|

시장보고서

상품코드

1889167

AMR 및 AGV 플릿 관리 소프트웨어 시장 : 제공 제품별, 플랫폼 유형별, 플릿 유형별, 용도별, 조직 규모별, 업계별, 지역별 예측Fleet Management Software Market for AMR/AGV By Fleet Type (AGV & AMR), Offering, Fleet Type, Application, Organization Size, Industry - Global Forecast to 2032 |

||||||

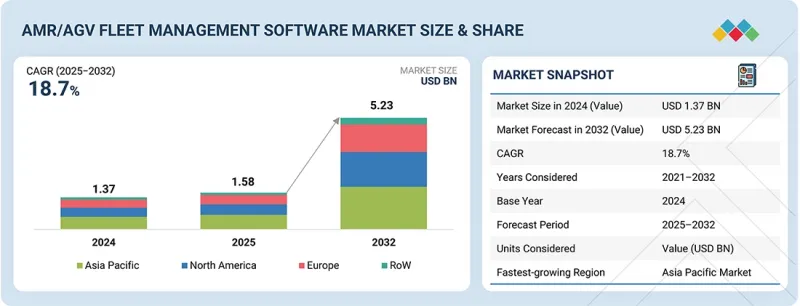

세계의 AMR 및 AGV 플릿 관리 소프트웨어 시장의 규모는 다양한 물류시설 및 제조시설에서의 이동로봇의 도입 증가를 배경으로 2025년 15억 8,000만 달러에서 2032년까지 52억 3,000만 달러에 달하고, CAGR 18.7%로 확대될 것으로 예측되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공 제품별, 플랫폼 유형별, 플릿 유형별, 용도별, 조직 규모별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

기업은 처리량을 높이고 업무 지연을 줄이기 위해 로봇 플릿을 확대하고 있으며, 이에 따라 라우팅, 교통 제어, 작업 할당, 충전 및 안전 규정 준수를 관리하는 중앙 집중식 플랫폼에 대한 수요가 증가하고 있습니다. WMS, MES, ERP 시스템과의 통합은 로봇 플릿과 광범위한 공급망 워크플로 간의 원활한 연동을 가능하게 하며, AI, 클라우드 컴퓨팅, IoT 데이터 스트림은 예측 유지와 실시간 최적화 능력을 강화합니다. 조직이 효율성, 정확성 및 확장 가능한 자동화에 주력하면서, 플릿 관리 소프트웨어는 지속적인 성능 개선과 장기적인 로봇 계획을 지원하는 핵심 운영 도구가 되고 있습니다.

창고, 제조 공장, EC 허브 및 물류 업무에서 이동 로봇 플릿의 도입이 증가함에 따라 소프트웨어 부문은 AMR 및 AGV 플릿 관리 소프트웨어 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 기업은 효율성 향상과 유휴 시간 절감을 위해 라우팅, 교통 제어, 작업 할당, 플릿 시각화, 안전 워크플로, 충전 조정을 통합 관리하는 중앙 플랫폼에 대한 투자를 추진하고 있습니다. AI 구동형 분석, 클라우드 기반 오케스트레이션, IoT 대응 데이터 흐름을 통해 실시간 최적화와 예측 유지보수가 강화되는 한편, 창고관리시스템(WMS), MES(제조실행시스템), ERP(전사적자원관리)와의 통합으로 엔드 투 엔드 공급망 프로세스 전체에서 협력적인 실행이 가능합니다. 조직이 자동화를 확대하고 다중 로봇 환경을 채택함에 따라 유연하고 성능이 높은 소프트웨어 플랫폼에 대한 수요가 가속화되고 있으며 예측 기간을 통해 본 부문의 견조한 성장을 지원할 것으로 예측됩니다.

멀티벤더 플릿 플랫폼 부문은 AMR 및 AGV 플릿 관리 소프트웨어 시장에서 가장 높은 CAGR로 성장할 것으로 예측됩니다. 이는 기업이 혼합 플릿을 도입함에 따라 서로 다른 공급업체의 AMR과 AGV를 통일적으로 제어하는 강력한 요구가 발생하기 때문입니다. 기업은 파렛트 처리, 피킹, 분류, 내부 물류 이동용으로 다양한 로봇을 조합하고 있으며, 집중 관리 플랫폼에 의해 이러한 다양한 플릿을 하나의 인터페이스로 운용 가능하게 됩니다. 이를 통해 협력적인 라우팅, 교통 제어, 작업 스케줄링, 충전 관리 및 안전 모니터링이 가능합니다. 조직이 벤더 선정의 유연성을 요구하고 단일 제조업체에의 의존도 저감을 도모하면서, 상호 운용성으로의 이행이 기세를 늘리고 있습니다. 멀티벤더 대응의 플릿 플랫폼은 창고관리시스템(WMS), MES(제조실행시스템), ERP(전사적자원관리)와의 제휴가 가능해, 클라우드 기반 최적화, AI 기반 의사 결정, IoT를 활용한 예측 유지보수를 서포트합니다. 이것은 플릿의 효율성을 향상시키고 운영 상의 병목 현상을 줄여줍니다. 자동화 프로그램이 여러 기지로 확대되고 기업이 로보틱스 투자를 확대하면서 처리량 향상, 워크플로 연속성 유지, 장기적인 자동화 전략 지원을 실현하는 멀티벤더 플랫폼에 대한 수요가 높아지고 있습니다.

아시아태평양은 중국, 일본, 한국, 인도, 동남아시아에서 창고 및 공장 자동화의 급속한 보급으로 AMR 및 AGV 플릿 관리 소프트웨어 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 제조업, 전자상거래, 소매 유통, 자동차, 전자기기, 제3자물류(3PL)의 기업은 처리량 향상과 노동력 의존도 저감을 목적으로 대규모 AMR 및 AGV 플릿을 도입하여 집중형 플릿 오케스트레이션 소프트웨어에 대한 수요가 높아지고 있습니다. 지역 내 각국 정부는 자금원조 프로그램, 우대조치, 국가자동화 이니셔티브를 통해 디지털 전환, 스마트 제조, 로보틱스 통합을 추진하고 있으며, 이에 따라 첨단 플릿 관리 플랫폼의 도입이 강화되고 있습니다. 아시아태평양은 비용 효율적인 제조 기지, 강력한 로보틱스 생산 능력 및 빠르게 성장하는 AMR 및 AGV 공급업체의 생태계를 갖추고 있으며, 이는 소프트웨어 도입을 가속화하고 있습니다. 이 지역에서는 AI 구동형 자동화, 클라우드 기반의 플릿 제어, IoT 대응의 운용 감시에 대한 투자가 활발해지고, 물류 및 생산 워크플로 전체의 속도, 정밀도, 실시간 의사결정이 향상되고 있습니다. 산업 자동화의 지속적인 확대와 복합 로봇 플릿의 이용 증가에 따라, 예측 기간 동안 아시아태평양은 세계의 AMR 및 AGV 플릿 관리 소프트웨어 시장에서 가장 성장률이 높은 지역으로 지속될 것으로 예측됩니다.

주요 조사 대상자의 내역

AMR 및 AGV 플릿 관리 소프트웨어 시장에서 사업을 전개하는 주요 조직의 경영 임원(CEO, 마케팅 디렉터, 혁신 기술 디렉터 등)에 대해 상세한 인터뷰를 실시했습니다.

이 보고서에서 다루는 주요 기업으로는 KUKA SE & Co. KGaA(독일), ABB(스위스), OMRON Corporation(일본), Siemens(독일), Ocado Group plc(영국), MITSUBISHI LOGISNEXT(일본), Symbotic Inc.(미국), Fives(중국), Geek Robots(덴마크), Addverb Technologies Limited(인도), Locus Robotics(미국), BlueBotics(스위스), SYNAOS(독일), KINEXON(독일), WAKU Robotics GmbH(독일), WEWO Techmotion(네덜란드), KNAPP AG(오스트리아), OTTO by Rockwell Automation Robot(중국), GreyOrange(조지아), Navitec Systems(핀란드), Formant(미국), InOrbit, Inc.(미국), SIGMATEK GmbH &Co KG(오스트리아), Deus Robotics(우크라이나) 등이 있습니다. 이 기업들은 교통 제어, 라우팅, 작업 할당, 실시간 모니터링, 분석, 기업 시스템과의 통합을 포함한 광범위한 고급 플릿 관리 소프트웨어 기능을 제공하며 성숙한 시장과 신흥 자동화 시장 모두에서 확고한 존재감을 확립합니다.

본 보고서는 AMR 및 AGV 플릿 관리 소프트웨어 시장에서 주요 진출기업의 상세한 경쟁 분석을 제공하고 각 회사의 기업 프로파일, 최근 동향 및 주요 시장 전략을 제시합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 상호연결된 시장과 분야 간 기회

- Tier 1, 2, 3 참가 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 투자 및 자금조달 시나리오

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객의 비즈니스에 영향을 미치는 동향 및 혁신

- 사례 연구 분석

- 2025년 미국 관세의 영향 - AMR 및 AGV 플릿 관리 소프트웨어 시장

제6장 기술의 진보, AI별 영향, 특허, 혁신

- 주요 기술

- 보완적 기술

- 기술 로드맵

- 특허 분석

- AMR 및 AGV 플릿 관리 소프트웨어 시장에 대한 AI의 영향

제7장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 업계의 미충족 요구

제9장 AMR 및 AGV 플릿 관리 소프트웨어 시장의 주요 기술과 표준

- 작업 할당에서 AI와 ML의 역할

- 플릿 시뮬레이션을 위한 디지털 트윈

- 실시간 조정을 위한 5G 및 엣지 컴퓨팅

- 컴퓨터 비전

- 차량 추적을 위한 블록체인

- 상호 운용성 표준

제10장 AMR 및 AGV 플릿 관리 플랫폼의 주요 기능

- 실시간 함대 감시

- 경로 최적화

- 교통 관리

- 충돌 회피

- 배터리 관리

- 예측 유지보수

- 퍼포먼스 분석

- 복수 브랜드 로봇 간 제휴

제11장 AMR 및 AGV 플릿 관리 소프트웨어 시장(제공 제품별)

- 소프트웨어

- 서비스

제12장 AMR 및 AGV 플릿 관리 소프트웨어 시장(플랫폼 유형별)

- 싱글벤더 플릿 플랫폼

- 멀티벤더 플릿 플랫폼

제13장 AMR 및 AGV 플릿 관리 소프트웨어 시장(플릿 유형별)

- 자율 이동 로봇(AMRS)

- 무인 반송차(AGVS)

- 하이브리드(멀티 로봇 플릿)

제14장 AMR 및 AGV 플릿 관리 소프트웨어 시장(용도별)

- 인트라 물류 및 자재 운송 관리

- 주문 처리와 피킹 업무

- 포장, 팔레타이징, 라인 피딩

- 크로스 도킹과 도크 간 수송

- 분류와 할당 관리

- 플릿 코디네이션과 존 관리

제15장 AMR 및 AGV 플릿 관리 소프트웨어 시장(조직 규모별)

- 대기업

- 중소기업

제16장 AMR 및 AGV 플릿 관리 소프트웨어 시장(업계별)

- 자동차

- 반도체 및 일렉트로닉스

- 항공

- 건강 관리

- 식품 및 음료

- 화학약품

- 전자상거래와 소매

- 물류 및 3PL

- 기타

제17장 AMR 및 AGV 플릿 관리 소프트웨어 시장(지역별)

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 호주

- 기타

- 기타 지역

- 중동

- 남미

- 아프리카

제18장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2021-2024년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석

- 기업평가와 재무지표(2024년)

- 브랜드 및 제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제19장 기업 프로파일

- 주요 진출기업

- KUKA SE & CO. KGAA

- ABB

- OMRON CORPORATION

- GEEKPLUS TECHNOLOGY CO., LTD.

- ADDVERB TECHNOLOGIES LIMITED

- SIEMENS

- FIVES

- GREYORANGE

- OCADO GROUP PLC.

- KNAPP AG

- MITSUBISHI LOGISNEXT CO., LTD

- OTTO BY ROCKWELL AUTOMATION

- MOBILE INDUSTRIAL ROBOTS

- LOCUS ROBOTICS

- SYMBOTIC INC.

- SYNAOS

- 기타 기업

- WEWO TECHMOTION

- SEEGRID

- SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- BLUEBOTICS

- KINEXON

- WAKU ROBOTICS GMBH

- NAVITEC SYSTEMS

- FORMANT

- INORBIT, INC.

- SIGMATEK GMBH & CO KG

- DEUS ROBOTICS

제20장 조사 방법

제21장 부록

CSM 25.12.23The global AMR/AGV fleet management software market is projected to increase from USD 1.58 billion in 2025 to USD 5.23 billion by 2032 with a CAGR of 18.7%, driven by the rising deployment of mobile robotics across various logistics and manufacturing facilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform Type, Fleet Type, Offering, Application, Organization Size, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Companies are expanding their robotic fleets to improve throughput and reduce operational delays, which increases demand for centralized platforms that manage routing, traffic control, task allocation, charging, and safety compliance. Integration with WMS, MES, and ERP systems enables seamless coordination between robotic fleets and broader supply chain workflows, while AI, cloud computing, and IoT data streams strengthen predictive maintenance and real-time optimization. As organizations focus on efficiency, accuracy, and scalable automation, fleet management software is becoming a core operational tool that supports continuous performance improvement and long-term robotics planning.

"Software to Grow with the Highest CAGR in the AMR/AGV Fleet Management Software Market"

The software segment is expected to record the highest CAGR in the AMR/AGV Fleet Management Software Market due to the rising deployment of mobile robot fleets across warehouses, manufacturing plants, e-commerce hubs, and logistics operations. Companies are investing in centralized platforms that manage routing, traffic control, task allocation, fleet visibility, safety workflows, and charging coordination to increase efficiency and reduce idle time. AI-driven analytics, cloud-based orchestration, and IoT-enabled data flows are strengthening real-time optimization and predictive maintenance, while integration with WMS, MES, and ERP systems is enabling coordinated execution across end-to-end supply chain processes. As organizations scale automation and adopt multi-robot environments, demand for flexible and high-performance software platforms is accelerating, which is expected to support strong growth for the segment throughout the forecast period.

"Multi-vendor Fleet Platform to Grow with the Highest CAGR in the AMR/AGV Fleet Management Software Market"

The multi-vendor fleet platform segment is expected to grow at the highest CAGR in the AMR/AGV Fleet Management Software Market as companies adopt mixed fleets, which creates a strong need for unified control of AMRs and AGVs from different suppliers. Enterprises are combining robots for pallet handling, picking, sorting, and intralogistics movement, and a centralized platform allows these varied fleets to operate through one interface with coordinated routing, traffic control, task scheduling, charging management, and safety oversight. The shift toward interoperability is gaining momentum as organizations seek flexibility in vendor selection and attempt to reduce dependence on a single manufacturer. Multi-vendor fleet platforms integrate with WMS, MES, and ERP systems and support cloud-based optimization, AI-driven decision making, and IoT-enabled predictive maintenance, which strengthens fleet efficiency and reduces operational bottlenecks. As automation programs expand across multiple sites and businesses scale their robotics investments, demand for multi-vendor platforms is rising due to their ability to improve throughput, maintain workflow continuity, and support long-term automation strategies.

"Asia Pacific to Witness the Highest Growth Driven by Expanding Automation and Rising Deployment of Mobile Robotics"

The Asia Pacific region is expected to record the highest CAGR in the AMR/AGV Fleet Management Software Market due to the rapid adoption of warehouse and factory automation across China, Japan, South Korea, India, and Southeast Asia. Companies in manufacturing, e-commerce, retail distribution, automotive, electronics, and third-party logistics are deploying large fleets of AMRs and AGVs to improve throughput and reduce labour dependency, which increases demand for centralized fleet orchestration software. Governments in the region are promoting digital transformation, smart manufacturing, and robotics integration through funding programs, incentive schemes, and national automation initiatives that strengthen the adoption of advanced fleet management platforms. Asia Pacific offers a cost-efficient manufacturing base, strong robotics production capacity, and a fast-growing ecosystem of AMR and AGV vendors, which accelerates software adoption. The region is experiencing strong investment in AI-driven automation, cloud-based fleet control, and IoT-enabled operational monitoring that improves speed, accuracy, and real-time decision-making across logistics and production workflows. With the continuous expansion of industrial automation and increasing use of mixed robotic fleets, Asia Pacific is expected to remain the fastest-growing region in the global AMR/AGV Fleet Management Software Market during the forecast period.

Breakdown of primaries

A variety of executives from key organizations operating in the AMR/AGV fleet management software market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 40%, C-level - 45%, and Others - 15%

- By Region: Asia Pacific - 41%, North America - 26%, Europe - 28%, and RoW - 5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenue as of 2024: tier 3: revenue less than USD 300 million; tier 2: revenue between USD 300 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: KUKA SE & Co. KGaA (Germany), ABB (Switzerland), OMRON Corporation (Japan), Siemens (Germany), Ocado Group plc (UK), MITSUBISHI LOGISNEXT CO., LTD. (Japan), Symbotic Inc. (US), Fives (France), Geekplus Technology Co., Ltd. (China), Mobile Industrial Robots (Denmark), Addverb Technologies Limited (India), Locus Robotics (US), BlueBotics (Switzerland), SYNAOS (Germany), KINEXON (Germany), WAKU Robotics GmbH (Germany), WEWO Techmotion (Netherlands), KNAPP AG (Austria), OTTO by Rockwell Automation (Canada), Seegrid (US), Suzhou Casun Intelligent Robot Co., Ltd. (China), GreyOrange (Georgia), Navitec Systems (Finland), Formant (US), InOrbit, Inc. (US), SIGMATEK GmbH & Co KG (Austria) and Deus Robotics(Ukraine). These companies provide a broad suite of advanced fleet management software capabilities, covering traffic control, routing, task allocation, real-time monitoring, analytics, and integration with enterprise systems, establishing a strong presence across both mature and emerging automation markets.

The study provides a detailed competitive analysis of these key players in the AMR/AGV fleet management software market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the AMR/AGV fleet management software market offers a comprehensive analysis, segmented by platform type, fleet type, offering, application, organization size, industry, and region. By offering, the AMR/AGV Fleet Management Software Market is segmented into software and services. By platform type, it includes single-vendor fleet platforms and multi-vendor fleet platforms. By fleet type, the market covers Autonomous Mobile Robots AMRs, Automated Guided Vehicles AGVs, and hybrid fleets that combine mixed robot types. By application, the market is segmented into intralogistics and material transport management, order fulfilment and picking operations, packaging, palletizing and line feeding, cross-docking and dock-to-dock transfers, sorting and allocation management, and fleet coordination and zone management. Organization size segmentation includes large enterprises and small and medium enterprises (SMEs). By industry, the market includes automotive, e-commerce and retail, chemicals, semiconductor and electronics, food and beverages, healthcare, aviation, logistics and 3PL, and other industries such as metal and heavy machinery, pulp and paper. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World. This segmentation supports detailed assessment of growth opportunities, adoption patterns, and technology developments shaping the global AMR/AGV Fleet Management Software Market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the AMR/AGV fleet management software market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising adoption of warehouse and factory automation supported by rapid deployment of AMRs and AGVs, Growing demand for centralized fleet orchestration, Increasing integration of AI, cloud platforms, and IoT data pipelines that enhance predictive maintenance and autonomous decision making), restraints (High complexity of integrating fleet software with existing WMS, MES, ERP, and OT systems), opportunities (Rising shift toward multi-vendor robotic fleets that require unified and vendor neutral fleet platforms for coordination and real time control, Increasing shift toward Robotics as a Service models which drives demand for subscription based and cloud managed fleet software platforms) and challenges (Difficulty in standardizing communication protocols across robots from different vendors) influencing the growth of the AMR/AGV fleet management software market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the AMR/AGV fleet management software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AMR/AGV fleet management software market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the AMR/AGV fleet management software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like KUKA SE & Co. KGaA (Germany), ABB (Switzerland), Omron Corporation (Japan), Geekplus Technology Co., Ltd. (China), Addverb Technologies Limited (India), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 3.2 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

- 3.3 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 3.4 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE

- 3.5 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE

- 3.6 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING

- 3.7 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY

- 3.8 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

- 3.9 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising adoption of warehouses and factory automation supported by rapid deployment of AMRs and AGVs

- 4.2.1.2 Growing demand for centralized fleet orchestration to manage multi-robot operations

- 4.2.1.3 Increasing adoption of data-driven operations and the need for predictive traffic optimization

- 4.2.1.4 Increasing expectations for real-time system-wide synchronization across automation assets

- 4.2.2 RESTRAINTS

- 4.2.2.1 High complexity of integrating fleet software with existing WMS, MES, ERP, and OT systems

- 4.2.2.2 Limited standardization of robot interfaces and operating logic across vendors

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Shift toward multi-vendor robotic fleets that require unified and vendor-neutral fleet platforms for coordination and real-time control

- 4.2.3.2 Robotics-as-a-service models driving demand for subscription-based and cloud-managed fleet software platforms

- 4.2.3.3 Expansion of hybrid cloud and edge deployment models that support real-time control and multi-site visibility

- 4.2.4 CHALLENGES

- 4.2.4.1 Difficulties in standardizing communication protocols across robots from different vendors

- 4.2.4.2 Rising cybersecurity requirements for connected fleet ecosystems

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL E-COMMERCE AND RETAIL INDUSTRY

- 5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE, BY TYPE

- 5.5.3 AVERAGE SELLING PRICE, BY REGION

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (842710)

- 5.7.2 EXPORT SCENARIO (842710)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 SYMBOTIC DEPLOYS AI-POWERED ROBOTIC AUTOMATION FOR SOUTHERN GLAZER'S DISTRIBUTION CENTERS

- 5.10.2 ASSOCIATED FOOD STORES IMPLEMENTS SYMBOTIC ROBOTIC AUTOMATION IN UTAH DISTRIBUTION CENTER

- 5.10.3 GREYORANGE PARTNERED WITH KENCO TO DEPLOY AI-DRIVEN WAREHOUSE ORCHESTRATION

- 5.10.4 BAILEY EQUIPMENT & INTRALOGISTICS PARTNERS WITH GREYORANGE TO EXPAND AI-ENABLED WAREHOUSE AUTOMATION

- 5.11 IMPACT OF 2025 US TARIFFS-AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 FLEET ORCHESTRATION AND TRAFFIC MANAGEMENT

- 6.1.2 NAVIGATION AND LOCALIZATION SYSTEMS

- 6.1.3 ROBOT CONTROL AND SAFETY INFRASTRUCTURE

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ENTERPRISE SYSTEM INTEGRATION

- 6.2.2 CONNECTIVITY AND EDGE COMPUTING CAPABILITIES

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI ON AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT AI IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS VERTICALS

9 KEY TECHNOLOGIES AND STANDARDS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 9.1 INTRODUCTION

- 9.2 ROLE OF AI & ML IN TASK ALLOCATION

- 9.2.1 ADVANCED TASK ALLOCATION AND ROUTING

- 9.2.2 PREDICTIVE CAPACITY PLANNING

- 9.2.3 AUTONOMOUS TRAFFIC GOVERNANCE

- 9.2.4 FAILURE PREDICTION AND RISK AVOIDANCE

- 9.2.5 EXECUTION QUALITY OPTIMIZATION

- 9.3 DIGITAL TWINS FOR FLEET SIMULATION

- 9.3.1 PURPOSE OF DIGITAL TWIN SYSTEMS

- 9.4 5G AND EDGE COMPUTING FOR REAL-TIME COORDINATION

- 9.5 COMPUTER VISION

- 9.6 BLOCKCHAIN FOR FLEET TRACKING

- 9.7 INTEROPERABILITY STANDARDS

- 9.7.1 VDA 5050

- 9.7.2 OPC UNIFIED ARCHITECTURE UA

- 9.7.3 MQTT

10 KEY FUNCTIONS OF AMR/AGV FLEET MANAGEMENT PLATFORMS

- 10.1 INTRODUCTION

- 10.2 REAL-TIME FLEET MONITORING

- 10.3 ROUTE OPTIMIZATION

- 10.4 TRAFFIC MANAGEMENT

- 10.5 COLLISION AVOIDANCE

- 10.6 BATTERY MANAGEMENT

- 10.7 PREDICTIVE MAINTENANCE

- 10.8 PERFORMANCE ANALYTICS

- 10.9 MULTI-BRAND ROBOT COORDINATION

11 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 SOFTWARE

- 11.2.1 CLOUD-BASED ORCHESTRATION PLATFORMS

- 11.2.1.1 Cloud orchestration gains momentum as enterprises centralize fleet intelligence across networks

- 11.2.2 ON-PREMISES ORCHESTRATION PLATFORMS

- 11.2.2.1 On-premises control platforms gain traction in latency-critical environments

- 11.2.3 HYBRID PLATFORMS

- 11.2.3.1 Hybrid orchestration expands as enterprises seek unified command across cloud and local systems

- 11.2.1 CLOUD-BASED ORCHESTRATION PLATFORMS

- 11.3 SERVICES

- 11.3.1 CONSULTING & SYSTEM DESIGN

- 11.3.1.1 Strategy-driven automation roadmaps increase demand for consulting and system design

- 11.3.2 IMPLEMENTATION & INTEGRATION

- 11.3.2.1 Complex robotics environments increase need for high-fidelity integration and precise execution

- 11.3.3 TRAINING & SUPPORT

- 11.3.3.1 Software-driven robot operations elevate importance of skilled operators and responsive support

- 11.3.4 MAINTENANCE & UPDATES

- 11.3.4.1 Expansion of large multi-site fleets increases the need for predictive maintenance and continuous software updates

- 11.3.5 MANAGED SERVICES

- 11.3.5.1 Demand for predictable automation outcomes accelerates growth of fully managed fleet operations

- 11.3.1 CONSULTING & SYSTEM DESIGN

12 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE

- 12.1 INTRODUCTION

- 12.2 SINGLE-VENDOR FLEET PLATFORMS

- 12.2.1 GROWING PREFERENCE FOR UNIFIED HARDWARE-SOFTWARE ECOSYSTEMS DRIVES DEMAND FOR SINGLE VENDOR PLATFORMS

- 12.3 MULTI-VENDOR FLEET PLATFORMS

- 12.3.1 RISING DEMAND FOR INTEROPERABILITY AND MIXED ROBOT ECOSYSTEMS ACCELERATES MULTI-VENDOR PLATFORM ADOPTION

13 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE

- 13.1 INTRODUCTION

- 13.2 AUTONOMOUS MOBILE ROBOTS (AMRS)

- 13.2.1 PICKING & SORTING AMRS

- 13.2.1.1 Surging E-commerce volumes drive large-scale adoption of picking and sorting AMRs

- 13.2.2 TRANSPORTATION AMRS

- 13.2.2.1 Increasing need for continuous, touchless material movement fuels demand for transportation AMRs

- 13.2.3 COLLABORATIVE AMRS

- 13.2.3.1 Human-centric workflows increase adoption of collaborative AMRs requiring advanced safety logic

- 13.2.1 PICKING & SORTING AMRS

- 13.3 AUTOMATED GUIDED VEHICLES (AGVS)

- 13.3.1 TOW/TUGGER AGVS

- 13.3.1.1 Expansion of industrial line feeding and batch transport drives demand

- 13.3.2 UNIT LOAD AGVS

- 13.3.2.1 Rising need for automated pallet, rack, and container movement strengthens unit deployment

- 13.3.3 PALLET TRUCK AGVS

- 13.3.3.1 Shift toward automated dock, warehouse, and cold storage handling accelerates pallet truck AGV adoption

- 13.3.4 ASSEMBLY LINE AGVS

- 13.3.4.1 Flexible production layouts and modular manufacturing boost assembly line AGV adoption

- 13.3.1 TOW/TUGGER AGVS

- 13.4 HYBRID (MULTI-ROBOT FLEETS)

- 13.4.1 GROWING NEED FOR MULTI-FUNCTION AND VENDOR-NEUTRAL AUTOMATION ACCELERATES HYBRID FLEET ADOPTION

14 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 INTRALOGISTICS & MATERIAL TRANSPORT MANAGEMENT

- 14.2.1 INCREASING DEMAND FOR CONTINUOUS MATERIAL FLOW STRENGTHENS NEED FOR INTELLIGENT TRANSPORT ORCHESTRATION

- 14.3 ORDER FULFILLMENT & PICKING OPERATIONS

- 14.3.1 GROWTH IN HIGH-VELOCITY FULFILLMENT DRIVES ADOPTION OF ADVANCED PICK EXECUTION PLATFORMS

- 14.4 PACKAGING, PALLETIZING, AND LINE FEEDING

- 14.4.1 AUTOMATION OF END-OF-LINE TASKS EXPANDS NEED FOR PRECISE LINE SUPPORT ORCHESTRATION

- 14.5 CROSS-DOCKING & DOCK-TO-DOCK TRANSFERS

- 14.5.1 GROWTH IN HIGH-THROUGHPUT LOGISTICS DRIVES NEED FOR REAL-TIME DOCK TRANSFER ORCHESTRATION

- 14.6 SORTING & ALLOCATION MANAGEMENT

- 14.6.1 RISING SKU COMPLEXITY AND PARCEL VOLUMES ACCELERATE DEMAND FOR INTELLIGENT ALLOCATION ORCHESTRATION

- 14.7 FLEET COORDINATION & ZONE MANAGEMENT

- 14.7.1 GROWING SCALE OF MOBILE ROBOT DEPLOYMENTS REINFORCES NEED FOR UNIFIED ZONE CONTROL

15 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

- 15.1 INTRODUCTION

- 15.2 LARGE ENTERPRISES

- 15.2.1 GROWING EMPHASIS ON MULTI-SITE AUTOMATION AND PROCESS STANDARDIZATION DRIVES ENTERPRISE-LEVEL ADOPTION

- 15.3 SMALL & MEDIUM ENTERPRISES (SMES)

- 15.3.1 SMES ACCELERATE AUTOMATION ADOPTION TO IMPROVE EFFICIENCY AND REDUCE OPERATIONAL BURDEN

16 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY

- 16.1 INTRODUCTION

- 16.2 AUTOMOTIVE

- 16.2.1 RISING PRODUCTION COMPLEXITY AND LINE AUTOMATION STRENGTHEN DEMAND FOR ADVANCED AMR/AGV FLEET SOFTWARE IN AUTOMOTIVE MANUFACTURING

- 16.3 SEMICONDUCTOR & ELECTRONICS

- 16.3.1 RISING DEMAND FOR ULTRA-RELIABLE, CONTAMINATION-FREE TRANSPORT ACCELERATES SOFTWARE-DRIVEN AMR/AGV COORDINATION

- 16.4 AVIATION

- 16.4.1 OPERATIONAL COMPLEXITY AND NEED FOR PRECISION STRENGTHEN ROLE OF SOFTWARE-LED AMR/AGV COORDINATION IN AVIATION

- 16.5 HEALTHCARE

- 16.5.1 GROWING DEMAND FOR SAFE, TRACEABLE, AND ROUND-THE-CLOCK TRANSPORT DRIVES ADOPTION OF SOFTWARE-ORCHESTRATED AMR/AGV WORKFLOWS IN HEALTHCARE FACILITIES

- 16.6 FOOD & BEVERAGES

- 16.6.1 HIGH-SPEED PRODUCTION CYCLES AND PERISHABILITY PRESSURES ACCELERATE NEED FOR SOFTWARE-ORCHESTRATED AMR/AGV OPERATIONS

- 16.7 CHEMICALS

- 16.7.1 SAFETY REQUIREMENTS AND HAZARDOUS MATERIAL HANDLING DRIVE ADOPTION OF AMR/AGV FLEET SOFTWARE IN CHEMICAL MANUFACTURING

- 16.8 E-COMMERCE & RETAIL

- 16.8.1 RAPID ORDER GROWTH AND HIGH-MIX FULFILLMENT INTENSIFY DEMAND FOR ADVANCED AMR/AGV FLEET SOFTWARE IN E-COMMERCE AND RETAIL

- 16.9 LOGISTICS/3PL

- 16.9.1 HIGH-THROUGHPUT, MULTI-CLIENT DISTRIBUTION DEMANDS STRONG SOFTWARE-ORCHESTRATED AMR/AGV COORDINATION

- 16.10 OTHER INDUSTRIES

17 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.2 NORTH AMERICA

- 17.2.1 US

- 17.2.1.1 Automation pressure in fulfillment and manufacturing accelerates fleet software integration

- 17.2.2 CANADA

- 17.2.2.1 Expansion of manufacturing and export-intensive supply chains drives adoption of AMR and AGV fleet management software

- 17.2.3 MEXICO

- 17.2.3.1 Rising robotics orchestration requirements driven by nearshoring and high-volume manufacturing

- 17.2.1 US

- 17.3 EUROPE

- 17.3.1 GERMANY

- 17.3.1.1 Strong industrial automation ecosystem accelerates adoption of AMR and AGV fleet management software

- 17.3.2 UK

- 17.3.2.1 Rising automation across fulfillment and manufacturing boosts demand for scalable fleet orchestration

- 17.3.3 FRANCE

- 17.3.3.1 Expansion of advanced warehousing and manufacturing automation drives software adoption

- 17.3.4 ITALY

- 17.3.4.1 Automation investments and high-mix manufacturing drive strong demand for fleet software

- 17.3.5 REST OF EUROPE

- 17.3.1 GERMANY

- 17.4 ASIA PACIFIC

- 17.4.1 CHINA

- 17.4.1.1 Large-scale manufacturing strength and high-volume fulfillment networks accelerate AMR and AGV fleet software adoption

- 17.4.2 JAPAN

- 17.4.2.1 Digitalization and workforce pressures accelerate robotics coordination needs

- 17.4.3 SOUTH KOREA

- 17.4.3.1 High automation intensity accelerates demand for intelligent fleet orchestration

- 17.4.4 INDIA

- 17.4.4.1 Expanding industrial output and digital supply chains accelerate fleet software adoption

- 17.4.5 AUSTRALIA

- 17.4.5.1 Operational Efficiency and Labor Constraints Strengthen Demand for Mobile Robot Orchestration

- 17.4.6 REST OF ASIA PACIFIC

- 17.4.1 CHINA

- 17.5 REST OF THE WORLD

- 17.5.1 MIDDLE EAST

- 17.5.1.1 Growing focus on smart logistics and manufacturing modernization accelerates software adoption

- 17.5.1.2 GCC Countries

- 17.5.1.3 Rest of Middle East

- 17.5.2 SOUTH AMERICA

- 17.5.2.1 Growing automation in manufacturing and expanding e-commerce networks drive demand for fleet coordination platforms

- 17.5.3 AFRICA

- 17.5.3.1 Industrial park expansion and digital supply chain programs increase the need for coordinated robot operations

- 17.5.1 MIDDLE EAST

18 COMPETITIVE LANDSCAPE

- 18.1 OVERVIEW

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 18.3 REVENUE ANALYSIS, 2020-2024

- 18.4 MARKET SHARE ANALYSIS

- 18.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 18.6 BRAND/PRODUCT COMPARISON

- 18.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 18.7.1 STARS

- 18.7.2 EMERGING LEADERS

- 18.7.3 PERVASIVE PLAYERS

- 18.7.4 PARTICIPANTS

- 18.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 18.7.5.1 Company footprint

- 18.7.5.2 Region footprint

- 18.7.5.3 Fleet type footprint

- 18.7.5.4 Platform type footprint

- 18.7.5.5 Industry footprint

- 18.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 18.8.1 PROGRESSIVE COMPANIES

- 18.8.2 RESPONSIVE COMPANIES

- 18.8.3 DYNAMIC COMPANIES

- 18.8.4 STARTING BLOCKS

- 18.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 18.8.5.1 Detailed list of key startups/SMEs

- 18.9 COMPETITIVE SCENARIO

- 18.9.1 PRODUCT LAUNCHES

- 18.9.2 DEALS

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- 19.1.1 KUKA SE & CO. KGAA

- 19.1.1.1 Business overview

- 19.1.1.2 Products/Solutions/Services offered

- 19.1.1.3 MnM view

- 19.1.1.3.1 Right to win

- 19.1.1.3.2 Strategic choices

- 19.1.1.3.3 Weaknesses/competitive threats

- 19.1.2 ABB

- 19.1.2.1 Business overview

- 19.1.2.2 Products/Solutions/Services offered

- 19.1.2.3 MnM view

- 19.1.2.3.1 Right to win

- 19.1.2.3.2 Strategic choices

- 19.1.2.3.3 Weaknesses/competitive threats

- 19.1.3 OMRON CORPORATION

- 19.1.3.1 Business overview

- 19.1.3.2 Products/Solutions/Services offered

- 19.1.3.3 MnM view

- 19.1.3.3.1 Right to win

- 19.1.3.3.2 Strategic choices

- 19.1.3.3.3 Weaknesses/competitive threats

- 19.1.4 GEEKPLUS TECHNOLOGY CO., LTD.

- 19.1.4.1 Business overview

- 19.1.4.2 Products/Solutions/Services offered

- 19.1.4.3 MnM view

- 19.1.4.3.1 Right to win

- 19.1.4.3.2 Strategic choices

- 19.1.4.3.3 Weaknesses/competitive threats

- 19.1.5 ADDVERB TECHNOLOGIES LIMITED

- 19.1.5.1 Business overview

- 19.1.5.2 Products/Solutions/Services offered

- 19.1.5.3 Recent developments

- 19.1.5.3.1 Deals

- 19.1.5.4 MnM view

- 19.1.5.4.1 Right to win

- 19.1.5.4.2 Strategic choices

- 19.1.5.4.3 Weaknesses/competitive threats

- 19.1.6 SIEMENS

- 19.1.6.1 Business overview

- 19.1.6.2 Products/Solutions/Services offered

- 19.1.7 FIVES

- 19.1.7.1 Business overview

- 19.1.7.2 Products/Solutions/Services offered

- 19.1.8 GREYORANGE

- 19.1.8.1 Business overview

- 19.1.8.2 Products/Solutions/Services offered

- 19.1.8.3 Recent developments

- 19.1.8.3.1 Deals

- 19.1.9 OCADO GROUP PLC.

- 19.1.9.1 Business overview

- 19.1.9.2 Products/Solutions/Services offered

- 19.1.10 KNAPP AG

- 19.1.10.1 Business overview

- 19.1.10.2 Products/Solutions/Services offered

- 19.1.11 MITSUBISHI LOGISNEXT CO., LTD

- 19.1.11.1 Business overview

- 19.1.11.2 Products/Solutions/Services offered

- 19.1.12 OTTO BY ROCKWELL AUTOMATION

- 19.1.12.1 Business overview

- 19.1.12.2 Products/Solutions/Services offered

- 19.1.12.3 Recent developments

- 19.1.12.3.1 Product enhancements

- 19.1.12.3.2 Deals

- 19.1.13 MOBILE INDUSTRIAL ROBOTS

- 19.1.13.1 Business overview

- 19.1.13.2 Products/Solutions/Services offered

- 19.1.13.3 Recent developments

- 19.1.13.3.1 Product launches

- 19.1.13.3.2 Deals

- 19.1.14 LOCUS ROBOTICS

- 19.1.14.1 Business overview

- 19.1.14.2 Products/Solutions/Services offered

- 19.1.14.3 Recent developments

- 19.1.14.3.1 Product launches

- 19.1.14.3.2 Deals

- 19.1.15 SYMBOTIC INC.

- 19.1.15.1 Business overview

- 19.1.15.2 Products/Solutions/Services offered

- 19.1.15.3 Recent developments

- 19.1.15.3.1 Deals

- 19.1.16 SYNAOS

- 19.1.16.1 Business overview

- 19.1.16.2 Products/Solutions/Services offered

- 19.1.16.3 Recent developments

- 19.1.16.3.1 Deals

- 19.1.1 KUKA SE & CO. KGAA

- 19.2 OTHER PLAYERS

- 19.2.1 WEWO TECHMOTION

- 19.2.2 SEEGRID

- 19.2.3 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- 19.2.4 BLUEBOTICS

- 19.2.5 KINEXON

- 19.2.6 WAKU ROBOTICS GMBH

- 19.2.7 NAVITEC SYSTEMS

- 19.2.8 FORMANT

- 19.2.9 INORBIT, INC.

- 19.2.10 SIGMATEK GMBH & CO KG

- 19.2.11 DEUS ROBOTICS

20 RESEARCH METHODOLOGY

- 20.1 RESEARCH DATA

- 20.1.1 SECONDARY AND PRIMARY RESEARCH

- 20.1.2 SECONDARY DATA

- 20.1.2.1 List of major secondary sources

- 20.1.2.2 Key data from secondary sources

- 20.1.3 PRIMARY DATA

- 20.1.3.1 Primary interviews with experts

- 20.1.3.2 Key data from primary sources

- 20.1.3.3 Key industry insights

- 20.1.3.4 Breakdown of primaries

- 20.2 MARKET SIZE ESTIMATION

- 20.2.1 TOP-DOWN APPROACH

- 20.2.2 BOTTOM-UP APPROACH

- 20.2.3 BASE NUMBER CALCULATION

- 20.3 MARKET FORECAST APPROACH

- 20.3.1 SUPPLY SIDE

- 20.3.2 DEMAND SIDE

- 20.4 DATA TRIANGULATION

- 20.5 RESEARCH ASSUMPTIONS

- 20.6 RESEARCH LIMITATIONS

- 20.7 RISK ASSESSMENT

21 APPENDIX

- 21.1 DISCUSSION GUIDE

- 21.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 21.3 CUSTOMIZATION OPTIONS

- 21.4 RELATED REPORTS

- 21.5 AUTHOR DETAILS