|

시장보고서

상품코드

1881231

농업 바이오테크놀러지 시장(-2030년) : 생물 유형, 유형, 기술, 용도별 예측Agriculture Biotechnology Market by Type of Organism (Plant, Animal, and Microbes), by Type, by Technology, and by Application - Global Forecast to 2030 |

||||||

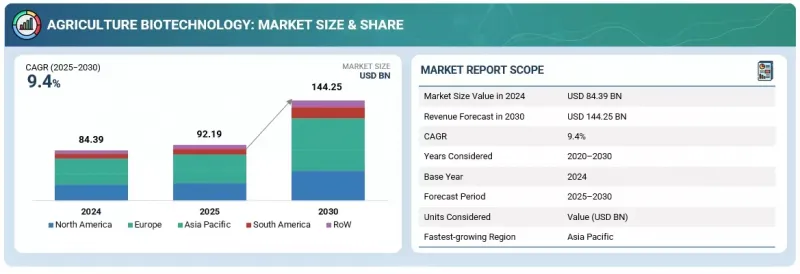

농업 바이오테크놀러지 시장 규모는 2025년 921억 9,000만 달러에서 2030년까지 연평균 복합 성장률(CAGR) 9.4%를 나타내 1,442억 5,000만 달러에 이를 것으로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 톤 |

| 부문 | 생물종, 기술, 유형, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

농업 바이오테크놀러지 시장의 성장은 주로 세계적인 식량 수요 증가, 경작 가능한 토지 감소, 지속 가능한 농업 솔루션의 필요성에 의해 추진되고 있습니다. 바이오테크놀러지은 환경에 미치는 영향을 줄이면서 작물 수확량을 늘리고 토양 건강을 개선하며 가축 생산성을 높이는 첨단 방법을 제공합니다. 유전자 변형(GM) 작물, 미생물 접종제 및 바이오 비료의 사용 증가는 더 나은 자원 관리와 화학 물질에 대한 의존도 감소를 지원합니다.

또한 기후 변화의 압력으로 가뭄 내성과 해충저항성을 가진 작물 품종의 도입이 가속되어 농업의 탄력성이 강화되고 있습니다. 각국 정부와 국제기구는 지원 규제, 연구 자금 및 지속가능성에 대한 노력을 통해 바이오테크놀러지 혁신을 촉진하고 있습니다. 또한 유전자 편집, 분자진단 및 미생물 공학의 급속한 발전으로 식물, 동물 및 미생물 시스템에서 농업 바이오테크놀러지의 사용이 확대되고 있습니다. 이러한 요인이 결합되어 세계적으로 첨단 기술과 환경 친화적이고 높은 수율의 농업으로의 전환을 추진하고 있습니다.

"예측 기간 동안 식물 바이오테크놀러지가 시장을 주도할 전망"

이 주도적 입장은 유전자 변형(GM) 작물의 광범위한 도입, 종자 형질 개발의 진전, 바이오 비료·바이오 농약의 이용 증가에 의한 것입니다. 세계적인 식량 수요 증가와 제한된 천연 자원 중 더 높은 작물 수율을 확보할 필요성이 결합되어 식물 바이오테크놀러지 솔루션의 도입을 촉진하고 있습니다. 농가는 제초제 내성, 해충 저항성, 스트레스 내성 향상 등의 특성을 가진 유전자 변형 품종을 선택하는 경향이 강해지고 있으며, 이로써 수율과 수익 향상을 도모하고 있습니다. 게다가 CRISPR 기술이나 분자 육종 기술에 있어서 혁신에 의해 작물의 개량 정밀도가 향상되어, 신품종의 신속한 상업화가 가능해지고 있습니다. 지속가능한 농업을 촉진하는 정부의 지원정책과 관민공동의 연구개발 투자가 함께 이 부문의 지위를 더욱 강화하고 있습니다. 기후 변화에 대한 내성과 영양가가 높은 작물에 대한 수요가 높아지는 가운데, 예측 기간 동안 식물바이오테크놀러지은 현대농업에서 혁신의 주요 추진력이 될 것입니다.

"유전 공학 및 유전자 편집 부서가 예측 기간 동안 시장을 주도할 전망"

유전 공학 및 유전자 편집 부서는 작물 및 가축 개선에 대한 혁신적인 효과로 인해 예측 기간 동안 시장을 견인할 것으로 예측됩니다. CRISPR-Cas9, TALEN, RNA 간섭(RNAi) 등의 기술로 과학자들은 수율, 스트레스 내성, 영양가가 뛰어난 정밀하고 고수량의 품종을 창출할 수 있게 되었습니다. 한 예로 Calyxt의 유전자 편집 대두를 들 수 있습니다. 이것은 더 건강한 고 올레산 오일을 생산하는 것으로 미국에서 상업화 된 최초의 CRISPR 기반 작물 중 하나입니다. 마찬가지로 Corteva Agriscience는 고급 유전자 편집 기술을 사용하여 내건성 옥수수를 개발하여 물 부족 지역의 내성을 크게 향상 시켰습니다.

축산 분야에서 Genus PLC는 돼지 생식기 호흡기 증후군(PRRS)에 내성이있는 돼지를 개발했습니다. 이것은 동물 복지의 향상과 경제적 손실의 감소로 이어지는 획기적인 결과입니다. 브라질, 미국, 아르헨티나의 각국 정부도 유전자 편집 작물의 규제를 완화하고 상업화의 가속을 지원하고 있습니다. 강력한 연구개발투자, 세계적 파트너십, 진화하는 생물안전성의 틀에 힘입어 유전공학과 유전자 편집기술이 2030년에 걸쳐 농업 바이오테크놀러지 분야에서 효율성, 지속가능성, 혁신을 견인하는 주요기술로 지속될 전망입니다.

"아시아태평양이 예측 기간 동안 최대 성장을 보여줄 전망"

아시아태평양은 식량 수요 증가, 농업 근대화 진전, 지속 가능한 농업 실천을 촉진하는 정부 지원 이니셔티브에 힘입어 예측 기간 동안 최대 성장이 예상됩니다. 중국, 인도, 일본, 필리핀 등 국가들은 작물 수율 향상, 가축 건강 증진, 토양 비옥도 개선을 목적으로 바이오테크놀러지 연구개발 투자를 확대하고 있습니다. 유전자 변형(GM) 작물, 미생물 바이오 비료 및 바이오 해충 방제 제품의 채용 증가가이 지역의 농업 구조를 변화시키고 있습니다.

본 보고서에서는 세계의 농업 바이오테크놀러지 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술·특허 동향, 법규제 환경, 시장 규모 추이와 예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 농업 바이오테크놀러지에서 생성형 AI의 영향

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 지표 가격 분석

- 무역 분석

- 주요 회의 및 이벤트

- 고객의 사업에 영향을 미치는 동향

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향(2025년) : 농업 바이오테크놀러지 시장

제7장 고객정세와 구매행동

- 의사결정 프로세스

- 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 최종 사용자 산업의 미충족 수요(Unmet Needs)

- 시장의 수익성

제8장 기술, 특허, 디지털, AI 도입을 통한 전략적 혁신

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 미래의 응용

- AI/생성형 AI가 농업 바이오테크놀러지 시장에 미치는 영향

- 성공 사례와 실제 적용 사례

제9장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제10장 농업 바이오테크놀러지 시장 : 생물종별

- 식물

- 동물

- 미생물

제11장 농업 바이오테크놀러지 시장 : 유형별

- 식물 바이오테크놀러지 시장 : 유형별

- 유전자 변형

- 형질전환 동물

- 미생물 바이오 비료

제12장 농업 바이오테크놀러지 시장 : 용도별

- 식물 바이오테크놀러지 시장 : 용도별

- 농작물 보호

- 수익 향상

- 영양 품질 개선

- 기후 내성 작물

- 동물 바이오테크놀러지 시장 : 용도별

- 내병성

- 성장·생산성 향상

- 동물 복지 솔루션

- 수의사 치료

- 미생물 바이오테크놀러지 시장 : 용도별

- 토양 건강 관리

- 해충 및 질병 방제

- 지속가능한 영양순환

- 바이오 정화 및 폐기물 이용

제13장 농업 바이오테크놀러지 시장 : 기술별

- 식물 바이오테크놀러지 시장 : 기술별

- 조직 배양

- 체세포 교잡

- 분자 진단

- 유전자 공학

- 동물 바이오테크놀러지 시장 : 기술별

- 배아 구출 및 이식

- 유전자 공학 및 CRISPR

- 분자 진단

- 백신 바이오테크놀러지

- 미생물 바이오테크놀러지 시장 : 기술별

- 발효 기술

- 메타게놈학 및 미생물 게놈학

- 분자 마커 보조 선택

- 합성 생물학

제14장 농업 바이오테크놀러지 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 스페인

- 영국

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 지역

- 중동

- 아프리카

제15장 경쟁 구도

- 개요

- 주요 기업의 전략

- 수익 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업평가와 재무지표

- 식물 바이오테크놀러지 기업 평가 매트릭스 : 주요 기업

- 동물 바이오테크놀러지 기업 평가 매트릭스 : 주요 기업

- 미생물 바이오테크놀러지 기업 평가 매트릭스 : 주요 기업

- 경쟁 시나리오

제16장 기업 프로파일

- 식물 바이오테크놀러지 기업

- BASF SE

- BAYER AG

- CORTEVA AGRISCIENCE

- SYNGENTA

- KWS SAAT SE & CO. KGAA

- UPL

- FMC CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- NUFARM

- PRO FARM GROUP

- 동물 바이오테크놀러지 기업

- ZOETIS SERVICES LLC

- ELANCO OR ITS AFFILIATES

- MERCK & CO., INC.

- CEVA

- VIRBAC

- HESTER BIOSCIENCES LIMITED

- GENUS PLC

- VAXXINOVA

- AB VISTA

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 미생물 바이오테크놀러지 기업

- VALENT USA LLC

- NOVONESIS GROUP

- INDIGO AG, INC.

- PIVOT BIO

- BIOATLANTIS LTD.

- CERTIS USA LLC

- ZYMOLENT BIOSCIENCES PVT. LTD.

- AGRICEN

- VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD.

- GROUNDWORK BIOAG

제17장 인접 시장과 관련 시장

제18장 부록

KTH 25.12.10The agriculture biotechnology market is estimated at USD 92.19 billion in 2025 and is projected to reach USD 144.25 billion by 2030, at a CAGR of 9.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Organism Type, Technology, Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

The growth of the agriculture biotechnology market is mainly driven by increasing global food demand, diminishing arable land, and the need for sustainable farming solutions. Biotechnology provides advanced methods to increase crop yields, improve soil health, and boost livestock productivity while reducing environmental impact. The rising use of genetically modified (GM) crops, microbial inoculants, and biofertilizers supports better resource management and less reliance on chemicals.

Moreover, climate change pressures have sped up the adoption of drought-tolerant and pest-resistant crop varieties, ensuring greater resilience in farming. Governments and international groups are encouraging biotech innovations through supportive regulations, research funding, and sustainability efforts. Additionally, quick progress in genome editing, molecular diagnostics, and microbial engineering is broadening the use of agricultural biotechnology in plant, animal, and microbial systems. Collectively, these factors are driving a shift toward high-tech, eco-friendly, and high-yield agriculture worldwide.

"Plant biotechnology is projected to dominate the market during the forecast period."

The plant biotechnology segment is expected to dominate the global agriculture biotechnology market during the forecast period. This leadership is due to widespread adoption of genetically modified (GM) crops, advancements in seed trait development, and increased use of biofertilizers and biopesticides. Rising global food demand, combined with the need for higher crop yields with limited natural resources, is fueling the adoption of plant biotechnology solutions. Farmers are increasingly opting for GM varieties that offer herbicide tolerance, pest resistance, and improved stress tolerance to achieve better yields and profits. Additionally, innovations in CRISPR and molecular breeding technologies are enhancing precision in crop improvement, enabling faster commercialization of new varieties. Supportive government policies promoting sustainable agriculture, along with public-private R&D investments, are further reinforcing this segment's position. The growing need for climate-resilient and nutrient-rich crops will continue to make plant biotechnology a key driver of innovation in modern agriculture throughout the forecast period.

"The genetic engineering and genome editing subsegment is projected to dominate the agriculture biotechnology market during the forecast period."

The genetic engineering and genome editing segment is expected to lead the agriculture biotechnology market during the forecast period due to its transformative effect on crop and livestock improvement. Technologies like CRISPR-Cas9, TALEN, and RNA interference (RNAi) are allowing scientists to create precise, high-yield varieties with better yield, stress tolerance, and nutritional content. An example is Calyxt's gene-edited soybean, which produces healthier high-oleic oil and was among the first CRISPR-based crops to be commercialized in the US. Likewise, Corteva Agriscience has developed drought-tolerant maize using advanced gene-editing methods, greatly enhancing resilience in water-scarce areas.

In livestock, Genus PLC has developed pigs resistant to Porcine Reproductive and Respiratory Syndrome (PRRS), a breakthrough that enhances animal welfare and cuts economic losses. Governments in Brazil, the US, and Argentina have also relaxed regulations on gene-edited crops, supporting faster commercialization. Supported by strong R&D investments, global partnerships, and evolving biosafety frameworks, genetic engineering and genome editing are set to remain the leading technologies that drive efficiency, sustainability, and innovation in agricultural biotechnology through 2030.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

The Asia Pacific region is expected to see the fastest growth in the agriculture biotechnology market during the forecast period, fueled by increasing food demands, expanding agricultural modernization, and government-supported initiatives that promote sustainable farming practices. Countries like China, India, Japan, and the Philippines are increasingly investing in biotechnology R&D to improve crop yields, livestock health, and soil fertility. The rising adoption of genetically modified (GM) crops, microbial biofertilizers, and bio-based pest control products is transforming the region's agricultural landscape.

India's approval of GM mustard (Dhara Mustard Hybrid-11) in 2023 and China's increasing commercialization of gene-edited soybean and maize varieties highlight the region's progressive regulatory approach. Additionally, strong support from regional organizations and public-private partnerships is driving innovation in genome editing, fermentation technologies, and microbial applications. With rapid population growth, limited arable land, and growing focus on food security, the Asia Pacific region is expected to remain the most dynamic and opportunity-rich area in the agriculture biotechnology market through 2030.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations in the agriculture biotechnology market.

- By Company Type: Tier 1-25%, Tier 2-45%, and Tier 3-30%

- By Designation: CXOs-20%, Managers-50%, Executives-30%

- By Region: North America-25%, Europe-20%, Asia Pacific-30%, South America-15%, and Rest of the World-10%

Prominent companies in the market include Bayer Crop Science, Corteva Agriscience, BASF SE, Syngenta AG, Zoetis Inc., Elanco Animal Health, and Novonesis (Novozymes and Chr. Hansen)

Research Coverage

This research report categorizes the agriculture biotechnology market by organism type (plants, animals, microbes), type (genetic modification, crop protection, soil enhancement, stress tolerance, transgenic animals, vaccines, feed additives, diagnostics, biofertilizers, biocontrol agents, microbial enzymes & biostimulants, microbial genomics & fermentation), technology (genetic engineering, molecular diagnostics, tissue culture, CRISPR, fermentation, metagenomics, synthetic biology, and molecular marker-assisted selection), application (crop protection, yield enhancement, disease resistance, animal health management, soil health improvement, and sustainable nutrient cycling), end user (farmers and producer groups, agribusinesses, seed and input companies, research institutions, and government agencies), and region (North America, Europe, Asia Pacific, South America, the Middle East, and Africa).

The report's scope includes detailed information about major factors such as drivers, restraints, challenges, and opportunities that influence the growth of agricultural biotechnology. A comprehensive analysis of key industry players offers insights into their businesses, services, key strategies, contracts, partnerships, agreements, product launches, mergers and acquisitions, and recent developments in the agriculture biotechnology market. This report also features a competitive analysis of emerging startups within the agriculture biotechnology ecosystem. Additionally, the study covers industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscapes, among other topics.

Reasons to Buy This Report

The report will provide market leaders and new entrants with approximate revenue figures for the overall agriculture biotechnology sector and its subsegments. It will also help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market pulse and offers information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points.

- Analysis of key drivers (growing demand for sustainable and high-yield biotechnology-based agriculture), restraints (high regulatory hurdles and lengthy approval processes for GMOs), opportunities (increasing adoption of microbial and bio-based agricultural inputs globally), and challenges (public skepticism and ethical concerns over genetic modification technologies) influencing the growth of the agriculture biotechnology market

- Product Development/Innovation: Detailed insights into ongoing R&D initiatives in genome editing, CRISPR applications, microbial biofertilizers, and biocontrol agents are included, along with emerging product launches across plant, animal, and microbial biotechnology segments.

- Market Development: The report offers comprehensive information about expanding market opportunities across developed and emerging regions, emphasizing growing investment in biotechnology-enabled agriculture.

- Market Diversification: Includes detailed analysis of new product innovations, regional adoption patterns, government-funded biotechnology initiatives, and expansion of key players into new applications such as climate-resilient crops and animal health solutions.

- Competitive Assessment: In-depth assessment of market share, company strategies, product portfolios, and innovation footprints of leading players such as Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Syngenta AG (Switzerland), Novonesis (Denmark), Ginkgo Bioworks (US), Zoetis Inc. (US), and ADM Animal Nutrition (US), among others in the agriculture biotechnology ecosystem.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.2.1 AGRICULTURE BIOTECHNOLOGY COMPANIES

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 AGRICULTURE BIOTECHNOLOGY MARKET OVERVIEW

- 4.2 AGRICULTURE BIOTECHNOLOGY MARKET: GROWTH RATES OF MAJOR REGIONAL SUBMARKETS

- 4.3 EUROPE: AGRICULTURE BIOTECHNOLOGY MARKET FOR PLANT BIOTECHNOLOGY, BY TYPE AND COUNTRY

- 4.4 AGRICULTURE BIOTECHNOLOGY MARKET, BY ORGANISM TYPE AND REGION

- 4.5 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 4.6 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 4.7 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing Need for Sustainable Food Production

- 5.2.1.2 Government Support and Regulatory Approvals

- 5.2.1.3 Rising Focus on Reducing Chemical Inputs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Public Perception and Ethical Concerns

- 5.2.2.2 Infrastructure and Cold Chain Limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion in Emerging Economies

- 5.2.3.2 Focus on Carbon-negative and Regenerative Agriculture

- 5.2.3.3 Growth in Microbial and Bio-based Inputs

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory Uncertainty and Trade Barriers

- 5.2.4.2 Dominance of Few Multinational Players

- 5.2.4.3 Climate and Disease Variability

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GEN AI ON AGRICULTURE BIOTECHNOLOGY

- 5.3.1 INTRODUCTION

- 5.3.2 USE OF GEN AI IN AGRICULTURE BIOTECHNOLOGY

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Using Gen AI to Enhance Crop Disease Diagnostics via Synthetic Imagery

- 5.3.3.2 PhytoSynth: Generative AI for Crop Disease Data Generation

- 5.3.4 IMPACT ON AGRICULTURE BIOTECHNOLOGY MARKET

- 5.3.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.2.2 BARGAINING POWER OF SUPPLIERS

- 6.2.3 BARGAINING POWER OF BUYERS

- 6.2.4 THREAT OF SUBSTITUTES

- 6.2.5 THREAT OF NEW ENTRANTS

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GLOBAL POPULATION GROWTH & FOOD DEMAND

- 6.3.2 STABLE GLOBAL GDP GROWTH AND MACRO PROJECTIONS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- 6.7 INDICATIVE PRICING ANALYSIS

- 6.7.1 INDICATIVE PRICING ANALYSIS, BY KEY COMPANY AND ORGANISM

- 6.7.2 INDICATIVE PRICING BY REGION

- 6.8 TRADE ANALYSIS

- 6.8.1 TRADE ANALYSIS OF HS CODE 843280: PREPARED CULTURE MEDIA FOR DEVELOPMENT OR MAINTENANCE OF MICROORGANISMS, INCLUDING VIRUSES AND THE LIKE, OR OF PLANT, HUMAN, OR ANIMAL CELLS

- 6.8.1.1 Export Trends of Agriculture Biotechnology under HS Code 382100 (2020-2024)

- 6.8.1.2 Import Trends of Agriculture Biotechnology under HS Code 382100 (2020-2024)

- 6.8.1 TRADE ANALYSIS OF HS CODE 843280: PREPARED CULTURE MEDIA FOR DEVELOPMENT OR MAINTENANCE OF MICROORGANISMS, INCLUDING VIRUSES AND THE LIKE, OR OF PLANT, HUMAN, OR ANIMAL CELLS

- 6.9 KEY CONFERENCES & EVENTS

- 6.10 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 6.11 INVESTMENT AND FUNDING SCENARIO

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 PIVOT BIO'S GENE-EDITED NITROGEN-FIXING MICROBES (2025)

- 6.12.2 NOVONESIS MICROBIAL SEED INOCULANT (JUMPSTART(R)) (2024)

- 6.12.3 RECOMBINETICS - GENE-EDITED LIVESTOCK FOR DISEASE RESISTANCE AND WELFARE ENHANCEMENT (2024)

- 6.13 IMPACT OF 2025 US TARIFF - AGRICULTURE BIOTECHNOLOGY MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON COUNTRY/REGION

- 6.13.4.1 United States

- 6.13.4.2 European Union

- 6.13.4.3 China

- 6.13.5 IMPACT ON END-USE INDUSTRIES

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 INTRODUCTION

- 7.2 DECISION-MAKING PROCESS

- 7.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.3.2 BUYING CRITERIA

- 7.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.6 MARKET PROFITABILITY

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 8.1 INTRODUCTION

- 8.2 KEY EMERGING TECHNOLOGIES

- 8.3 COMPLEMENTARY TECHNOLOGIES

- 8.4 TECHNOLOGY/PRODUCT ROADMAP

- 8.5 PATENT ANALYSIS

- 8.5.1 LIST OF MAJOR PATENTS

- 8.6 FUTURE APPLICATIONS

- 8.7 IMPACT OF AI/GEN AI ON AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.1 TOP USE CASES AND MARKET POTENTIAL

- 8.7.1.1 AI Use Cases in Agriculture Biotechnology Market

- 8.7.1.1.1 AI-driven Genomic Selection and Trait Discovery

- 8.7.1.1.2 Precision Bio-input Design and Microbial Optimization

- 8.7.1.1.3 Market Potential Impact of AI in Agricultural Biotechnology

- 8.7.1.1.4 Acceleration of R&D and Commercialization Pipelines

- 8.7.1.1.5 Enabling Data-driven Sustainable Agriculture and Global Scalability

- 8.7.1.1 AI Use Cases in Agriculture Biotechnology Market

- 8.7.2 BEST PRACTICES IN AGRICULTURE BIOTECHNOLOGY PROCESSING

- 8.7.3 CASE STUDIES OF AI IMPLEMENTATION IN AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.3.1 Using Gen AI to Enhance Crop Disease Diagnostics via Synthetic Imagery

- 8.7.3.2 PhytoSynth: Generative AI for Crop Disease Data Generation

- 8.7.4 INTERCONNECTED & ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 8.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AGRICULTURE BIOTECHNOLOGY MARKET

- 8.7.1 TOP USE CASES AND MARKET POTENTIAL

- 8.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

9 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 REGIONAL REGULATIONS AND COMPLIANCE

- 9.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 9.2.2 INDUSTRY STANDARDS

- 9.3 SUSTAINABILITY INITIATIVES

- 9.3.1 CARBON IMPACT AND ECO-APPLICATIONS OF AGRICULTURE BIOTECHNOLOGY

- 9.4 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 9.5 CERTIFICATIONS, LABELING, ECO-STANDARDS

10 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE OF ORGANISM

- 10.1 INTRODUCTION

- 10.2 PLANTS

- 10.2.1 GROWING GLOBAL FOOD DEMAND, CLIMATE CHANGE RESILIENCE, AND SUSTAINABILITY GOALS ACCELERATING ADOPTION OF PLANT BIOTECHNOLOGY

- 10.3 ANIMALS

- 10.3.1 RISING PROTEIN DEMAND, DISEASE PREVENTION NEEDS, AND SUSTAINABLE LIVESTOCK PRODUCTION DRIVING ANIMAL BIOTECHNOLOGY ADVANCEMENTS

- 10.4 MICROBIALS

- 10.4.1 RISING DEMAND FOR SUSTAINABLE SOIL HEALTH, BIOFERTILIZERS, AND ECO-FRIENDLY PEST CONTROL DRIVES MICROBIAL BIOTECHNOLOGY GROWTH

11 AGRICULTURE BIOTECHNOLOGY MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 PLANT BIOTECHNOLOGY MARKET, BY TYPE

- 11.2.1 GROWING FOCUS ON ENHANCING CROP YIELD, STRESS RESISTANCE, AND SUSTAINABILITY

- 11.2.2 GENETIC MODIFICATION

- 11.2.2.1 Crop protection (Biopesticides, Herbicide-tolerant Traits)

- 11.2.2.1.1 Rising pest resistance, yield loss, and sustainability goals drive innovation in biotechnology-based crop protection

- 11.2.2.2 Soil enhancement (Biofertilizers, Microbial Solutions)

- 11.2.2.2.1 Declining soil fertility and sustainable farming practices are driving demand for biotechnology-based soil enhancement solutions

- 11.2.2.3 Stress tolerance (Drought/Heat-resistant Crops)

- 11.2.2.3.1 Climate change, erratic weather, and yield instability are driving demand for stress-tolerant biotechnology crops

- 11.2.2.4 Animal biotechnology market, by type

- 11.2.2.4.1 Focus on improving livestock productivity, health, and genetic performance

- 11.2.2.1 Crop protection (Biopesticides, Herbicide-tolerant Traits)

- 11.2.3 TRANSGENIC ANIMALS

- 11.2.3.1 Animal vaccine development

- 11.2.3.1.1 Increasing livestock diseases and zoonotic threats drive demand for advanced biotechnology-based animal vaccine solutions

- 11.2.3.2 Feed additives & nutrient optimization

- 11.2.3.2.1 Rising demand for efficient, sustainable livestock production drives adoption of biotechnology-based feed additives globally

- 11.2.3.3 Animal health diagnostics

- 11.2.3.3.1 Growing disease incidence and need for early detection drive innovation in biotechnology-based animal diagnostics

- 11.2.3.4 Microbial biotechnology market, by type

- 11.2.3.4.1 Expanding use of microbes in agriculture enhances yield and sustainability

- 11.2.3.1 Animal vaccine development

- 11.2.4 MICROBIAL BIOFERTILIZERS

- 11.2.4.1 Biocontrol agents (Fungi, Bacteria)

- 11.2.4.1.1 Stringent pesticide regulations and growing demand for residue-free, sustainable crop protection accelerate biocontrol adoption globally

- 11.2.4.2 Microbial enzymes & biostimulants

- 11.2.4.2.1 Rising demand for eco-friendly, stress-resilient crop enhancement solutions drives microbial enzyme and biostimulant adoption globally

- 11.2.4.3 Microbial genomics & fermentation

- 11.2.4.3.1 Advancements in microbial genomics and precision fermentation enable high-efficiency, scalable bio-based agricultural innovations globally

- 11.2.4.1 Biocontrol agents (Fungi, Bacteria)

12 AGRICULTURE BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 PLANT BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.2.1 CROP PROTECTION

- 12.2.1.1 Increasing pest resistance and need for sustainable pest control drive innovation in biotech crop protection

- 12.2.2 YIELD ENHANCEMENT

- 12.2.2.1 Rising food demand and limited arable land accelerate adoption of high-yield biotechnology-based crop systems

- 12.2.3 NUTRITIONAL QUALITY IMPROVEMENT

- 12.2.3.1 Rising focus on combating micronutrient deficiency fuels demand for biotechnology-based nutritional crop improvement

- 12.2.4 CLIMATE-RESILIENT CROPS

- 12.2.4.1 Intensifying climate variability and food security concerns drive investment in biotechnology-based resilient crop development

- 12.2.1 CROP PROTECTION

- 12.3 ANIMAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.3.1 DISEASE RESISTANCE

- 12.3.1.1 Rising livestock disease outbreaks and antibiotic resistance drive adoption of genetic and molecular resistance solutions

- 12.3.2 GROWTH & PRODUCTIVITY ENHANCEMENT

- 12.3.2.1 Increasing protein demand and emission-reduction mandates promote biotechnology adoption for livestock growth and productivity enhancement

- 12.3.3 ANIMAL WELFARE SOLUTIONS

- 12.3.3.1 Rising ethical concerns and regulatory focus on humane production drive demand for biotechnology-enabled animal welfare systems

- 12.3.4 VETERINARY THERAPEUTICS

- 12.3.4.1 Growing prevalence of zoonotic diseases and advancements in biologics fuel growth of veterinary biotechnology therapeutics

- 12.3.1 DISEASE RESISTANCE

- 12.4 MICROBIAL BIOTECHNOLOGY MARKET, BY APPLICATION

- 12.4.1 SOIL HEALTH MANAGEMENT

- 12.4.1.1 Increasing focus on regenerative agriculture and soil restoration drives adoption of microbial soil health management technologies

- 12.4.2 PEST & DISEASE CONTROL

- 12.4.2.1 Rising pesticide restrictions and demand for organic produce drive adoption of microbial pest control solutions

- 12.4.3 SUSTAINABLE NUTRIENT CYCLING

- 12.4.3.1 Growing nutrient inefficiency and fertilizer price volatility accelerate adoption of microbial nutrient cycling technologies

- 12.4.4 BIOREMEDIATION & WASTE UTILIZATION

- 12.4.4.1 Rising agricultural waste generation and environmental pollution drive adoption of microbial bioremediation technologies

- 12.4.1 SOIL HEALTH MANAGEMENT

13 AGRICULTURE BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 PLANT BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.2.1 TISSUE CULTURE

- 13.2.1.1 Growing need for disease-free, high-quality planting materials and export-grade crops accelerates tissue culture adoption globally

- 13.2.2 SOMATIC HYBRIDIZATION

- 13.2.2.1 Advancements in cell fusion and interspecies hybridization foster innovation in developing resilient and high-yield crop hybrids

- 13.2.3 MOLECULAR DIAGNOSTICS

- 13.2.3.1 Increasing global biosecurity regulations and focus on disease-free seed trade enhance molecular diagnostic adoption in agriculture

- 13.2.4 GENETIC ENGINEERING

- 13.2.4.1 Genetic engineering represents most transformative technology in modern plant biotechnology

- 13.2.1 TISSUE CULTURE

- 13.3 ANIMAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.3.1 EMBRYO RESCUE & TRANSFER

- 13.3.1.1 Growing demand for genetic improvement, reproductive efficiency, and conservation drives widespread adoption of embryo transfer technologies

- 13.3.2 GENETIC ENGINEERING & CRISPR

- 13.3.2.1 Expanding use of CRISPR-Cas9 in livestock breeding drives precision genetic improvement and sustainability in animal farming

- 13.3.3 MOLECULAR DIAGNOSTICS

- 13.3.3.1 Rising livestock disease incidence and demand for rapid, accurate pathogen detection bolster molecular diagnostic adoption globally

- 13.3.4 VACCINE BIOTECHNOLOGIES

- 13.3.4.1 Rising zoonotic disease threats and focus on antibiotic-free livestock production accelerate biotech vaccine innovations globally

- 13.3.1 EMBRYO RESCUE & TRANSFER

- 13.4 MICROBIAL BIOTECHNOLOGY MARKET, BY TECHNOLOGY

- 13.4.1 FERMENTATION TECHNOLOGY

- 13.4.1.1 Increasing use of sustainable biofertilizers and precision fermentation drives growth in microbial input production technologies

- 13.4.2 METAGENOMICS & MICROBIAL GENOMICS

- 13.4.2.1 Expanding soil microbiome research and AI-based genomic analysis accelerate innovation in precision microbial biotechnology

- 13.4.3 MOLECULAR MARKER-ASSISTED SELECTION

- 13.4.3.1 Rising need for efficient microbial strain identification promotes adoption of molecular marker-assisted selection technologies

- 13.4.4 SYNTHETIC BIOLOGY

- 13.4.4.1 Expanding investments in engineered microbes and metabolic design accelerate adoption of synthetic biology in agriculture and biotechnology

- 13.4.1 FERMENTATION TECHNOLOGY

14 AGRICULTURE BIOTECHNOLOGY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Expanding bioengineering investments, AI-integrated field trials, and streamlined GMO regulations drive US biotechnology market leadership

- 14.2.2 CANADA

- 14.2.2.1 Supportive biosafety regulations and strong genomic research collaborations boost biotechnology advancement and sustainability in Canada

- 14.2.3 MEXICO

- 14.2.3.1 Expanding gene-editing research and sustainable agriculture policies accelerate biotechnology adoption and innovation in Mexico

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Strong federal R&D support and industrial-scale bio-innovation reinforce Germany's leadership in sustainable agricultural biotechnology

- 14.3.2 ITALY

- 14.3.2.1 Expanding bioinput research programs and regional sustainability initiatives accelerate biotechnology adoption in Italy's agri-sector

- 14.3.3 FRANCE

- 14.3.3.1 Strong government R&D investment and progressive biosafety policies enhance France's leadership in sustainable agricultural biotechnology

- 14.3.4 SPAIN

- 14.3.4.1 Expanding gene-editing research and strong government funding boost Spain's sustainable agricultural biotechnology development

- 14.3.5 UK

- 14.3.5.1 Regulatory reforms and strong R&D investments strengthen UK's leadership in precision agricultural biotechnology innovation

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Expanding GMO approvals and strong state-led R&D investments reinforce China's leadership in agricultural biotechnology innovation

- 14.4.2 INDIA

- 14.4.2.1 Government-led biotech missions and microbial innovation drive India's agricultural transformation toward sustainable productivity growth

- 14.4.3 JAPAN

- 14.4.3.1 Strong government funding and innovation-driven industry partnerships accelerate Japan's agricultural biotechnology advancement

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Progressive gene-editing reforms and climate-resilient R&D accelerate biotechnology growth in Australia and New Zealand

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Expanding GMO approvals and microbial innovation solidify Brazil's leadership in agricultural biotechnology development

- 14.5.2 ARGENTINA

- 14.5.2.1 Global leadership in GM wheat and microbial bioinputs strengthens Argentina's agricultural biotechnology innovation capacity

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Government-backed innovation and food security strategies drive biotechnology adoption across Middle East's arid regions

- 14.6.2 AFRICA

- 14.6.2.1 Expanding GM approvals and microbial innovation strengthen Africa's resilience in sustainable agricultural biotechnology adoption

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYERS' STRATEGIES, 2022-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 BAYER AG (GERMANY)

- 15.5.2 SYNGENTA AG (SWITZERLAND)

- 15.5.3 CORTEVA (US)

- 15.5.4 ZOETIS INC. (US)

- 15.5.5 NOVONESIS GROUP (DENMARK)

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6.1 COMPANY VALUATION

- 15.6.2 EV/EBITDA

- 15.7 PLANT BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Application footprint

- 15.8 ANIMAL BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.8.1 STARS

- 15.8.2 EMERGING LEADERS

- 15.8.3 PERVASIVE PLAYERS

- 15.8.4 PARTICIPANTS

- 15.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.8.5.1 Company footprint

- 15.8.5.2 Region footprint

- 15.8.5.3 Type footprint

- 15.8.5.4 Application footprint

- 15.9 MICROBIAL BIOTECHNOLOGY COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.9.1 STARS

- 15.9.2 EMERGING LEADERS

- 15.9.3 PERVASIVE PLAYERS

- 15.9.4 PARTICIPANTS

- 15.9.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.9.5.1 Company footprint

- 15.9.5.2 Region footprint

- 15.9.5.3 Type footprint

- 15.9.5.4 Application footprint

- 15.10 COMPETITIVE SCENARIO

- 15.10.1 PRODUCT LAUNCHES

- 15.10.2 DEALS

- 15.10.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 PLANT BIOTECHNOLOGY COMPANIES

- 16.1.1 BASF SE

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 BAYER AG

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 CORTEVA AGRISCIENCE

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 SYNGENTA

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 KWS SAAT SE & CO. KGAA

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 UPL

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches

- 16.1.6.3.2 Deals

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 FMC CORPORATION

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Expansions

- 16.1.7.3.4 Other developments

- 16.1.7.4 MnM view

- 16.1.8 SUMITOMO CHEMICAL CO., LTD.

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Expansions

- 16.1.8.4 MnM view

- 16.1.9 NUFARM

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.9.4 MnM view

- 16.1.10 PRO FARM GROUP

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.4 MnM view

- 16.1.1 BASF SE

- 16.2 ANIMAL BIOTECHNOLOGY COMPANIES

- 16.2.1 ZOETIS SERVICES LLC

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 Recent developments

- 16.2.1.3.1 Other developments

- 16.2.1.3.2 Expansions

- 16.2.1.4 MnM view

- 16.2.1.4.1 Key strengths

- 16.2.1.4.2 Strategic choices

- 16.2.1.4.3 Weaknesses and competitive threats

- 16.2.2 ELANCO OR ITS AFFILIATES

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 Recent developments

- 16.2.2.3.1 Product launches

- 16.2.2.4 MnM view

- 16.2.2.4.1 Key strengths

- 16.2.2.4.2 Strategic choices

- 16.2.2.4.3 Weaknesses and competitive threats

- 16.2.3 MERCK & CO., INC.

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 Recent developments

- 16.2.3.3.1 Expansions

- 16.2.3.4 MnM view

- 16.2.3.4.1 Key strengths

- 16.2.3.4.2 Strategic choices

- 16.2.3.4.3 Weaknesses and competitive threats

- 16.2.4 CEVA

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 Recent developments

- 16.2.4.3.1 Expansions

- 16.2.4.4 MnM view

- 16.2.5 VIRBAC

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 Recent developments

- 16.2.5.3.1 Product launches

- 16.2.5.4 MnM view

- 16.2.5.4.1 Key strengths

- 16.2.5.4.2 Strategic choices

- 16.2.5.4.3 Weaknesses and competitive threats

- 16.2.6 HESTER BIOSCIENCES LIMITED

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 MnM view

- 16.2.7 GENUS PLC

- 16.2.7.1 Business overview

- 16.2.7.2 Products/Solutions/Services offered

- 16.2.7.3 MnM view

- 16.2.8 VAXXINOVA

- 16.2.8.1 Business overview

- 16.2.8.2 Products/Solutions/Services offered

- 16.2.8.3 MnM view

- 16.2.9 AB VISTA

- 16.2.9.1 Business overview

- 16.2.9.2 Products/Solutions/Services offered

- 16.2.9.3 MnM view

- 16.2.10 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 16.2.10.1 Business overview

- 16.2.10.2 Products/Solutions/Services offered

- 16.2.10.3 Recent developments

- 16.2.10.3.1 Product launches

- 16.2.10.4 MnM view

- 16.2.10.4.1 Key strengths

- 16.2.10.4.2 Strategic choices

- 16.2.10.4.3 Weaknesses and competitive threats

- 16.2.1 ZOETIS SERVICES LLC

- 16.3 MICROBE BIOTECHNOLOGY COMPANIES

- 16.3.1 VALENT U.S.A. LLC

- 16.3.1.1 Business overview

- 16.3.1.2 Products/Solutions/Services offered

- 16.3.1.3 Recent developments

- 16.3.1.3.1 Deals

- 16.3.1.3.2 Expansions

- 16.3.1.4 MnM view

- 16.3.1.4.1 Key strengths

- 16.3.1.4.2 Strategic choices

- 16.3.1.4.3 Weaknesses and competitive threats

- 16.3.2 NOVONESIS GROUP

- 16.3.2.1 Business overview

- 16.3.2.2 Products/Solutions/Services offered

- 16.3.2.3 Recent developments

- 16.3.2.3.1 Product launches

- 16.3.2.3.2 Deals

- 16.3.2.3.3 Expansions

- 16.3.2.4 MnM view

- 16.3.2.4.1 Key strengths

- 16.3.2.4.2 Strategic choices

- 16.3.2.4.3 Weaknesses and competitive threats

- 16.3.3 INDIGO AG, INC.

- 16.3.3.1 Business overview

- 16.3.3.2 Products/Solutions/Services offered

- 16.3.3.3 Recent developments

- 16.3.3.3.1 Product launches

- 16.3.3.3.2 Deals

- 16.3.3.3.3 Expansions

- 16.3.3.4 MnM view

- 16.3.3.4.1 Key strengths

- 16.3.3.4.2 Strategic choices

- 16.3.3.4.3 Weaknesses and competitive threats

- 16.3.4 PIVOT BIO

- 16.3.4.1 Business overview

- 16.3.4.2 Products/Solutions/Services offered

- 16.3.4.3 Recent developments

- 16.3.4.3.1 Other developments

- 16.3.4.3.2 Expansions

- 16.3.4.4 MnM view

- 16.3.4.4.1 Key strengths

- 16.3.4.4.2 Strategic choices

- 16.3.4.4.3 Weaknesses and competitive threats

- 16.3.5 BIOATLANTIS LTD.

- 16.3.5.1 Business overview

- 16.3.5.2 Products/Solutions/Services offered

- 16.3.5.3 Recent developments

- 16.3.5.3.1 Product launches

- 16.3.5.3.2 Deals

- 16.3.5.4 MnM view

- 16.3.5.4.1 Key strengths

- 16.3.5.4.2 Strategic choices

- 16.3.5.4.3 Weaknesses and competitive threats

- 16.3.6 CERTIS USA L.L.C.

- 16.3.6.1 Business overview

- 16.3.6.2 Products/Solutions/Services offered

- 16.3.6.3 Recent developments

- 16.3.6.3.1 Product launches

- 16.3.6.3.2 Deals

- 16.3.6.4 MnM view

- 16.3.7 ZYMOLENT BIOSCIENCES PVT. LTD.

- 16.3.7.1 Business overview

- 16.3.7.2 Products/Solutions/Services offered

- 16.3.7.3 Recent developments

- 16.3.7.3.1 Other developments

- 16.3.7.4 MnM view

- 16.3.8 AGRICEN

- 16.3.8.1 Business overview

- 16.3.8.2 Products/Solutions/Services offered

- 16.3.8.3 Recent developments

- 16.3.8.3.1 Deals

- 16.3.8.4 MnM view

- 16.3.9 VARSHA BIOSCIENCE AND TECHNOLOGY INDIA PVT LTD.

- 16.3.9.1 Business overview

- 16.3.9.2 Products/Solutions/Services offered

- 16.3.9.3 Recent developments

- 16.3.9.4 MnM view

- 16.3.10 GROUNDWORK BIOAG

- 16.3.10.1 Business overview

- 16.3.10.2 Products/Solutions/Services offered

- 16.3.10.3 Recent developments

- 16.3.10.3.1 Product launches

- 16.3.10.3.2 Deals

- 16.3.10.4 MnM view

- 16.3.1 VALENT U.S.A. LLC

17 ADJACENT AND RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 LIMITATIONS

- 17.3 PLANT BIOTECHNOLOGY MARKET

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.4 AGRICULTURAL MICROBIALS MARKET

- 17.4.1 MARKET DEFINITION

- 17.4.2 AGRICULTURAL MICROBIALS MARKET, BY APPLICATION

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS