|

시장보고서

상품코드

1873965

블랙 마스터배치 시장 : 담체 수지별, 최종 이용 산업별, 유형별, 지역별 예측(-2030년)Black Masterbatch Market by Carrier Resin, End-use Industry, by Type, and Region - Global Forecasts to 2030 |

||||||

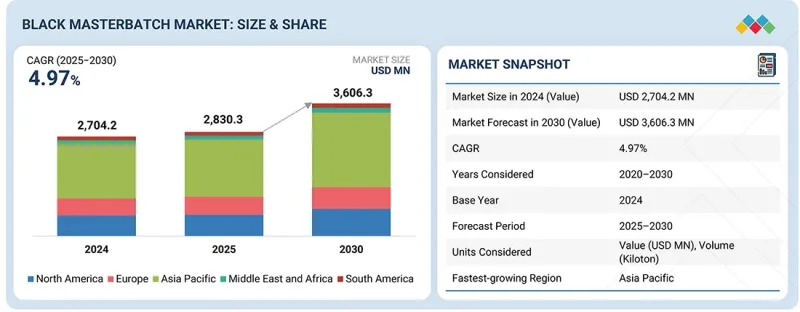

세계의 블랙 마스터배치 시장 규모는 2025년에 28억 3,030만 달러, 2030년까지 36억 630만 달러에 이를 것으로 예측되며, 2025-2030년에 CAGR로 4.97%를 나타낼 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 담체 수지, 최종 이용 산업, 유형, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동, 아프리카, 남미 |

"인프라 개발과 도시화가 시장을 견인하고 있습니다."

인프라 개발과 도시화는 특히 세계 각국이 도시와 산업 기반의 근대화에 많은 투자를 하고 있는 가운데 블랙 마스터배치 수요의 중요한 성장 촉진요인이 되고 있습니다. 아시아태평양, 중동 및 아프리카의 신흥 경제권에서의 급속한 도시화는 내구성, 내후성, 미관이 뛰어난 건축자재에 대한 강한 수요를 창출하고 있습니다. 유엔에 따르면 2050년까지 세계 인구의 약 68%가 도시에 거주할 것으로 예측되고 있으며, 주택, 교통망, 유틸리티, 스마트 인프라에 대한 대규모 투자를 촉진하고 있습니다.

블랙 마스터배치는 이 변화에서 중요한 역할을 합니다. 파이프, 케이블, 지붕판, 창틀, 건설용 필름 등의 용도에 있어서 자외선 내성, 강화된 내구성, 균일한 착색을 제공합니다. 북미와 유럽과 같은 선진 지역에서는 미국의 Infrastructure Investment and Jobs Act(IIJA) 및 EU의 Green Infrastructure Strategy와 같은 인프라 업데이트 노력이 성능과 지속가능성을 향상시킨 고급 고분자 재료의 사용을 더욱 촉진하고 있습니다.

이 세계 인프라 개발의 급증은 현대 건설의 내구성, 시각적 매력, 지속가능성 향상에 있어 블랙 마스터배치가 수행하는 중요한 역할을 부각하고 있습니다. 그 응용은 탄력적이고 환경적으로 효율적인 선진 기술을 이용한 도시 개발을 향한 세계적인 움직임과 밀접하게 연동하고 있습니다.

선형 저밀도 폴리에틸렌(LLDPE)은 예측 기간 동안 수량 기준으로 가장 빠르게 성장하는 블랙 마스터배치 시장의 캐리어 수지 부문이 될 것으로 추정됩니다.

LLDPE 담체 수지 부문은 예측 기간에 수량 기준으로 가장 빠른 속도로 확대될 것으로 예측됩니다. 뛰어난 기계적 강도, 적응성, 합리적인 가격은 성장의 주요 성장 촉진요인이며, 건설, 포장, 농업을 포함한 다양한 최종 이용 산업에서 인기있는 선택이되었습니다. LLDPE 기반의 블랙 마스터배치는 카본블랙의 분산성 향상, 내구성 강화, 자외선 내성 개량을 실현하기 때문에 필름이나 지오멤브레인에 최적입니다. 재생가능하고 경량인 포장재료에 대한 수요가 증가함에 따라 LLDPE의 인플레이션 필름과 압출성형용도에서의 사용이 극적으로 증가하고 있습니다. LLDPE는 가공의 용이성과 폭넓은 폴리머와의 상용성으로 인해, 변화하는 블랙 마스터배치 시장에서 1대 촉진요인이 되고 있습니다.

섬유 산업 부문은 블랙 마스터배치 시장에서 최종 이용 산업별로 수량 기준으로 세 번째로 성장이 빠른 부문이 될 것으로 예측됩니다.

세계의 블랙 마스터배치 시장에서 섬유 산업은 수량 기준으로 3위 성장 속도를 보여주는 최종 용도 부문입니다. 카펫, 자동차 인테리어, 섬유, 산업용 응용 분야 등에서 합성 섬유의 사용 증가가 이 성장을 가속하고 있으며, 블랙 마스터배치는 균일한 발색성, 자외선 안정성, 내구성 향상을 제공합니다. 특히 스포츠웨어, 지오텍스타일, 가구에서 기능성과 미적 특성을 향상시킨 고성능 섬유에 대한 수요가 높아짐에 따라 소비도 증가하고 있습니다. 또한, 직포·부직포 용도에 있어서의 폴리에스테르 섬유와 폴리프로필렌 섬유의 채용의 확대가, 안정된 수요를 지지하고 있습니다. 텍스타일 의류 산업이 지속 가능하고 색안정성이 높은 재료로 이행하는 중, 제조업체는 정교한 블랙 마스터배치 제제를 이용해 균일한 색 분산성과 내후성의 향상을 실현하고 있어, 이것이 시장의 확대를 추진하고 있습니다.

"2024년 유럽이 수량 기준으로 3위인 블랙 마스터배치 시장이었습니다."

유럽의 견조한 자동차, 포장, 건설 부문이 2024년 동지역에서 블랙 마스터배치 시장의 큰 성장 촉진요인이 되었습니다. 고성능으로 재활용 가능하며 색 안정성이 우수한 플라스틱 재료의 사용을 촉진하는 엄격한 환경 규제와 품질 기준이 수요를 지원합니다. 유럽 제조업체들은 소비재, 건축 부재 및 자동차 인테리어에서 제품의 내구성, 내자외선성 및 시각적 매력을 향상시키기 위해 블랙 마스터배치를 점점 더 활용하고 있습니다. 게다가 이 지역의 순환형 경제 원칙으로의 전환과 재활용 플라스틱 이용의 확대가 정교한 마스터배치 제제 시장을 뒷받침하고 있습니다. 독일, 이탈리아, 프랑스 등의 국가들은 혁신을 활용한 생산과 지속가능한 제조 기준에 대한 강한 주력으로 계속 큰 기여를 하고 있습니다.

이 보고서는 세계의 블랙 마스터배치 시장에 대한 조사 분석을 통해 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 주요 인사이트

- 블랙 마스터배치 시장의 매력적인 기회

- 블랙 마스터배치 시장 : 최종 이용 산업별, 지역별

- 블랙 마스터배치 시장 : 담체 수지별

- 블랙 마스터배치 시장 : 국가별

제4장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 연결된 시장과 부문 간 기회

- 연결된 시장

- 부문 간 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 새로운 비즈니스 모델

- 에코시스템의 변화

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 서론

- 주요 경제권의 GDP 동향과 예측

- 세계 자동차 업계 동향

- 공급망 분석

- 원재료 공급자

- 블랙 마스터배치 제조업체

- 유통 네트워크

- 최종 이용 산업

- 생태계 분석

- 가격 설정 분석

- 최종 이용 산업의 평균 판매 가격 : 주요 기업별(2024년)

- 블랙 마스터배치의 평균 판매 가격 동향 : 지역별(2022-2024년)

- 무역 분석

- 수출 시나리오(HS 코드 320649)

- 수입 시나리오(HS 코드 320649)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혁신

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향(2025년) - 블랙 마스터배치 시장

- 서론

- 주요 관세

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허

- 주요 신기술

- 트윈 스크류 압출

- 하이퍼 분산 기술

- 보완 기술

- 마스터배치 첨가제 시스템

- 전도성 폴리머 화합물

- 기술/제품 로드맵

- 단기(2025-2027년)

- 중기(2027-2030년)|확장과 표준화

- 장기(2030-2035년 이후)

- 특허 분석

- 접근 방식

- 문서 유형

- 주요 출원인

- 관할분석

- 블랙 마스터배치 시장에 대한 AI/생성형 AI의 영향

- 연구개발의 가속과 제제의 혁신

- 생산 효율과 공정 제어 향상

- 예지보전과 운용 계속

- 최적화된 공급망과 비용 관리

제7장 지속가능성과 규제정세

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 규제 정책의 대처

- 안전 프로토콜

- 지속가능한 개발

- 표준화

- 순환형 경제

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업에서의 미충족 수요(Unmet Needs)

제9장 블랙 마스터배치 시장 : 담체 수지별

- 서론

- 폴리프로필렌

- 선형 저밀도 폴리에틸렌

- 저밀도 폴리에틸렌

- 고밀도 폴리에틸렌

- 폴리에틸렌 테레프탈레이트

- 폴리염화비닐

- 폴리스티렌

- 폴리아미드

- 기타 담체 수지

제10장 블랙 마스터배치 시장 : 최종 이용 산업별

- 서론

- 자동차

- 포장

- 인프라

- 전기 및 전자

- 소비재

- 농업

- 섬유

- 기타 최종 이용 산업

제11장 블랙 마스터배치 시장 : 유형별

- 서론

- 표준 블랙 마스터배치

- 고제트니스 블랙 마스터배치

- UV 차단 블랙 마스터배치

- 전도성 블랙 마스터배치

- 재활용 폴리머 호환 블랙 마스터배치

제12장 블랙 마스터배치 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 태국

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 중동 및 아프리카

- 이란

- 남아프리카

- 튀르키예

- 남미

- 브라질

- 아르헨티나

제13장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 제품 비교

- 기업 평가 및 재무 지표

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- AVIENT CORPORATION

- AMPACET CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS BV

- CABOT CORPORATION

- PLASTIBLENDS

- HUBRON INTERNATIONAL

- TOSAF

- BLEND COLOURS PRIVATE LIMITED

- RTP COMPANY

- PLASTIKA KRITIS SA

- 스타트업/중소기업

- VIBRANT COLOR TECH PVT LTD.

- US MASTERBATCH JOINT STOCK COMPANY

- GABRIEL-CHEMIE GMBH

- ASTRA POLYMERS

- PERFECT COLOURANTS & PLASTICS PVT. LTD.

- KOTHARI POLYMERS

- DELTA TECNIC

- ABBEY VIETNAM

- ALOK

- JKP MASTERBATCH

- PURE POLYMERS

- MASKOM PLASTIC INDUSTRY AND TRADE JOINT STOCK COMPANY

- MALION NEW MATERIALS CO., LTD.

- EUP GROUP

- REPIN MASTERBATCHES

제15장 조사 방법

제16장 인접 시장과 관련 시장

- 서론

- 제한

- 마스터배치 시장

- 시장의 정의

- 시장 개요

- 마스터배치 시장 : 지역별

- 아시아태평양

- 유럽

- 북미

- 중동 및 아프리카

- 남미

제17장 부록

KTH 25.11.27The black masterbatch market size was USD 2,830.3 million in 2025 and is projected to reach USD 3,606.3 million by 2030, at a CAGR of 4.97%, between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Carrier Resin, End-use Industries, Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Infrastructure development and urbanization are driving the market."

Infrastructure development and urbanization are pivotal drivers propelling the demand for black masterbatches, particularly as nations worldwide invest heavily in modernizing their cities and industrial bases. Rapid urbanization in emerging economies across Asia Pacific, the Middle East, and Africa is generating strong demand for durable, weather-resistant, and aesthetically appealing construction materials. According to the United Nations, nearly 68% of the world's population is projected to live in urban areas by 2050, driving large-scale investments in housing, transportation networks, utilities, and smart infrastructure.

Black masterbatches play a vital role in this transformation, offering UV resistance, enhanced durability, and consistent coloration for applications such as pipes, cables, roofing sheets, window profiles, and construction films. In developed regions such as North America and Europe, infrastructure renewal initiatives like the U.S. Infrastructure Investment and Jobs Act (IIJA) and the EU's Green Infrastructure Strategy are further boosting the use of advanced polymer materials with improved performance and sustainability attributes.

This global surge in infrastructure development underscores the critical role of black masterbatches in enhancing the durability, visual appeal, and sustainability of modern construction. Their application aligns closely with the worldwide push toward resilient, eco-efficient, and technologically advanced urban development.

The linear low-density polyethylene is estimated to be the fastest-growing carrier resin segment of the black masterbatch market, in terms of volume, during the forecast period.

In terms of volume, the LLDPE carrier resin segment is expected to expand at the fastest pace during the forecast period. Its superior mechanical strength, adaptability, and affordability are the primary factors driving this growth, as they make it a popular option for various end-use industries, including construction, packaging, and agriculture. LLDPE-based black masterbatches are perfect for films and geomembranes because they provide better carbon black dispersion, increased durability, and improved UV resistance. The use of LLDPE in blown film and extrusion applications has increased dramatically due to the growing demand for recyclable and lightweight packaging materials. LLDPE is positioned as a major growth driver in the changing black masterbatch landscape due to the resin's ease of processing and compatibility with a broad range of polymers.

The fibers industry segment is projected to be the third fastest-growing segment by end-use industry in the black masterbatch market, in terms of volume.

Within the global black masterbatch market, the Fibers industry is the third fastest-growing end-use segment in terms of volume. The increasing use of synthetic fibers in carpets, automotive interiors, textiles, and industrial applications-where black masterbatches offer uniform coloration, UV stability, and improved durability-is what is driving this growth. Consumption has also increased due to the growing need for high-performance fibers with better functional and aesthetic qualities, particularly in sportswear, geotextiles, and home furnishings. Furthermore, steady adoption is supported by the increasing preference for polyester and polypropylene fibers in both woven and nonwoven applications. Manufacturers are using sophisticated black masterbatch formulations to achieve uniform color dispersion and improved weatherability as the textile and apparel industries transition to sustainable and color-stable materials, which is propelling market expansion.

"Europe was the third-largest black masterbatch market, in terms of volume, in 2024."

Europe's robust automotive, packaging, and construction sectors are the main drivers of its black masterbatch market in 2024. Strict environmental and product quality regulations, which promote the use of high-performance, recyclable, and color-stable plastic materials, support the demand. Black masterbatches are being used more and more by European manufacturers to improve the longevity, UV resistance, and visual appeal of their products in consumer goods, building components, and automobile interiors. Furthermore, the market for sophisticated masterbatch formulations has been bolstered by the region's ongoing transition to circular economy principles and the growing use of recycled plastics. With the help of innovation-driven production and a strong focus on sustainable manufacturing standards, nations such as Germany, Italy, and France continue to make significant contributions.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 18%, and Rest of the World - 7%

The key players profiled in the report include Avient Corporation (US), LyondellBasell Industries Holdings B.V. (US), Ampacet Corporation (US), Cabot Corporation (US), Plastiblends (India), Hubron International (UK), Tosaf (Israel), Blend Colours Private Limited (India), RTP Company (US), Plastika Kritis S.A. (Greece), and other players (15).

Study Coverage

This report segments the market for black masterbatches based on carrier resin, end-use industry, type, and region, and provides estimations of the overall market size (in USD million) across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the black masterbatch market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the black masterbatch market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on black masterbatch offered by top players in the global market

- Analysis of key drivers (Government regulations and policies promoting sustainable materials, infrastructure development and urbanization, advancements in automotive manufacturing, rising demand for packaging applications), restraints (Volitality in raw material prices and supply chain disruptions, stringent environmental and regulatory compliance burdens), opportunities (Expansion in semiconductor and electronics industries, rising demand in 3D printing and additive manufacturing), challenges (Intense price based competition).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the black masterbatch market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for black masterbatch across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global black masterbatch market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the black masterbatch market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY CARRIER RESIN

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: ASIA PACIFIC MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BLACK MASTERBATCH MARKET

- 3.2 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY AND REGION

- 3.3 BLACK MASTERBATCH MARKET, BY CARRIER RESIN

- 3.4 BLACK MASTERBATCH MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Government regulations and policies promoting sustainable materials

- 4.2.1.2 Infrastructure development and urbanization

- 4.2.1.3 Advancements in automotive manufacturing

- 4.2.1.4 Rising demand for packaging applications

- 4.2.2 RESTRAINTS

- 4.2.2.1 Volatility in raw material prices and supply chain disruptions

- 4.2.2.2 Rising environmental and regulatory compliance burdens

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion in semiconductor and electronics industries

- 4.2.3.2 Rising demand in 3D printing and additive manufacturing

- 4.2.4 CHALLENGES

- 4.2.4.1 Intense price-based competition in global market

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.4.1 EMERGING BUSINESS MODELS

- 4.4.2 ECOSYSTEM SHIFTS

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF SUBSTITUTES

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 BLACK MASTERBATCH MANUFACTURERS

- 5.3.3 DISTRIBUTION NETWORK

- 5.3.4 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF END-USE INDUSTRY, BY KEY PLAYERS, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF BLACK MASTERBATCH, BY REGION, 2022-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO (HS CODE-320649)

- 5.6.2 IMPORT SCENARIO (HS CODE-320649)

- 5.7 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 VALVES FOR CHALK IN BLACK MASTERBATCH PRODUCTION

- 5.10.2 ADDRESSING DISPERSION ISSUES IN BLACK MASTERBATCH PRODUCTION

- 5.10.3 LAUNCH OF REPLASBLAK UNIVERSAL CIRCULAR BLACK MASTERBATCHES BY CABOT CORPORATION

- 5.11 IMPACT OF 2025 US TARIFF - BLACK MASTERBATCH MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFFS

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT AND PATENTS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 TWIN-SCREW EXTRUSION

- 6.1.2 HYPER DISPERSION TECHNOLOGY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MASTERBATCH ADDITIVE SYSTEMS

- 6.2.2 CONDUCTIVE POLYMER COMPOUNDS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027)

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+)

- 6.4 PATENT ANALYSIS

- 6.4.1 APPROACH

- 6.4.2 DOCUMENT TYPE

- 6.4.3 TOP APPLICANTS

- 6.4.4 JURISDICTION ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON BLACK MASTERBATCH MARKET

- 6.5.1 ACCELERATED R&D AND FORMULATION INNOVATION

- 6.5.2 ENHANCED PRODUCTION EFFICIENCY AND PROCESS CONTROL

- 6.5.3 PREDICTIVE MAINTENANCE AND OPERATIONAL CONTINUITY

- 6.5.4 OPTIMIZED SUPPLY CHAIN AND COST MANAGEMENT

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 REGULATORY POLICY INITIATIVES

- 7.2.1 SAFETY PROTOCOLS

- 7.2.2 SUSTAINABLE DEVELOPMENT

- 7.2.3 STANDARDIZATION

- 7.2.4 CIRCULAR ECONOMY

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

9 BLACK MASTERBATCH MARKET, BY CARRIER RESIN

- 9.1 INTRODUCTION

- 9.2 POLYPROPYLENE

- 9.2.1 EXTENSIVE USE OF POLYPROPYLENE IN PACKAGING AND AUTOMOTIVE APPLICATIONS

- 9.3 LINEAR LOW-DENSITY POLYETHYLENE

- 9.3.1 RISING DEMAND FOR FLEXIBLE AND DURABLE FILMS IN PACKAGING AND AGRICULTURE

- 9.4 LOW-DENSITY POLYETHYLENE

- 9.4.1 INCREASING USE OF LDPE IN FILM APPLICATIONS REQUIRING FLEXIBILITY AND OPTICAL CLARITY

- 9.5 HIGH-DENSITY POLYETHYLENE

- 9.5.1 GROWING DEMAND FOR RIGID AND UV-RESISTANT PLASTIC PRODUCTS IN INDUSTRIAL APPLICATIONS

- 9.6 POLYETHYLENE TEREPHTHALATE

- 9.6.1 RISING DEMAND FOR HIGH-PERFORMANCE AND AESTHETIC PACKAGING SOLUTIONS

- 9.7 POLYVINYL CHLORIDE

- 9.7.1 EXPANDING USE OF POLYVINYL CHLORIDE IN CONSTRUCTION AND ELECTRICAL APPLICATIONS

- 9.8 POLYSTYRENE

- 9.8.1 RISING DEMAND FOR HIGH-GLOSS AND RIGID PLASTIC COMPONENTS IN PACKAGING AND CONSUMER GOODS

- 9.9 POLYAMIDE

- 9.9.1 GROWING ADOPTION OF HIGH-PERFORMANCE PLASTICS IN AUTOMOTIVE AND ELECTRICAL APPLICATIONS

- 9.10 OTHER CARRIER RESINS

10 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 INCREASING USE OF LIGHTWEIGHT AND AESTHETIC PLASTIC COMPONENTS IN AUTOMOTIVE DESIGN

- 10.3 PACKAGING

- 10.3.1 RISING DEMAND FOR VISUALLY APPEALING, UV-STABLE, AND RECYCLABLE PACKAGING SOLUTIONS

- 10.4 INFRASTRUCTURE

- 10.4.1 EXPANDING CONSTRUCTION ACTIVITIES AND DEMAND FOR DURABLE PLASTIC INFRASTRUCTURE COMPONENTS

- 10.5 ELECTRICAL & ELECTRONICS

- 10.5.1 GROWING DEMAND FOR ELECTRICALLY INSULATIVE AND AESTHETIC PLASTIC COMPONENTS IN ELECTRONICS

- 10.6 CONSUMER GOODS

- 10.6.1 INCREASING USE OF AESTHETIC AND DURABLE PLASTICS IN CONSUMER GOODS MANUFACTURING

- 10.7 AGRICULTURE

- 10.7.1 RISING ADOPTION OF UV-STABLE AND WEATHER-RESISTANT PLASTICS IN MODERN AGRICULTURE

- 10.8 FIBERS

- 10.8.1 GROWING DEMAND FOR DEEP-COLORED AND UV-STABLE SYNTHETIC FIBERS IN TEXTILES AND INDUSTRIAL APPLICATIONS

- 10.9 OTHER END-USE INDUSTRIES

11 BLACK MASTERBATCH MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 STANDARD BLACK MASTERBATCH

- 11.2.1 EXPANDING PLASTIC CONSUMPTION IN PACKAGING AND CONSUMER GOODS

- 11.3 HIGH JETNESS BLACK MASTERBATCH

- 11.3.1 RISING DEMAND FOR AESTHETIC AND PREMIUM-QUALITY PLASTIC COMPONENTS

- 11.4 UV-RESISTANT BLACK MASTERBATCH

- 11.4.1 GROWING USE OF PLASTICS IN OUTDOOR AND INFRASTRUCTURE APPLICATIONS

- 11.5 CONDUCTIVE BLACK MASTERBATCH

- 11.5.1 RISING DEMAND FOR ELECTRICALLY SAFE AND STATIC-CONTROL MATERIALS

- 11.6 RECYCLED POLYMER COMPATIBLE BLACK MASTERBATCH

- 11.6.1 INCREASING FOCUS ON CIRCULAR ECONOMY AND SUSTAINABLE PLASTICS

12 BLACK MASTERBATCH MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Dominant manufacturing base and strong downstream demand

- 12.2.2 JAPAN

- 12.2.2.1 Technological advancements and high-quality manufacturing standards to drive market

- 12.2.3 INDIA

- 12.2.3.1 Expanding manufacturing base and rapid growth in packaging and construction sectors

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Strong electronics and automotive manufacturing base driving specialty black masterbatch demand

- 12.2.5 THAILAND

- 12.2.5.1 Rising consumer goods production and growing demand for aesthetic, durable plastic products

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Expanding use of black masterbatches in automotive and packaging sectors

- 12.3.2 CANADA

- 12.3.2.1 Growing adoption of high-performance black masterbatches in sustainable and durable applications

- 12.3.3 MEXICO

- 12.3.3.1 Expanding manufacturing base and increasing foreign investments in plastic processing

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Strong automotive manufacturing driving black masterbatch demand

- 12.4.2 UK

- 12.4.2.1 Expanding packaging sector enhancing market growth

- 12.4.3 FRANCE

- 12.4.3.1 Green building and infrastructure upgrades bolster black masterbatch applications

- 12.4.4 RUSSIA

- 12.4.4.1 Agriculture and packaging growth fuel masterbatch usage in film and pipe applications

- 12.4.5 SPAIN

- 12.4.5.1 Consumer goods & electronics manufacturing spur masterbatch uptake in Spain

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 IRAN

- 12.5.1.1 Surging automotive production amid polymer demand growth

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Packaging Industry Growth Underpins Masterbatch Demand

- 12.5.3 TURKEY

- 12.5.3.1 Construction Sector Boom Elevates Masterbatch Usage in Plastics

- 12.5.1 IRAN

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expanding plastic processing and packaging industries supported by local manufacturing strength

- 12.6.2 ARGENTINA

- 12.6.2.1 Growing industrial output and rising adoption of polymer-based packaging solutions

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Carrier resin footprint

- 13.5.5.4 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 PRODUCT COMPARISON

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 EXPANSIONS

- 13.9.3 DEALS

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- 14.1.1 AVIENT CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM View

- 14.1.1.4.1 Right to Win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 AMPACET CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM View

- 14.1.2.4.1 Right to Win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Other developments

- 14.1.3.4 MnM View

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 CABOT CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM View

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 PLASTIBLENDS

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM View

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 HUBRON INTERNATIONAL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.2.1 Deals

- 14.1.7 TOSAF

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BLEND COLOURS PRIVATE LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.9 RTP COMPANY

- 14.1.9.1 Business Overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 PLASTIKA KRITIS S.A.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 AVIENT CORPORATION

- 14.2 START-UP/SMES PLAYERS

- 14.2.1 VIBRANT COLOR TECH PVT LTD.

- 14.2.2 US MASTERBATCH JOINT STOCK COMPANY

- 14.2.3 GABRIEL-CHEMIE GMBH

- 14.2.4 ASTRA POLYMERS

- 14.2.5 PERFECT COLOURANTS & PLASTICS PVT. LTD.

- 14.2.6 KOTHARI POLYMERS

- 14.2.7 DELTA TECNIC

- 14.2.8 ABBEY VIETNAM

- 14.2.9 ALOK

- 14.2.10 JKP MASTERBATCH

- 14.2.11 PURE POLYMERS

- 14.2.12 MASKOM PLASTIC INDUSTRY AND TRADE JOINT STOCK COMPANY

- 14.2.13 MALION NEW MATERIALS CO., LTD.

- 14.2.14 EUP GROUP

- 14.2.15 REPIN MASTERBATCHES

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Primary interview - demand side and supply side

- 15.1.2.3 Breakdown of primary interviews

- 15.1.2.4 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.2.1 BOTTOM-UP APPROACH

- 15.2.2 TOP-DOWN APPROACH

- 15.3 DATA TRIANGULATION

- 15.4 GROWTH FORECAST

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

- 15.7 RISK ASSESSMENT

16 ADJACENT & RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATION

- 16.3 MASTERBATCH MARKETMARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.4 MASTERBATCH MARKET, BY REGION

- 16.4.1 ASIA PACIFIC

- 16.4.2 EUROPE

- 16.4.3 NORTH AMERICA

- 16.4.4 MIDDLE EAST & AFRICA

- 16.4.5 SOUTH AMERICA

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS