|

시장보고서

상품코드

1829979

열전달유체 시장 : 제품 유형별, 온도별, 최종 이용 산업별, 지역별 - 예측(-2030년)Heat Transfer Fluids Market by Product Type, Temperature, Application, End-Use Industry, and Region - Global Forecast to 2030 |

||||||

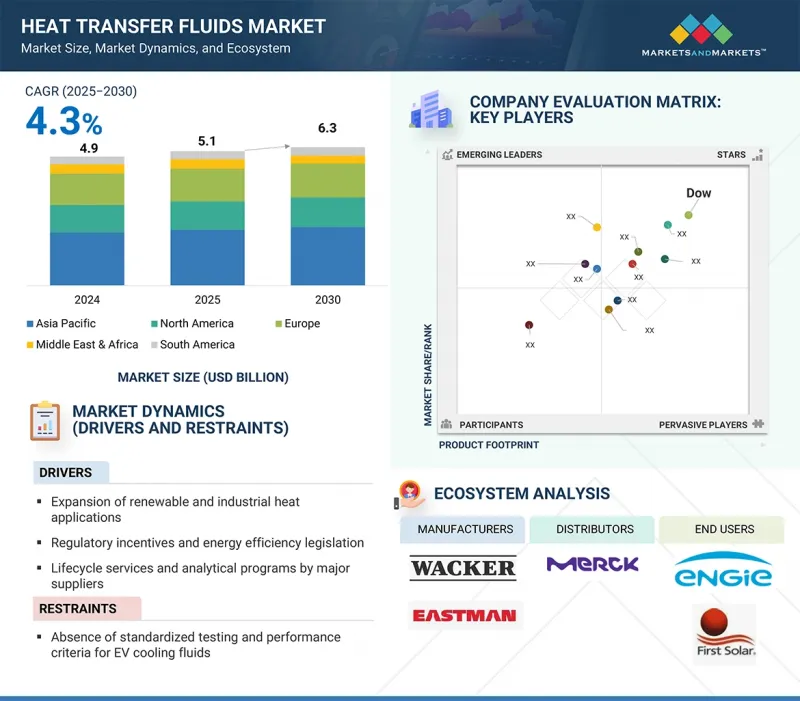

열전달유체 시장 규모는 2025년 51억 달러에서 2030년에는 63억 달러로 성장하고, 예측 기간 중 연평균 복합 성장률(CAGR)은 4.3%를 보일 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2024년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 유닛 | 금액(10억 달러/100만 달러) 및 킬로톤 |

| 부문 | 제품 유형별, 온도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

열전달유체 시장의 성장은 급속한 산업화, 에너지 효율화에 대한 요구 증가, 주요 최종 사용 산업 확대 등 몇 가지 중요한 요인에 의해 주도되고 있습니다. 특히 신흥국에서는 산업 공정의 고도화 및 보급에 따라 효과적인 열 관리 솔루션에 대한 요구가 매우 중요해지고 있습니다. 화학, 석유화학, 자동차, 식음료, 제약, HVAC 등의 산업은 최적의 작동 온도를 유지하고 효율적인 공정을 보장하기 위해 열 매체에 크게 의존하고 있습니다. 열 매체는 에너지 소비를 줄이고 전체 열 시스템의 성능을 향상시키는 데 필수적이기 때문에 에너지 절약과 효율성에 대한 관심이 높아지면서 시장을 더욱 촉진하고 있습니다.

또한, 태양광 및 풍력 발전과 같은 재생에너지원의 채택은 에너지 저장 및 전달을 위한 고도의 열전달유체를 요구하고 있습니다. 더 나은 열 안정성, 낮은 유지보수, 더 높은 안전성을 제공하는 열전달유체 배합의 기술 혁신도 시장 확대를 뒷받침하고 있습니다. 또한, 엄격한 환경 규제와 지속 가능한 산업 관행으로의 전환은 고성능, 친환경 열매의 사용을 촉진하고 시장을 더욱 확대시키고 있습니다. 이러한 복합적인 요인들이 다양한 분야에서 강력한 수요를 창출하여 전체 시장 성장에 박차를 가하고 있습니다.

합성유체는 우수한 성능 특성으로 인해 까다로운 산업 응용 분야에 매우 적합하기 때문에 열 매체 시장에서 가장 빠르게 성장하고 두 번째로 큰 부문을 차지하고 있습니다. 광유나 글리콜 기반 유체와 달리 합성유체는 열 안정성이 뛰어나 고온이나 저온에서도 분해되지 않고 효율적으로 작동할 수 있습니다. 이러한 품질로 인해 화학 처리, 제약, 고온 제조 등 열적 요구가 까다로운 산업에 적합합니다. 또한, 합성유체는 열전달 효율이 우수하고 휘발성이 낮아 시스템의 안전성과 내구성이 향상됩니다. 또한, 합성유체는 산화 및 오염에 대한 저항성이 높기 때문에 유지보수 비용을 절감하고 열전달 시스템의 수명을 연장할 수 있습니다. 또한, 합성유체는 더 엄격한 환경 및 안전 기준을 충족하는 경우가 많기 때문에 규제가 엄격한 지역에서는 선호되는 선택이 될 수 있습니다. 합성유는 광유에 비해 비용이 높은 경향이 있지만, 장기적인 성능 우위와 운영 효율성은 투자를 정당화할 수 있어 시장 점유율을 확보하고 있습니다.

중온용 열전달유체는 성능, 비용, 다용도성의 최적의 균형을 제공하고 다양한 산업 업무에 적합하여 열전달유체 업계에서 두 번째로 큰 시장 점유율을 차지하고 있습니다. 보통 150℃에서 400℃ 사이에서 작동하는 이 유체들은 화학 가공, 플라스틱, 석유 및 가스, 식음료 제조 등 안정적인 가열과 냉각이 필요하지만 고온 유체나 극저온 유체와 같은 극한의 내성이 요구되지 않는 산업에서 널리 사용되고 있습니다. 급속한 열화 없이 안정적인 열 성능을 발휘할 수 있어 고온 합성유체에 비해 비용 효율이 높고, 냉동 및 콜드체인 용도 외에는 저온 유체보다 폭넓은 적용이 가능합니다. 폴리머 및 수지 생산, 정제, 일반 제조 등의 분야에서 중온 HTF는 정확한 온도 제어를 보장하고 에너지 소비를 줄이며 공정 효율을 향상시키기 위해 필수 불가결한 존재가 되었습니다. 또한, 신흥국의 산업화 발전과 에너지 효율적이고 안전한 열 관리 솔루션의 필요성이 이러한 유체에 대한 수요를 증가시키고 있습니다. 연속 공정과 배치 공정 모두에서 다재다능하고 유지보수 및 교체 주기가 용이하여 중온용 유체는 전 세계 열 매체 시장에서 두 번째로 많이 사용되는 유체입니다.

화학, 고분자, 의약품, 가공식품, 금속 등 수요 증가를 배경으로 세계 제조업이 빠르게 성장함에 따라 산업 가공은 열전달유체(HTF) 시장에서 가장 빠르게 성장하고 있는 분야입니다. 이러한 산업에서는 증류, 중합, 결정화, 정제, 반응기 가열 등의 공정에서 정확한 열 관리가 필요하며, HTF는 효율성, 안전성, 제품 일관성을 보장합니다. 산업 공정의 발전은 특히 아시아태평양, 중동 및 라틴아메리카의 신흥 경제 국가에서 급속한 산업화, 도시화 및 인프라 개발로 인해 화학 공장, 정유소 및 제조 시설에 대한 대규모 투자가 이루어지고 있습니다. 또한, 더 엄격한 에너지 효율 규제와 지속가능성 목표에 따라 산업계는 전통적인 난방 방식에서 에너지 손실을 줄이고 장비 수명을 연장하며 작동 신뢰성을 향상시키는 첨단 HTF로 전환하고 있습니다. 환경 친화적이고 오래 지속되는 HTF의 개발 등 지속적인 기술 발전은 산업 현장에서의 채택을 더욱 촉진하고 있습니다. HVAC, 자동차 등 다른 용도에 비해 산업용 가공에는 많은 양의 HTF가 사용됩니다. 이처럼 최종 사용 산업의 확대, 규제 강화, 기술력 향상 등이 복합적으로 작용하여 산업용 가공은 전 세계적으로 열매의 응용 분야로 급성장하고 있습니다.

HVAC 산업은 가정, 기업 및 산업에서 에너지 효율적인 냉난방 솔루션에 대한 전 세계적인 수요 증가로 인해 열전달 매체(HTF)의 최종 사용 분야로 빠르게 성장하고 있습니다. 급속한 도시화, 인구 증가, 생활 수준 향상으로 인해 특히 아시아태평양, 중동, 라틴아메리카의 개발도상국에서는 공조, 냉장, 난방 시스템에 대한 수요가 증가하고 있습니다. 한편, 북미와 유럽의 성숙한 시장에서는 에너지 효율과 환경 기준을 충족하기 위해 HVAC 시스템을 업그레이드하고 있으며, 이는 에너지 손실을 줄이면서 더 나은 열 성능을 제공하는 첨단 HTF의 채택을 촉진하고 있습니다. 또한, 콜드체인 물류, 데이터센터, 그린빌딩의 성장으로 인해 저온에서 중온 범위에서 안정적으로 작동하는 글리콜 및 합성 HTF에 대한 수요가 증가하고 있습니다. 지속가능성에 대한 관심이 높아짐에 따라 각 제조업체들은 HVAC 용도에 특화된 친환경적이고 무해한 HTF를 출시하고 있으며, 그 채택이 더욱 가속화되고 있습니다. 다른 분야에 비해 HVAC는 시스템 업그레이드 진행, 기후 변화, 냉방 의존도 증가, 에너지 효율이 높은 건축기술 추진 정책 등으로 인해 높은 성장 잠재력을 가지고 있습니다. 이러한 요인으로 인해 HVAC는 열 매체 시장에서 가장 빠르게 성장하는 최종 이용 산업이 되었습니다.

세계의 열전달유체 시장에 대해 조사했으며, 제품 유형별/온도별/최종 이용 산업별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 생성형 AI의 영향

제6장 업계 동향

- 서론

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 공급망 분석

- 가격 분석

- 투자 상황과 자금조달 시나리오

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 관세 및 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 전망

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 열전달유체 시장

제7장 열전달유체 시장(제품 유형별)

- 서론

- 미네랄 오일

- 합성 유체

- 글리콜 기반 유체

- 기타

제8장 열전달유체 시장(온도별)

- 서론

- 저온

- 중온

- 고온

- 초고온

제9장 열전달유체 시장(최종 이용 산업별)

- 서론

- 화학제품 및 석유화학제품

- 석유 및 가스

- 자동차

- 재생에너지

- 의약품

- 식품 및 음료

- 공조 설비

- 기타 최종 이용 산업

제10장 열전달유체 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 영국

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 아르헨티나

- 브라질

- 기타

제11장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 브랜드 및 제품 비교 분석

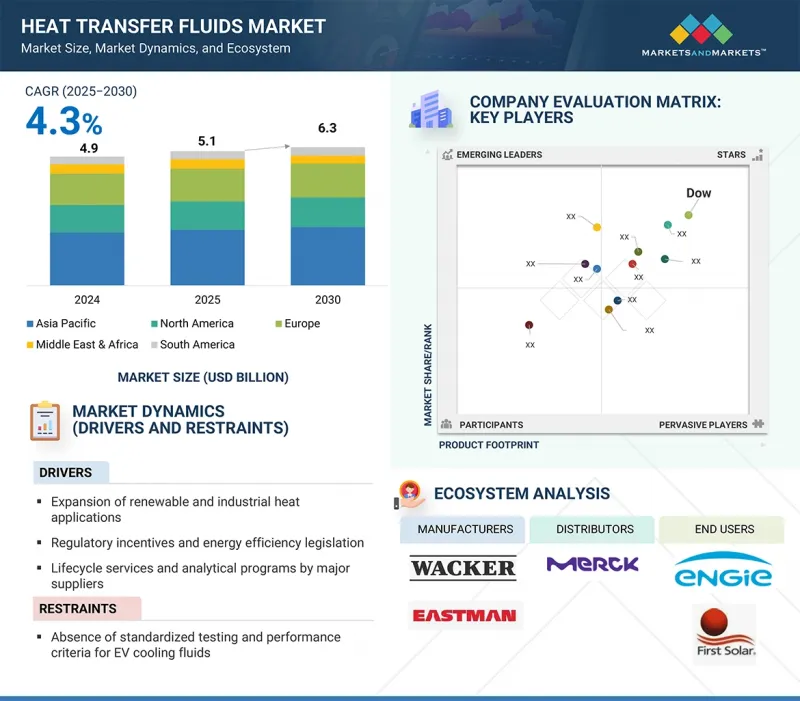

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 시장 진출기업

- DOW

- EASTMAN CHEMICAL COMPANY

- EXXON MOBIL CORPORATION

- CHEVRON CORPORATION

- HUNTSMAN CORPORATION

- SHELL PLC

- LANXESS

- CLARIANT

- WACKER CHEMIE AG

- INDIAN OIL CORPORATION LTD.

- SCHULTZ CANADA CHEMICALS LTD.

- 기타 기업

- PARATHERM

- ARKEMA

- BASF SE

- DALIAN RICHFORTUNE CHEMICALS CO., LTD.

- BRITISH PETROLEUM

- DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC

- DYNALENE

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- GLOBAL HEAT TRANSFER LTD.

- ISEL

- PARAS LUBRICANTS LTD.

- PETRO-CANADA LUBRICANTS, INC.

- PHILLIPS 66 COMPANY

- RADCO INDUSTRIES, INC.

- SCHAEFFER MANUFACTURING CO.

제13장 부록

LSH 25.10.15The heat transfer fluids market is projected to grow from USD 5.1 billion in 2025 to USD 6.3 billion by 2030, registering a CAGR of 4.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2024 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion/Million) and Volume (Kiloton) |

| Segments | Product Type, Temperature, Application, End-use Industry, And Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The growth of the heat transfer fluids market is driven by several key factors, including rapid industrialization, rising energy efficiency needs, and the expansion of major end-use industries. As industrial processes become more advanced and widespread, especially in emerging economies, the requirement for effective thermal management solutions becomes crucial. Industries such as chemical, petrochemical, automotive, food and beverage, pharmaceuticals, and HVAC heavily rely on heat transfer fluids to maintain optimal operating temperatures and ensure efficient processes. The increasing emphasis on energy conservation and efficiency further propels the market, as heat transfer fluids are essential in reducing energy consumption and improving overall thermal system performance.

Additionally, the adoption of renewable energy sources like solar and wind power demands advanced heat transfer fluids for energy storage and transfer. Technological innovations in heat transfer fluid formulations-offering better thermal stability, lower maintenance, and higher safety-also support market expansion. Furthermore, strict environmental regulations and the shift toward sustainable industrial practices promote the use of high-performance, eco-friendly heat transfer fluids, expanding the market further. These combined factors create strong demand across various sectors, fueling overall market growth.

"Synthetic fluids, by product type, to be fastest-growing segment in terms of value during forecast period"

Synthetic fluids represent the fastest-growing and second-largest segment in the heat transfer fluids market due to their superior performance features, making them highly suitable for demanding industrial uses. Unlike mineral oils and glycol-based fluids, synthetic options provide exceptional thermal stability, enabling efficient operation at both high and low temperatures without breaking down. This quality makes them ideal for industries with strict thermal needs, such as chemical processing, pharmaceuticals, and high-temperature manufacturing. Additionally, synthetic fluids offer excellent heat transfer efficiency and lower volatility, improving system safety and durability. Their advanced formulas also resist oxidation and fouling better, which helps lower maintenance costs and extends the lifespan of heat transfer systems. Moreover, synthetic fluids often comply with stricter environmental and safety standards, making them a preferred choice in regions with rigorous regulations. Although they tend to be more costly than mineral oils, their long-term performance advantages and operational efficiency justify the investment, securing their prominent market share.

"Medium temperature to be second-largest segment in heat transfer fluids market in terms of value during forecast period"

Medium-temperature heat transfer fluids hold the second-largest market share in the heat transfer fluids industry because they provide an optimal balance between performance, cost, and versatility, making them suitable for a wide range of industrial operations. These fluids, usually functioning between 150°C and 400°C, are widely used in industries such as chemical processing, plastics, oil and gas, and food and beverage manufacturing, where consistent heating and cooling are needed but the extreme resistance of high-temperature or cryogenic fluids is not required. Their ability to deliver stable thermal performance without rapid degradation makes them highly cost-effective compared to high-temperature synthetics, while offering broader applicability than low-temperature fluids outside refrigeration and cold chain applications. In sectors like polymer and resin production, refining, and general manufacturing, medium-temperature HTFs ensure precise temperature control, reduce energy consumption, and improve process efficiency, making them essential. Moreover, the increasing industrialization in emerging economies and the need for energy-efficient and safer thermal management solutions are boosting demand for these fluids. Their versatility in both continuous and batch processes and easier maintenance and replacement cycles helps ensure that medium-temperature fluids remain the second most used category in the global heat transfer fluids market.

"Industrial processing to be fastest-growing application segment of heat transfer fluids in terms of value during forecast period"

Industrial processing is the fastest-growing segment in the heat transfer fluids (HTFs) market because global manufacturing is expanding quickly, driven by increasing demand for chemicals, polymers, pharmaceuticals, processed food, and metals. These industries need precise thermal management in processes like distillation, polymerization, crystallization, refining, and reactor heating, where HTFs ensure efficiency, safety, and product consistency. Growth in industrial processing is especially strong in emerging economies across Asia-Pacific, the Middle East, and Latin America, where rapid industrialization, urbanization, and infrastructure development are fueling significant investments in chemical plants, refineries, and manufacturing facilities. Additionally, stricter energy efficiency regulations and sustainability goals are encouraging industries to switch from traditional heating methods to advanced HTFs that reduce energy loss, extend equipment lifespan, and enhance operational reliability. Ongoing technological progress, including the development of eco-friendly and longer-lasting HTFs, further promotes adoption in industrial settings. Compared to other applications like HVAC or automotive, industrial processing uses larger volumes of HTFs but and This combination of expanding end-use industries, regulatory backing, and technological improvements makes industrial processing the fastest-growing application area for heat transfer fluids globally.

"HVAC to be fastest-growing end-use industry segment of heat transfer fluids market in terms of value during forecast period"

The HVAC industry is rapidly becoming the fastest-growing end-use sector for heat transfer fluids (HTFs) due to the increasing global demand for energy-efficient cooling and heating solutions in homes, businesses, and industry. Rapid urbanization, population growth, and higher living standards are boosting the need for air conditioning, refrigeration, and heating systems, especially in developing regions across Asia-Pacific, the Middle East, and Latin America. Meanwhile, mature markets in North America and Europe are increasingly upgrading HVAC systems to meet stricter energy efficiency and environmental standards, which boosts the adoption of advanced HTFs that offer better thermal performance with less energy loss. Additionally, the growth of cold chain logistics, data centers, and green buildings is raising demand for glycol-based and synthetic HTFs that can operate reliably across low- and medium-temperature ranges. With a greater focus on sustainability, manufacturers are also launching eco-friendly and non-toxic HTFs designed specifically for HVAC applications, further speeding up their adoption. Compared to other sectors, HVAC has high growth potential driven by ongoing system upgrades, climate change, increasing reliance on cooling, and policies promoting energy-efficient building tech. These factors make HVAC the fastest-growing end-use industry in the heat transfer fluids market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations in the heat transfer fluids market. Additionally, information was gathered through secondary research to assess and validate the market size of different segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, South America - 5%.

The heat transfer fluids market comprises Dow (US), Eastman Chemical Company (US), ExxonMobil (US), Chevron Corporation (US), Huntsman Corporation (US), Shell PLC (UK), Lanxess (Germany), Clariant (Switzerland), Wacker Chemie AG (Germany), Indian Oil Corporation Ltd. (India), and Schultz Canada Chemicals Ltd. (Canada). The study provides an in-depth competitive analysis of key players in the Heat transfer fluids market, including their company profiles, recent developments, and main market strategies.

Research Coverage

This report segments the heat transfer fluids market based on product type, temperature, application, end-use industry, and region, and provides estimates for the overall market value across different regions. A detailed analysis of key industry players has been conducted to offer insights into their business overviews, products and services, key strategies, and expansions related to the heat transfer fluids market.

Key benefits of buying report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Heat transfer fluids market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers: (Increasing expansion in renewable and industrial heat applications), restraints (Absence of standardized testing and performance criteria for EV cooling fluids), opportunities (Customized, application-specific formulations in HTF industry), and challenges (Balancing performance with environmental compliance).

- Market Penetration: Comprehensive information on the heat transfer fluids offered by top players in the heat transfer fluids market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, partnerships, agreements, joint ventures, collaborations, announcements, awards, and market expansion.

- Market Development: The report provides comprehensive information about lucrative emerging markets and analyzes the heat transfer fluids market across regions.

- Market Capacity: Production capacities of companies manufacturing heat transfer fluids are provided wherever available, along with upcoming capacities for the heat transfer fluids market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Heat transfer fluids market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEAT TRANSFER FLUIDS MARKET

- 4.2 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE

- 4.3 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE

- 4.4 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY

- 4.5 HEAT TRANSFER FLUIDS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion in renewable and industrial heat applications

- 5.2.1.2 Regulatory incentives and energy efficiency legislation

- 5.2.1.3 Lifecycle services and analytical programs by major suppliers

- 5.2.1.4 Rising adoption of immersion cooling in EVs and electronics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of standardized testing and performance criteria for EV cooling fluids

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Customized, application-specific formulations

- 5.2.3.2 Technological innovation in immersion and direct cooling

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing performance with environmental compliance

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF GENERATIVE AI ON HEAT TRANSFER FLUIDS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021-2024

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT TYPE, 2021-2024

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2014-2024

- 6.8.3 PATENT PUBLICATION TRENDS

- 6.8.4 INSIGHTS

- 6.8.5 LEGAL STATUS OF PATENTS

- 6.8.6 JURISDICTION ANALYSIS

- 6.8.7 TOP APPLICANTS

- 6.8.8 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 841950)

- 6.9.2 EXPORT SCENARIO (HS CODE 841950)

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF AND REGULATORY REGULATIONS RELATED TO HEAT TRANSFER FLUIDS MARKET

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 REGULATIONS RELATED TO HEAT TRANSFER FLUIDS MARKET

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ITC MAURYA ENHANCED HEAT PUMP EFFICIENCY WITH NANO-ENHANCED HEAT TRANSFER FLUIDS

- 6.15.2 ENHANCING SOLAR POWER PLANT EFFICIENCY THROUGH ADVANCED HEAT TRANSFER FLUID PERFORMANCE

- 6.15.3 EXTENDING THERMAL LIMITS AND RELIABILITY: VERSALIS' TRANSITION TO THERMINOL FOR HIGH-TEMPERATURE DISTILLATION

- 6.16 IMPACT OF 2025 US TARIFF - HEAT TRANSFER FLUIDS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 HEAT TRANSFER FLUIDS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 MINERAL OILS

- 7.2.1 COST-EFFECTIVE COMPARED TO GLYCOL-BASED AND SYNTHETIC FLUIDS-KEY FACTOR DRIVING MARKET GROWTH

- 7.3 SYNTHETIC FLUIDS

- 7.3.1 ENVIRONMENTALLY FRIENDLY NATURE TO SUPPORT ADOPTION

- 7.4 GLYCOL-BASED FLUIDS

- 7.4.1 OFFER EXCELLENT CORROSION INHIBITION PROPERTIES-KEY FACTOR PROPELLING MARKET GROWTH

- 7.5 OTHER PRODUCT TYPES

- 7.5.1 NANOFLUIDS

- 7.5.2 IONIC LIQUIDS

- 7.5.3 BIO-BASED HTF

- 7.5.4 MOLTEN SALTS

8 HEAT TRANSFER FLUIDS MARKET, BY TEMPERATURE

- 8.1 INTRODUCTION

- 8.2 LOW TEMPERATURE

- 8.2.1 NEED TO ENHANCE EFFICIENCY IN COOLING & CRYOGENICS SYSTEMS TO DRIVE MARKET

- 8.3 MEDIUM TEMPERATURE

- 8.3.1 RISING INDUSTRIALIZATION AND URBANIZATION TO SUPPORT MARKET GROWTH

- 8.4 HIGH TEMPERATURE

- 8.4.1 VITAL ROLE IN ENERGY-INTENSIVE INDUSTRIES TO DRIVE MARKET

- 8.5 ULTRA-HIGH TEMPERATURE

- 8.5.1 USE IN HIGHLY SPECIALIZED APPLICATIONS TO DRIVE ADOPTION

9 HEAT TRANSFER FLUIDS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CHEMICAL & PETROCHEMICAL

- 9.2.1 IMPLEMENTATION IN CHEMICAL PLANTS OWING TO LOW VOLATILITY PROPERTIES TO PROPEL MARKET

- 9.3 OIL & GAS

- 9.3.1 ADOPTION IN OIL & GAS PLANTS TO REDUCE VIBRATIONS IN TRANSDUCERS, CABLES, AND CONTROL VALVES TO PROPEL MARKET

- 9.4 AUTOMOTIVE

- 9.4.1 USE IN AUTOMOBILE BATTERIES, COMPRESSORS, AND MOTORS FOR EFFICIENT HEAT TRANSFER TO PROPEL MARKET

- 9.5 RENEWABLE ENERGY

- 9.5.1 DEPLOYMENT IN CSP PLANTS DUE TO HIGH OXIDATION RESISTANCE AND THERMAL STABILITY TO PROPEL MARKET

- 9.6 PHARMACEUTICALS

- 9.6.1 IMPLEMENTATION OF FOOD-GRADE HEAT TRANSFER FLUIDS IN PHARMACEUTICAL APPLICATIONS TO PROPEL MARKET

- 9.7 FOOD & BEVERAGES

- 9.7.1 UTILIZATION OF HEAT TRANSFER FLUIDS AS SUBSTITUTE FOR STEAM IN FOOD PROCESSING PLANTS TO PROPEL MARKET

- 9.8 HVAC

- 9.8.1 CORROSION RESISTANCE AND LONG-TERM STABILITY OF HEAT TRANSFER FLUIDS TO INCREASE DEMAND FOR HVAC APPLICATIONS

- 9.9 OTHER END-USE INDUSTRIES

- 9.9.1 ELECTRICAL & ELECTRONICS

- 9.9.2 AEROSPACE

10 HEAT TRANSFER FLUIDS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Thriving chemical and automotive sectors to propel market

- 10.2.2 JAPAN

- 10.2.2.1 Automotive sector to drive demand

- 10.2.3 INDIA

- 10.2.3.1 Government initiatives for renewable energy to support market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Thriving automotive & chemical industry to drive market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Increasing demand for renewable energy to drive market

- 10.3.2 CANADA

- 10.3.2.1 Focus on renewable energy sector to drive demand

- 10.3.3 MEXICO

- 10.3.3.1 Thriving petrochemical and automotive manufacturing sectors to propel market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Strong manufacturing sector to drive growth

- 10.4.2 ITALY

- 10.4.2.1 Established manufacturing and food & beverages sectors to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Technological & sustainability initiatives to drive market

- 10.4.4 UK

- 10.4.4.1 Focus on renewable energy sector and commitment to circular economy to drive market

- 10.4.5 SPAIN

- 10.4.5.1 Government initiatives for renewable energy sector to drive demand

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 UAE

- 10.5.1.1.1 Government initiatives and strategic diversification to drive demand

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Government commitment to economic diversification to drive demand

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 UAE

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Burgeoning industrial sector, coupled with government schemes, to drive market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 ARGENTINA

- 10.6.1.1 Government initiatives to drive demand

- 10.6.2 BRAZIL

- 10.6.2.1 Diverse industrial landscape to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 ARGENTINA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Product type footprint

- 11.6.5.2 End-use industry footprint

- 11.6.5.3 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DOW

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 EASTMAN CHEMICAL COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 EXXON MOBIL CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 CHEVRON CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 HUNTSMAN CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 SHELL PLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 LANXESS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 CLARIANT

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.9 WACKER CHEMIE AG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.10 INDIAN OIL CORPORATION LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.11 SCHULTZ CANADA CHEMICALS LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.1 DOW

- 12.2 OTHER PLAYERS

- 12.2.1 PARATHERM

- 12.2.2 ARKEMA

- 12.2.3 BASF SE

- 12.2.4 DALIAN RICHFORTUNE CHEMICALS CO., LTD.

- 12.2.5 BRITISH PETROLEUM

- 12.2.6 DUPONT TATE & LYLE BIOPRODUCTS COMPANY LLC

- 12.2.7 DYNALENE

- 12.2.8 HINDUSTAN PETROLEUM CORPORATION LIMITED

- 12.2.9 GLOBAL HEAT TRANSFER LTD.

- 12.2.10 ISEL

- 12.2.11 PARAS LUBRICANTS LTD.

- 12.2.12 PETRO-CANADA LUBRICANTS, INC.

- 12.2.13 PHILLIPS 66 COMPANY

- 12.2.14 RADCO INDUSTRIES, INC.

- 12.2.15 SCHAEFFER MANUFACTURING CO.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS