|

시장보고서

상품코드

1856025

불화칼륨 시장 : 형상별, 순도별, 용도별, 최종 이용 산업별, 지역별 - 예측(-2032년)Potassium Fluoride Market by Form, Purity, Application, End-use Industry - Global Forecast to 2032 |

||||||

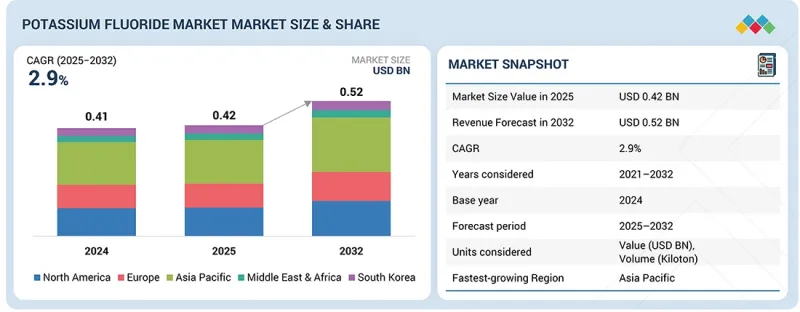

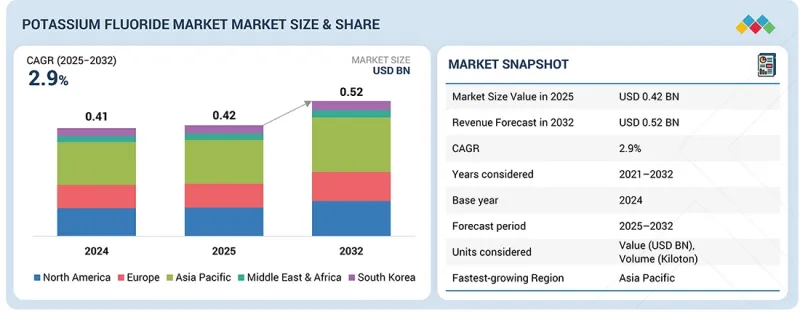

불화칼륨 시장 규모는 2025년 4억 2,000만 달러에서 2032년에는 5억 2,000만 달러로 성장하여 예측 기간 동안 CAGR은 2.9%를 기록할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 검토 단위 | 금액(100만 달러/억 달러), 킬로톤 |

| 부문 | 형상별, 순도별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

불화칼륨의 수요는 첨단 화합물 제조에서 불소화제로서의 중요한 역할에 힘입어 전 세계적으로 화학 합성 및 재료 합성이 지속적으로 확대됨에 따라 증가하고 있습니다. 불화칼륨이 정밀하고 효율적인 반응을 가능하게 하는 의약품, 농약, 특수 화학제품의 수요 증가에 대응하기 위해 제조업체들은 생산능력을 확대하고 있습니다. 현대적인 연구 개발 활동은 또한 생산 공정에서 더 높은 일관성과 성능을 달성하기 위해 고순도 불화칼륨 등급의 사용을 촉진하고 있습니다. 또한, 화학 제조의 지리적 확장, 특히 신흥 경제국에서의 확대는 불화칼륨의 안전한 대량 공급을 우선시하는 시설에 대한 수요를 증폭시키고 있습니다.

불화칼륨 시장에서 순도 95-99% 부문은 성능과 비용 효율성이 최적의 균형을 이루며 가장 큰 점유율을 차지하고 있습니다. 이 순도 범위는 대부분의 산업 응용 분야의 요구 사항을 충족하며, 초순수 등급과 관련된 높은 제조 비용을 부담하지 않고도 충분한 반응성과 신뢰성을 제공합니다. 또한, 고순도 등급에 비해 제조 및 취급이 용이하여 널리 이용 가능하며, 대규모 운영에도 쉽게 이용할 수 있습니다. 또한, 순도 95%-99%의 불화칼륨은 화학적 특성이 안정적이기 때문에 엄격한 정확도가 중요하지 않은 공정에서도 예측 가능한 결과를 보장합니다. 실용성과 경제성으로 인해 이 순도 범위는 대다수의 시장 진입 기업에게 선호되는 선택이 되었습니다.

화학 산업은 광범위한 화학 공정에서 필수적인 역할을 하기 때문에 불화칼륨 시장에서 가장 큰 점유율을 차지하고 있습니다. 불화칼륨은 필수적인 시약으로 작용하여 정확한 불소 활성을 필요로 하는 반응을 촉진하고 다양한 화합물의 합성 및 변환을 가능하게 합니다. 화학적 안정성과 일관된 반응성은 산업 작업에서 신뢰성과 예측 가능성을 제공하고, 제어되고 효율적인 반응을 보장합니다. 불화칼륨은 그 효과가 공정의 결과에 직접적으로 영향을 미치는 화학 생산에서 다양한 용도로 사용되고 있습니다. 다양한 화학 공정에서 불화칼륨이 광범위하게 사용되는 것은 산업에서 불화칼륨의 중요성을 입증합니다. 그 결과, 이 시약에 대한 일관된 높은 수요로 인해 화학 부문은 불화칼륨 시장의 주요 최종 용도 부문으로 자리매김하고 있습니다.

아시아태평양은 급속한 산업화, 강력한 제조 능력, 양호한 경제 상황에 힘입어 불화칼륨 시장에서 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 이 지역은 풍부한 원료 가용성, 낮은 생산 비용, 불화칼륨의 대규모 생산을 지원하는 잘 구축된 화학 제조 인프라의 혜택을 누리고 있습니다. 아시아태평양 각국 정부는 불화칼륨과 같은 필수 화합물의 공급망을 강화하기 위해 화학제품의 생산과 수출을 적극적으로 장려하고 있습니다. 도시화의 진전, 인구 증가, 무역 활동의 확대는 이 지역 전체의 소비 확대에 더욱 기여하고 있습니다. 생산능력에 대한 지속적인 투자와 강력한 수출 잠재력으로 아시아태평양은 불화칼륨의 세계 허브가 되어 국제 시장에서의 빠른 성장에 박차를 가하고 있습니다.

세계의 불화칼륨 시장에 대해 조사했으며, 형태별, 순도별, 용도별, 최종 이용 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 생성형 AI의 영향

제6장 업계 동향

- 소개

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 2025년 미국 관세가 불화칼륨 시장에 미치는 영향

- 가격 분석

- 투자와 자금 조달 시나리오

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 관세와 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

제7장 불화칼륨 포장 형태

- 소개

- 드럼

- 백

- 보틀

- 벌크 컨테이너

제8장 불화칼륨 판매 경로

- 소개

- 직접 판매

- 온라인 소매업체

제9장 불화칼륨 시장(형상별)

- 소개

- 고체

- 액체

제10장 불화칼륨 시장(순도별)

- 소개

- 95-99%

- 99% 이상

제11장 불화칼륨 시장(용도별)

- 소개

- 불소화 및 분석 시약

- 유리 에칭

- 플럭스

- 금속 표면처리

- 촉매

- 전해 첨가제

- 농약 제제

- 기타

제12장 불화칼륨 시장(최종 이용 산업별)

- 소개

- 농약

- 화학제품

- 유리·금속

- 의약품

- 일렉트로닉스·반도체

- 기타 최종 이용 산업

제13장 불화칼륨 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 아르헨티나

- 브라질

- 기타

제14장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석, 2024년

- 매출 분석, 2021-2024년

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오와 동향

제15장 기업 개요

- 주요 진출 기업

- AARTI INDUSTRIES LTD.

- GUJARAT FLUOROCHEMICALS LIMITED

- MORITA CHEMICAL INDUSTRIES CO., LTD.

- NAVIN FLUORINE INTERNATIONAL LIMITED

- HONEYWELL INTERNATIONAL INC.

- SOLVAY

- NACALAI

- DERIVADOS DEL FLUOR

- FUJIFILM WAKO PURE CHEMICAL CORPORATION

- TANFAC INDUSTRIES LTD.

- 기타 기업

- HARSHIL INDUSTRIES

- JAYFLUORIDE PRIVATE LIMITED

- S. B. CHEMICALS

- HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- PARTH INDUSTRIES

- YINGKE NEW MATERIALS CO., LTD.

- NANTONG JINXING FLUORIDES CHEMICAL CO., LTD.

- MARUTI INDUSTRIES

- FENGYUAN GROUP

- FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD.

- QSHI INDUSTRY(SHANGHAI) CO., LTD.

- EREZTECH LLC

- KISHIDA CHEMICAL CO., LTD.

- JUNSEI CHEMICAL CO., LTD.

- HUNAN HEAVEN MATERIALS DEVELOPMENT CO., LTD.

제16장 부록

KSM 25.11.10The potassium fluoride market size is projected to grow from USD 0.42 billion in 2025 to USD 0.52 billion by 2032, registering a CAGR of 2.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Form, Purity, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The demand for potassium fluoride is increasing as global chemical and material synthesis continues to expand, driven by its critical role as a fluorinating agent in producing advanced compounds. Manufacturers are scaling up capacity to meet rising requirements in pharmaceuticals, agrochemicals, and specialty chemicals, where potassium fluoride enables precise and efficient reactions. Modern research and development activities are also fostering the use of high-purity potassium fluoride grades to achieve greater consistency and performance in production processes. In addition, the growing geographic spread of chemical manufacturing, particularly in emerging economies, is amplifying demand as facilities prioritize secure and large-volume supplies of potassium fluoride.

"By purity, the 95-99% segment is anticipated to account for the largest market share during the forecast period."

The 95-99% purity segment accounts for the largest share in the potassium fluoride market due to its optimal balance of performance and cost-effectiveness. This purity range meets the requirements of most industrial applications, providing sufficient reactivity and reliability without incurring the higher production costs associated with ultra-pure grades. It is easier to manufacture and handle compared with higher-purity variants, making it widely available and accessible for large-scale operations. Additionally, the 95%-99% purity potassium fluoride offers consistent chemical properties, ensuring predictable results in processes where exact precision is not critical. Its practicality, combined with economic efficiency, makes this purity range the preferred choice for a majority of market participants.

"By end-use industry, the chemical segment is anticipated to account for the largest market share during the forecast period."

The chemical industry represents the largest share in the potassium fluoride market due to its integral role in a wide range of chemical processes. Potassium fluoride functions as an essential reagent, facilitating reactions that require precise fluoride activity and enabling the synthesis and transformation of various chemical compounds. Its chemical stability and consistent reactivity provide reliability and predictability in industrial operations, ensuring controlled and efficient reactions. The compound is employed in numerous applications within chemical production, where its effectiveness directly impacts process outcomes. The extensive utilization of potassium fluoride across multiple chemical processes underscores its significance in the industry. Consequently, the consistent and high demand for this reagent establishes the chemical sector as the predominant end-use segment in the potassium fluoride market.

"Asia Pacific is anticipated to account for the largest market share during the forecast period."

Asia Pacific is anticipated to account for the largest market share in the potassium fluoride market, driven by rapid industrialization, strong manufacturing capabilities, and favorable economic conditions. The region benefits from an abundant availability of raw materials, lower production costs, and a well-established chemical manufacturing infrastructure, which supports the large-scale output of potassium fluoride. Governments across Asia Pacific are actively encouraging chemical production and export, strengthening the supply chain for essential compounds like potassium fluoride. Rising urbanization, population growth, and expanding trade activities further contribute to increasing consumption across the region. With continuous investment in production capacity and strong export potential, Asia Pacific has become a global hub for potassium fluoride, fueling its rapid growth in the international market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Potassium Fluoride market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, the Middle East & Africa -5%, and South America- 5%

The potassium fluoride market comprises major Aarti Industries Ltd. (India), Gujarat Fluorochemicals Limited (India), MORITA CHEMICAL INDUSTRIES CO., LTD. (Japan), Navin Fluorine International Limited (India), Honeywell International Inc. (US), NACALAI TESQUE, INC. (Japan), Tanfac Industries Ltd. (India), FUJIFILM Wako Pure Chemical Corporation (Japan), Solvay (Belgium), DERIVADOS DEL FLUOR (Spain). The study includes an in-depth competitive analysis of these key players in the potassium fluoride market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the potassium fluoride market on the basis of form, purity, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the potassium fluoride market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Potassium Fluoride market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Increased agrochemical industry activities drive higher industrial use of potassium fluoride), restraints (Strict regulations on handling, transporting, and disposing fluoride compounds increase operational and compliance costs), opportunities (Expanding semiconductor fabrication worldwide widens opportunities for high-purity potassium fluoride), and challenges (Limited production facilities outside Asia-Pacific increase dependency on imports for global markets) influencing the growth of Potassium Fluoride market.

- Market Penetration: Comprehensive information on the potassium fluoride offered by top players in the global Potassium Fluoride market.

- Product Development/Innovation: Detailed insights on upcoming technologies, expansions, and partnerships in the Potassium Fluoride market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the potassium fluoride market across regions.

- Market Capacity: Production capacity of the companies is provided wherever available, with upcoming capacities for the Potassium Fluoride market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the potassium fluoride market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POTASSIUM FLUORIDE MARKET

- 4.2 POTASSIUM FLUORIDE MARKET, BY FORM

- 4.3 POTASSIUM FLUORIDE MARKET, BY PURITY

- 4.4 POTASSIUM FLUORIDE MARKET, BY APPLICATION

- 4.5 POTASSIUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 4.6 POTASSIUM FLUORIDE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased activities in agrochemical industry

- 5.2.1.2 Enhanced fluorination capabilities and versatile industrial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of substitute fluoride compounds

- 5.2.2.2 Stringent regulations on handling, transporting, and disposing of fluoride compounds increasing operational and compliance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding semiconductor fabrication worldwide

- 5.2.3.2 Vertical integration to strengthen supply and boost profitability

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited production facilities outside Asia Pacific

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GEN AI ON POTASSIUM FLUORIDE MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SOURCING

- 6.3.2 MANUFACTURING & PROCESSING

- 6.3.3 DISTRIBUTION & LOGISTICS

- 6.3.4 END-USE APPLICATIONS & UTILIZATION

- 6.4 IMPACT OF 2025 US TARIFFS ON POTASSIUM FLUORIDE MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 KEY IMPACT ON VARIOUS REGIONS

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON END-USE INDUSTRY

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY FORM, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE OF POTASSIUM FLUORIDE, BY KEY PLAYERS, 2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED, 2015-2024

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 EXPORT SCENARIO (HS CODE 281520)

- 6.10.2 IMPORT SCENARIO (HS CODE 281520)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO POTASSIUM FLUORIDE MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 EFFECT OF POTASSIUM FLUORIDE POSTDEPOSITION TREATMENTS ON OPTOELECTRONIC PROPERTIES OF CU(IN,GA)SE2 SINGLE CRYSTALS

- 6.16.2 POTASSIUM FLUORIDE POSTDEPOSITION TREATMENT WITH ETCHING STEP ON BOTH CU-RICH AND CU-POOR CUINSE2 THIN FILM SOLAR CELLS

7 PACKAGING FORMATS OF POTASSIUM FLUORIDE

- 7.1 INTRODUCTION

- 7.2 DRUMS

- 7.3 BAGS

- 7.4 BOTTLES

- 7.5 BULK CONTAINERS

8 SALES CHANNEL FOR POTASSIUM FLUORIDE

- 8.1 INTRODUCTION

- 8.2 DIRECT SALES

- 8.3 ONLINE RETAILERS

9 POTASSIUM FLUORIDE MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 SOLID

- 9.2.1 DEMAND IN BULK FLUORINATION AND CATALYST APPLICATIONS TO DRIVE MARKET

- 9.3 LIQUID

- 9.3.1 REQUIREMENT FOR PRECISION DOSING IN ELECTRONICS ETCHING AND PHARMACEUTICAL BUFFERING TO DRIVE MARKET GROWTH

10 POTASSIUM FLUORIDE MARKET, BY PURITY

- 10.1 INTRODUCTION

- 10.2 95-99%

- 10.2.1 DEMAND FOR RELIABLE AND VERSATILE INDUSTRIAL REAGENTS FOR CONSISTENT CHEMICAL PERFORMANCE FUELING MARKET GROWTH

- 10.3 >99%

- 10.3.1 ADOPTION IN ADVANCED CHEMICAL PROCESSES TO FUEL DEMAND

11 POTASSIUM FLUORIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 FLUORINATION & ANALYTICAL REAGENT

- 11.2.1 ADVANCEMENTS IN NUCLEOPHILIC FLUORINATION TO DRIVE MARKET GROWTH

- 11.3 GLASS ETCHING

- 11.3.1 DEMAND FOR HIGH-PERFORMANCE GLASS TO DRIVE ADOPTION IN CHEMICAL ETCHING PROCESSES

- 11.4 FLUX

- 11.4.1 EXPANSION OF INDUSTRIAL METALWORKING SECTOR TO DRIVE DEMAND

- 11.5 METAL SURFACE TREATMENT

- 11.5.1 RISING INDUSTRIAL COATING AND ETCHING NEEDS SUPPORTING MARKET GROWTH

- 11.6 CATALYST

- 11.6.1 ADOPTION IN ADVANCED ORGANIC SYNTHESIS IN PHARMACEUTICAL DEVELOPMENT TO SUPPORT MARKET GROWTH

- 11.7 ELECTROLYTE ADDITIVE

- 11.7.1 DEMAND FOR IONIC CONDUCTIVITY AND STABILITY IN NEXT-GENERATION ENERGY STORAGE SYSTEMS TO INCREASE ADOPTION

- 11.8 AGROCHEMICAL FORMULATIONS

- 11.8.1 GROWING PRECISION FARMING TO DRIVE ADOPTION OF SUSTAINABLE FLUORINATED AGROCHEMICALS

- 11.9 OTHER APPLICATIONS

- 11.9.1 WATER FLUORIDATION

- 11.9.2 FOOD ANTISEPTIC

12 POTASSIUM FLUORIDE MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 AGROCHEMICAL

- 12.2.1 EXPANSION OF AGRICULTURE SECTOR TO FUEL MARKET GROWTH

- 12.3 CHEMICAL

- 12.3.1 EXPANDING APPLICATIONS OF POTASSIUM FLUORIDE AS VERSATILE REAGENT AND CATALYST TO DRIVE DEMAND

- 12.4 GLASS & METAL

- 12.4.1 EXPANSION OF HIGH-PERFORMANCE SPECIALTY GLASS PRODUCTION TO SUPPORT MARKET GROWTH

- 12.5 PHARMACEUTICAL

- 12.5.1 INCREASED ACTIVITIES IN NEXT-GENERATION DRUG DEVELOPMENT TO DRIVE MARKET

- 12.6 ELECTRONICS & SEMICONDUCTORS

- 12.6.1 RISING SEMICONDUCTOR SALES TO ACCELERATE DEMAND FOR HIGH-PURITY POTASSIUM FLUORIDE IN CHIP FABRICATION

- 12.7 OTHER END-USE INDUSTRIES

- 12.7.1 FOOD & BEVERAGES

- 12.7.2 WOOD & BREWING INDUSTRY

- 12.7.3 WATER TREATMENT

- 12.7.4 TEXTILE

13 POTASSIUM FLUORIDE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Strong chemical manufacturing base fueling demand

- 13.2.2 JAPAN

- 13.2.2.1 Presence of advanced electronics and semiconductor industry to drive demand

- 13.2.3 INDIA

- 13.2.3.1 Growth in agrochemical manufacturing supporting market growth

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Significant investment in R&D for high-quality materials to drive demand

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Strong demand from pharmaceutical industry fueling market growth

- 13.3.2 CANADA

- 13.3.2.1 Growing metal refining and processing activities to boost demand in industrial applications

- 13.3.3 MEXICO

- 13.3.3.1 Emergence as major manufacturing hub to drive demand

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 Growth of automotive and electronics sectors to boost demand in metal treatment processes

- 13.4.2 ITALY

- 13.4.2.1 Demand for etching in luxury and technical glassware to support market growth

- 13.4.3 FRANCE

- 13.4.3.1 Expansion of chemical industry fueling demand for potassium fluoride in fluorination processes

- 13.4.4 UK

- 13.4.4.1 Presence of strong pharmaceutical research & development to support market growth

- 13.4.5 SPAIN

- 13.4.5.1 Expanding chemical and agrochemical industries to drive market growth

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Increased investment in industrial sector under Vision 2030 to drive market

- 13.5.1.2 UAE

- 13.5.1.2.1 Government incentives for high-tech industrial chemicals to increase demand

- 13.5.1.3 Rest of GCC countries

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Development of mining and metallurgical sector to increase adoption

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 ARGENTINA

- 13.6.1.1 Agricultural intensification driving need for agrochemical synthesis

- 13.6.2 BRAZIL

- 13.6.2.1 Strengthening trade partnerships and export opportunities to support market growth

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 ARGENTINA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2021-2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Form footprint

- 14.5.5.4 Purity footprint

- 14.5.5.5 End-use industry footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AARTI INDUSTRIES LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strengths

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 GUJARAT FLUOROCHEMICALS LIMITED

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Key strengths

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 MORITA CHEMICAL INDUSTRIES CO., LTD.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 NAVIN FLUORINE INTERNATIONAL LIMITED

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 HONEYWELL INTERNATIONAL INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Others

- 15.1.6 SOLVAY

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.7 NACALAI

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 DERIVADOS DEL FLUOR

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 FUJIFILM WAKO PURE CHEMICAL CORPORATION

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 TANFAC INDUSTRIES LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.1 AARTI INDUSTRIES LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 HARSHIL INDUSTRIES

- 15.2.2 JAYFLUORIDE PRIVATE LIMITED

- 15.2.3 S. B. CHEMICALS

- 15.2.4 HENAN YELLOW RIVER NEW MATERIAL TECHNOLOGY CO., LTD.

- 15.2.5 PARTH INDUSTRIES

- 15.2.6 YINGKE NEW MATERIALS CO., LTD.

- 15.2.7 NANTONG JINXING FLUORIDES CHEMICAL CO., LTD.

- 15.2.8 MARUTI INDUSTRIES

- 15.2.9 FENGYUAN GROUP

- 15.2.10 FOSHAN NANHAI SHUANGFU CHEMICAL CO., LTD.

- 15.2.11 QSHI INDUSTRY (SHANGHAI) CO., LTD.

- 15.2.12 EREZTECH LLC

- 15.2.13 KISHIDA CHEMICAL CO., LTD.

- 15.2.14 JUNSEI CHEMICAL CO., LTD.

- 15.2.15 HUNAN HEAVEN MATERIALS DEVELOPMENT CO., LTD.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS