|

시장보고서

상품코드

1840078

실리콘 접착제 시장 : 유형별, 기술별, 최종 이용 산업별, 지역별 예측(-2030년)Silicone Adhesives Market by Type (One-Component, Two-Component), Technology (Non-PSA, PSA), End-use Industry (Building & Construction, Electrical & Electronics, Transportation, Medical, Other End-use Industries), and Region - Global Forecast to 2030 |

||||||

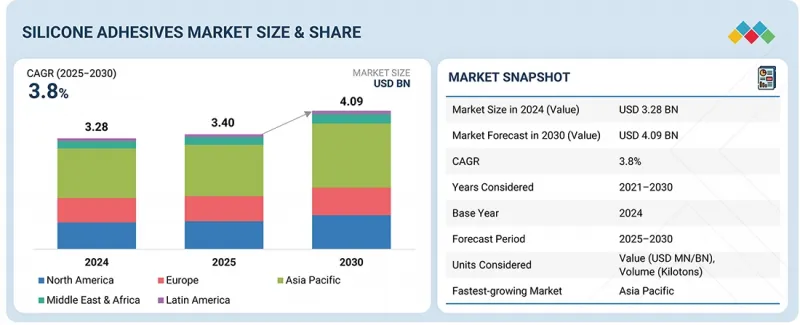

세계의 실리콘 접착제 시장 규모는 2025년에 34억 달러, 2030년까지 40억 9,000만 달러에 이를 것으로 예측되며, 2025-2030년에 CAGR은 3.8%를 나타낼 것으로 전망됩니다.

전기자동차의 보급, 지속가능한 건축에 대한 수요 증가, 의료비 증가가 실리콘 접착제 시장을 견인할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러, 킬로톤 |

| 부문 | 유형, 기술, 최종 이용 산업, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동, 아프리카, 남미 |

그러나 시장은 높은 가격과 원료 가격의 변동에 대한 제약에 직면하고 있습니다. 실리콘 접착제는 폴리우레탄, 아크릴, 에폭시 등의 다른 접착제에 비해 비교적 비쌉니다. 이 비용의 벽은 대규모 프로젝트와 대량 생산에서 더욱 커지고 단가의 약간의 차이가 전체 예산에 큰 영향을 줄 수 있습니다.

"1액형 부문이 2025-2030년에 가장 높은 CAGR을 나타낼 것으로 예측됩니다."

1액형 부문은 간편성, 비용 효율성, 성능 측면에서 큰 이점을 제공하기 때문에 예측 기간 동안 실리콘 접착제 시장에서 최고의 CAGR을 나타낼 전망입니다. 2액형과 같이 혼합이나 경화제, 복잡한 도포장치를 필요로 하지 않기 때문에 도포시의 노동이나 미스를 줄일 수 있습니다. 실온이나 수분이 있는 상태에서도 경화할 수 있기 때문에 자동차, 건설, 전자산업 등 신속한 조립이나 접착이 요구되는 많은 산업에서 편리합니다.

"비 PSA 부문이 2030년 최대 시장 점유율을 획득할 것으로 예상됩니다."

유형별 실리콘 접착제 시장에서 가장 큰 제품은 비PSA(비감압성) 실리콘 접착제입니다. 이는 자동차, 항공우주, 전자, 건축과 같은 고성능뿐만 아니라 강력하고 내구성 있는 접착이 요구되는 산업에서의 사용에 기인합니다. 점착성이나 박리 강도가 필요한 용도에 한정되는 PSA에 비해 비PSA 실리콘은 내열성, 내약품성, 유연성, 장기적인 내구성이 우수합니다. 또한 구조 용도와 고응력 용도에 유용합니다. 전기자동차의 보급, 전자기기의 소형화 및 고출력화, 에너지 절약으로 지속 가능한 건축물 증가에 의해 가혹한 조건하에서도 사용할 수 있는 접착제가 요구되게 되어 있습니다.

"아시아태평양의 실리콘 접착제 시장이 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다."

아시아태평양은 높은 산업화 수준, 자동차·전자기기 제조거점 확대, 인프라 개발 투자 증가로 실리콘 접착제 시장이 고성장을 보이고 있습니다. 전기자동차의 주요 수출처인 소비자 일렉트로닉스, 중국, 인도, 한국, 일본 등의 국가들은 고성능 접착 솔루션의 선도적입니다. 또한, 고령화 프로세스와 의료비의 상승에 의해 확대되고 있는 의료 산업도, 의료기기에의 실리콘 접착제의 채용을 뒷받침하고 있습니다.

본 보고서에서는 세계의 실리콘 접착제 시장에 대해 조사 분석하여 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

- 실리콘 접착제 제조업체에게 매력적인 기회

- 실리콘 접착제 : 유형별

- 실리콘 접착제 : 기술별

- 실리콘 접착제 : 최종 이용 산업별

- 아시아태평양의 실리콘 접착제 시장 : 유형별, 지역별(2024년)

- 실리콘 접착제 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 산업 동향

- 가격 설정 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 핵심 기술

- 보완 기술

- 인접 기술

- 실리콘 접착제 시장에 대한 생성형 AI의 영향

- 특허 분석

- 서론

- 조사 방법

- 무역 분석

- 수출 시나리오(HS 코드 350691)

- 수입 시나리오(HS 코드 350691)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 규제 상황과 틀

- 규제기관, 정부기관, 기타 조직

- 규제 틀

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 거시경제 분석

- 서론

- GDP의 동향과 예측

- 투자 및 자금조달 시나리오

- 실리콘 접착제 시장에 대한 미국 관세의 영향(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제6장 실리콘 접착제 시장 : 기술별

- 서론

- 비PSA

- PSA

제7장 실리콘 접착제 시장 : 유형별

- 서론

- 1액형

- 2액형

제8장 실리콘 접착제 시장 : 최종 이용 산업별

- 서론

- 건축 및 건설

- 의료

- 운송

- 전기 및 전자

- 기타 최종 이용 산업

제9장 실리콘 접착제 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 대만

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 기업 평가 및 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- HENKEL AG& CO. KGAA

- HB FULLER COMPANY

- WACKER CHEMIE AG

- 3M

- KCC SILICONE CORPORATION

- ELKEM ASA

- SHIN-ETSU CHEMICAL CO., LTD.

- SIKA AG

- DOW

- AVERY DENNISON CORPORATION

- ILLINOIS TOOL WORKS INC.

- 기타 기업

- DELO INDUSTRIAL ADHESIVES

- JIANGSU ZHIXIN NEW MATERIALS CO., LTD.

- SHENZHEN DEEPMATERIAL TECHNOLOGIES CO., LTD

- MASTER BOND

- ADHESIVES RESEARCH, INC.

- GERGONNE GROUP

- CHT GROUP

- HERNON MANUFACTURING

- JIANGXI NEW JIAYI NEW MATERIALS CO., LTD.

- 3 SIGMA

- SHENZHEN KANGLIBANG SCIENCE& TECHNOLOGY CO., LTD

- GUANGDONG HENGDA NEW MATERIAL TECHNOLOGY CO., LTD.

- CSL SILICONES INC.

- SILICONE SOLUTIONS

- CONNECT PRODUCTS BV

제12장 인접 시장과 관련 시장

- 서론

- 제한 사항

- 실리콘 시장

- 시장 정의

- 실리콘 시장 : 유형별

- 실리콘 시장 : 최종 이용 산업별

- 실리콘 시장 : 지역별

제13장 부록

KTH 25.10.22The silicone adhesives market size is projected to be USD 3.40 billion in 2025 and USD 4.09 billion by 2030, at a CAGR of 3.8% from 2025 to 2030. The rising adoption of electric vehicles, the growing demand for sustainable building, and increased healthcare spending are expected to drive the silicone adhesives market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) Volume (Kiloton) |

| Segments | Type, Technology, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

However, the market encounters limitations concerning its high prices and raw material price fluctuations. Silicone adhesives are relatively expensive compared with other adhesive types, such as polyurethane, acrylic, and epoxy. This cost barrier becomes even more significant in large-scale projects or high-volume production, where small differences in per-unit cost can substantially impact overall budgets.

"One-component segment is projected to exhibit the highest CAGR from 2025 to 2030"

The one-component segment is expected to record the highest CAGR in the silicone adhesives market during the forecast period since it can provide a major advantage in terms of ease, cost-efficiency, and performance. They do not need mixing, curing agents, and complicated application equipment as in the case of two-component systems, and this saves labor time and mistakes during application. They are convenient in many industries that require quick assembly and bonding, such as the automotive, construction, and electronics industries, as they can cure at room temperature and in the presence of moisture.

"Non-PSAs segment is projected to capture the largest market share in 2030"

The largest product in the silicone adhesives market based on type is non-PSA (non-pressure-sensitive) silicone adhesives due to their application in industries with a high need for strong and durable bonding, as well as high performance, such as automotive, aerospace, electronics, and construction. Compared with PSAs, which are restricted to uses that necessitate tackiness and peel strength, non-PSA silicones possess better heat resistance, chemical resistance, flexibility, and long-term durability. They are useful in structural applications and high-stress applications. Their use is increasing due to the growing use of electric vehicles, miniaturization and high-power electronics, and energy-efficient and sustainable buildings demanding adhesives that can survive in extreme conditions.

"Asia Pacific silicone adhesives market is projected to grow at the highest CAGR during the forecast period"

Asia Pacific is experiencing high growth in the silicone adhesives market due to the high industrialization level, the expanding automotive and electronics manufacturing base, and the increasing investment in infrastructure development. Major destinations of electric vehicles, consumer electronics, and countries such as China, India, South Korea, and Japan are major powerhouses in the high-performance bonding solutions. Moreover, the healthcare industry, which is also expanding due to ageing processes and the cost of healthcare, also boosts the adoption of silicone adhesives in medical devices and equipment.

By Company Type: Tier 1 - 25%, Tier 2 - 42%, and Tier 3 - 33%

By Designation: C-level Executives - 20%, Directors - 30%, and Others - 50%

By Region: North America - 20%, Europe - 10%, Asia Pacific - 40%, South America - 10%, and Middle East & Africa - 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Wacker Chemie AG (Germany), 3M (US), and KCC SILICONE CORPORATION (South Korea), Elkem ASA (Norway), Shin-Etsu Chemical Co., Ltd. (Japan), Sika AG (Switzerland), Dow (US), and Avery Dennison Corporation (US), among other companiess are covered in the report.

The study includes an in-depth competitive analysis of these key players in the silicone adhesives market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the silicone adhesives market based on type (one-component, two-component), technology (PSA, non-PSA), end-use industry (building & construction, medical transportation, electrical & electronics, others), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the silicone adhesives market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, mergers, product launches, expansions, and acquisitions, associated with the silicone adhesives market. This report covers a competitive analysis of upcoming startups in the silicone adhesives market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall silicone adhesives market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising electric vehicle adoption, aging populations and higher healthcare spending, mounting demand for energy-efficient and sustainable buildings), restraints (fluctuations in raw material prices, high cost compared with alternatives), opportunities (increasing demand from emerging markets, rise of flexible and wearable electronics), and challenges (intense competition and price pressure, customer awareness & adoption barriers)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the silicone adhesives market

- Market Development: Comprehensive information about profitable markets-the report analyzes the silicone adhesives market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the silicone adhesives market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Wacker Chemie AG (Germany), 3M (US), and KCC SILICONE CORPORATION (South Korea), Elkem ASA (Norway), Shin-Etsu Chemical Co., Ltd. (Japan), Sika AG (Switzerland), Dow (US), and Avery Dennison Corporation (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR SILICONE ADHESIVE MANUFACTURERS

- 4.2 SILICONE ADHESIVES, BY TYPE

- 4.3 SILICONE ADHESIVES, BY TECHNOLOGY

- 4.4 SILICONE ADHESIVES, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE AND REGION, 2024

- 4.6 SILICONE ADHESIVES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising electric vehicle adoption

- 5.2.1.2 Aging populations and higher healthcare spending

- 5.2.1.3 Rising demand for energy-efficient and sustainable buildings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in raw material prices

- 5.2.2.2 High cost compared to alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand from emerging markets

- 5.2.3.2 Rise of flexible and wearable electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense competition and price pressure

- 5.2.4.2 Customer awareness & adoption barriers

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING ANALYSIS BASED ON REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 RTV (Room Temperature Vulcanizing) curing

- 5.7.1.2 Silicone Pressure-Sensitive Adhesives (PSA)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Hybrid sealants

- 5.7.2.2 Silicone primers

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Silicone coatings

- 5.7.3.2 Surface coating technologies

- 5.7.1 KEY TECHNOLOGIES

- 5.8 IMPACT OF GEN AI ON SILICONE ADHESIVES MARKET

- 5.8.1 INTRODUCTION

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO (HS CODE 350691)

- 5.10.2 IMPORT SCENARIO (HS CODE 350691)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE & FRAMEWORK

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 ASTM F2468

- 5.12.2.2 ASTM D6411

- 5.12.2.3 ISO 10993-1:2018

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON SILICON ADHESIVES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 END-USE INDUSTRY IMPACT

- 5.18.5.1 Medical

- 5.18.5.2 Building & Construction

- 5.18.5.3 Transportation

- 5.18.5.4 Electronics

6 SILICONE ADHESIVES MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 NON-PSA

- 6.2.1 RISE IN USE IN STRUCTURAL BONDING TO DRIVE MARKET GROWTH

- 6.3 PSA

- 6.3.1 INCREASING USE IN MEDICAL APPLICATIONS TO DRIVE MARKET DEMAND

7 SILICONE ADHESIVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ONE-COMPONENT

- 7.2.1 SIMPLICITY OF APPLICATION PROCESS TO DRIVE MARKET GROWTH

- 7.3 TWO-COMPONENT

- 7.3.1 INNOVATIONS IN FAST CURING TO DRIVE MARKET GROWTH

8 SILICONE ADHESIVE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BUILDING & CONSTRUCTION

- 8.2.1 RISING HOUSING DEMAND AND AGING INFRASTRUCTURE TO DRIVE MARKET

- 8.3 MEDICAL

- 8.3.1 RISING PREVALENCE OF CHRONIC WOUNDS AND EXPANSION OF REMOTE HEALTHCARE AND WEARABLE MEDICAL DEVICES TO PROPEL MARKET

- 8.4 TRANSPORTATION

- 8.4.1 RISING ELECTRIC VEHICLE ADOPTION AND BATTERY APPLICATIONS TO PROPEL MARKET

- 8.5 ELECTRICAL & ELECTRONICS

- 8.5.1 5G EXPANSION AND IOT PROLIFERATION TO PROPEL MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 SILICONE ADHESIVES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Sustainable construction and urban renewal initiatives to drive market

- 9.2.2 INDIA

- 9.2.2.1 Rapid expansion of real estate and construction sector to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Government-supported smart city initiatives and urban infrastructure to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Government-supported semiconductor industry expansion to drive market

- 9.2.5 TAIWAN

- 9.2.5.1 Global leadership in semiconductor and electronics manufacturing to drive market

- 9.2.6 INDONESIA

- 9.2.6.1 Government push toward electric vehicle adoption and carbon reduction to drive market

- 9.2.7 VIETNAM

- 9.2.7.1 Rapid growth of passenger vehicles and electric vehicle adoption to drive market

- 9.2.8 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Rapid increase in EV sales to propel market

- 9.3.2 CANADA

- 9.3.2.1 Strong electronics and electrical equipment trade with US to drive market

- 9.3.3 MEXICO

- 9.3.3.1 Expanding automotive and EV manufacturing base to drive market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Medical industry to drive market growth

- 9.4.2 FRANCE

- 9.4.2.1 Medical and automotive sectors to help growth

- 9.4.3 UK

- 9.4.3.1 Automotive industry and government plans to boost market growth

- 9.4.4 ITALY

- 9.4.4.1 Transportation sector to drive market

- 9.4.5 RUSSIA

- 9.4.5.1 Government support for industrial growth to drive market

- 9.4.6 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growing construction, transportation, and electronics industries to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Government focus on automotive industry to drive growth

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Saudi Arabia's Vision 2030 to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Government initiatives supporting homeownership and infrastructure to drive market

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Rising adoption of new-energy vehicles (NEVs) and EVs to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.5.2 FINANCIAL METRICS

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Type footprint

- 10.7.5.5 Technology footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs, 2024

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 HENKEL AG & CO. KGAA

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 H.B. FULLER COMPANY

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 WACKER CHEMIE AG

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product Launches

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 3M

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 KCC SILICONE CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ELKEM ASA

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 SHIN-ETSU CHEMICAL CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.7.4 MnM view

- 11.1.8 SIKA AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Expansions

- 11.1.8.4 MnM view

- 11.1.9 DOW

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.4 MnM view

- 11.1.10 AVERY DENNISON CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.4 MnM view

- 11.1.11 ILLINOIS TOOL WORKS INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.4 MnM view

- 11.1.1 HENKEL AG & CO. KGAA

- 11.2 OTHER PLAYERS

- 11.2.1 DELO INDUSTRIAL ADHESIVES

- 11.2.2 JIANGSU ZHIXIN NEW MATERIALS CO., LTD.

- 11.2.3 SHENZHEN DEEPMATERIAL TECHNOLOGIES CO., LTD

- 11.2.4 MASTER BOND

- 11.2.5 ADHESIVES RESEARCH, INC.

- 11.2.6 GERGONNE GROUP

- 11.2.7 CHT GROUP

- 11.2.8 HERNON MANUFACTURING

- 11.2.9 JIANGXI NEW JIAYI NEW MATERIALS CO., LTD.

- 11.2.10 3 SIGMA

- 11.2.11 SHENZHEN KANGLIBANG SCIENCE &TECHNOLOGY CO., LTD

- 11.2.12 GUANGDONG HENGDA NEW MATERIAL TECHNOLOGY CO., LTD.

- 11.2.13 CSL SILICONES INC.

- 11.2.14 SILICONE SOLUTIONS

- 11.2.15 CONNECT PRODUCTS B.V.

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 SILICONE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 SILICONE MARKET, BY TYPE

- 12.3.3 SILICONE MARKET, BY END-USE INDUSTRY

- 12.3.4 SILICONE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS