|

시장보고서

상품코드

1914124

자동차 디지털 콕핏 시장 : 기기별, 용도별, 차량 유형별, EV 유형별, 디스플레이 유형별, 디스플레이 사이즈별(-2032년)Automotive Digital Cockpit Market by Equipment, Application, Vehicle Type, EV Type, Display Type, Display Size - Global Forecast to 2032 |

||||||

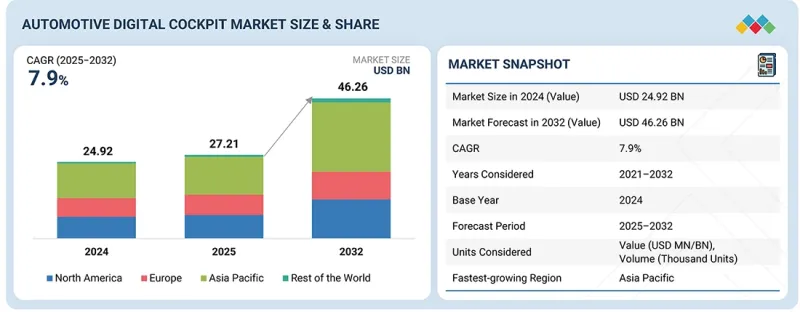

자동차 디지털 콕핏 시장 규모는 2025년 272억 1,000만 달러에 달했고, CAGR 7.9%로 성장하고, 2032년에는 462억 6,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 가치(달러) |

| 부문 | 장비, 용도, 차량 유형, EV 유형, 디스플레이 유형, 디스플레이 크기 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 세계 기타 지역 |

자동차 제조업체가 주요 지역 전체에서 연결성이 높고 소프트웨어 중심 차량 플랫폼으로의 전환을 가속화하고 있기 때문에 시장은 계속 성장하고 있습니다. 대형 디스플레이, 통합형 인포테인먼트 시스템, 디지털 클러스터, 지능형 드라이버 모니터링의 소비자 채택이 증가하고 있는 것은 대중차와 고급차 모두에서 조종석 업그레이드를 추진하고 있습니다. 그래픽 처리, 중앙 집중식 컴퓨팅, 클라우드 연계 서비스의 발전으로 보다 풍부한 인터페이스와 지속적인 개선이 가능합니다. 전기자동차의 생산 확대는 에너지 분석과 실시간 제어 기능을 제공하는 조종석 시스템에 대한 수요를 더욱 높이고 있습니다. 디지털 조종실의 혁신, 음성 상호작용, 멀티스크린 레이아웃에 대한 적극적인 투자가 차내 경험 향상에 기여하고 있습니다. 운전자의 주의력과 안전성에 대한 규제의 초점 확대도 신형차 도입에 있어서의 첨단 조종석 기술의 통합을 뒷받침하고 있습니다.

"디스플레이 크기별로는 5-10인치가 2024년 최대 점유율을 차지"

컴팩트 카, 미들 클래스 자동차, 일부 프리미엄 차종에 대한 광범위한 채택이 이것을 견인하고 있습니다. 이 부문은 시인성, 비용 효율성, 대시보드에 대한 적응성의 적절한 균형을 제공하며 디지털 계기 클러스터, 인포테인먼트 디스플레이 및 보조 제어 화면의 핵심을 담당합니다. 자동차 제조업체가 5-10인치 디스플레이를 선호하는 이유는 내비게이션, 미디어, 경보, 시스템 진단 등 중요한 차량 기능을 지원하면서 높은 저렴함과 생산 확장성을 유지할 수 있기 때문입니다. 터치 응답성, 밝기 제어, 고해상도 시각화를 통해 시스템 비용을 늘리지 않고도 사용자 경험을 개선했습니다. 조종석 설계가 소프트웨어 정의 아키텍처로 전환하는 동안 5-10인치 디스플레이는 현대 컴퓨팅 플랫폼 및 연결 서비스와 높은 호환성을 유지합니다.

"EV 유형별로 BEV 부문이 예측 기간 동안 가장 빠른 성장률을 보여줄 전망"

EV 생산량 증가와 디지털 퍼스트의 자동차 플랫폼으로의 전환은 전동 파워트레인을 보완하는 첨단 조종석 솔루션의 필요성을 촉진하고 있습니다. EV 사용자는 충전 상태 파악, 에너지 관리 데이터, 경로 최적화 및 성능 업데이트를 제공하는 기능이 풍부한 캐빈 인터페이스를 요구합니다. 이러한 추세로 고해상도 스크린, 스마트 클러스터, 클라우드 지원 인포테인먼트 시스템의 사용이 증가하고 있습니다. 자동차 제조업체는 조종석 기능과 핵심 전력 관리 작업을 통합하기 위해 도메인 컨트롤러 기반 아키텍처를 표준화합니다. 정책 인센티브와 충전 네트워크의 급속한 확대가 보다 정교한 조종석 구성으로의 전환을 가속화하고 있습니다. 기계적 제약이 적은 EV 플랫폼은 멀티 스크린과 몰입형 인터페이스의 통합을 용이하게 합니다. 세계 EV 보급률이 꾸준히 상승하는 가운데 강력한 디스플레이와 HMI 포트폴리오를 갖춘 기술 공급자는 EV 개발 파이프라인 전반에서 크게 성장할 수 있는 입장에 있습니다.

"용도별로 인포테인먼트 부문이 2032년 최대 점유율을 차지할 전망"

커넥티드 서비스와 개인화된 미디어 경험에 대한 수요가 높아지는 가운데 2032년에는 인포테인먼트 부문이 가장 큰 점유율을 차지할 것으로 예측됩니다. 자동차 제조업체는 네비게이션, 미디어, 통화, 메시지 기능, 스마트폰 연계, 차량 설정을 단일 인터페이스에 통합하는 플랫폼을 우선적으로 채택하고 있습니다. 그래픽 처리 기술의 발전과 소프트웨어 정의 콕핏 아키텍처는 OTA를 통한 지속적인 기능 업그레이드를 가능하게 합니다. 처리 능력, 그래픽 렌더링, 클라우드 통합의 발전으로 자연스러운 음성 상호 작용, 예측 제안, 중단없는 미디어 액세스 등의 고급 기능이 실현되었습니다. OEM사는 또한 인포테인먼트를 고수익 채널로 하는 구독형 서비스를 확대하고 있습니다. 디지털 편의성과 몰입형 인터랙션에 대한 기대가 높아지는 가운데, 인포테인먼트 시스템은 2032년까지 주요 용도로서의 지위를 유지할 전망입니다.

본 보고서에서는 세계 자동차 디지털 콕핏 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분, 지역별, 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미개척 시장 및 미충족 수요 분석

- 상호 연결된 시장 및 산업 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 기술의 진보, AI에 의한 영향, 특허, 혁신, 장래의 응용

- 기술 분석

- 기술 로드맵

- 특허 분석

- 미래의 응용

- AI/생성형 AI가 자동차 디지털 콕핏 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

제6장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제7장 고객정세와 구매행동

- 의사결정 프로세스

- 이해관계자와 구매평가기준

- 채택 장벽과 내부 과제

- 다양한 최종 사용자 산업의 미충족 요구

- 시장 수익성

제8장 업계 동향

- 거시경제지표

- 생태계 분석

- 공급망 분석

- 가격 분석

- 고객의 사업에 영향을 미치는 동향과 혼란

- 투자 및 자금조달 시나리오

- 이용 사례별 자금 조달

- 2026-2027년 주요 회의 및 이벤트

- 무역 분석

- 사례 연구 분석

- 2025년 미국 관세의 영향

- OEM 및 공급업체 프로그램의 전략적 변화

- OEM 분석

- XPENG

- NIO

- LEAPMOTOR

- GEELY ZEEKR

- TATA MOTORS

- VOLKSWAGEN AUDI

- BMW

- STELLANTIS

- MERCEDES BENZ

- FORD MOTOR COMPANY

- GENERAL MOTORS

제9장 자동차 디지털 콕핏 시장 : 기기별

- 디지털 악기 클러스터

- 디지털 센터 콘솔

- 인포테인먼트 유닛

- 후석 인포테인먼트 유닛

- 조수석 인포테인먼트 유닛

- 헤드업 디스플레이(HUD)

- 운전자 모니터링 시스템

- 주요 산업 인사이트

제10장 자동차 디지털 콕핏 시장 : 차량 유형별

- 승용차

- 소형 상용차(LCV)

- 대형 상용차(HCV)

- 주요 산업 인사이트

제11장 자동차 디지털 콕핏 시장 : EV 유형별

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 주요 산업 인사이트

제12장 자동차 디지털 콕핏 시장 : 용도별

- 인포테인먼트

- 드라이버 모니터링과 어시스턴스

- 차량 및 쾌적성 제어 시스템

- 주요 산업 인사이트

제13장 자동차 디지털 콕핏 시장 : 디스플레이 사이즈별

- 5인치 미만

- 5-10인치

- 10인치 초과

- 주요 산업 인사이트

제14장 자동차 디지털 콕핏 시장 : 디스플레이 유형별

- 액정 디스플레이(LCD)

- 유기 LED(OLED)

- 박막 트랜지스터 액정 디스플레이(TFT-LCD)

- 주요 산업 인사이트

제15장 자동차 디지털 콕핏 시장 : 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 이탈리아

- 스페인

- 영국

- 러시아

- 기타

- 기타 지역

- 브라질

- 이란

- 기타

제16장 경쟁 구도

- 주요 진입기업의 전략/강점

- 시장 점유율 분석

- 수익 분석

- 기업평가와 재무지표

- 브랜드 / 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 / 중소기업

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 기업

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- HARMAN INTERNATIONAL

- VISTEON CORPORATION

- DENSO CORPORATION

- VALEO

- MITSUBISHI ELECTRIC CORPORATION

- TOMTOM INTERNATIONAL BV

- APTIV

- LG ELECTRONICS

- FORVIA

- MAGNA INTERNATIONAL INC.

- HYUNDAI MOBIS

- ALPS ALPINE CO., LTD.

- 기타 기업

- QUALCOMM TECHNOLOGIES, INC.

- NXP SEMICONDUCTORS

- MARELLI HOLDINGS CO., LTD.

- ZF FRIEDRICHSHAFEN AG

- PIONEER CORPORATION

- SONY CORPORATION

- INFINEON TECHNOLOGIES AG

- JVCKENWOOD CORPORATION

- FUJITSU LIMITED

- FORYOU CORPORATION

- MAGNETI MARELLI SPA

제18장 조사 방법

제19장 부록

SHWThe automotive digital cockpit market is projected to grow from USD 27.21 billion in 2025 to USD 46.26 billion in 2032 at a CAGR of 7.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Equipment, Application, Vehicle Type, EV Type, Display Type, Display Size |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the world |

The market is growing as automakers accelerate the shift to connected, software-driven vehicle platforms across all major regions. The rising consumer adoption of large displays, integrated infotainment systems, digital clusters, and intelligent driver monitoring is driving cockpit upgrades in both mass-market and premium vehicles. Advancements in graphics processing, centralized computing, and cloud-linked services are enabling richer interfaces and continuous feature enhancements. Growing electric vehicle production is further increasing demand for cockpit systems that provide energy insights and real-time control functions. Strong investments in digital cockpit innovation, voice interaction, and multiscreen layouts are improving in-cabin experiences. Expanding regulatory focus on driver attention and safety is also supporting the integration of advanced cockpit technologies across new model launches.

"The 5-10" display segment accounted for the largest share of the automotive digital cockpit market in 2024."

The 5-10" display segment accounted for the largest share of the automotive digital cockpit market in 2024, driven by its extensive deployment across compact, mid-range, and selected premium vehicles. This segment offers the right mix of clarity, cost efficiency, and dashboard adaptability, making it central to digital instrument clusters, infotainment displays, and auxiliary control screens. Automakers favor 5-10" displays because these displays support essential vehicle functions such as navigation, media, alerts, and system diagnostics while maintaining strong affordability and production scalability. Enhancements in touch responsiveness, brightness control, and high-resolution visuals have improved user experience without raising system expense. As cockpit designs shift toward software-defined architectures, 5-10" displays remain highly compatible with modern compute platforms and connected services.

"The BEV segment is projected to register the fastest growth during the forecast period."

The battery electric vehicle (BEV) segment is expected to register the fastest growth in the automotive digital cockpit market during the forecast period. Increasing EV output and the transition to digital-first automotive platforms are driving the need for advanced cockpit solutions that complement electric powertrains. EV users seek feature-rich cabin interfaces that provide charging insights, energy management data, route optimization, and performance updates. This trend is increasing the use of high-resolution screens, smart clusters, and cloud-enabled infotainment systems. Automakers are standardizing domain controller-based architectures to unify cockpit functions with core power management operations. Policy incentives and rapid expansion of charging networks are accelerating the shift toward more sophisticated cockpit setups. EV platforms, with fewer mechanical limitations, also support easier integration of multiscreen and immersive interfaces. With global EV penetration rising steadily, technology providers with strong display and HMI portfolios are positioned to capture substantial growth across EV development pipelines.

"The infotainment segment is projected to hold the largest share of the automotive digital cockpit market in 2032."

The infotainment segment is expected to hold the largest share of the automotive digital cockpit market in 2032 as demand grows for connected services and personalized media experiences. Automakers are prioritizing platforms that integrate navigation, media, calls, and messaging, smartphone features, and vehicle settings within a single interface. Advancements in graphics processing and software-defined cockpit architectures enable continuous feature upgrades through over-the-air updates. Advancements in processing capability, graphic rendering, and cloud integration are enabling advanced functions such as natural voice interaction, predictive suggestions, and uninterrupted media access. OEMs are also expanding subscription-based offerings that make infotainment a high-value revenue channel. With rising expectations for digital convenience and immersive interaction, infotainment systems are set to remain the dominant application segment by 2032.

"The Asia Pacific is projected to hold the largest share of the automotive digital cockpit market in 2032."

The Asia Pacific accounted for the largest share of the automotive digital cockpit market in 2032. Strong vehicle production in China, India, Japan, and South Korea, combined with rapid EV adoption, is driving substantial demand for advanced cockpit systems. Automakers in the region are integrating digital clusters, infotainment units, passenger displays, and driver monitoring systems to meet rising customer expectations for connected and intelligent in-cabin experiences. Government support for electrification, connectivity standards, and safety compliance is further accelerating technology uptake. With continuous investments in software-defined vehicle platforms and cockpit electronics, the Asia Pacific region remains a crucial market for digital cockpit solutions.

Extensive primary interviews have been conducted with key industry experts in the automotive digital cockpit market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type -OEM - 45%, Tier 1 - 35%, and Others - 20%

- By Designation -Directors- 35%, C- C-level Executives - 35%, and Others - 30%

- By Region - Asia Pacific - 32%, Europe - 28%, North America - 36%, and RoW - 4%

The automotive digital cockpit market is dominated by a few globally established players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International. The study includes an in-depth competitive analysis of these key players in the automotive digital cockpit market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the automotive digital cockpit market. It forecasts its size by equipment (infotainment unit, rear infotainment unit, passenger infotainment unit, HUD, digital instrument cluster, digital center console, driver monitoring system), by electric vehicle type (battery electric vehicle and plug in hybrid electric vehicle), by vehicle type (passenger car, light commercial vehicle, heavy commercial vehicle), by display type (LCD, OLED, TFT LCD), by display size (<5", 5 to 10", >10"), and by application (infotainment, driver monitoring & assistance, vehicle and comfort control system). It also discusses market drivers, restraints, opportunities, and challenges. The report provides detailed market analysis across four key regions (North America, Europe, the Asia Pacific, and the Rest of the World). The report includes a review of the supply chain and the competitive landscape of key players operating in the automotive digital cockpit ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (growing consumer demand for premium in-cabin experiences, rising shift toward software-defined vehicles), restraints (high cost of advanced cockpit electronics), opportunities (growth in multimodal HMI, AR visualization, and interior sensing systems, increasing adoption of highway driving assist technology), challenges (increasing cybersecurity, data governance, and OTA coordination pressures, managing OTA complexity across distributed cockpit and vehicle compute units)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the automotive digital cockpit market

- Market Development: Comprehensive information about lucrative markets by analyzing the automotive digital cockpit market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automotive digital cockpit market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 2.4 HIGH-GROWTH SEGMENTS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE DIGITAL COCKPIT MARKET

- 3.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT

- 3.3 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE

- 3.4 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION

- 3.5 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE

- 3.6 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EV TYPE

- 3.7 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE

- 3.8 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising shift toward software-defined vehicles

- 4.2.1.2 Growing consumer demand for premium in-cabin experiences

- 4.2.1.3 Regulatory mandates driving expansion of cockpit safety technologies

- 4.2.1.4 Expansion of electric vehicles increasing demand for digital-centric cabin interfaces

- 4.2.2 RESTRAINTS

- 4.2.2.1 High cost of advanced cockpit electronics

- 4.2.2.2 Semiconductor and display supply vulnerabilities affecting cockpit system production

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing investment in AR and HUD technologies

- 4.2.3.2 Increasing adoption of highway driving assist technology

- 4.2.3.3 Growth in multimodal HMI, advanced visualization, and interior sensing systems

- 4.2.4 CHALLENGES

- 4.2.4.1 Increasing cybersecurity, data governance, and OTA coordination pressures in connected cockpits

- 4.2.4.2 Managing OTA complexity across distributed cockpit and vehicle computing units

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 TECHNOLOGY ANALYSIS

- 5.1.1 KEY TECHNOLOGIES

- 5.1.1.1 Advanced Display Technologies (LCD, OLED, Mini LED)

- 5.1.1.2 Cockpit Domain Controllers and High-performance SoCs

- 5.1.1.3 Natural Language Processing and Voice Assistants

- 5.1.2 COMPLEMENTARY TECHNOLOGIES

- 5.1.2.1 Interior Cameras and Driver Monitoring Systems

- 5.1.2.2 Gesture Control, Haptic Interaction, and Ambient Interfaces

- 5.1.3 ADJACENT TECHNOLOGIES

- 5.1.3.1 Central Vehicle Compute and Zonal Architectures

- 5.1.3.2 Connectivity, Telematics, and V2X Integration

- 5.1.1 KEY TECHNOLOGIES

- 5.2 TECHNOLOGY ROADMAP

- 5.3 PATENT ANALYSIS

- 5.4 FUTURE APPLICATIONS

- 5.5 IMPACT OF AI/GENERATIVE AI ON AUTOMOTIVE DIGITAL COCKPIT MARKET

- 5.5.1 TOP USE CASES AND MARKET POTENTIAL

- 5.5.2 BEST PRACTICES

- 5.5.3 CASE STUDIES

- 5.5.4 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.5.5 CLIENTS' READINESS TO ADOPT AI/GENERATIVE AI

- 5.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 5.6.1 TOYOTA MOTOR CORPORATION: DIGITAL COCKPIT INTEGRATION THROUGH TOYOTA SAFETY CONNECT

- 5.6.2 HYUNDAI MOTOR COMPANY: PANORAMIC DISPLAY AND DOMAIN-BASED COCKPIT ARCHITECTURE

- 5.6.3 GENERAL MOTORS: GOOGLE BUILT-IN SERVICES FOR CONNECTED COCKPIT EXPERIENCES

6 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 REGULATORY LANDSCAPE FOR AUTOMOTIVE DIGITAL COCKPIT SYSTEMS

- 6.1.3 INDUSTRY STANDARDS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.5 MARKET PROFITABILITY

- 7.5.1 REVENUE POTENTIAL

- 7.5.2 COST DYNAMICS

8 INDUSTRY TRENDS

- 8.1 MACROECONOMIC INDICATORS

- 8.1.1 INTRODUCTION

- 8.1.2 GDP TRENDS AND FORECAST

- 8.1.3 TRENDS IN GLOBAL AUTOMOTIVE INFOTAINMENT INDUSTRY

- 8.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 8.2 ECOSYSTEM ANALYSIS

- 8.2.1 RAW MATERIAL & DISPLAY COMPONENT SUPPLIERS

- 8.2.2 COMPONENT & SEMICONDUCTOR SUPPLIERS

- 8.2.3 COCKPIT SOFTWARE & HMI PROVIDERS

- 8.2.4 TIER 1 SUPPLIERS/SYSTEM INTEGRATORS

- 8.2.5 OEMS (AUTOMAKERS)

- 8.3 SUPPLY CHAIN ANALYSIS

- 8.4 PRICING ANALYSIS

- 8.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2024

- 8.4.2 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022-2024

- 8.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 8.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 8.6 INVESTMENT AND FUNDING SCENARIO

- 8.7 FUNDING, BY USE CASE

- 8.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 8.9 TRADE ANALYSIS

- 8.9.1 IMPORT SCENARIO (HS CODE 8537)

- 8.9.2 EXPORT SCENARIO (HS CODE 8537)

- 8.10 CASE STUDY ANALYSIS

- 8.10.1 CONTINENTAL DELIVERED HIGH-PERFORMANCE COCKPIT COMPUTING FOR VOLKSWAGEN

- 8.10.2 VISTEON SUPPLIED SMARTCORE DOMAIN CONTROLLER FOR BMW MINI

- 8.10.3 HARMAN INTERNATIONAL'S READY CARE AI-BASED COGNITIVE DISTRACTION MONITORING FOR BMW

- 8.10.4 LG'S PANORAMIC AUTOMOTIVE DISPLAY FOR MERCEDES-BENZ

- 8.10.5 VALEO DEVELOPED SMARTCOCKPIT DIGITAL SOLUTIONS IN COLLABORATION WITH GOOGLE AND RENAULT

- 8.10.6 MAGNA'S GEN5 FRONT CAMERA MODULE FOR EUROPEAN OEM

- 8.10.7 APTIV'S SOFTWARE-DEFINED VEHICLE COCKPIT PLATFORM FOR GLOBAL OEM

- 8.10.8 DENSO'S ADVANCED DRIVE COMPONENTS FOR LEXUS LS AND TOYOTA MIRAI

- 8.11 IMPACT OF 2025 US TARIFFS

- 8.11.1 INTRODUCTION

- 8.11.2 KEY TARIFF RATES

- 8.11.3 PRICE IMPACT ANALYSIS

- 8.11.4 IMPACT ON COUNTRIES/REGIONS

- 8.11.5 IMPACT ON AUTOMOTIVE INDUSTRY

- 8.12 STRATEGIC SHIFTS IN OEM AND SUPPLIER PROGRAMS

- 8.13 OEM ANALYSIS

- 8.13.1 XPENG

- 8.13.1.1 Digital cockpit strategy overview

- 8.13.1.2 Key digital cockpit technologies and components used

- 8.13.1.3 Key programs and model adoption

- 8.13.2 NIO

- 8.13.2.1 Digital cockpit strategy overview

- 8.13.2.2 Key programs and model adoption

- 8.13.3 LEAPMOTOR

- 8.13.3.1 Digital cockpit strategy overview

- 8.13.3.2 Key programs and component architecture

- 8.13.3.3 Featured models and adoption pathway

- 8.13.4 GEELY ZEEKR

- 8.13.4.1 Digital cockpit strategy overview

- 8.13.4.2 Key programs and model adoption

- 8.13.5 TATA MOTORS

- 8.13.5.1 Digital cockpit strategy overview

- 8.13.5.2 Digital cockpit components used

- 8.13.5.3 Key programs and model adoption

- 8.13.6 VOLKSWAGEN AUDI

- 8.13.6.1 Digital cockpit strategy overview

- 8.13.6.2 Key programs and model adoption

- 8.13.7 BMW

- 8.13.7.1 Digital cockpit strategy overview

- 8.13.7.2 Key programs and model adoption

- 8.13.8 STELLANTIS

- 8.13.8.1 Digital cockpit strategy overview

- 8.13.8.2 Key programs and model adoption

- 8.13.9 MERCEDES BENZ

- 8.13.9.1 Digital cockpit strategy overview

- 8.13.9.2 Key programs and model adoption

- 8.13.10 FORD MOTOR COMPANY

- 8.13.10.1 Digital cockpit strategy overview

- 8.13.10.2 Cockpit architecture and technology focus

- 8.13.10.3 Key programs and model adoption

- 8.13.11 GENERAL MOTORS

- 8.13.11.1 Digital cockpit strategy overview

- 8.13.11.2 Key programs and model adoption

- 8.13.1 XPENG

9 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT

- 9.1 INTRODUCTION

- 9.1.1 OPERATIONAL DATA

- 9.2 DIGITAL INSTRUMENT CLUSTER

- 9.2.1 SHIFT FROM ANALOG CLUSTERS TO FULLY DIGITAL AND RECONFIGURABLE DISPLAYS TO DRIVE DEMAND

- 9.3 DIGITAL CENTRAL CONSOLE

- 9.3.1 GROWING ADOPTION OF LARGE-FORMAT CENTRAL CONSOLES FOR NAVIGATION, MEDIA, AND CONNECTED SERVICES TO DRIVE DEMAND

- 9.4 INFOTAINMENT UNIT

- 9.4.1 INCREASING INTEGRATION OF CONNECTED INFOTAINMENT PLATFORMS AND EMBEDDED SOFTWARE ECOSYSTEMS TO DRIVE DEMAND

- 9.5 REAR INFOTAINMENT UNIT

- 9.5.1 EXPANDING USE OF REAR INFOTAINMENT SYSTEMS TO ENHANCE ENTERTAINMENT AND CABIN PERSONALIZATION

- 9.6 PASSENGER INFOTAINMENT UNIT

- 9.6.1 INCREASED INSTALLATION OF PASSENGER INFOTAINMENT UNITS FOR CO-NAVIGATION AND ENTERTAINMENT

- 9.7 HEAD-UP DISPLAY (HUD)

- 9.7.1 GROWING USE OF HUDS TO SUPPORT SAFETY VISUALIZATION AND DRIVER AWARENESS

- 9.8 DRIVER MONITORING SYSTEM

- 9.8.1 INCREASED DEPLOYMENT OF CAMERA-BASED DRIVER MONITORING TO SUPPORT SAFETY REGULATION AND ADAS ALIGNMENT

- 9.9 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CAR (PC)

- 10.2.1 PASSENGER VEHICLE DIGITALIZATION DRIVING ADOPTION OF ADVANCED DISPLAYS AND UNIFIED COCKPIT COMPUTE PLATFORMS

- 10.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 10.3.1 EXPANDING FLEET CONNECTIVITY TO DRIVE DEMAND FOR FUNCTIONAL TELEMATICS-DRIVEN COCKPIT PLATFORMS

- 10.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 10.4.1 HIGHER OPERATIONAL COMPLEXITY ACCELERATING DEPLOYMENT OF DURABLE DIAGNOSTICS-FOCUSED COCKPIT SYSTEMS

- 10.5 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 BATTERY ELECTRIC VEHICLE (BEV)

- 11.2.1 GROWING BEV PENETRATION DRIVING RAPID ADOPTION OF MULTI-DISPLAY AND SOFTWARE-CENTRIC COCKPIT ARCHITECTURES

- 11.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 11.3.1 RISING PHEV ADOPTION INCREASING DEMAND FOR HYBRID MODE VISUALIZATION AND INTEGRATED DUAL POWERTRAIN INTERFACES

- 11.4 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 INFOTAINMENT

- 12.2.1 EXPANDING USE OF CONNECTED MEDIA, NAVIGATION, AND CLOUD SERVICES TO DRIVE GROWTH

- 12.3 DRIVER MONITORING & ASSISTANCE

- 12.3.1 INCREASING SOFTWARE INTEGRATION BETWEEN CLUSTER DISPLAYS, HEAD-UP DISPLAYS, AND DRIVER MONITORING SYSTEMS TO DRIVE DEMAND

- 12.4 VEHICLE & COMFORT CONTROL SYSTEM

- 12.4.1 INCREASING SHIFT TOWARD CENTRALIZED DIGITAL CONTROL OF VEHICLE FUNCTIONS TO ENHANCE USER EXPERIENCE

- 12.5 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE

- 13.1 INTRODUCTION

- 13.2 <5"

- 13.2.1 GROWING ROLE OF SMALL FORMAT DISPLAYS IN COST-OPTIMIZED VEHICLES TO SUPPORT DEMAND

- 13.3 5-10"

- 13.3.1 STRONG GROWTH IN COMPACT SUVS AND CROSSOVER MODELS TO SUPPORT DEMAND

- 13.4 >10"

- 13.4.1 RAPID ELECTRIFICATION AND PREMIUM VEHICLE LAUNCHES TO DRIVE DEMAND

- 13.5 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE

- 14.1 INTRODUCTION

- 14.2 LIQUID CRYSTAL DISPLAY (LCD)

- 14.2.1 LCD MAINTAINING BROAD MARKET COVERAGE THROUGH COST EFFICIENCY, RELIABILITY, AND SCALABLE ADOPTION ACROSS GLOBAL VEHICLE SEGMENTS

- 14.3 ORGANIC LIGHT EMITTING DIODE (OLED)

- 14.3.1 OLED ADVANCING PREMIUM COCKPIT EXPERIENCES WITH HIGH CONTRAST OUTPUT, FLEXIBLE FORM FACTORS, AND IMMERSIVE VISUAL PERFORMANCE

- 14.4 THIN FILM TRANSISTOR-LIQUID CRYSTAL DISPLAY (TFT-LCD)

- 14.4.1 TFT LCD STRENGTHENING MID-PREMIUM COCKPIT DEPLOYMENTS THROUGH HIGHER BRIGHTNESS, IMPROVED VIEWING ANGLES, AND STABLE OPERATIONAL RESILIENCE

- 14.5 KEY INDUSTRY INSIGHTS

15 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Strengthening domestic digital cockpit ecosystem through technology capability and local supply support to drive market

- 15.2.2 INDIA

- 15.2.2.1 Scaling digital cockpit adoption through connectivity and cost-efficient local engineering to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Advancing digital cockpit systems through engineering quality and connected service expansion to drive market

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Growing software-defined vehicle programs and premium display integration to drive demand

- 15.2.5 THAILAND

- 15.2.5.1 Expanding EV production and local electronics investment to drive market

- 15.2.6 REST OF ASIA PACIFIC

- 15.2.1 CHINA

- 15.3 NORTH AMERICA

- 15.3.1 US

- 15.3.1.1 Expansion of connected services and multi-display EV platforms to drive demand

- 15.3.2 CANADA

- 15.3.2.1 Growth in safety regulation compliance and expanding fleet digitalization to drive demand

- 15.3.3 MEXICO

- 15.3.3.1 Strong assembly and export orientation to drive demand

- 15.3.1 US

- 15.4 EUROPE

- 15.4.1 GERMANY

- 15.4.1.1 Premium-vehicle programs and software-centric cockpit architectures to drive market

- 15.4.2 FRANCE

- 15.4.2.1 Scaled rollout of modular digital cockpits across mass-market vehicles to drive demand

- 15.4.3 ITALY

- 15.4.3.1 Design-driven cockpit refresh cycles and feature standardization to drive growth

- 15.4.4 SPAIN

- 15.4.4.1 Export-focused compact vehicle manufacturing and compliance-driven feature upgrades to drive demand

- 15.4.5 UK

- 15.4.5.1 Luxury interior differentiation and brand-specific cockpit design to drive market

- 15.4.6 RUSSIA

- 15.4.6.1 Production stabilization and localized platform simplification to sustain cockpit integration

- 15.4.7 REST OF EUROPE

- 15.4.1 GERMANY

- 15.5 REST OF THE WORLD (ROW)

- 15.5.1 BRAZIL

- 15.5.1.1 High smartphone penetration and standardized infotainment adoption to drive demand

- 15.5.2 IRAN

- 15.5.2.1 Platform continuity and cost-controlled digital upgrades to sustain demand

- 15.5.3 OTHERS

- 15.5.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT, 2024

- 16.7.5.1 Company footprint, 2024

- 16.7.5.2 Region footprint, 2024

- 16.7.5.3 Equipment footprint, 2024

- 16.7.5.4 Vehicle type footprint, 2024

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of startups

- 16.8.5.2 Competitive benchmarking of startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 CONTINENTAL AG

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Expansions

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 ROBERT BOSCH GMBH

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 HARMAN INTERNATIONAL

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.3.4 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 VISTEON CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Expansions

- 17.1.4.3.4 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 DENSO CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 VALEO

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Expansions

- 17.1.6.4 MnM view

- 17.1.6.4.1 Right to win

- 17.1.6.4.2 Strategic choices

- 17.1.6.4.3 Weaknesses and competitive threats

- 17.1.7 MITSUBISHI ELECTRIC CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Other developments

- 17.1.8 TOMTOM INTERNATIONAL BV

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Other developments

- 17.1.9 APTIV

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Deals

- 17.1.9.3.2 Expansions

- 17.1.10 LG ELECTRONICS

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions offered

- 17.1.10.2.1 Product launches/developments

- 17.1.10.2.2 Deals

- 17.1.11 FORVIA

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches/developments

- 17.1.11.3.2 Deals

- 17.1.12 MAGNA INTERNATIONAL INC.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches/developments

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Expansions

- 17.1.12.3.4 Other developments

- 17.1.13 HYUNDAI MOBIS

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches/developments

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Other developments

- 17.1.14 ALPS ALPINE CO., LTD.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.14.3.3 Other developments

- 17.1.1 CONTINENTAL AG

- 17.2 OTHER PLAYERS

- 17.2.1 QUALCOMM TECHNOLOGIES, INC.

- 17.2.2 NXP SEMICONDUCTORS

- 17.2.3 MARELLI HOLDINGS CO., LTD.

- 17.2.4 ZF FRIEDRICHSHAFEN AG

- 17.2.5 PIONEER CORPORATION

- 17.2.6 SONY CORPORATION

- 17.2.7 INFINEON TECHNOLOGIES AG

- 17.2.8 JVCKENWOOD CORPORATION

- 17.2.9 FUJITSU LIMITED

- 17.2.10 FORYOU CORPORATION

- 17.2.11 MAGNETI MARELLI S.P.A

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviews: Demand and supply sides

- 18.1.2.2 Key industry insights and breakdown of primary interviews

- 18.1.2.3 List of primary participants

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ASSESSMENT

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, AT THE REGIONAL LEVEL (FOR REGIONS COVERED IN THE REPORT)

- 19.4.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, AT THE REGIONAL LEVEL (FOR THE REGIONS COVERED IN THE REPORT)

- 19.4.3 COMPANY INFORMATION

- 19.4.4 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS