|

시장보고서

상품코드

1915210

플릿 텔레매틱스 시장 : 차종별, 패키지 유형별, 벤더 유형별, 솔루션 유형별, 지역별 - 세계 예측(-2032년)Fleet Telematics Market by Vehicle Type (LCV, HCV), Package Type (Entry Level, Mid Tier, Advanced), Vendor Type (OEMs, Aftermarket), Solution Type (Embedded, Portable, Smartphone/Cellular), and Region - Global Forecast to 2032 |

||||||

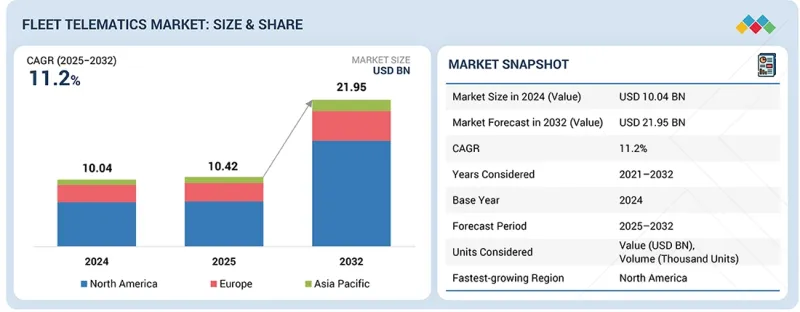

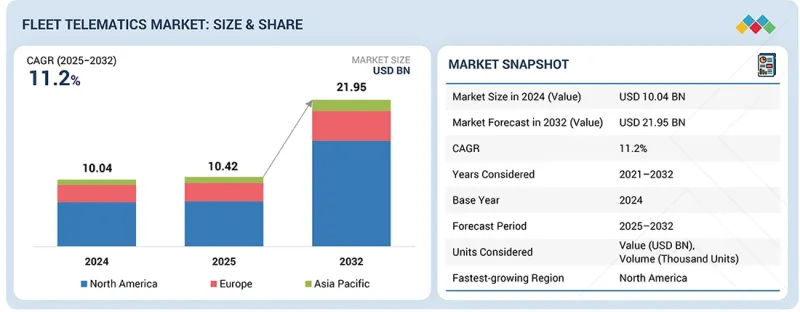

세계의 플릿 텔레매틱스 시장 규모는 2025년 104억 2,000만 달러에서 2032년까지 219억 5,000만 달러에 달할 것으로 예측되며, CAGR로 11.2%의 성장이 전망됩니다. 상용차용 텔레매틱스 패키지 채택은 실시간 부품 건전성 분석, 로드 사이클 분석, 다중 자산 가시화, 규정 준수 워크플로 자동화 등 더 깊은 운영 인텔리전스를 요구하는 플릿 기업들에 의해 꾸준히 진화하고 있습니다. 스마트폰/셀룰러 텔레매틱스는 설치가 필요 없는 모델이기 때문에 소규모 플릿이나 하청 플릿 사이에서 계속해서 큰 점유율을 차지하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 100만/10억 달러 |

| 부문 | 패키지 유형, 솔루션 유형, 차종, 벤더 유형 |

| 대상 지역 | 아시아태평양, 유럽, 북미 |

동시에, 자산이 운영자 간에 자주 이동하는 임대, 임대, 직업 부문에서는 휴대용 기기가 여전히 필수적입니다. 채용 패턴도 차종에 따라 채용 패턴이 나뉘어져 있습니다. 예를 들어, LCV 차량은 배송 성능, 주행 수준에서의 이용률, 워크플로우의 디지털화를 우선시하는 반면, HCV 차량은 스트레스 주기 모니터링, 유지보수 간격 최적화, 화물 상태의 가시성을 요구하고 있습니다.

"애프터마켓 부문은 예측 기간 동안 플릿 텔레매틱스 시장에서 주도적인 위치를 차지할 것으로 예상됩니다."

벤더 유형별로는 애프터마켓 부문이 플릿 텔레매틱스 시장을 주도할 것으로 예상됩니다. 이는 대부분의 차량이 서로 다른 연식, 브랜드, 사양의 차량을 운영하고 있으며, 애프터마켓 시스템은 개조된 장치와 OEM 데이터 통합을 통해 이 모든 것을 연결할 수 있기 때문입니다. 애프터마켓 플랫폼은 특정 브랜드에 종속된 OEM 포털과 달리 광범위한 호환성, 강력한 분석, 고급 보고, 빈번한 OTA 업데이트를 제공합니다. 또한, 차량에 단일 표준화된 인터페이스를 제공하므로 여러 OEM 시스템을 관리할 필요가 없습니다. 인도를 비롯한 신흥 시장을 포함한 많은 지역에서 기존 차량 기반의 OEM 탑재 텔레매틱스 채택률은 여전히 낮으며, 애프터마켓 솔루션이 노후 차량과 레거시 차량을 디지털화하는 유일한 실용적인 수단으로 사용되고 있습니다. 상호운용성 문제와 파편화된 OEM 표준은 서로 다른 차량 플랫폼의 데이터를 단일 대시보드에 통합할 수 있는 애프터마켓 애그리게이터에 대한 수요를 더욱 촉진하고 있습니다.

애프터마켓의 주요 기업들은 OEM 임베디드 데이터 통합을 빠르게 진행하고 있습니다. 예를 들어, Geotab은 Ford, General Motors(OnStar), Mercedes-Benz, Volvo Cars, Stellantis 브랜드, BMW Group, Renault, the Volkswagen Group 등 다양한 자동차 제조업체의 OEM 텔레매틱스 데이터를 통합하고 있습니다. 이를 통해 차량은 공장 출고 시 장착된 텔레매틱스 데이터와 후 장착된 텔레매틱스 데이터를 하나의 플랫폼으로 통합하여 일원화하여 관리할 수 있습니다.

"고급 부문이 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다."

패키지 유형별로 보면 예측 기간 동안 플릿 텔레매틱스 시장에서 가장 높은 성장률을 보일 것으로 예상되는 부문은 어드밴스드(Advanced) 부문입니다. 이러한 텔레매틱스는 원격 진단, 예지 정비, 충돌 감지, 컴플라이언스 모니터링, 실시간 비디오 이벤트 분석과 같은 고부가가치 기능을 제공하며, 이 모든 것이 차량의 비용 절감과 운영 성과 향상에 기여합니다. 안전, 연비, 규제 대응에 대한 요구가 높아짐에 따라 사업자들은 운전자 교육, 예방 정비 워크플로우, 지속적인 컴플라이언스 관리를 가능하게 하는 시스템 도입을 추진하고 있습니다. 차량이 소프트웨어 정의 및 데이터 중심 운영으로 전환함에 따라, 고급 솔루션이 제공하는 끊김 없는 고품질 데이터 스트림이 요구되고 있습니다.

세계의 플릿 텔레매틱스 시장에 대해 조사 분석했으며, 주요 촉진요인 및 저해요인, 제품 개발 및 혁신, 경쟁 구도에 대해 조사 분석하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 중요한 인사이트

- 플릿 텔레매틱스 시장 기업에서 매력적인 기회

- 플릿 텔레매틱스 시장 : 벤더 유형별

- 플릿 텔레매틱스 시장 : 차종별

- 플릿 텔레매틱스 시장 : 패키지 유형별

- 플릿 텔레매틱스 시장 : 솔루션 유형별

- 플릿 텔레매틱스 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 플릿 텔레매틱스 시장의 시장 역학의 영향

- 미충족 수요와 화이트 스페이스

- 플릿 텔레매틱스 시장의 미충족 수요

- 화이트 스페이스 기회

- 상호 접속된 시장과 부문 횡단적인 기회

- 상호 접속된 시장

- 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 활동

제5장 업계 동향

- 거시경제 지표

- GDP 동향과 예측

- 세계의 상용차 업계 동향

- 세계의 플릿 업계 동향

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 가격 책정 분석

- 플릿 텔레매틱스 패키지 유형 평균판매가격 : 주요 기업별

- 플릿 텔레매틱스 평균판매가격 동향 : 패키지 유형별

- 평균판매가격 동향 : 지역별

- 생태계 분석

- 공급망 분석

- 사례 연구 분석

- 투자와 자금 조달 시나리오

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 주요 회의와 이벤트(2026-2027년)

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스의 주요 이해관계자

- 구입 기준

- 채용 장벽과 내부 과제

- 시장 수익성

- 잠재적 매출

- 비용 역학

- 마진 기회 : 용도별

- 규제 상황과 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속가능성에 대한 대처

- 전기·하이브리드 차량으로의 전환

- 실시간 배기 가스·에너지 모니터링

- 그린 물류·스마트 시티 시스템과의 통합

- 데이터 기반 인사이트를 활용한 연비 최적화

- 특허 분석

- 플릿 텔레매틱스 시장에 대한 생성형 AI의 영향

- 예측적·생성적 유지보수 모델링

- 지능형 경로·행동 최적화

- 플릿 인사이트·보고 자동화

- 디지털 트윈·시뮬레이션 기능

- 주요 신기술

- 엣지 컴퓨팅

- 5G 연결성

- 디지털 트윈

- AI 드리븐 비디오 텔레매틱스

- 빅데이터 애널리틱스

- 보완 기술

- V2X 통신

- 클라우드 컴퓨팅 플랫폼

- 플릿 훈련용 AR/VR 인터페이스

- 스마트 시티 인프라 통합

- 생체인식 차량 액세스 시스템

- 기술/제품 로드맵

- 단기|기반 구축과 조기 상업화(2025-2027년)

- 중기|확장과 표준화(2028-2030년)

- 장기|대규모 상업화와 파괴적 변화(2031-2035년 이후)

- 주요 기업 비용 절감에 대한 차량 텔레매틱스의 영향

- 주요 기업 비용 절감 분석

- 플릿 텔레매틱스 솔루션 비용 분석

- 플릿 텔레매틱스 데이터 플랜 인사이트 : OEM별

- 상용차 텔레매틱스 아키텍처 인사이트

- 하드웨어 중심 아키텍처에서 소프트웨어 정의 아키텍처로의 전환

- 계층화·모듈화 시스템 설계

- 데이터 처리를 목적으로 한 엣지·클라우드 제휴

- 차량 도메인 컨트롤러·ADAS 시스템과의 통합

- 설계에 짜넣어진 사이버 보안과 기능 안전

- 플릿 텔레매틱스 시장 생태계 : 향후 용도

- 자율적 플릿 운영·원격 운전

- 예측적·생성적 유지보수 플랫폼

- 동적 보험·이용 기반 비즈니스 모델

- 통합 스마트 물류·공급망 네트워크

- 그린 플릿 관리·카본 인텔리전스

제6장 플릿 텔레매틱스 시장 : 패키지 유형별

- 엔트리 레벨

- 미드 티어

- 어드밴스드

- 중요한 인사이트

제7장 플릿 텔레매틱스 시장 : 솔루션 유형별

- 임베디드

- 휴대용

- 스마트폰/셀룰러

- 중요한 인사이트

제8장 플릿 텔레매틱스 시장 : 차종별

- 소형 상용차

- 대형 상용차

- 중요한 인사이트

제9장 플릿 텔레매틱스 시장 : 벤더 유형별

- OEM

- 애프터마켓

- 중요한 인사이트

제10장 플릿 텔레매틱스 시장 : 지역별

- 북미

- 미국

- 캐나다

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 유럽

- 프랑스

- 독일

- 이탈리아

- 스페인

- 영국

제11장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석(2025년)

- 상장 기업/공개 기업 상위 5개사 매출 분석

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- 기업 평가 매트릭스 : 주요 기업(2025년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2025년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- GEOTAB INC.

- VERIZON

- TRIMBLE INC.

- SAMSARA INC.

- POWERFLEET

- TELETRAC NAVMAN US LTD

- MASTERNAUT LIMITED

- TOMTOM INTERNATIONAL BV

- OMNITRACS

- MICROLISE LIMITED

- PTC

- AZUGA, A BRIDGESTONE COMPANY

- 기타 기업

- OCTO GROUP SPA

- ZONAR SYSTEMS, INC.

- SPIREON

- LYTX, INC.

- MOTIVE TECHNOLOGIES, INC.

- VOLKSWAGEN GROUP

- MAHINDRA&MAHINDRA LTD.

- SUN-TECH INTERNATIONAL GROUP LIMITED

- CALAMP

- RAM TRACKING

- LINXUP

- ITRIANGLE

- NOREGON

제13장 조사 방법

제14장 부록

KSM 26.02.05The fleet telematics market is projected to grow from USD 10.42 billion in 2025 to USD 21.95 billion by 2032 at a CAGR of 11.2%. The adoption of telematics packages for commercial vehicles is moving steadily toward advanced tiers as fleets seek deeper operational intelligence, including real-time component health insights, load cycle analytics, multi-asset visibility, and automated compliance workflows. Smartphone/cellular telematics continues to gain a significant share among small and subcontracted fleets due to its zero installation model.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Package type, Solution Type, Vehicle Type, Vendor Type (OEMS, Aftermarket) |

| Regions covered | Asia Pacific, Europe, and North America |

At the same time, portable devices remain essential for rental, leasing, and vocational segments where assets regularly shift between operators. Adoption patterns are also diverging by vehicle class. For example, LCV fleets are prioritizing delivery performance, trip level utilization, and workflow digitization, whereas HCV fleets demand stress cycle monitoring, maintenance interval optimization, and cargo condition visibility.

"The aftermarket segment is projected to dominate the fleet telematics market during the forecast period."

By vendor type, the aftermarket segment is projected to lead the fleet telematics market, as most fleets operate vehicles of different ages, brands, and configurations, and aftermarket systems can connect all of them through retrofit devices or OEM data integrations. Unlike OEM portals tied to specific brands, aftermarket platforms offer broader compatibility, stronger analytics, richer reporting, and frequent over-the-air feature updates. They also give fleets a single, standardized interface, reducing the need to manage multiple OEM systems. In many regions, including India and other emerging markets, OEM-installed telematics adoption in the existing vehicle base is still low, making aftermarket solutions the only practical way to digitize older or legacy vehicles. Interoperability challenges and fragmented OEM standards further propel the demand for aftermarket aggregators that can combine data from different vehicle platforms into one dashboard.

Aftermarket leaders are rapidly integrating OEM-embedded data. For instance, Geotab integrates OEM telematics data from a wide range of vehicle manufacturers, including Ford, General Motors (OnStar), Mercedes-Benz, Volvo Cars, Stellantis brands, BMW Group, Renault, and the Volkswagen Group, enabling fleets to consolidate factory-installed and retrofit telematics data on a single platform for unified management.

"The advanced segment is projected to grow at the highest rate during the forecast period."

By package type, the advanced segment is projected to grow at the highest rate in the fleet telematics market during the forecast period. These telematics deliver high-value capabilities, such as remote diagnostics, predictive maintenance, crash detection, compliance monitoring, and real-time video and event analytics, all of which help fleets reduce costs and improve operational performance. Rising safety, fuel, and regulatory demands are pushing operators to adopt systems that enable driver coaching, proactive maintenance workflows, and continuous compliance management. As fleets transition toward software-defined and data-centric operations, they require uninterrupted, high-quality data streams that advanced solutions are built to provide. Increasing operational complexity across mixed and high utilization fleets further accelerates the demand for platforms that consolidate diagnostics, sensor data, driver behavior insights, and maintenance information into a single management view. As a result, many players are undertaking strategies to capture this demand. For example, Samsara's 2025 AI Safety Suite demonstrated crash rate reductions of nearly 75% using automated video analysis and real-time driver coaching. Likewise, Daimler Truck's global Truck Data Center (TDC) enabled factory-level remote diagnostics and OTA updates as standard on new models. Similarly, ZF's TX-CONNECT platform integrated predictive maintenance and advanced sensor data across trucks and trailers. Many other players are undertaking similar developments for long-term advantages, such as low operating costs, strong safety performance, reduced downtime, and better regulatory alignment.

"Asia Pacific is projected to grow at a significant rate during the forecast period."

Asia Pacific is projected to be the fastest-growing regional market during the forecast period. The growth of the region can be attributed to China's advanced connectivity infrastructure, strong 4G/5G penetration, and nationwide digital transport systems. Government mandates for safety, hazardous goods tracking, and Beidou-based positioning continue to drive the adoption of telematics across trucks, buses, and LCVs, while leading logistics operators, such as JD Logistics, SF Express, and Alibaba Cainiao, depend on advanced routing, cold chain, and real-time freight-visibility tools. Rapid expansion of autonomous driving pilots, ADAS integration, and OEM-connected platforms is pushing the demand for higher-value telematics packages.

Chinese OEMs, including Foton, Dongfeng, SAIC, and BYD, are standardizing embedded connectivity in new commercial vehicles, accelerating market penetration. In September 2025, the Chinese government announced that China had established a complete industrial chain system for key intelligent connected vehicle technologies, covering smart cockpits, autonomous driving, cloud connectivity, and vehicle control. China's long-term auto roadmap targets over 80% penetration of new energy and connected vehicles by 2040. It expects to reinforce continued growth for connected and telematics-enabled commercial fleets.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 32%, Tier 1 - 48%, and Tier 2 - 20%

- By Designation: CXOs - 31%, Managers - 53%, and Executives - 16%

- By Region: North America - 43%, Asia Pacific - 24%, Europe - 33%

The fleet telematics market is dominated by major players, such as Geotab Inc. (Canada), Verizon (US), Trimble Inc. (US), Samsara Inc. (US), and Powerfleet (US). These companies have adopted a mix of organic and inorganic growth strategies, such as product launches, strategic partnerships, joint ventures, mergers & acquisitions, and expansion of production facilities, to strengthen their international footprint and capture a larger market share. Through these strategies, they have expanded across regions by offering differentiated telematics portfolios tailored to specific fleet segments, including advanced safety and compliance modules, multi-asset visibility solutions, industry-specific workflows, and integrated platforms that connect vehicles, trailers, and operational systems into a unified ecosystem.

Research Coverage

This research report categorizes the fleet telematics market by Vehicle Type (Light Commercial Vehicle, Heavy Commercial Vehicle), Package Type (Entry Level, Mid Tier, Advanced), Vendor Type (OEMs, Aftermarket), Solution Type (Embedded, Portable, Smartphone/Cellular), and Region. It covers the competitive landscape and profiles of the major players of the fleet telematics market. Further, the study includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall fleet telematics market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following pointers:

- Analysis of key drivers (Increasing demand for intelligent fleet operations; focus on fuel efficiency and reducing vehicle downtime, technology-driven transformation in fleet management) restraints (Connectivity limitations in remote areas and developing markets, integration complexity with legacy fleet systems and multi-brand vehicles), opportunities (Convergence of V2X communication and autonomous mobility; digital transformation through AI and smart infrastructure, expanding opportunities in logistics and transportation, cross-platform integration and API-driven ecosystems), and challenges (Escalating cost of ownership (TCO), challenges in user adoption, lack of standardization)

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the fleet telematics market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the fleet telematics market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as Geotab Inc. (Canada), Verizon (US), Trimble Inc. (US), Samsara Inc. (US), and Powerfleet (US), in the fleet telematics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING FLEET TELEMATICS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLEET TELEMATICS MARKET

- 3.2 FLEET TELEMATICS MARKET, BY VENDOR TYPE

- 3.3 FLEET TELEMATICS MARKET, BY VEHICLE TYPE

- 3.4 FLEET TELEMATICS MARKET, BY PACKAGE TYPE

- 3.5 FLEET TELEMATICS MARKET, BY SOLUTION TYPE

- 3.6 FLEET TELEMATICS MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing demand for intelligent fleet operations

- 4.2.1.2 Focus on fuel efficiency and reducing vehicle downtime

- 4.2.1.3 Technology-driven transformation in fleet management

- 4.2.1.4 Need for strengthening compliance and safety standards

- 4.2.2 RESTRAINTS

- 4.2.2.1 Connectivity limitations in remote areas and developing markets

- 4.2.2.2 Integration complexity with legacy fleet systems and multi-brand vehicles

- 4.2.2.3 Data security and user trust issues

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Convergence of V2X communication and autonomous mobility

- 4.2.3.2 Digital transformation through AI and smart infrastructure

- 4.2.3.3 Expanding opportunities in logistics and transportation

- 4.2.3.4 Cross-platform integration and API-driven ecosystems

- 4.2.4 CHALLENGES

- 4.2.4.1 Escalating TCO (total cost of ownership)

- 4.2.4.2 User adoption challenges

- 4.2.4.3 Lack of standardization

- 4.2.5 IMPACT OF MARKET DYNAMICS ON FLEET TELEMATICS MARKET

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN FLEET TELEMATICS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/-2/-3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER-1/-2/-3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 MACROECONOMICS INDICATORS

- 5.1.1 INTRODUCTION

- 5.1.2 GDP TRENDS AND FORECAST

- 5.1.3 TRENDS IN GLOBAL COMMERCIAL VEHICLE INDUSTRY

- 5.1.4 TRENDS IN GLOBAL FLEET INDUSTRY

- 5.2 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF FLEET TELEMATICS PACKAGE TYPES, BY KEY PLAYER

- 5.3.2 AVERAGE SELLING PRICE TREND OF FLEET TELEMATICS, BY PACKAGE TYPE

- 5.3.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 UNLOCKING FLEET ELECTRIFICATION POTENTIAL THROUGH DATA-DRIVEN EV SUITABILITY ANALYSIS

- 5.6.2 SCHLUMBERGER ADOPTED POWERFLEET'S MIX TO IMPROVE OPERATIONAL EFFICIENCY

- 5.6.3 OMV PETROM IMPLEMENTED POWERFLEET'S MIX TO IMPROVE FLEET EFFICIENCY AND PRODUCTIVITY

- 5.6.4 ATWELL ADOPTED GEOTAB'S FLEET MANAGEMENT PLATFORM TO ENHANCE FLEET SAFETY AND IMPROVE VEHICLE UTILIZATION

- 5.7 INVESTMENT & FUNDING SCENARIO

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- 5.8.2 EXPORT SCENARIO

- 5.9 KEY CONFERENCES & EVENTS, 2026-2027

- 5.10 DECISION-MAKING PROCESS

- 5.11 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 5.13 MARKET PROFITABILITY

- 5.13.1 REVENUE POTENTIAL

- 5.13.2 COST DYNAMICS

- 5.13.3 MARGIN OPPORTUNITIES, BY APPLICATION

- 5.14 REGULATORY LANDSCAPE AND COMPLIANCE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 INDUSTRY STANDARDS

- 5.15 SUSTAINABILITY INITIATIVES

- 5.15.1 TRANSITION TOWARD ELECTRIFIED AND HYBRID FLEETS

- 5.15.2 REAL-TIME EMISSION AND ENERGY MONITORING

- 5.15.3 INTEGRATION WITH GREEN LOGISTICS AND SMART CITY SYSTEMS

- 5.15.4 FUEL EFFICIENCY OPTIMIZATION THROUGH DATA-DRIVEN INSIGHTS

- 5.16 PATENT ANALYSIS

- 5.17 IMPACT OF GENERATIVE AI ON FLEET TELEMATICS MARKET

- 5.17.1 PREDICTIVE AND GENERATIVE MAINTENANCE MODELING

- 5.17.2 INTELLIGENT ROUTE AND BEHAVIOR OPTIMIZATION

- 5.17.3 AUTOMATED FLEET INSIGHTS AND REPORTING

- 5.17.4 DIGITAL TWIN AND SIMULATION CAPABILITIES

- 5.18 KEY EMERGING TECHNOLOGIES

- 5.18.1 EDGE COMPUTING

- 5.18.2 5G CONNECTIVITY

- 5.18.3 DIGITAL TWINS

- 5.18.4 AI-DRIVEN VIDEO TELEMATICS

- 5.18.5 BIG DATA ANALYTICS

- 5.19 COMPLEMENTARY TECHNOLOGIES

- 5.19.1 V2X COMMUNICATION (VEHICLE-TO-EVERYTHING)

- 5.19.2 CLOUD COMPUTING PLATFORMS

- 5.19.3 AR/VR INTERFACES FOR FLEET TRAINING

- 5.19.4 SMART CITY INFRASTRUCTURE INTEGRATION

- 5.19.5 BIOMETRIC VEHICLE ACCESS SYSTEM

- 5.20 TECHNOLOGY/PRODUCT ROADMAP

- 5.20.1 SHORT TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 5.20.2 MID TERM (2028-2030) | EXPANSION & STANDARDIZATION

- 5.20.3 LONG TERM (2031-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 5.21 IMPACT OF VEHICLE TELEMATICS ON COST SAVINGS OF KEY PLAYERS

- 5.21.1 COST SAVING ANALYSIS FOR KEY PLAYERS

- 5.21.1.1 Webfleet

- 5.21.1.2 Geotab Inc.

- 5.21.2 COST ANALYSIS OF FLEET TELEMATICS SOLUTIONS

- 5.21.1 COST SAVING ANALYSIS FOR KEY PLAYERS

- 5.22 INSIGHTS INTO FLEET TELEMATICS DATA PLANS, BY OEM

- 5.23 INSIGHTS INTO COMMERCIAL VEHICLE TELEMATICS ARCHITECTURE

- 5.23.1 SHIFT FROM HARDWARE-CENTRIC TO SOFTWARE-DEFINED ARCHITECTURE

- 5.23.2 LAYERED AND MODULAR SYSTEM DESIGN

- 5.23.3 EDGE-CLOUD COLLABORATION FOR DATA PROCESSING

- 5.23.4 INTEGRATION WITH VEHICLE DOMAIN CONTROLLERS AND ADAS SYSTEMS

- 5.23.5 CYBERSECURITY AND FUNCTIONAL SAFETY EMBEDDED BY DESIGN

- 5.24 FLEET TELEMATICS MARKET ECOSYSTEM: FUTURE APPLICATIONS

- 5.24.1 AUTONOMOUS FLEET OPERATIONS AND REMOTE DRIVING

- 5.24.2 PREDICTIVE AND GENERATIVE MAINTENANCE PLATFORMS

- 5.24.3 DYNAMIC INSURANCE AND USAGE-BASED BUSINESS MODELS

- 5.24.4 INTEGRATED SMART LOGISTICS AND SUPPLY CHAIN NETWORKS

- 5.24.5 GREEN FLEET MANAGEMENT AND CARBON INTELLIGENCE

6 FLEET TELEMATICS MARKET, BY PACKAGE TYPE

- 6.1 INTRODUCTION

- 6.2 ENTRY LEVEL

- 6.2.1 INCREASING ADOPTION OF TELEMATICS BY SMALL AND MEDIUM-SIZED FLEETS TO PROPEL GROWTH

- 6.3 MID TIER

- 6.3.1 RISING DEMAND FOR ADVANCED ANALYTICS, PREDICTIVE MAINTENANCE, AND ABILITY TO EXPAND FLEETS TO BOOST MARKET

- 6.4 ADVANCED

- 6.4.1 NEED FOR CUSTOMIZABLE SOLUTIONS FOR COMPLEX FLEET MANAGEMENT CHALLENGES TO FUEL SEGMENT GROWTH

- 6.5 KEY PRIMARY INSIGHTS

7 FLEET TELEMATICS MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.2 EMBEDDED

- 7.2.1 NEED FOR INTEGRATION OF ADVANCED FEATURES OF EMBEDDED SYSTEMS WITH DEEP VEHICLE INSIGHTS TO FUEL GROWTH

- 7.3 PORTABLE 125 7.3.1 EASE OF TRANSFER BETWEEN VEHICLES AND LOW UPFRONT COSTS TO DRIVE DEMAND FOR PORTABLE TELEMATICS SOLUTIONS

- 7.4 SMARTPHONE/CELLULAR

- 7.4.1 SMARTPHONES/CELLULAR NETWORKS PROVIDE ADVANCED MANAGEMENT FEATURES TO FLEET TELEMATICS

- 7.5 KEY PRIMARY INSIGHTS

8 FLEET TELEMATICS MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 LIGHT COMMERCIAL VEHICLE

- 8.2.1 SURGE IN E-COMMERCE AND FOCUS ON ROUTE OPTIMIZATION TO FUEL SEGMENT GROWTH

- 8.3 HEAVY COMMERCIAL VEHICLE

- 8.3.1 DEMAND FOR EFFECTIVE FUEL MANAGEMENT SYSTEM AND REAL-TIME DRIVER MONITORING TO DRIVE MARKET

- 8.4 KEY PRIMARY INSIGHTS

9 FLEET TELEMATICS MARKET, BY VENDOR TYPE

- 9.1 INTRODUCTION

- 9.2 OEMS

- 9.2.1 NEED FOR TIGHT INTEGRATION AND PER-VEHICLE SPECIALIZATION TO FUEL GROWTH

- 9.3 AFTERMARKET

- 9.3.1 GROWING DEMAND FOR CUSTOMIZABLE AND SCALABLE TELEMATICS SOLUTIONS TO DRIVE GROWTH

- 9.4 KEY PRIMARY INSIGHTS

10 FLEET TELEMATICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Technological advancements in AI-powered fleet management solutions to propel growth

- 10.2.2 CANADA

- 10.2.2.1 Rising demand for efficient fuel management prompts businesses to invest in telematics

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Presence of vast commercial fleets to drive market

- 10.3.2 INDIA

- 10.3.2.1 Rising e-commerce sector to boost growth

- 10.3.3 JAPAN

- 10.3.3.1 Focus on technological innovations in automotive sector to boost market

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Emphasis on improving fuel economy and operational efficiency to spur growth

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 FRANCE

- 10.4.1.1 Surge in adoption of vehicle-tracking and fuel management systems to drive market growth

- 10.4.2 GERMANY

- 10.4.2.1 Presence of leading OEMs to drive market

- 10.4.3 ITALY

- 10.4.3.1 Demand for cost-optimized fleet and fuel management solutions to boost adoption of telematics solutions

- 10.4.4 SPAIN

- 10.4.4.1 Growing focus on driver-behavior monitoring and route optimization to drive market

- 10.4.5 UK

- 10.4.5.1 Need for integration of telematics with new technologies and efficient fuel management solutions to propel growth

- 10.4.1 FRANCE

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2025

- 11.4 REVENUE ANALYSIS OF TOP FIVE LISTED/PUBLIC PLAYERS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Solution type footprint

- 11.7.5.4 Vehicle type footprint

- 11.7.5.5 Vendor type footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 11.8.5.1 Detailed list of startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES & DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSION

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GEOTAB INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches & developments

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 VERIZON

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches & developments

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 TRIMBLE INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches & developments

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 SAMSARA INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches & developments

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansion

- 12.1.4.3.4 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 POWERFLEET

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches & developments

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansion

- 12.1.5.3.4 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 TELETRAC NAVMAN US LTD

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches & developments

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 MASTERNAUT LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches & developments

- 12.1.7.3.2 Deals

- 12.1.8 TOMTOM INTERNATIONAL BV

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches & developments

- 12.1.8.3.2 Deals

- 12.1.9 OMNITRACS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches & developments

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 MICROLISE LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches & developments

- 12.1.10.3.2 Deals

- 12.1.11 PTC

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches & developments

- 12.1.11.3.2 Deals

- 12.1.12 AZUGA, A BRIDGESTONE COMPANY

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches & developments

- 12.1.1 GEOTAB INC.

- 12.2 OTHER PLAYERS

- 12.2.1 OCTO GROUP SPA

- 12.2.2 ZONAR SYSTEMS, INC.

- 12.2.3 SPIREON

- 12.2.4 LYTX, INC.

- 12.2.5 MOTIVE TECHNOLOGIES, INC.

- 12.2.6 VOLKSWAGEN GROUP

- 12.2.7 MAHINDRA&MAHINDRA LTD.

- 12.2.8 SUN-TECH INTERNATIONAL GROUP LIMITED

- 12.2.9 CALAMP

- 12.2.10 RAM TRACKING

- 12.2.11 LINXUP

- 12.2.12 ITRIANGLE

- 12.2.13 NOREGON

13 RESEARCH METHODOLOGY

- 13.1 RESEARCH DATA

- 13.1.1 SECONDARY DATA

- 13.1.1.1 List of key secondary sources

- 13.1.1.2 Key data from secondary sources

- 13.1.2 PRIMARY DATA

- 13.1.2.1 Primary interview participants

- 13.1.2.2 Key industry insights and breakdown of primary interviews

- 13.1.2.3 List of primary interviewees

- 13.1.1 SECONDARY DATA

- 13.2 MARKET SIZE ESTIMATION

- 13.2.1 BOTTOM-UP APPROACH

- 13.2.2 TOP-DOWN APPROACH

- 13.3 DATA TRIANGULATION

- 13.4 FACTOR ANALYSIS

- 13.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 13.5 RESEARCH ASSUMPTIONS

- 13.6 RESEARCH LIMITATIONS

- 13.7 RISK ASSESSMENT

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.3.1 FLEET TELEMATICS MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 14.3.2 FLEET TELEMATICS MARKET, BY SOLUTION TYPE, AT COUNTRY LEVEL

- 14.3.3 COMPANY INFORMATION

- 14.3.3.1 Profiling of additional market players (up to 5)

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS