|

시장보고서

상품코드

1834229

자율주행용 HD 지도 시장(-2032년) : 서비스 유형(맵핑 및 현지화, 업데이트 및 유지보수), 차량 유형(PC 및 CV), 솔루션 유형(임베디드 및 클라우드), 이용 형태, 자동화 수준(L2, L3, L4, L5), 지역별HD Maps for Autonomous Driving Market by Service Type (Mapping & Localization, Update & Maintenance), Vehicle Type (PC & CV), Solution Type (Embedded & Cloud), Usage Type, Level of Automation (L2, L3, L4, L5), and Region - Global Forecast to 2032 |

||||||

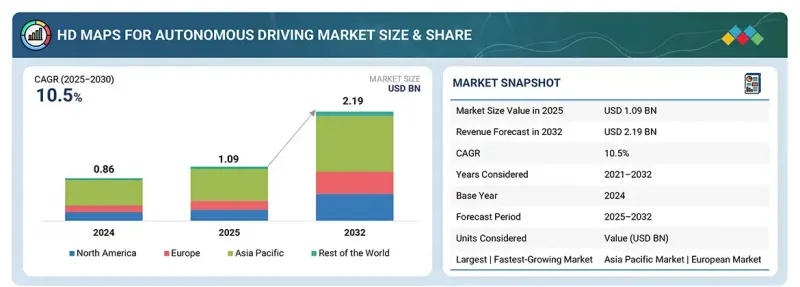

세계의 자율주행용 HD 지도 시장 규모는 2025년 10억 9,000만 달러에서 예측 기간 동안 CAGR 10.5%로 추이하고, 2032년에는 21억 9,000만 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액(달러) |

| 부문별 | 서비스 유형, 자동화 수준, 솔루션 유형, 이용 형태, 차량 유형, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽 및 기타 지역 |

자율주행용 HD 지도 시장은 시맨틱 맵핑의 발전으로 급속히 확대되고 있습니다. 이것은 도로뿐만 아니라 신호등, 횡단 보도, 차선 표시 등의 물체를 인식하고 컨텍스트 교통 상황을 이해할 수 있는 지도를 나타냅니다. 또한 블록체인 기술과 안전한 데이터 공유 프레임워크를 사용하여 차량 플릿 전체에서 지도 업데이트의 신뢰성과 투명성을 보장하는 움직임이 확산되고 있습니다. 또한, 에너지 효율이 높은 지도 생성 기술에 대한 주목도 높아지고 있어, 자동 운전차의 계산 부하를 억제하면서, 고정밀도를 유지하는 것이 요구되고 있습니다. HD 지도의 데이터는 보통 LiDAR, 카메라, GPS, 레이더 등의 센서를 탑재한 차량 플릿이 수집합니다. 이러한 차량이 주행하는 동안 도로 및 주변 환경에 대한 자세한 정보를 지속적으로 획득하고 업데이트하면 클라우드 소싱과 센서 퓨전의 정확하고 최신 지도가 유지됩니다. 이러한 요소가 자율주행용 HD 지도 시장의 성장을 강력하게 뒷받침하고 있습니다.

예측 기간 동안 솔루션 유형별로는 임베디드 부문이 큰 점유율을 차지할 전망

임베디드 솔루션은 실시간으로 고정밀 위치 및 네비게이션을 차량 내에서 직접 수행하여 로컬 처리를 통해 통신 지연을 줄이고 안전성이 요구되는 동적 운전 환경에서 신속한 응답을 가능하게 합니다. 이러한 시스템은 클라우드 연결에 독립적으로 작동하므로 통신 환경이 제한된 지역에서도 신뢰성과 내결함성을 보장할 수 있습니다. 또한 V2X와 자동차 센서의 실시간 데이터를 통합하여 HD 지도을 항상 최신 상태로 유지하고 자동 운전에 필요한 지속적인 업데이트를 지원합니다. 도시 인프라의 복잡성과 상세한 환경 이해에 대한 요구가 증가함에 따라 정밀 도로 모양과 교통 시나리오를 처리할 수 있는 고성능 임베디드 지도 시스템에 대한 수요가 증가하고 있습니다. 게다가 반도체 기술과 센서 퓨전 알고리즘의 발전으로 이러한 시스템은 보다 효율적이고 저비용이 되고 있습니다.

자동화 수준별로, 자율주행 차량 부문이 예측 기간 동안 현저한 성장을 이룰 전망

이 성장은 AI, HD 매핑, LiDAR, 센서 퓨전 기술의 급속한 진보에 의해 지원되고 있으며, 인간의 조작을 필요로 하지 않는 완전 자동 운전(레벨 4, 레벨 5)의 실현을 가능하게 하고 있습니다. 또한 로보택시, 무인셔틀, 물류차량에 대한 투자가 증가하고 있으며, 각국 정부의 스마트모빌리티 추진 정책이 시장 확대를 뒷받침하고 있습니다. Waymo, Uber, Baidu Apollo 등의 상업용 로보 택시 서비스의 도시 전개도 HD 지도 수요를 끌어올리고 있습니다. 이러한 기업들은 센티미터 단위의 위치 정밀도와 상세한 도로 이해, 실시간 네비게이션을 실현하기 위해 HD 지도를 활용하여 안전성, 쾌적성, 운행 신뢰성을 높이고 있습니다.

"예측 기간 동안 유럽이 가장 높은 성장률을 보일 전망"

유럽에서 HD 지도 수요는 EU의 엄격한 안전 규제, 고급차로의 레벨 2 및 레벨 3 자율주행 기능 확대, 스마트 이동성 및 커넥티드 인프라에 대한 정부 지원에 의해 추진되고 있습니다. 도시 지역에서의 자동 운전 실증 실험 증가도 채용을 가속시키고 있습니다.

본 보고서에서는 세계의 자율운전용 HD 지도 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술·특허 동향, 법규제 환경, 사례연구, 시장 규모 추이와 예측, 각종 구분 및 지역/주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

제6장 업계 동향

- 거시경제지표

- 생태계 분석

- 공급망 분석

- 가격 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 전략적 전망과 성장 기회

- 무역 분석

- 2025-2026년 주요 회의 및 이벤트

- 고객의 사업에 영향을 미치는 동향/혼란

- 규제 상황

- 특허 분석

- 자율주행 시장에서 생성형 AI의 HD 지도에 대한 영향

- ADAS 개발 강화를 위한 하이브리드 매핑 전략

- 맵리스 자동 운전 컨셉이 HD 지도에 미치는 영향

- 자동 운전 모빌리티에서 HD 매핑의 진화하는 비즈니스 모델

- 현지화를 위한 주요 산업 솔루션에 대한 MNM 통찰

- HD 지도 데이터 포맷과 표준화 상황

- AV 에코시스템에서 HD 지도의 단계적 도입 전략

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- HD 매핑 서비스 제공업체 : 경쟁 구도

- OEM HD 매핑 솔루션의 비교 분석

- HD 지도의 미래 응용

- 성공 사례와 실세계에서의 응용

제7장 자율주행용 HD 지도 시장 : 자동화 수준별

- 반자율주행차

- 레벨 2

- 레벨 3

- 자율주행차

- 레벨 4

- 레벨 5

- 주요 인사이트

제8장 자율주행용 HD 지도 시장 : 서비스 유형별

- 매핑 및 현지화

- 업데이트 및 유지보수

- 광고

- 주요 인사이트

제9장 자율주행용 HD 지도 시장 : 솔루션 유형별

- 임베디드

- 클라우드 기반

- 주요 인사이트

제10장 자율주행용 HD 지도 시장 : 이용 형태별

- 퍼스널 모빌리티

- 상용 모빌리티

- 주요 인사이트

제11장 자율주행용 HD 지도 시장 : 차량 유형별

- 승용차

- 상용차

- 주요 인사이트

제12장 자율주행용 HD 지도 시장 : 지역별

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 이탈리아

- 스페인

- 영국

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 기타 지역

- 거시경제 전망

- 브라질

- 남아프리카

- 러시아

- 사우디아라비아

- 아랍에미리트(UAE)

제13장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 시장 점유율 분석

- 톱 5사의 수익 분석

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- HERE

- BAIDU INC.

- TOMTOM INTERNATIONAL BV

- NVIDIA CORPORATION

- MOBILEYE

- WAYMO LLC

- DYNAMIC MAP PLATFORM CO., LTD.

- NAVINFO CO., LTD.

- LUMINAR TECHNOLOGIES, INC.

- THE SANBORN MAP COMPANY, INC.

- MOMENTA

- MAPBOX

- 기타 기업

- CE INFO SYSTEMS LTD.

- NAVMII

- RMSI

- ZENRIN CO., LTD.

- WOVEN BY TOYOTA, INC.

- SWIFT NAVIGATION, INC.

- IMERIT

- VOXELMAPS

- HYUNDAI AUTOEVER CORP.

- GENESYS INTERNATIONAL CORPORATION LTD

- GEOMATE

- INTELLIAS

- MORAI INC.

제15장 부록

JHS 25.10.20The HD maps for autonomous driving market is projected to grow from USD 1.09 billion in 2025 to USD 2.19 billion by 2032, at a CAGR of 10.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By service type, level of automation, solution type, usage type, vehicle type, and region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The HD maps for autonomous driving market is growing with the rise of semantic mapping, where maps show roads and interpret objects, such as traffic lights, crosswalks, and lane markings for contextual awareness. Another emerging trend is the use of blockchain and secure data-sharing frameworks to ensure reliability and trust in map updates across fleets. In addition, energy-efficient mapping techniques are gaining attention to reduce the computational load on autonomous vehicles while maintaining accuracy. Data for HD maps is typically collected through fleets of sensor-equipped vehicles using LiDAR, cameras, GPS, and radar, which continuously capture and update detailed road and environment information. This crowdsourced and sensor-fusion approach ensures maps remain precise and up to date for autonomous driving. All these factors are boosting the growth of the HD maps for autonomous driving market.

The embedded segment is projected to account for a significant share during the forecast period.

By solution type, the embedded segment is projected to account for a significant share during the forecast period. Embedded solutions offer real-time, high-precision localization and navigation directly within a vehicle's onboard systems, processing mapping data locally to reduce latency and enable faster response times critical for safety in dynamic driving environments. These systems operate independently of cloud connectivity, providing enhanced reliability and resilience, especially in areas with limited or no network coverage. By seamlessly integrating real-time data from sensors and vehicle-to-everything (V2X) communication, embedded solutions ensure that HD maps remain current and accurate, supporting the continuous updates required by autonomous vehicles. The growing complexity of urban infrastructure and the need for detailed environmental understanding further drive the demand for sophisticated embedded mapping systems capable of handling intricate road geometries and traffic scenarios. With advancements in semiconductor technology and sensor fusion algorithms, these systems are becoming increasingly cost-effective and efficient.

Companies such as HERE (Netherlands), Baidu Inc. (China), Hyundai Autoever Corporation (South Korea), and Mapbox (US) offer embedded HD Map solutions. The Volvo EX90 and Polestar 3 were among the first to feature Google's embedded HD maps to improve driver assistance. NIO also provides an offline mode for its HD maps in the Navigation on Pilot system of the NIO ET7, allowing use in areas with weak or no internet connection. Similarly, BMW's Personal Pilot Level 2+ system uses HERE Technologies' embedded HD maps to enable "on-map" driving.

The autonomous vehicles segment is projected to grow at a significant rate during the forecast period.

By level of automation, the autonomous vehicles segment is projected to grow at a significant rate during the forecast period. The growth of HD maps in autonomous vehicles, including Level 4 and Level 5 autonomy, is driven by major advancements in AI, HD mapping, LiDAR, and sensor fusion, making fully autonomous driving possible without human input. Increasing investments in robotaxis, autonomous shuttles, and logistics fleets, supported by government smart mobility programs, are speeding up large-scale adoption. The launch of commercial robotaxi services by companies such as Waymo, Uber, and Baidu Apollo in selected urban areas further boosts the market. These players use HD maps to provide centimeter-level localization, detailed road understanding, and real-time navigation for safe autonomous driving. This helps them improve ride reliability, enhance passenger safety, and ensure smooth operation in complex urban environments.

In September 2025, Uber Technologies (China) and Momenta (China) plan to begin testing Level 4 autonomous robotaxi services in Munich, Germany. Similarly, in August 2025, Kia partnered with Autonomous A2Z to develop Level 4 self-driving cars using Kia's PBV (Platform Beyond Vehicle) system, with plans to showcase these vehicles at the 2025 Asia Pacific Economic Cooperation summit in Gyeongju, South Korea. In addition, the use of autonomous driving in freight and delivery operations helps lower costs and tackle driver shortages, creating more opportunities for HD maps.

"Europe is projected to grow at the highest rate during the forecast period."

Europe is projected to grow at the highest rate in the HD maps for autonomous driving market during the forecast period. The demand for HD maps in Europe will be driven by stringent EU safety regulations, the expansion of Level 2+ and Level 3 semi-autonomous driving features in premium vehicles, and strong government backing for smart mobility and connected infrastructure. Growing autonomous trials in urban mobility further accelerate adoption.

Companies such as HERE (Netherlands), TomTom International BV (Netherlands), and Navmii (UK) provide HD maps for autonomous driving vehicles in Europe. In August 2025, HERE partnered with DAF Trucks N.V. in the EU co-funded MODI Project to advance and test Level 4 automated freight transport across Europe. In this project, DAF contributes its expertise in commercial vehicles. At the same time, HERE provides its High-Definition Live Map (HDLM), which functions as an external sensor, with data collected from DAF's sensor-equipped automated trucks feeding into HERE's platform to keep the maps continuously updated for safe and reliable operations. Likewise, in April 2025, HERE signed an MoU with Lotus Robotics, the intelligent driving division of Lotus Technology, to develop an advanced Highway Navigation Pilot that delivers Level 2+ (L2+) automated driving functions. The partnership combined Lotus's sensor perception stack with HERE's high-precision maps to enable safer, more advanced driving features, including hands-off driving in certain conditions. The solution, planned for European approval in 2025, will be used in future Lotus vehicles and offered to other automakers.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEM - 8%, Tier I - 74%, and Tier 2/3 - 8%

- By Designation: CXOs - 36%, Managers - 51%, and Executives - 13%

- By Region: North America - 24%, Europe - 30%, Asia Pacific - 38%, and ROW - 8%

The HD maps for autonomous driving market is dominated by major players, including HERE (Netherlands), Baidu, Inc. (China), TomTom International BV (Netherlands), NVIDIA Corporation (US), and Mobileye (Israel). These companies offer highly detailed, lane-level HD maps with real-time updates to support autonomous driving and ADAS. They also provide value-added services, such as dynamic map layers (traffic, road conditions, and weather), cloud-based map delivery platforms, crowdsourced data integration, sensor fusion solutions, and software tools for path planning, localization, and navigation.

Research Coverage

The report covers the HD maps for autonomous driving market by service type (mapping & localization, update & maintenance, and advertisement), vehicle type (passenger car and commercial vehicle), solution type (embedded and cloud-based), usage type, level of automation, and region. It covers the major HD maps' competitive landscape and company profiles for autonomous driving market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall HD maps for autonomous driving market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The Report Provides Insight into the Following Pointers:

- Analysis of key drivers (Rising penetration of autonomous vehicles in the global mobility ecosystem, focus on leveraging next-gen mapping and data collection for enhanced navigation, emergence of autonomous urban mobility applications, increasing adoption of L2 and L3 ADAS-equipped vehicles), restraints (lack of global standardization, less reliability in untested environments), opportunities (integration with traffic and infrastructure systems for optimized urban navigation, map-as-a-service enabling scalable and flexible adoption, adoption in emerging markets with 5G expansion), and challenges (high cost of development and maintenance, complex real-time merging of multi-sensor data, dependence on high-bandwidth networks and advanced edge computing infrastructure).

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the HD maps for autonomous driving market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the HD maps for autonomous driving market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as HERE (Netherlands), Baidu, Inc. (China), TomTom International BV (Netherlands), NVIDIA Corporation (US), and Mobileye (Israel) in the HD maps for autonomous driving market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF STRATEGIC CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.2.5 Primary interviewees

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BASE NUMBER CALCULATION

- 2.2.3 MARKET FORECAST APPROACH

- 2.2.3.1 Supply side

- 2.2.3.2 Demand side

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HD MAPS FOR AUTONOMOUS DRIVING MARKET

- 4.2 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE

- 4.3 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE

- 4.4 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE

- 4.5 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION

- 4.6 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE

- 4.7 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising penetration of autonomous vehicles into global mobility ecosystem

- 5.2.1.2 Focus on leveraging next-gen mapping and data collection for enhanced navigation

- 5.2.1.3 Emergence of autonomous urban mobility applications

- 5.2.1.4 Increasing adoption of L2 and L3 ADAS-equipped vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of global standardization

- 5.2.2.2 Less reliability in untested environments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration with traffic and infrastructure systems for optimized urban navigation

- 5.2.3.2 Map-as-a-service enabling scalable and flexible adoption

- 5.2.3.3 Adoption in emerging markets with 5G expansion

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of development and maintenance

- 5.2.4.2 Complex real-time merging of multi-sensor data

- 5.2.4.3 Dependence on high-bandwidth networks and advanced edge computing infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 MACROECONOMIC INDICATORS

- 6.1.1 INTRODUCTION

- 6.1.2 GDP TRENDS AND FORECAST

- 6.1.3 TRENDS IN GLOBAL AUTONOMOUS DRIVING INDUSTRY

- 6.1.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 6.2 ECOSYSTEM ANALYSIS

- 6.2.1 HD MAP PROVIDERS

- 6.2.2 AUTONOMOUS DRIVING SOFTWARE/PLATFORM PROVIDERS

- 6.2.3 CLOUD INFRASTRUCTURE PROVIDERS

- 6.2.4 SENSOR PROVIDERS

- 6.2.5 TELEMATICS & CONNECTIVITY PROVIDERS

- 6.2.6 OEMS

- 6.2.7 FLEET OPERATORS/MOBILITY PROVIDERS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 INDICATIVE PRICING OF AUTONOMOUS DRIVING SOFTWARE SUITE OFFERED BY KEY PLAYERS

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.5.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.5.4 MARKET PROFITABILITY

- 6.5.4.1 Revenue potential

- 6.5.4.2 Cost dynamics

- 6.5.4.3 Margin opportunities, by application

- 6.5.5 DECISION-MAKING PROCESS

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 MERCEDES-BENZ INTEGRATED HERE'S HD LIVE MAP INTO ITS DRIVE PILOT SYSTEM

- 6.6.2 INTELLIAS CONCEPTUALIZED, DEVELOPED, AND SCALED CLOUD-BASED HD MAPPING AND LOCATION DATA PLATFORM FOR AUTONOMOUS DRIVING

- 6.6.3 MAGNASOFT DEPLOYED AI-DRIVEN CONTINUOUS IMPROVEMENT PROCESSES THAT ENABLED REAL-TIME DETECTION OF CHANGES IN TRAFFIC PATTERNS AND ROAD CONDITIONS

- 6.6.4 INFOSYS DEPLOYED MULTI-SOURCE HD MAPPING SOLUTION SPECIFICALLY DESIGNED FOR ADAS IN URBAN ENVIRONMENTS

- 6.7 INVESTMENT & FUNDING SCENARIO

- 6.8 STRATEGIC OUTLOOK AND GROWTH OPPORTUNITIES

- 6.8.1 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 6.8.1.1 Interconnected markets

- 6.8.1.2 Cross-sector opportunities

- 6.8.2 STRATEGIC MOVES BY OEMS AND TIER-1 & TIER-2/3 PLAYERS

- 6.8.1 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 852691)

- 6.9.2 EXPORT SCENARIO (HS CODE 852691)

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.12 REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 KEY REGULATIONS

- 6.12.3 REGULATIONS GOVERNING AUTONOMOUS VEHICLE USAGE, BY COUNTRY

- 6.13 PATENT ANALYSIS

- 6.13.1 INTRODUCTION

- 6.13.2 METHODOLOGY

- 6.13.3 DOCUMENT TYPE

- 6.13.4 INSIGHTS

- 6.13.5 LEGAL STATUS OF PATENTS

- 6.13.6 JURISDICTION ANALYSIS

- 6.13.7 TOP PATENT APPLICANTS

- 6.13.8 LIST OF PATENTS

- 6.14 IMPACT OF GENERATIVE AI ON HD MAPS FOR AUTONOMOUS DRIVING MARKET

- 6.14.1 ACCELERATED MAP CREATION AND UPDATES

- 6.14.2 ENHANCED LOCALIZATION ACCURACY

- 6.14.3 COST REDUCTION THROUGH SYNTHETIC DATA

- 6.14.4 DYNAMIC MAP PERSONALIZATION

- 6.15 HYBRID MAPPING STRATEGIES FOR ENHANCING ADAS DEVELOPMENT

- 6.16 IMPACT OF MAPLESS AUTONOMY CONCEPT ON HD MAPS

- 6.17 EVOLVING BUSINESS MODELS FOR HD MAPPING IN AUTONOMOUS MOBILITY

- 6.17.1 LICENSING AND SUBSCRIPTION-BASED MODEL

- 6.17.2 CROWDSOURCED MAPPING AND DATA-AS-A-SERVICE (DAAS)

- 6.17.3 PAY-PER-USE MODEL

- 6.18 MNM INSIGHTS ON KEY INDUSTRY SOLUTIONS FOR LOCALIZATION

- 6.18.1 GNSS AND AUGMENTED POSITIONING

- 6.18.2 HD MAP-BASED LOCALIZATION

- 6.18.3 LIDAR AND CAMERA-BASED LOCALIZATION

- 6.18.4 SENSOR FUSION

- 6.18.5 V2X-ENABLED COOPERATIVE LOCALIZATION

- 6.19 HD MAP DATA FORMATS AND STANDARDIZATION LANDSCAPE

- 6.19.1 CORE COMPONENTS OF HD MAP DATA

- 6.19.1.1 Geometric layer

- 6.19.1.2 Semantic layer

- 6.19.1.3 Localization layer

- 6.19.1.4 Dynamic/Update layer

- 6.19.2 KEY STANDARDS AND FORMATS

- 6.19.1 CORE COMPONENTS OF HD MAP DATA

- 6.20 PHASED ADOPTION STRATEGY OF HD MAPS IN AV ECOSYSTEM

- 6.20.1 ASSISTED DRIVING & PILOT DEPLOYMENTS

- 6.20.2 LIMITED AUTONOMY IN CONTROLLED ENVIRONMENTS

- 6.20.3 EXPANDED COVERAGE & REAL-TIME UPDATES

- 6.20.4 FULL AUTONOMY & ECOSYSTEM INTEGRATION

- 6.21 KEY EMERGING TECHNOLOGIES

- 6.21.1 INTRODUCTION

- 6.21.2 MULTI-SENSOR FUSION FOR HIGH PRECISION HD MAPPING WITH LIDAR, RADAR, AND CAMERAS

- 6.21.3 SLAM (SIMULTANEOUS LOCALIZATION AND MAPPING) IN HD MAPS FOR AUTONOMOUS DRIVING

- 6.21.4 5G CONNECTIVITY AND VEHICLE-TO-EVERYTHING (V2X) TECHNOLOGY FOR AUTONOMOUS DRIVING

- 6.22 COMPLEMENTARY TECHNOLOGIES

- 6.22.1 SECURING AND VALIDATING HD MAPS WITH BLOCKCHAIN

- 6.22.2 ENHANCING HD MAPS WITH MACHINE LEARNING (ML)-POWERED ANALYTICS

- 6.23 TECHNOLOGY/PRODUCT ROADMAP

- 6.23.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.23.2 MID-TERM (2028-2030) | EXPANSION & STANDARDIZATION

- 6.23.3 LONG-TERM (2031-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.24 HD MAPPING SERVICE PROVIDERS: COMPETITIVE LANDSCAPE

- 6.25 COMPARATIVE ANALYSIS OF OEM HD MAPPING SOLUTIONS

- 6.26 FUTURE APPLICATIONS OF HD MAPS

- 6.27 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.27.1 WAYMO'S COMMERCIAL ROBOTAXI OPERATIONS IN US

- 6.27.2 MOBILEYE REM: CROWDSOURCED HD MAPPING ACROSS EUROPE

- 6.27.3 BAIDU APOLLO GO: CHINA'S ROBOTAXI EXPANSION

7 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION

- 7.1 INTRODUCTION

- 7.2 SEMI-AUTONOMOUS VEHICLE

- 7.2.1 GROWING DEMAND FOR ADVANCED ADAS-EQUIPPED VEHICLES TO DRIVE MARKET

- 7.2.2 LEVEL 2

- 7.2.3 LEVEL 3

- 7.3 AUTONOMOUS VEHICLE

- 7.3.1 RISING USE OF AUTONOMOUS DRIVING VEHICLES IN URBAN MOBILITY OPERATIONS TO DRIVE DEMAND

- 7.3.2 LEVEL 4

- 7.3.3 LEVEL 5

- 7.4 KEY PRIMARY INSIGHTS

8 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE

- 8.1 INTRODUCTION

- 8.2 MAPPING & LOCALIZATION

- 8.2.1 INTEGRATION OF AI, 5G, AND CROWDSOURCED DATA IN HD MAPS TO DRIVE MARKET

- 8.3 UPDATE & MAINTENANCE

- 8.3.1 RISING NEED FOR REAL-TIME HD MAP UPDATES AND PREDICTIVE MAINTENANCE TO DRIVE MARKET

- 8.4 ADVERTISEMENT

- 8.5 KEY PRIMARY INSIGHTS

9 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE

- 9.1 INTRODUCTION

- 9.2 EMBEDDED

- 9.2.1 DEMAND FOR ONBOARD MAPPING AND SENSOR FUSION TECHNOLOGIES TO DRIVE MARKET

- 9.3 CLOUD-BASED

- 9.3.1 FOCUS ON ADOPTING SCALABLE CLOUD PLATFORMS FOR AUTONOMOUS NAVIGATION TO DRIVE MARKET

- 9.4 KEY PRIMARY INSIGHTS

10 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE

- 10.1 INTRODUCTION

- 10.2 PERSONAL MOBILITY

- 10.2.1 RISING DEMAND FOR ADAS-EQUIPPED PASSENGER CARS TO DRIVE MARKET

- 10.3 COMMERCIAL MOBILITY

- 10.3.1 GROWING REGULATORY EMPHASIS ON APPROVALS FOR AUTONOMOUS VEHICLE TESTING TO DRIVE MARKET

- 10.4 KEY PRIMARY INSIGHTS

11 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 PASSENGER CAR

- 11.2.1 POPULARITY OF CONNECTED-CAR ECOSYSTEMS EQUIPPED WITH REAL-TIME MAPPING TO DRIVE MARKET

- 11.3 COMMERCIAL VEHICLE

- 11.3.1 AUTONOMOUS FLEET NAVIGATION AND PREDICTIVE ROUTING TO DRIVE MARKET

- 11.4 KEY PRIMARY INSIGHTS

12 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 High production of vehicles and favourable investment norms to drive growth

- 12.2.3 INDIA

- 12.2.3.1 Increased focus on emission-friendly vehicles and vehicle safety regulations to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Increased sales of mid-range cars to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Rapid integration of HD maps into autonomous vehicle technologies to boost growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Increased production of passenger cars to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Need for improving road safety through advanced ADAS features to drive market

- 12.3.4 ITALY

- 12.3.4.1 Presence of major OEMs to drive advancements in HD map technology

- 12.3.5 SPAIN

- 12.3.5.1 Rise in government initiatives for advanced automotive systems to drive market

- 12.3.6 UK

- 12.3.6.1 Rising automotive output in country to spur demand for HD maps

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Rising investments by OEMs in emerging megatrends to drive market

- 12.4.3 CANADA

- 12.4.3.1 Heightened awareness of consumers regarding vehicle safety to drive adoption of HD maps

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Collaboration between autonomous driving companies and other tech companies to boost growth

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 Rapid growth of automotive sector and rising number of vehicle manufacturers to drive demand

- 12.5.4 RUSSIA

- 12.5.4.1 Changing market dynamics aligned with rising production of autonomous vehicles to drive growth

- 12.5.5 SAUDI ARABIA

- 12.5.5.1 Rising domestic demand for vehicles and support of government-backed initiatives to boost growth

- 12.5.6 UAE

- 12.5.6.1 Rapid investments in electric and autonomous vehicle infrastructure to boost growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Usage type footprint

- 13.7.5.4 Vehicle type footprint

- 13.7.5.5 Level of automation footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSION

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HERE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BAIDU INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 TOMTOM INTERNATIONAL BV

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product/Service launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NVIDIA CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 MOBILEYE

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 WAYMO LLC

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 DYNAMIC MAP PLATFORM CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product/Service launches/developments

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansion

- 14.1.7.3.4 Other developments

- 14.1.8 NAVINFO CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Other developments

- 14.1.9 LUMINAR TECHNOLOGIES, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 THE SANBORN MAP COMPANY, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 MOMENTA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 MAPBOX

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product/Service launches/developments

- 14.1.12.3.2 Deals

- 14.1.1 HERE

- 14.2 OTHER PLAYERS

- 14.2.1 CE INFO SYSTEMS LTD.

- 14.2.2 NAVMII

- 14.2.3 RMSI

- 14.2.4 ZENRIN CO., LTD.

- 14.2.5 WOVEN BY TOYOTA, INC.

- 14.2.6 SWIFT NAVIGATION, INC.

- 14.2.7 IMERIT

- 14.2.8 VOXELMAPS

- 14.2.9 HYUNDAI AUTOEVER CORP.

- 14.2.10 GENESYS INTERNATIONAL CORPORATION LTD

- 14.2.11 GEOMATE

- 14.2.12 INTELLIAS

- 14.2.13 MORAI INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.3.1 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 15.3.2 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, AT COUNTRY LEVEL

- 15.3.3 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, AT COUNTRY LEVEL

- 15.3.4 COMPANY INFORMATION

- 15.3.4.1 Profiling of additional market players (up to five)

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS