|

시장보고서

상품코드

1883938

고무 트랙 시장 : 용도별, 기계 유형별, 트레드 패턴별, 트랙 유형별, 판매 채널별, 고무 트랙 패드별, 지역별 - 예측(-2032년)Rubber Track Market By Application, Equipment Type, Thread Pattern, Track Type, Sales Channel, Rubber Track Pad and Region - Global Forecast to 2032 |

||||||

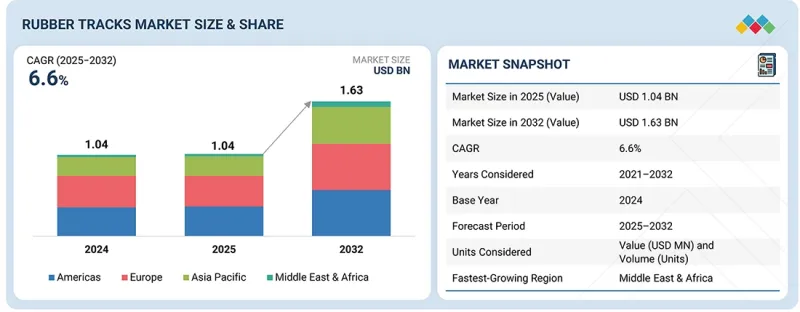

세계의 고무 트랙 OE 시장 규모는 2025년 10억 4,000만 달러에서 2032년까지 16억 3,000만 달러에 이를 것으로 예측되며, CAGR 6.6%로 성장이 전망됩니다.

고무 트랙 시장 전체의 성장은 트랙션의 향상, 접지압의 감소, 기동성의 향상이 필수적인 농업과 건설에 있어서 소형, 고출력의 기계 채용 증가에 의해 촉진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 10억 달러 |

| 부문 | 용도, 기계 유형, 트레드 패턴, 트랙 유형, 판매 채널 |

| 대상 지역 | 아메리카, 유럽, 아시아태평양, 중동 및 아프리카 |

또한 고무 컴파운드, 보강 코어 기술, 지형 최적화 트레드 설계의 진보로 내구성 및 성능이 향상되어 OEM 및 교체용 수요가 가속화되고 있습니다. 게다가 독일과 프랑스에서의 활발한 농업 활동, 주택 및 인프라 개발의 확대에 수반하는 소형 기계 수요 증가가 이 지역에서 고무 트랙 채용의 고가치 기회를 창출하고 있습니다.

'트레드 패턴별로는 C 패턴 부문이 예측 기간에 가장 큰 시장 규모를 차지할 전망입니다.'

C 패턴 부문이 예측 기간에 가장 큰 시장 규모를 차지할 전망입니다. 이 부문의 성장은 주로 뛰어난 트랙션 역학과 사면 주행 능력에 기인하고 있으며, 연약 지반 및 그라디언트, 높은 부력 성능을 필요로 하는 지형에서의 작업에 널리 채용되고 있습니다. 블록 패턴 설계와 마찬가지로 C 패턴 트랙은 OEM 기준을 준수하려는 사용자에게 탁월한 선택입니다. C 패턴의 채용이 가장 많은 것은 주로 농업용 트랙터와 수확기, 특히 논용 트랙터, 과수원 및 포도원용 트랙터, 구릉지용 콤바인 수확기입니다. C 패턴 러그 형상에 의해 선단부가 연약한 지면에 침투하는 것이 가능해집니다. 동시에 구부러진 후연면이 부력 성능을 높이고 슬립을 줄입니다. 이러한 패턴은 특히 지형이 어려운 건설 현장 및 임업 작업에 사용되는 소형 크롤러 로더에도 채택됩니다. 부정지에서의 균일한 그립은 정지나 자재 관리에 있어서 매우 중요합니다. 아메리카에서는 포도밭, 과수원, 특수 작물 농장이 밀집되어 있기 때문에 C 패턴 고무 유형의 채용률이 높아지고 있습니다. 또한 Bobcat과 John Deere와 같은 OEM 제조업체가 이 지역에서 강한 존재를 보여주므로 구릉지역에 최적화된 소형 로더와 좁은 폭 트랙터에서 C 패턴 트랙의 채용이 촉진되고 있습니다.

판매 채널별로 예측 기간 동안 OE 부문이 애프터마켓 부문을 초과하는 규모를 유지할 것으로 예측됩니다.

OE(Original Equipment) 부문은 높은 단가에도 불구하고 고무 트랙 시장을 계속 견인하고 있습니다. 그 성장은 특히 미니 굴삭기, 소형 트랙, 멀티 터레인 로더 및 기타 소형 기계 카테고리와 같은 도시 인프라 및 주택 프로젝트에서 증가하는 새로운 기계에 대한 세계의 강한 수요에 직결되기 때문입니다. 애프터마켓은 안정적이지만 OEM 생산이 가장 큰 수량을 차지하고 OE가 시장 확대의 주요 요인이 되고 있습니다. OEM은 또한 최적의 통합성, 성능 및 보증 신뢰성을 보장하는 엄격하게 테스트된 프리미엄 고무 트랙 시스템을 선호합니다. 이는 최종 사용자에게 확실한 적합성과 장기적인 가치를 제공합니다. 이 품질과 기계적 수준의 호환성에 대한 주력은 고무 트랙 시장에서 성장 부문으로서 OE 채널의 지위를 강화하고 있습니다.

'아메리카가 예측 기간에 최대 시장 규모를 차지할 전망입니다.'

소형 트랙 로더, 멀티테레인 로더, 농업용 트랙터 등 소형기계의 매출 증가로 아메리카가 최대 시장 규모를 차지할 것으로 예측되고 있습니다. Caterpillar, John Deere, Kubota, JCB, Bobcat과 같은 아메리카의 주요 OEM 제조업체는 트랙이 장착된 소형 기계 및 농업 트랙터를 개발했으며 OE와 애프터마켓 모두에 대한 수요를 창출하고 있습니다.

이 보고서는 세계의 고무 트랙 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 고무 트랙 시장의 기업에게 매력적인 기회

- 고무 트랙 시장 : 판매 채널별

- 고무 트랙 시장 : 용도별

- 고무 트랙 시장 : 트레드 패턴별

- 고무 트랙 시장 : 트랙 유형별

- 고무 트랙 시장 : 지역별

제5장 시장 개요

- 서문

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 언멧 요구 및 화이트 스페이스

- 사이즈 및 장비의 표준화

- 스마트 유통, 현장 모바일 피팅

- 재활용성 및 지속 가능한 재료

- 상호접속된 시장 및 부문 간 기회

- 건설, 공업 및 유틸리티 기계

- 농업, 방위 및 임업

- 눈, 관광, 원격 유틸리티 차량

제6장 업계 동향

- 거시경제지표

- 서문

- GDP의 동향 및 예측

- 세계의 오프 하이웨이 업계 동향(ICE EV)

- 생태계 분석

- 원재료 공급자

- 고무 트랙 제조업체

- OEM 기계 제조업체

- 판매자 및 애프터마켓

- 최종 사용자

- 규제 기관 및 지속가능기관

- 공급망 분석

- HS코드

- 수출 시나리오

- 수입 시나리오

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 미국의 2025년 관세

- 서문

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 대한 영향

- 사례 연구 분석

- 가격 설정 분석

- 고무 트랙의 평균 판매 가격 동향 : 용도별

- 평균 판매 가격의 동향 : 지역별

- 투자 및 자금조달 시나리오

- 의사결정 프로세스

- 주요 이해관계자 및 구매 기준

- 채용 장벽 및 내부 과제

제7장 전략적 파괴 : 기술 및 특허별

- 기술 분석

- 서문

- 주요 신기술

- 보완 기술

- 인접 기술

- 특허 분석

제8장 지속가능성 및 규제 정세

- 규제 상황

- 지속가능성에 대한 노력

- 고무 재활용 노력

- 고무 트랙에 대한 순환형 경제의 길

제9장 고무 트랙 시장 : 용도별

- 서문

- 건설 및 광업

- 농업 및 하베스터

- 중요한 지견

제10장 고무 트랙 시장 : 기계 유형별

- 서문

- 농업용 트랙터

- 콤바인

- 소형 트랙 및 멀티 터레인 로더

- 미니 굴삭기

- 기타 기계 유형

- 중요한 지견

제11장 고무 트랙 시장 : 판매 채널별

- 서문

- OE

- 애프터마켓

- 중요한 지견

제12장 고무 트랙 시장 : 트레드 패턴별

- 서문

- 블록 패턴

- C 패턴

- 스트레이트 바

- 멀티바

- 지그재그

- 기타

- 중요한 지견

제13장 고무 트랙 시장 : 트랙 유형별

- 서문

- 오버랩핑 및 비연속 와이어 스트랜드

- 연속 와이어 스트랜드

- 중요한 지견

제14장 고무 트랙 패드 시장 규모, 예측 및 동향

- 서문

- 의미

- 고무 트랙 패드의 유형

- 트랙 패드 선택 가이드

- 고무 트랙 패드 시장 규모 및 예측

- 고무 트랙 패드 시장 : 주요 기업

- BRIDGESTON CORPORATION

- EVERPADS CO., LTD

- RIO RUBBER TRACK

- ASTRAK

- TRACK PADS AUSTRALIA

- KMK RUBBER MANUFACTURING SDN BHD.

- GLOBAL TRACK WAREHOUSE

- SUPERIOR TIRE & RUBBER CORP.

- 고무 트랙 패드 시장의 주요 기술 동향

- 업계 인사이트

제15장 고무 트랙 시장 : 지역별

- 서문

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 인도네시아

- 아메리카

- 미국

- 캐나다

- 멕시코

- 브라질

- 중동 및 아프리카

- 남아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

제16장 경쟁 구도

- 개요

- 시장 점유율 분석(2024년)

- 건설 기계용 고무 트랙 시장

- 농업용 고무 트랙 시장

- 상위 3사의 수익 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 브랜드 비교

- 기업의 평가

- 재무지표

- 딜러 및 판매업자 목록 : 지역별

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 아메리카

- 전략적 파트너십과 OEM 제휴

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 기업

- BRIDGESTONE CORPORATION

- MCLAREN INDUSTRIES INC.

- GLOBAL TRACK WAREHOUSE

- CAMSO

- YOKOHAMA TWS

- GRIZZLY RUBBER TRACKS

- ASTRAK

- SOUCY

- MATTRACKS INC.

- JIAXING TAITE RUBBER CO., LTD.

- VMT INTERNATIONAL

- RUBBER TRACK SOLUTIONS INC.

- RIO RUBBER TRACK

- 기타 주요 기업

- TVH PARTS HOLDING NV

- BALKRISHNA INDUSTRIES LIMITED(BKT)

- XRTS RUBBER TRACKS & TIRES

- RUBTRACK TRACKED VEHICLE SYSTEMS CO., LTD.

- ACE VENTURA TYRES & TRACKS LLP

- DRB INDUSTRIAL CO., LTD.

- TRIDENT LIMITED

- HINOWA

- PROTIRE

- EVERPADS CO., LTD

- COHIDREX, SL

- ITR BENELUX

- GATOR TRACK

제18장 시장 및 시장의 권고

- 고무 트랙의 주요 시장이 될 유럽

- 고무 트랙 제조업체의 핵심 초점이 될 농업 장비

- C 패턴과 블록 패턴의 고무 트랙는 고무 트랙 공급업체에게 중요한 트레드 패턴 유형입니다.

- 결론

제19장 부록

AJY 25.12.17The rubber tracks OE market is projected to grow from USD 1.04 billion in 2025 to USD 1.63 billion by 2032 at a CAGR of 6.6%. The overall growth of the rubber tracks market is being propelled by the rising adoption of compact and high-horsepower machinery in agriculture and construction, where improved traction, lower ground pressure, and enhanced mobility are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Application, Equipment Type, Tread Pattern, Track Type, and Sales Channel (OE and Aftermarket) |

| Regions covered | Americas, Europe, Asia Pacific, and Middle East & Africa |

Additionally, advancements in rubber compounds, reinforced core technologies, and terrain-optimized tread designs are boosting durability and performance, accelerating their demand in OEM and for replacement. Moreover, vigorous agricultural activity in Germany and France, and growing compact equipment demand driven by significant residential and infrastructure developments, are creating high-value opportunities for the adoption of rubber tracks in the region.

"By tread pattern, the C-pattern segment is projected to be the largest market during the forecast period."

The C-Pattern segment is projected to be the largest market during the forecast period. The growth of the segment is mainly driven by its superior traction dynamics and slope-handling capabilities, due to which it has been widely used across equipment operating on soft soils, gradients, and terrain requiring high flotation. Similar to block-pattern designs, c-pattern tracks are an excellent option for users who want to stay aligned with OEM standards. The highest adoption of C-Pattern is mainly in agricultural tractors and harvesters, particularly in rice paddy tractors, orchard/vineyard tractors, and hillside combine harvesters, where the C-shaped lug geometry allows the leading edge to dig into soft ground. At the same time, the curved trailing face enhances flotation and reduces slippage. These patterns are also adopted in compact track loaders used especially in terrain-challenged construction zones and forestry operations, where consistent grip on uneven slopes is critical for grading, site prep, and material handling. There is a high adoption of C-Pattern rubber type in the Americas due to the high concentration of vineyards, orchards, and specialty crop farms in the region. Additionally, the strong presence of OEMs, such as Bobcat and John Deere, in the region supports the adoption of C-Pattern tracks in compact loaders and narrow tractors optimized for hilly terrains.

"By sales channel, the OE segment is projected to be a larger segment than the aftermarket during the forecast period."

The Original Equipment (OE) segment continues to lead the rubber tracks market, even at a higher unit price, because its growth is directly linked to the strong global demand for new machinery, particularly mini-excavators, compact track/multi-terrain loaders, and other compact equipment categories increasingly used in urban infrastructure and residential projects. While the aftermarket remains steady, OEM production drives the highest volume, making OE the primary contributor to market expansion. OEMs also favor premium, rigorously tested rubber track systems that ensure optimal integration, performance, and warranty reliability, offering end users a guaranteed fit and long-term value. This focus on quality and machine-level compatibility reinforces the OE channel's position as a growing segment in the rubber tracks market.

"The Americas is projected to be the largest market during the forecast period."

The Americas is projected to account for the largest market, driven by the increasing sales of compact machinery like compact track loaders, multi-terrain loaders, and farm tractors. Major OEMs such as Caterpillar, John Deere, Kubota, JCB, and Bobcat from the Americas are developing compact equipment and farm tractors with tracks, which is creating both OE and aftermarket demand.

In the US and Canada, the use of compact track loaders, mini-excavators, and tracked carriers is significantly higher in construction and civil works projects. These machines benefit from rubber tracks due to their low ground disturbance, strong traction on mixed terrain, and smooth operation in urban or sensitive job sites. As a result, contractors prefer rubber-tracked equipment for roadwork, utilities, landscaping, and infrastructure projects where stability and surface protection are essential.

OEMs such as John Deere, CNH Industrial, and CLAAS have developed several rubber track variants of their 300-350+ HP high-horsepower tractors and combine harvesters. These configurations are preferred for large-acreage farming because they deliver superior flotation, reduced soil compaction, and higher traction under heavy loads. Additionally, in the Americas, C-Pattern and block-pattern rubber tracks are most widely used across compact construction and agricultural equipment. Major suppliers in the region include Camso (CEAT), Bridgestone, Continental, and Mattracks, all of which support the rising demand for OEM and aftermarket demand.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key companies operating in this market.

Here is the breakdown of the interviews conducted:

- By Company Type: OEMs - 20%, Rubber Track Manufacturers - 80%

- By Designation: C-Level - 30%, Director-Level - 50%, and Others - 20%

- By Region: Asia Pacific - 30%, The Americas - 20%, Europe - 40%, RoW - 10%

Note: Others include Sales Managers, Operational Heads, Supply Chain Heads/Managers.

The key players in the rubber tracks market are Bridgestone Corporation (Japan), Camso Inc. (Canada), McLaren Industries Inc. (US), Global Track Warehouse (Australia), and Grizzly Rubber Tracks (US). These companies adopt various strategies to maintain their position in the global rubber tracks market. Some of these strategies are mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the rubber tracks market and its segments. The report also discusses ups and downs in rubber tracks, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. It would further help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Market Dynamics: Analysis of key drivers (Performance advantages driving shift from tires to rubber tracks; growth of vineyard, orchard, and specialty crop cultivation), restraints (High cost and compatibility), opportunities (Electrification of agricultural and construction equipment, rental market push), and challenges (Weight and efficiency penalties on specific drive systems, lack of viable end-of-life solution) influencing the growth of the rubber tracks market

- Product Developments/Innovation: Detailed insights into upcoming technologies and product & service launches in the rubber tracks market

- Market Development: Comprehensive market information (the report analyses the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the rubber tracks market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like Bridgestone Corporation (Japan), Camso Inc. (Canada), McLaren Industries Inc. (US), Global Track Warehouse (Australia), and Grizzly Rubber Tracks (US) in the rubber tracks market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for estimating base numbers

- 2.1.1.2 Key secondary sources for estimating market size

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Key primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RESEARCH ASSUMPTIONS AND RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 DISRUPTIVE TRENDS SHAPING MARKET

- 3.3 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.4 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RUBBER TRACKS MARKET

- 4.2 RUBBER TRACKS MARKET, BY SALES CHANNEL

- 4.3 RUBBER TRACKS MARKET, BY APPLICATION

- 4.4 RUBBER TRACKS MARKET, BY TREAD PATTERN

- 4.5 RUBBER TRACKS MARKET, BY TRACK TYPE

- 4.6 RUBBER TRACKS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Performance advantages driving shift from tires to rubber tracks

- 5.2.1.2 Growth of vineyard, orchard, and specialty crop cultivation

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and compatibility issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Electrification of agriculture and construction equipment

- 5.2.3.2 Rental market push

- 5.2.4 CHALLENGES

- 5.2.4.1 Recycling issues

- 5.2.4.2 Weight and efficiency penalties on specific drive systems

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 STANDARDIZATION OF SIZES AND FITMENT

- 5.3.2 SMART DISTRIBUTION AND ON-SITE MOBILE FITTING

- 5.3.3 RECYCLABILITY AND SUSTAINABLE MATERIALS

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 CONSTRUCTION AND INDUSTRIAL/UTILITY EQUIPMENT

- 5.4.2 AGRICULTURE AND DEFENSE/FORESTRY

- 5.4.3 SNOW, TOURISM, AND REMOTE UTILITY VEHICLES

6 INDUSTRY TRENDS

- 6.1 MACROECONOMIC INDICATORS

- 6.1.1 INTRODUCTION

- 6.1.2 GDP TRENDS AND FORECAST

- 6.1.3 TRENDS IN GLOBAL OFF-HIGHWAY INDUSTRY (ICE+EV)

- 6.1.3.1 Sales growth trend of construction equipment, 2025 vs. 2030

- 6.1.3.2 Farm tractor growth trend, by HP, 2025 vs. 2032

- 6.2 ECOSYSTEM ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 RUBBER TRACK MANUFACTURERS

- 6.2.3 OEM EQUIPMENT BUILDERS

- 6.2.4 DISTRIBUTORS/AFTERMARKET

- 6.2.5 END USERS

- 6.2.6 REGULATORY & SUSTAINABILITY BODIES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 HS CODE

- 6.4.1 EXPORT SCENARIO

- 6.4.1.1 Germany

- 6.4.1.2 China

- 6.4.1.3 US

- 6.4.1.4 Poland

- 6.4.1.5 Italy

- 6.4.2 IMPORT SCENARIO

- 6.4.2.1 US

- 6.4.2.2 Germany

- 6.4.2.3 Mexico

- 6.4.2.4 China

- 6.4.2.5 France

- 6.4.1 EXPORT SCENARIO

- 6.5 KEY CONFERENCES & EVENTS, 2025-2026

- 6.6 US 2025 TARIFF

- 6.6.1 INTRODUCTION

- 6.6.2 KEY TARIFF RATES

- 6.6.3 PRICE IMPACT ANALYSIS

- 6.6.4 IMPACT ON COUNTRY/REGION

- 6.6.4.1 US

- 6.6.4.2 Europe

- 6.6.4.3 Asia Pacific

- 6.6.5 IMPACT ON END-USE INDUSTRY

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 GATOR TRACK SUPPLIED HYBRID RUBBER TRACK SYSTEMS WITH REINFORCED STEEL CORDS AND HEAT-RESISTANT COMPOUNDS

- 6.7.2 NISSITRAC INTRODUCED AGRICULTURE-SPECIFIC RUBBER TRACKS USING SOFT TREAD COMPOUNDS FOR IMPROVED TRACTION ON UNEVEN, MUDDY TERRAIN

- 6.7.3 RTS IMPLEMENTED SHIPHAWK ADVANCED SHIPPING PLATFORM TO AUTOMATE LTL SHIPPING

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF RUBBER TRACKS, BY APPLICATION

- 6.8.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.9 INVESTMENT & FUNDING SCENARIO

- 6.10 DECISION-MAKING PROCESS

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 ADOPTION BARRIERS & INTERNAL CHALLENGES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY AND PATENTS

- 7.1 TECHNOLOGY ANALYSIS

- 7.1.1 INTRODUCTION

- 7.1.2 KEY EMERGING TECHNOLOGIES

- 7.1.2.1 IoT and telemetry in track wear monitoring

- 7.1.2.2 Sustainability trend: Recycling, use of recycled materials, and circular economy impact

- 7.1.2.3 Autonomous equipment and track requirements

- 7.1.2.4 Performance comparison: Durability, noise, and soil protection

- 7.1.2.5 Innovation trends: Recyclable materials, hybrid designs, and anti-vibration solutions

- 7.1.3 COMPLEMENTARY TECHNOLOGIES

- 7.1.3.1 Advanced polymer science and nanomaterials

- 7.1.3.2 Additive manufacturing (3D printing) for tooling and prototyping

- 7.1.4 ADJACENT TECHNOLOGIES

- 7.1.4.1 Electrification of compact and off-highway equipment

- 7.2 PATENT ANALYSIS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGULATORY LANDSCAPE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 INITIATIVES FOR RUBBER RECYCLING

- 8.2.2 CIRCULAR ECONOMY PATHWAYS FOR RUBBER TRACKS

- 8.2.2.1 Key takeaways

9 RUBBER TRACKS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CONSTRUCTION & MINING

- 9.2.1 INCREASE IN CONSTRUCTION AND MINING ACTIVITIES TO DRIVE MARKET

- 9.3 AGRICULTURE & HARVESTERS

- 9.3.1 PRECISION FARMING AND TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

- 9.4 PRIMARY INSIGHTS

10 RUBBER TRACKS MARKET, BY EQUIPMENT TYPE

- 10.1 INTRODUCTION

- 10.2 AGRICULTURE TRACTORS

- 10.2.1 RISING DEMAND FOR HIGH-TRACTION, LOW-COMPACTION SOLUTIONS TO DRIVE MARKET

- 10.3 COMBINE HARVESTERS

- 10.3.1 RISING ADOPTION OF HIGH-CAPACITY TRACKED COMBINE HARVESTERS TO SUPPORT GROWTH

- 10.3.1.1 Typical combine harvester configurations in North America

- 10.3.1.2 Major track suppliers and their partnerships or supply relationships with combine harvester OEMS in North America

- 10.3.1 RISING ADOPTION OF HIGH-CAPACITY TRACKED COMBINE HARVESTERS TO SUPPORT GROWTH

- 10.4 COMPACT TRACK/MULTI-TERRAIN LOADERS

- 10.4.1 INCREASING DEMAND FOR HIGH-DURABILITY, LOW-VIBRATION EQUIPMENT TO BOOST GROWTH

- 10.5 MINI-EXCAVATORS

- 10.5.1 INCREASING DEMAND FOR COMPACT AND SURFACE-FRIENDLY EXCAVATION SOLUTIONS TO DRIVE MARKET

- 10.6 OTHER EQUIPMENT TYPES

- 10.7 PRIMARY INSIGHTS

11 RUBBER TRACKS MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OE

- 11.2.1 NEED FOR HIGH-QUALITY FIT AND DURABILITY TO DRIVE MARKET

- 11.3 AFTERMARKET

- 11.3.1 COST-COMPETITIVENESS AND FREQUENT REPLACEMENT CYCLES TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 RUBBER TRACKS MARKET, BY TREAD PATTERN

- 12.1 INTRODUCTION

- 12.2 BLOCK-PATTERN

- 12.2.1 OEM STANDARDIZATION OF BLOCK-PATTERN TRACKS TO DRIVE MARKET

- 12.3 C-PATTERN

- 12.3.1 INCREASING USE OF EXCAVATORS AND LOADERS IN FORESTRY, PLANTATION, AND SLOPE-INTENSIVE TERRAIN TO DRIVE MARKET

- 12.4 STRAIGHT-BAR

- 12.4.1 RISING DEMAND FOR HIGH-TRACTION FORWARD-PUSH CAPABILITY IN GRADING AND FORESTRY APPLICATIONS TO DRIVE MARKET

- 12.5 MULTI-BAR

- 12.5.1 BETTER DISTRIBUTION OF GROUND LOAD ACROSS MULTIPLE CONTACT LINES TO SUPPORT MARKET GROWTH

- 12.6 ZIG-ZAG

- 12.6.1 RISING DEMAND FOR TRACKS THAT PROVIDE BALANCED FORWARD TRACTION TO SUPPORT GROWTH

- 12.7 OTHERS

- 12.8 PRIMARY INSIGHTS

13 RUBBER TRACKS MARKET, BY TRACK TYPE

- 13.1 INTRODUCTION

- 13.2 OVERLAPPING/NON-CONTINUOUS WIRE STRAND

- 13.2.1 COST-EFFECTIVENESS OF DESIGN TO DRIVE DEMAND

- 13.3 CONTINUOUS WIRE STRAND

- 13.3.1 ENHANCED DURABILITY AND UNIFORM LOAD DISTRIBUTION TO DRIVE GROWTH

- 13.4 PRIMARY INSIGHTS

14 RUBBER TRACK PADS MARKET SIZE, FORECAST, AND TRENDS

- 14.1 INTRODUCTION

- 14.1.1 DEFINITION

- 14.1.2 TYPES OF RUBBER TRACK PADS

- 14.1.2.1 Bolt-on track pads

- 14.1.2.2 Chain-on track pads

- 14.1.2.3 Clip-on track pads

- 14.1.3 TRACK PAD SELECTION GUIDE

- 14.2 MARKET SIZING AND FORECAST FOR RUBBER TRACK PADS

- 14.3 RUBBER TRACK PADS MARKET: KEY PLAYERS

- 14.3.1 BRIDGESTON CORPORATION

- 14.3.2 EVERPADS CO., LTD

- 14.3.3 RIO RUBBER TRACK

- 14.3.4 ASTRAK

- 14.3.5 TRACK PADS AUSTRALIA

- 14.3.6 KMK RUBBER MANUFACTURING SDN BHD.

- 14.3.7 GLOBAL TRACK WAREHOUSE

- 14.3.8 SUPERIOR TIRE & RUBBER CORP.

- 14.4 KEY TECHNOLOGY TRENDS IN RUBBER TRACK PADS MARKET

- 14.4.1 ADVANCED RUBBER COMPOUND FORMULATIONS

- 14.5 INDUSTRY INSIGHTS

15 RUBBER TRACKS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 EUROPE

- 15.2.1 GERMANY

- 15.2.1.1 Dominance of high-horsepower tracked machinery to support market growth

- 15.2.2 FRANCE

- 15.2.2.1 Advanced agricultural mechanization to drive market

- 15.2.3 UK

- 15.2.3.1 High demand for mini-excavators to drive market

- 15.2.4 ITALY

- 15.2.4.1 Specialized terrain requirements to support market

- 15.2.5 SPAIN

- 15.2.5.1 Deployment of tracked machinery in urban construction and high-value agriculture sectors to support growth

- 15.2.6 RUSSIA

- 15.2.6.1 Large-scale deployment of construction machinery to drive market

- 15.2.7 REST OF EUROPE

- 15.2.1 GERMANY

- 15.3 ASIA PACIFIC

- 15.3.1 CHINA

- 15.3.1.1 Heavy investments in infrastructural development to drive market

- 15.3.2 JAPAN

- 15.3.2.1 Technological innovation and expanding domestic production capacity to drive market

- 15.3.3 INDIA

- 15.3.3.1 Rising mechanization and adoption of compact equipment to drive market

- 15.3.4 INDONESIA

- 15.3.4.1 Adoption of rubber tracks in equipment used in agriculture and infrastructure to support market

- 15.3.1 CHINA

- 15.4 AMERICAS

- 15.4.1 US

- 15.4.1.1 High replacement demand from large rental fleets to drive market

- 15.4.2 CANADA

- 15.4.2.1 Increased investments in residential and non-residential construction activities to drive market

- 15.4.3 MEXICO

- 15.4.3.1 Increased investments in private and public sectors to support growth

- 15.4.4 BRAZIL

- 15.4.4.1 Increasing demand for farm tractors to drive market

- 15.4.1 US

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 SOUTH AFRICA

- 15.5.1.1 Infrastructure development programs to achieve UN sustainable development goals to drive market

- 15.5.2 SAUDI ARABIA

- 15.5.2.1 Increasing number of construction projects to support market

- 15.5.3 UAE

- 15.5.3.1 Rapid growth in construction industry to drive market

- 15.5.1 SOUTH AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 MARKET SHARE ANALYSIS, 2024

- 16.2.1 CONSTRUCTION EQUIPMENT RUBBER TRACKS MARKET

- 16.2.2 AGRICULTURE RUBBER TRACKS MARKET

- 16.3 REVENUE ANALYSIS OF TOP THREE PLAYERS

- 16.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.4.1 STARS

- 16.4.2 EMERGING LEADERS

- 16.4.3 PERVASIVE PLAYERS

- 16.4.4 PARTICIPANTS

- 16.4.5 COMPANY FOOTPRINT

- 16.5 BRAND COMPARISON

- 16.6 COMPANY VALUATION

- 16.7 FINANCIAL METRICS

- 16.8 LIST OF DEALERS/DISTRIBUTORS, BY REGION

- 16.8.1 ASIA PACIFIC

- 16.8.2 EUROPE

- 16.8.3 MIDDLE EAST & AFRICA

- 16.8.4 AMERICAS

- 16.9 STRATEGIC PARTNERSHIPS & OEM TIE-UPS

- 16.9.1 STRATEGIC PARTNERSHIPS & OEM TIE-UPS

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.10.2 DEALS

- 16.10.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 BRIDGESTONE CORPORATION

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 MnM view

- 17.1.1.3.1 Key strengths

- 17.1.1.3.2 Strategic choices

- 17.1.1.3.3 Weaknesses and competitive threats

- 17.1.2 MCLAREN INDUSTRIES INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 MnM view

- 17.1.2.3.1 Key strengths

- 17.1.2.3.2 Strategic choices

- 17.1.2.3.3 Weaknesses and competitive threats

- 17.1.3 GLOBAL TRACK WAREHOUSE

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 CAMSO

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 MnM view

- 17.1.4.3.1 Key strengths

- 17.1.4.3.2 Strategic choices

- 17.1.4.3.3 Weaknesses and competitive threats

- 17.1.5 YOKOHAMA TWS

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 GRIZZLY RUBBER TRACKS

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.7 ASTRAK

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Other developments

- 17.1.8 SOUCY

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Other developments

- 17.1.9 MATTRACKS INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.10 JIAXING TAITE RUBBER CO., LTD.

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Other developments

- 17.1.11 VMT INTERNATIONAL

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.12 RUBBER TRACK SOLUTIONS INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.13 RIO RUBBER TRACK

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.1 BRIDGESTONE CORPORATION

- 17.2 OTHER KEY PLAYERS

- 17.2.1 TVH PARTS HOLDING NV

- 17.2.2 BALKRISHNA INDUSTRIES LIMITED (BKT)

- 17.2.3 XRTS RUBBER TRACKS & TIRES

- 17.2.4 RUBTRACK TRACKED VEHICLE SYSTEMS CO., LTD.

- 17.2.5 ACE VENTURA TYRES & TRACKS LLP

- 17.2.6 DRB INDUSTRIAL CO., LTD.

- 17.2.7 TRIDENT LIMITED

- 17.2.8 HINOWA

- 17.2.9 PROTIRE

- 17.2.10 EVERPADS CO., LTD

- 17.2.11 COHIDREX, S.L.

- 17.2.12 ITR BENELUX

- 17.2.13 GATOR TRACK

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 EUROPE TO BE MAJOR MARKET FOR RUBBER TRACKS

- 18.2 AGRICULTURE EQUIPMENT TO BE KEY FOCUS AREA FOR RUBBER TRACK MANUFACTURERS

- 18.3 C-PATTERN AND BLOCK-PATTERN RUBBER TRACKS ARE KEY TREAD PATTERN TYPES FOR RUBBER TRACK SUPPLIERS

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 RUBBER TRACKS MARKET, BY TRACK TYPE, AT THE COUNTRY LEVEL

- 19.4.2 RUBBER TRACKS MARKET, BY TREAD PATTERN, AT THE COUNTRY LEVEL

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS