|

시장보고서

상품코드

1822289

CLT(Cross Laminated Timber) 시장 : 유형별, 업계별, 최종 용도별, 지역별 - 예측(-2030년)Cross Laminated Timber Market by Type, End Use, Industry, and Region - Global Forecast to 2030 |

||||||

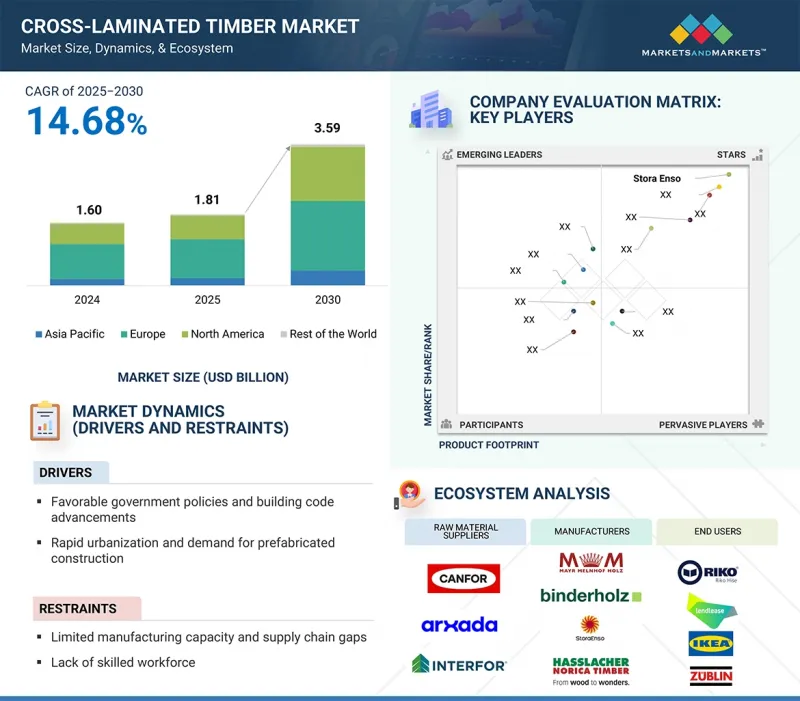

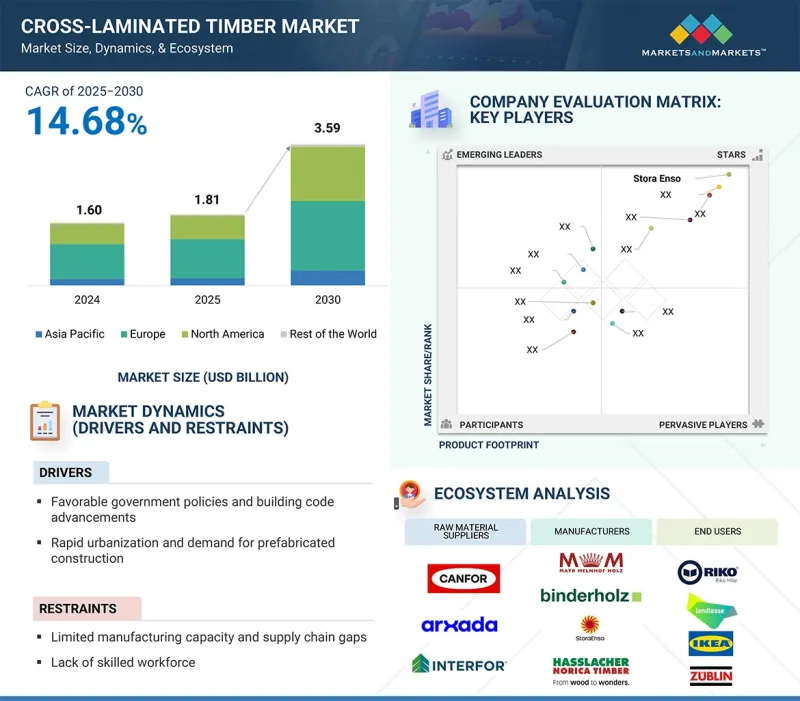

CLT(Cross Laminated Timber)(CLT) 시장 규모는 2024년에 16억 달러로 평가되었습니다.

이 시장은 예측 기간 동안 14.68%의 연평균 복합 성장률(CAGR)로 확대되어 2030년에는 35억 9,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 유닛 | 금액(100만 달러) 및 1,000입방미터(Thousand Cubic Meter) |

| 부문 | 유형별, 업계별, 최종 용도별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 기타 지역 |

접착제 접착 CLT(Cross Laminated Timber) 부문은 CLT 시장에서 가장 큰 카테고리이며, 2030년까지 가장 큰 시장 점유율을 유지할 것으로 예측됩니다. 한편, 기계적으로 고정되는 분야는 꾸준히 발전하고 있습니다. 접착제 접합 CLT 시장에서의 우위는 높은 구조적 강도, 매끄러운 마감, 정밀한 조립식 가공에 기인합니다. 접착 접합은 고성능 구조용 접착제를 사용하여 목재의 수직 층을 영구적으로 접합하는 공법을 말합니다. 이 제조 공정은 목재의 편재를 최소화하고 뒤틀림을 줄이며 내화성, 내습성, 내진동성이 우수하여 벽, 바닥, 지붕 등의 건축 프로젝트에 매우 적합합니다.

접착제 접합 CLT 패널은 유리한 강도 대 중량 비율과 깔끔한 건축 디자인 가능성으로 인해 특히 고층 및 중층 건축에 적합합니다. 또한, 바이오 및 저 VOC 접착제의 도입으로 이러한 패널의 환경 성능이 향상되어 녹색 건축의 세계적 추세와 일치합니다. 프리패브리케이션에서 접착제 접합 CLT의 유연성은 간단한 구조와 함께 현장 작업을 줄이고 신속한 건축 공정을 촉진하여 도시 개발에 이상적인 재료가 되었습니다. 건설 업계에서 속도, 강도, 지속가능성, 설계 유연성에 대한 요구가 높아짐에 따라 접착접합 CLT는 앞으로도 세계 시장을 선도할 것으로 예측됩니다. 또한, 주요 제조업체들은 R&D, 자동화, 친환경 인증에 자본을 투자하고 있으며, 접착제 접합 CLT는 진화하는 대량 목재 건설 산업에서 최고의 성능 부문으로서의 입지를 강화하고 있습니다.

구조용 부문은 CLT 시장에서 가장 큰 시장 점유율을 차지할 것으로 예상되며, 예측 기간 동안 계속 지배적일 것으로 예측됩니다. CLT 패널은 하중을 견뎌야 하는 구조물에 매우 적합하며, 주거 및 상업시설의 벽, 바닥, 지붕, 전단벽에 적합합니다. 여러 층으로 구성된 십자형 라멜라 구조는 강도, 치수 안정성, 내화성과 같은 구조 건축에 필수적인 특성을 가지고 있습니다. 지속 가능한 건축물에 대량 목재 사용이 증가함에 따라 CLT는 가볍고 이산화탄소 배출량이 적으며 조립식 가공이 용이하여 콘크리트나 철골에 대한 비용 효율적인 대안으로 여겨지고 있습니다. 유럽, 북미, 아시아태평양에서 중층 및 고층 목조 건축물 증가는 구조 부문의 우위를 더욱 뒷받침하고 있습니다. 오스트리아, 캐나다, 미국과 같은 국가의 건축법에서는 현재 고층 건축물에서도 목조 건축을 허용하고 있으며, CLT와 같은 구조적으로 안정적인 솔루션의 인기가 높아지고 있습니다. 한편, 클래딩, 파사드, 파티션과 같은 비구조적 용도는 CLT의 미적, 열적 특성으로 인해 인기를 끌고 있지만, 아직 시장 규모는 작습니다. 건설 부문이 탄소 중립을 지향하는 가운데, CLT의 사용은 보다 친환경적인 건물로의 큰 전환을 촉진할 태세를 갖추고 있습니다. CLT가 지진, 열, 음향 하중 관리에 효과적임이 입증됨에 따라 구조용 최종 용도 분야가 CLT 시장을 주도할 것으로 보입니다.

주택 분야는 CLT 시장에서 가장 빠르게 성장하고 있는 틈새 시장입니다. 산업별로는 가장 빠르게 성장할 것으로 예측됩니다. 현재 학교, 상업용 건물, 시설 등 비주거용 건축이 큰 시장 점유율을 차지하고 있지만, 도시화 진행, 정부의 주택 정책, 친환경 주택에 대한 소비자 선호도 변화 등 여러 가지 요인으로 인해 주택 부문이 빠르게 성장하고 있습니다. CLT는 단독주택, 연립주택, 중저층 공동주택에서 인기가 높아지고 있습니다. 그 주된 이유는 빠른 시공 방법, 디자인의 대량 맞춤화 가능성, 에너지 절약으로 이어지는 에너지 효율성에 있습니다. 부재를 현장 밖에서 조립식으로 제작할 수 있어 공사 일정의 대폭적인 단축에 기여하고, 현장의 건설 작업을 최소화하여 이웃에 대한 피해를 줄일 수 있습니다. 그 결과 CLT는 특히 도시 및 교외 주택 건설에 있어 실용적인 선택이 될 수 있습니다. 또한, 구매자들은 미관을 중시하는 경향이 있으며, 그 결과 노출된 목재 구조의 아름다움에 대한 평가가 높아지고 있습니다. 생체 친화적 디자인의 영향으로 많은 건축가와 주택 소유주들이 매스 팀버를 주요 건축자재로 선택하게 되었습니다. 한편, 교육시설, 헬스케어 빌딩, 복합 오피스 빌딩, 리테일 공간 등 비주거용도는 특히 대규모 프로젝트에서 CLT의 중요한 수요처로 남을 것으로 보입니다. 그럼에도 불구하고 지속 가능한 주택을 지원하는 정책, 탄소 중립 건축 요건, 녹색 건물에 대한 보조금에 대한 관심이 높아지면서 주택 건설에 새로운 트렌드를 만들어내고 있습니다.

CLT 시장에서는 현재 유럽이 가장 큰 점유율을 차지하고 있으며, 이러한 추세는 앞으로도 지속될 것으로 예측됩니다. 이러한 우위는 CLT의 조기 도입, 선진화된 제조 생태계, 구조용 인공목재 사용을 촉진하는 건축법 등에 기인합니다. 오스트리아, 독일, 스위스, 북유럽 국가들은 지속가능한 임업과 건축 적용에 대한 강력한 문화적, 산업적 유산을 바탕으로 대량 목재 건축의 선두주자로 자리매김하고 있습니다. 아시아태평양은 더욱 빠르게 성장할 것으로 예측됩니다. 이러한 성장의 원동력은 도시화율 증가, 지속가능성에 대한 요구, 보다 모듈화된 공법으로의 전환입니다. 일본, 중국, 한국, 호주는 정부의 시범 프로그램 및 건축법 개정에 힘입어 대량 목재 건축물에 대한 대규모 투자를 진행하고 있습니다. 일본의 목조 건축의 전통과 내진 구조에 중점을 두는 자세는 CLT의 특성과 잘 부합합니다. 한편, 중국에서는 환경문제와 자원의 효율적 이용에 대한 인식이 높아지면서 매스 팀버에 대한 관심이 높아지고 있습니다.

세계의 CLT(Cross Laminated Timber) 시장에 대해 조사했으며, 유형별, 산업별, 최종 용도별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

제6장 업계 동향

- 공급망 분석

- 가격 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 생태계 분석

- 기술 분석

- 사례 연구 분석

- 무역 분석

- 규제 상황

- 2025년-2026년 주요 컨퍼런스 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- 2025년 미국 관세의 영향-개요

- AI/생성형 AI가 CLT(Cross Laminated Timber) 시장에 미치는 영향

제7장 CLT(Cross Laminated Timber) 시장(유형별)

- 서론

- 접착제 접착 유형

- 기계적 고정 유형

제8장 CLT(Cross Laminated Timber) 시장(업계별)

- 서론

- 주택용

- 비주택용

제9장 CLT(Cross Laminated Timber) 시장(최종 용도별)

- 서론

- 구조적

- 비구조적

제10장 CLT(Cross Laminated Timber) 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 호주 및 뉴질랜드

- 기타

- 유럽

- 독일

- 오스트리아

- 이탈리아

- 체코

- 프랑스

- 스웨덴

- 스위스

- 영국

- 슬로바키아

- 기타

- 북미

- 미국

- 캐나다

- 기타 지역

제11장 경쟁 구도

- 서론

- 주요 시장 진출기업이 채택한 전략

- 시장 점유율 분석, 2024년

- 매출 분석

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 제품 비교 분석

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 시장 진출기업

- MAYR-MELNHOF HOLZ

- STORA ENSO

- BINDERHOLZ GMBH

- HASSLACHER HOLDING GMBH

- SCHILLIGER HOLZ AG

- EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG

- KLH MASSIVHOLZ GMBH

- MERCER MASS TIMBER

- XLAM

- PFEIFER HOLDING GMBH

- 기타 기업

- LION LUMBER

- SMARTLAM NORTH AMERICA

- CLT FINLAND LTD(HOISKO)

- PEETRI PUIT OU(ARCWOOD)

- B&K STRUCTURES LTD

- THEURL AUSTRIAN PREMIUM TIMBER

- GROUPE LEBEL INC.(IB EWP)

- NORDIC STRUCTURES

- D.R. JOHNSON LUMBER CO.

- W. U. J. DERIX GMBH & CO.

- URBEM

- ZUBLIN TIMBER GMBH

- CROSSLAM AUSTRALIA

- STERLING STRUCTURAL

- FRERES ENGINEERED WOOD

제13장 인접 시장과 관련 시장

제14장 부록

LSH 25.09.30The cross-laminated timber (CLT) market was valued at USD 1.60 billion in 2024 and is projected to reach USD 3.59 billion by 2030, at a CAGR of 14.68% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Cubic Meter) |

| Segments | Type, End-use, Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

"Increasing adoption of adhesive-bonded CLT to drive the cross-laminated timber market"

The adhesive-bonded cross-laminated timber (CLT) segment is the largest category in the CLT market and is expected to maintain the largest market share through 2030. Meanwhile, the mechanically fastened segment is steadily developing. The dominance of adhesive-bonded CLT in the market can be attributed to its high structural strength, smooth finish, and precise prefabrication. Adhesive bonding refers to a construction method that permanently joins perpendicular layers of timber using high-performance structural adhesives. This production process minimizes uneven distribution, reduces warping, and provides good resistance to fire, moisture, and vibration, making it highly desirable for construction projects such as walls, floors, and roofs.

Adhesive-bonded CLT panels are particularly suitable for high-rise and mid-rise buildings due to their advantageous strength-to-weight ratio and their potential for clean architectural designs. Moreover, the introduction of bio-based and low-VOC adhesive formulations has improved the environmental performance of these panels, aligning with global trends in green construction. The flexibility of adhesive-bonded CLT in prefabrication, along with its straightforward construction, facilitates faster building processes with less on-site work, making it an ideal material for urban development. Given the increasing demands in the construction industry for speed, strength, sustainability, and design flexibility, it is anticipated that adhesive-bonded CLT will continue to lead the global market. Furthermore, leading manufacturers are capitalizing on research and development, automation, and green certification, reinforcing the position of adhesive-bonded CLT as the top-performing segment in the evolving mass timber construction industry.

"Structural applications continue to dominate the CLT market, by end use"

The structural applications segment is expected to hold the largest market share in the CLT market and will likely remain dominant throughout the forecast period. CLT panels are highly suitable for structures that must bear loads, making them ideal for residential and commercial walls, floors, roofs, and shear walls. Their cross-oriented lamella structure, composed of multiple layers, provides strength, dimensional stability, and fire resistance-qualities essential for structural constructions. With the increasing use of mass timber in sustainable buildings, CLT is increasingly viewed as a cost-effective alternative to concrete and steel due to its lighter weight, smaller carbon footprint, and ease of prefabrication. The dominance of the structural segment is further supported by the rise of mid-rise and tall wood buildings in Europe, North America, and some parts of the Asia Pacific. Construction codes in countries like Austria, Canada, and the US are now accommodating timber construction in taller structures, making structurally stable solutions like CLT increasingly popular. On the other hand, non-structural applications such as cladding, facades, and partitioning are gaining traction primarily due to the aesthetic and thermal properties of CLT, although they remain a small segment of the market. As the construction sector moves toward carbon-neutral practices, the use of CLT is poised to drive a significant shift toward more environmentally friendly buildings. Given its demonstrated effectiveness in managing seismic, thermal, and acoustic loads, the structural end-use segment is set to lead the CLT market.

"Residential sector to register the fastest growth in the CLT market"

The residential sector is the most rapidly growing niche within the CLT market. It is estimated to experience the fastest growth among industry verticals. While non-residential construction-such as schools, commercial buildings, and institutional structures-currently holds a larger market share, the residential segment is expanding quickly due to several factors, including increased urbanization, government housing initiatives, and a shift in consumer preferences toward eco-friendly homes. CLT is becoming increasingly popular in single-family homes, row houses, and low-to-mid-rise apartment complexes. This is largely because of its fast installation method, the mass customization possibilities of designs, and its energy efficiency, which leads to significant energy savings. The ability to prefabricate components off-site contributes to considerable reductions in construction schedules, minimizes on-site construction work, and decreases disturbances to neighboring properties. As a result, CLT is a practical choice for housing construction, particularly in urban and suburban areas. Additionally, buyers are placing more importance on aesthetics, which has led to a growing appreciation for the beauty of exposed timber structures. The influence of biophilic design is also gaining traction, prompting many architects and homeowners to select mass timber as their primary construction material. On the other hand, non-residential applications, such as educational facilities, healthcare buildings, office complexes, and retail spaces, will continue to be significant consumers of CLT, particularly for large-scale projects. Nevertheless, the rising interest in policies supporting sustainable housing, carbon-neutral building requirements, and subsidies for green buildings are creating new trends in residential construction.

"Europe dominates the CLT market, while Asia Pacific is the fastest-growing region"

Europe currently holds the largest share of the CLT market, and this trend is expected to continue in the coming years. This dominance can be attributed to early adoption of CLT, advanced manufacturing ecosystems, and building codes that promote the use of engineered wood for structural applications. Countries such as Austria, Germany, Switzerland, and those in the Nordic region are leaders in mass timber architecture, supported by a strong cultural and industrial heritage in sustainable forestry and its application in construction. The Asia Pacific region is anticipated to experience even faster growth. This increase is driven by rising urbanization rates, sustainability requirements, and a shift toward more modular construction methods. Japan, China, South Korea, and Australia are making significant investments in mass timber buildings, spurred by government pilot programs and updates to building codes. Japan's tradition of timber architecture and its focus on earthquake-resistant structures align well with the properties of CLT. Meanwhile, in China, interest in mass timber is growing due to a heightened awareness of environmental issues and the efficient use of resources.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the cross-laminated timber market

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Mayr-Melnhof Holz (Austria), Stora Enso (Finland), Binderholz GmbH (Austria), HASSLACHER Holding GmbH (Austria), Schilliger Holz AG (Switzerland), Eugen Decker Holzindustrie KG (Germany), KLH Massivholz GmbH (Austria), Mercer Mass Timber (Canada), XLam (Australia), and Pfeifer Holding GmbH (Austria)

Research Coverage

This report segments the market for cross-laminated timber based on type, end-use, industry, and region, and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for cross-laminated timber.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the cross laminated timber market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on cross-laminated timber offered by top players in the global market.

- Analysis of key drivers (favorable government policies and building code advancements, rapid urbanization, and demand for prefabricated construction), restraints (limited manufacturing capacity and supply chain gaps and lack of skilled workforce), opportunities (growing demand in commercial and institutional buildings and potential in renovation and adaptive reuse projects), and challenges (moisture sensitivity and durability concerns) influencing the growth of the cross-laminated timber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cross-laminated timber market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for cross-laminated timber across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global cross-laminated timber market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the cross-laminated timber market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY INDUSTRY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY END USE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CROSS-LAMINATED TIMBER MARKET

- 4.2 CROSS-LAMINATED TIMBER MARKET, BY REGION

- 4.3 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE AND COUNTRY

- 4.4 REGIONAL ANALYSIS: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY AND REGION

- 4.5 CROSS-LAMINATED TIMBER MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable government policies and building code advancements

- 5.2.1.2 Rapid urbanization and demand for prefabricated construction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited manufacturing capacity and supply chain gaps

- 5.2.2.2 Lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand in commercial and institutional buildings

- 5.2.3.2 Potential in renovation and adaptive reuse projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Moisture sensitivity and durability concerns

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE BY INDUSTRY, BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF CROSS-LAMINATED TIMBER, BY REGION, 2022-2024

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Cross-lamination configuration and panel engineering

- 6.5.1.2 Protective technologies, fire safety engineering, and sustainability innovations in cross-laminated timber

- 6.5.2 COMPLIMENTARY TECHNOLOGIES

- 6.5.2.1 Weatherproofing and building envelope solutions in cross-laminated timber construction

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CROSS-LAMINATED TIMBER APPLICATION IN COMMERCIAL OFFICE

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 441882)

- 6.7.2 EXPORT SCENARIO (HS CODE 441882)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 FSC Certification (Forest Stewardship Council)

- 6.8.2.2 EPA TSCA (Toxic Substances Control Act)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON CROSS-LAMINATED TIMBER MARKET

7 CROSS-LAMINATED TIMBER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ADHESIVE BONDED

- 7.2.1 SUPERIOR PROPERTIES AND LOW PRODUCTION COST

- 7.2.2 POLYURETHANE (PUR)

- 7.2.3 MELAMINE-UREA-FORMALDEHYDE (MUF)

- 7.3 MECHANICALLY FASTENED

- 7.3.1 ENHANCED STRENGTH AND STABILITY OF STRUCTURES

- 7.3.2 SELF-TAPPING SCREWS (STS)

- 7.3.3 DOWEL-TYPE FASTENERS

8 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 EVOLUTION OF BUILDING CODES OFFERS OPPORTUNITIES FOR CROSS-LAMINATED TIMBER MARKET

- 8.3 NON-RESIDENTIAL

- 8.3.1 OPPORTUNITIES OFFERED FOR MASS CONSTRUCTION OF TIMBER BUILDINGS

- 8.3.2 PUBLIC

- 8.3.3 INDUSTRIAL

- 8.3.4 OTHERS

9 CROSS-LAMINATED TIMBER MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 STRUCTURAL

- 9.2.1 HIGH DEMAND IN STRUCTURAL END USE SEGMENT

- 9.3 NON-STRUCTURAL

- 9.3.1 USED AS SUBSTITUTES FOR BOLTED MATS

10 CROSS-LAMINATED TIMBER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Large investments by global manufacturers to boost

- 10.2.2 JAPAN

- 10.2.2.1 Investments in infrastructural markets by public and private sectors to boost demand

- 10.2.3 AUSTRALIA AND NEW ZEALAND

- 10.2.3.1 Technology-driven economy to drive market

- 10.2.4 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Presence of major distribution channels to increase demand

- 10.3.2 AUSTRIA

- 10.3.2.1 Investments and government approach toward sustainability to drive market

- 10.3.3 ITALY

- 10.3.3.1 High disposable income and rising FII investments

- 10.3.4 CZECH REPUBLIC

- 10.3.4.1 Emerging market and rising development to propel demand

- 10.3.5 FRANCE

- 10.3.5.1 Government initiatives and enhanced technology in building & construction industry to drive market

- 10.3.6 SWEDEN

- 10.3.6.1 Residential market to drive demand for cross-laminated timber

- 10.3.7 SWITZERLAND

- 10.3.7.1 Domestic demand for Swiss construction to drive growth

- 10.3.8 UK

- 10.3.8.1 BREXIT to hamper industry growth in short term

- 10.3.9 SLOVAKIA

- 10.3.9.1 Increase in housing units boosts demand for cross-laminated timber

- 10.3.10 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Growing sustainable material usage in construction industry to boost market

- 10.4.2 CANADA

- 10.4.2.1 Government investments in building & construction sector to propel market

- 10.4.1 US

- 10.5 REST OF THE WORLD

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 End use footprint

- 11.5.5.5 Industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 MAYR-MELNHOF HOLZ

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 STORA ENSO

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BINDERHOLZ GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansion

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HASSLACHER HOLDING GMBH

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SCHILLIGER HOLZ AG

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product Launches

- 12.1.5.3.2 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.7 KLH MASSIVHOLZ GMBH

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 MERCER MASS TIMBER

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 XLAM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 PFEIFER HOLDING GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 MAYR-MELNHOF HOLZ

- 12.2 OTHER COMPANIES

- 12.2.1 LION LUMBER

- 12.2.2 SMARTLAM NORTH AMERICA

- 12.2.3 CLT FINLAND LTD (HOISKO)

- 12.2.4 PEETRI PUIT OU (ARCWOOD)

- 12.2.5 B&K STRUCTURES LTD

- 12.2.6 THEURL AUSTRIAN PREMIUM TIMBER

- 12.2.7 GROUPE LEBEL INC. (IB EWP)

- 12.2.8 NORDIC STRUCTURES

- 12.2.9 D.R. JOHNSON LUMBER CO.

- 12.2.10 W. U. J. DERIX GMBH & CO.

- 12.2.11 URBEM

- 12.2.12 ZUBLIN TIMBER GMBH

- 12.2.13 CROSSLAM AUSTRALIA

- 12.2.14 STERLING STRUCTURAL

- 12.2.15 FRERES ENGINEERED WOOD

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATION

- 13.3 ENGINEERED WOOD ADHESIVES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 ENGINEERED WOOD ADHESIVES MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 EUROPE

- 13.4.4 REST OF THE WORLD

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS