|

시장보고서

상품코드

1923693

페인트 및 코팅 시장 예측(-2030년) : 수지 유형별, 기술별, 최종 용도 산업별, 지역별Paints & Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Fluoropolymer), Technology (Waterborne Coatings, Solventborne Coatings, Powder Coatings), End-use Industry (Architectural, Industrial), Region - Global Forecast to 2030 |

||||||

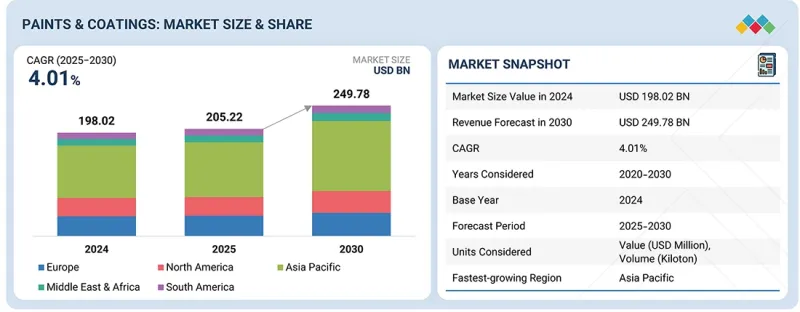

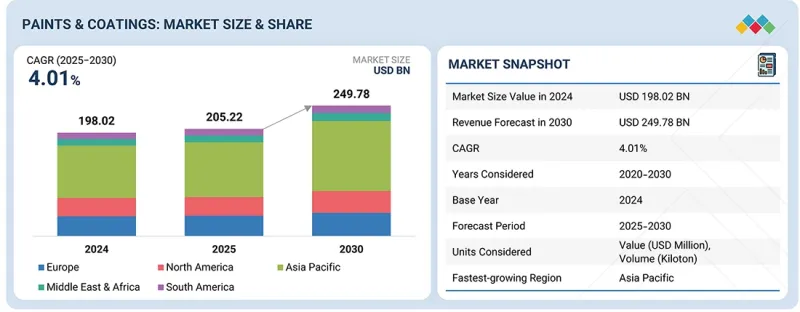

세계의 페인트·코팅 시장 규모는 2025년 2,052억 2,000만 달러에서 2030년까지 2,497억 8,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 4.01%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 수지 유형, 기술, 최종 용도 산업, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

"페인트 및 코팅 시장 성장 가속화, 규제 압력과 지속가능성 의무화"

환경 규제와 지속가능성 목표는 페인트 및 코팅 시장에 큰 영향을 미치고 있습니다. 배출가스 및 유해물질에 대한 규제가 강화되고 있으며, 전 세계에서 환경 부하가 적은 제품만을 선호하고 있습니다. 이러한 변화하는 수요는 오염이 적고 작업자에게 안전한 수성, 제로 VOC 또는 저 VOC 하이 솔리드 코팅 솔루션에 대한 수요를 촉진하고 있습니다. 또한 기업은 지속가능성 목표를 설정하고 친환경 경영을 지원하는 기업과의 협업을 선택하고 있습니다. 친환경 코팅이 사용되는 건설 및 산업 분야에서 기업은 규제 요건을 충족시킬 뿐만 아니라 브랜드 이미지를 향상시키기 위해 친환경 코팅을 사용하고 있습니다. 소비자들은 특히 가정, 학교, 병원에서 실내 공기질과 표면 안전에 대한 인식이 높아지고 있습니다. 따라서 제조업체들은 성능은 물론 환경 친화적인 제품을 개발함으로써 이러한 요구에 부응하고 있습니다. 규제와 사회가 주도하는 청정 솔루션으로의 전환은 모든 부문에서 페인트 및 코팅 시장의 주요 성장 동력이 되고 있습니다.

"에폭시 수지가 예측 기간 중 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

에폭시 도료는 기계적 응력, 충격, 마모에 견디는 특성이 있으며, 도료 및 코팅 시장에서 채택이 증가하고 있습니다. 파이프라인, 저장탱크, 중장비의 표면에는 균열이나 박리 없이 지속적인 마모에 견딜 수 있는 코팅이 요구됩니다. 에폭시 수지는 높은 경도와 우수한 접착력을 제공하며, 가혹한 작동 조건에서도 기판을 보호합니다. 이러한 내구성은 유지보수 빈도와 수명주기 비용을 줄여주며, 이는 상업시설과 인접한 산업시설에서 특히 가치가 있습니다. 자산 소유자가 단기적인 비용 절감보다 장기적인 성능을 우선시하는 가운데, 에폭시 수지는 고부하 보호 용도로 계속 인기를 얻고 있습니다.

"불소 수지는 예측 기간 중 페인트 및 코팅 부문에서 두 번째로 높은 성장률을 보일 것으로 예측됩니다. "

불소 수지는 2025-2030년 페인트 및 코팅 분야에서 두 번째로 높은 성장률을 보일 것으로 예측됩니다. 불소 수지는 햇빛, 비, 열, 오염에 대한 독보적인 장기적 내성을 가지고 있으며, 높은 평가를 받고 있습니다. 이러한 수지로 생산된 코팅은 야외 환경에서 수십 년이 지나도 색조, 광택, 표면 강도를 유지할 수 있습니다. 따라서 재도장이 비용적으로뿐만 아니라 기술적으로도 어려운 건물 외장, 기념비, 교량, 고급 건축 프로젝트에 적합합니다. 따라서 부동산 소유주나 개발자들은 퇴색이나 초킹이 적고 오래 지속되는 것을 원하고 있습니다. 도시가 성장하고 더 많은 구조물이 랜드마크로 자리 잡으면서 열악한 야외 환경에서도 안정성을 유지하는 이러한 코팅에 대한 수요는 페인트 및 코팅 시장에서 불소수지의 점유율 확대를 지속적으로 촉진하고 있습니다.

"2024년 북미는 세계 도료 및 코팅 시장에서 금액 기준으로 3번째로 큰 점유율을 차지했습니다. "

북미는 2024년 전체 페인트 및 코팅 시장에서 금액 기준으로 세 번째 점유율을 차지했습니다. 북미에는 기계, 장비, 소비재, 항공우주, 중공업 등의 부문으로 구성된 방대한 산업 기반이 존재합니다. 이러한 산업 및 공장에서는 바닥, 기계, 보관 장소, 완제품을 보호하기 위해 코팅이 널리 사용됩니다. 이러한 코팅은 마모, 화학 물질 및 열에 대한 노출의 영향에 대응할 수 있습니다. 기업이 시설 현대화를 계속하고 안전 및 품질 기준을 강화함에 따라 코팅의 사용이 증가하고 있습니다. 이러한 강력한 산업적 입지를 바탕으로 산업 용도료 및 코팅은 이 지역 시장에서 중요한 성장 동력이 되고 있습니다.

세계의 페인트·코팅 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- 페인트·코팅 시장에서의 매력적인 기회

- 페인트·코팅 시장 : 최종 용도 산업별, 지역별

- 페인트·코팅 시장 : 기술별

- 페인트·코팅 시장 : 국가별

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 상호접속된 시장과 부문 횡단적인 기회

- 상호접속된 시장

- 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- GDP의 동향과 예측

- 세계의 자동차 업계의 동향

- 공급망 분석

- 원재료

- 제조업체

- 유통 네트워크

- 최종사용자

- 에코시스템 분석

- 가격결정 분석

- 주요 기업의 평균 판매 가격 : 최종 용도 산업별(2024년)

- 페인트·코팅의 평균 판매 가격 동향 : 지역별(2022-2025년)

- 무역 분석

- 수입 시나리오(HS 코드 3209)

- 수출 시나리오(HS 코드 3209)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 개요

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 규제 상황과 지속가능성에 관한 구상

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

- 지속가능성 구상

- 탄소의 영향 삭감

- 에코 애플리케이션 유효화

- 지속가능성에 대한 영향과 규제 정책 구상

- 인증, 라벨, 환경기준

제7장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업에서 미충족 요구

제8장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 주요 신기술

- 수성 코팅 기술

- 용제계 코팅 기술

- 분체 코팅 기술

- 보완 기술

- 표면 처리·사전 처리 기술

- 컬러 매칭·디지털 배합 기술

- 기술/제품 로드맵

- 단기|배합 정치화·조기 시장 참여(2025-2027년)

- 중기|퍼포먼스 스케일업·시장 표준화(2027-2030년)

- 장기|첨단 소재·지속가능 산업 전환(2030-2035년 이후)

- 특허 분석

- 어프로치

- 문헌 유형

- 주요 출원자

- 관할 분석

- 페인트·코팅 시장에 대한 AI/생성형 AI의 영향

- 주요 사용 사례와 시장의 장래성

- 페인트·코팅 처리에서 베스트 프랙티스

- 페인트·코팅 시장에서 AI 도입 사례 연구

- 상호접속된 인접 에코시스템과 시장 기업에 대한 영향

- 페인트·코팅 시장에서 생성형 AI의 채택에 대한 고객 준비 상황

제9장 페인트·코팅 시장 : 기술별

- 수성 코팅

- 용제계 코팅

- 분체 코팅

- 기타 기술

제10장 페인트·코팅 시장 : 수지 유형별

- 아크릴 수지

- 알키드 수지

- 에폭시 수지

- 폴리에스테르 수지

- 폴리우레탄 수지

- 플루오로폴리머 수지

- 비닐 수지

- 기타 수지 유형

제11장 페인트·코팅 시장 : 최종 용도 산업별

- 건축

- 주택

- 비주택

- 산업

- 일반 산업

- 보호

- 자동차 보수

- 자동차 OEM

- 목재

- 선박

- 코일

- 포장

- 항공우주

- 레일

제12장 페인트·코팅 시장 : 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 인도네시아

- 태국

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 튀르키예

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 이집트

- 남미

- 브라질

- 아르헨티나

제13장 경쟁 구도

- 주요 참여 기업의 전략/강점, 2020년 1월-2025년 11월

- 시장 점유율 분석(2024년)

- 매출 분석(2020-2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 제품 비교 분석

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- THE SHERWIN-WILLIAMS COMPANY

- PPG INDUSTRIES, INC.

- AKZO NOBEL N.V.

- NIPPON PAINT HOLDINGS CO., LTD.

- AXALTA COATING SYSTEMS LLC

- ASIAN PAINTS LIMITED

- KANSAI PAINT CO., LTD.

- RPM INTERNATIONAL INC.

- BASF COATINGS GMBH

- JOTUN A/S

- 스타트업/중소기업

- HEMPEL A/S

- BERGER PAINTS INDIA LIMITED

- SHALIMAR PAINTS

- MASCO CORPORATION

- S.K. KAKEN CO., LTD.

- BECKERS GROUP

- DUNN-EDWARDS CORPORATION

- TIGER COATINGS GMBH & CO. KG

- SACAL INTERNATIONAL GROUP LTD.

- DIAMOND VOGEL

- VISTA PAINT CORPORATION

- INDIGO PAINTS PVT. LTD.

- BENJAMIN MOORE & CO.

- DAW SE

- HIS PAINT MANUFACTURING COMPANY

제15장 인접 시장과 관련 시장

- 제한

- 분체 코팅 시장

- 시장 정의

- 시장의 개요

- 분체 코팅 시장 : 지역별

- 아시아태평양

- 유럽

- 북미

- 중동 및 아프리카

- 남미

제16장 조사 방법

제17장 부록

KSAThe paints & coatings market is projected to grow from USD 205.22 billion in 2025 and to reach USD 249.78 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 4.01% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Resin Type, Technology, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Regulatory pressure and sustainability mandates to accelerate paints & coatings market growth"

Environmental regulations and sustainability goals are significantly influencing the paint & coatings market. Rules on emissions and hazardous substances are getting stricter and only products with lower environmental impacts are preferred globally. Demand for water based, zero to minimal VOC, and high solid coating solutions that cause less pollution and are safer for workers is thus being driven by this changing demand. Also, companies have set sustainability targets and decide to work with the companies who support greener operations. In construction and industrial sectors, where environmentally friendly coatings are used, companies not only meet compliance requirements but also improve their brand image. Consumers are also getting more conscious of indoor air quality and surface safety, particularly in homes, schools, and hospitals. Therefore, the manufacturers are responding to this need by creating products that not only deliver performance but are also environmentally friendly. The move towards cleaner solutions driven by regulations and society is still the primary factor driving the growth of the paints & coatings market in all segments.

"Epoxy resins to witness the highest CAGR during forecast period"

Epoxy coatings withstand mechanical stress, impact or abrasion, which drives their adoption in the paints & coatings market. Pipelines, storage tanks and heavy machinery surfaces require coatings that endure constant wear without cracking or peeling. Epoxy resins provide high hardness also excellent adhesion, which protects substrates under demanding operating conditions. This durability reduces maintenance frequency and lifecycle costs, which is particularly valuable in industrial next to commercial facilities. As asset owners prioritize long term performance over short term savings, epoxy resins continue to gain preference for heavy duty protective applications.

"Fluoropolymer resins are projected to be the second fastest-growing resin type of paints & coatings during forecast period"

Fluoropolymer resins are projected to be the second fastest-growing resin type of paints & coatings, between 2025 and 2030. Fluoropolymer resins are valued for their unparalleled resistance to sun, rain, heat, and pollution for a long period of time. Coatings produced from these resins, even after several decades of exposure to outdoor weather, can retain color, gloss, and surface strength, making them appropriate for external parts of buildings, monuments, bridges, and premium architectural projects where it is not only costly but also difficult to repaint. Property owners and developers thus, seek long duration with little fading or chalking. With cities growing and more structures becoming landmarks, the need for these kinds of coatings, which remain stable even under harsh outdoor conditions, continues to drive the fluoropolymer resin share in the paints & coatings market.

"North America accounted for third-largest share in global paints & coatings market, in terms of value, in 2024"

North America held the third-largest share in the overall paints & coatings market, in terms of value, in 2024. The North American region houses an extensive base of industries from sectors such as machinery, equipment, consumer goods, aerospace, and heavy industries. Coatings are widely used in these industries and factories to safeguard floors, machines, storage areas, and finished products. These coatings make it possible to counteract the effects of wear, chemical, and heat exposure. The use of coatings rises since the companies continue to modernize their facilities and elevate safety and quality standards. This strong industrial presence makes industrial paints & coatings a key growth pillar in the regional market.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW- 5%

The key players profiled in the report include The Sherwin-Williams Company (US), PPG Industries, Inc. (US), Akzo Nobel N.V. (The Netherlands), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating Systems LLC (US), Asian Paints Limited (India), Kansai Paint Co., Ltd. (Japan), RPM International Inc. (US), BASF Coatings GmbH (Germany), and Jotun A/S (Norway).

Study Coverage

This report segments the market for paints & coatings based on resin type, technology, end-use industry, and region, and provides estimations of value (in USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the paints & coatings market.

Reasons to Buy this Report

This research report is focused on various levels of analysis-industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the paints & coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on paints & coatings offered by top players in the global market

- Analysis of key drivers: (Environmental regulations boosting demand for VOC-free coatings, growing popularity of elastomeric coatings in tilt-up concrete in building & construction industry, and technological advancements in powder coating technology), restraints (Difficulty in obtaining thin films in powder coatings, raw material shortage in paints & coatings industry), opportunities (Increasing applications of fluoropolymers in building & construction industry, growing demand for high-performance fluorine resin-based coatings) and challenges (Stringent regulatory policies) influencing the growth of paints & coatings market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the paints & coatings market

- Market Development: Comprehensive information about lucrative emerging markets-the report analyzes the market for paints & coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global paints & coatings market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the paints & coatings market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY RESIN TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PAINTS & COATINGS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PAINTS & COATINGS MARKET

- 3.2 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY AND REGION

- 3.3 PAINTS & COATINGS MARKET, BY TECHNOLOGY

- 3.4 PAINTS & COATINGS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Environmental regulations boosting demand for VOC-free coatings

- 4.2.1.2 Growing popularity of elastomeric coatings in tilt-up concrete in building & construction

- 4.2.1.3 Technological advancements in powder coating technology

- 4.2.2 RESTRAINTS

- 4.2.2.1 Difficulty in obtaining thin films in powder coatings

- 4.2.2.2 Raw material shortage in paints & coatings industry

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing applications of fluoropolymers in building & construction industry

- 4.2.3.2 Growing demand for high-performance fluorine resin-based coatings

- 4.2.4 CHALLENGES

- 4.2.4.1 Stringent regulatory policies

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIALS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTION NETWORK

- 5.3.4 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF PAINTS & COATINGS, BY REGION, 2022-2025

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 3209)

- 5.6.2 EXPORT SCENARIO (HS CODE 3209)

- 5.7 KEY CONFERENCES & EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8.1 REVENUE SHIFTS & REVENUE POCKETS FOR PAINTS & COATINGS MARKET

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 IMPROVING INDUSTRIAL FLOOR DURABILITY AND REDUCING MAINTENANCE

- 5.10.2 EXTENDING PIPELINE LIFE WITH CORROSION PROTECTION

- 5.11 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 6.1 REGIONAL REGULATIONS AND COMPLIANCE

- 6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1.2 INDUSTRY STANDARDS

- 6.2 SUSTAINABILITY INITIATIVES

- 6.2.1 CARBON IMPACT REDUCTION

- 6.2.2 ECO-APPLICATION ENABLEMENT

- 6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

8 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 8.1 KEY EMERGING TECHNOLOGIES

- 8.1.1 WATERBORNE COATINGS TECHNOLOGY

- 8.1.2 SOLVENTBORNE COATINGS TECHNOLOGY

- 8.1.3 POWDER COATING TECHNOLOGY

- 8.2 COMPLEMENTARY TECHNOLOGIES

- 8.2.1 SURFACE PREPARATION AND PRETREATMENT TECHNOLOGIES

- 8.2.2 COLOR MATCHING AND DIGITAL FORMULATION TECHNOLOGIES

- 8.3 TECHNOLOGY/PRODUCT ROADMAP

- 8.3.1 SHORT-TERM (2025-2027) | FORMULATION REFINEMENT & EARLY MARKET ENTRY

- 8.3.2 MID-TERM (2027-2030) | PERFORMANCE SCALE-UP & MARKET STANDARDIZATION

- 8.3.3 LONG-TERM (2030-2035+) | ADVANCED MATERIALS & SUSTAINABLE INDUSTRY TRANSITION

- 8.4 PATENT ANALYSIS

- 8.4.1 APPROACH

- 8.4.2 DOCUMENT TYPES

- 8.4.3 TOP APPLICANTS

- 8.4.4 JURISDICTION ANALYSIS

- 8.5 IMPACT OF AI/GEN AI ON PAINTS & COATINGS MARKET

- 8.5.1 TOP USE CASES AND MARKET POTENTIAL

- 8.5.2 BEST PRACTICES IN PAINTS & COATINGS PROCESSING

- 8.5.3 CASE STUDIES OF AI IMPLEMENTATION IN PAINTS & COATINGS MARKET

- 8.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 8.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PAINTS & COATINGS MARKET

9 PAINTS & COATINGS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 WATERBORNE COATINGS

- 9.2.1 USE OF ENVIRONMENT-FRIENDLY RAW MATERIALS TO DRIVE DEMAND

- 9.3 SOLVENTBORNE COATINGS

- 9.3.1 RISING PREFERENCE IN HUMID ENVIRONMENTS TO BOOST DEMAND

- 9.4 POWDER COATINGS

- 9.4.1 LOW VOC EMISSION AND COST EFFICIENCY TO DRIVE MARKET

- 9.5 OTHER TECHNOLOGIES

10 PAINTS & COATINGS MARKET, BY RESIN TYPE

- 10.1 INTRODUCTION

- 10.2 ACRYLIC RESINS

- 10.2.1 HIGH DEMAND IN AUTOMOTIVE AND BUILDING & CONSTRUCTION INDUSTRIES TO DRIVE MARKET

- 10.3 ALKYD RESINS

- 10.3.1 WIDE APPLICATION ON WOOD AND CONCRETE WALLS TO BOOST DEMAND

- 10.4 EPOXY RESINS

- 10.4.1 GOOD ADHESION AND HIGH CHEMICAL RESISTANCE TO BOOST MARKET

- 10.5 POLYESTER RESINS

- 10.5.1 RISING DEMAND IN LOW-VOC WATERBORNE FORMULATIONS TO DRIVE MARKET

- 10.6 POLYURETHANE RESINS

- 10.6.1 SURGE IN USE OF CONVENTIONAL SOLVENT-BORNE TECHNOLOGIES TO BOOST MARKET

- 10.7 FLUOROPOLYMER RESINS

- 10.7.1 RISING ADOPTION OF LIGHTWEIGHT HIGH-PERFORMANCE MATERIALS IN AEROSPACE INDUSTRY TO FUEL GROWTH

- 10.8 VINYL RESINS

- 10.8.1 EXCELLENT TOUGHNESS AND GOOD WATER & CHEMICAL RESISTANCE TO DRIVE MARKET

- 10.9 OTHER RESIN TYPES

11 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 ARCHITECTURAL

- 11.2.1 RESIDENTIAL

- 11.2.1.1 New construction

- 11.2.1.1.1 High income levels and economic growth to drive market

- 11.2.1.2 Remodel & repaint

- 11.2.1.2.1 Increased expenditure on home renovation projects to drive demand

- 11.2.1.1 New construction

- 11.2.2 NON RESIDENTIAL

- 11.2.2.1 Commercial

- 11.2.2.1.1 Growing investment in private sector and increasing commercial office spaces to drive market

- 11.2.2.2 Industrial

- 11.2.2.2.1 Growth in industrial sector to boost demand for architectural coatings

- 11.2.2.3 Infrastructure

- 11.2.2.3.1 Rise in infrastructural developments in emerging economies to boost market

- 11.2.2.1 Commercial

- 11.2.1 RESIDENTIAL

- 11.3 INDUSTRIAL

- 11.3.1 GENERAL INDUSTRIAL

- 11.3.1.1 Surge in use of powder-coated products to fuel demand for general industrial equipment

- 11.3.2 PROTECTIVE

- 11.3.2.1 Wide applications in consumer products and heavy machinery to boost demand

- 11.3.3 AUTOMOTIVE REFINISH

- 11.3.3.1 Increase in vehicle use to propel demand for coatings

- 11.3.4 AUTOMOTIVE OEMS

- 11.3.4.1 Pressing need for electric vehicles to drive market

- 11.3.5 WOOD

- 11.3.5.1 Increasing construction and infrastructure activities to drive demand for wood coatings

- 11.3.6 MARINE

- 11.3.6.1 Rise in offshore drilling to boost demand for marine coatings

- 11.3.7 COIL

- 11.3.7.1 Wide application in automotive and construction sectors to drive demand

- 11.3.8 PACKAGING

- 11.3.8.1 Improved lifestyles and changing food habits to fuel demand for packaging coatings

- 11.3.9 AEROSPACE

- 11.3.9.1 Development of chrome-free coating technology to drive market

- 11.3.10 RAIL

- 11.3.10.1 High-speed and modern rail expansion to drive coatings demand

- 11.3.1 GENERAL INDUSTRIAL

12 PAINTS & COATINGS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Rapid industrialization and urbanization to drive market

- 12.2.2 INDIA

- 12.2.2.1 Growth of industrial manufacturing clusters to drive demand

- 12.2.3 JAPAN

- 12.2.3.1 Increased investments in infrastructural sector by public and private sectors to boost demand

- 12.2.4 INDONESIA

- 12.2.4.1 Growth of marine and shipbuilding activities to propel market

- 12.2.5 THAILAND

- 12.2.5.1 Growth of automotive component exports to fuel demand

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Presence of major manufacturers to boost market

- 12.3.2 CANADA

- 12.3.2.1 Expansion of residential housing and multi-family projects to fuel growth

- 12.3.3 MEXICO

- 12.3.3.1 Expansion of industrial and manufacturing facilities to boost demand

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Rising demand for electric vehicles to drive market

- 12.4.2 UK

- 12.4.2.1 Rising demand for energy-efficient buildings to drive market

- 12.4.3 FRANCE

- 12.4.3.1 Integration of decorative and protective coatings in heritage restoration to propel growth

- 12.4.4 ITALY

- 12.4.4.1 Increasing use of advanced coatings in automotive OEM production to drive market

- 12.4.5 SPAIN

- 12.4.5.1 Increasing demand for machinery & equipment to drive market

- 12.4.6 TURKEY

- 12.4.6.1 Expansion of industrial and chemical manufacturing to drive demand

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 UAE

- 12.5.1.1.1 Government policies and R&D investments to drive market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Increasing government investments in chemical manufacturing to drive market

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Increasing use of industrial and protective coatings to drive demand

- 12.5.3 EGYPT

- 12.5.3.1 Expansion of infrastructure projects and rail modernization to drive demand

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expansion of automotive OEM and refinish production to fuel growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Increasing population and improved economic conditions to drive demand

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-NOVEMBER 2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Resin type footprint

- 13.5.5.4 Technology footprint

- 13.5.5.5 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMES

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 PRODUCT COMPARISON ANALYSIS

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 THE SHERWIN-WILLIAMS COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 PPG INDUSTRIES, INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 AKZO NOBEL N.V.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services/Solutions offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NIPPON PAINT HOLDINGS CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services/Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product Launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 AXALTA COATING SYSTEMS LLC

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 ASIAN PAINTS LIMITED

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 KANSAI PAINT CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services/Solutions offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.8 RPM INTERNATIONAL INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Expansions

- 14.1.9 BASF COATINGS GMBH

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.10 JOTUN A/S

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Expansions

- 14.1.1 THE SHERWIN-WILLIAMS COMPANY

- 14.2 STARTUP/SMES

- 14.2.1 HEMPEL A/S

- 14.2.2 BERGER PAINTS INDIA LIMITED

- 14.2.3 SHALIMAR PAINTS

- 14.2.4 MASCO CORPORATION

- 14.2.5 S.K. KAKEN CO., LTD.

- 14.2.6 BECKERS GROUP

- 14.2.7 DUNN-EDWARDS CORPORATION

- 14.2.8 TIGER COATINGS GMBH & CO. KG

- 14.2.9 SACAL INTERNATIONAL GROUP LTD.

- 14.2.10 DIAMOND VOGEL

- 14.2.11 VISTA PAINT CORPORATION

- 14.2.12 INDIGO PAINTS PVT. LTD.

- 14.2.13 BENJAMIN MOORE & CO.

- 14.2.14 DAW SE

- 14.2.15 HIS PAINT MANUFACTURING COMPANY

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATION

- 15.3 POWDER COATINGS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 POWDER COATINGS MARKET, BY REGION

- 15.4.1 ASIA PACIFIC

- 15.4.2 EUROPE

- 15.4.3 NORTH AMERICA

- 15.4.4 MIDDLE EAST & AFRICA

- 15.4.5 SOUTH AMERICA

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Primary interview - demand side and supply side

- 16.1.2.3 Breakdown of primary interviews

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 GROWTH FORECAST

- 16.3.1 SUPPLY SIDE

- 16.3.2 DEMAND SIDE

- 16.4 DATA TRIANGULATION

- 16.5 FACTOR ANALYSIS

- 16.6 RESEARCH ASSUMPTIONS

- 16.7 RESEARCH LIMITATIONS

- 16.8 RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS