|

시장보고서

상품코드

1889165

펫바이오틱스 시장 : 유형(프로바이오틱스, 프리바이오틱스, 포스트바이오틱스), 용도Pet Biotics Market By Type (Probiotics, Prebiotics, and Postbiotics), Application (Dry, Wet, Supplements, and Snacks & Treats), Pet (Dogs, Cats, and Other Pets), Form, Function, Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

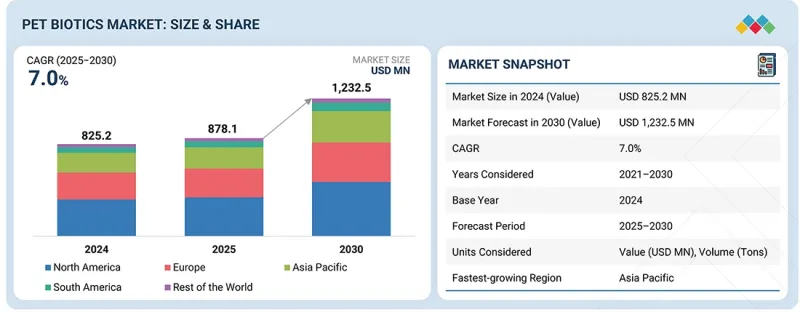

펫바이오틱스 시장의 규모는 2025년 8억 7,810만 달러에서 CAGR 7.0%로 성장을 지속하여 2030년에 12억 3,250만 달러에 달할 것으로 예측됩니다.

세계의 펫바이오틱스 시장은 반려동물의 인간화가 진행됨에 따라 현저한 성장을 이루고 있습니다. 주인이 인간의 영양 관리와 유사한 마이크로바이옴 지원 솔루션을 요구하는 가운데 고급 장내 건강 성분에 대한 수요가 높아지고 있기 때문입니다. 또한 면역력 향상, 스트레스 경감, 소화 기능, 종합적인 건강 퍼포먼스 등의 예방 의료에 대한 관심이 높아지고 있으며, 반려동물 먹이, 보충제, 간식 및 스낵에서의 프로바이오틱스, 프리바이오틱스, 포스트바이오틱스 등의 기능성 바이오틱스의 이용이 가속화되고 있습니다. 게다가 프리미엄화의 동향, 천연, 클린 라벨, 과학적 근거에 근거한 배합으로의 이행은 임상적으로 검증된 고품질 바이오틱스 균주에 큰 기회를 창출하고 있습니다. 게다가, 맞춤 및 병태특이적 영양 관리에 대한 수요의 급증은 과민증, 연령 관련 문제, 품종 특유의 요구에 대응하는 표적 바이오틱스의 잠재력을 확대하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 가치(달러) 및 톤 |

| 부문 | 유형, 용도, 반려동물, 형태, 기능, 제조 기술(질적), 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 세계 지역 |

그러나 고품질 균주공급망의 복잡성, 지역 간 규제 불통일, 소비자 신뢰 구축을 위한 강력한 과학적 뒷받침의 필요성 등이 펫바이오틱스 시장에서 과제가 될 것으로 예측됩니다. 또한 다양한 반려동물 식품 매트릭스에서 생체 생물학의 안정성과 생존을 보장하는 것은 여전히 기술적 과제로 남아 있습니다.

전반적으로, 건강 의식 증가와 마이크로바이옴에 초점을 맞춘 영양에 대한 수요 증가는 펫바이오틱스 제조업체가 시장에서 큰 점유율을 얻는 성장 기회를 가져왔습니다.

"유형별로 프로바이오틱스 부문이 예측 기간 동안 점유율의 대부분을 차지할 전망"

프로바이오틱스는 반려동물의 소화기 건강, 면역력 및 종합적인 건강 상태를 지원하는 기능성 영양에 대한 강한 소비자 수요로 시장을 독점하고 있습니다. 락토바실러스, 비피도박테리움, 바실러스, 사카로마이세스 세레비시아에 등의 프로바이오틱스 균주가 측정 가능한 장내 환경과 면역에 유익한 효과를 가져오는 것으로 과학적으로 입증되어, 반려동물 식품 브랜드는 설득력 있는 건강 효과를 주장할 수 있게 됩니다. 마이크로캡슐화나 균주 특이적 배합과 같은 기술적 진보에 의해 가공 및 보존 시의 프로바이오틱스의 생존율 유지가 가능하게 되었습니다. 또한 지속적인 특허 활동과 제품 혁신은 높은 상업적 가치를 창출합니다. 균주의 감수성, 가공 시 생존율 저하, 장기 연구 부족 등의 과제는 존재하지만, 실증된 건강 효과, 소비자의 인지도, 업계 투자가 함께 프로바이오틱스를 건식사료, 습식사료, 간식, 보충제에서 선호되는 원료로 자리매김하고 있습니다.

"반려동물 유형별로 개 부문이 높은 시장 점유율을 유지할 전망"

이 동향은 주로 반려동물의 인간화가 진행되고 있기 때문입니다. 주인은 개를 가족의 일원으로 여기고 건강과 웰빙 전반에 투자하는 경향이 강해지고 있습니다. 개는 관절통, 소화기계 문제, 피부 알레르기 등의 일반적인 건강 문제로 고통받는 경우가 많으며, 이들은 표적형 영양 보조 식품에 의해 관리가 가능합니다. 따라서, 관절의 건강, 피모의 윤기, 면역 기능을 서포트하는 등 개 전용으로 설계된 프로바이오틱스나 프리바이오틱스의 수요가 현저한 성장을 보이고 있습니다.

"지역별로는 북미가 예측기간 중 시장을 견인할 것으로 전망"

북미가 펫바이오틱스 시장을 선도하는 배경에는 높은 반려동물 사육률, 반려동물 건강에 대한 소비 지출의 활발함, 선진적인 산업 인프라가 결합되어 있습니다. 이 지역의 반려동물 소유자 사이에는 기능성 영양에 대한 의식이 높아 장내 환경의 건강 촉진, 면역력 향상, 종합적인 웰니스에 기여하는 프로바이오틱스, 프리바이오틱스, 포스트바이오틱스의 수요가 견조합니다. 또한 이 지역에는 확립된 반려동물 식품 산업이 존재하고 민감한 바이오틱스 성분의 유효성을 유지하기 위한 첨단 제조 기술을 활용하고 있습니다. 게다가 북미 기업은 건식사료, 습식사료, 간식, 영양제 등 다양한 펫바이오틱스 제품 개발에 있어 우세한 입장에 있습니다. 또한 지원 규제 프레임워크, 견고한 유통 네트워크, R&D 및 제품 혁신에 대한 엄청난 투자는 펫바이오틱스 분야에서의 소비 확대와 시장 리더십을 이끌 것으로 예측됩니다.

본 보고서에서는 세계의 펫바이오틱스 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법적 규제 환경, 사례연구, 시장의 규모의 추이와 예측, 지역 및 주요 국가별 각종 구분 및 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 새로운 사업 기회

- 관련 시장 및 이업종과의 분야 횡단적 기회

- Tier 1, 2, 3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년 주요 회의 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향 및 혁신

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 펫바이오틱스 시장

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 미래의 응용

- 기술 분석

- 특허 분석

- 미래의 응용

- 생성형 AI가 반려동물 식품 업계에 미치는 영향

- 성공 사례와 실세계에서의 응용

제7장 규제 상황과 지속가능성에 관한 대처

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 규제 정책이 지속가능성 이니셔티브에 미치는 영향

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매 프로세스에 참여하는 주요 이해관계자와 그 평가 기준

- 채용 장벽과 내부 과제

- 다양한 최종 사용자 산업의 미충족 요구

- 시장 수익성

- 수익 가능성

제9장 펫바이오틱스 시장 : 유형별

- 프로바이오틱스

- 박테리아

- 효모 및 진균

- 프리바이오틱스

- 올리고당

- 이눌린

- 폴리덱스트로스

- 기타

- 포스트바이오틱스

- 박테리아

- 효모 및 진균

- 사카로마이세스 세레비시아

- 사카로마이세스 보울라디

제10장 펫바이오틱스 시장 : 용도별

- 건식사료

- 습식사료

- 영양제

- 간식과 스낵

제11장 펫바이오틱스 시장 : 형태별

- 건식

- 습식

제12장 펫바이오틱스 시장 : 반려동물별

- 개

- 고양이

- 기타

제13장 펫바이오틱스 시장 : 기능별

- 소화기계 및 장의 건강

- 면역조절

- 대사와 체중 관리

- 구강과 치아의 건강

- 기타 기능

제14장 펫바이오틱스 시장 : 제조 기술별

- 발효

- 원심분리 및 여과

- 건조 및 안정화

- 캡슐화 및 보호

- 불활성화 및 세포 파괴

- 배합 및 믹스

- 품질관리 및 보관

제15장 펫바이오틱스 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 세계 지역

- 중동

- 아프리카

제16장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 기업평가와 재무지표

- 브랜드 및 제품 비교

- 기업평가 매트릭스 : 주요 기업

- 기업평가 매트릭스 : 스타트업 및 중소기업

- 경쟁 시나리오와 동향

제17장 기업 프로파일

- 주요 기업

- ADM

- ALLTECH(US)

- KERRY GROUP PLC

- INTERNATIONAL FLAVORS & FRAGRANCES INC

- DSM-FIRMENICH

- CARGILL, INCORPORATED

- PROBI

- INGREDION(US)

- KEMIN INDUSTRIES, INC.

- BENEO GMBH

- PHILEO BY LESAFFRE

- LALLEMAND INC.

- SACCO SYSTEM

- SANZYME BIOLOGICS

- ORFFA

- 스타트업 및 중소기업

- SYNBIO TECH INC.

- CANBIOCIN INC.

- BIO-CAT

- SPECIALTY ENZYMES & PROBIOTICS

- CREATIVE ENZYMES

- VERB BIOTICS

- BIOTENOVA SDN. BHD.

- BIOPROX HEALTHCARE

- PELLUCID LIFESCIENCES PVT. LTD

- HOLLISON, LLC.(US)

제18장 조사 방법

제19장 인접 시장과 관련 시장

제20장 부록

CSM 25.12.23The pet biotics market is estimated to be worth USD 878.1 million in 2025 and is projected to reach USD 1,232.5 million by 2030, at a CAGR of 7.0%. The global pet biotics market is experiencing significant growth, driven by the rising humanization of pets, which is increasing demand for advanced gut-health ingredients as owners seek microbiome-supporting solutions similar to those used in human nutrition. Additionally, there is a growing focus on preventive health, including immunity, stress reduction, digestion, and overall health performance, which is accelerating the use of functional biotics such as probiotics, prebiotics, and postbiotics, in pet food, supplements, treats & snacks. Furthermore, premiumization trends and the shift toward natural, clean-label, and scientifically backed formulations create strong opportunities for high-quality, clinically validated biotic strains. Additionally, the surge in individualized and condition-specific nutrition opens the door for targeted biotics addressing sensitivities, age-related issues, and breed-specific needs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Tons) |

| Segments | By Type, application, pet, form, functions, manufacturing technology (qualitative), and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Rest of the World (RoW) |

However, supply chain complexity for high-quality strains, regulatory inconsistencies across regions, and the need for strong scientific substantiation to build consumer trust are expected to pose challenges in the pet biotics market. Furthermore, ensuring the stability and survivability of biotics in various pet food matrices also remains a technical challenge.

Overall, increasing wellness awareness and demand for microbiome-focused nutrition present substantial growth opportunities for pet biotics manufacturers to gain a significant share in the market.

"Probiotic type is expected to hold a dominant market share during the forecast period"

The probiotic types in the pet biotic segments dominate the market due to strong consumer demand for functional nutrition that supports digestive health, immunity, and overall well-being in pets. Scientific evidence demonstrates that probiotic strains, such as Lactobacillus, Bifidobacterium, Bacillus, and Saccharomyces cerevisiae, provide measurable gut and immune benefits, which allows pet food brands to make compelling health claims. Technological advances, such as microencapsulation and strain-specific formulation, help maintain probiotic viability during processing and storage, while ongoing patent activity and product innovation indicate a high commercial value. Despite challenges like strain sensitivity, viability loss during processing, and limited long-term studies, the combination of proven health benefits, consumer awareness, and industry investment has made probiotics a preferred ingredient in dry food, wet food, treats, and supplements.

"Dog segment is expected to hold a strong market share among the pet types in the pet biotics market"

Dogs are expected to dominate the pet type segment in the pet biotics market. This trend is primarily driven by the increasing humanization of pets, where pet owners are more inclined to treat their dogs as family members and invest in their overall health and wellness. Dogs often suffer from common health issues such as joint pain, digestive problems, and skin allergies, which can be managed through targeted nutritional supplements. As a result, the demand for probiotics & prebiotics tailored specifically for dogs, such as those supporting joint health, coat shine, and immune function, is witnessing significant growth.

"North America is expected to dominate the global pet biotics market during the forecast period"

North America dominates the pet biotics market due to a combination of high pet ownership, strong consumer spending on pet health, and advanced industry infrastructure. With high awareness among pet owners in the region of functional nutrition, the demand for probiotics, prebiotics, and postbiotics is strong, as these products can promote gut health, immunity, and overall wellness. The region also has a well-established pet food industry that utilizes advanced manufacturing technologies to maintain the viability of sensitive biotic ingredients. Additionally, North American companies are well-positioned to develop a wide range of pet biotic products, including dry and wet foods, treats, and supplements. Furthermore, supportive regulatory frameworks, robust distribution networks, and considerable investment in R&D and product innovation are expected to drive consumption and market leadership in the pet biotic segment.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the pet biotics market.

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: Directors - 25%, Managers - 35%, Others - 40%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 35%, South America - 10%, and Rest of the World - 5%

Prominent companies in the market include ADM (US), Alltech (US), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (US), dsm-firmenich (Netherlands), Cargill, Incorporated (US), Probi (Sweden), Kemin Industries, Inc. (US), BENEO GmbH (Germany), Ingredion (US), Lallemand Inc. (Canada), Sacco System (Italy), Phileo by Lesaffre (France), Sanzyme Biologics (India), Orffa (Netherlands), BIO-CAT (US), and others.

Research Coverage

This research report categorizes the pet biotics market by type (probiotics, prebiotics, and postbiotics), application (dry food, wet food, supplements, and snacks & treats), pet (dogs, cats, and other pets), function (digestive/gut health, immune modulation, metabolic & weight management, oral & dental health, other functions), manufacturing technology (qualitative) (fermentation, centrifugation & filtration, drying & stabilization, encapsulation & protection, inactivation & cell disruption, formulation & blending, and quality control & storage), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the pet biotic industry. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the pet biotics market. This report provides a competitive analysis of emerging startups in the pet biotics market ecosystem. Furthermore, the study covers industry-specific trends, including technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others.

Reasons to Buy This Report

The report provides market leaders/new entrants with information on the closest approximations of revenue numbers for the overall pet biotics and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising pet humanization and preventive health focus), restraints (heat and moisture sensitivity of microbial strains), opportunities (rising demand for gut-health-focused and functional pet foods), and challenges (supply chain complexity for live microbes) influencing the growth of the pet biotics market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the pet biotics market

- Market Development: Comprehensive information about lucrative markets-analysis of pet biotics across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the pet biotics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as ADM (US), Alltech (US), Kerry Group plc (Ireland), International Flavors & Fragrances Inc. (US), dsm-firmenich (Netherlands), Cargill, Incorporated (US), Probi (Sweden), Kemin Industries, Inc. (US), BENEO GmbH (Germany), Ingredion (US), Lallemand Inc. (Canada), Sacco System (Italy), Phileo by Lesaffre (France), Sanzyme Biologics (India), Orffa (Netherlands), BIO-CAT (US), and other players in the pet biotics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PET BIOTICS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PET BIOTICS MARKET

- 3.2 PET BIOTICS MARKET, BY PET AND REGION

- 3.3 PET BIOTICS MARKET, BY TYPE

- 3.4 PET BIOTICS MARKET, BY PET

- 3.5 PET BIOTICS MARKET, BY APPLICATION

- 3.6 PET BIOTICS MARKET, BY FORM

- 3.7 PET BIOTICS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surge in pet adoption rates

- 4.2.1.2 Rise in pet humanization and focus on preventive health

- 4.2.1.3 Growing veterinary recommendations and clinical backing

- 4.2.1.4 Premiumization and functional food trends

- 4.2.2 RESTRAINTS

- 4.2.2.1 Heat and moisture sensitivity of probiotic strains

- 4.2.2.2 Shelf-life viability concerns

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Innovation in ingredient formulation

- 4.2.3.2 Rising demand for gut-health-focused and functional pet foods

- 4.2.3.3 Increase in pet expenditure with substantial increase in pet food expenditure

- 4.2.3.4 Increase in urban pet lifestyle experiences: Pet cafes, rentals, and pet-friendly travel

- 4.2.4 CHALLENGES

- 4.2.4.1 Supply chain complexity for live microbes

- 4.2.4.2 Competition from alternative digestive health solutions

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN PET BIOTICS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES - SYNBIOTIC (COMBINATION OF PROBIOTICS & PREBIOTICS)

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 SHIFT TOWARD PREVENTIVE PET HEALTH THROUGH SUPPLEMENT ADOPTION

- 5.2.3 EXPANSION OF PET INSURANCE COVERAGE GLOBALLY

- 5.2.4 ECO-CONSCIOUS PET OWNERSHIP DRIVING DEMAND FOR BIOTIC-BASED PET PRODUCTS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 SOURCING

- 5.3.3 PRODUCTION & PROCESSING

- 5.3.4 DISTRIBUTION

- 5.3.5 MARKETING & SALES

- 5.3.6 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 DEMAND SIDE

- 5.4.2 SUPPLY SIDE

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LIVESTOCK

- 5.5.2 AVERAGE SELLING PRICE TREND OF PET BIOTICS, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO OF HS CODE 3002

- 5.6.2 EXPORT SCENARIO OF HS CODE 3002

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 STABILIZED PLANT-BASED PROBIOTIC INTEGRATION BY A&B INGREDIENTS TO ENHANCE DIGESTIVE AND SKIN HEALTH IN DOGS

- 5.10.2 PROBIOWORLD'S DUAL-ACTION PET BIOTIC FORMULATION FOR DENTAL AND GUT HEALTH ENHANCEMENT

- 5.10.3 CHR. HANSEN (PART OF NOVONESIS GROUP) - PIONEERING SCIENCE-BASED PROBIOTICS PORTFOLIO FOR EVERY PET LIFE STAGE

- 5.11 IMPACT OF 2025 US TARIFF - PET BIOTICS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGY ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Fermentation

- 6.1.1.2 Filtration

- 6.1.1.3 Freeze-drying (Lyophilization)

- 6.1.1.4 Microencapsulation and nanoencapsulation

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 IoT-based fermentation monitoring

- 6.1.2.2 Enzymatic hydrolysis

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 Genome-scale metabolic modeling

- 6.1.3.2 Bioinformatics

- 6.1.3.3 Digital fermentation control

- 6.1.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.1.4.1 Short-term | Foundation & Early Commercialization

- 6.1.4.2 Mid-term | Expansion & Standardization

- 6.1.4.3 Long-term | Mass Commercialization & Disruption

- 6.1.1 KEY TECHNOLOGIES

- 6.2 PATENT ANALYSIS

- 6.3 FUTURE APPLICATIONS

- 6.3.1 PSYCHOBIOTICS FOR BEHAVIORAL AND COGNITIVE HEALTH IN PETS

- 6.3.2 SYNBIOTICS AS NEXT-GENERATION GUT HEALTH SOLUTIONS IN PETS

- 6.3.3 ENGINEERED/BREED-PRECISION PROBIOTIC STRAINS FOR PET HEALTH

- 6.3.4 MICROBIOME-LINKED DIAGNOSTIC TOOLS FOR TARGETED PET BIOTIC THERAPIES

- 6.3.5 SPORE-BASED PROBIOTICS FOR SHELF-STABLE, HIGH-TEMPERATURE PET FOOD PROCESSING

- 6.4 IMPACT OF GEN AI ON PET FOOD INDUSTRY

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICE OF GEN AI IN PET FOOD INDUSTRY

- 6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN PET INDUSTRY

- 6.4.3.1 CanBiocin's data-intelligent approach to enhancing fermentation efficiency and yield

- 6.4.3.2 Harmonizing formulation systems: PPF's pan-European implementation of BESTMIX Recipe Management

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PET BIOTICS

- 6.4.6 IMPACT OF AI/GENERATIVE AI ON PET BIOTICS MARKET

- 6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 LABELING REQUIREMENTS AND CLAIMS

- 7.1.4 ANTICIPATED REGULATORY CHANGES IN NEXT 5-10 YEARS

- 7.1.4.1 Mandatory validation of CFU viability & functional claims

- 7.1.4.2 Global harmonization of pet biotics ingredient approvals

- 7.1.4.3 Enhanced safety and antimicrobial-resistance (AMR) risk evaluation

- 7.1.4.4 Digital labeling, data transparency, and smart packaging requirements

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 SUSTAINABLE SOURCING

- 7.2.2 CARBON FOOTPRINT REDUCTION INITIATIVES

- 7.2.3 CIRCULAR ECONOMY APPROACHES

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS APPLICATION INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.6 REVENUE POTENTIAL

- 8.6.1 COST DYNAMICS

- 8.6.2 MARGIN OPPORTUNITIES, BY INGREDIENT SOURCE

9 PET BIOTICS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 PROBIOTICS

- 9.2.1 BACTERIA

- 9.2.1.1 Driving Digestive Strength and Immune Resilience in Companion Animals Through Science-backed Bacterial Probiotics

- 9.2.1.2 Lactobacillus

- 9.2.1.3 Bifidobacterium

- 9.2.1.4 Enterococcus

- 9.2.1.5 Bacillus

- 9.2.1.6 Streptococcus thermophilus

- 9.2.2 YEAST & FUNGI

- 9.2.2.1 Advanced yeast solutions transforming digestive wellness in companion animals

- 9.2.2.2 Saccharomyces cerevisiae

- 9.2.2.3 Saccharomyces Boulardii

- 9.2.1 BACTERIA

- 9.3 PREBIOTICS

- 9.3.1 STRENGTHENING GUT ECOLOGY FOR LONG-TERM VITALITY AND IMMUNE STRENGTH

- 9.3.2 OLIGOSACCHARIDES

- 9.3.2.1 Fructooligosaccharides (FOS)

- 9.3.2.2 Mannanoligosaccharides (MOS)

- 9.3.2.3 Galactooligosaccharides (GOS)

- 9.3.3 INULIN

- 9.3.4 POLYDEXTROSE

- 9.3.5 OTHER PREBIOTIC TYPES

- 9.4 POSTBIOTICS

- 9.4.1 PREMIUM POSTBIOTIC SOLUTIONS DESIGNED FOR STABILITY, SAFETY, AND SUPERIOR PERFORMANCE

- 9.4.2 BACTERIA

- 9.4.2.1 Lactobacillus

- 9.4.2.2 Bifidobacterium

- 9.4.2.3 Other bacteria

- 9.5 YEAST & FUNGI

- 9.5.1 FUNCTIONAL YEAST INNOVATION SHAPING FUTURE OF PET WELLNESS

- 9.5.2 SACCHAROMYCES CEREVISIAE

- 9.5.3 SACCHAROMYCES BOULARDII

10 PET BIOTICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 DRY FOOD

- 10.1.1.1 Long-lasting gut health protection in every crunchy bite

- 10.1.2 WET FOOD

- 10.1.2.1 Smooth integration, stronger digestion-biotics that thrive in wet formats

- 10.1.3 SUPPLEMENTS

- 10.1.3.1 Premium supplement solutions for proactive pet well-being

- 10.1.4 SNACKS & TREATS

- 10.1.4.1 Reward with purpose-treats enriched with biotics for everyday vitality

- 10.1.1 DRY FOOD

11 PET BIOTICS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 DRY

- 11.2.1 STABLE, SCALABLE, AND SCIENCE-FORWARD-DRY BIOTICS POWERING NEXT-GENERATION PET WELLNESS

- 11.3 LIQUID

- 11.3.1 EASE OF INCORPORATION, PRECISION DOSING, AND SMOOTH DELIVERY FOR SENSITIVE AND RECOVERING PETS TO DRIVE DEMAND

12 PET BIOTICS MARKET, BY PET

- 12.1 INTRODUCTION

- 12.2 DOGS

- 12.2.1 DAILY GUT AND IMMUNE SUPPORT FOR HEALTHIER, HAPPIER CANINE COMPANIONS

- 12.3 CATS

- 12.3.1 GENTLE, TARGETED GUT SUPPORT CRAFTED FOR SENSITIVE FELINE DIGESTION

- 12.4 OTHER PETS

13 PET BIOTICS MARKET, BY FUNCTION

- 13.1 INTRODUCTION

- 13.2 DIGESTIVE/GUT HEALTH

- 13.3 IMMUNE MODULATION

- 13.4 METABOLIC & WEIGHT MANAGEMENT

- 13.5 ORAL & DENTAL HEALTH

- 13.6 OTHER FUNCTIONS

14 PET BIOTICS MARKET, BY MANUFACTURING TECHNOLOGY

- 14.1 INTRODUCTION

- 14.2 FERMENTATION

- 14.3 CENTRIFUGATION & FILTRATION

- 14.4 DRYING & STABILIZATION

- 14.5 ENCAPSULATION & PROTECTION

- 14.6 INACTIVATION & CELL DISRUPTION

- 14.7 FORMULATION & BLENDING

- 14.8 QUALITY CONTROL & STORAGE

15 PET BIOTICS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Global hub for pet biotics innovation, powered by presence of leading ingredient and technology companies

- 15.2.2 CANADA

- 15.2.2.1 Rising hub for functional pet nutrition and microbiome wellness

- 15.2.3 MEXICO

- 15.2.3.1 Rising market for digestive wellness and microbiome nutrition

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Strong consumer demand for pet biotics to drive market

- 15.3.2 UK

- 15.3.2.1 Expanding companion-animal base to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Rising health concerns to strengthen demand for pet biotics

- 15.3.4 ITALY

- 15.3.4.1 Growing pet humanization and premium nutrition trends to fuel market

- 15.3.5 SPAIN

- 15.3.5.1 Wellness-driven pet culture to accelerate pet biotics adoption

- 15.3.6 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Rapid urban growth and wellness priorities to drive market

- 15.4.2 JAPAN

- 15.4.2.1 Health, premiumization, and sustainability to drive demand for pet biotics

- 15.4.3 INDIA

- 15.4.3.1 Consumer shift toward functional and preventive nutrition products to drive market

- 15.4.4 AUSTRALIA & NEW ZEALAND

- 15.4.4.1 Demand for premium and functional nutrition to support market growth

- 15.4.5 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 SOUTH AMERICA

- 15.5.1 BRAZIL

- 15.5.1.1 Expanding pet market to drive demand for pet biotics

- 15.5.2 ARGENTINA

- 15.5.2.1 Steady pet market growth to fuel pet biotics demand

- 15.5.3 REST OF SOUTH AMERICA

- 15.5.1 BRAZIL

- 15.6 REST OF THE WORLD

- 15.6.1 MIDDLE EAST

- 15.6.1.1 Rising pet humanization and urbanization to fuel demand for pet biotics

- 15.6.2 AFRICA

- 15.6.2.1 Growing focus on pet health to drive market

- 15.6.1 MIDDLE EAST

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS

- 16.4 MARKET SHARE ANALYSIS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Regional footprint

- 16.7.5.3 Type footprint

- 16.7.5.4 Pet footprint

- 16.7.5.5 Application footprint

- 16.7.5.6 Form footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.9 COMPETITIVE SCENARIO AND TRENDS

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 ADM

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Services/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 ALLTECH (US)

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Services/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 KERRY GROUP PLC

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Services/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Deals

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 INTERNATIONAL FLAVORS & FRAGRANCES INC

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Services/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 DSM-FIRMENICH

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Services/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 CARGILL, INCORPORATED

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Services/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.6.3.3 Other developments

- 17.1.6.4 MnM view

- 17.1.6.4.1 Key strengths

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses & competitive threats

- 17.1.7 PROBI

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Services/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.4 MnM view

- 17.1.8 INGREDION (US)

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Services/Solutions offered

- 17.1.8.3 Recent developments

- 17.1.8.4 MnM view

- 17.1.9 KEMIN INDUSTRIES, INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Services/Solutions offered

- 17.1.9.3 MnM view

- 17.1.10 BENEO GMBH

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Services/Solutions offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Other Developments

- 17.1.10.4 MnM view

- 17.1.11 PHILEO BY LESAFFRE

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Services/Solutions offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Deals

- 17.1.11.4 MnM view

- 17.1.12 LALLEMAND INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Services/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.12.4 MnM view

- 17.1.13 SACCO SYSTEM

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Services/Solutions offered

- 17.1.13.3 Recent developments

- 17.1.13.4 MnM view

- 17.1.14 SANZYME BIOLOGICS

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Services/Solutions offered

- 17.1.14.3 Recent developments

- 17.1.14.4 MnM view

- 17.1.15 ORFFA

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Services/Solutions offered

- 17.1.15.3 Recent developments

- 17.1.15.4 MnM view

- 17.1.1 ADM

- 17.2 STARTUPS/SMES

- 17.2.1 SYNBIO TECH INC.

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Services/Solutions offered

- 17.2.1.3 Recent developments

- 17.2.1.4 MnM view

- 17.2.2 CANBIOCIN INC.

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Services/Solutions offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Deals

- 17.2.2.4 MnM view

- 17.2.3 BIO-CAT

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Services/Solutions offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Deals

- 17.2.3.4 MnM view

- 17.2.4 SPECIALTY ENZYMES & PROBIOTICS

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Services/Solutions offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches

- 17.2.4.4 MnM view

- 17.2.5 CREATIVE ENZYMES

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Services/Solutions offered

- 17.2.5.3 Recent developments

- 17.2.5.4 MnM view

- 17.2.6 VERB BIOTICS

- 17.2.7 BIOTENOVA SDN. BHD.

- 17.2.8 BIOPROX HEALTHCARE

- 17.2.9 PELLUCID LIFESCIENCES PVT. LTD

- 17.2.10 HOLLISON, LLC. (US)

- 17.2.1 SYNBIO TECH INC.

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Key data from primary sources

- 18.1.2.2 Breakdown of primary profiles

- 18.1.2.3 Key insights from industry experts

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 TOP-DOWN APPROACH

- 18.2.2 SUPPLY-SIDE ANALYSIS

- 18.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 18.3 DATA TRIANGULATION AND MARKET BREAKUP

- 18.4 RESEARCH ASSUMPTIONS

- 18.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

19 ADJACENT & RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 STUDY LIMITATIONS

- 19.3 PET SUPPLEMENTS MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 PET FOOD INGREDIENTS MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS