|

시장보고서

상품코드

1883934

알루미늄 금속 분말 시장 예측(-2030년) : 유형별, 프로세스별, 순도별, 최종 용도 산업별, 지역별Aluminum Metal Powder Market by Type, Process, Purity, End-Use Industry and Region - Forecast to 2030 |

||||||

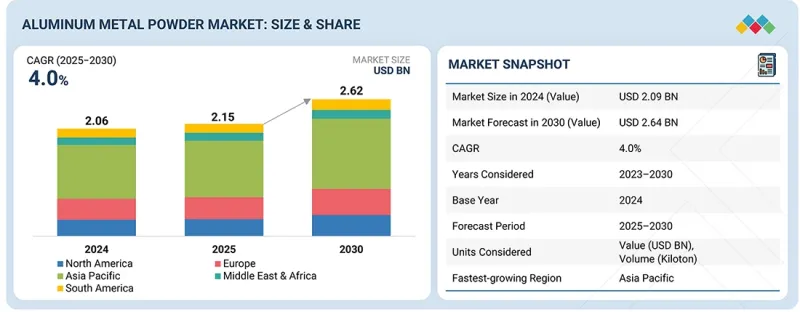

알루미늄 금속 분말 시장 규모는 2025년에 21억 7,000만 달러로 추정되며, 2030년까지 26억 4,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간 중 CAGR 4.0%를 기록할 전망입니다.

유형별로는 플레이크 부문이 전체 시장에서 두 번째 점유율을 차지하고 있습니다. 이는 금속성 외관, 반사성, 표면 피복성이 중요한 도료 및 코팅, 인쇄 잉크, 플라스틱, 산업용 가공제 등에서의 사용 확대가 주요 요인으로 작용하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(100만 달러) 및 킬로톤 |

| 부문 | 유형별, 프로세스별, 순도별, 최종 용도 산업별, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동 및 아프리카, 남미 |

알루미늄 플레이크는 제어된 반응성과 미적 특성이 필요한 AAC 블록 및 특수 코팅과 같은 건축자재에도 점점 더 많이 활용되고 있습니다. 진화하는 디자인 동향과 점점 더 엄격해지는 성능 기준에 힘입어 자동차 페인트, 건축 가공제, 보호 산업용 페인트에 대한 채택이 증가하면서 플레이크 카테고리의 강력한 시장 입지를 더욱 강화해 나가고 있습니다.

알루미늄 금속 분말 시장의 전해질 부문은 특수 용도에 필요한 초순수 알루미늄 분말의 생산 능력에 힘입어 예측 기간 중 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 전해질 유래 분말은 뛰어난 화학적 순도와 제어된 입자 특성을 가지고 있으며, 전자기기, 고성능 야금, 항공우주 부품, 첨단 화학 배합에 적합합니다. 배터리 기술, 전도성 페이스트, 정밀 적층 조형에서 고순도 재료에 대한 수요 증가가 전해법 유래 분말의 채택을 더욱 강화하고 있습니다. 또한 고사양 제조에 대한 투자 증가와 무공해 금속 분말을 필요로 하는 산업의 확대는 기존 제조 경로에 비해 이 부문의 빠른 성장을 주도하고 있습니다.

알루미늄 금속 분말 시장에서 순도 99% 이상 부문은 고성능 및 정밀도가 요구되는 응용 분야에서의 사용 확대에 힘입어 예측 기간 중 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 초순수 알루미늄 분말은 오염 제어, 안정된 전도성, 우수한 재료 안정성이 요구되는 전자기기, 항공우주 합금, 적층 성형, 첨단 화학 공정에 필수적인 소재입니다. 전기자동차 배터리 부품, 열전도 계면 재료, 특수 야금 배합제 등에서의 채용 확대가 수요를 더욱 촉진하고 있습니다. 산업계가 깨끗하고 고효율적인 제조로 전환하고 품질 기준이 엄격해짐에 따라 최종사용자가 차세대 기술의 신뢰성과 성능을 우선시함에 따라 순도 99% 이상 카테고리는 계속 확대되고 있습니다.

항공우주 및 방위 분야의 알루미늄 금속 분말 시장은 예측 기간 중 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 항공기 부품, 추진 시스템, 구조 부품에서 경량 및 고강도 알루미늄 합금의 채택이 증가하고 있기 때문입니다. 알루미늄 분말은 적층제조(적층제조) 및 분말야금 공정에서 열 안정성과 내피로성이 우수하고 무게가 최적화된 복잡한 항공우주 부품을 제조하는 데 필수적인 요소입니다. 고체 추진제, 화공품, 첨단 에너지 소재 등의 국방용도 고순도 및 특수 알루미늄 분말 수요 증가에 기여하고 있습니다. 이 분야가 차세대 항공기, 우주 시스템, 고성능 소재에 대한 투자를 가속화함에 따라 알루미늄 금속 분말의 소비는 제조 및 현대화 프로그램 모두에서 계속 증가하고 있습니다.

유럽은 자동차 경량화, 산업 기계, 항공우주 및 방위 제조 분야의 강력한 수요에 힘입어 예측 기간 중 알루미늄 금속 분말 시장에서 세 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 특히 독일, 프랑스, 영국 등에서의 적층제조 기술의 급속한 보급은 구조 부품 및 고정밀 부품에 고성능 알루미늄 분말의 사용을 가속화하고 있습니다. 지속가능한 건축자재, 첨단 코팅, 전기자동차(EV) 생산에 대한 투자 증가는 시장 성장을 더욱 촉진하고 있습니다. 또한 유럽의 엄격한 품질 및 환경 기준은 고순도 및 특수 알루미늄 분말의 개발을 촉진하고 있으며, 이 지역 세계 시장에서의 꾸준한 확장을 강화하고 있습니다.

세계의 알루미늄 금속 분말 시장에 대해 조사했으며, 유형별, 프로세스별, 순도별, 최종 용도 산업별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 주요 인사이트

제4장 시장 개요

- 서론

- 시장 역학

- 미충족 요구와 공백

- 상호접속된 시장과 분야 횡단적인 기회

- 새로운 비즈니스 모델과 에코시스템의 변화

- Tier1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 지표

- 밸류체인 분석

- 에코시스템 분석

- 가격 분석

- 무역 분석, 2020-2024년

- 2025-2027년의 주요 컨퍼런스와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세가 알루미늄 금속 분말 시장에 미치는 영향

제6장 기술의 진보, AI별 영향, 특허, 혁신, 향후 응용

- 주요 신규 기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 알루미늄 금속 분말 시장에 미치는 영향

- 성공 사례와 실세계에 대한 응용

제7장 지속가능성과 규제 상황

- 지역의 규제와 컴플라이언스

- 지속가능성 구상

- 지속가능성에 대한 영향과 규제 정책 구상

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입자 이해관계자와 구입 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업으로부터의 미충족 요구

- 시장 수익성

제9장 알루미늄 금속 분말 시장(유형별)

- 서론

- 분말

- 플레이크

제10장 알루미늄 금속 분말 시장(프로세스별)

- 서론

- 무화

- 분쇄

- 전해

제11장 알루미늄 금속 분말 시장(순도별)

- 서론

- 92%-98%

- 98%-99%

- 99% 이상

제12장 알루미늄 금속 분말 시장(최종 용도 산업별)

- 서론

- 페인트와 코팅

- 폭발물과 불꽃놀이

- 건설·인프라

- 산업용

- 일렉트로닉스

- 자동차·운송

- 항공우주 및 방위

- 기타

제13장 알루미늄 금속 분말 시장(지역별)

- 서론

- 북미

- 유럽

- 아시아태평양

- 중동 및 아프리카

- 남미

제14장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석

- 제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제15장 기업 개요

- 주요 참여 기업

- VALIMET, INC.

- MMP INDUSTRIES LTD.

- MEPCO

- KYMERA INTERNATIONAL

- HOGANAS AB

- NOVACENTRIX

- ZHANGQIU METALLIC PIGMENT CO., LTD.

- TOYO ALUMINIUM K.K.

- CNPC POWDER

- AMG

- CHINA ANSTEEL GROUP CORPORATION LIMITED

- HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.

- CARLFORS BRUK

- AVL METAL POWDERS N.V.

- GRANGES

- 기타 기업

- AMERICAN ELEMENTS

- SRI KALISWARI METAL POWDERS PVT LTD.

- THE ARASAN ALUMINIUM INDUSTRIES

- BELMONT METALS

- BN INDUSTRIES

- SHIVAM PROTECO PVT. LTD.

- SCHLENK SE

- UNITED STATES METAL POWDERS, INC.

- N.B. ENTERPRISES

- JAYESH GROUP

제16장 조사 방법

제17장 부록

KSA 25.12.17The aluminum metal powder market is estimated at USD 2.17 billion in 2025 and is projected to reach USD 2.64 billion by 2030, registering a CAGR of 4.0% during the forecast period. Based on type, the flakes segment accounted for the second-largest share of the overall market, driven by its growing use in paints & coatings, printing inks, plastics, and industrial finishes where metallic appearance, reflectivity, and surface coverage are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Process, Purity, End-use Industry, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Aluminum flakes are also increasingly utilized in construction materials such as AAC blocks and specialty coatings that require controlled reactivity and aesthetic properties. Their rising adoption in automotive coatings, architectural finishes, and protective industrial coatings supported by evolving design trends and stricter performance standards continues to reinforce the strong market position of the flakes category.

"The electrolysis process segment is projected to be the second-fastest-growing segment during the forecast period."

The electrolysis segment of the aluminum metal powder market is projected to witness the second-highest CAGR during the forecast period, supported by its ability to produce ultra-high-purity aluminum powders required in specialized applications. Electrolysis-derived powders offer exceptional chemical purity and controlled particle characteristics, making them suitable for electronics, high-performance metallurgy, aerospace components, and advanced chemical formulations. Growing demand for high-purity materials in battery technologies, conductive pastes, and precision additive manufacturing is further strengthening the adoption of electrolysis-based powders. Additionally, increasing investments in high-specification manufacturing and the expansion of industries requiring contamination-free metal powders are driving the segment's accelerated growth relative to conventional production routes.

"The >99% purity segment is projected to register the second-highest growth rate during the forecast period."

The >99% purity segment of the aluminum metal powder market is projected to register the second-highest CAGR during the forecast period, driven by its growing use in high-performance and precision-critical applications. Ultra-high-purity aluminum powders are essential in electronics, aerospace alloys, additive manufacturing, and advanced chemical processes where contamination control, consistent conductivity, and superior material stability are required. Their increasing adoption in EV battery components, thermal interface materials, and specialized metallurgical formulations further supports demand. With industries shifting toward cleaner, higher-efficiency manufacturing and increasingly stringent quality standards, the >99% purity category continues to expand as end users prioritize reliability and performance in next-generation technologies.

"The aerospace & defense segment is projected to register the second-highest growth rate during the forecast period."

The aerospace & defense segment of the aluminum metal powder market is projected to register the second-highest CAGR during the forecast period, driven by the increasing adoption of lightweight, high-strength aluminum alloys in aircraft components, propulsion systems, and structural parts. Aluminum powders are essential in additive manufacturing and powder metallurgy processes used to produce complex, weight-optimized aerospace parts with superior thermal stability and fatigue resistance. Defense applications such as solid propellants, pyrotechnics, and advanced energetic materials also contribute to rising demand for high-purity and specialty aluminum powders. As the sector accelerates investment in next-generation aircraft, space systems, and high-performance materials, consumption of aluminum metal powder continues to expand across both manufacturing and modernization programs.

"Europe is projected to register the third-highest CAGR in the aluminum metal powder market during the forecast period."

Europe is projected to register the third-highest CAGR in the aluminum metal powder market during the forecast period, supported by strong demand from automotive lightweighting, industrial machinery, and aerospace & defense manufacturing. The region's rapid adoption of additive manufacturing, especially in Germany, France, and the U.K., is accelerating the use of high-performance aluminum powders for structural and high-precision components. Increasing investments in sustainable construction materials, advanced coatings, and EV production further contribute to market growth. Additionally, Europe's stringent quality and environmental standards are driving the development of high-purity, specialty aluminum powders, reinforcing the region's steady expansion in the global market.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 50%, the Middle East & Africa - 10%, and Latin America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market include Valimet, Inc. (US), MMP Industries Ltd. (India), MEPCO (India), Kymera International (US), Hoganas AB (Swden), NovaCentrix (US), Zhangqiu Metallic Pigment Co., Ltd. (China), Toyo Aluminium k.k (Japan), CNPC Powder (Canada), AMG Advanced Metallurgical Group NV (UK), China Ansteel Group Corporation Limited (China), Henan Yuanyang Powder Technology Co., Ltd. (China), Carlfors Bruk (Sweden), AVL Metal Powders n.v. (Belgium), Granges (Sweden).

Research Coverage

This research report categorizes the aluminum metal powder market by type (powder, flakes), process (atomization, comminution, electrolysis), Purity (92%-98%, 98%-99%, >99%), end-use industry (paints & coatings, construction & infrastructure, industrial, electronics, automotive, aerospace & defence), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the aluminum metal powder market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the aluminum metal powder market. This report includes a competitive analysis of upcoming startups in the aluminum metal powder market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aluminum metal powder market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing adoption of aluminum powders in AAC blocks, refractories, and construction chemicals due to rapid infrastructure expansion), restraints (High energy consumption and operational complexity associated with atomization and high-purity production), opportunities (Expanding use of aluminum powders in EV battery housings, conductive coatings, and heat dissipation applications), and challenges (Volatility in aluminum prices and energy costs directly impacting powder production economics) influencing the growth of the aluminum metal powder market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the aluminum metal powder market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aluminum metal powder market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the aluminum metal powder market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Valimet, Inc. (US), MMP Industries Ltd. (India), MEPCO (India), Kymera International (US), Hoganas AB (Swden), NovaCentrix (US), Zhangqiu Metallic Pigment Co., Ltd. (China), Toyo Aluminium k.k (Japan), CNPC Powder (Canada), AMG Advanced Metallurgical Group NV (UK), China Ansteel Group Corporation Limited (China), Henan Yuanyang Powder Technology Co., Ltd. (China), Carlfors Bruk (Sweden), AVL Metal Powders n.v. (Belgium), Granges (Sweden).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING ALUMINUM METAL POWDER MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM METAL POWDER MARKET

- 3.2 ALUMINUM METAL POWDER, BY TYPE AND REGION, 2024

- 3.3 ALUMINUM METAL POWDER, BY PURITY

- 3.4 ALUMINUM METAL POWDER, BY PROCESS

- 3.5 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 3.6 ALUMINUM METAL POWDER MARKET, BY KEY COUNTRIES

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growth of additive manufacturing and 3D printing

- 4.2.1.2 Strong infrastructure growth in emerging regions supporting construction material demand

- 4.2.1.3 Growing automotive production to drive higher consumption of aluminum metal powder

- 4.2.2 RESTRAINTS

- 4.2.2.1 Raw material price volatility and high energy consumption

- 4.2.2.2 Stringent environmental and safety regulations

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Growing demand for specialized aluminum powder grades for advanced applications

- 4.2.3.2 Shift toward sustainable, circular, and energy-efficient production

- 4.2.4 CHALLENGES

- 4.2.4.1 Competition from substitute materials

- 4.2.4.2 High technological and capital requirements limiting new market entry

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN ALUMINUM METAL POWDER MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN PAINTS AND COATINGS INDUSTRY

- 5.2.4 TRENDS IN GLOBAL CONSTRUCTION & INFRASTRUCTURE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS

- 5.6 TRADE ANALYSIS, 2020-2024

- 5.6.1 IMPORT SCENARIO (HS CODE 7603)

- 5.6.2 EXPORT SCENARIO (HS CODE 7603)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HOGANAS: ALUMINUM POWDER FOR LIGHTWEIGHT POWDER METALLURGY COMPONENTS

- 5.10.2 AMG ADVANCED METALLURGIC GROUP N.V.: SPHERICAL POWDERS FOR ADDITIVE MANUFACTURING

- 5.10.3 PPG INDUSTRIES: ALUMINUM POWDER FOR CORROSION-RESISTANT INDUSTRIAL COATINGS

- 5.11 IMPACT OF 2025 US TARIFF ON ALUMINUM METAL POWDER MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 GAS ATOMIZATION (GA)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 PLASMA SPHEROIDIZATION (PS)

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 PATENTS BY CENTRAL SOUTH UNIVERSITY

- 6.4.9 PATENTS BY KUNMING UNIVERSITY OF SCIENCE AND TECHNOLOGY

- 6.4.10 PATENTS BY GUANGDONG BRUNP RECYCLING TECHNOLOGY CO., LTD.

- 6.5 FUTURE APPLICATIONS

- 6.5.1 ADDITIVE MANUFACTURING COMPONENTS: LIGHTWEIGHT 3D-PRINTED STRUCTURES

- 6.5.2 CONDUCTIVE COATINGS AND PIGMENTS: ADVANCED SURFACE PROTECTION

- 6.5.3 HYDROGEN STORAGE MATERIALS: CLEAN ENERGY REVOLUTION

- 6.5.4 SOLID ROCKET PROPELLANTS: AEROSPACE & DEFENSE INNOVATION

- 6.5.5 THERMAL MANAGEMENT SYSTEMS: ELECTRONICS & EV COOLING

- 6.6 IMPACT OF AI/GEN AI ON ALUMINUM METAL POWDER MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN ALUMINUM POWDER PROCESSING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM METAL POWDER MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ALUMINUM METAL POWDER MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 EQUISPHERES & UNIVERSITY OF SOUTHERN DENMARK: SAFER ALUMINUM AM POWDER

- 6.7.2 TECHNICAL UNIVERSITY OF MUNICH & AMAZEMET: ALUMINUM SCRAP TO AM POWDER FOR CIRCULAR ECONOMY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM METAL POWDER

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM METAL POWDER

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES BY APPLICATION

9 ALUMINUM METAL POWDER MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 POWDER

- 9.2.1 LIGHTWEIGHTING AND ADVANCED MANUFACTURING TO DRIVE DEMAND

- 9.3 FLAKES

- 9.3.1 ALUMINUM FLAKES ENHANCING PERFORMANCE AND DURABILITY IN INDUSTRIAL AND COATINGS MARKETS

10 ALUMINUM METAL POWDER MARKET, BY PROCESS

- 10.1 INTRODUCTION

- 10.2 ATOMIZATION

- 10.2.1 GROWING ADOPTION OF ATOMIZATION FOR HIGH-PERFORMANCE ALUMINUM METAL POWDERS

- 10.3 COMMINUTION

- 10.3.1 RISING INDUSTRIAL AND CONSTRUCTION DEMAND SUPPORTING GROWTH OF COMMINUTION-BASED ALUMINUM METAL POWDERS

- 10.4 ELECTROLYSIS

- 10.4.1 HIGH-PURITY REQUIREMENTS IN ELECTRONICS, DEFENSE, AND ADVANCED MANUFACTURING TO DRIVE ELECTROLYTIC ALUMINUM METAL POWDER ADOPTION

11 ALUMINUM METAL POWDER MARKET, BY PURITY

- 11.1 INTRODUCTION

- 11.2 92%-98%

- 11.2.1 POWERING COST-EFFECTIVE GROWTH ACROSS CONSTRUCTION, METALLURGY, AND CHEMICAL INDUSTRIES

- 11.3 98%-99%

- 11.3.1 RISING DEMAND FUELLED BY LIGHTWEIGHT MOBILITY, EV THERMAL SYSTEMS, AND HIGH-PERFORMANCE INDUSTRIAL APPLICATIONS

- 11.4 >99%

- 11.4.1 EFFECTIVE HANDLING AND SUPERIOR CORROSION RESISTANCE TO FUEL DEMAND

12 ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 PAINTS & COATINGS

- 12.2.1 GROWING NEED FOR HIGH-PERFORMANCE METALLIC AND PROTECTIVE COATINGS BOOSTING DEMAND

- 12.3 EXPLOSIVES & FIREWORKS

- 12.3.1 GROWING USE OF HIGH-REACTIVITY ALUMINUM METAL POWDERS DRIVING DEMAND IN PYROTECHNICS AND INDUSTRIAL EXPLOSIVES

- 12.4 CONSTRUCTION & INFRASTRUCTURE

- 12.4.1 RISING ADOPTION OF AAC BLOCKS AND LIGHTWEIGHT BUILDING MATERIALS DRIVING DEMAND

- 12.5 INDUSTRIAL

- 12.5.1 EXPANDING USE IN WELDING, METALLURGY, AND ADVANCED MANUFACTURING PROCESSES TO PROPEL DEMAND

- 12.6 ELECTRONICS

- 12.6.1 INCREASING DEMAND FOR CONDUCTIVE AND THERMAL MANAGEMENT MATERIALS TO BOOST DEMAND

- 12.7 AUTOMOTIVE & TRANSPORTATION

- 12.7.1 LIGHTWEIGHTING AND EV PRODUCTION ACCELERATING MATERIAL CONSUMPTION TO BOOST DEMAND

- 12.8 AEROSPACE & DEFENSE

- 12.8.1 HIGH-ENERGY PROPELLANT AND ADDITIVE MANUFACTURING APPLICATIONS DRIVING GROWTH

- 12.9 OTHER END-USE INDUSTRIES

13 ALUMINUM METAL POWDER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.2.2 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.2.3 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.2.4 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.2.5 NORTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.2.5.1 US

- 13.2.5.1.1 Rising adoption of lightweight materials to increase demand

- 13.2.5.2 Canada

- 13.2.5.2.1 Expanding advanced manufacturing capabilities to boost demand

- 13.2.5.3 Mexico

- 13.2.5.3.1 Growing industrial clusters drive specialized aluminum powder consumption

- 13.2.5.1 US

- 13.3 EUROPE

- 13.3.1 EUROPE: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.3.2 EUROPE: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.3.3 EUROPE: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.3.4 EUROPE: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.3.5 EUROPE: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.3.5.1 Germany

- 13.3.5.1.1 Engineering-led manufacturing ecosystem to accelerate demand for high-performance aluminum metal powders

- 13.3.5.2 France

- 13.3.5.2.1 Advanced materials, aerospace integration, and industrial modernization to drive market

- 13.3.5.3 UK

- 13.3.5.3.1 Innovation-led manufacturing and aerospace engine programs to elevate demand

- 13.3.5.4 Spain

- 13.3.5.4.1 Expanding automotive supply base and industrial coatings to accelerate demand

- 13.3.5.5 Italy

- 13.3.5.5.1 High-precision manufacturing and surface engineering expansion to drive demand

- 13.3.5.6 Rest of Europe

- 13.3.5.1 Germany

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.4.2 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.4.3 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.4.4 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.4.5 ASIA PACIFIC: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.4.5.1 China

- 13.4.5.1.1 Large-scale manufacturing, metallurgical capacity, and EV supply chain expansion to intensify demand

- 13.4.5.2 Japan

- 13.4.5.2.1 Precision engineering strength and advanced materials innovation to support demand

- 13.4.5.3 India

- 13.4.5.3.1 Expanding manufacturing base and infrastructure growth to increase consumption

- 13.4.5.4 South Korea

- 13.4.5.4.1 High technology manufacturing and electronics leadership to strengthen demand

- 13.4.5.5 Rest of Asia Pacific

- 13.4.5.1 China

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.5.2 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.5.3 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.5.4 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.5.5 MIDDLE EAST & AFRICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.5.5.1 GCC Countries

- 13.5.5.1.1 UAE

- 13.5.5.1.1.1 Advanced manufacturing push and aerospace ecosystem strengthen demand for aluminum metal powders

- 13.5.5.1.2 Saudi Arabia

- 13.5.5.1.2.1 Mega projects and industrial modernization to boost aluminum metal powder demand

- 13.5.5.1.3 Rest of GCC Countries

- 13.5.5.1.1 UAE

- 13.5.5.2 South Africa

- 13.5.5.2.1 Automotive components and mining equipment manufacturing support aluminum powder demand

- 13.5.5.3 Rest of Middle East & Africa

- 13.5.5.1 GCC Countries

- 13.6 SOUTH AMERICA

- 13.6.1 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY TYPE

- 13.6.2 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PROCESS

- 13.6.3 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY PURITY

- 13.6.4 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY END-USE INDUSTRY

- 13.6.5 SOUTH AMERICA: ALUMINUM METAL POWDER MARKET, BY COUNTRY

- 13.6.5.1 Brazil

- 13.6.5.1.1 Automotive, construction, and metallurgical strength to drive demand

- 13.6.5.2 Argentina

- 13.6.5.2.1 Industrial machinery, metalworking, and coatings applications to increase consumption

- 13.6.5.3 Rest of South America

- 13.6.5.1 Brazil

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS

- 14.5 PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Type footprint

- 14.6.5.4 Process footprint

- 14.6.5.5 Purity footprint

- 14.6.5.6 End-use industry footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 VALIMET, INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 MMP INDUSTRIES LTD.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 MEPCO

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 KYMERA INTERNATIONAL

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 HOGANAS AB

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 NOVACENTRIX

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 MnM view

- 15.1.6.3.1 Right to win

- 15.1.6.3.2 Strategic choices

- 15.1.6.3.3 Weaknesses and competitive threats

- 15.1.7 ZHANGQIU METALLIC PIGMENT CO., LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 MnM view

- 15.1.7.3.1 Right to win

- 15.1.7.3.2 Strategic choices

- 15.1.7.3.3 Weaknesses and competitive threats

- 15.1.8 TOYO ALUMINIUM K.K.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.8.3.1 Right to win

- 15.1.8.3.2 Strategic choices

- 15.1.8.3.3 Weaknesses and competitive threats

- 15.1.9 CNPC POWDER

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Product launches

- 15.1.9.4 MnM view

- 15.1.9.4.1 Right to win

- 15.1.9.4.2 Strategic choices

- 15.1.9.4.3 Weaknesses and competitive threats

- 15.1.10 AMG

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 MnM view

- 15.1.10.3.1 Right to win

- 15.1.10.3.2 Strategic choices

- 15.1.10.3.3 Weaknesses and competitive threats

- 15.1.11 CHINA ANSTEEL GROUP CORPORATION LIMITED

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 MnM view

- 15.1.11.3.1 Right to win

- 15.1.11.3.2 Strategic choices

- 15.1.11.3.3 Weaknesses and competitive threats

- 15.1.12 HENAN YUANYANG POWDER TECHNOLOGY CO., LTD.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 MnM view

- 15.1.12.3.1 Right to win

- 15.1.12.3.2 Strategic choices

- 15.1.12.3.3 Weaknesses and competitive threats

- 15.1.13 CARLFORS BRUK

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 MnM view

- 15.1.13.3.1 Right to win

- 15.1.13.3.2 Strategic choices

- 15.1.13.3.3 Weaknesses and competitive threats

- 15.1.14 AVL METAL POWDERS N.V.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 MnM view

- 15.1.14.3.1 Right to win

- 15.1.14.3.2 Strategic choices

- 15.1.14.3.3 Weaknesses and competitive threats

- 15.1.15 GRANGES

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.4 MnM view

- 15.1.15.4.1 Right to win

- 15.1.15.4.2 Strategic choices

- 15.1.15.4.3 Weaknesses and competitive threats

- 15.1.1 VALIMET, INC.

- 15.2 OTHER PLAYERS

- 15.2.1 AMERICAN ELEMENTS

- 15.2.2 SRI KALISWARI METAL POWDERS PVT LTD.

- 15.2.3 THE ARASAN ALUMINIUM INDUSTRIES

- 15.2.4 BELMONT METALS

- 15.2.5 BN INDUSTRIES

- 15.2.6 SHIVAM PROTECO PVT. LTD.

- 15.2.7 SCHLENK SE

- 15.2.8 UNITED STATES METAL POWDERS, INC.

- 15.2.9 N.B. ENTERPRISES

- 15.2.10 JAYESH GROUP

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary interview participants

- 16.1.2.3 Breakdown of interviews with experts

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 BASE NUMBER CALCULATION

- 16.3.1 APPROACH 1: DEMAND-SIDE ANALYSIS

- 16.3.2 APPROACH 2: SUPPLY-SIDE ANALYSIS

- 16.4 FORECAST NUMBER CALCULATION

- 16.5 DATA TRIANGULATION

- 16.6 FACTOR ANALYSIS

- 16.7 RESEARCH ASSUMPTIONS

- 16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS