|

시장보고서

상품코드

1923689

고강도 알루미늄 합금 시장 예측(-2030년) : 등급별, 인장 강도별, 제법별, 제품 형태별, 가공 방법별, 최종 용도 산업별, 지역별High Strength Aluminum Alloys Market by Grade, Tensile Strength, Formulation, Product Form, Processing Method, End-use Industry, and Region - Forecast to 2030 |

||||||

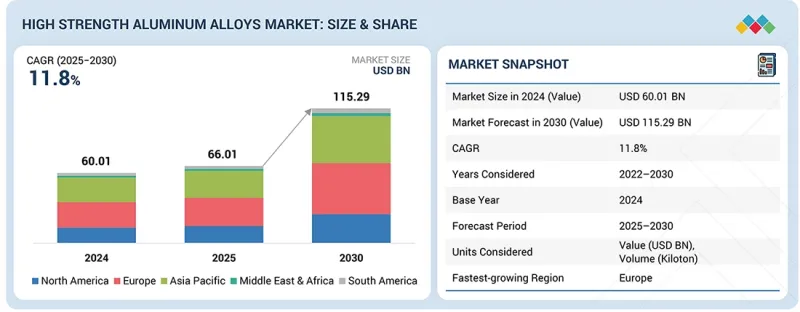

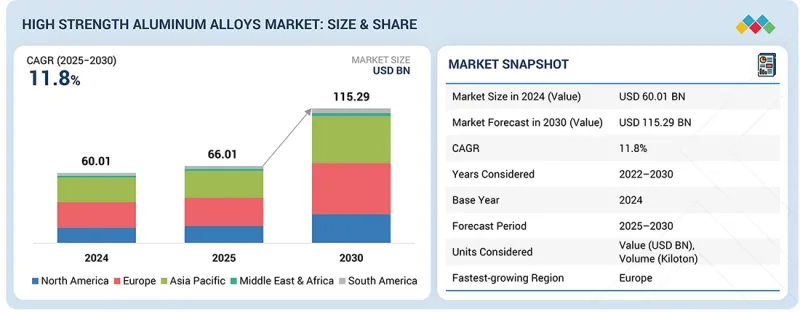

세계의 고강도 알루미늄 합금 시장 규모는 2025년 660억 1,000만 달러에서 2030년까지 1,152억 9,000만 달러에 달할 것으로 예측되며, 2025-2030년에 CAGR로 11.8%의 성장이 전망되고 있습니다.

차세대 생산 기술에 대한 투자 증가는 고강도 알루미늄 합금에 대한 세계 수요를 지속적으로 촉진하고 있습니다. 이는 많은 기업이 정교하고 정밀하게 설계된 구조를 구현할 수 있는 능력을 갖춘 소재를 요구하고 있기 때문입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2022-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 등급, 인장 강도, 제법, 제품 형태, 가공 방법, 최종 용도 산업, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동 및 아프리카, 남미 |

다양한 고강도 등급의 취급에 대한 역사적 과제에도 불구하고 자동화, 적층제조, 효율적인 성형 기술의 발전으로 항공우주, 전기자동차, 로봇공학, 산업 장비 등의 산업에서 고강도 합금이 큰 비용 증가 없이도 활용될 수 있게 되었습니다. 이러한 발전과 진보를 바탕으로 산업 및 기업에서 강도, 내구성, 경량화 등 특정 장점과 이점을 가진 미션 크리티컬한 부품 및 기능에 2xxx, 6xxx, 7xxx 및 초강력 등급의 채택이 크게 촉진될 것으로 예측됩니다.

"2024년, 열처리 합금 부문이 전체 고강도 알루미늄 합금 시장에서 가장 큰 점유율을 차지했습니다. "

열처리 알루미늄 합금은 탁월한 가단성을 가지고 있으므로 고강도 알루미늄 합금 중 가장 큰 시장 점유율을 차지하고 있습니다. 열처리 알루미늄 합금은 강도와 강성을 유지하면서 경량화를 실현하는 특성으로 항공우주, 자동차, 전기자동차, 중장비 등 고부가가치 산업에서 없어서는 안 될 존재입니다. 비열처리 합금에 비해 열처리 알루미늄 합금은 비교할 수 없는 가공성과 내식성을 가지고 있습니다. 경량화가 요구되는 항공기, 고효율화가 요구되는 자동차, 그리고 고성능 산업 부품에 대한 수요가 지속됨에 따라 열처리 알루미늄 합금은 앞으로도 시장에서 우위를 점할 것으로 보입니다.

"2024년 아시아태평양이 전체 고강도 알루미늄 합금 시장에서 두 번째 점유율을 차지했습니다. "

아시아태평양은 제조 거점으로서의 우위와 대규모 산업 성장으로 인해 고강도 알루미늄 합금의 두 번째 시장으로 부상하고 있습니다. 중국, 일본, 한국, 인도 등 아시아태평양 국가에서는 항공우주, 자동차, 전기자동차, 철도, 건설 등 다양한 산업이 빠르게 성장하고 있으며, 고강도 및 초고강도 알루미늄 합금에 대한 건전하고 지속적인 수요를 보이고 있습니다. 현지 기술의 발전과 국내외 투자 증가로 현지 생산 능력은 빠르게 향상되고 있습니다. 이들 기업은 경량화, 고효율화, 고강도를 추구하고 있으므로 첨단 알루미늄 합금의 채택률이 빠르게 가속화되고 있는 것으로 판단됩니다.

세계의 고강도 알루미늄 합금 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- 고강도 알루미늄 합금 시장에서의 매력적인 기회

- 고강도 알루미늄 합금 시장 : 최종 용도 산업별, 지역별

- 고강도 알루미늄 합금 시장 : 등급별

- 고강도 알루미늄 합금 시장 : 인장 강도별

- 고강도 알루미늄 합금 시장 : 제품 형태별

- 고강도 알루미늄 합금 시장 : 제법별

- 고강도 알루미늄 합금 시장 : 가공 방법별

- 고강도 알루미늄 합금 시장 : 국가별

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 고강도 알루미늄 합금 시장에서의 미충족 요구

- 화이트 스페이스 기회

- 상호접속된 시장과 부문 횡단적인 기회

- 상호접속된 시장

- 부문 횡단적인 기회

- 새로운 비즈니스 모델과 에코시스템의 변화

- 새로운 비즈니스 모델

- 에코시스템의 변화

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 지표

- GDP의 동향과 예측

- 세계의 자동차·운송 업계의 동향

- 세계의 항공우주·방위 업계의 동향

- 밸류체인 분석

- 에코시스템 분석

- 가격결정 분석

- 평균 판매 가격 : 주요 기업별

- 평균 판매 가격 동향 : 지역별

- 무역 분석

- 수입 시나리오(HS 코드 760429)

- 수출 시나리오(HS 코드 760429)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 고강도 알루미늄 합금 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 기술, 특허, 디지털, AI의 도입에 의한 전략적 파괴

- 주요 기술

- 롤링

- 단조

- 압출

- 보완 기술

- 기술/제품 로드맵

- 단기|기반 구축과 조기 상업화(2025-2027년)

- 중기|확장과 표준화(2027-2030년)

- 장기|대규모 상업화와 파괴적 변화(2030-2035년 이후)

- 특허 분석

- 조사 방법

- 문서 유형

- 인사이트

- 특허의 법적 지위

- 관할 분석

- 주요 출원자

- Novelis의 특허 리스트

- 향후 용도

- 항공우주 구조와 추진부품 : 차세대 경량 기체와 발사 시스템

- 자동차 경량화와 전기화 : EV 보디 구조, 배터리 인클로저, 섀시 시스템

- 방위·탄도 방호 시스템 : 장갑차와 고강도 군 시설

- 재생에너지·전력 인프라 : 풍력, 태양광, 수소 시스템 컴포넌트

- 산업 기계·로보틱스 : 고정도 프레임과 자동화 구조

- 고강도 알루미늄 합금 시장에 대한 AI/생성형 AI의 영향

- 주요 사용 사례와 시장의 장래성

- 고강도 알루미늄 합금 가공에서 베스트 프랙티스

- 고강도 알루미늄 합금 시장에서 AI 도입 사례 연구

- 상호접속된 인접 에코시스템과 시장 기업에 대한 영향

- 고강도 알루미늄 합금 시장에서 생성형 AI의 채택에 대한 고객 준비 상황

- 성공 사례와 실세계에 대한 응용

- Alcoa Corporation : 메가 캐스팅 합금에 의한 EV 구조의 혁신

- Constellium : AHEADD CP1에 의한 컴포넌트의 혁신

- Boeing : 777X와 737 조립의 AI 기반 자동화

제7장 지속가능성과 규제 상황

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 구상

- 지속가능성에 대한 영향과 규제 정책 구상

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업으로부터의 미충족 요구

- 시장의 수익성

- 잠재적 매출

- 비용 역학

- 이익 기회 : 최종 용도 산업별

제9장 고강도 알루미늄 합금 시장 : 제법별

- 열처리

- 비열처리

제10장 고강도 알루미늄 합금 시장 : 등급별

- 2XXX 시리즈

- 6XXX 시리즈

- 7XXX 시리즈

- 기타 등급

제11장 고강도 알루미늄 합금 시장 : 가공 방법별

- 냉간 가공

- 열간 가공

제12장 고강도 알루미늄 합금 시장 : 제품 형태별

- 단조 제품

- 압출 제품

- 롤 제품

제13장 고강도 알루미늄 합금 시장 : 인장 강도별

- 고강도

- 초고강도

제14장 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 자동차·운송

- 항공우주·방위

- 선박

- 기타 최종 용도 산업

제15장 고강도 알루미늄 합금 시장 : 지역별

- 북미

- 북미의 고강도 알루미늄 합금 시장 : 등급별

- 북미의 고강도 알루미늄 합금 시장 : 인장 강도별

- 북미의 고강도 알루미늄 합금 시장 : 제법별

- 북미의 고강도 알루미늄 합금 시장 : 제품 형태별

- 북미의 고강도 알루미늄 합금 시장 : 가공 방법별

- 북미의 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 북미의 고강도 알루미늄 합금 시장 : 국가별

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 아시아태평양의 고강도 알루미늄 합금 시장 : 등급별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 인장 강도별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 제법별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 제품 형태별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 가공 방법별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 아시아태평양의 고강도 알루미늄 합금 시장 : 국가별

- 유럽

- 유럽의 고강도 알루미늄 합금 시장 : 등급별

- 유럽의 고강도 알루미늄 합금 시장 : 인장 강도별

- 유럽의 고강도 알루미늄 합금 시장 : 제법별

- 유럽의 고강도 알루미늄 합금 시장 : 제품 형태별

- 유럽의 고강도 알루미늄 합금 시장 : 가공 방법별

- 유럽의 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 유럽의 고강도 알루미늄 합금 시장 : 국가별

- 중동 및 아프리카

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 등급별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 인장 강도별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 제법별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 제품 형태별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 가공 방법별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 중동 및 아프리카의 고강도 알루미늄 합금 시장 : 국가별

- 남미

- 남미의 고강도 알루미늄 합금 시장 : 등급별

- 남미의 고강도 알루미늄 합금 시장 : 인장 강도별

- 남미의 고강도 알루미늄 합금 시장 : 제법별

- 남미의 고강도 알루미늄 합금 시장 : 제품 형태별

- 남미의 고강도 알루미늄 합금 시장 : 가공 방법별

- 남미의 고강도 알루미늄 합금 시장 : 최종 용도 산업별

- 남미의 고강도 알루미늄 합금 시장 : 국가별

제16장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업

- RIO TINTO

- HINDALCO INDUSTRIES LTD.

- ALUMINIUM BAHRAIN B.S.C.

- ALCOA CORPORATION

- ALUMINUM CORPORATION OF CHINA LIMITED

- RUSAL

- CENTURY ALUMINUM COMPANY

- CHINA HONGQIAO GROUP LIMITED

- EMIRATES GLOBAL ALUMINIUM PJSC

- NORSK HYDRO ASA

- VEDANTA LIMITED

- CONSTELLIUM

- KAISER ALUMINUM

- UACJ CORPORATION

- ELKA MEHR KIMIYA

- 기타 기업

- ALBRAS

- YK ALUMINIUM

- AMAG AUSTRIA METALL AG

- TRIMET ALUMINIUM SE

- AVON METALS LTD

- ARCONIC

- BELMONT METALS

- GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD

- JINDAL ALUMINIUM LIMITED

- TEXA METAL ALLOY PVT. LTD

제18장 조사 방법

제19장 부록

KSA 26.02.13The high strength aluminum alloys market is expected to reach USD 115.29 billion by 2030 from USD 66.01 billion in 2025, at a CAGR of 11.8% from 2025 to 2030. Rising investment in next-generation production technologies continues to drive the global demand for high strength aluminum alloys, as more and more businesses seek materials with capabilities that allow for sophisticated and precisely engineered designs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Grade, Tensile Strength, Formulation, Product Form, Processing Method, and End-Use Industry, And Region |

| Regions covered | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

Despite the historical challenges of working with various high-strength grades, advancements in automation, additive manufacturing, and efficient forming technologies now enable industries such as aerospace, electric vehicles, robotics, and industrial equipment to utilize high-strength alloys without incurring significant costs. Noting these developments and advancements, there will be significant encouragement for industries and businesses to increasingly use 2xxx, 6xxx, 7xxx, and ultra-high strength grades for mission-critical components and functions with specific benefits and advantages associated with strength, endurance, and weight reduction.

"Heat treatable alloy segment accounted for largest share of the overall high strength aluminum alloy market in 2024."

Heat treatable Aluminum alloys have the biggest market share among high strength aluminum alloys because they have unmatched malleability. Heat treatable Aluminum alloys have unparalleled properties that make them indispensable in high-value industries like aerospace, automotive, EVs, and heavy machines because weight reduction without sacrificing strength and rigidity depends on them. Heat treatable Aluminum alloys have unmatched manufacturability and corrosion resistance compared to non-heat treatable ones. Heat treatable Aluminum alloys will continue dominating the market due to consistent demand for lighter aircraft and more efficient cars and high-performance industrial components.

"Asia Pacific accounted for second largest share of the overall high strength aluminum alloy market in 2024."

The Asia Pacific region represents the second-largest market for high strength aluminum alloys due to it's prime location for fabrication and large-scale industrial growth. Asia Pacific nations like China, Japan, South Korea, and India have been expanding various industries like aerospace, autos, electric vehicles, railways, and construction at a rapid rate, thus displaying healthy and consistent demands for high strength and ultra-high strength aluminum alloys. There has been rapid advancements in local production capacity, backed by advancements in local technologies and rising local and foreign investment within these nations. Since these businesses focus on developing lighter, more efficient, and stronger materials, it can be seen that adoption rates for advanced aluminum alloys accelerate at a rapid rate.

This study has been validated through primary interviews with industry experts globally. The primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation: C-level - 50%, Director-level - 30%, and Managers - 20%

- By Region: North America - 15%, Europe - 50%, Asia Pacific - 20%, the Middle East & Africa - 10%, and South America - 5%

The report provides a comprehensive analysis of the following companies:

Prominent companies in this market Rio Tinto (England), Hindalco Industries (India), Aluminium Bahrain B.S.C (Bahrain), Alcoa Corporation (US), RusAL (Russia), Century Aluminum Company (US), China Hongqiao Group (China), Emirates Global Aluminium PJSC (UAE), Norsk Hydro ASA (Norway), Aluminum Corporation of China Limited (China), Vedanta Limited (India), Constellium (France), Kaiser Aluminum (US), UACJ Corporation (Japan), Elka Mehr Kimiya (Iran).

Research Coverage

This research report categorizes the high strength aluminum alloy market By Grade (2xxx Series, 5xxx Series, 7xxx Series), By Tensile Strength (High Strength, Ultra High Strength), By Formulation (Heat Treatable Alloy, Non-Heat Treatable), Product Form ( Forging, Sheet, Plate, Extrusion, Other product forms), Processing methods (Cold working, Hot working), End-Use Industry (Automotive & Transportation, Aerospace & Defense, Marine, Other End-Use Industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the high strength aluminum alloy market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions and services, key strategies, and recent developments in the high strength aluminum alloy market are all covered. This report includes a competitive analysis of upcoming startups in the high strength aluminum alloy market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall high strength aluminum alloy market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand in aerospace & defence industry), restraints (High production and process cost), opportunities (Rising adoption in additive manufacturing), and challenges (Volatility in raw material prices) are influencing the growth of the high strength aluminum alloy market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the high strength aluminum alloy market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the high strength aluminum alloy market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the high strength aluminum alloy market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Rio Tinto (England), Hindalco Industries (India), Aluminium Bahrain B.S.C (Bahrain), Alcoa Corporation (US), RusAL (Russia), Century Aluminum Company (US), China Hongqiao Group (China), Emirates Global Aluminium PJSC (UAE), Norsk Hydro ASA (Norway), Aluminum Corporation of China Limited (China), Vedanta Limited (India), Constellium (France), Kaiser Aluminum (US), UACJ Corporation (Japan), Elka Mehr Kimiya (Iran).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 3.2 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY AND REGION

- 3.3 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 3.4 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 3.5 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 3.6 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 3.7 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 3.8 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing demand in aerospace & defense sector

- 4.2.1.2 Increasing adoption in electric vehicles and battery enclosures

- 4.2.2 RESTRAINTS

- 4.2.2.1 High production and processing costs

- 4.2.2.2 Availability of substitutes

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for light-weight materials in sports equipment manufacturing

- 4.2.3.2 Growing adoption in additive manufacturing

- 4.2.4 CHALLENGES

- 4.2.4.1 Limited formability

- 4.2.4.2 Volatility in raw material prices

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 760429)

- 5.6.2 EXPORT SCENARIO (HS CODE 760429)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 HIGH-STRENGTH ALUMINUM ALLOYS IN ADVANCED AIRCRAFT PROGRAM

- 5.10.2 LUCID MOTORS PARTNERED WITH AP&T TO ADVANCE LIGHTWEIGHT STRUCTURES THROUGH ALUMINUM HOT-FORMING

- 5.10.3 APPLICATION OF HIGH-STRENGTH ALUMINUM ALLOYS IN PRESSURE VESSEL ENGINEERING

- 5.11 IMPACT OF 2025 US TARIFF ON HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 ROLLING

- 6.1.2 FORGING

- 6.1.3 EXTRUSION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 LASER POWDER BED FUSION

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 PATENT ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF PATENTS BY NOVELIS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AEROSPACE STRUCTURAL AND PROPULSION COMPONENTS: NEXT-GENERATION LIGHTWEIGHT AIRFRAMES AND LAUNCH SYSTEMS

- 6.5.2 AUTOMOTIVE LIGHTWEIGHTING AND ELECTRIFICATION: EV BODY STRUCTURES, BATTERY ENCLOSURES, AND CHASSIS SYSTEMS

- 6.5.3 DEFENSE AND BALLISTIC PROTECTION SYSTEMS: ARMORED VEHICLES AND HIGH-STRENGTH MILITARY STRUCTURES

- 6.5.4 RENEWABLE ENERGY AND POWER INFRASTRUCTURE: WIND, SOLAR, AND HYDROGEN SYSTEM COMPONENTS

- 6.5.5 INDUSTRIAL MACHINERY AND ROBOTICS: HIGH-PRECISION FRAMES AND AUTOMATION STRUCTURES

- 6.6 IMPACT OF AI/GEN AI ON HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN HIGH-STRENGTH ALUMINUM ALLOYS PROCESSING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN HIGH-STRENGTH ALUMINUM ALLOYS MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 ALCOA CORPORATION: INNOVATING EV STRUCTURES WITH MEGACASTING ALLOYS

- 6.7.2 CONSTELLIUM: REVOLUTIONIZING COMPONENTS WITH AHEADD CP1

- 6.7.3 BOEING: AI-DRIVEN AUTOMATION FOR 777X AND 737 ASSEMBLY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF HIGH-STRENGTH ALUMINUM ALLOYS

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF HIGH-STRENGTH ALUMINUM ALLOYS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY END-USE INDUSTRY

9 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 9.1 INTRODUCTION

- 9.2 HEAT TREATABLE 111 9.2.1 EXPANSION OF ADVANCED MANUFACTURING APPLICATIONS

- 9.3 NON-HEAT TREATABLE 113 9.3.1 INCREASING DEMAND FOR CORROSION-RESISTANT STRUCTURAL APPLICATIONS

10 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 10.1 INTRODUCTION

- 10.2 2XXX SERIES

- 10.2.1 INCREASING DEMAND FROM AEROSPACE INDUSTRY

- 10.3 6XXX SERIES

- 10.3.1 RISING AUTOMOTIVE LIGHTWEIGHTING AND STRUCTURAL INTEGRATION

- 10.4 7XXX SERIES

- 10.4.1 MANUFACTURING INNOVATIONS AND EXPANDED INDUSTRIAL ADOPTION

- 10.5 OTHER GRADES

11 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 11.1 INTRODUCTION

- 11.2 COLD WORKING

- 11.2.1 RISING DEMAND FOR PRECISION AND SURFACE QUALITY THROUGH COLD WORKING

- 11.3 HOT WORKING

- 11.3.1 GROWING ADOPTION OF HOT WORKING FOR LARGE AND COMPLEX COMPONENTS

12 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 12.1 INTRODUCTION

- 12.2 FORGED PRODUCTS

- 12.2.1 STRUCTURAL INTEGRITY FOR CRITICAL LOAD-BEARING APPLICATIONS

- 12.3 EXTRUDED PRODUCTS

- 12.3.1 DESIGN FLEXIBILITY AND LIGHTWEIGHT EFFICIENCY ACROSS HIGH-VOLUME APPLICATIONS

- 12.4 ROLLED PRODUCTS

- 12.4.1 HIGH-VOLUME FLAT PRODUCTS FOR SCALABLE LIGHTWEIGHT MANUFACTURING

13 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 13.1 INTRODUCTION

- 13.2 HIGH STRENGTH

- 13.2.1 GROWING DEMAND FOR LIGHTWEIGHT AND DURABLE MATERIALS

- 13.3 ULTRA-HIGH STRENGTH

- 13.3.1 INNOVATION IN ENERGY AND INDUSTRIAL EQUIPMENT

14 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 14.1 INTRODUCTION

- 14.2 AUTOMOTIVE & TRANSPORTATION

- 14.2.1 LIGHTWEIGHT STRUCTURAL INTEGRATION TO MEET SAFETY AND EFFICIENCY TARGETS

- 14.3 AEROSPACE & DEFENSE

- 14.3.1 ADVANCED MATERIAL PERFORMANCE FOR FLIGHT AND DEFENSE RELIABILITY

- 14.4 MARINE

- 14.4.1 GROWTH IN MARINE APPLICATIONS FOR HIGH-STRENGTH ALUMINUM ALLOYS

- 14.5 OTHER END-USE INDUSTRIES

15 HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 15.2.2 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 15.2.3 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 15.2.4 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 15.2.5 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 15.2.6 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 15.2.7 NORTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

- 15.2.8 US

- 15.2.8.1 Strong presence of major manufacturers and high-value end users

- 15.2.9 CANADA

- 15.2.9.1 Government support and export-oriented manufacturing

- 15.2.10 MEXICO

- 15.2.10.1 Expanding automotive manufacturing base

- 15.3 ASIA PACIFIC

- 15.3.1 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 15.3.2 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 15.3.3 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 15.3.4 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 15.3.5 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 15.3.6 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 15.3.7 ASIA PACIFIC: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

- 15.3.7.1 China

- 15.3.7.1.1 Automotive electrification and high-speed rail expansion

- 15.3.7.2 South Korea

- 15.3.7.2.1 EV revolution and structural weight reduction

- 15.3.7.3 India

- 15.3.7.3.1 Strategic industrial growth and defense modernization

- 15.3.7.4 Japan

- 15.3.7.4.1 Technological advancements and strong industrial base

- 15.3.7.5 Rest of Asia Pacific

- 15.3.7.1 China

- 15.4 EUROPE

- 15.4.1 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 15.4.2 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 15.4.3 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 15.4.4 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 15.4.5 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 15.4.6 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 15.4.7 EUROPE: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

- 15.4.7.1 Germany

- 15.4.7.1.1 Growing adoption in lightweight engineering

- 15.4.7.2 France

- 15.4.7.2.1 Aerospace precision and automotive lightweighting

- 15.4.7.3 UK

- 15.4.7.3.1 Evolution of lightweighting technologies in aerospace & defense sector

- 15.4.7.4 Italy

- 15.4.7.4.1 Industrial modernization and advanced manufacturing

- 15.4.7.5 Spain

- 15.4.7.5.1 Innovations in alloy formulations

- 15.4.7.6 Russia

- 15.4.7.6.1 Innovations in alloy formulations

- 15.4.7.7 Rest of Europe

- 15.4.7.1 Germany

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 15.5.2 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 15.5.3 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 15.5.4 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 15.5.5 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 15.5.6 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 15.5.7 MIDDLE EAST & AFRICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

- 15.5.7.1 GCC countries

- 15.5.7.1.1 UAE

- 15.5.7.1.1.1 Presence of major aluminum producers

- 15.5.7.1.2 Saudi Arabia

- 15.5.7.1.2.1 Shift toward advanced manufacturing and lightweighting

- 15.5.7.1.3 Rest of GCC countries

- 15.5.7.1.1 UAE

- 15.5.7.2 South Africa

- 15.5.7.2.1 Expansion of domestic manufacturing and extrusion capabilities

- 15.5.7.3 Rest of Middle East & Africa

- 15.5.7.1 GCC countries

- 15.6 SOUTH AMERICA

- 15.6.1 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY GRADE

- 15.6.2 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY TENSILE STRENGTH

- 15.6.3 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY FORMULATION

- 15.6.4 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PRODUCT FORM

- 15.6.5 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY PROCESSING METHOD

- 15.6.6 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY END-USE INDUSTRY

- 15.6.7 SOUTH AMERICA: HIGH-STRENGTH ALUMINUM ALLOYS MARKET, BY COUNTRY

- 15.6.7.1 Brazil

- 15.6.7.1.1 Rise of corrosion-resistant structures in construction sector

- 15.6.7.2 Argentina

- 15.6.7.2.1 Rising renewable energy projects

- 15.6.7.3 Rest of South America

- 15.6.7.1 Brazil

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS

- 16.4 MARKET SHARE ANALYSIS

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.6.5.1 Company footprint

- 16.6.5.2 Region footprint

- 16.6.5.3 Grade footprint

- 16.6.5.4 Tensile strength footprint

- 16.6.5.5 Formulation footprint

- 16.6.5.6 Processing method footprint

- 16.6.5.7 Product form footprint

- 16.6.5.8 End-use industry footprint

- 16.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- 16.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.7.5.1 Detailed list of key startups/SMEs

- 16.7.5.2 Competitive benchmarking of key startups/SMEs

- 16.8 COMPANY VALUATION AND FINANCIAL METRICS

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 RIO TINTO

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HINDALCO INDUSTRIES LTD.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 MnM view

- 17.1.2.3.1 Right to win

- 17.1.2.3.2 Strategic choices

- 17.1.2.3.3 Weaknesses and competitive threats

- 17.1.3 ALUMINIUM BAHRAIN B.S.C.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Right to win

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 ALCOA CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 ALUMINUM CORPORATION OF CHINA LIMITED

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 MnM view

- 17.1.5.3.1 Right to win

- 17.1.5.3.2 Strategic choices

- 17.1.5.3.3 Weaknesses and competitive threats

- 17.1.6 RUSAL

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.7 CENTURY ALUMINUM COMPANY

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.8 CHINA HONGQIAO GROUP LIMITED

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.9 EMIRATES GLOBAL ALUMINIUM PJSC

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.2.1 Deals

- 17.1.9.2.2 Expansions

- 17.1.10 NORSK HYDRO ASA

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 VEDANTA LIMITED

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 CONSTELLIUM

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.2.1 Deals

- 17.1.13 KAISER ALUMINUM

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.14 UACJ CORPORATION

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.15 ELKA MEHR KIMIYA

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.1 RIO TINTO

- 17.2 OTHER PLAYERS

- 17.2.1 ALBRAS

- 17.2.2 YK ALUMINIUM

- 17.2.3 AMAG AUSTRIA METALL AG

- 17.2.4 TRIMET ALUMINIUM SE

- 17.2.5 AVON METALS LTD

- 17.2.6 ARCONIC

- 17.2.7 BELMONT METALS

- 17.2.8 GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD

- 17.2.9 JINDAL ALUMINIUM LIMITED

- 17.2.10 TEXA METAL ALLOY PVT. LTD

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Key data from primary sources

- 18.1.2.2 Key primary interview participants

- 18.1.2.3 Breakdown of primary interviews

- 18.1.2.4 Key industry insights

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 BASE NUMBER CALCULATION

- 18.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 18.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 18.4 MARKET FORECAST APPROACH

- 18.4.1 SUPPLY SIDE

- 18.4.2 DEMAND SIDE

- 18.5 DATA TRIANGULATION

- 18.6 FACTOR ANALYSIS

- 18.7 RESEARCH ASSUMPTIONS

- 18.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS