|

시장보고서

상품코드

1927586

화재 방지 시스템 시장 : 제공 제품별, 제품별, 서비스별, 업계별, 지역별 - 예측(-2030년)Fire Protection System Market by Product, Service - Global Forecast to 2030 |

||||||

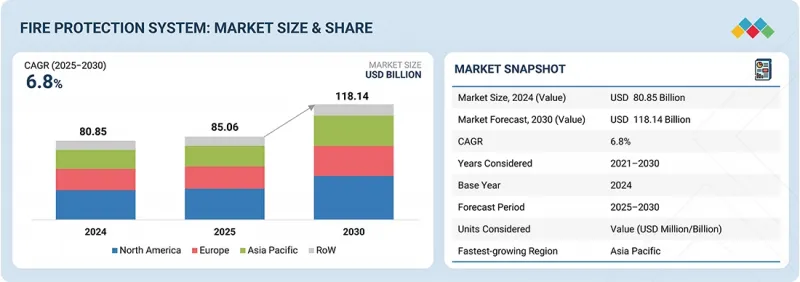

세계의 화재 방지 시스템 시장 규모는 2025년 850억 6,000만 달러에서 2030년까지 1,181억 4,000만 달러에 성장하고, CAGR 6.8%로 확대될 것으로 예측됩니다.

세계 소방 시스템 시장은 세계 산업화의 발전, 도시 인프라 구축 확대, 보다 엄격한 소방 안전 규정의 시행을 배경으로 괄목할 만한 성장을 보이고 있습니다. 각 업계에서는 운용 리스크 최소화, 자산 손실 방지, 규제 준수 보장을 위한 통합 안전 솔루션 도입을 우선순위로 두고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공 제품별, 제품별, 서비스별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

IoT 기반 화재 감시, AI 지원 화재 분석, 예지보전 시스템 등의 기술 발전으로 상황 인식과 대응 시간이 향상되고 있습니다. 산업 안전 현대화를 위한 정부의 이니셔티브, 보험 요건, 인식 제고 캠페인이 도입을 더욱 촉진하고 있습니다. 신흥 경제국의 제조 공장, 에너지 시설, 물류 기지 건설 증가와 더불어 지속가능성과 친환경 소방 시스템에 대한 관심이 높아짐에 따라, 소방 생태계에서 세계 벤더와 서비스 제공업체에게 큰 기회를 창출하고 있습니다.

2024년에는 석유 및 가스, 제조, 에너지, 화학 분야의 안전 솔루션에 대한 수요 증가로 인해 산업 분야가 화재 방지 시스템 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 각 산업은 엄격한 화재 방지 규정 하에 운영되고 있으며, 화재 위험으로부터 인력, 장비, 중요 자산을 보호하기 위해 첨단 시스템에 의존하고 있습니다. 정유소, 발전소, 생산시설 등 고위험 환경에서는 자동 소화 시스템, 화염 및 열 감지기, 원격 모니터링 플랫폼의 도입이 크게 증가하고 있습니다. 화재 방지 시스템을 플랜트 자동화 및 SCADA 프레임워크와 통합하는 추세가 증가하면서 신뢰성과 운영 안전성이 더욱 향상되고 있습니다. 또한, 잦은 개보수 프로젝트와 노후화된 소방시스템의 현대화가 지속적인 시장 수요를 견인하고 있습니다. 다운타임 감소, 보험 책임 감소, 물적 손실 억제에 대한 관심이 높아지면서 산업 분야는 전 세계 화재 방지 시스템 수익의 주요 기여 분야로 자리매김하고 있습니다.

화재 분석 부문은 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이는 예측형 화재 위험 모델링과 데이터 기반 안전 계획의 중요성이 높아진 것이 주요 요인으로 작용하고 있습니다. 이러한 시스템은 화재 거동을 실시간으로 시뮬레이션하고 평가할 수 있어 조직이 사고 대응 준비를 강화하고 규정 준수를 보장하는 데 도움이 됩니다. AI, 디지털 트윈, IoT 기반 데이터 수집을 통합하여 기존의 소방안전관리를 예방적, 예측적 프레임워크로 전환할 수 있습니다. 화재 분석 소프트웨어는 산업 및 상업 인프라의 성능 기반 설계를 지원하고, 위험 감소 및 대피 계획을 위한 정밀한 인사이트를 제공합니다. 현대식 시설의 복잡성과 자산 가치의 상승에 따라 감지 및 소화 시스템을 보완하는 분석 솔루션에 대한 투자가 확대되고 있습니다. 또한, 보험사와 규제 당국이 화재 분석을 컴플라이언스 및 안전 감사에 필수적인 도구로 인식하는 움직임이 가속화되면서 전 세계 주요 산업 및 인프라 프로젝트에서 화재 분석 도입을 촉진하고 있습니다.

아시아태평양은 2030년 기준 세계 화재 방지 시스템 시장에서 가장 큰 점유율을 차지할 것으로 예상되며, 예측 기간이 끝날 때까지 그 우위를 유지할 것으로 예측됩니다. 중국, 인도, 일본, 한국의 급속한 산업화, 도시 확장, 상업 및 제조 인프라에 대한 투자 증가는 첨단 화재 방지 기술에 대한 강력한 수요를 주도하고 있습니다. 각국 정부는 보다 엄격한 안전 기준을 시행하고 있으며, 이는 자동 감지, 소화, 분석 시스템의 도입 확대로 이어지고 있습니다. 이 지역의 근로자 안전, 컴플라이언스, 자산 보호에 대한 관심이 높아지면서 시장 확대에 더욱 박차를 가하고 있습니다. 지역 및 세계 기업들은 비용 효율적이고 확장성이 뛰어나며 IoT 지원 솔루션을 통해 입지를 강화하고 있습니다. 아시아태평양은 인식 증가, 규제 시행, 건설 활동 증가로 인해 화재 방지 시스템 분야에서 가장 크고 역동적인 지역 시장으로 자리매김하고 있습니다.

소방 시스템 시장의 주요 업계 전문가를 대상으로 광범위한 1차 조사를 실시하고, 2차 조사를 통해 수집된 다양한 부문 및 하위 부문 시장 규모를 확정 및 검증했습니다. 본 보고서의 1차 조사 대상자 내역은 다음과 같습니다.

Johnson Controls(아일랜드), Honeywell International Inc.(미국), Siemens(독일), Robert Bosch GmbH(독일), Eaton(아일랜드)과 같은 몇몇 주요 세계 기업들에 의해 주도되고 있습니다. 주요 진입기업들이 주도하고 있습니다.

방화시스템 시장의 주요 기업들에 대해 기업 프로파일, 최근 동향, 주요 시장 전략을 포함한 상세한 경쟁 분석을 실시하였습니다.

조사 범위

이 보고서에서는 화재 방지 시스템 시장을 세분화하여 분석합니다. 제품별, 서비스별, 산업별, 업종별, 산업별 시장 규모를 예측했습니다. 또한 시장 성장 촉진요인, 억제요인, 기회, 과제에 대해서도 논의했습니다. 북미, 유럽, 아시아태평양 등 4개 주요 지역의 상세한 시장 분석을 제공하여 시장 동향을 종합적으로 파악할 수 있습니다. 본 보고서에는 방화시스템 생태계에서 사업을 영위하는 주요 기업들공급망과 경쟁상황에 대한 검토도 포함되어 있습니다.

본 보고서 구매의 주요 이점

- 주요 촉진요인 분석(세계 인프라 개발 확대와 첨단 안전시스템에 대한 수요 증가, 위험 및 손실 최소화를 위한 기업별 소방투자 증가, 연기감지기 및 화재안전시스템에 대한 세계 규제 및 컴플라이언스 기준 강화, 주거 및 상업용 건물에서 케이블이 필요 없는 화재안전시스템에 대한 수요 증가), 제약요인(개발도상국의 소비자 인식 부족, 오작동 및 감지 신뢰성 문제로 인한 첨단 화재안전시스템의 설치 및 유지보수 비용 증가) 증가), 제약요인(첨단 소방시스템의 높은 설치 및 유지보수 비용, 개발도상국의 낮은 소비자 인지도와 소방안전 대책 미흡, 오작동 및 감지 신뢰성 문제로 인한 소방안전 도입에 미치는 영향), 기회요인(첨단 거품소화시스템 및 물분무소화시스템의 도입 확대, 안전 및 모니터링 강화를 위한 IoT 통합형 스마트 화재 감지 장치의 보급 확대, 화재 안전 및 컴플라이언스 향상을 위한 정부 건축 기준 강화), 과제(복잡한 화재 감지 시스템 통합 및 설정의 어려움, 진화하고 다양해지는 규제 준수 과제에 대한 대응)

- 서비스 개발/혁신 : 방화시스템 시장의 신기술 동향, 연구개발 활동, 제품 출시에 대한 상세 분석

- 시장 개발: 다양한 지역의 소방 시스템 시장 분석을 통해 수익성 높은 시장에 대한 종합적인 정보를 제공합니다.

- 시장 다각화 : 소방 시스템 시장의 신제품 및 서비스, 미개척 지역, 최근 동향, 투자 동향에 대한 종합적인 정보를 제공합니다.

- 경쟁사 평가: Johnson Controls(아일랜드), Honeywell International Inc.(미국), Siemens(독일), Robert Bosch GmbH(독일), Eaton(아일랜드) 등 주요 기업의 시장 점유율, 성장전략, 서비스 제공 내용에 대한 상세한 평가

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 프리미엄 인사이트

제4장 시장 개요

- 시장 역학

- 미충족 요구와 공백

- 연결된 시장과 분야간 기회

- Tier1/2/3참여 기업 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2026년 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향-개요

제6장 기술 진보, AI 별 영향, 특허, 혁신

- 주요 신기술

- 보완적 기술

- 특허 분석

- AI/생성형 AI가 화재 방지 시스템 시장에 미치는 영향

제7장 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 그 평가 기준

- 채택 장벽과 내부 과제

- 다양한 업계 미충족 요구

제9장 화재 방지 시스템 시장(제공 제품별)

- 제품

- 서비스

제10장 화재 방지 시스템 시장(제품별)

- 소화

- 소화 스프링클러

- 화재 감지

- 화재 분석

- 화재 대응

제11장 화재 방지 시스템 시장(서비스별)

- 엔지니어링 서비스

- 설치 및 설계 서비스

- 유지관리 서비스

- 매니지드 서비스

- 기타

제12장 화재 방지 시스템 시장(업계별)

- 주택

- 상업

- 산업

제13장 화재 방지 시스템 시장(지역별)

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 기타

- 기타 지역

- 기타 지역 거시경제 전망

- 중동

- 아프리카

- 남미

제14장 경쟁 구도

- 주요 시장 진출기업 경쟁 전략/강점

- 매출 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제15장 기업 개요

- 주요 시장 진출기업

- HONEYWELL INTERNATIONAL INC.

- JOHNSON CONTROLS

- ROBERT BOSCH GMBH

- SIEMENS

- EATON

- GENTEX CORPORATION

- HALMA PLC

- HOCHIKI CORPORATION

- TELEDYNE TECHNOLOGIES INCORPORATED

- MSA(MSA SAFETY INCORPORATED)

- SECOM CO., LTD.

- RESIDEO TECHNOLOGIES INC.

- NOHMI BOSAI LTD.

- ABB

- NAFFCO

- 기타 주요 기업

- API GROUP CORPORATION

- DNV AS

- MINIMAX VIKING GMBH

- 기타 기업

- ARGUS FIRE PROTECTION COMPANY LTD.

- BAKERRISK

- CIQURIX

- ENCORE FIRE PROTECTION

- FIKE

- FIRE & GAS DETECTION TECHNOLOGIES, INC.

- GEXCON

- INSIGHT NUMERICS, LLC

- NAPCO SECURITY TECHNOLOGIES, INC.

- ORR PROTECTION

- POTTER ELECTRIC SIGNAL COMPANY, LLC

- SCHRACK SECONET AG

- SECURITON AG

- S&S SPRINKLER CO. LLC.

- MARIOFF CORPORATION

- MIRCOM GROUP OF COMPANIES

- CONSILIUM SAFETY GROUP AB

- NETATMO

제16장 조사 방법

제17장 부록

LSHThe global fire protection system market is projected to grow from USD 85.06 billion in 2025 to USD 118.14 billion by 2030, growing at a CAGR of 6.8%. The global fire protection system market is witnessing considerable growth driven by increasing industrialization, urban infrastructure development, and stricter fire safety regulations worldwide. Industries prioritize integrated safety solutions that minimize operational risks, prevent asset losses, and ensure regulatory compliance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Service, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

Technological advancements such as IoT-enabled fire monitoring, AI-assisted fire analysis, and predictive maintenance systems enhance situational awareness and response times. Government initiatives for industrial safety modernization, insurance requirements, and awareness campaigns are further propelling adoption. Growing construction of manufacturing plants, energy facilities, and logistics hubs in emerging economies, combined with a focus on sustainability and eco-friendly suppression systems, creates strong opportunities for global vendors and service providers in the fire protection ecosystem.

"Industrial vertical accounted for the largest share of the fire protection system market in 2024"

In 2024, industrial vertical is expected to account for the largest fire protection system market share due to the rising demand for safety solutions across oil & gas, manufacturing, energy, and chemical sectors. Industries operate under stringent fire safety regulations and rely on advanced systems to protect personnel, equipment, and critical assets from fire hazards. Adoption of automated suppression systems, flame and heat detectors, and remote monitoring platforms has increased substantially in high-risk environments such as refineries, power plants, and production facilities. The growing trend of integrating fire protection systems with plant automation and SCADA frameworks further enhances reliability and operational safety. Additionally, frequent retrofitting projects and the modernization of legacy fire systems are driving sustained market demand. The emphasis on reducing downtime, insurance liabilities, and material losses positions the industrial vertical as the dominant contributor to global fire protection system revenues.

"Fire analysis segment to register highest CAGR in the fire protection system market during the forecast period"

The fire analysis segment is projected to register the highest CAGR during the forecast period, driven by the growing importance of predictive fire risk modeling and data-driven safety planning. These systems enable real-time simulation and assessment of fire behavior, helping organizations improve incident preparedness and ensure regulatory compliance. Integrating AI, digital twins, and IoT-based data collection transforms traditional fire safety management into proactive and predictive frameworks. Fire analysis software supports performance-based design in industrial and commercial infrastructure, offering precise insights for risk mitigation and evacuation planning. The increasing complexity of modern facilities and high asset values is prompting greater investment in analytical solutions that complement detection and suppression systems. Moreover, insurance providers and regulatory bodies increasingly recognize fire analysis tools as essential for compliance and safety auditing, further driving adoption across critical industries and infrastructure projects globally.

"Asia Pacific to hold largest share of fire protection system market in 2030"

Asia Pacific accounted for the highest market share in the global fire protection system market in 2030 and is expected to maintain its dominance by the end of the forecast period. Rapid industrialization, urban expansion, and rising investments in commercial and manufacturing infrastructure across China, India, Japan, and South Korea drive strong demand for advanced fire protection technologies. Governments are enforcing stricter safety standards, leading to increased deployment of automated detection, suppression, and analysis systems. The region's growing focus on worker safety, compliance, and property protection further supports market expansion. Local and global players are strengthening their presence through cost-effective, scalable, and IoT-enabled solutions. With increasing awareness, regulatory enforcement, and construction activity, Asia Pacific continues to represent the largest and most dynamic regional market for fire protection systems.

Extensive primary interviews were conducted with key industry experts in the fire protection system market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 33%, C-level Executives - 48%, and Others - 19%

- By Region: Asia Pacific - 33%, Europe - 25%, North America - 30%, and RoW - 12%

The fire protection system market is dominated by a few globally established players, such as Johnson Controls (Ireland), Honeywell International Inc. (US), Siemens (Germany), Robert Bosch GmbH (Germany), and Eaton (Ireland).

The study includes an in-depth competitive analysis of these key players in the fire protection system market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the fire protection system market. It forecasts its size by product (fire suppression, fire response, fire sprinkler, fire detection and fire analysis), by service (engineering services, installation & design services, maintenance services, managed services, and other services), and by vertical (residential, commercial (academia & institutional, retail, healthcare, hospitality, BFSI)), and industrial (energy & power; government, manufacturing; oil, gas & mining; transportation & logistics; other industries). It also discusses the market's drivers, restraints, opportunities, and challenges. It provides a detailed market analysis across four key regions (North America, Europe, Asia Pacific, and RoW). The report includes a review of the supply chain and the competitive landscape of key players operating in the fire protection system ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (expanding global infrastructure development and rising demand for advanced safety systems, rising enterprise investments in fire protection to minimize risks and losses, strengthening global regulations and compliance standards for smoke alarm and fire safety systems and rising demand for cable-free fire safety systems in residential and commercial buildings), restraints (high installation and upkeep expenses of advanced fire protection systems, limited consumer awareness and inadequate fire safety adoption in developing regions, false alarms and detection reliability issues impacting fire safety adoption), opportunities (growing adoption of advanced foam-based and water mist fire suppression systems, expanding use of IoT-integrated smart fire detection devices for enhanced safety and monitoring and strengthening government building codes to improve fire safety and compliance), challenges (challenges in integrating and configuring complex fire detection systems and navigating evolving and diverse regulatory compliance challenges)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the fire protection system market

- Market Development: Comprehensive information about lucrative markets by analyzing the fire protection system market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the fire protection system market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Johnson Controls (Ireland), Honeywell International Inc. (US), Siemens (Germany), Robert Bosch GmbH (Germany), and Eaton (Ireland)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN FIRE PROTECTION SYSTEM MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FIRE PROTECTION SYSTEM MARKET

- 3.2 FIRE PROTECTION SYSTEM MARKET, BY OFFERING

- 3.3 FIRE PROTECTION SYSTEM MARKET, BY PRODUCT

- 3.4 FIRE PROTECTION SYSTEM MARKET, BY SERVICE

- 3.5 FIRE PROTECTION SYSTEM MARKET, BY VERTICAL

- 3.6 FIRE PROTECTION SYSTEM MARKET IN NORTH AMERICA, BY VERTICAL AND COUNTRY

- 3.7 FIRE PROTECTION SYSTEM MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of global construction and infrastructure development projects

- 4.2.1.2 Enterprise-led adoption of fire protection systems to address safety and liability risks

- 4.2.1.3 Evolving fire safety codes and regulations

- 4.2.1.4 Growing deployment of cable-free fire safety systems in residential and commercial buildings

- 4.2.2 RESTRAINTS

- 4.2.2.1 High installation and maintenance costs associated with advanced fire protection systems

- 4.2.2.2 Low consumer awareness and limited fire safety infrastructure in developing countries

- 4.2.2.3 False alarms, detection failures, and reliability concerns in fire alarm systems

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Growing adoption of advanced foam-based and water mist fire suppression systems

- 4.2.3.2 Expanding use of IoT-integrated smart fire detection devices

- 4.2.3.3 Government-led building code revisions

- 4.2.4 CHALLENGES

- 4.2.4.1 Challenges associated with integrating and configuring complex fire detection systems

- 4.2.4.2 Addressing evolving regulatory and compliance pressures in fire protection systems

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN FIRE PROTECTION SYSTEM MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL OIL & GAS AND MINING INDUSTRY

- 5.2.4 TRENDS IN ENERGY & POWER INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF FIRE DETECTION PRODUCTS, BY KEY PLAYER, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF FIRE PROTECTION SYSTEM, BY PRODUCT, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF HEAT DETECTOR, BY REGION, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 853110)

- 5.6.2 EXPORT SCENARIO (HS CODE 853110)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 SARACEN FIRE PROTECTION INSTALLS FULLY COMPLIANT FIRE ALARMS IN FOOD PRODUCTION PLANT IN ENGLAND TO ENSURE EARLY FIRE DETECTION

- 5.10.2 ETON COLLEGE DEPLOYS NOTIFIER'S FIRE DETECTION TECHNOLOGY TO MEET SAFETY STANDARDS

- 5.10.3 ROYAL PAPWORTH HOSPITAL APPOINTS STATIC SYSTEMS GROUP TO MODERNIZE FIRE ALARM AND MANAGEMENT SYSTEMS

- 5.10.4 HONEYWELL INTEGRATES ADVANCED FIRE SAFETY SOLUTION INTO DOHA METRO'S AUTOMATED RAIL SYSTEM TO ENHANCE SAFETY

- 5.10.5 JOHNSON CONTROLS HELPS MAJOR PACIFIC NORTHWEST AIRPORT ENHANCE FIRE SAFETY AND REDUCE OPERATING COSTS

- 5.11 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 INTERNET OF THINGS (IOT)

- 6.1.2 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 VIDEO IMAGE SMOKE AND FLAME DETECTION SYSTEMS

- 6.2.2 CLOUD COMPUTING

- 6.3 PATENT ANALYSIS

- 6.4 IMPACT OF AI/GEN AI ON FIRE PROTECTION SYSTEM MARKET

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS OF FIRE PROTECTION SYSTEMS

- 6.4.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION IN FIRE PROTECTION SYSTEM MARKET

- 6.4.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT AI/GENERATIVE AI IN FIRE PROTECTION SYSTEM MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS VERTICALS

9 FIRE PROTECTION SYSTEM MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 PRODUCTS

- 9.2.1 STRINGENT FIRE SAFETY REGULATIONS TO BOOST DEMAND

- 9.3 SERVICES

- 9.3.1 GROWING FOCUS ON ENHANCING SYSTEM LONGEVITY TO SPUR DEMAND

10 FIRE PROTECTION SYSTEM MARKET, BY PRODUCT

- 10.1 INTRODUCTION

- 10.2 FIRE SUPPRESSION

- 10.2.1 FIRE SUPPRESSION REAGENTS

- 10.2.1.1 Chemicals

- 10.2.1.1.1 Growing focus on safeguarding high-value assets to boost demand

- 10.2.1.1.2 Dry chemical systems

- 10.2.1.1.3 Wet chemical systems

- 10.2.1.2 Gases

- 10.2.1.2.1 Rising demand from data centers, hospitals, and chemical storage facilities to stimulate market growth

- 10.2.1.2.2 Carbon-dioxide clean-agent fire suppression systems

- 10.2.1.2.3 FM-200 clean-agent fire suppression systems

- 10.2.1.2.4 Other clean-agent fire suppression systems

- 10.2.1.3 Water

- 10.2.1.3.1 Increasing deployment of water mist and hybrid systems for efficient fire control and asset safety to drive market

- 10.2.1.4 Foam

- 10.2.1.4.1 Elevating demand for advanced foam concentrates to protect industrial sites to support market growth

- 10.2.1.1 Chemicals

- 10.2.1 FIRE SUPPRESSION REAGENTS

- 10.3 FIRE SPRINKLER

- 10.3.1 WET FIRE SPRINKLERS

- 10.3.1.1 Simple design and ease of operation to drive widespread adoption

- 10.3.2 DRY FIRE SPRINKLERS

- 10.3.2.1 Rising deployment in cold spaces to contribute to market growth

- 10.3.3 PRE-ACTION FIRE SPRINKLERS

- 10.3.3.1 Elevating deployment in water-sensitive environments to fuel market growth

- 10.3.4 DELUGE FIRE SPRINKLERS

- 10.3.4.1 Surging installation in high-hazard environments to drive segmental growth

- 10.3.5 OTHER FIRE SPRINKLERS

- 10.3.1 WET FIRE SPRINKLERS

- 10.4 FIRE DETECTION

- 10.4.1 CONVENTIONAL SYSTEMS

- 10.4.2 ADDRESSABLE SYSTEMS

- 10.4.3 FLAME DETECTORS

- 10.4.3.1 Single IR

- 10.4.3.1.1 Ability to sense variations in received light signals to drive adoption in indoor environments

- 10.4.3.2 Single UV

- 10.4.3.2.1 High-speed detection and reduced false alarms to fuel demand

- 10.4.3.3 Dual UV/IR

- 10.4.3.3.1 Increasing use in manufacturing and industrial plants to foster market growth

- 10.4.3.4 Triple IR

- 10.4.3.4.1 Long-range detection ability and false alarm immunity to facilitate demand

- 10.4.3.5 Multi IR

- 10.4.3.5.1 Ability to detect hydrogen and hydrocarbon flames to spur deployment

- 10.4.3.1 Single IR

- 10.4.4 SMOKE DETECTORS

- 10.4.4.1 Photoelectric smoke detectors

- 10.4.4.1.1 Escalating adoption in commercial spaces with risk of smoldering fires to facilitate market growth

- 10.4.4.2 Ionization smoke detectors

- 10.4.4.2.1 Rising use to detect flaming fires to drive market

- 10.4.4.3 Dual-sensor smoke detectors

- 10.4.4.3.1 Surging deployment in hospitals, banks, and other commercial spaces to augment market growth

- 10.4.4.4 Aspirating smoke detectors

- 10.4.4.4.1 Potential to provide comprehensive fire protection across commercial and industrial sectors to create opportunities

- 10.4.4.5 Duct smoke detectors

- 10.4.4.5.1 Stringent mandates to install duct smoke detectors in HVAC systems to accelerate demand

- 10.4.4.1 Photoelectric smoke detectors

- 10.4.5 HEAT DETECTORS

- 10.4.5.1 Increasing use of heat detectors in small, confined spaces to enhance fire safety to propel market

- 10.5 FIRE ANALYSIS

- 10.5.1 GREATER EMPHASIS ON REAL-TIME SITUATIONAL MAPPING AND INFORMED DECISION-MAKING TO DRIVE MARKET

- 10.6 FIRE RESPONSE

- 10.6.1 GOVERNMENT-ENFORCED SAFETY REGULATIONS TO BOOST DEMAND

- 10.6.2 EMERGENCY LIGHTING SYSTEMS

- 10.6.3 VOICE EVACUATION & PUBLIC ALERT SYSTEMS

- 10.6.4 SECURE COMMUNICATION SYSTEMS

- 10.6.5 FIRE ALARM DEVICES

11 FIRE PROTECTION SYSTEM MARKET, BY SERVICE

- 11.1 INTRODUCTION

- 11.2 ENGINEERING SERVICES

- 11.2.1 RISING FOCUS ON FIRE SAFETY PLANNING AND COMPLIANCE TO DRIVE DEMAND

- 11.3 INSTALLATION & DESIGN SERVICES

- 11.3.1 NEED FOR CUSTOMIZED FIRE PROTECTION SYSTEM DESIGNS TO FUEL SEGMENTAL GROWTH

- 11.4 MAINTENANCE SERVICES

- 11.4.1 NECESSITY FOR TIMELY MONITORING TO ENSURE SYSTEM RELIABILITY TO FUEL DEMAND

- 11.5 MANAGED SERVICES

- 11.5.1 STRINGENT SAFETY REGULATIONS AND COMPLEXITY OF MODERN FIRE PROTECTION PRODUCTS TO BOOST DEMAND

- 11.6 OTHER SERVICES

12 FIRE PROTECTION SYSTEM MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 RESIDENTIAL

- 12.2.1 GOVERNMENT INITIATIVES TO DEPLOY FIRE SAFETY MEASURES TO ELEVATE DEMAND

- 12.3 COMMERCIAL

- 12.3.1 ACADEMIA & INSTITUTIONS

- 12.3.1.1 Growing focus of higher education facilities on preserving life, knowledge, and heritage to accelerate demand

- 12.3.2 RETAIL BUILDINGS

- 12.3.2.1 Construction of new retail buildings stores to boost demand

- 12.3.3 HEALTHCARE FACILITIES

- 12.3.3.1 Government initiatives and investments in fire safety upgrades and infrastructure improvements to fuel market growth

- 12.3.4 HOSPITALITY FACILITIES

- 12.3.4.1 Need for regular inspection of indoor cooking systems to drive adoption

- 12.3.5 GOVERNMENT & OFFICE BUILDINGS

- 12.3.5.1 Significant focus on protecting public assets and ensuring operational continuity to spike demand

- 12.3.6 ENTERTAINMENT & ASSEMBLY BUILDINGS

- 12.3.6.1 Emphasis on occupant safety and emergency preparedness to spur deployment

- 12.3.7 BFSI BUILDINGS

- 12.3.7.1 Need to protect crucial data to ensure business continuity to drive demand

- 12.3.1 ACADEMIA & INSTITUTIONS

- 12.4 INDUSTRIAL

- 12.4.1 ENERGY & POWER

- 12.4.1.1 Fire risks from fossil fuels and renewable energy sources to accelerate adoption

- 12.4.2 MANUFACTURING

- 12.4.2.1 Growing attention to protect workers and reduce financial losses to encourage adoption

- 12.4.3 OIL & GAS AND MINING

- 12.4.3.1 Rising fire hazards in oil, gas, and mining facilities to boost demand

- 12.4.4 TRANSPORTATION & LOGISTICS

- 12.4.4.1 Stringent government regulations to propel market

- 12.4.5 IT & TELECOM

- 12.4.5.1 Growing need to safeguard critical IT and telecom infrastructure to accelerate adoption

- 12.4.6 PHARMACEUTICALS & CHEMICALS

- 12.4.6.1 Emphasis on explosion prevention and safety compliance to fuel installations

- 12.4.7 OTHER INDUSTRIES

- 12.4.1 ENERGY & POWER

13 FIRE PROTECTION SYSTEM MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Significant presence of fire protection service providers to accelerate market growth

- 13.2.3 CANADA

- 13.2.3.1 Growing construction activities and expansion of oil & gas sector to foster market growth

- 13.2.4 MEXICO

- 13.2.4.1 Rising warehouse infrastructure investments and regulatory initiatives to propel market

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Government initiatives to enhance building safety to drive demand

- 13.3.3 GERMANY

- 13.3.3.1 Stringent fire safety regulations and technological modernization to foster market growth

- 13.3.4 FRANCE

- 13.3.4.1 Government-led building safety modernization initiatives to stimulate market growth

- 13.3.5 ITALY

- 13.3.5.1 Elevating adoption of digital fire safety technologies to augment demand

- 13.3.6 SPAIN

- 13.3.6.1 Enforcement of strict fire protection requirements to fuel market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Increasing real estate projects to expedite market growth

- 13.4.3 JAPAN

- 13.4.3.1 Growing focus on improving emergency response services to create growth opportunities

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Government initiatives to minimize fire-related damage to drive market

- 13.4.5 INDIA

- 13.4.5.1 Growing industrialization and infrastructure development projects to boost demand

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 GCC

- 13.5.2.1.1 Saudi Arabia

- 13.5.2.1.1.1 Expanding construction and industrial sectors to boost demand

- 13.5.2.1.2 UAE

- 13.5.2.1.2.1 Government's focus on sustainability and advanced building technologies to drive adoption

- 13.5.2.1.3 Rest of GCC

- 13.5.2.1.1 Saudi Arabia

- 13.5.2.2 Rest of Middle East

- 13.5.2.1 GCC

- 13.5.3 AFRICA

- 13.5.3.1 Industrial expansion and infrastructure investment to drive market

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Expanding retail industry to create growth potential

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY & SME/STARUP PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Product footprint

- 14.7.5.4 Service footprint

- 14.7.5.5 Vertical footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 JOHNSON CONTROLS

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 ROBERT BOSCH GMBH

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 SIEMENS

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 EATON

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 GENTEX CORPORATION

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.7 HALMA PLC

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 HOCHIKI CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.9 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.10 MSA (MSA SAFETY INCORPORATED)

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 SECOM CO., LTD.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 RESIDEO TECHNOLOGIES INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.12.3.2 Deals

- 15.1.13 NOHMI BOSAI LTD.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 ABB

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 NAFFCO

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.2 OTHER KEY PLAYERS

- 15.2.1 API GROUP CORPORATION

- 15.2.2 DNV AS

- 15.2.3 MINIMAX VIKING GMBH

- 15.3 OTHER PLAYERS

- 15.3.1 ARGUS FIRE PROTECTION COMPANY LTD.

- 15.3.2 BAKERRISK

- 15.3.3 CIQURIX

- 15.3.4 ENCORE FIRE PROTECTION

- 15.3.5 FIKE

- 15.3.6 FIRE & GAS DETECTION TECHNOLOGIES, INC.

- 15.3.7 GEXCON

- 15.3.8 INSIGHT NUMERICS, LLC

- 15.3.9 NAPCO SECURITY TECHNOLOGIES, INC.

- 15.3.10 ORR PROTECTION

- 15.3.11 POTTER ELECTRIC SIGNAL COMPANY, LLC

- 15.3.12 SCHRACK SECONET AG

- 15.3.13 SECURITON AG

- 15.3.14 S&S SPRINKLER CO. LLC.

- 15.3.15 MARIOFF CORPORATION

- 15.3.16 MIRCOM GROUP OF COMPANIES

- 15.3.17 CONSILIUM SAFETY GROUP AB

- 15.3.18 NETATMO

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 List of major secondary sources

- 16.1.1.2 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary participants

- 16.1.2.3 Breakdown of primary interviews

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.2.3 MARKET SIZE ESTIMATION FOR BASE YEAR

- 16.3 MARKET FORECAST APPROACH

- 16.3.1 SUPPLY SIDE

- 16.3.2 DEMAND SIDE

- 16.4 DATA TRIANGULATION

- 16.5 RESEARCH ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS