|

시장보고서

상품코드

1901399

식품 포장 시장 : 재료별, 포장 유형별, 형태별, 기술별, 식품 유형별, 용도별, 지역별 예측Food Packaging Market by Material, Packaging Type, Format, Technology, Food Type, Application, Region - Global Forecast to 2030 |

||||||

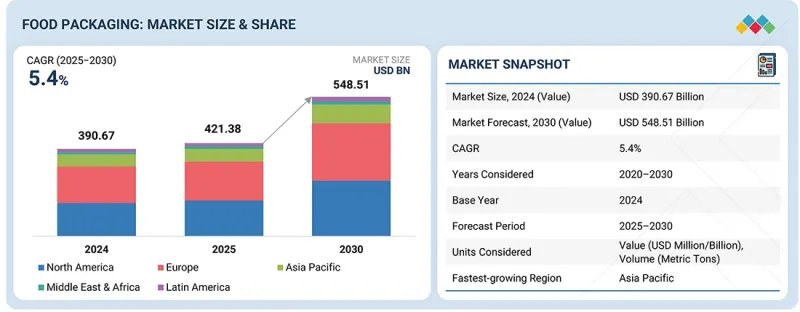

세계의 식품 포장 시장의 규모는 2025년에 4,213억 8,000만 달러를 달성하였고, 2030년까지 5,485억 1,000만 달러에 이를 것으로 예측되며, 예측기간 동안 CAGR 5.4%의 성장이 예상됩니다.

포장은 신선도 유지, 보존 기간 연장, 안전한 운송 확보에 중요한 역할을 하기 때문에 식품 포장 시장은 상당한 성장을 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2025-2030년 |

| 기준연도 | 2024년 |

| 예측기간 | 2025-2030년 |

| 단위 | 달러, 미터톤 |

| 부문 | 재료, 포장 유형, 형태, 기술, 식품 유형, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

식품의 편의성, 안전성, 지속 가능성에 대한 소비자 수요가 증가함에 따라 시장은 다양한 지역에서 확대되고 있으며, 신흥 경제권에서는 특히 강한 성장 가능성이 예상됩니다. 기술 진보, 규제 지원, 업계 주요 기업의 혁신은 다양한 용도에서 식품 포장 채택을 더욱 촉진하고 있으며, 이 부문은 역동적이고 빠르게 진화하고 있습니다.

"육류, 닭고기, 해산물 용도 부문이 예측기간 동안 현저한 CAGR을 나타낼 것으로 추정됩니다."

육류, 닭고기, 해산물 부문이 예측기간 동안 식품 포장 시장에서 대폭 성장할 전망입니다. 이러한 성장은 세계적인 동물성 단백질 소비 증가와 복잡한 공급망 전체에서 요구되는 신선도, 품질, 안전성 유지에 의해 발생할 전망입니다. 진공 스킨 포장(VSP), 가스 치환 포장(MAP), 고차단성 필름 등의 포장 솔루션은 신선한 단백질 제품의 보존 기간 연장과 부패 방지를 위해 빠르게 채택되고 있습니다. 특히 냉장 및 냉동육 제품에 대한 콜드체인 물류와 전자상거래 식료품 유통 채널이 확대되는 가운데, 내구성, 내열성, 위변조 방지 기능을 갖춘 포장 형태에 대한 수요가 현저하게 높아지고 있습니다. 또한 환경 기준과 식품 안전 기준을 모두 충족하는 재활용 가능한 트레이, 단일 소재 필름 및 바이오 플라스틱으로의 전환이 진행되고 있으며 지속 가능성도 이 부문의 재구성에 중요한 역할을 합니다. 포장 기술의 지속적인 혁신과 위생 및 추적성에 대한 규제 강화가 진행됨에 따라, 육류, 닭고기, 해산물 부문은 세계의 식품 포장 업계에서 가장 역동적이고 중요한 성장 분야 중 하나입니다.

"포장 유형별로 백 부문이 견조한 성장을 유지할 것으로 예측됩니다."

가벼운 구조, 재료 효율성 및 다양한 식품 카테고리에 대한 적응성으로 인해, 백은 식품 포장 시장에서 점점 더 선호되고 있습니다. 백은 고속 충전 시스템 및 자동 포장 라인과의 호환성으로 대규모 식품 생산에 이상적입니다. 재밀봉 가능한 지퍼가 달린 백과 필로우 백은 스낵, 베이커리 제품, 냉동 식품, 신선 식품 등 건조 및 반유동성 제품에 뛰어난 기능을 제공합니다. 첨단 차단성에 의해 장기 보존을 가능하게 하면서, 소비자의 편리성과 보관의 용이함을 실현하고 있습니다. 동시에, 지속 가능성에 대한 노력은 성능을 저하시키지 않으면서 재활용 목표를 달성하는 종이 및 단일 소재로 만들어진 백 설계의 혁신을 촉진하고 있습니다. 조리 식품의 지속적인 성장, EC 식료품 배송, 지속 가능성을 중시한 포장 전환의 흐름으로 인해, 소재 혁신과 유연하고 효율적인 포장 솔루션에 대한 수요 증가에 힘입어 백 부문은 견조한 성장을 유지할 것으로 예측됩니다.

"북미가 세계의 식품 포장 시장에서 큰 점유율을 차지할 것으로 추정됩니다."

북미는 대규모 식품 및 음료산업, 식품 접촉 재료와 안전성에 관한 엄격한 규제기준, 포장 식품의 편리성, 신선도, 지속 가능성에 대한 소비자 수요 증가에 의해 세계의 식품 포장 시장에서 큰 점유율을 차지할 것으로 예측되고 있습니다. 이 지역은 제조 인프라 확립, 첨단 포장 기술, 재생재료 활용, 보존기간 연장, 경량화 솔루션 등의 혁신에 적극적으로 투자하는 주요 세계 기업의 존재로 혜택을 받고 있습니다. 2024년 4월, Amcor Plc는 위스콘신 주 오슈코시에서 북미 역사상 최대 규모의 유제품 부문용 인쇄 및 가공 능력 확장 계획을 발표했습니다. 이는 식품 용도를 위한 연질 포장과 지속 가능한 형태를 위한 노력입니다. 또한 2024년 3월에는 Stonyfield Organic과의 공동 개발로 북미 최초로 전체 폴리에틸렌(PE) 스파우트 파우치를 도입했습니다. 이는 다층 구조를 재활용성을 고려한 단일 소재 필름으로 대체한 제품입니다. 이러한 움직임은 식품 포장 부문에서 혁신의 추진과 생산 확대에 있어 이 지역이 전략적 역할을 담당하고 있음을 보여줍니다. 따라서, 북미는 앞으로도 세계의 식품 포장 시장의 성장에 크게 기여할 전망입니다.

이 보고서는 세계의 식품 포장 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 제품 개발 및 혁신 및 경쟁 구도에 대한 인사이트를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요한 인사이트

- 식품 포장 시장의 기업에게 매력적인 기회

- 식품 포장 시장 : 재료별, 지역별

- 식품 포장 시장 : 금속 유형별

- 식품 포장 시장 : 용도별

- 식품 포장 시장 : 기술별

- 식품 포장 시장 : 국가별

제4장 시장 개요

- 식품 포장 시장 : 촉진요인, 억제요인, 기회, 과제

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구 및 사업 기회

- 연관 시장 및 부문 간 기회

- 농업 및 식품 가공

- 재료 및 화학제품

- 물류, 소매, 전자상거래

- 기술 및 디지털화

- 폐기물 관리 및 순환형 경제

- 에너지와 제조의 시너지 효과

- Tier 1, 2, 3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 도시화와 도시 인구 밀도의 상승

- 가처분 소득과 가계 소비 지출의 성장

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 수요측

- 공급측

- 가격 설정 분석

- 평균 판매 가격 동향 : 재료별

- 평균 판매 가격 동향 : 지역별

- 무역 분석

- HS코드 3923의 무역 분석 : 플라스틱제 상품 운송 또는 포장 용품

- HS코드 7010의 무역 분석 : 카보이, 병, 플라스크, 단지, 항아리, 약병, 앰플 및 기타 유리 용기(상품 운송 또는 포장용)

- HS코드 4819의 무역분석 : 식품 포장용 종이 및 판지 포장 용기

- 주요 회의 및 이벤트

- 고객 사업에 영향을 끼치는 동향

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 식품 포장 시장

- 주요 관세율

- 가격 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 사용 산업에 대한 영향

제6장 기술, 특허, 디지털, AI의 도입에 의한 전략적 파괴

- 주요 신기술

- 보완 기술

- 기술 및 제품 로드맵

- 특허 분석

- 미래 용도

- 식품 포장 시장에 대한 AI 및 생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 식품 포장 가공에서의 베스트 프랙티스

- 식품 포장 시장에서의 AI 도입 사례 연구

- 연관 인접 생태계와 시장 기업에 미치는 영향

- 식품 포장 시장에서 생성형 AI 채용에 대한 고객의 준비 상황

- 성공 사례와 실세계 응용

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 구매 프로세스의 주요 이해관계자

- 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 사용 산업에서의 미충족 요구

- 시장의 수익성

제8장 식품 포장 시장 : 재료별

- 플라스틱

- 종이 및 판지

- 유리

- 금속

- 기타 재료

제9장 식품 포장 시장 : 포장 유형별

- 백

- 파우치

- 병

- 단지

- 박스

- 기타 포장 유형

제10장 식품 포장 시장 : 형태별

- 연질

- 경질

- 반경질

제11장 식품 포장 시장 : 기술별

- 가스 치환 포장(MAP)

- 액티브 포장

- 스마트 포장

- 진공 포장

- 무균 포장

- 레토르트 포장

- 일반 포장

제12장 식품 포장 시장 : 용도별

- 유제품

- 육류, 닭고기, 해산물

- 과일 및 채소

- 제빵 및 제과류

- 스낵 및 시리얼

- 편의점 식품 및 즉석 식품

- 기타 용도

제13장 식품 포장 시장 : 식품 유형별

- 냉동 식품

- 냉장 식품

- 통조림 식품

- 상온 보존 식품

제14장 식품 포장 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 폴란드

- 노르웨이

- 스웨덴

- 오스트리아

- 그리스

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 말레이시아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 콜롬비아

- 기타 남미

- 기타 지역

- 중동

- 아프리카

제15장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2020-2024년)

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 브랜드 및 제품 비교

- AMCOR PLC(스위스)

- SEALED AIR(미국)

- MONDI(영국)

- TETRA LAVAL(스위스)

- HUHTAMAKI OYJ(핀란드)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무 지표

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 기업

- AMCOR PLC

- SEALED AIR

- MONDI

- TETRA LAVAL

- HUHTAMAKI OYJ

- CROWN

- SONOCO

- INTERNATIONAL PAPER

- WINPAK LTD.

- SMURFIT WESTROCK

- GRAPHIC PACKAGING HOLDING COMPANY

- PROAMPAC

- KLOCKNER PENTAPLAST

- CONSTANTIA FLEXIBLES

- GENPAK

- COVERIS

- CHAUDHARY GLASSPACK

- ECOLEAN

- KNACK FLEXIPACK LLP

- GUANGZHOU SME PLASTIC CORP

- FIBMOLD PACKAGING PVT. LTD.

- PACKIRO GMBH

- ALTERPACKS

- NOTPLA PACKAGING

- ECOINNO

제17장 조사 방법

제18장 부록

CSM 26.01.16The market for food packaging is estimated to be USD 421.38 billion in 2025 and is projected to reach USD 548.51 billion by 2030, at a CAGR of 5.4% during the forecast period. The food packaging market is witnessing significant growth as packaging plays a vital role in preserving freshness, extending shelf life, and ensuring safe transportation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (Metric Tons) |

| Segments | By Material, Packaging Type, Format, Technology, Food Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, RoW |

Driven by rising consumer demand for convenience, safety, and sustainability in food products, the market is expanding across various regions, with emerging economies showing strong potential. Technological advancements, regulatory support, and innovation by leading industry players are further fueling the adoption of food packaging in various applications, making the sector a dynamic and rapidly evolving.

"The meat, poultry, and seafood application segment is estimated to witness a notable CAGR during the forecast period."

The meat, poultry, and seafood segment is projected to grow significantly in the food packaging market during the forecast period. This growth is driven by rising global consumption of animal-based proteins and the need to preserve their freshness, quality, and safety across increasingly complex supply chains. Packaging solutions such as vacuum skin packaging (VSP), modified atmosphere packaging (MAP), and high-barrier films are being rapidly adopted to extend shelf life and reduce spoilage of perishable protein products. As cold-chain logistics and e-commerce grocery channels expand-particularly for chilled and frozen meat-the demand for durable, temperature-resistant, and tamper-evident packaging formats has grown significantly. Sustainability is also playing a significant role in reshaping this segment, with a shift toward recyclable trays, mono-material films, and bio-based plastics that meet both environmental and food safety standards. With ongoing innovation in packaging technologies and increasing regulatory emphasis on hygiene and traceability, the meat, poultry & seafood segment remains one of the most dynamic and essential growth areas within the global food packaging industry.

"The bags segment, among packaging types, is estimated to maintain robust growth."

Bags are increasingly preferred in the food packaging market due to their lightweight structure, material efficiency, and adaptability across diverse food categories. Their compatibility with high-speed filling systems and automated packaging lines makes them ideal for large-scale food production. Resealable zipper and pillow bags offer excellent functionality for dry and semi-liquid products, including snacks, bakery items, frozen foods, and fresh produce. The format supports extended shelf life through advanced barrier properties while allowing for consumer convenience and easy storage. In parallel, the push for sustainability has led to innovations in paper-based and mono-material bag designs that meet recyclability targets without compromising performance. With continued growth in ready-to-eat foods, e-commerce grocery delivery, and sustainability-driven packaging shifts, the bags segment is expected to maintain robust growth, supported by material innovations and growing demand for flexible, efficient packaging solutions.

"North America is estimated to hold a significant share of the global food packaging market."

North America is anticipated to hold a substantial share of the global food packaging market, driven by its large-scale food & beverage industry, strong regulatory standards for food contact materials and safety, and growing consumer demand for convenience, freshness, and sustainability in packaged foods. The region benefits from an established manufacturing infrastructure, advanced packaging technologies, and major global players actively investing in innovations such as recycled content, shelf life extension formats, and lightweight solutions. In April 2024, Amcor plc announced its largest-ever North American capacity expansion of printing and converting for the dairy segment, at its Oshkosh, Wisconsin site-supporting flexible packaging and sustainable formats for food applications. In March 2024, Amcor also introduced the first all polyethylene (PE) spouted pouch in North America, developed in collaboration with Stonyfield Organic, replacing multi-laminate structures with a mono material film designed for recyclability. These developments underscore the region's strategic role in driving innovation and scaling production in the food packaging sector. As a result, North America is well-positioned to continue being a key contributor to the global food packaging market's growth.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the food packaging market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, and Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World (Middle East and Africa) - 10%

Prominent companies in the market include Amcor Plc (Switzerland), Sealed Air (US), Mondi (UK), Tetra Pak International S.A. (Switzerland), Huhtamaki (Finland), Crown (US), Sonoco Products Company (US), DS Smith (UK), Silgan Containers (US), WestRock Company (US), Graphic Packaging International, LLC (US), International Paper (US), Smurfit Westrock (Ireland), ProAmpac (US), and Genpak (US).

Other players include * Ecolean (Sweden), Alpla (Austria), Greif (US), Uflex Limited (India), Printpack (US), Winpak Ltd. (Canada), Coveris (Austria), Klockner Pentaplast (Luxembourg), and Rengo Co., Ltd. (Japan).

Research Coverage:

This research report categorizes the food packaging market, by material (plastic, paper and paperboard, glass, metal, and other materials), packaging type (bags, pouches, bottles, jars, boxes, trays, clamshells, others), format (flexible, rigid, semi-rigid), technology (MAP, active, smart, vacuum, aseptic, retort, and traditional packaging), food type (frozen food, chilled food, canned food, shelf stable food), application [bakery & confectionery, dairy products, meat, poultry and seafood, fresh produce (fruits and vegetables), convenience foods and ready meals, snacks and breakfast cereals, sauces and condiments, baby food, others (whole grain food, cereals, pulses, and oils)], and region (North America, Europe, Asia Pacific, South America, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the food packaging market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, and agreements. The study includes new product & service launches, mergers & acquisitions, and recent developments associated with the food packaging market. This report also includes a competitive analysis of emerging startups in the food packaging market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall packaging and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

1. In-depth segmentation across material, packaging type, format, technology, food type, and application: This report offers an in-depth analysis of the food packaging market, categorizing it by material (plastic, paper and paperboard, glass, metal, and other materials), packaging type (bags, pouches, bottles, jars, boxes, trays, clamshells, others), format (flexible, rigid, semi-rigid), technology (MAP, active, smart, vacuum, aseptic, retort, and traditional packaging), food type (frozen food, chilled food, canned food, shelf stable food), application [bakery & confectionery, dairy products, meat, poultry and seafood, fresh produce (fruits and vegetables), convenience foods and ready meals, snacks and breakfast cereals, sauces and condiments, baby food, others (whole grain food, cereals, pulses, and oils)]. Such detailed segmentation enables stakeholders to pinpoint high-growth areas, optimize product development, and strategically position offerings along the supply chain.

2. Region-specific insights focusing on emerging markets: The report provides country- and region-specific analysis, emphasizing opportunities in rapidly growing markets such as Asia Pacific, North America, Europe, and South America. It explores regional regulatory frameworks, key demand drivers, and investment trends, serving as a critical guide for companies pursuing expansion or localization strategies.

3. Competitive intelligence and innovation landscape: Leading market participants, including Amcor plc, Sealed Air, Mondi, and Tetra Pak International S.A., are profiled in detail. The report covers recent developments such as new product launches, mergers & acquisitions, facility expansions, and R&D initiatives, helping users benchmark competitors and monitor emerging innovation trends.

4. Demand forecasts backed by data-driven methodologies: Market sizing and growth projections through 2030 are developed using a combination of top-down and bottom-up approaches, validated by industry experts, trade associations, and official government data. These insights provide reliable guidance for investment planning and market opportunity assessment in the food packaging sector.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 GLOBAL MARKET SHARE AND GROWTH RATE SNAPSHOT

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD PACKAGING MARKET

- 3.2 FOOD PACKAGING MARKET, BY MATERIAL AND REGION

- 3.3 FOOD PACKAGING MARKET, BY METAL TYPE

- 3.4 FOOD PACKAGING MARKET, BY APPLICATION

- 3.5 FOOD PACKAGING MARKET, BY TECHNOLOGY

- 3.6 FOOD PACKAGING MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 FOOD PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 4.2.1 DRIVERS

- 4.2.1.1 Growing emphasis on food safety, hygiene, and shelf-life extension

- 4.2.1.2 Increasing demand for convenient and ready-to-eat food products

- 4.2.1.3 Rising popularity of sustainable and recyclable packaging solutions

- 4.2.1.4 Impact of GLP-1 weight-loss drugs and evolving nutrition guidelines on packaged food consumption

- 4.2.2 RESTRAINTS

- 4.2.2.1 Rising cost of raw materials and eco-friendly packaging alternatives

- 4.2.2.2 Changing dietary habits and health-focused lifestyles limiting demand for processed foods

- 4.2.2.3 Stringent government regulations and compliance requirements

- 4.2.2.4 Limited recycling infrastructure and collection systems

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advancements in biodegradable and compostable packaging materials

- 4.2.3.2 Shift toward personalized food experiences

- 4.2.3.3 Government initiatives and policy support driving circular packaging innovation

- 4.2.3.4 Digitalization and smart packaging technologies

- 4.2.3.5 Expansion of healthy and portion-controlled packaged food formats

- 4.2.4 CHALLENGES

- 4.2.4.1 Maintaining food safety standards with sustainable packaging materials

- 4.2.4.2 Rising industry complexity

- 4.2.4.3 Waste management and environmental concerns

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 INTRODUCTION

- 4.3.2 EMERGING GAPS AND INNOVATION WHITE SPACES

- 4.3.2.1 Truly circular/end-of-life packaging

- 4.3.2.2 Affordable smart/active packaging

- 4.3.2.3 User-friendly packaging design

- 4.3.2.4 Packaging optimized for e-commerce

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 AGRICULTURE AND FOOD PROCESSING

- 4.4.2 MATERIALS AND CHEMICALS

- 4.4.3 LOGISTICS, RETAIL, AND E-COMMERCE

- 4.4.4 TECHNOLOGY AND DIGITALIZATION

- 4.4.5 WASTE MANAGEMENT AND CIRCULAR ECONOMY

- 4.4.6 ENERGY AND MANUFACTURING SYNERGIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY KEY PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.2 BARGAINING POWER OF SUPPLIERS

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 THREAT OF SUBSTITUTES

- 5.2.5 THREAT OF NEW ENTRANTS

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 URBANIZATION AND RISING URBAN POPULATION DENSITY

- 5.3.2 GROWTH IN DISPOSABLE INCOME AND HOUSEHOLD CONSUMPTION EXPENDITURE

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 DEMAND SIDE

- 5.6.2 SUPPLY SIDE

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND, BY MATERIAL

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE ANALYSIS OF HS CODE 3923: ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS

- 5.8.1.1 Export trends of food packaging under HS Code 3923, 2020-2024

- 5.8.1.2 Import trends of food packaging under HS Code 3923, 2020-2024

- 5.8.2 TRADE ANALYSIS OF HS CODE 7010: CARBOYS, BOTTLES, FLASKS, JARS, POTS, PHIALS, AMPOULES, AND OTHER CONTAINERS, OF GLASS, OF A KIND USED FOR THE CONVEYANCE OR PACKING OF GOODS

- 5.8.2.1 Export trends of food packaging under HS Code 7010, 2020-2024

- 5.8.2.2 Import trends of food packaging under HS Code 7010, 2020-2024

- 5.8.3 TRADE ANALYSIS OF HS CODE 4819: PAPER AND PAPERBOARD PACKAGING CONTAINERS IN THE FOOD PACKAGING MARKET

- 5.8.3.1 Export trends of food packaging under HS Code 4819, 2020-2024

- 5.8.3.2 Import trends of food packaging under HS Code 4819, 2020-2024

- 5.8.1 TRADE ANALYSIS OF HS CODE 3923: ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS

- 5.9 KEY CONFERENCES & EVENTS

- 5.10 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 NESTLE'S ADOPTION OF PAPER-BASED PACKAGING FOR CONFECTIONERY (MARCH 2024)

- 5.12.2 UNILEVER'S SMART QR TRACEABILITY FOR ICE-CREAM PACKAGING (JULY 2023)

- 5.12.3 DANONE'S USE OF RECYCLED PET (RPET) FOR YOGURT PACKAGING (JANUARY 2025)

- 5.13 IMPACT OF 2025 US TARIFF - FOOD PACKAGING MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.4.1 North America

- 5.13.4.2 Europe

- 5.13.4.3 Asia Pacific

- 5.13.4.4 South America

- 5.13.4.5 Middle East & Africa

- 5.13.5 IMPACT ON END-USE INDUSTRY

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 INTRODUCTION

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 LIST OF MAJOR PATENTS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI ON FOOD PACKAGING MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES IN FOOD PACKAGING PROCESSING

- 6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN FOOD PACKAGING MARKET

- 6.7.3.1 AI-driven packaging design & sustainability simulation

- 6.7.3.2 AI-enabled smart packaging & digital traceability

- 6.7.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN FOOD PACKAGING MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 INTRODUCTION

- 7.2 DECISION-MAKING PROCESS

- 7.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.3.2 BUYING CRITERIA

- 7.4 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.6 MARKET PROFITABILITY

8 FOOD PACKAGING MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 PLASTIC

- 8.2.1 COST-EFFECTIVENESS AND EASY AVAILABILITY TO DRIVE DEMAND

- 8.2.2 LOW-DENSITY POLYETHYLENE (LDPE)

- 8.2.3 HIGH-DENSITY POLYETHYLENE (HDPE)

- 8.2.4 POLYPROPYLENE (PP)

- 8.2.5 POLYETHYLENE TEREPHTHALATE (PET)

- 8.2.6 POLYSTYRENE (PS)

- 8.2.7 POLYVINYL CHLORIDE (PVC)

- 8.2.8 OTHER PLASTIC MATERIALS

- 8.3 PAPER & PAPERBOARD

- 8.3.1 ECO-FRIENDLY INNOVATION AND SUSTAINABILITY TO DRIVE DEMAND

- 8.3.2 CORRUGATED BOARD

- 8.3.3 BOXBOARD

- 8.3.4 FLEXIBLE PAPER

- 8.3.5 OTHER PAPER & PAPERBOARD MATERIALS

- 8.4 GLASS

- 8.4.1 RISING POPULARITY OF PREMIUM, SAFE, AND RECYCLABLE FOOD PACKAGING TO DRIVE DEMAND

- 8.5 METAL

- 8.5.1 DURABILITY AND INNOVATION TO DRIVE DEMAND

- 8.5.2 STEEL/TINPLATE

- 8.5.3 ALUMINUM

- 8.6 OTHER MATERIALS

9 FOOD PACKAGING MARKET, BY PACKAGING TYPE

- 9.1 INTRODUCTION

- 9.2 BAGS

- 9.2.1 REQUIREMENT FOR LIGHTWEIGHT PROTECTIVE FORMATS AND CONVERSION FLEXIBILITY TO DRIVE DEMAND

- 9.3 POUCHES

- 9.3.1 NEED FOR HIGH-BARRIER, CONVENIENT SINGLE-SERVE FORMATS AND LIGHTWEIGHT EFFICIENCY TO DRIVE DEMAND

- 9.4 BOTTLES

- 9.4.1 NEED FOR TRANSPARENT, PROCESS-COMPLIANT, AND EFFICIENT SUPPLY-CHAIN SOLUTIONS TO DRIVE DEMAND

- 9.5 JARS

- 9.5.1 NEED FOR RESEALABLE VISIBILITY AND EXTENDED SHELF-LIFE FORMATS TO DRIVE DEMAND

- 9.6 BOXES

- 9.6.1 GROWING REQUIREMENT FOR SHELF PRESENCE AND EFFICIENT MATERIAL USE TO DRIVE DEMAND

- 9.7 OTHER PACKAGING TYPES

10 FOOD PACKAGING MARKET, BY FORMAT

- 10.1 INTRODUCTION

- 10.2 FLEXIBLE

- 10.2.1 RISING ADOPTION OF LIGHTWEIGHT, RECYCLABLE, AND FLEXIBLE FORMATS TO DRIVE MARKET

- 10.3 RIGID

- 10.3.1 INCREASED FOCUS ON PRODUCT SAFETY AND SHELF STABILITY IN RIGID FORMATS TO DRIVE MARKET

- 10.4 SEMI-RIGID

- 10.4.1 EXPANDING DEMAND FOR CONVENIENCE AND FRESHNESS PRESERVATION IN SEMI-RIGID FORMATS TO DRIVE MARKET

11 FOOD PACKAGING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 MODIFIED ATMOSPHERE PACKAGING (MAP)

- 11.2.1 INCREASING FOCUS ON EXTENDED SHELF LIFE AND FRESHNESS PRESERVATION IN PERISHABLE FOODS TO DRIVE MARKET

- 11.3 ACTIVE PACKAGING

- 11.3.1 GROWING DEMAND FOR ADVANCED PRESERVATION AND CONTAMINATION CONTROL IN PACKAGED FOODS TO DRIVE MARKET

- 11.4 SMART PACKAGING

- 11.4.1 RISING NEED FOR REAL-TIME MONITORING AND TRACEABILITY SOLUTIONS IN FOOD PACKAGING TO DRIVE MARKET

- 11.5 VACUUM PACKAGING

- 11.5.1 GROWING EMPHASIS ON HYGIENIC PRESERVATION AND EXTENDED SHELF LIFE IN FOOD PACKAGING TO DRIVE MARKET

- 11.6 ASEPTIC PACKAGING

- 11.6.1 RISING IMPLEMENTATION OF STERILE AND SHELF-STABLE PACKAGING SOLUTIONS TO DRIVE MARKET

- 11.7 RETORT PACKAGING

- 11.7.1 RISING POPULARITY OF READY-TO-EAT AND CONVENIENCE FOOD TO DRIVE MARKET

- 11.8 CONVENTIONAL PACKAGING

- 11.8.1 COST-EFFECTIVENESS AND WIDESPREAD INDUSTRY ADOPTION TO DRIVE MARKET

12 FOOD PACKAGING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 DAIRY PRODUCTS

- 12.2.1 NEED FOR IMPROVED SHELF-LIFE, SAFETY, AND BARRIER PERFORMANCE TO DRIVE MARKET

- 12.3 MEAT, POULTRY, AND SEAFOOD

- 12.3.1 INCREASING FOCUS ON FRESHNESS PRESERVATION AND CONTAMINATION CONTROL TO DRIVE MARKET

- 12.4 FRUITS & VEGETABLES

- 12.4.1 DEMAND FOR ENHANCED FRESHNESS AND REDUCED WASTE TO DRIVE MARKET

- 12.5 BAKERY & CONFECTIONERY

- 12.5.1 RISING DEMAND FOR ADVANCED BARRIERS AND ANTIMICROBIAL PACKAGING TO DRIVE MARKET

- 12.6 SNACKS & BREAKFAST CEREALS

- 12.6.1 RISING CONSUMER PREFERENCE FOR PORTION-CONTROLLED AND SHELF-STABLE PACKAGING TO DRIVE MARKET

- 12.7 CONVENIENCE FOODS & READY MEALS

- 12.7.1 GROWING URBANIZATION AND ON-THE-GO LIFESTYLE TO BOOST MARKET

- 12.8 OTHER APPLICATIONS

13 FOOD PACKAGING MARKET, BY FOOD TYPE

- 13.1 INTRODUCTION

- 13.2 FROZEN FOOD

- 13.3 CHILLED FOOD

- 13.4 CANNED FOOD

- 13.5 SHELF-STABLE FOOD

14 FOOD PACKAGING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Expansion of online grocery purchase and circular packaging regulation to drive market

- 14.2.2 CANADA

- 14.2.2.1 Increased consumption of baked and confectionery products to drive market

- 14.2.3 MEXICO

- 14.2.3.1 Rising meat consumption and processed food production to drive market

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Increased growth in German food processing industry to drive market

- 14.3.2 UK

- 14.3.2.1 Evolving consumer preferences and technological advancements to fuel market growth

- 14.3.3 FRANCE

- 14.3.3.1 Consistent growth in demand for baked goods to drive market

- 14.3.4 SPAIN

- 14.3.4.1 High growth of food industry to drive market

- 14.3.5 ITALY

- 14.3.5.1 Growth in processed food production and retail expansion to drive market

- 14.3.6 POLAND

- 14.3.6.1 Expansion of packaging market volume and shifting materials mix to drive food packaging demand

- 14.3.7 NORWAY

- 14.3.7.1 Rising exports of seafood to drive market

- 14.3.8 SWEDEN

- 14.3.8.1 Need for circular and intelligent packaging solutions to drive market

- 14.3.9 AUSTRIA

- 14.3.9.1 Shift toward recyclable and bio-based materials in processed food sector to drive market

- 14.3.10 GREECE

- 14.3.10.1 Growing consumer demand for sustainable food packaging to drive market

- 14.3.11 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Increased import and production of meat and seafood to drive market

- 14.4.2 INDIA

- 14.4.2.1 Expansion of packaged convenience food consumption to drive market

- 14.4.3 JAPAN

- 14.4.3.1 Shifting food contact packaging regulations to drive market

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Sustainability targets and circular packaging initiatives to propel market

- 14.4.5 MALAYSIA

- 14.4.5.1 Rising demand for convenient and sustainable food packaging to drive market

- 14.4.6 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Shift toward recyclable and reduced plastic packaging to drive market

- 14.5.2 ARGENTINA

- 14.5.2.1 Increased meat and poultry production to drive market

- 14.5.3 CHILE

- 14.5.3.1 Expansion of seafood exports and sustainability policies to drive market

- 14.5.4 COLOMBIA

- 14.5.4.1 Large food sector base and sustainability regulation to drive market

- 14.5.5 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD (ROW)

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Expansion of food manufacturing and sustainable packaging policies to drive market

- 14.6.2 AFRICA

- 14.6.2.1 Increased demand for food and meat to drive market

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 AMCOR PLC (SWITZERLAND)

- 15.5.2 SEALED AIR (US)

- 15.5.3 MONDI (UK)

- 15.5.4 TETRA LAVAL (SWITZERLAND)

- 15.5.5 HUHTAMAKI OYJ (FINLAND)

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Region footprint

- 15.6.5.3 Material footprint

- 15.6.5.4 Packaging type footprint

- 15.6.5.5 Application footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.7.5.1 Key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.8.1 COMPANY VALUATION

- 15.8.2 EV/EBITDA

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 AMCOR PLC

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 SEALED AIR

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 MONDI

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 TETRA LAVAL

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 HUHTAMAKI OYJ

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 CROWN

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Expansions

- 16.1.6.3.2 Other developments

- 16.1.6.4 MnM view

- 16.1.6.4.1 Right to win

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 SONOCO

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.7.3.2 Deals

- 16.1.7.3.3 Expansions

- 16.1.7.3.4 Other developments

- 16.1.7.4 MnM view

- 16.1.7.4.1 Right to win

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 INTERNATIONAL PAPER

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.8.3.2 Other developments

- 16.1.8.4 MnM view

- 16.1.8.4.1 Right to win

- 16.1.8.4.2 Strategic choices

- 16.1.8.4.3 Weaknesses and competitive threats

- 16.1.9 WINPAK LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.9.3.3 Expansions

- 16.1.9.4 MnM view

- 16.1.9.4.1 Right to win

- 16.1.9.4.2 Strategic choices

- 16.1.9.4.3 Weaknesses and competitive threats

- 16.1.10 SMURFIT WESTROCK

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.4 MnM view

- 16.1.10.4.1 Right to win

- 16.1.10.4.2 Strategic choices

- 16.1.10.4.3 Weaknesses and competitive threats

- 16.1.11 GRAPHIC PACKAGING HOLDING COMPANY

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Expansions

- 16.1.11.4 MnM view

- 16.1.11.4.1 Right to win

- 16.1.11.4.2 Strategic choices

- 16.1.11.4.3 Weaknesses and competitive threats

- 16.1.12 PROAMPAC

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Expansions

- 16.1.12.4 MnM view

- 16.1.12.4.1 Right to win

- 16.1.12.4.2 Strategic choices

- 16.1.12.4.3 Weaknesses and competitive threats

- 16.1.13 KLOCKNER PENTAPLAST

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.13.3.2 Deals

- 16.1.13.3.3 Expansions

- 16.1.13.3.4 Other developments

- 16.1.13.4 MnM view

- 16.1.13.4.1 Right to win

- 16.1.13.4.2 Strategic choices

- 16.1.13.4.3 Weaknesses and competitive threats

- 16.1.14 CONSTANTIA FLEXIBLES

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Product launches

- 16.1.14.3.2 Deals

- 16.1.14.4 MnM view

- 16.1.14.4.1 Right to win

- 16.1.14.4.2 Strategic choices

- 16.1.14.4.3 Weaknesses and competitive threats

- 16.1.15 GENPAK

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Product launches

- 16.1.15.3.2 Expansions

- 16.1.15.4 MnM view

- 16.1.15.4.1 Right to win

- 16.1.15.4.2 Strategic choices

- 16.1.15.4.3 Weaknesses and competitive threats

- 16.1.16 COVERIS

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Product launches

- 16.1.16.3.2 Deals

- 16.1.16.3.3 Expansions

- 16.1.16.4 MnM view

- 16.1.17 CHAUDHARY GLASSPACK

- 16.1.17.1 Business overview

- 16.1.17.2 Products/Solutions/Services offered

- 16.1.17.3 Recent developments

- 16.1.17.4 MnM view

- 16.1.17.4.1 Right to win

- 16.1.18 ECOLEAN

- 16.1.18.1 Business overview

- 16.1.18.2 Products/Solutions/Services offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches

- 16.1.18.3.2 Deals

- 16.1.18.4 MnM view

- 16.1.19 KNACK FLEXIPACK LLP

- 16.1.19.1 Business overview

- 16.1.19.2 Products/Solutions/Services offered

- 16.1.19.3 Recent developments

- 16.1.19.4 MnM view

- 16.1.20 GUANGZHOU SME PLASTIC CORP

- 16.1.20.1 Business overview

- 16.1.20.2 Products/Solutions/Services offered

- 16.1.20.3 Recent developments

- 16.1.20.4 MnM view

- 16.1.21 FIBMOLD PACKAGING PVT. LTD.

- 16.1.22 PACKIRO GMBH

- 16.1.23 ALTERPACKS

- 16.1.24 NOTPLA PACKAGING

- 16.1.25 ECOINNO

- 16.1.1 AMCOR PLC

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary participants

- 17.1.2.2.1 Food packaging companies

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.2.3 TOP-DOWN APPROACH

- 17.3 DATA TRIANGULATION

- 17.4 FACTOR ANALYSIS

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS