|

시장보고서

상품코드

1876440

전기자동차용 반도체 시장 : 기술별, 추진 방식별, 용도별, 구성 요소별, 지역별 예측(-2032년)EV Semiconductors Market by Technology, Propulsion, Application, Component, and Region - Global Forecast to 2032 |

||||||

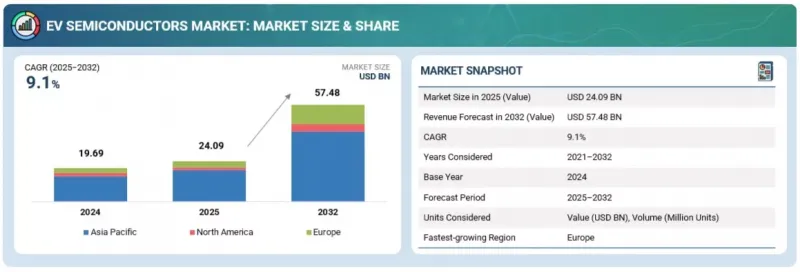

전기자동차용 반도체 시장 규모는 2025년 240억 9,000만 달러에 이르고, CAGR 9.1%를 나타내 2032년에는 574억 8,000만 달러에 이를 것으로 예측됩니다.

이 시장의 성장은 승용차 1대당 반도체 탑재량 증가와 완전 전동 플랫폼으로의 이행에 의해 견인되고 있습니다. 전기자동차는 안전과 자동화 기능을 위해 많은 센서와 컴퓨팅을 필요로 하기 때문에 ADAS(첨단 운전자 보조 시스템)는 내연 기관차보다 높은 보급률로 고성능 마이크로 컴퓨터, 레이더, 비전 칩이 요구됩니다. 급속 충전, 긴 수명화, 정밀한 셀 감시에는 고정밀 아날로그 프론트엔드, 파워 디바이스, 기능 안전 프로세서가 필요하기 때문에 배터리 전자 기기는 보다 고도화되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 단위 | 수량(100만 단위) 및 금액(100만 달러) |

| 부문 | 기술별, 추진 방식별, 용도별, 구성 요소 유형별 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

SiC 및 GaN을 포함한 광대역 갭 기술, 하이브리드 SiC GaN 인버터 및 고급 패키징은 효율성 향상, 발열 감소, 소형 고출력 설계를 가능하게 합니다. 미국 CHIPS법과 EU칩스법 등의 정부 주도의 시책에 의해 텍사스 기기, Infineon, ST 마이크로 일렉트로닉스에 의한 현지 팹 확장이 진행되고 있습니다. 소프트웨어 정의 차량 플랫폼은 메모리와 프로세싱에 대한 수요를 증가시키고 OEM 공급업체와의 긴밀한 협력이 혁신을 가속화하고 있습니다. 프리미엄 BEV의 800V 아키텍처는 급속 충전 및 항속 거리 연장을 위한 첨단 파워 반도체의 채용을 추진하고 있습니다. Audi A6 및 Mercedes-Benz C 클래스와 같은 모델에 사용되는 48V 시스템은 완전한 고전압 EV 설계로 전환하지 않고 높은 전기 부하를 지원하는 효율적인 전력 장치에 대한 수요를 지속하고 있습니다.

배터리 관리 시스템(BMS) 용도는 전기자동차용 반도체 시장에서 크게 성장할 것으로 예측됩니다. 현대의 BMS 하드웨어는 대형 배터리 팩 내부에서 정밀한 측정, 고속 데이터 처리, 효율적인 열 제어를 실현해야 합니다. 셀 전압, 온도, 충전 상태, 건강 상태의 정확성을 달성하려면 고급 마이크로컨트롤러, 전원 관리 IC, 센서 및 통신 모듈이 필요합니다.

2025년 4월, STMicroelectronics는 소프트웨어 구동 배터리 제어와 유연한 셀 밸런스 아키텍처를 지원하는 '스텔러 with xMemory' 마이크로컴퓨터를 발표했습니다. 마찬가지로 2025년 3월에는 Renesas가 연료 게이지 IC, 마이크로컴퓨터, 아날로그 프론트엔드를 단일 설계로 통합한 RBMS F 플랫폼을 출시했습니다. 이것에 의해 고장 검출의 고속화에 의한 안전성 향상과, 충전·방전의 최적화를 실현하고 있습니다. 마찬가지로 2025년 6월에는 NXP Semiconductors가 TTTech Auto 인수를 완료하여 고에너지 배터리 시스템을 위한 실시간 기능 안전 컴퓨팅을 강화했습니다. 패키징 개선과 고전력 밀도 배터리로의 전환으로 BMS 모듈 내부에서 SiC 및 GaN 기반 부품 사용도 증가하고 있습니다. 이들은 발열을 줄이고 효율을 향상시키기 위해서입니다. 이러한 발전으로 BMS는 북미 및 중국의 EV 생산 기지에서 반도체 수요를 견인하는 가장 강력한 요인 중 하나가 되었습니다.

MOSFET, IGBT, SiC 및 GaN과 같은 광대역 갭 디바이스를 포함하는 파워 IC 모듈은 인버터, 자동차 충전기 및 DC-DC 컨버터에 필수적이며 차량 효율, 항속 거리 및 열 성능에 직접적인 영향을 미칩니다. Porsche Taycan과 Ford Mustang Mach-E는 에너지 효율을 높이고 빠른 충전을 실현하기 위해 SiC 기반 인버터를 사용합니다. 업계가 차세대 파워 디바이스의 스케일링에 주력하고 있는 것을 반영해, Infineon과 ROHM이 2025년 3월에 체결한 SiC 파워 패키지에 관한 협력 각서는 차세대 파워 디바이스의 스케일링을 향한 업계의 대처를 부각하고 있습니다. 마찬가지로 ST 마이크로 일렉트로닉스가 2025년 9월에 패널 레벨 패키징에 투자한 것은 자동차용 파워 반도체의 효율성과 신뢰성을 더욱 향상시키는 것입니다.

고성능 BEV의 800V 플랫폼 채택 가속화와 세계 EV 생산 확대로 고효율 파워 디바이스 수요가 증가하고 있습니다. 하이브리드 SiC-GaN 솔루션과 첨단 열 관리 패키징에 대한 투자는 OEM이 고출력 밀도, 저손실 및 시스템 전체의 신뢰성 향상을 실현하는 데 도움이 되었으며 파워 반도체 부문은 전기자동차용 반도체 시장에서 중요한 성장 촉진요인으로 자리매김하고 있습니다.

유럽에서는 승용차의 전동화 진전과 지역 자동차 제조의 견고한 기반을 배경으로 전기자동차용 반도체 시장이 현저한 성장을 이룰 것으로 예측되고 있습니다. Volkswagen, BMW, Stellantis와 같은 주요 OEM 제조업체는 BEV 라인업 확장 및 소프트웨어 정의 차량 플랫폼에 대한 투자를 추진하고 있으며 고성능 마이크로 컴퓨터, 파워 일렉트로닉스, 레이더/ADAS 칩에 대한 수요를 증가시키고 있습니다. 동시에 주요 중국계 OEM 제조업체도 유럽에서 제조 기지를 확립하고 있습니다. 예를 들어, 2025년 3월에는 BYD가 유럽 시장을 위한 새로운 공장을 헝가리에 건설할 계획을 발표했습니다. EU칩법은 주요 성장 촉진요인으로, 465억 달러를 넘는 관민투자를 통해 2030년까지 유럽 반도체 세계 점유율을 20%로 두배로 늘리는 것을 목표로 자동차용 칩 등 중요한 부품에서의 자급률과 공급망의 내장해성을 강화합니다.

이 지역의 주요 투자 사례로는 Infineon의 드레스덴 공장 확장에 대한 49억 달러 투자, STMicroelectronics에 의한 카타니아의 SiC 팹 프로젝트(55억 달러 규모), 합작 투자(프랑스 그르노블 근교의 ST와 GlobalFoundries에 의한 82억 달러 규모의 FD-SOI 팹)를 들 수 있습니다. Infineon TechnologiesAG와 STMicroelectronics를 포함한 유럽 공급업체는 고효율 인버터 및 자동차 충전기 수요에 대응하기 위해 SiC 및 GaN 생산을 확대하고 있습니다. 전동화에 대한 정부 지원, EV 의무화, 에너지 효율적인 차량용 전자기기에 대한 인센티브와 함께 이러한 움직임은 유럽을 전기자동차용 반도체 시장의 주요 성장 지역으로 자리잡고 있습니다.

본 보고서에서는 세계의 전기자동차용 반도체 시장에 대해 조사했으며 기술별, 추진 방식별, 구성 요소별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 서론

- 시장 역학

- 미충족 수요(Unmet Needs)와 백스페이스

- 연결된 시장과 부문 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 거시경제지표

- 생태계 분석

- 공급망 분석

- 가격 분석

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 이용 사례별 자금 조달

- 주요 회의 및 이벤트

- 무역 분석

- 사례 연구 분석

- 미국 관세(2025년)

제6장 기술의 진보, AI별 영향, 특허, 혁신, 향후 응용

- 주요 기술

- 보완적 기술

- 인접 기술

- 기술 로드맵

- 특허 분석

- 미래의 응용

- AI/생성형 AI의 영향

- 성공 사례와 실세계에의 응용

- 지역 반도체 핫스팟과 현지화 동향

- SiC 및 GaN 웨이퍼의 집중에 있어서 공급 체인 리스크

- 정책이 반도체 조달을 형성

- 차세대 반도체의 비용 추이

- EV 부품의 반도체 점유율

- 조달 모델 : 멀티 공급업체 vs. 캡티브 디자인

- 미래 EV 모델 출시 파이프라인과 반도체 수요

제7장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요(Unmet Needs)

- 시장 수익성

제9장 전기자동차용 반도체 시장(기술별)

- 서론

- 실리콘 기반 반도체

- 와이드 밴드갭 반도체

- 주요 인사이트

제10장 전기자동차용 반도체 시장(추진 방식별)

- 서론

- BEV

- PHEV

- 주요 인사이트

제11장 전기자동차용 반도체 시장(구성 요소별)

- 서론

- 전력 IC 및 모듈

- 마이크로컨트롤러 및 프로세서

- 이산 소자

- 통신 및 인터페이스 IC

- 센서 IC

- 게이트 드라이버 IC

- 메모리 및 스토리지 IC

- 기타

- 주요 인사이트

제12장 전기자동차용 반도체 시장(용도별)

- 서론

- BMS

- 파워트레인 시스템

- ADAS

- 차체 및 섀시

- 인포테인먼트 및 커넥티비티

- 주요 인사이트

제13장 전기자동차용 반도체 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 유럽

- 독일

- 프랑스

- 이탈리아

- 스페인

- 영국

- 북미

- 미국

- 캐나다

- 멕시코

제14장 경쟁 구도

- 서론

- 주요 참가 기업의 전략/강점(2022-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 신흥기업/중소기업(2024년)

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 진출기업

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- TEXAS INSTRUMENTS INCORPORATED

- RENESAS ELECTRONICS CORPORATION

- QUALCOMM TECHNOLOGIES, INC.

- NVIDIA CORPORATION

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- ANALOG DEVICES, INC.

- ROBERT BOSCH GMBH

- MICRON TECHNOLOGY, INC.

- MICROCHIP TECHNOLOGY INC.

- 기타 기업

- TOSHIBA CORPORATION

- POLAR SEMICONDUCTOR, LLC

- ROHM CO., LTD.

- MARVELL

- BROADCOM

- MITSUBISHI ELECTRIC CORPORATION

- STARPOWER SEMICONDUCTOR LTD.

- SEMIKRON DANFOSS

- CAMBRIDGE GAN DEVICES

- HUAWEI TECHNOLOGIES CO., LTD.

- BOS SEMICONDUCTORS

- ENSILICA

- INDIE

제16장 조사 방법

제17장 부록

KTH 25.11.28The EV semiconductors market is projected to reach USD 57.48 billion in 2032, growing from USD 24.09 billion in 2025, at a CAGR of 9.1%. The market's growth is driven by increasing semiconductor content per passenger car and the shift to fully electric platforms. EVs use more sensors and computing for safety and automation features, so ADAS requires high-performance MCUs, radar, and vision chips at higher penetration than ICE vehicles. Battery electronics are becoming more advanced because fast charging, longer cycle life, and precise cell monitoring need high-accuracy analog front ends, power devices, and functional safety processors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Million Units) and Value (USD Million) |

| Segments | Technology, Propulsion, Application, Component Type |

| Regions covered | Asia Pacific, Europe, and North America |

Wide-bandgap technologies, including SiC and GaN, hybrid SiC GaN inverters, and advanced packaging, improve efficiency, lower heat, and enable compact high-power designs. Government initiatives, such as the US CHIPS Act and the EU Chips Act, drive local fab expansion by Texas Instruments, Infineon, and STMicroelectronics. Software-defined vehicle platforms increase the demand for memory and processing, and tighter OEM supplier collaboration accelerates innovation. 800V architectures in premium BEVs are pushing the adoption of advanced power semiconductors for faster charging and a longer range. 48V systems in models like Audi A6 and Mercedes-Benz C Class sustain demand for efficient power devices to support high electrical load without moving to full high voltage EV designs.

"Battery management system applications are expected to witness notable demand in the EV semiconductors market during the forecast period."

Battery management system applications are set to witness substantial growth in the EV semiconductors market. Modern BMS hardware must deliver precise measurement, fast data processing, and efficient thermal control inside large battery packs. Advanced microcontrollers, power management ICs, sensors, and communication modules are required to achieve cell voltage, temperature, charge state, and health accuracy.

In April 2025, STMicroelectronics announced its Stellar with xMemory MCUs that support software-driven battery control and flexible cell balancing architectures. Similarly, in March 2025, Renesas launched the RBMS F platform, which combines fuel gauge ICs, microcontrollers, and analog front ends in one design that improves safety through faster fault detection and optimizes charging and discharging. Likewise, in June 2025, NXP Semiconductors completed its acquisition of TTTech Auto to enhance real-time functional safety computing for high-energy battery systems. Packaging improvements and shifting toward high-power-density batteries also increase the use of SiC and GaN-based components inside BMS modules because they reduce heat and improve efficiency. These developments make BMS one of North America and China's strongest semiconductor demand drivers across EV production hubs.

"By component type, the power ICs & modules segment is projected to register strong growth in the EV semiconductors market during the forecast period."

Power ICs & modules, including MOSFETs, IGBTs, and wide-bandgap devices such as SiC and GaN, are critical for inverters, onboard chargers, and DC-DC converters and directly impact vehicle efficiency, range, and thermal performance. Porsche Taycan and Ford Mustang Mach-E employ SiC-based inverters to enhance energy efficiency and enable faster charging. Reflecting the industry's focus on scaling these next-generation power devices, Infineon and ROHM's March 2025 memorandum of understanding to collaborate on SiC power packages highlights industry efforts to scale next-generation power devices. Similarly, STMicroelectronics' investment in September 2025 in panel-level packaging further improves the efficiency and reliability of power semiconductors for automotive applications.

The accelerated adoption of 800V platforms in high-performance BEVs and ongoing global EV production are increasing the demand for high-efficiency power devices. Investments in hybrid SiC-GaN solutions and advanced thermal management packaging are helping OEMs achieve high power density, low losses, and improved overall system reliability, positioning the power semiconductor segment as a significant growth driver in the EV semiconductors market.

"Europe is projected to witness significant growth in the EV semiconductors market during the forecast period."

Europe is projected to experience significant growth in the EV semiconductors market, driven by the increasing passenger car electrification and strong regional automotive manufacturing. Leading OEMs such as Volkswagen, BMW, and Stellantis are expanding BEV lineups and investing in software-defined vehicle platforms, increasing demand for high-performance MCUs, power electronics, and radar/ADAS chips. At the same time, key Chinese OEMs are establishing European manufacturing presence. For instance, in March 2025, BYD announced plans for a new plant in Hungary to serve the European market. The EU Chips Act is a primary catalyst, aiming to double Europe's global semiconductor market share to 20% by 2030 through over USD 46.5 billion in public and private investment, fostering self-sufficiency and supply chain resilience for critical components like automotive chips.

Key investments in the region include Infineon's investment of USD 4.9 billion for expansion in Dresden, STMicroelectronics' SiC fab project worth USD 5.5 billion in Catania, and joint ventures (USD 8.2 billion FD-SOI fab by ST and GlobalFoundries near Grenoble, France). European suppliers, including Infineon Technologies AG and STMicroelectronics, are scaling SiC and GaN production to meet demand for high-efficiency inverters and onboard chargers. Combined with government support for electrification, EV mandates, and incentives for energy-efficient vehicle electronics, these developments position Europe as a key growth region for the EV semiconductors market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 41%, Tier II - 36%, and Tier III - 23%

- By Designation: Directors - 32%, Managers - 47%, and Others - 21%

- By Region: Asia Pacific - 27%, North America - 42%, and Europe - 31%

The EV semiconductors market is dominated by major players, including Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Texas Instruments Incorporated (US), Renesas Electronics Corporation (Japan), and more. These companies are expanding their portfolios to strengthen their market position.

Research Coverage:

The report covers the EV semiconductors market in terms of Technology (Silicon-based Semiconductor, Wide-Bandgap Semiconductor), Propulsion [Battery Electric Vehicle (BEV) and Plug-In Hybrid Electric Vehicle (PHEV)], Application (Battery Management System, Powertrain System, ADAS, Body & Chassis, and Infotainment & Connectivity), Component Type (Power ICs & Modules, Microcontrollers & Processors, Discretes, Communication & Interface ICs, Sensor ICs, Gate Driver ICs, Memory & Storage ICs, Other Semiconductors), and Region. It covers the competitive landscape and company profiles of significant players in the EV semiconductors market. The study includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the EV semiconductors market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report will also help stakeholders understand the EV semiconductors market's current and future pricing trends.

- The report will also help market leaders/new entrants with information on various market trends based on technology, propulsion, application, component type, and Region.

The report provides insight into the following pointers:

- Analysis of key drivers (Rising EV adoption, high semiconductor content per EV, technological advancements in chip design and integration), restraints (Long qualification cycles and strict automotive reliability standards; high cost of advanced materials; and geopolitical, trade, and export control risks; fragmented standards and interoperability challenges), opportunities (Growth in wide-bandgap materials, expansion in emerging markets, tier-1 and OEM partnerships/co-development), and challenges (Intense competition and margin pressure; cybersecurity, safety, and liability concerns).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the EV semiconductors market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the EV semiconductors market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Texas Instruments Incorporated (US), and Renesas Electronics Corporation (Japan), among others, in the EV semiconductors market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV SEMICONDUCTORS MARKET

- 3.2 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY

- 3.3 EV SEMICONDUCTORS MARKET, BY PROPULSION

- 3.4 EV SEMICONDUCTORS MARKET, BY APPLICATION

- 3.5 EV SEMICONDUCTORS MARKET, BY COMPONENT

- 3.6 EV SEMICONDUCTORS MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increased semiconductor content in EVs

- 4.2.1.2 Innovations in chip design and integration

- 4.2.1.3 Heightened EV adoption

- 4.2.1.4 Rapid evolution of EV architectures

- 4.2.2 RESTRAINTS

- 4.2.2.1 Long qualification cycles and strict automotive reliability standards

- 4.2.2.2 High cost of advanced materials

- 4.2.2.3 Fragmented standards and limited interoperability

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Extensive use of wide-bandgap materials

- 4.2.3.2 Expansion into emerging markets

- 4.2.3.3 Collaborations between Tier 1s and OEMs

- 4.2.3.4 Emerging applications of EV semiconductors

- 4.2.4 CHALLENGES

- 4.2.4.1 Stiff competition and margin pressure

- 4.2.4.2 Cybersecurity, safety, and liability concerns

- 4.2.4.3 Geopolitical, trade, and export control risks

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 POWER ELECTRONICS FOR 800V SYSTEMS

- 4.3.2 EV ARCHITECTURE AND COMPUTING

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMIC INDICATORS

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL EV INDUSTRY

- 5.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 5.2 ECOSYSTEM ANALYSIS

- 5.2.1 RAW MATERIAL SUPPLIERS

- 5.2.2 CHIP DESIGN COMPANIES

- 5.2.3 FOUNDRIES

- 5.2.4 OSAT PROVIDERS

- 5.2.5 COMPONENT MANUFACTURERS

- 5.2.6 TIER-1 SUPPLIERS

- 5.2.7 OEMS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF EV SEMICONDUCTORS OFFERED BY KEY PLAYERS

- 5.4.2 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 FUNDING, BY USE CASE

- 5.8 KEY CONFERENCES AND EVENTS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8541)

- 5.9.2 EXPORT SCENARIO (HS CODE 8541)

- 5.9.3 TRADE RESTRICTIONS

- 5.9.4 US-CHINA EXPORT BANS

- 5.9.5 EU SUBSIDY RACE

- 5.9.6 IMPACT OF LOCALIZATION POLICIES ON SOURCING

- 5.9.7 CXO PRIORITIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ELECTROTHERMAL SIMULATION FOR AEC COMPLIANCE IN AUTOMOTIVE SMART FET DRIVERS

- 5.10.2 SMART DATA CONTROL ROOM INTEGRATION FOR SEMICONDUCTOR MANUFACTURING OPTIMIZATION

- 5.10.3 LEGACY SEMICONDUCTOR FAB MODERNIZATION THROUGH ADVANCED AUTOMATION PLATFORM

- 5.10.4 RAPID EV MOTOR CONTROL UNIT DEVELOPMENT THROUGH SEMICONDUCTOR SENSOR INTEGRATION

- 5.10.5 POWER ELECTRONICS AND COMPOUND SEMICONDUCTORS ACCELERATE EV INNOVATION

- 5.10.6 BYD ADVANCES EV SEMICONDUCTOR INNOVATION WITH 1500V SIC CHIPS FOR 1000V SUPER E-PLATFORM

- 5.10.7 WIDE-BANDGAP SEMICONDUCTORS ENABLING 800V POWERTRAIN

- 5.11 2025 US TARIFF

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.5 IMPACT ON AUTOMOTIVE INDUSTRY

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 SIC MOSFETS AND JFETS

- 6.1.2 800V TRACTION INVERTERS

- 6.1.3 GAN HEMTS

- 6.1.4 COMPACT ONBOARD CHARGERS AND DC-DC CONVERTERS

- 6.1.5 HYBRID SIC-GAN MODULES

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED PACKAGING AND INTEGRATION

- 6.2.2 NEXT-GENERATION SENSOR SEMICONDUCTORS

- 6.2.3 POWER AND CONTROL ICS

- 6.2.4 HIGH-VOLTAGE INTERCONNECTS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 AI AND EDGE PROCESSING CHIPS

- 6.3.2 V2X AND CONNECTIVITY SEMICONDUCTORS

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES

- 6.7.3 CASE STUDIES

- 6.7.4 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.8.1 INFINEON TECHNOLOGIES AG: AI-ENHANCED POWER MODULE OPTIMIZATION

- 6.8.2 TEXAS INSTRUMENTS INCORPORATED: PREDICTIVE SEMICONDUCTOR MANUFACTURING

- 6.8.3 STMICROELECTRONICS: AI-ASSISTED DESIGN AND VERIFICATION

- 6.8.4 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY: AI-DRIVEN YIELD AND SUPPLY CHAIN RESILIENCE

- 6.9 REGIONAL SEMICONDUCTOR HOTSPOTS AND LOCALIZATION DYNAMICS

- 6.10 SUPPLY CHAIN RISKS IN SIC AND GAN WAFER CONCENTRATION

- 6.11 POLICY DRIVES SHAPING SEMICONDUCTOR SOURCING

- 6.12 COST TRAJECTORIES FOR NEXT-GENERATION SEMICONDUCTORS

- 6.13 SEMICONDUCTOR SHARE OF EV BILL OF MATERIALS

- 6.14 SOURCING MODELS: MULTI-SUPPLIER VS. CAPTIVE DESIGN

- 6.15 FUTURE EV MODEL LAUNCH PIPELINE AND SEMICONDUCTOR DEMAND

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

9 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 SILICON-BASED SEMICONDUCTOR

- 9.2.1 STRONG ECOSYSTEM FOR MCUS, SENSORS, AND POWER ICS TO DRIVE MARKET

- 9.3 WIDE-BANDGAP SEMICONDUCTOR

- 9.3.1 SOFTWARE-BASED ARCHITECTURE, ADAS ADVANCEMENTS, AND SHIFT TO 800V EV ARCHITECTURE TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 EV SEMICONDUCTORS MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 BEV

- 10.2.1 ADOPTION OF SIC/GAN POWER DEVICES FOR TRACTION INVERTERS TO DRIVE MARKET

- 10.3 PHEV

- 10.3.1 DEMAND FOR DUAL-MODE BMS ICS AND POWER MODULES FOR MULTI-VOLTAGE SYSTEMS TO DRIVE MARKET

- 10.4 PRIMARY INSIGHTS

11 EV SEMICONDUCTORS MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 POWER IC & MODULE

- 11.2.1 TRANSITION TO HIGH-VOLTAG EV ARCHITECTURE AND WBG MATERIALS TO DRIVE MARKET

- 11.3 MICROCONTROLLER & PROCESSOR

- 11.3.1 GROWTH OF ZONAL/DOMAIN CONTROLLERS AND REAL-TIME SENSOR FUSION FOR ADAS TO DRIVE MARKET

- 11.4 DISCRETE

- 11.4.1 INCREASE IN 48V SUBSYSTEMS FOR BODY AND COMFORT ELECTRONICS TO DRIVE MARKET

- 11.5 COMMUNICATION & INTERFACE IC

- 11.5.1 DEPLOYMENT OF MULTI-PROTOCOL 10 GBPS ETHERNET & V2X AND TELEMATICS GATEWAYS TO DRIVE MARKET

- 11.6 SENSOR IC

- 11.6.1 RAPID SENSOR PROLIFERATION FOR LIDAR, IMAGING RADAR, AND BMS TO DRIVE MARKET

- 11.7 GATE DRIVER IC

- 11.7.1 PRECISION CONTROL OF HIGH-SPEED SIC/GAN MOSFETS TO DRIVE MARKET

- 11.8 MEMORY & STORAGE IC

- 11.8.1 HIGH-BANDWIDTH DRAM FOR INFOTAINMENT AND RESILIENT NAND STORAGE FOR OTA/DIAGNOSTICS TO DRIVE MARKET

- 11.9 OTHER SEMICONDUCTORS

- 11.10 PRIMARY INSIGHTS

12 EV SEMICONDUCTORS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 BMS

- 12.2.1 FOCUS ON CELL-LEVEL MONITORING AND COMPLEX THERMAL MANAGEMENT TO DRIVE MARKET

- 12.3 POWERTRAIN SYSTEM

- 12.3.1 SIC MOSFET TRANSITION AND INTEGRATED GATE DRIVERS TO DRIVE MARKET

- 12.4 ADAS

- 12.4.1 HIGHER LEVEL OF AUTONOMY AND HIGH-SPEED IN-VEHICLE NETWORKS TO DRIVE MARKET

- 12.5 BODY & CHASSIS

- 12.5.1 ELECTRIFICATION OF MECHANICAL SYSTEMS AND SHIFT TO ZONAL CONTROLLERS TO DRIVE MARKET

- 12.6 INFOTAINMENT & CONNECTIVITY

- 12.6.1 INNOVATION IN SDV ARCHITECTURE, OTA UPDATES, AND HIGH-SPEED CONNECTIVITY MODULES TO DRIVE MARKET

- 12.7 PRIMARY INSIGHTS

13 EV SEMICONDUCTORS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Local semiconductor production scale and localization efforts for SiC/GaN semiconductors to drive market

- 13.2.2 INDIA

- 13.2.2.1 Government incentives for local manufacturing and substantial investments by OEMs to drive market

- 13.2.3 JAPAN

- 13.2.3.1 Power semiconductor leadership and high ADAS integration to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Strong local EV battery supply chains and high export focus to drive market

- 13.2.1 CHINA

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Premium EV platforms with high semiconductor content to drive market

- 13.3.2 FRANCE

- 13.3.2.1 Growing ADAS integration in passenger EVs to drive market

- 13.3.3 ITALY

- 13.3.3.1 SiC FAB scale-ups and robust supplier ecosystem to drive market

- 13.3.4 SPAIN

- 13.3.4.1 EU funding alignment and strong local manufacturing hub to drive market

- 13.3.5 UK

- 13.3.5.1 Increased SiC production and government-supported industrialization and development centers to drive market

- 13.3.1 GERMANY

- 13.4 NORTH AMERICA

- 13.4.1 US

- 13.4.1.1 Rigorous onshoring policies and supporting government funding to drive market

- 13.4.2 CANADA

- 13.4.2.1 Strong automotive semiconductor R&D and growing IC design hubs to drive market

- 13.4.3 MEXICO

- 13.4.3.1 Export-focused assembly hubs and integration into North American supply chains to drive market

- 13.4.1 US

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Technology footprint

- 14.7.5.4 Application footprint

- 14.7.5.5 Propulsion footprint

- 14.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of start-ups/SMEs

- 14.8.5.2 Competitive benchmarking of start-ups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 INFINEON TECHNOLOGIES AG

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.3.4 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 STMICROELECTRONICS

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.3.4 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 NXP SEMICONDUCTORS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.3.4 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 TEXAS INSTRUMENTS INCORPORATED

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.3.4 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 RENESAS ELECTRONICS CORPORATION

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Expansions

- 15.1.5.3.4 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 QUALCOMM TECHNOLOGIES, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches/developments

- 15.1.6.3.2 Expansions

- 15.1.7 NVIDIA CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.8 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Expansions

- 15.1.9 ANALOG DEVICES, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Expansions

- 15.1.10 ROBERT BOSCH GMBH

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches/developments

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Expansions

- 15.1.11 MICRON TECHNOLOGY, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Expansions

- 15.1.11.3.2 Other developments

- 15.1.12 MICROCHIP TECHNOLOGY INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches/developments

- 15.1.12.3.2 Deals

- 15.1.12.3.3 Expansions

- 15.1.1 INFINEON TECHNOLOGIES AG

- 15.2 OTHER PLAYERS

- 15.2.1 TOSHIBA CORPORATION

- 15.2.2 POLAR SEMICONDUCTOR, LLC

- 15.2.3 ROHM CO., LTD.

- 15.2.4 MARVELL

- 15.2.5 BROADCOM

- 15.2.6 MITSUBISHI ELECTRIC CORPORATION

- 15.2.7 STARPOWER SEMICONDUCTOR LTD.

- 15.2.8 SEMIKRON DANFOSS

- 15.2.9 CAMBRIDGE GAN DEVICES

- 15.2.10 HUAWEI TECHNOLOGIES CO., LTD.

- 15.2.11 BOS SEMICONDUCTORS

- 15.2.12 ENSILICA

- 15.2.13 INDIE

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Secondary sources

- 16.1.1.2 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Primary interviews: demand and supply sides

- 16.1.2.2 Breakdown of primary interviews

- 16.1.2.3 Primary participants

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 DATA TRIANGULATION

- 16.4 FACTOR ANALYSIS

- 16.5 RESEARCH ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RISK ASSESSMENT

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.4.1 EV SEMICONDUCTORS MARKET FOR HYBRID ELECTRIC VEHICLES AT REGIONAL LEVEL (FOR COUNTRIES COVERED IN REPORT)

- 17.4.2 EV SEMICONDUCTORS MARKET, BY TECHNOLOGY, FOR ADDITIONAL COUNTRIES (FOR COUNTRIES NOT COVERED IN REPORT)

- 17.4.3 COMPANY INFORMATION (PROFILING OF UP TO FIVE ADDITIONAL MARKET PLAYERS)

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS