINUM FLUORIDE MARKET, BY GRADE

- 4.6 ALUMINUM FLUORIDE MARKET, BY APPLICATION

- 4.7 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 4.8 ALUMINUM FLUORIDE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging aluminum production to elevate aluminum fluoride requirements in electrolytic processes

- 5.2.1.2 Improved smelter utilization ensures steady demand

- 5.2.2 RESTRAINTS

- 5.2.2.1 Declining fluorite and aluminum hydroxide prices exert margin pressure on producers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward fluorosilicic acid (FSA)-based aluminum fluoride production

- 5.2.3.2 Growing adoption of vertical integration by aluminum producers to supply aluminum fluoride and stabilize costs

- 5.2.4 CHALLENGES

- 5.2.4.1 Just-in-time procurement by aluminum smelters limits demand recovery

- 5.2.4.2 Regulatory pressure on hydrofluoric acid use

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT ON ALUMINUM FLUORIDE MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY GRADE, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE OF ALUMINUM FLUORIDE, BY GRADE, 2024

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.8.2.1 Patent publication trends

- 6.8.3 INSIGHTS

- 6.8.4 LEGAL STATUS OF PATENTS

- 6.8.5 JURISDICTION ANALYSIS

- 6.8.6 TOP APPLICANTS

- 6.8.7 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 282612)

- 6.9.2 EXPORT SCENARIO (HS CODE 282612)

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF ANALYSIS

- 6.11.2 STANDARDS AND REGULATORY LANDSCAPE

- 6.11.2.1 Regulatory bodies, government agencies, and other organizations

- 6.11.2.2 Standards

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 IMPROVEMENT IN SODIUM REDUCTION PROCESS DURING TAC THROUGH ALF3

- 6.15.2 VARIATION IN ALUMINUM SMELTING CELL THERMAL STATE WITH CONTROL IMPLICATIONS

- 6.15.3 OPTIMIZING ALUMINUM SMELTING EFFICIENCY WITH SYSTEMATIC FLUORIDE CONTROL

- 6.16 IMPACT OF 2025 US TARIFF - ALUMINUM FLUORIDE MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON REGION

- 6.16.4.1 North America

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON PRODUCT TYPE

7 ALUMINUM FLUORIDE MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 SMELTER GRADE

- 7.2.1 EFFECTIVE FLUXING AGENT IN ELECTROLYTIC REDUCTION OF ALUMINA TO ALUMINUM METAL-KEY FACTOR DRIVING MARKET

- 7.3 CATALYST GRADE

- 7.3.1 WIDELY USED IN PROCESSES WHERE PRECISE CONTROL OVER REACTION KINETICS AND SELECTIVITY IS CRITICAL

- 7.4 TECHNICAL GRADE

- 7.4.1 BROAD UTILITY, COST-EFFICIENCY, AND ADAPTABLE CHARACTERISTICS TO DRIVE ADOPTION

- 7.5 LABORATORY GRADE

- 7.5.1 EXCEPTIONAL CHEMICAL PURITY, MINIMAL IMPURITIES, AND CONSISTENT PHYSICAL PROPERTIES TO DRIVE GROWTH

- 7.6 HIGH-PURITY GRADE

- 7.6.1 DEMAND FOR ULTRA-PURE ALUMINUM FLUORIDE IN PRECISION MANUFACTURING TO DRIVE MARKET

8 ALUMINUM FLUORIDE MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 ANHYDROUS

- 8.2.1 PREFERRED CHOICE FOR APPLICATIONS REQUIRING MAXIMUM RELIABILITY AND EFFICIENCY

- 8.3 DRY

- 8.3.1 IMPROVES SMELTING PERFORMANCE AND PRODUCT QUALITY THROUGH EFFICIENT MOISTURE-CONTROLLED FLUXING SOLUTIONS

- 8.4 WET

- 8.4.1 DRIVES EFFICIENT SMELTING AND RECYCLING INNOVATION THROUGH MOISTURE-RICH ALUMINUM FLUORIDE SOLUTIONS

9 ALUMINUM FLUORIDE MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 POWDER

- 9.2.1 PREFERRED CHOICE DUE TO SUPERIOR CHEMICAL PERFORMANCE AND FLEXIBILITY IN DOSING

- 9.3 GRANULE

- 9.3.1 COMPATIBILITY WITH VARIETY OF DOSING SYSTEMS TO SUPPORT ADOPTION

- 9.4 PELLET

- 9.4.1 LARGER PARTICLE SIZE AND DENSE COMPOSITION TO DRIVE ADOPTION

10 ALUMINUM FLUORIDE MARKET, BY BULK DENSITY

- 10.1 INTRODUCTION

- 10.2 LOW-BULK DENSITY

- 10.2.1 ADVANTAGEOUS IN CERTAIN SMELTING TECHNOLOGIES WHERE RAPID INCORPORATION INTO BATH IS REQUIRED

- 10.3 HIGH-BULK DENSITY

- 10.3.1 SUPERIOR HANDLING, PACKING EFFICIENCY, AND PURITY TO DRIVE MARKET GROWTH

11 ALUMINUM FLUORIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ELECTROLYTE ADDITIVE

- 11.2.1 ROLE OF ALUMINUM FLUORIDE IN OPTIMIZING ELECTROLYTIC BATH EFFICIENCY AND ENERGY SAVINGS TO DRIVE MARKET

- 11.3 FLUX AGENT

- 11.3.1 ENERGY SAVINGS AND IMPROVED REFINING IN METAL PRODUCTION WITH ADVANCED FLUX AGENTS TO PROPEL MARKET

- 11.4 CATALYST/CATALYST SUPPORT

- 11.4.1 IMPROVED CATALYTIC PERFORMANCE AND DURABILITY IN DIVERSE CHEMICAL MANUFACTURING PROCESSES TO DRIVE MARKET

- 11.5 FUNCTIONAL ADDITIVE

- 11.5.1 ADVANCING INDUSTRIAL MATERIALS WITH MULTIFUNCTIONAL ADDITIVES FOR ENHANCED DURABILITY AND PERFORMANCE TO DRIVE MARKET

- 11.6 OPTICAL COATING MATERIAL

- 11.6.1 OPTICAL CLARITY AND DURABILITY FUELED BY ADVANCED COATING MATERIALS TO DRIVE DEMAND

- 11.7 FLUORO INTERMEDIATE

- 11.7.1 HIGH-QUALITY PRODUCTION OF FLUORINE-CONTAINING COMPOUNDS TO PROPEL MARKET

- 11.8 OTHER APPLICATIONS

- 11.8.1 CORROSION INHIBITORS

- 11.8.2 ETCHING/SURFACE TREATMENT

12 ALUMINUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 ALUMINUM

- 12.2.1 OPTIMIZING ELECTROLYTE BATH PERFORMANCE FOR EFFICIENT AND SUSTAINABLE ALUMINUM SMELTING PROCESSES TO DRIVE MARKET

- 12.3 CERAMICS & GLASS

- 12.3.1 INCREASING CERAMIC TILE PRODUCTION AND GLASS INNOVATION TO PROPEL CONSUMPTION OF ALUMINUM FLUORIDE

- 12.4 CHEMICAL & PETROCHEMICAL

- 12.4.1 CATALYTIC EFFICIENCY AND FLUORINATION NEEDS TO PROPEL DEMAND FOR ALUMINUM FLUORIDE

- 12.5 ELECTRONICS & OPTICS

- 12.5.1 DEMAND FOR ULTRA-PURE MATERIALS TO DRIVE MARKET

- 12.6 AUTOMOTIVE

- 12.6.1 ADVANCEMENTS IN VEHICLE DESIGN DRIVE DEMAND FOR LIGHTWEIGHT MATERIALS

- 12.7 AEROSPACE

- 12.7.1 ADVANCEMENTS IN LIGHTWEIGHT AEROSPACE MATERIALS AND RIGOROUS QUALITY STANDARDS TO DRIVE DEMAND

- 12.8 CONSTRUCTION

- 12.8.1 ENHANCED ALUMINUM ALLOY REQUIREMENTS IN CONSTRUCTION TO DRIVE DEMAND

- 12.9 OTHER END-USE INDUSTRIES

- 12.9.1 METALWORKING & WELDING

- 12.9.2 MEDICAL & PHARMACEUTICAL

13 ALUMINUM FLUORIDE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Dominance in global aluminum production to drive market

- 13.2.2 JAPAN

- 13.2.2.1 Growth in electronics sector to increase demand

- 13.2.3 INDIA

- 13.2.3.1 Rising demand from automotive and aerospace sectors to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Growth of export-oriented ceramics and glass manufacturing industries to drive market

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Growing aerospace and automotive industries to increase demand

- 13.3.2 CANADA

- 13.3.2.1 Presence of established aluminum industry to propel market

- 13.3.3 MEXICO

- 13.3.3.1 Rise as key manufacturing hub for aluminum to support market growth

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Growth in commercial vehicle and specialty automotive sectors to drive market

- 13.4.2 ITALY

- 13.4.2.1 Growth in construction industry to drive demand

- 13.4.3 FRANCE

- 13.4.3.1 Research into aluminum alloys to boost usage

- 13.4.4 UK

- 13.4.4.1 Growth in industrial and manufacturing sectors to drive market

- 13.4.5 SPAIN

- 13.4.5.1 Rising adoption of low-carbon footprint tires to drive market

- 13.4.6 RUSSIA

- 13.4.6.1 Expansion of domestic aluminum smelting capacity to propel market

- 13.4.7 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Saudi Arabia's vision 2030 spurs investment in aluminum sector

- 13.5.1.2 UAE

- 13.5.1.2.1 Major aluminum smelting hub in Dubai to boost demand

- 13.5.1.3 Rest of GCC countries

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Growing construction activities to increase consumption of aluminum fluoride

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 ARGENTINA

- 13.6.1.1 Expansion of automotive sector to drive demand

- 13.6.2 BRAZIL

- 13.6.2.1 Rise in aluminum production to propel demand

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 ARGENTINA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS

- 14.4 REVENUE ANALYSIS

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Form footprint

- 14.5.5.4 Grade footprint

- 14.5.5.5 End-use industry footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 BRAND/PRODUCT COMPARISON

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 EXPANSIONS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 FLUORSID

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 INDUSTRIES CHIMIQUES DU FLUOR

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses & competitive threats

- 15.1.3 ALUFLUOR

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses & competitive threats

- 15.1.4 GULF FLUOR

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses & competitive threats

- 15.1.5 ALUFLUORIDE LIMITED

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 ORBIA FLUOR & ENERGY MATERIALS

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Other developments

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses & competitive threats

- 15.1.7 PHOSAGRO GROUP

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Expansions

- 15.1.7.4 MnM view

- 15.1.7.4.1 Key strengths

- 15.1.7.4.2 Strategic choices

- 15.1.7.4.3 Weaknesses & competitive threats

- 15.1.8 DO-FLUORIDE NEW MATERIALS CO., LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.8.3.1 Key strengths

- 15.1.8.3.2 Strategic choices

- 15.1.8.3.3 Weaknesses & competitive threats

- 15.1.9 HUNAN NONFERROUS FLUORIDE CHEMICAL GROUP CO., LTD.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 MnM view

- 15.1.9.3.1 Key strengths

- 15.1.9.3.2 Strategic choices

- 15.1.9.3.3 Weaknesses & competitive threats

- 15.1.10 AB LIFOSA

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Other developments

- 15.1.10.4 MnM view

- 15.1.10.4.1 Key strengths

- 15.1.10.4.2 Strategic choices

- 15.1.10.4.3 Weaknesses & competitive threats

- 15.1.1 FLUORSID

- 15.2 OTHER PLAYERS

- 15.2.1 SHANDONG HAIRUN NEW MATERIAL TECHNOLOGY CO., LTD.

- 15.2.2 HENAN JINHE INDUSTRY CO., LTD.

- 15.2.3 ELIXIRGROUP

- 15.2.4 HENAN WEILAI ALUMINUM (GROUP) CO., LTD

- 15.2.5 NAVIN FLUORINE INTERNATIONAL LIMITED

- 15.2.6 DERIVADOS DEL FLUOR

- 15.2.7 TANFAC INDUSTRIES LTD.

- 15.2.8 YINGKE NEW MATERIALS CO., LTD.

- 15.2.9 LICHE OPTO GROUP CO., LTD

- 15.2.10 JIAOZUO JINHONGLI ALUMINUM CO., LTD.

- 15.2.11 VRIK PHARMA

- 15.2.12 FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD

- 15.2.13 HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- 15.2.14 PARTH INDUSTRIES

- 15.2.15 S B CHEMICALS

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS