|

시장보고서

상품코드

1893727

문서 AI 시장 : 제공 유형별(IDP, 문서 워크플로 자동화, 생성형 AI 문서 생성, ECM, 거버넌스 도구), 활용 사례별(-2030년)Document AI Market by Offering (IDP, Document Workflow Automation, Generative AI Document Generation, ECM, and Governance Tools), Use Case (Compliance Reports, Customer Feedback, KYC Document, RFP Responses, Purchase Orders) - Global Forecast to 2030 |

||||||

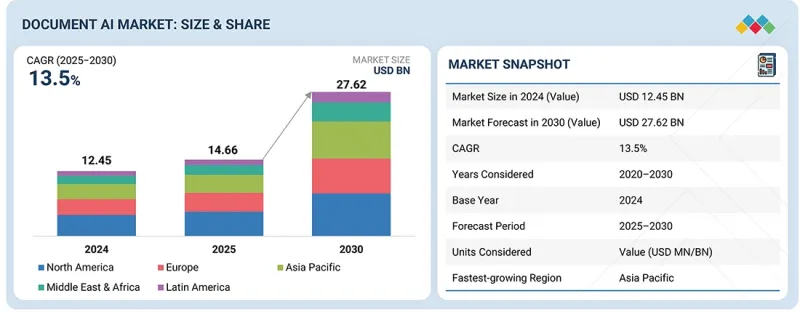

세계 문서 AI 시장 규모는 예측 기간 동안 CAGR 13.5%로 성장하여 2025년 146억 6,000만 달러, 2030년에는 276억 2,000만 달러에 이를 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러 |

| 부문 | 제공 구분, 문서 유형, 이용 사례, 업종, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

적응형 문서 학습 모델은 시스템이 실시간 사용자 피드백을 통해 자체 개선할 수 있게 하고, 수동 재교육의 필요성을 줄이고, 다양한 문서 형식의 정확성을 향상시켜 시장이 성장하고 있습니다. 또한 그래프 기반 문서 인텔리전스는 여러 페이지에 걸쳐 문서 내의 엔티티와 관련성을 결합하여 컨텍스트 이해를 강화하고 있으며, 이는 특히 법무, 보험 및 규정 준수 업무에서 가치가 높습니다. 그러나 업계를 가로지르는 문서 데이터 형식의 표준화가 제한적이기 때문에 상호 운용성이 저해되고 대규모의 원활한 모델 배포가 방해됩니다.

"제공 구분별로는 기업이 엔드 투 엔드의 자동화와 컴플라이언스 대응 데이터 처리를 우선하는 가운데 IDP 솔루션이 시장을 주도"

지능형 문서 처리(IDP) 솔루션은 비구조화 및 반구조화 문서 워크플로우 전반에서 완전한 자동화를 가능하게 함으로써 최대 점유율을 차지할 것으로 예측됩니다. IDP 플랫폼은 OCR, NLP, 머신러닝을 통합하고 송장, 양식, 계약서 및 규정 준수 문서에서 정밀도로 데이터를 추출, 분류 및 검증합니다. 은행, 보험, 의료 등 업계 기업들은 문서 처리 시간 단축, 수동 데이터 입력 감소, 감사 대응 가능한 디지털 기록 유지를 목적으로 IDP를 도입하고 있습니다. 원격 업무의 급속한 확대와 종이없는 추진으로 클라우드 기반 IDP 플랫폼에 대한 수요가 더욱 커지고 있습니다. UiPath, ABBYY, Kofax 등공급업체는 생성형 AI, RPA 통합 및 특정 도메인을 위한 사전 학습된 모델을 통해 IDP 솔루션을 강화하여 신속한 도입과 높은 투자 대 효과를 제공합니다. 게다가 설명 가능한 AI와 데이터 계보 기능에 대한 수요 증가는 규제 준수 요건과 일치하여 기업 규모의 문서 자동화에 있어서의 IDP의 기반으로서의 지위를 확고하게 하고 있습니다.

"문서 유형별로 비구조화 문서가 시장을 견인 : 기업에 의한 복잡하고 대량의 컨텐츠 처리의 자동화가 진전"

문서 유형별로 비구조화 부서가 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이는 고정 템플릿이 없는 전자 메일, 계약서, 보고서, 필기 메모, 멀티미디어 풍부한 기록을 처리할 필요성이 증가하고 있음을 반영합니다. 은행, 의료, 정부 등 업계에 상관없이 기업 데이터의 대부분은 여전히 구조화되지 않았으며 다양한 문서 형식을 이해할 수 있는 고급 AI 모델에 대한 수요가 커지고 있습니다. 레이아웃 인식 트랜스포머, 멀티모달 AI, 자연 언어 이해의 최근 발전으로 인해 문서 AI 시스템은 텍스트, 테이블 및 이미지에서 컨텍스트 정보를 동시에 정확하게 추출할 수 있습니다. Google, Microsoft, AWS 등공급업체는 특정 업계를 위해 미세 조정된 사전 학습된 모델을 활용하여 멀티포맷 문서를 처리하는 솔루션을 확장하고 있습니다. 컴플라이언스 중심의 자동화 및 데이터 거버넌스 요구 사항, 특히 감사 추적 및 고객 커뮤니케이션 분야에서도 비정형 문서 처리의 도입이 가속화되고 있습니다. 기업이 레거시 아카이브를 디지털화하고 검색 가능한 문서 리포지토리를 구축하는 데 중점을 둔 비정형 문서 인텔리전스는 대규모 디지털 에코시스템 전반에서 효율성을 높이고 의사결정을 개선하며 규제 투명성을 보장하는 핵심 기술이 되었습니다.

"아시아태평양은 혁신과 진화하는 전략에 힘입어 급속한 성장을 이루고 북미는 시장 규모로 주도적 입장을 유지"

문서 AI 시장은 지역 차이가 현저하고, 아시아태평양은 Digital India나 일본의 Society 5.0 등 국가 이니셔티브에 지지되어 인도, 인도네시아, 베트남 등에서의 급속한 디지털 변혁을 배경으로, 가장 높은 성장률이 전망되고 있습니다. 다국어 OCR과 자연 언어 처리 기능의 필요성으로 인해 기업은 BFSI(은행, 금융, 보험), 의료, 물류, 정부 분야의 워크플로우 자동화를 통해 클라우드 기반 문서 AI 및 IDP 솔루션에 대한 투자를 확대하고 있습니다. 핀테크, 디지털 결제, 전자 거버넌스의 등장도 컴플라이언스, 온보딩, 본인 확인에서 문서 자동화의 필요성을 촉진하고 있습니다.

한편, 북미는 첨단 인프라, 조기 도입, 구글, 마이크로소프트, AWS, IBM, 어도비 등 벤더의 존재로 인해 2025년 시장을 선도할 것으로 예측됩니다. HIPAA, SOX, GDPR(EU 개인정보보호규정) 등의 엄격한 규제로, 특히 금융, 보험, 의료 분야에서 분류, 계약 분석, 청구 처리에 AI를 활용하는 AI 구동형 컴플라이언스 및 감사 솔루션의 도입이 진행되고 있습니다. 생성형 AI, RAG, 설명 가능성 모델의 통합으로 문서의 정확성과 이해도가 향상되었습니다. 이처럼 북미의 혁신과 아시아태평양의 디지털 성장이 함께 세계 문서 AI의 전망을 형성하고 시장 확대를 추진하고 있습니다.

이 보고서는 세계 문서 AI 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술·특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 상호 연결된 시장과 산업 간 기회

- Tier 1/2/3 기업의 전략적 움직임

- 문서 처리에서 엔터프라이즈 지식 인텔리전스로의 전환

- 자율적인 문서 워크플로우로의 이행

- AI 거버넌스와 윤리적 고려 사항에 관한 문서 AI 도입

제6장 업계 동향

- Porter's Five Forces 분석

- 공급망 분석

- 문서 AI의 진화

- 생태계 분석

- 가격 분석

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025-2026년 주요 회의 및 이벤트

- 고객의 사업에 영향을 주는 동향/혁신

제7장 기술의 진보, AI에 의한 영향, 특허, 혁신, 장래의 응용

- 주요 신기술

- OCR

- NLP

- 컴퓨터 비전

- 신경망

- LLM(대규모 언어 모델)

- 지식 그래프

- 보완적 기술

- RPA

- 클라우드 컴퓨팅

- 데이터 주석 및 라벨링

- 사이버 보안

- 데이터베이스와 데이터 레이크 기술

- 인접 기술

- 음성 텍스트 변환과 음성 인식

- 디지털 ID 검증

- 블록체인

- IoT

- 증강현실과 가상현실(AR/VR)

- 특허 분석

- 미래의 응용

제8장 규제 상황

- 지역 규제 및 규정 준수

제9장 고객정세와 구매행동

- 의사결정 프로세스

- 구매 이해관계자 및 구매평가기준

- 채택 장벽과 내부 과제

- 다양한 최종 사용자 업계의 미충족 요구

- 시장 수익성

제10장 문서 AI 시장 : 제공 구분별

- 솔루션

- IDP

- 문서 워크플로우 자동화

- 생성형 AI 문서 생성

- ECM과 거버넌스 툴

- 서비스

- 전문 서비스

- 매니지드 서비스

- 전개 모드

- 클라우드

- On-Premise

제11장 문서 AI 시장 : 문서 유형별

- 구조화

- 비구조화

- 반구조화

- 멀티모달/혼합 컨텐츠

제12장 문서 AI 시장 : 이용 사례별

- 재무 및 회계

- 인보이스 및 세금 서류

- 영수증 및 비용 환급

- 은행 거래 명세서

- 재무보고서 및 규제 관련 서류

- 경비 정산서

- 기타

- 인사

- 이력서/CVS

- 온보딩 문서

- 급여 계산

- 정책 문서

- 기타

- 법무 및 규정 준수

- 계약

- 합의

- NDA

- 규제 당국에 제출 서류

- 컴플라이언스 보고서

- 기타

- 고객 서비스

- KYC 문서

- 청구서

- 고객으로부터의 피드백

- 서비스 요청

- 기타

- 마케팅 & 판매

- 제안서

- RFP 답변서

- 조사 결과

- 캠페인 자료

- 기타

- 공급망과 물류

- 주문서

- 납품서

- 선하증권

- 출하 명세서

- 기타

제13장 문서 AI 시장 : 산업별

- 은행, 금융서비스 및 보험(BFSI)

- 수송 및 물류

- 헬스케어 & 생명과학

- 정부 및 공공 부문

- 소매 및 E커머스

- 제조

- 에너지 및 유틸리티

- 통신

- 교육

- 기타

제14장 문서 AI 시장 : 지역별

- 북미

- 시장 성장 촉진요인

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 시장 성장 촉진요인

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 시장 성장 촉진요인

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 싱가포르

- 기타

- 중동 및 아프리카

- 시장 성장 촉진요인

- 거시경제 전망

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 카타르

- 기타

- 라틴아메리카

- 시장 성장 촉진요인

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제15장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 제품 비교

- 기업평가와 재무지표

- 기업 평가 매트릭스 : 주요 기업

- 기업평가 매트릭스: 스타트업/중소기업

- 경쟁 시나리오

제16장 기업 프로파일

- 지능형 문서 처리

- 주요 기업

- 기타 기업

- 생성형 AI 문서 생성

- 주요 기업

제17장 인접 시장과 관련 시장

제18장 부록

SHW 26.01.06The global Document AI market is anticipated to grow at a compound annual growth rate (CAGR) of 13.5% over the forecast period, from an estimated USD 14.66 billion in 2025 to USD 27.62 billion by 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, document type, use case, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

The market is growing as adaptive document learning models enable systems to self-improve through real-time user feedback, reducing the need for manual retraining and improving accuracy across diverse document formats. Also, graph-based document intelligence is enhancing contextual understanding by linking entities and relationships within multi-page documents, which is particularly valuable for legal, insurance, and compliance workflows. However, limited standardization of document data formats across industries continues to restrain interoperability and hinders seamless model deployment at scale.

"IDP solutions dominate the Document AI market as enterprises prioritize end-to-end automation and compliance-ready data processing"

Intelligent Document Processing (IDP) solutions are projected to hold the largest market share in the Document AI market, driven by their ability to deliver complete automation across unstructured and semi-structured document workflows. IDP platforms integrate OCR, NLP, and machine learning to extract, classify, and validate data from invoices, forms, contracts, and compliance documents with high accuracy. Enterprises in sectors such as banking, insurance, and healthcare are adopting IDP to accelerate document turnaround times, reduce manual data entry, and maintain audit-ready digital records. The rapid expansion of remote operations and paperless initiatives has further increased demand for cloud-based IDP platforms. Vendors like UiPath, ABBYY, and Kofax are enhancing IDP solutions with generative AI, RPA integration, and pre-trained models for specific domains, enabling faster deployments and higher ROI. Additionally, the growing need for explainable AI and data lineage capabilities aligns with regulatory compliance requirements, reinforcing IDP's position as the preferred foundation for enterprise-scale document automation.

"Unstructured documents lead the Document AI market as enterprises automate complex, high-volume content processing"

Unstructured document types are expected to hold the largest market share in the Document AI market, reflecting the growing need to process emails, contracts, reports, handwritten notes, and multimedia-rich records that lack fixed templates. Across industries such as banking, healthcare, and government, most enterprise data remains unstructured, creating a significant demand for advanced AI models capable of understanding variable document formats. Recent advancements in layout-aware transformers, multimodal AI, and natural language understanding are allowing Document AI systems to accurately extract contextual information from text, tables, and images simultaneously. Vendors like Google, Microsoft, and AWS have expanded their solutions to handle multi-format documents using pre-trained models fine-tuned for specific industries. The adoption of unstructured document processing is also being accelerated by compliance-driven automation and data governance requirements, particularly for audit trails and customer communications. As enterprises focus on digitizing legacy archives and enabling searchable document repositories, unstructured document intelligence has become central to driving efficiency, improving decision-making, and ensuring regulatory transparency across large-scale digital ecosystems.

"Asia Pacific to witness rapid growth fueled by innovation and evolving strategies, while North America leads in market size"

The Document AI market exhibits strong regional differences, with the Asia Pacific region predicted to grow the fastest due to the rapid digital transformation in countries such as India, Indonesia, and Vietnam, supported by initiatives like Digital India and Japan's Society 5.0. Businesses are increasingly investing in cloud-based Document AI and IDP solutions to automate workflows in BFSI, healthcare, logistics, and government, driven by the need for multilingual OCR and natural language processing capabilities. The rise of fintech, digital payments, and e-governance is also driving the need for document automation in compliance, onboarding, and identity verification. Meanwhile, North America is expected to lead in 2025, thanks to its advanced infrastructure, early adoption, and vendors such as Google, Microsoft, AWS, IBM, and Adobe. Strict regulations, such as HIPAA, SOX, and GDPR, are driving the adoption of AI-driven compliance and audit solutions, particularly in the finance, insurance, and healthcare sectors, which utilize AI for classification, contract analysis, and claims processing. The integration of generative AI, RAG, and explainability models enhances document accuracy and understanding. Thus, North America's innovation and Asia Pacific's digital growth are jointly shaping the global Document AI landscape, driving market expansion.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the market.

- By Company: Tier I - 33%, Tier II - 44%, and Tier III - 23%

- By Designation: Directors - 36%, Managers - 41%, and others - 23%

- By Region: North America - 39%, Europe - 18%, Asia Pacific - 32%, Middle East & Africa - 4%, and Latin America - 7%

The report includes the study of key players offering solutions and services. It profiles major vendors in the Document AI market. The major players in the Document AI market include Google (US), Microsoft (US), SAP (Germany), IBM (US), AWS (US), Oracle (US), Adobe (US), ABBYY (US), Automation Anywhere (US), UiPath (US), Appian (US), H2O.ai (US), EdgeVerve (India), Super.ai (US), Rossum (UK), Tungsten Automation (US), OpenText (Canada), Hyland (US), Hyperscience (US), EXL (US), Snowflake (US), Salesforce (US), Grooper (US), DocDigitizer (US), Cinnamon (Japan), Docugami (US), Mistral AI (France), Upstage (US), DocByte (Belgium), Infrrd (US), Docketry (US), OpenAI (US), Gamma (US), AidocMaker (US), Anthropic (US), Checkbox (US), Docubee (US), DocuPilot (US), Docsumo (US), Formstack (US), HyperWrite (US), Lindy (US), QuillBot (US), and Scribe (US).

Research coverage

This research report covers the Document AI market, which has been segmented by offering, document type, use cases, and vertical. The offering segment is split into solutions and services. The solutions segment is further split into IDP, Document Workflow Automation, Generative AI Document Generation, and ECM & Governance Tools. Services are segmented into professional and managed services. The market, by document type, includes structured, unstructured, semi-structured, and multimodal/mixed content. Use cases include finance & accounting, legal & compliance, customer service, marketing & sales, HR, and supply chain & logistics. The verticals covered are BFSI, healthcare & life sciences, government & public sector, retail & e-commerce, manufacturing, energy & utilities, telecommunications, transportation & logistics, education, and other verticals. The regional analysis covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (advancements in OCR+NER fusion pipelines delivering higher precision, growth of e-signature and e-workflow ecosystems tying documents to transactions, marketplace bundling of capture tools with analytics and BI tools), restraints (cross-border data residency limits for model training and telemetry, high annotation cost for rare and long-tail templates), opportunities (synthetic-document marketplaces for niche training datasets, generative-assisted contract drafting integrated with clause libraries, auto-remediation engines that self-heal extraction errors through feedback loops), and challenges (maintaining extraction stability as templates and forms evolve, securing annotation supply chains against malicious or low-quality labels)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches

- Market Development: Comprehensive information about lucrative markets-the report analyses the Document AI market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like Google (US), Microsoft (US), SAP (Germany), IBM (US), AWS (US), Oracle (US), Adobe (US), ABBYY (US), Automation Anywhere (US), UiPath (US), Appian (US), H2O.ai (US), EdgeVerve (India), Super.ai (US), Rossum (UK), Tungsten Automation (US), OpenText (Canada), Hyland (US), Hyperscience (US), EXL (US), Snowflake (US), Salesforce (US), Grooper (US), DocDigitizer (US), Cinnamon (Japan), Docugami (US), Mistral AI (France), Upstage (US), DocByte (Belgium), Infrrd (US), Docketry (US), OpenAI (US), Gamma (US), AidocMaker (US), Anthropic (US), Checkbox (US), Docubee (US), DocuPilot (US), Docsumo (US), Formstack (US), HyperWrite (US), Lindy (US), QuillBot (US), and Scribe (US)

The report also helps stakeholders understand the pulse of the Document AI market, providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DOCUMENT AI MARKET

- 4.2 DOCUMENT AI MARKET, BY SOLUTION

- 4.3 NORTH AMERICA: DOCUMENT AI MARKET, BY TOP SOLUTIONS AND DOCUMENT TYPES

- 4.4 DOCUMENT AI MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in OCR+NER fusion pipelines delivering higher precision

- 5.2.1.2 Growth of e-signature and e-workflow ecosystems tying documents to transactions

- 5.2.1.3 Marketplace bundling of capture tools with analytics and BI tools

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cross-border data residency limits for model training and telemetry

- 5.2.2.2 High annotation cost for rare and long-tail templates

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Synthetic-document marketplaces for niche training datasets

- 5.2.3.2 Generative-assisted contract drafting integrated with clause libraries

- 5.2.3.3 Auto-remediation engines that self-heal extraction errors through feedback loops

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintaining extraction stability as templates and forms evolve

- 5.2.4.2 Securing annotation supply chains against malicious or low-quality labels

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN DOCUMENT AI MARKET

- 5.3.2 WHITE-SPACE OPPORTUNITIES IN DOCUMENT AI MARKET

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.5.1 KEY MOVES AND STRATEGIC FOCUS

- 5.6 TRANSITION FROM DOCUMENT PROCESSING TO ENTERPRISE KNOWLEDGE INTELLIGENCE

- 5.7 MOVEMENT TOWARD AUTONOMOUS DOCUMENT WORKFLOWS

- 5.8 AI GOVERNANCE AND ETHICAL CONSIDERATIONS IN DOCUMENT AI ADOPTION

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITION RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 EVOLUTION OF DOCUMENT AI

- 6.4 ECOSYSTEM ANALYSIS

- 6.4.1 INTELLIGENT DOCUMENT PROCESSING PROVIDERS

- 6.4.2 GEN AI DOCUMENT GENERATION PROVIDERS

- 6.4.3 DOCUMENT WORKFLOW AUTOMATION PROVIDERS

- 6.4.4 ECM & GOVERNANCE PROVIDERS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 6.5.2 AVERAGE SELLING PRICE, BY USE CASE, 2025

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 VERYFI ENABLES KOLLWITZOWEN TO PROVIDE FAIR PROMOTIONS WITH INSTANT RECEIPT VALIDATIONS

- 6.7.2 INFRRD AI TRANSFORMS MEDTECH LEADER'S PURCHASE ORDER PROCESSING BY AUTOMATING MULTI-LANGUAGE DOCUMENTS

- 6.7.3 DOCSUMO ACCELERATES NS TRUCKING'S DISPATCH TICKET PROCESSING BY 4X WITH AI DATA EXTRACTION

- 6.7.4 INDICO DATA CUTS GLOBAL SPECIALTY INSURER'S SUBMISSION PROCESSING TIME TO UNDER 30 SECONDS WITH AI AUTOMATION

- 6.7.5 ROSSUM BOOSTS VEOLIA'S INVOICE PROCESSING SPEED BY 8X WITH AI-DRIVEN WORKFLOW AUTOMATION

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 OCR

- 7.1.2 NLP

- 7.1.3 COMPUTER VISION

- 7.1.4 NEURAL NETWORKS

- 7.1.5 LLM

- 7.1.6 KNOWLEDGE GRAPHS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 RPA

- 7.2.2 CLOUD COMPUTING

- 7.2.3 DATA ANNOTATION AND LABELING

- 7.2.4 CYBERSECURITY

- 7.2.5 DATABASE & DATA LAKE TECHNOLOGIES

- 7.3 ADJACENT TECHNOLOGIES

- 7.3.1 SPEECH-TO-TEXT AND VOICE RECOGNITION

- 7.3.2 DIGITAL IDENTITY VERIFICATION

- 7.3.3 BLOCKCHAIN

- 7.3.4 INTERNET OF THINGS (IOT)

- 7.3.5 AUGMENTED AND VIRTUAL REALITY (AR/VR)

- 7.4 PATENT ANALYSIS

- 7.4.1 METHODOLOGY

- 7.4.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 7.4.3 INNOVATION AND PATENT APPLICATIONS

- 7.5 FUTURE APPLICATIONS

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATIONS

- 8.1.2.1 North America

- 8.1.2.1.1 Executive Order 14110 on Safe, Secure, and Trustworthy AI (US)

- 8.1.2.1.2 Artificial Intelligence and Data Act-AIDA (Canada)

- 8.1.2.2 Europe

- 8.1.2.2.1 Europe Artificial Intelligence Act (European Union)

- 8.1.2.2.2 General Data Protection Regulation (European Union)

- 8.1.2.2.3 Data Protection Act 2018 (UK)

- 8.1.2.2.4 Federal Data Protection Act (Germany)

- 8.1.2.2.5 French Data Protection Act (France)

- 8.1.2.2.6 Personal Data Protection Code-Legislative Decree 196/2003 (Italy)

- 8.1.2.2.7 Organic Law 3/2018 (Spain)

- 8.1.2.2.8 UAVG and Public-Sector Algorithm Transparency (Netherlands)

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 Interim Measures for the Management of Generative AI Services (China)

- 8.1.2.3.2 Digital Personal Data Protection Act, 2023 (India)

- 8.1.2.3.3 Act on the Protection of Personal Information (Japan)

- 8.1.2.3.4 Basic Act on Artificial Intelligence (South Korea)

- 8.1.2.3.5 Personal Data Protection Act (Singapore)

- 8.1.2.4 Middle East & Africa

- 8.1.2.4.1 Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (UAE)

- 8.1.2.4.2 Personal Data Protection Law (KSA)

- 8.1.2.4.3 Protection of Personal Information Act (South Africa)

- 8.1.2.4.4 Personal Data Privacy Protection Law (Qatar)

- 8.1.2.4.5 Law on the Protection of Personal Data No. 6698 (Turkey)

- 8.1.2.5 Latin America

- 8.1.2.5.1 General Data Protection Law - LGPD (Brazil)

- 8.1.2.5.2 Federal Law on Protection of Personal Data Held by Private Parties (Mexico)

- 8.1.2.5.3 Personal Data Protection Law No. 25,326 (Argentina)

- 8.1.2.1 North America

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.1.1 STRATEGIC EVALUATION AND BUSINESS CASE ALIGNMENT

- 9.1.2 TECHNICAL VALIDATION AND VENDOR DIFFERENTIATION

- 9.1.3 PROCUREMENT, CHANGE MANAGEMENT, AND LONG-TERM VALUE REALIZATION

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USER VERTICALS

- 9.5 MARKET PROFITABILITY

10 DOCUMENT AI MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.1.1 DRIVERS: DOCUMENT AI MARKET, BY OFFERING

- 10.2 SOLUTIONS

- 10.2.1 IDP

- 10.2.1.1 Enabling high-accuracy extraction and automation of unstructured data

- 10.2.2 DOCUMENT WORKFLOW AUTOMATION

- 10.2.2.1 Bridging IDP and business operations for seamless processing

- 10.2.3 GEN AI DOCUMENT GENERATION

- 10.2.3.1 Redefining content creation and document authoring workflows

- 10.2.4 ECM & GOVERNANCE TOOLS

- 10.2.4.1 Ensuring security, compliance, and structured document management

- 10.2.1 IDP

- 10.3 SERVICES

- 10.3.1 PROFESSIONAL SERVICES

- 10.3.1.1 Enabling seamless implementation and strategic alignment of Document AI

- 10.3.1.2 Consulting & advisory

- 10.3.1.3 Deployment & integration

- 10.3.1.4 Support & training

- 10.3.2 MANAGED SERVICES

- 10.3.2.1 Enabling scalable and cost-effective Document AI operations

- 10.3.1 PROFESSIONAL SERVICES

- 10.4 DEPLOYMENT MODE

- 10.4.1 CLOUD

- 10.4.1.1 Accelerating time-to-value and global scalability of Document AI

- 10.4.2 ON-PREMISES

- 10.4.2.1 Essential for data-sensitive and regulated industries

- 10.4.1 CLOUD

11 DOCUMENT AI MARKET, BY DOCUMENT TYPE

- 11.1 INTRODUCTION

- 11.1.1 DRIVERS: DOCUMENT AI MARKET, BY DOCUMENT TYPE

- 11.2 STRUCTURED

- 11.2.1 DRIVING HIGH-VOLUME, HIGH-ACCURACY AUTOMATION AT SCALE

- 11.3 UNSTRUCTURED

- 11.3.1 POWERING NEXT WAVE OF INTELLIGENT DOCUMENT UNDERSTANDING

- 11.4 SEMI-STRUCTURED

- 11.4.1 BRIDGING RULE-BASED AUTOMATION AND ADAPTIVE AI MODELS

- 11.5 MULTIMODAL/MIXED CONTENT

- 11.5.1 UNLOCKING NEW FRONTIERS IN COMPLEX DATA UNDERSTANDING

12 DOCUMENT AI MARKET, BY USE CASE

- 12.1 INTRODUCTION

- 12.1.1 DRIVERS: DOCUMENT AI MARKET, BY USE CASE

- 12.2 FINANCE & ACCOUNTING

- 12.2.1 INVOICES & TAX FORMS

- 12.2.1.1 Streamlining payables with intelligent data extraction and validation

- 12.2.2 RECEIPTS & REIMBURSEMENT CLAIMS

- 12.2.2.1 Accelerating employee expense management through automated capture

- 12.2.3 BANK STATEMENTS

- 12.2.3.1 Enabling transparent financial reconciliation and anomaly detection

- 12.2.4 FINANCIAL REPORTS & REGULATORY FILINGS

- 12.2.4.1 Ensuring compliance and accuracy in complex disclosures

- 12.2.5 EXPENSE FORMS

- 12.2.5.1 Reducing manual entry and policy violations through context-aware automation

- 12.2.6 OTHER FINANCE & ACCOUNTING USE CASES

- 12.2.1 INVOICES & TAX FORMS

- 12.3 HR

- 12.3.1 RESUMES/CVS

- 12.3.1.1 Accelerating talent acquisition with AI-driven resume intelligence

- 12.3.2 ONBOARDING DOCUMENTS

- 12.3.2.1 Streamlining employee onboarding with intelligent document automation

- 12.3.3 PAYROLL

- 12.3.3.1 Automating payroll documentation for compliance and accuracy

- 12.3.4 POLICY DOCUMENT

- 12.3.4.1 Enforcing policy compliance through AI-driven document governance

- 12.3.5 OTHER HR USE CASES

- 12.3.1 RESUMES/CVS

- 12.4 LEGAL & COMPLIANCE

- 12.4.1 CONTRACTS

- 12.4.1.1 Automating contract lifecycle management for speed and risk reduction

- 12.4.2 AGREEMENTS

- 12.4.2.1 Streamlining agreement validation and compliance auditing through AI

- 12.4.3 NDAS

- 12.4.3.1 Enhancing confidentiality governance with automated NDA monitoring

- 12.4.4 REGULATORY FILINGS

- 12.4.4.1 Accelerating regulatory compliance through AI-enabled document intelligence

- 12.4.5 COMPLIANCE REPORTS

- 12.4.5.1 Ensuring continuous audit readiness with automated compliance documentation

- 12.4.6 OTHER LEGAL & COMPLIANCE USE CASES

- 12.4.1 CONTRACTS

- 12.5 CUSTOMER SERVICE

- 12.5.1 KYC DOCUMENTS

- 12.5.1.1 Accelerating customer verification and compliance through AI-powered KYC automation

- 12.5.2 CLAIM FORMS

- 12.5.2.1 Streamlining claim processing through context-aware document understanding

- 12.5.3 CUSTOMER FEEDBACK

- 12.5.3.1 Turning unstructured customer feedback into actionable insights with AI

- 12.5.4 SERVICE REQUEST

- 12.5.4.1 Automating service request handling for faster and more personalized support

- 12.5.5 OTHER CUSTOMER SERVICE USE CASES

- 12.5.1 KYC DOCUMENTS

- 12.6 MARKETING & SALES

- 12.6.1 PROPOSALS

- 12.6.1.1 Streamlining proposal creation and review with AI-powered document intelligence

- 12.6.2 RFP RESPONSES

- 12.6.2.1 Accelerating RFP lifecycle management with intelligent document automation

- 12.6.3 SURVEY RESULTS

- 12.6.3.1 Transforming customer insights from survey documents into strategic intelligence

- 12.6.4 CAMPAIGN COLLATERAL

- 12.6.4.1 Optimizing marketing content management with AI-driven document structuring

- 12.6.5 OTHER MARKETING & SALES USE CASES

- 12.6.1 PROPOSALS

- 12.7 SUPPLY CHAIN & LOGISTICS

- 12.7.1 PURCHASE ORDERS

- 12.7.1.1 Automating procurement approvals and supplier coordination with intelligent PO processing

- 12.7.2 DELIVERY NOTES

- 12.7.2.1 Streamlining goods receipt and verification through automated delivery note processing

- 12.7.3 BILLS OF LADING

- 12.7.3.1 Ensuring shipping accuracy and regulatory compliance with intelligent bill of lading processing

- 12.7.4 SHIPMENT MANIFESTS

- 12.7.4.1 Enabling real-time cargo visibility and tracking with AI-enabled manifest digitization

- 12.7.5 OTHER SUPPLY CHAIN & LOGISTICS USE CASES

- 12.7.1 PURCHASE ORDERS

13 DOCUMENT AI MARKET, BY VERTICAL

- 13.1 INTRODUCTION

- 13.1.1 DRIVERS: DOCUMENT AI MARKET, BY VERTICAL

- 13.2 BFSI

- 13.2.1 MODERNIZING HIGH-VOLUME FINANCIAL DOCUMENTATION WITH AI-DRIVEN PRECISION

- 13.3 TRANSPORTATION & LOGISTICS

- 13.3.1 AUTOMATING SHIPMENT AND COMPLIANCE DOCUMENTATION FOR FASTER SUPPLY CHAIN FLOWS

- 13.4 HEALTHCARE & LIFE SCIENCES

- 13.4.1 IMPROVING CLINICAL ACCURACY AND ADMINISTRATIVE EFFICIENCY WITH DOCUMENT AI

- 13.5 GOVERNMENT & PUBLIC SECTOR

- 13.5.1 ACCELERATING ADMINISTRATIVE EFFICIENCY AND CITIZEN SERVICES THROUGH DOCUMENT INTELLIGENCE

- 13.6 RETAIL & E-COMMERCE

- 13.6.1 ENHANCING TRANSACTION SPEED AND CUSTOMER EXPERIENCE WITH AUTOMATED DOCUMENT FLOWS

- 13.7 MANUFACTURING

- 13.7.1 DRIVING PRODUCTION EFFICIENCY AND COMPLIANCE WITH AUTOMATED DOCUMENT INTELLIGENCE

- 13.8 ENERGY & UTILITIES

- 13.8.1 STRENGTHENING REGULATORY COMPLIANCE AND ASSET MANAGEMENT WITH AI-DRIVEN DOCUMENT PROCESSING

- 13.9 TELECOMMUNICATIONS

- 13.9.1 STREAMLINING SERVICE DOCUMENTATION AND REGULATORY PROCESSES THROUGH AUTOMATION

- 13.10 EDUCATION

- 13.10.1 EMPOWERING EDUCATIONAL EFFICIENCY THROUGH AI-DRIVEN DOCUMENT INTELLIGENCE

- 13.11 OTHER VERTICALS

14 DOCUMENT AI MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 NORTH AMERICA: DOCUMENT AI MARKET DRIVERS

- 14.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 14.2.3 US

- 14.2.3.1 Innovation leadership and regulatory maturity to drive market

- 14.2.4 CANADA

- 14.2.4.1 Public sector digitization and cloud adoption to drive market

- 14.3 EUROPE

- 14.3.1 EUROPE: DOCUMENT AI MARKET DRIVERS

- 14.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 14.3.3 UK

- 14.3.3.1 Early enterprise digitalization and regulatory clarity to strengthen market

- 14.3.4 GERMANY

- 14.3.4.1 Manufacturing leadership and data sovereignty to drive Document AI adoption

- 14.3.5 FRANCE

- 14.3.5.1 Public sector digitization and language localization to boost market

- 14.3.6 ITALY

- 14.3.6.1 Modernization of public administration and BFSI to drive market

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 ASIA PACIFIC: DOCUMENT AI MARKET DRIVERS

- 14.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 14.4.3 CHINA

- 14.4.3.1 National digital ecosystem and e-government push to fuel demand for Document AI

- 14.4.4 INDIA

- 14.4.4.1 Digital governance and rapid cloud adoption to power Document AI uptake

- 14.4.5 JAPAN

- 14.4.5.1 Workforce automation and paperless initiatives to drive Document AI adoption

- 14.4.6 SOUTH KOREA

- 14.4.6.1 High digital readiness and AI integration to fuel market

- 14.4.7 SINGAPORE

- 14.4.7.1 Innovation-led adoption and regulatory clarity to strengthen market

- 14.4.8 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 MIDDLE EAST & AFRICA: DOCUMENT AI MARKET DRIVERS

- 14.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 14.5.3 SAUDI ARABIA

- 14.5.3.1 National digitalization and Vision 2030 to catalyze Document AI ecosystem

- 14.5.4 UAE

- 14.5.4.1 Early government adoption and smart infrastructure programs to drive Document AI leadership

- 14.5.5 SOUTH AFRICA

- 14.5.5.1 Urban enterprise digitalization and BFSI modernization to fuel the market

- 14.5.6 QATAR

- 14.5.6.1 Vision 2030 and national digital infrastructure investments to market

- 14.5.7 REST OF MIDDLE EAST & AFRICA

- 14.6 LATIN AMERICA

- 14.6.1 LATIN AMERICA: DOCUMENT AI MARKET DRIVERS

- 14.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 14.6.3 BRAZIL

- 14.6.3.1 Strict e-invoicing regulations and tax modernization programs to drive market

- 14.6.4 MEXICO

- 14.6.4.1 Tax digitalization and e-signature expansion to accelerate Document AI adoption

- 14.6.5 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 PRODUCT COMPARISON

- 15.5.1 PRODUCT COMPARATIVE ANALYSIS, BY DOCUMENT AI SOLUTION TYPE (IDP)

- 15.5.1.1 Document AI (Google)

- 15.5.1.2 Azure AI Document Intelligence (Microsoft)

- 15.5.1.3 Amazon Textract & Comprehend (AWS)

- 15.5.1.4 ABBYY Vantage (ABBYY)

- 15.5.1.5 Kofax TotalAgility (Tungsten Automation)

- 15.5.2 PRODUCT COMPARATIVE ANALYSIS, BY DOCUMENT AI SOLUTION TYPE (DOCUMENT WORKFLOW AUTOMATION)

- 15.5.2.1 UiPath Document Understanding (UiPath)

- 15.5.2.2 IQ Bot (Automation Anywhere)

- 15.5.2.3 Intelligent Capture & Magellan (OpenText)

- 15.5.2.4 IBM Watson Discovery & Automation (IBM)

- 15.5.2.5 Intelligent Document Processing Platform (Infrrd)

- 15.5.3 PRODUCT COMPARATIVE ANALYSIS, BY DOCUMENT AI SOLUTION TYPE (GEN AI DOCUMENT GENERATION)

- 15.5.3.1 Gamma's intelligent formatting and design tools (Gamma)

- 15.5.3.2 GPT-4/ChatGPT Enterprise (OpenAI)

- 15.5.3.3 Gen AI-enhanced IDP (Docsumo)

- 15.5.3.4 AI Writing Suite (QuillBot)

- 15.5.3.5 Claude AI (Anthropic)

- 15.5.4 PRODUCT COMPARATIVE ANALYSIS, BY DOCUMENT AI SOLUTION TYPE (ECM & GOVERNANCE TOOLS)

- 15.5.4.1 AI-powered Process & Content Governance (Appian)

- 15.5.4.2 Document Data Governance Cloud (Snowflake)

- 15.5.4.3 XtractEdge for Document Governance (EdgeVerve)

- 15.5.4.4 OnBase & Alfresco ECM (Hyland)

- 15.5.4.5 Intelligent Digital Preservation Platform (Docbyte)

- 15.5.1 PRODUCT COMPARATIVE ANALYSIS, BY DOCUMENT AI SOLUTION TYPE (IDP)

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 IDP, DOCUMENT WORKFLOW AUTOMATION, AND ECM & GOVERNANCE TOOLS

- 15.7.1.1 Stars

- 15.7.1.2 Emerging leaders

- 15.7.1.3 Pervasive players

- 15.7.1.4 Participants

- 15.7.2 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.2.1 Company footprint

- 15.7.2.2 Regional footprint

- 15.7.2.3 Offering footprint

- 15.7.2.4 Use case footprint

- 15.7.2.5 Vertical footprint

- 15.7.3 GENERATIVE AI DOCUMENT GENERATION

- 15.7.3.1 Stars

- 15.7.3.2 Emerging leaders

- 15.7.3.3 Pervasive players

- 15.7.3.4 Participants

- 15.7.4 COMPANY FOOTPRINT: KEY PLAYERS (GENERATIVE AI DOCUMENT GENERATION), 2024

- 15.7.4.1 Company footprint

- 15.7.4.2 Regional footprint

- 15.7.4.3 Offering footprint

- 15.7.4.4 Use case footprint

- 15.7.4.5 Vertical footprint

- 15.7.1 IDP, DOCUMENT WORKFLOW AUTOMATION, AND ECM & GOVERNANCE TOOLS

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 IDP, DOCUMENT WORKFLOW AUTOMATION, ECM & GOVERNANCE TOOLS

- 15.8.1.1 Progressive Companies

- 15.8.1.2 Responsive companies

- 15.8.1.3 Dynamic companies

- 15.8.1.4 Starting blocks

- 15.8.2 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.2.1 Detailed list of key startups/SMEs

- 15.8.2.2 Competitive benchmarking of key startups/SMEs

- 15.8.1 IDP, DOCUMENT WORKFLOW AUTOMATION, ECM & GOVERNANCE TOOLS

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 15.9.2 DEALS

16 COMPANY PROFILES

- 16.1 INTRODUCTION

- 16.2 INTELLIGENT DOCUMENT PROCESSING

- 16.2.1 KEY PLAYERS

- 16.2.1.1 Google

- 16.2.1.1.1 Business overview

- 16.2.1.1.2 Products/Solutions/Services offered

- 16.2.1.1.3 Recent developments

- 16.2.1.1.3.1 Product launches and enhancements

- 16.2.1.1.3.2 Deals

- 16.2.1.1.4 MnM view

- 16.2.1.1.4.1 Key strengths

- 16.2.1.1.4.2 Strategic choices

- 16.2.1.1.4.3 Weaknesses and competitive threats

- 16.2.1.2 Microsoft

- 16.2.1.2.1 Business overview

- 16.2.1.2.2 Products/Solutions/Services offered

- 16.2.1.2.3 Recent developments

- 16.2.1.2.3.1 Product launches and enhancements

- 16.2.1.2.3.2 Deals

- 16.2.1.2.4 MnM view

- 16.2.1.2.4.1 Key strengths

- 16.2.1.2.4.2 Strategic choices

- 16.2.1.2.4.3 Weaknesses and competitive threats

- 16.2.1.3 Hyland

- 16.2.1.3.1 Business overview

- 16.2.1.3.2 Products/Solutions/Services offered

- 16.2.1.3.3 Recent developments

- 16.2.1.3.3.1 Product launches and enhancements

- 16.2.1.3.3.2 Deals

- 16.2.1.3.4 MnM view

- 16.2.1.3.4.1 Key strengths

- 16.2.1.3.4.2 Strategic choices

- 16.2.1.3.4.3 Weaknesses and competitive threats

- 16.2.1.4 IBM

- 16.2.1.4.1 Business overview

- 16.2.1.4.2 Products/Solutions/Services offered

- 16.2.1.4.3 Recent developments

- 16.2.1.4.3.1 Product launches and enhancements

- 16.2.1.4.3.2 Deals

- 16.2.1.4.4 MnM view

- 16.2.1.4.4.1 Key strengths

- 16.2.1.4.4.2 Strategic choices

- 16.2.1.4.4.3 Weaknesses and competitive threats

- 16.2.1.5 AWS

- 16.2.1.5.1 Business overview

- 16.2.1.5.2 Products/Solutions/Services offered

- 16.2.1.5.3 Recent developments

- 16.2.1.5.3.1 Product launches and enhancements

- 16.2.1.5.3.2 Deals

- 16.2.1.5.4 MnM view

- 16.2.1.5.4.1 Key strengths

- 16.2.1.5.4.2 Strategic choices

- 16.2.1.5.4.3 Weaknesses and competitive threats

- 16.2.1.6 Snowflake

- 16.2.1.6.1 Business overview

- 16.2.1.6.2 Products/Solutions/Services offered

- 16.2.1.6.3 Recent developments

- 16.2.1.6.3.1 Product launches and enhancements

- 16.2.1.6.3.2 Deals

- 16.2.1.7 Oracle

- 16.2.1.7.1 Business overview

- 16.2.1.7.2 Products/Solutions/Services offered

- 16.2.1.7.3 Recent developments

- 16.2.1.7.3.1 Product launches and enhancements

- 16.2.1.7.3.2 Deals

- 16.2.1.7.3.3 Other developments

- 16.2.1.8 Adobe

- 16.2.1.8.1 Business overview

- 16.2.1.8.2 Products/Solutions/Services offered

- 16.2.1.8.3 Recent developments

- 16.2.1.8.3.1 Product launches and enhancements

- 16.2.1.8.3.2 Deals

- 16.2.1.9 ABBYY

- 16.2.1.9.1 Business overview

- 16.2.1.9.2 Products/Solutions/Services offered

- 16.2.1.9.3 Recent developments

- 16.2.1.9.3.1 Product launches and enhancements

- 16.2.1.9.3.2 Deals

- 16.2.1.10 Automation Anywhere

- 16.2.1.10.1 Business overview

- 16.2.1.10.2 Products/Solutions/Services offered

- 16.2.1.10.3 Recent developments

- 16.2.1.10.3.1 Product launches and enhancements

- 16.2.1.10.3.2 Deals

- 16.2.1.11 UiPath

- 16.2.1.11.1 Business overview

- 16.2.1.11.2 Products/Solutions/Services offered

- 16.2.1.11.3 Recent developments

- 16.2.1.11.3.1 Product launches and enhancements

- 16.2.1.11.3.2 Deals

- 16.2.1.12 Appian

- 16.2.1.12.1 Business overview

- 16.2.1.12.2 Products/Solutions/Services offered

- 16.2.1.12.3 Recent developments

- 16.2.1.12.3.1 Product launches and enhancements

- 16.2.1.12.3.2 Deals

- 16.2.1.13 EdgeVerve (Infosys)

- 16.2.1.14 Tungsten Automation

- 16.2.1.15 OpenText

- 16.2.1.16 SAP

- 16.2.1.17 EXL

- 16.2.1.18 Salesforce

- 16.2.1.19 H20.ai

- 16.2.1.20 Scribe

- 16.2.1.21 Docketry

- 16.2.1.22 Cohere

- 16.2.1.1 Google

- 16.2.2 OTHER PLAYERS

- 16.2.2.1 Grooper

- 16.2.2.2 Hyperscience

- 16.2.2.3 DocDigitizer

- 16.2.2.4 Super.ai

- 16.2.2.5 Cinnamon AI

- 16.2.2.6 Docugami

- 16.2.2.7 DocByte

- 16.2.2.8 Infrrd

- 16.2.2.9 Rossum

- 16.2.2.10 Docubee

- 16.2.2.11 Docsumo

- 16.2.2.12 Checkbox

- 16.2.2.13 Mindee

- 16.2.1 KEY PLAYERS

- 16.3 GENERATIVE AI DOCUMENT GENERATION

- 16.3.1 KEY PLAYERS

- 16.3.1.1 OpenAI

- 16.3.1.1.1 Business overview

- 16.3.1.1.2 Products/Solutions/Services offered

- 16.3.1.1.3 Recent developments

- 16.3.1.1.3.1 Product launches and enhancements

- 16.3.1.1.3.2 Deals

- 16.3.1.2 Gamma

- 16.3.1.3 Upstage

- 16.3.1.4 Aidocmaker

- 16.3.1.5 Anthropic

- 16.3.1.6 Mistral AI

- 16.3.1.7 DocuPilot

- 16.3.1.8 Intellistack

- 16.3.1.9 HyperWrite (OthersideAI)

- 16.3.1.10 Lindy

- 16.3.1.11 QuillBot

- 16.3.1.1 OpenAI

- 16.3.1 KEY PLAYERS

17 ADJACENT AND RELATED MARKETS

- 17.1 INTRODUCTION

- 17.2 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 17.2.1 MARKET DEFINITION

- 17.2.2 MARKET OVERVIEW

- 17.2.2.1 Artificial intelligence (AI) market, by offering

- 17.2.2.2 Artificial intelligence (AI) market, by technology

- 17.2.2.3 Artificial intelligence (AI) market, by business function

- 17.2.2.4 Artificial intelligence (AI) market, by enterprise application

- 17.2.2.5 Artificial intelligence (AI) market, by end user

- 17.2.2.6 Artificial intelligence (AI) market, by region

- 17.3 AI DETECTOR MARKET - GLOBAL FORECAST TO 2030

- 17.3.1 MARKET DEFINITION

- 17.3.2 MARKET OVERVIEW

- 17.3.2.1 AI detector market, by offering

- 17.3.2.2 AI detector market, by detection modality

- 17.3.2.3 AI detector market, by application

- 17.3.2.4 AI detector market, by end user

- 17.3.2.5 AI detector market, by region

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS