|

시장보고서

상품코드

1919589

차량용 인포테인먼트 시장 : 컴포넌트별, 용도별, OS별, 접속성별, 폼 팩터별, 디스플레이 사이즈별, 배치별, ICE 및 EV별, 지역별 예측(-2032년)In-vehicle Infotainment Market by Component, Application, OS, Connectivity, Form Factor, Display Size, Location, ICE & EV, and Region - Global Forecast to 2032 |

||||||

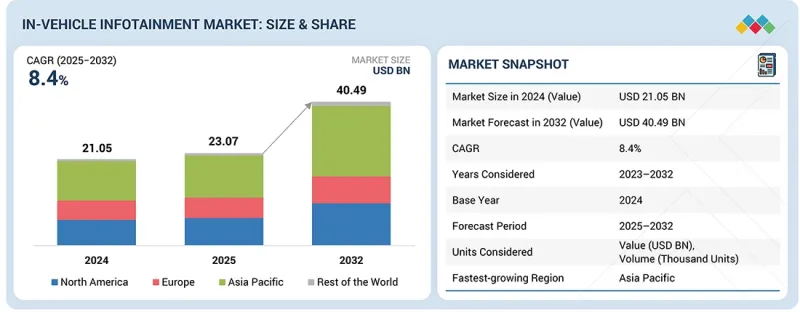

세계의 차량용 인포테인먼트 시장 규모는 2025년 230억 7,000만 달러에서 2032년까지 404억 9,000만 달러에 이를 것으로 예상되며 CAGR 8.4%의 성장이 예상됩니다. 독일, 이탈리아, 영국 등 유럽 국가에서 커넥티드카와 프리미엄카에 대한 수요 증가, 첨단 드라이버 인포메이션 엔터테인먼트 기능의 통합 확대, 더욱 강화된 차량용 디지털 체험에 대한 고객의 강한 선호가 결합되어 시장 성장을 가속시킬 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 수량(1,000대), 금액(100만 달러) |

| 부문 | 부품, OS, 용도, 배치, 연결성, 폼 팩터, 디스플레이 크기, 레트로 피트, ICE 자동차 유형, 전기자동차 유형 |

| 대상 지역 | 아시아태평양, 북미, 유럽 및 기타 지역 |

아시아태평양의 차량용 인포테인먼트 시장은 중국, 한국, 일본의 프리미엄 제품과 프리미엄 EV 제품의 확대에 따라 성장하고 있습니다. 또한 5G의 급속한 보급, 커넥티드 서비스에 대한 소비자의 높은 수용도, 정부 주도의 인텔리전트 모빌리티 프로그램이 차량용 인포테인먼트의 성장을 가속하고, 승용차를 중심으로 모든 차량 부문에서 인포테인먼트의 채용을 가속화하고 있습니다.

"인포테인먼트 유닛 부문이 예측 기간 중 차량용 인포테인먼트 시장을 견인할 것으로 전망"

컴포넌트별로는 OEM이 중고급 승용차와 소형차를 위한 중대형 통합 디지털 디스플레이로의 전환을 가속화하는 동안 인포테인먼트 유닛 부문이 계속해서 주요 부문이 될 것으로 예측됩니다. 아시아의 신흥 시장에서 디스플레이 크기는 일반적으로 차량 가격대에 따라 확대됩니다. 엔트리 모델에서는 3-5인치, 미들 부문에서는 8-10인치, 프리미엄 모델에서는 12인치 이상이 일반적입니다. 대형 센터 스크린(10인치 이상)은 네비게이션, 미디어, 차량 기능, 스마트 앱, 심지어 특정 ADAS 오버레이까지 디지털화가 진행되는 동안 스마트폰과 비슷한 풍부한 인터페이스를 가능하게 함으로써 강한 수요를 모으고 있습니다. 중가격대의 차에서는 8-10.25인치의 디스플레이 유닛을 제공함으로써 대폭적인 인테리어 변경 없이 비용 효율적인 "프리미엄감"을 실현하여 가치인식을 높일 수 있습니다. 또한, 프리미엄 모델과 럭셔리 모델은 멀티 스크린 캐빈, 특히 후방 좌석 인포테인먼트 시스템의 보급을 촉진합니다. 이러한 고해상도 디스플레이는 스트리밍, 게임, 심리스 디바이스 연동을 가능하게 하고, 유럽이나 북미 등의 프리미엄 카 보급률이 높은 지역에서 특히 현저하게 채용이 진행되고 있습니다. 디지털 플릿 관리 시스템의 보급이 확대됨에 따라 OEM은 픽업 트럭, 밴 및 대형 트럭 부문에서도 보다 크고 고성능의 디스플레이 통합을 추진하고 있습니다.

필러 투 필러 디스플레이는 중앙 집중식 컴퓨터와 고성능 자동차용 SoC로 구현되어 프리미엄 자동차에서 조종석의 주요 동향이 되고 있습니다. 기기 클러스터와 인포테인먼트 시스템을 단일 연속 스크린에 통합함으로써 OEM은 풍부한 HMI, 실시간 시각화 및 소프트웨어 차별화를 강화할 수 있습니다. 구체적인 사례로는 Mercedes-Benz의 MBUX Hyperscreen, BMW의 차세대 파노라믹 디스플레이 컨셉(Panoramic iDrive), 주요 중국 EV 제조업체의 사례를 들 수 있습니다. 또한 승객 디스플레이는 미디어 시청, 게임, 디지털 서비스를 지원하면서 운전자 주의 산만 방지 규정을 준수하는 독립적인 차량용 경험 레이어로 진화를 보여줍니다. Mercedes-Benz, Audi, Hyundai-Kia와 같은 자동차 제조업체들은 이러한 디스플레이를 커넥티드 서비스 및 OTA 지원 기능 업그레이드를 통해 수익을 창출하는 인터페이스로 자리매김하고 있습니다.

차량용 스크린은 대형화 및 다화면화가 진행되어, 커넥티드인 디지털 라이프 스타일의 연장으로서 인식되는 경향이 강해지고 있습니다. 또한 후방 좌석 인포테인먼트 시스템은 직관적인 조작성, 다기능성, 승객의 쾌적성 향상을 추구하여 설계됩니다. 이러한 점에서 인포테인먼트 유닛 부문은 2032년까지 컴포넌트 시장을 계속 견인할 것으로 예측됩니다.

이 보고서는 세계의 차량용 인포테인먼트 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 제품 개발 및 혁신, 경쟁 구도에 대한 지식을 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

- 차량용 인포테인먼트 시장에서의 매력적인 기회

- 차량용 인포테인먼트 시장 : 형태별

- 차량용 인포테인먼트 시장 : 컴포넌트별

- 차량용 인포테인먼트 시장 : 배치별

- 차량용 인포테인먼트 시장 : OS별

- 차량용 인포테인먼트 시장 : 용도별

- 차량용 인포테인먼트 시장 : ICE차 유형별

- 차량용 인포테인먼트 시장 : 접속성별

- 전기자동차용 인포테인먼트 시장 : 차량 유형별

- 차량용 인포테인먼트 레트로 피트 시장 : 차량 유형별

- 차량용 인포테인먼트 레트로 피트 시장 : 디스플레이 사이즈별

- 차량용 인포테인먼트 시장 : 지역별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

제5장 업계 동향

- 공급망 분석

- 생태계 분석

- 고객사업에 영향을 주는 동향/혼란

- 가격 설정 분석

- 평균 가격대 : 차량용 인포테인먼트 시스템, 지역별(2023년?2024년)

- 평균 가격대 : 차량용 인포테인먼트 시스템, 차량 유형별(2023년?2024년)

- 평균 가격대 : 차량용 인포테인먼트 시스템, 컴포넌트별(2023년?2024년)

- 참고 가격 동향 : 차량용 인포테인먼트 시스템, 주요 기업별(2023년 및 2024년)

- 무역 분석

- 수입 시나리오(2020-2024년)

- 수출 시나리오(2020-2024년)

- 투자 및 자금조달 시나리오

- 주요 회의 및 이벤트(2026년)

- 사례 연구 분석

- 차량용 인포테인먼트 시장 : OEM 분석

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 미래 용도

- 특허 분석

- 주요 신기술

- 승객용 디스플레이

- 필러 투 필러 디스플레이

- 소프트웨어 정의 차량(SDV)

- 수익화 및 서비스 레이어 생태계(차량용 결제, 구독, 컨텐츠 스트리밍)

- 보완 기술

- 접속성 및 텔레매틱스 모듈(TCUS, V2X, 클라우드 통합)

- 자동차용 휴먼 머신 인터페이스(HMI) 시스템

- 미래 용도

- AI 구동 콕핏 어시스턴트

- 크로스 디바이스 디지털 연속성

- A 및 생성형 AI의 영향

제7장 지속가능성과 규제정세

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 차량용 인포테인먼트 규제 및 규격 : 국가 및 지역별

제8장 고객 정세와 구매행동

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 승용차

- 상용차

제9장 차량용 인포테인먼트 시장 : ICE 차량 유형별

- 승용차(PC)

- 소형 상용차(LCV)

- 대형 상용차(HCV)

- 중요 인사이트

제10장 전기자동차용 인포테인먼트 시장 : 전기자동차 유형별

- 배터리 전기자동차(BEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 연료전지 전기자동차(FCEV)

- 중요 인사이트

제11장 차량용 인포테인먼트 레트로 피트 시장 : 차량 유형별

- 승용차

- 상용차

- 중요 인사이트

제12장 차량용 인포테인먼트 시장 : 용도별

- 네비게이션

- 가상 퍼스널 어시스턴트(VPA)

- 앱 스토어

- 음악

- 뒷좌석 인포테인먼트

- 중요 인사이트

제13장 차량용 인포테인먼트 시장 : 컴포넌트별

- 인포테인먼트 유닛

- 승객용 디스플레이

- 디지털 계기 클러스터

- 헤드업 디스플레이

- 중요 인사이트

제14장 차량용 인포테인먼트 시장 : 접속성별

- 3G/4G

- 5G

- 중요 인사이트

제15장 차량용 인포테인먼트 시장 : 디스플레이 사이즈별

- 디스플레이 사이즈 5인치 미만

- 디스플레이 사이즈 5-10인치

- 디스플레이 사이즈 10인치 초과

- 중요 인사이트

제16장 차량용 인포테인먼트 시장 : 형식별

- 내장형 식

- 테저드 형식

- 통합 형식

- 중요 인사이트

제17장 차량용 인포테인먼트 시장 : 지역별

- 전열 인포테인먼트 시스템

- 후열 인포테인먼트 시스템

- 중요 인사이트

제18장 차량용 인포테인먼트 시장 : OS별

- Linux

- QNX

- Android

- 기타 OS

- Wind River

- OEM/내제

- 중요 인사이트

제19장 차량용 인포테인먼트 시장 : 지역별

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 기타 유럽

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 기타 지역

- 거시경제 전망

- 브라질

- 남아프리카

- 기타

- 중요 인사이트

제20장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2023-2025년)

- 시장 점유율 분석(2024년)

- 주요 기업의 수익 분석(2020-2024년)

- 기업 평가와 재무지표(2024년)

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 차량용 인포테인먼트 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제21장 기업 프로파일

- 주요 기업

- ALPS ALPINE CO., LTD.

- GARMIN LTD

- PIONEER CORPORATION

- HARMAN INTERNATIONAL

- PANASONIC CORPORATION

- ROBERT BOSCH GMBH

- MITSUBISHI ELECTRIC CORPORATION

- TOMTOM INTERNATIONAL BV

- CONTINENTAL AG

- VISTEON CORPORATION

- 기타 기업

- DESAY INDUSTRY

- DENSO CORPORATION

- JVCKENWOOD CORPORATION

- FUJITSU

- FORYOU CORPORATION

- HYUNDAI MOBIS

- FORD MOTOR COMPANY

- APTIV

- MARELLI HOLDINGS CO., LTD.

- GENERAL MOTORS

- AUDI AG

- BMW GROUP

- AISIN CORPORATION

- ALLEGRO MICROSYSTEMS, INC.

- FAURECIA SE

제22장 조사 방법

제23장 부록

JHS 26.02.09The in-vehicle infotainment market is projected to grow from USD 23.07 billion in 2025 to USD 40.49 billion by 2032 at a CAGR of 8.4%. The increasing demand for connected and premium vehicles from European countries, such as Germany, Italy, and the UK, combined with the expanding integration of advanced driver information and entertainment features, as well as stronger customer preference for enhanced in-cabin digital experiences, will accelerate market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (000 Units) and Value (USD Million) |

| Segments | By Component, Operating System, Application, Location, Connectivity, Form Factor, Display Size, Retrofit by Vehicle Type, ICE Vehicle Type, and Electric Vehicle by Vehicle Type |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The Asia Pacific market for in-vehicle infotainment is expanding as China, South Korea, and Japan scale premium and premium EV products. In addition, the rapid deployment of 5G, strong consumer adoption of connected services, and government-backed intelligent mobility programs are accelerating infotainment adoption across vehicle segments, particularly in passenger cars, driven by the growth in in-vehicle infotainment.

"The infotainment unit segment is projected to lead the in-vehicle infotainment market during the forecast period."

By component, the infotainment unit segment is projected to remain the dominant segment as OEMs accelerate the move toward mid- to large-size integrated digital displays across medium to high-end passenger and light-duty vehicles. In developing Asian markets, display sizes typically scale with vehicle price bracket: 3-5 inches in entry-level cars, 8-10 inches in the mid-segment, and above 12 inches in premium models. Larger central screens (> 10") are gaining strong traction because they enable a richer, more smartphone-like interface while supporting the growing shift of navigation, media, vehicle functions, smart apps, and even specific ADAS overlays into digital form. For mid-priced cars, offering an 8-10.25" display unit also delivers a cost-effective 'premium feel', boosting perceived value without major interior redesigns. Furthermore, premium and luxury models are simultaneously driving growth in multi-screen cabins, especially rear-seat infotainment systems. These high-resolution displays enable streaming, gaming, and seamless device integration, and their adoption is quite prominent in regions with higher premium-vehicle penetration, such as Europe and North America. The rising adoption of digital fleet-management systems is prompting OEMs to integrate larger, more capable displays in the pickup, van, and heavy truck segments.

Pillar-to-pillar displays are becoming a key cockpit trend in premium vehicles, enabled by centralized computers and high-performance automotive SoCs. By integrating the instrument cluster and infotainment systems into a single, continuous screen, OEMs can enhance HMI richness, real-time visualization, and software-led differentiation. Examples include Mercedes-Benz MBUX Hyperscreen and next-generation panoramic display concepts from BMW (Panoramic iDrive) and leading Chinese EV OEMs. Additionally, passenger displays are evolving as a distinct in-cabin experience layer, supporting media consumption, gaming, and digital services while remaining compliant with driver-distraction regulations. OEMs such as Mercedes-Benz, Audi, and Hyundai-Kia are positioning these displays as revenue-generating interfaces through connected services and OTA-enabled feature upgrades.

As larger and more numerous screens in vehicles are increasingly viewed as an extension of a connected, digital lifestyle, and rear-seat infotainment systems are designed for intuitive control, multi-functionality, and enhanced passenger comfort, the infotainment unit segment is projected to continue dominating the components market by 2032.

"The embedded segment is projected to grow at the highest rate in the in-vehicle infotainment market during the forecast period."

By form factor, the embedded segment is poised to be the fastest-growing segment in the in-vehicle infotainment market during the forecast period. This is primarily due to the increasing integration of OEM-fitted units in SUVs and mid-range passenger vehicles. Automakers are increasingly standardizing embedded platforms across their vehicle lineups, offering features such as 4G/5G connectivity, ADAS-linked human-machine interfaces, head-up displays, and manufacturer-grade navigation systems. This approach ensures consistent performance, seamless integration, and secure delivery of infotainment functions across models.

Regulatory changes are further driving the adoption of embedded infotainment systems across regions. For example, in Europe, requirements like eCall expansion, cybersecurity compliance (UNECE R155), and updated software update mandates (UNECE R156) encourage OEMs to implement embedded systems capable of managing emergency services, over-the-air updates, and safety-critical applications reliably. Similarly, in North America, the 2024 NHTSA mandate for automatic emergency braking (FMVSS 127) underscores the importance of seamless integration between infotainment and safety alerts.

With consumer demand for connected, digitally rich cabins on the rise, advances in embedded technology, including 5G connectivity, AI-driven voice control, and cloud-based navigation, are expected to drive the strong growth of embedded infotainment units during the forecast period.

"North America is projected to be the second-largest market for in-vehicle infotainment during the forecast period."

North America remains the second-largest regional market, supported by strong demand for mid- and full-size SUVs and pickup trucks in the US and Canada, higher disposable incomes, and rapid adoption of connected-vehicle features. Automotive OEMs, such as Ford, General Motors, Toyota, Hyundai-Kia, and Tesla, are integrating advanced HMIs, cloud-based navigation, voice-driven interfaces, and OTA-enabled cockpit systems into their mainstream models. The regulatory framework is also shaping this growth, with the 2024 NHTSA mandate requiring automatic emergency braking with pedestrian detection for all light vehicles. As a result, OEMs are accelerating the integration of enhanced digital displays, sensor-fusion alert layers, and real-time ADAS feedback into their infotainment clusters. Additionally, the increasing amount of time drivers spend in vehicles, averaging nearly an hour per day in the US, further reinforces the demand for more capable, intuitive, and connected in-car systems. Moreover, newly launched electric and premium models, such as the Ford F-150 Lightning, Mercedes-Benz GLC, Hyundai Ioniq 6, and BMW i7, demonstrate the shift toward multi-screen layouts, AI-enabled voice assistants, app-store-style ecosystems, and seamless phone-to-vehicle continuity.

Furthermore, the region is witnessing a more substantial uptake of larger central displays, fully digital clusters, co-passenger screens, and integrated infotainment-ADAS interface-features that are increasingly expected, even in mid-segment SUVs. Together, these technological and regulatory forces will continue to strengthen the demand for the in-vehicle infotainment market across the region through the forecast period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: In-vehicle Infotainment Suppliers - 45%, Automotive OEMs - 35%, and Others - 20%

- By Designation: C-Level - 35%, Directors - 35%, and Others - 30%

- By Region: Asia Pacific - 65%, Europe - 10%, and North America - 25%

The in-vehicle Infotainment market is led by established players, such as Harman International (US), Panasonic Corporation (Japan), Alps Alpine Co., Ltd. (Japan), Robert Bosch GmbH (Germany), and Continental AG (Germany).

Research Coverage:

The study segments the in-vehicle infotainment market and forecasts the market size based on ICE Vehicle Type (Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicle), Component (Infotainment Unit, Passenger Display, Display Instrument Cluster, and Head-Up Display), Operating System (Android, Linux, QNX, Microsoft, and Others), Application [Navigation, Virtual Personal Assistant (VPA), App Store, Music, and Rear Seat], Location (Front Row and Rear Row), Connectivity (3G/4G and 5G), Form (Embedded, Tethered, and Integrated), Display Size (< 5", 5"-10", and > 10"), Retrofit by Vehicle Type (Passenger Car and Commercial Vehicle), Electric Vehicle by Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Fuel-Cell Electric Vehicle), and Region (Asia Pacific, North America, Europe, and the Rest of the World).

The study includes an in-depth competitive analysis of the significant In-vehicle infotainment manufacturers, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall In-vehicle infotainment market and its sub-segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following points:

- Analysis of key drivers (Expansion of connected and intelligent in-cabin ecosystem enhancing Safety, Comfort, and Experience, increase in demand for rear-seat entertainment, expansion of the global smartphone ecosystem and integration of cloud-based connectivity), restraints (Additional cost of annual subscriptions in infotainment systems, lack of seamless connectivity fragmented operating systems (Android Automotive, QNX, AGL), opportunities (Government mandates on telematics and e-call services; emergence of technologies such as 5G and AI), and challenges (Cybersecurity challenge))

- Product Development/Innovation: Insights into next-generation IVI platforms, AI-enabled human-machine interfaces, multi-display cockpits, and software-defined infotainment architectures

- Market Development: Analysis of demand trends across North America, Europe, and Asia Pacific driven by connected vehicle adoption, regulatory requirements, and rising consumer expectations for digital experiences

- Market Diversification: Evaluation of infotainment solutions across passenger cars, commercial vehicles, and electric vehicles, including opportunities in subscription-based services and cloud-enabled features

- Competitive Assessment: In-depth assessment of market positioning, technology focus, and growth strategies of key players, such as ALPS ALPINE CO., LTD. (Japan), Garmin (US), Pioneer Corporation (Japan), Harman International (US), and Panasonic Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IN-VEHICLE INFOTAINMENT MARKET

- 3.2 IN-VEHICLE INFOTAINMENT MARKET, BY FORM

- 3.3 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT

- 3.4 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION

- 3.5 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM (OS)

- 3.6 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION

- 3.7 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE

- 3.8 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 3.9 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY VEHICLE TYPE

- 3.10 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE

- 3.11 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY DISPLAY SIZE

- 3.12 IN-VEHICLE INFOTAINMENT MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of connected and intelligent in-cabin ecosystems enhancing safety, comfort, and experience

- 4.2.1.2 Increase in demand for rear-seat entertainment

- 4.2.1.3 Expansion of global smartphone ecosystem and integration of cloud-based connectivity

- 4.2.2 RESTRAINTS

- 4.2.2.1 Additional cost of annual subscriptions in infotainment systems

- 4.2.2.2 Lack of seamless connectivity

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Government mandates on telematics and e-call services

- 4.2.3.2 Emergence of 5G, AI, and other technologies

- 4.2.3.2.1 5G

- 4.2.3.2.2 AI

- 4.2.4 CHALLENGES

- 4.2.4.1 Cybersecurity issues

- 4.2.1 DRIVERS

5 INDUSTRY TRENDS

- 5.1 SUPPLY CHAIN ANALYSIS

- 5.2 ECOSYSTEM ANALYSIS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY REGION, 2023 VS. 2024 (USD)

- 5.4.2 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY VEHICLE TYPE, 2023 VS. 2024 (USD)

- 5.4.3 AVERAGE PRICE RANGE: IN-VEHICLE INFOTAINMENT SYSTEMS, BY COMPONENT, 2023 VS. 2024 (USD)

- 5.4.4 INDICATIVE PRICE TREND: IN-VEHICLE INFOTAINMENT SYSTEMS, BY KEY PLAYERS, 2023 VS. 2024 (USD)

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT SCENARIO, 2020-2024

- 5.5.2 EXPORT SCENARIO, 2020-2024

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ACCURACY, TRACEABILITY, AND REPEATABILITY DRIVING BATTENBERG'S HAPTIC TESTING SUCCESS

- 5.8.2 VOLVO & POLESTAR'S ANDROID AUTOMOTIVE INFOTAINMENT PLATFORM BUILT WITH APTIV

- 5.8.3 AUTOSYNC - DESIGNING SAFER, SMARTER INFOTAINMENT DASHBOARD

- 5.8.4 SNAPP AUTOMOTIVE'S QUEST FOR EXCELLENCE IN IN-CAR LANGUAGE INPUT

- 5.8.5 APTERA DELIVERED WORLD'S MOST EFFICIENT ELECTRIC VEHICLE IN UNDER ONE YEAR

- 5.9 IN-VEHICLE INFOTAINMENT MARKET: OEM ANALYSIS

- 5.9.1 DISPLAY SIZES OF IN-VEHICLE INFOTAINMENT SYSTEMS, BY OEM

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 PATENT ANALYSIS

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.2.1 PASSENGER DISPLAY

- 6.2.2 PILLAR-TO-PILLAR DISPLAY

- 6.2.3 SOFTWARE-DEFINED VEHICLE (SDV)

- 6.2.4 MONETIZATION & SERVICE-LAYER ECOSYSTEMS (IN-CAR PAYMENTS, SUBSCRIPTIONS, AND CONTENT STREAMING)

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.3.1 CONNECTIVITY & TELEMATICS MODULES (TCUS, V2X, CLOUD INTEGRATION)

- 6.3.2 AUTOMOTIVE HUMAN-MACHINE INTERFACE (HMI) SYSTEMS

- 6.4 FUTURE APPLICATIONS

- 6.4.1 AI-DRIVEN COCKPIT ASSISTANTS

- 6.4.2 CROSS-DEVICE DIGITAL CONTINUITY

- 6.5 IMPACT OF AI/ GENERATIVE AI

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 IN-VEHICLE INFOTAINMENT REGULATIONS/STANDARDS, BY COUNTRY/REGION

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2 BUYING CRITERIA

- 8.2.1 PASSENGER CARS

- 8.2.2 COMMERCIAL VEHICLES

9 IN-VEHICLE INFOTAINMENT MARKET, BY ICE VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CAR (PC)

- 9.2.1 GROWING CONSUMER PREFERENCE FOR CONNECTED, PERSONALIZED CABIN EXPERIENCES TO DRIVE SEGMENTAL GROWTH

- 9.3 LIGHT COMMERCIAL VEHICLE (LCV)

- 9.3.1 DEMAND FOR CONNECTED COCKPIT SOLUTIONS TO DRIVE SEGMENTAL GROWTH

- 9.4 HEAVY COMMERCIAL VEHICLE (HCV)

- 9.4.1 DEMAND FOR INFOTAINMENT PLATFORMS THAT INTEGRATE NAVIGATION, ADVANCED TELEMATICS, ADAS INTERFACES, AND REAL-TIME FLEET MONITORING TO DRIVE SEGMENTAL GROWTH

- 9.5 PRIMARY INSIGHTS

10 ELECTRIC VEHICLE INFOTAINMENT MARKET, BY ELECTRIC VEHICLE (EV) TYPE

- 10.1 INTRODUCTION

- 10.2 BATTERY ELECTRIC VEHICLE (BEV)

- 10.2.1 INCREASING BEV SHIPMENTS TO DRIVE SEGMENTAL GROWTH

- 10.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 10.3.1 INCREASING SALES IN ASIA PACIFIC TO DRIVE SEGMENTAL GROWTH

- 10.4 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 10.4.1 GROWING DEMAND FOR ALTERNATIVE FUEL VEHICLES TO DRIVE SEGMENTAL GROWTH

- 10.5 PRIMARY INSIGHTS

11 IN-VEHICLE INFOTAINMENT RETROFIT MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 PASSENGER CAR

- 11.2.1 INCREASING ADOPTION OF SMARTPHONE-INTEGRATED ECOSYSTEMS TO DRIVE SEGMENTAL GROWTH

- 11.3 COMMERCIAL VEHICLE

- 11.3.1 INVESTMENT IN SCALABLE AFTERMARKET INFOTAINMENT AND TELEMATICS UPGRADES TO DRIVE SEGMENTAL GROWTH

- 11.4 PRIMARY INSIGHTS

12 IN-VEHICLE INFOTAINMENT MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 NAVIGATION

- 12.2.1 INTEGRATION WITH TRAFFIC DATA TO DRIVE SEGMENTAL GROWTH

- 12.3 VIRTUAL PERSONAL ASSISTANT (VPA)

- 12.3.1 ENHANCED CONVENIENCE, SAFETY, AND CONNECTIVITY TO DRIVE SEGMENTAL GROWTH

- 12.4 APP STORE

- 12.4.1 GROWING OEM PARTNERSHIPS WITH SOFTWARE SUPPLIERS TO DRIVE SEGMENTAL GROWTH

- 12.5 MUSIC

- 12.5.1 SMARTPHONE INTEGRATION WITH VARIOUS MUSIC STREAMING APPLICATIONS TO DRIVE SEGMENTAL GROWTH

- 12.6 REAR-SEAT INFOTAINMENT

- 12.6.1 MEDLEY OF FEATURES IN REAR-SEAT INFOTAINMENT SYSTEMS TO DRIVE SEGMENTAL GROWTH

- 12.7 PRIMARY INSIGHTS

13 IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT

- 13.1 INTRODUCTION

- 13.2 INFOTAINMENT UNIT

- 13.2.1 SHIFT TOWARD RICHER NAVIGATION, SAFETY VISUALIZATION, VEHICLE DIAGNOSTICS, AND AI-DRIVEN INTERFACES TO DRIVE SEGMENTAL GROWTH

- 13.3 PASSENGER DISPLAY

- 13.3.1 AVAILABILITY OF PASSENGER DISPLAYS IN HIGH-SEGMENT VEHICLES TO DRIVE SEGMENTAL GROWTH

- 13.4 DIGITAL INSTRUMENT CLUSTER

- 13.4.1 TRANSITION TOWARD SOFTWARE-DEFINED ARCHITECTURE TO DRIVE SEGMENTAL GROWTH

- 13.5 HEAD-UP DISPLAY

- 13.5.1 SHIFT TO AR-ENABLED HUDS, INTEGRATED WITH ADVANCED SENSORS AND CONNECTED NAVIGATION TO DRIVE SEGMENTAL GROWTH

- 13.6 PRIMARY INSIGHTS

14 IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 14.1 INTRODUCTION

- 14.2 3G/4G

- 14.2.1 OPERATIONAL BACKBONE FOR MASS-MARKET AND MID-RANGE VEHICLES

- 14.3 5G

- 14.3.1 TO BECOME FOUNDATION FOR NEXT-GENERATION IN-VEHICLE INFOTAINMENT SYSTEMS

- 14.4 PRIMARY INSIGHTS

15 IN-VEHICLE INFOTAINMENT MARKET, BY DISPLAY SIZE

- 15.1 INTRODUCTION

- 15.2 <5" DISPLAY SIZE

- 15.2.1 SPACE AND COST MANAGEMENT IN VEHICLES TO DRIVE DEMAND

- 15.3 5"-10" DISPLAY SIZE

- 15.3.1 DEMAND FOR LUXURY FEATURES IN MID-TO-HIGH-END PASSENGER CAR SEGMENTS TO DRIVE GROWTH

- 15.4 >10" DISPLAY SIZE

- 15.4.1 INCREASED USE IN LUXURY CARS TO DRIVE DEMAND

- 15.5 PRIMARY INSIGHTS

16 IN-VEHICLE INFOTAINMENT MARKET, BY FORM

- 16.1 INTRODUCTION

- 16.2 EMBEDDED FORM

- 16.2.1 INCREASING DEMAND FOR CLOUD-ENABLED NAVIGATION, VEHICLE DIAGNOSTICS, AND SUBSCRIPTION-BASED SERVICES TO DRIVE SEGMENTAL GROWTH

- 16.3 TETHERED FORM

- 16.3.1 RISE OF APP-BASED NAVIGATION, MUSIC STREAMING, AND PAYMENT SERVICES TO DRIVE SEGMENTAL GROWTH

- 16.4 INTEGRATED FORM

- 16.4.1 EMPHASIS ON INTEGRATED CLUSTERS THAT CONSOLIDATE NAVIGATION, TELEMATICS, AND DRIVER-ASSIST INFORMATION TO DRIVE SEGMENTAL GROWTH

- 16.5 PRIMARY INSIGHTS

17 IN-VEHICLE INFOTAINMENT MARKET, BY LOCATION

- 17.1 INTRODUCTION

- 17.2 FRONT-ROW INFOTAINMENT SYSTEM

- 17.2.1 GROWING DEMAND FOR FRONT-ROW SYSTEMS THAT COMBINE ENTERTAINMENT WITH REAL-TIME DRIVING INTELLIGENCE TO DRIVE SEGMENTAL GROWTH

- 17.3 REAR-ROW INFOTAINMENT SYSTEM

- 17.3.1 INCREASING SALES OF LUXURY VEHICLES TO DRIVE SEGMENTAL GROWTH

- 17.4 PRIMARY INSIGHTS

18 IN-VEHICLE INFOTAINMENT MARKET, BY OPERATING SYSTEM

- 18.1 INTRODUCTION

- 18.2 LINUX

- 18.2.1 OPEN-SOURCE AND CUSTOMIZABLE

- 18.3 QNX

- 18.3.1 STRONG ADOPTION IN PREMIUM AND COMMERCIAL SEGMENTS

- 18.4 ANDROID

- 18.4.1 SUPPORTS RICHER, SOFTWARE-DEFINED USER EXPERIENCES

- 18.5 OTHER OPERATING SYSTEMS

- 18.5.1 WIND RIVER

- 18.5.2 OEM/IN-HOUSE

- 18.6 PRIMARY INSIGHTS

19 IN-VEHICLE INFOTAINMENT MARKET, BY REGION

- 19.1 INTRODUCTION

- 19.2 ASIA PACIFIC

- 19.2.1 MACROECONOMIC OUTLOOK

- 19.2.2 CHINA

- 19.2.2.1 Rapid innovation cycles in smart cockpits to drive market

- 19.2.2.2 China: Vehicle production data

- 19.2.3 INDIA

- 19.2.3.1 Strong investments in semiconductor and electronics manufacturing to drive market

- 19.2.3.2 India: Vehicle production data

- 19.2.4 JAPAN

- 19.2.4.1 Regulatory push on ADAS, cybersecurity, and connected car data standards to drive market

- 19.2.4.2 Japan: Vehicle production data

- 19.2.5 SOUTH KOREA

- 19.2.5.1 Development of connected mobility infrastructure to drive market

- 19.2.5.2 South Korea: Vehicle production data

- 19.2.6 REST OF ASIA PACIFIC

- 19.3 EUROPE

- 19.3.1 MACROECONOMIC OUTLOOK

- 19.3.2 UK

- 19.3.2.1 Growing affordability of high-end vehicles to drive market

- 19.3.2.2 UK: Vehicle production data

- 19.3.3 GERMANY

- 19.3.3.1 Strong demand for premium vehicles to drive market

- 19.3.3.2 Germany: Vehicle production data

- 19.3.4 FRANCE

- 19.3.4.1 Heavy investments by OEMs in security technologies to drive market

- 19.3.4.2 France: Vehicle production data

- 19.3.5 SPAIN

- 19.3.5.1 Adoption of AI and cognitive computing to drive market

- 19.3.5.2 Spain: Vehicle production data

- 19.3.6 ITALY

- 19.3.6.1 Intelligent mobility infrastructure through large-scale C-ITS and smart city programs to drive market

- 19.3.6.2 Italy: Vehicle production data

- 19.3.7 RUSSIA

- 19.3.7.1 Growing adoption of embedded software systems to drive market

- 19.3.7.2 Russia: Vehicle production data

- 19.3.8 REST OF EUROPE

- 19.3.8.1 Rest of Europe: Vehicle production data

- 19.4 NORTH AMERICA

- 19.4.1 MACROECONOMIC OUTLOOK

- 19.4.2 US

- 19.4.2.1 Growing reliance on real-time navigation, streaming, diagnostics, and AI-based driver-assist functions to drive market

- 19.4.2.2 US: Vehicle production data

- 19.4.3 CANADA

- 19.4.3.1 Growing demand for reliable navigation, diagnostics, and OTA-enabled infotainment platforms to drive market

- 19.4.3.2 Canada: Vehicle production data

- 19.4.4 MEXICO

- 19.4.4.1 Shift toward electric and software-defined vehicles to drive market

- 19.4.4.2 Mexico: Vehicle production data

- 19.5 REST OF THE WORLD (ROW)

- 19.5.1 MACROECONOMIC OUTLOOK

- 19.5.2 BRAZIL

- 19.5.2.1 Development of low-cost infotainment units to drive market

- 19.5.2.2 Brazil: Vehicle production data

- 19.5.3 SOUTH AFRICA

- 19.5.3.1 Establishment of advanced product testing and automotive homologation centers to drive market

- 19.5.3.2 South Africa: Vehicle production data

- 19.5.4 OTHERS

- 19.5.4.1 Others: Vehicle production data

- 19.6 PRIMARY INSIGHTS

20 COMPETITIVE LANDSCAPE

- 20.1 OVERVIEW

- 20.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 20.3 MARKET SHARE ANALYSIS, 2024

- 20.4 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- 20.5 COMPANY VALUATION & FINANCIAL METRICS, 2024

- 20.5.1 COMPANY VALUATION

- 20.5.2 FINANCIAL METRICS

- 20.6 BRAND/PRODUCT COMPARISON

- 20.7 COMPANY EVALUATION MATRIX: IN-VEHICLE INFOTAINMENT KEY PLAYERS, 2024

- 20.7.1 STARS

- 20.7.2 EMERGING LEADERS

- 20.7.3 PERVASIVE PLAYERS

- 20.7.4 PARTICIPANTS

- 20.7.5 COMPANY FOOTPRINT

- 20.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 20.8.1 PROGRESSIVE COMPANIES

- 20.8.2 RESPONSIVE COMPANIES

- 20.8.3 DYNAMIC COMPANIES

- 20.8.4 STARTING BLOCKS

- 20.8.5 COMPETITIVE BENCHMARKING

- 20.8.5.1 List of startups/SMEs

- 20.8.5.2 Competitive benchmarking of startups/SMEs

- 20.9 COMPETITIVE SCENARIO

- 20.9.1 PRODUCT LAUNCHES

- 20.9.2 DEALS

- 20.9.3 OTHER DEVELOPMENTS

21 COMPANY PROFILES

- 21.1 KEY PLAYERS

- 21.1.1 ALPS ALPINE CO., LTD.

- 21.1.1.1 Business overview

- 21.1.1.2 Products offered

- 21.1.1.3 Recent developments

- 21.1.1.3.1 Product launches

- 21.1.1.3.2 Deals

- 21.1.1.3.3 Expansions

- 21.1.1.4 MnM view

- 21.1.1.4.1 Right to win

- 21.1.1.4.2 Strategic choices

- 21.1.1.4.3 Weaknesses & competitive threats

- 21.1.2 GARMIN LTD

- 21.1.2.1 Business overview

- 21.1.2.2 Products offered

- 21.1.2.3 Recent developments

- 21.1.2.3.1 Product launches

- 21.1.2.3.2 Deals

- 21.1.2.4 MnM view

- 21.1.2.4.1 Right to win

- 21.1.2.4.2 Strategic choices

- 21.1.2.4.3 Weaknesses & competitive threats

- 21.1.3 PIONEER CORPORATION

- 21.1.3.1 Business overview

- 21.1.3.2 Products offered

- 21.1.3.3 Recent developments

- 21.1.3.3.1 Product launches

- 21.1.3.3.2 Deals

- 21.1.3.3.3 Expansions

- 21.1.3.4 MnM view

- 21.1.3.4.1 Right to win

- 21.1.3.4.2 Strategic choices

- 21.1.3.4.3 Weaknesses and competitive threats

- 21.1.4 HARMAN INTERNATIONAL

- 21.1.4.1 Business overview

- 21.1.4.2 Products offered

- 21.1.4.3 Recent developments

- 21.1.4.3.1 Product launches

- 21.1.4.3.2 Deals

- 21.1.4.3.3 Expansions

- 21.1.4.4 MnM view

- 21.1.4.4.1 Right to win

- 21.1.4.4.2 Strategic choices

- 21.1.4.4.3 Weaknesses & competitive threats

- 21.1.5 PANASONIC CORPORATION

- 21.1.5.1 Business overview

- 21.1.5.2 Products offered

- 21.1.5.3 Recent developments

- 21.1.5.3.1 Product launches

- 21.1.5.3.2 Deals

- 21.1.5.3.3 Other developments

- 21.1.5.4 MnM view

- 21.1.5.4.1 Right to win

- 21.1.5.4.2 Strategic choices

- 21.1.5.4.3 Weaknesses & competitive threats

- 21.1.6 ROBERT BOSCH GMBH

- 21.1.6.1 Business overview

- 21.1.6.2 Products offered

- 21.1.6.3 Recent developments

- 21.1.6.3.1 Product launches

- 21.1.6.3.2 Deals

- 21.1.7 MITSUBISHI ELECTRIC CORPORATION

- 21.1.7.1 Business overview

- 21.1.7.2 Products offered

- 21.1.7.3 Recent developments

- 21.1.7.3.1 Product launches

- 21.1.7.3.2 Deals

- 21.1.7.3.3 Other developments

- 21.1.8 TOMTOM INTERNATIONAL BV

- 21.1.8.1 Business overview

- 21.1.8.2 Products offered

- 21.1.8.3 Recent developments

- 21.1.8.3.1 Product launches

- 21.1.8.3.2 Deals

- 21.1.8.3.3 Other developments

- 21.1.9 CONTINENTAL AG

- 21.1.9.1 Business overview

- 21.1.9.2 Products offered

- 21.1.9.3 Recent developments

- 21.1.9.3.1 Product launches

- 21.1.9.3.2 Deals

- 21.1.9.3.3 Expansions

- 21.1.9.3.4 Other developments

- 21.1.10 VISTEON CORPORATION

- 21.1.10.1 Business overview

- 21.1.10.2 Products offered

- 21.1.10.3 Recent developments

- 21.1.10.3.1 Product launches

- 21.1.10.3.2 Deals

- 21.1.10.3.3 Expansions

- 21.1.10.3.4 Other developments

- 21.1.1 ALPS ALPINE CO., LTD.

- 21.2 OTHER PLAYERS

- 21.2.1 DESAY INDUSTRY

- 21.2.2 DENSO CORPORATION

- 21.2.3 JVCKENWOOD CORPORATION

- 21.2.4 FUJITSU

- 21.2.5 FORYOU CORPORATION

- 21.2.6 HYUNDAI MOBIS

- 21.2.7 FORD MOTOR COMPANY

- 21.2.8 APTIV

- 21.2.9 MARELLI HOLDINGS CO., LTD.

- 21.2.10 GENERAL MOTORS

- 21.2.11 AUDI AG

- 21.2.12 BMW GROUP

- 21.2.13 AISIN CORPORATION

- 21.2.14 ALLEGRO MICROSYSTEMS, INC.

- 21.2.15 FAURECIA S.E.

22 RESEARCH METHODOLOGY

- 22.1 RESEARCH DATA

- 22.1.1 SECONDARY DATA

- 22.1.1.1 List of key secondary sources

- 22.1.1.2 Key data from secondary sources

- 22.1.2 PRIMARY DATA

- 22.1.1 SECONDARY DATA

- 22.2 MARKET SIZE ESTIMATION

- 22.2.1 BOTTOM-UP APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY COMPONENT, VEHICLE TYPE, AND COUNTRY (ICE VEHICLES)

- 22.2.2 TOP-DOWN APPROACH: IN-VEHICLE INFOTAINMENT MARKET, BY CONNECTIVITY

- 22.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 22.3 FACTOR ANALYSIS

- 22.4 DATA TRIANGULATION

- 22.5 RESEARCH ASSUMPTIONS & RISK ASSESSMENT

- 22.6 RESEARCH LIMITATIONS

23 APPENDIX

- 23.1 INSIGHTS OF INDUSTRY EXPERTS

- 23.2 DISCUSSION GUIDE

- 23.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 23.4 CUSTOMIZATION OPTIONS

- 23.5 RELATED REPORTS

- 23.6 AUTHOR DETAILS