|

시장보고서

상품코드

1829980

세라믹 매트릭스 복합재(CMC) 시장 : 섬유 유형별, 섬유 재료별, 매트릭스 유형별, 최종 이용 산업별, 지역별 - 예측(-2030년)Ceramic Matrix Composites Market by Fiber Type, Fiber Material, Matrix Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

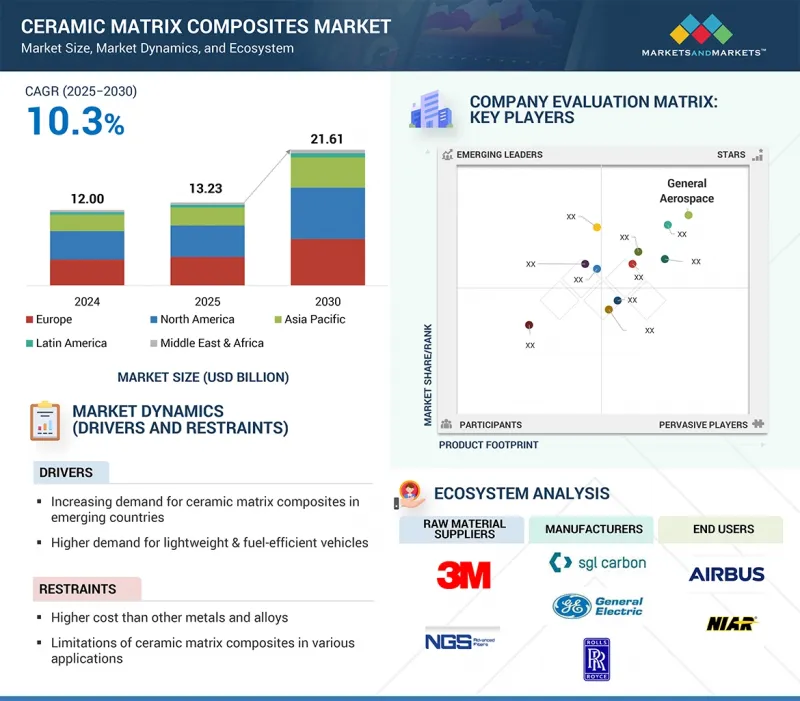

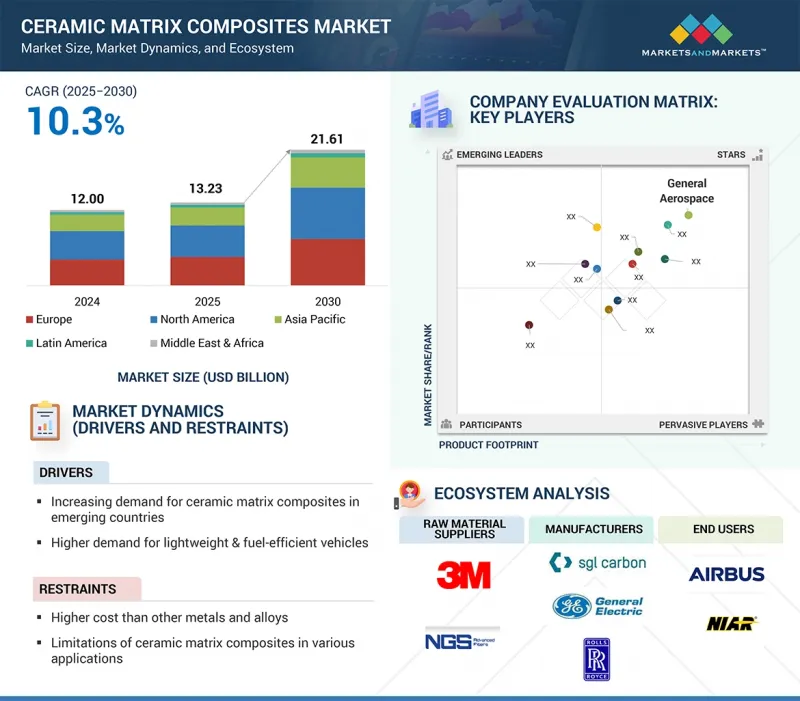

세계의 세라믹 매트릭스 복합재(CMC) 시장 규모는 2024년 120억 달러에서 2030년까지 216억 1,000만 달러에 이르고, 예측 기간에 금액 기준 CAGR 10.3%의 성장이 전망됩니다.

이는 C/SiC 매트릭스 유형의 경량화와 뛰어난 내열성, 기계적 강도의 장점으로 인해 최고 온도를 필요로 하는 용도에 사용되고 있습니다. C/SiC 복합재료는 항공우주, 방위, 하이테크 자동차 산업에서 극한의 열적, 기계적 하중에 대한 내성이 매우 중요한 항공기 브레이크 시스템, 로켓 노즐, 열 보호 시스템, 스포츠카 브레이크 디스크 등의 부품에 사용되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러, 킬로톤 |

| 부문 | 섬유 유형, 섬유 재료, 매트릭스 유형, 최종 이용 산업, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

차세대 항공기 및 미래형 자동차 시스템에서 연비 효율, 저배출, 주행 중 신뢰성에 대한 요구가 높아짐에 따라 C/SiC 복합재료에 대한 수요가 더욱 증가하고 있습니다. 또한, 화학기상함침법(CVI), 고분자 함침 및 열분해법(PIP) 등 새로운 제조 공정의 개발과 낮은 생산비용으로 제품 성능의 향상으로 C/SiC 복합재료는 선호되는 소재가 되었습니다. 지속적인 연구개발 활동으로 C/SiC 세라믹 기반 복합재료의 특성을 향상시키고, 응용 범위를 지속적으로 확대하고 있습니다. 이러한 뛰어난 특성으로 인해 C/SiC 세라믹 기반 복합재료는 항공우주, 자동차, 에너지 및 전력, 산업 등 최종 이용 산업에서 매우 선호되고 있습니다.

"금액 기준으로 볼 때, 2024년 전체 세라믹 기반 복합재료 시장에서 자동차 최종 이용 산업이 두 번째로 큰 비중을 차지했습니다. "

자동차 최종 용도 부문은 효율성, 안전성, 내구성 향상으로 고성능 자동차 및 고급 자동차에 CMC가 사용됨에 따라 세계 세라믹 기반 복합재료 시장에서 두 번째로 큰 시장 점유율을 차지했습니다. C/SiC 기반 복합재료는 내마모성, 경량성, 성능 특성 저하 없이 고열을 견딜 수 있는 우수한 특성으로 인해 자동차 브레이크 디스크, 클러치 및 기타 고응력 조건에 노출되는 부품에 널리 활용되고 있습니다. 주행거리, 가속도, 제동 능력을 향상시키기 위해 정교한 소재를 필요로 하는 전기자동차 및 스포츠카에 대한 수요가 증가함에 따라 산업계에서 세라믹 기반 복합재료의 범위가 확대되고 있습니다. 자동차의 경량화는 자동차 산업이 엄격한 배기가스 규제를 준수하고 연비를 향상시키기 위한 정책에 기인하며, 이 또한 세라믹 기반 복합재료와 같은 첨단 경량화 재료의 사용이 급증하는 한 요인으로 작용하고 있습니다. 이러한 요소들로 인해 자동차 산업은 세라믹 기반 복합재료의 최종 이용 산업 중 두 번째로 큰 시장입니다.

"연속 섬유 유형 부문은 예측 기간 동안 금액 기준으로 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. "

섬유 유형별로 보면, 연속 섬유 유형 부문은 단섬유 유형이나 다진 섬유 유형보다 강도, 내구성, 내열성이 우수하여 예측 기간 동안 세라믹 기반 복합재료 시장에서 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 연속 섬유는 재료의 전체 길이에 걸쳐 연속적이기 때문에 하중의 빠른 전달, 높은 파괴 인성, 가혹한 열적 및 기계적 조건에서 균열에 대한 견고성을 제공합니다. 이러한 장점으로 인해 연속섬유는 경량성과 고온 적용이 가장 중요한 항공기 엔진, 가스 터빈 부품, 우주선 방열판, 브레이크 시스템 등 고성능 응용 분야에 매우 적합합니다. 또한, 산업계는 연비 향상, 배출가스 감소, 부품의 수명 연장을 실현하는 재료로 전환하고 있으며, 이는 모두 연속 섬유 세라믹 기반 복합재료의 시간 프레임에 속합니다. 따라서 항공우주, 국방, 에너지, 첨단 자동차 분야에서의 사용 확대가 예상에 따라 성장 전망이 밝습니다.

"유럽의 세라믹 기반 복합재료 시장은 예측 기간 동안 2위 시장 점유율을 기록할 것으로 예측됩니다. "

2024년 북미가 가장 큰 시장 점유율을 차지한 반면, 유럽은 두 번째 시장 점유율을 차지했습니다. 시장 점유율 3위는 아시아태평양입니다. 유럽은 탄탄한 산업 기반, 다수의 제조 시설, 산업 주요 기업들이 집중되어 있어 예측 기간 동안 세라믹 기반 복합재료에서 두 번째 점유율을 차지할 것으로 예측됩니다. 독일, 프랑스, 영국은 세라믹 기반 복합재료를 제조하는 주요 국가로 여러 연구센터를 보유하고 있습니다. CeramTec(독일), SAFRAN Ceramics(프랑스) 등의 기업은 항공우주, 자동차, 에너지 산업에서 고성능 세라믹 기반 복합재료 부품 제조에 종사하고 있습니다.

세계의 세라믹 기반 복합재료 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 세라믹 매트릭스 복합재(CMC) 시장의 매력적인 기회

- 세라믹 매트릭스 복합재(CMC) 시장 : 최종 이용 산업별, 지역별(2024년)

- 세라믹 매트릭스 복합재(CMC) 시장 : 섬유 유형별

- 세라믹 매트릭스 복합재(CMC) 시장 : 매트릭스 유형별

- 세라믹 매트릭스 복합재(CMC) 시장 : 최종 이용 산업별

- 세라믹 매트릭스 복합재(CMC) 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 공급망 분석

- 원재료

- 제품 제조업체

- 최종사용자

- 밸류체인 분석

- 생태계 분석

- 가격 결정 분석

- 주요 기업이 제공하는 세라믹 매트릭스 복합재(CMC) 평균 판매량

- 평균 판매 가격 동향 : 지역별

- 평균 판매 가격 동향 : 지역별(2022년-2024년)

- 거시경제 전망

- 서론

- GDP 동향과 예측

- 세라믹 매트릭스 복합재(CMC) 시장 동향

- 기술 분석

- 주요 기술

- 보완 기술

- 주요 이해관계자와 구입 기준

- 무역 데이터 애널리틱스

- 수입 시나리오(HS코드 681511)

- 수출 시나리오(HS코드 681511)

- 특허 분석

- 서론

- 조사 방법

- 문헌 유형

- 인사이트

- 특허 법적 지위

- 관할 분석

- 주요 출원자

- 규제 상황

- 세라믹 매트릭스 복합재(CMC) 시장 규제

- 규제기관, 정부기관, 기타 조직

- 주요 컨퍼런스 및 이벤트(2025년-2026년)

- 사례 연구 분석

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- AI/생성형 AI의 영향

- 투자 및 자금조달 시나리오

- 세라믹 매트릭스 복합재(CMC) 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 세라믹 매트릭스 복합재(CMC) 시장 : 매트릭스 유형별

- 서론

- 산화물/산화물 세라믹 매트릭스 복합재(CMC)

- C/SiC 세라믹 매트릭스 복합재(CMC)

- C/C 세라믹 매트릭스 복합재(CMC)

- SiC/SiC 세라믹 매트릭스 복합재(CMC)

제7장 세라믹 매트릭스 복합재(CMC) 시장 : 섬유 유형별

- 서론

- 연속

- 직물

- 기타 섬유 유형

- FELT/MAT

- CHOPPED

- TWILL

- BRAIDED

- ROPES AND BELTS

제8장 세라믹 매트릭스 복합재(CMC) 시장 : 섬유 재료별

- 서론

- 알루미나

- SiC

- 탄소

- 기타 섬유 재료

제9장 세라믹 매트릭스 복합재(CMC) 시장 : 최종 이용 산업별

- 서론

- 항공우주 및 방위

- 자동차

- 에너지 및 전력

- 산업

- 기타 최종 이용 산업

제10장 세라믹 매트릭스 복합재(CMC) 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 유럽

- 프랑스

- 독일

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

- 이스라엘

- 남아프리카공화국

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석(2020년-2024년)

- 시장 점유율 분석(2024년)

- 브랜드 및 제품 비교 분석

- 기업 평가 매트릭스

- 스타트업/중소기업 평가 매트릭스

- 세라믹 매트릭스 복합재(CMC) 제조업체 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- GE AEROSPACE

- ROLLS-ROYCE PLC

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SGL CARBON

- COORSTEK INC.

- LANCER SYSTEMS

- AXIOM MATERIALS

- ULTRAMET

- CFC CARBON CO., LTD.

- SPIRIT AEROSYSTEMS, INC.

- COIC

- APPLIED THIN FILMS, INC.

- 기타 기업

- PRECISION CASTPARTS CORP.

- STAR FIRE SYSTEMS INC.

- PYROMERAL SYSTEMS

- ZIRCAR ZIRCONIA, INC.

- UNITED COMPOSITES B.V.

- TOUCHSTONE ADVANCED COMPOSITES

- BJS CERAMICS GMBH

- WPX FASERKERAMIK GMBH

- KERAMIKBLECH

- MORGAN ADVANCED MATERIALS

- KYOCERA CORPORATION

- UBE CORPORATION

- SCHUNK GROUP

제13장 부록

LSH 25.10.15The ceramic matrix composites market is projected to grow from USD 12.0 billion in 2024 to USD 21.61 billion by 2030, at a CAGR of 10.3% in terms of value during the forecast period. Due to Carbon/SiC matrix type weight savings benefits, outstanding thermal resistance, and mechanical strength, it is used in applications that require highest temperatures. C/SiC composites are used in the aerospace, defense, and high-tech automobile industries in parts of aircraft, such as braking systems, rocket nozzles, thermal protection systems, and brake discs of sports cars where resistance to extreme thermal and mechanical loads is highly critical.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | By Fiber Type, By Fiber Material, By Matrix Type, By End-use Industry, By Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

The increasing requirement for fuel efficiency, low emissions, and reliability during operation in new generation aircraft and future automotive systems is further fueling the demand for C/SiC composites. Also, the development of new manufacturing processes, such as chemical vapor infiltration (CVI) and polymer infiltration and pyrolysis (PIP), along with improved product performance at lower production costs makes it a preferred material. Ongoing research & development efforts continue to enhance the properties and expand the range of applications for C/SiC ceramic matrix composites. These exceptional properties make them highly desirable for end-use industries like aerospace, automotive, energy & power, and industrial.

''In terms of value, the automotive end-use industry accounted for the second largest share of the overall ceramic matrix composites market in 2024.''

The automotive end-use segment represented the second-largest market share of the global ceramic matrix composites market, in terms of value, due to the use of CMCs in high-performance and luxury automobiles due to their improved efficiency, safety, and durability. Composites of carbon/silicon carbide have been widely applied in automotive brake discs, clutches, and other parts which undergo high-stress conditions because of their outstanding properties, such as wear resistance, light weight, and resistance to high heat without loss of performance characteristics. The increasing demand for electric vehicles and sports cars, which need refined materials to increase range, acceleration, and braking capability has increased the scope of the ceramic matrix composites in industry. Vehicle weight reduction is attributed to policies for the automotive industry to comply with strict emission standards and increase fuel economy, which has also contributed to the upsurge in the use of advanced lightweight materials, such as ceramic matrix composites. All these elements make the automotive industry the second-largest market for ceramic matrix composites in terms of end-use industry.

''The continuous fiber type segment is expected to register the second-highest CAGR during the forecast period, in terms of value.''

Based on fiber type, the continuous fiber type segment is expected to register the second-highest CAGR during the forecast period in the ceramic matrix composites market due to the fact that their structure offers superior strength, durability, and thermal resistance, than the short or chopped fiber type. Continuous fibers are continuous over the entire length of a material, and this permits the quick transfer of the loadings, high fracture toughness, and robustness to cracking under harsh thermal and mechanical conditions. These benefits render the continuous fiber as super applicable in high-performance applications, such as in aircraft engines, gas turbine parts, spacecraft heat shields, and braking systems, where lightweight and high-temperature application is paramount. Moreover, industries are also moving toward materials that can facilitate fuel efficiency, reduce emissions, and longer lifespan of components, all of which is within the time frame of continuous fiber ceramic matrix composites. Consequently, their good growth outlook is attributable to the prospects of their expanded use in aerospace, defense, energy, and advanced automotive applications.

"During the forecast period, the ceramic matrix composites market in Europe is projected to register the second-largest market share."

The ceramic matrix composite market has been studied in North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. Europe accounted for the second-largest market share in 2024, whereas North America accounted for the largest market share in 2024. At the third place in terms of market share stood Asia Pacific. Europe is expected to have the second-largest share in ceramic matrix composites during the forecast period because the region is endowed with a robust industrial base, multiple manufacturing facilities, and concentration of the major players in the industry. Germany, France, and UK are major countries manufacturing ceramic matrix composites and have multiple research centers. Companies such as CeramTec (Germany) and SAFRAN Ceramics (France) are engaged in manufacturing high-performance ceramic matrix composite components in the aerospace, automotive, and energy industries. The European aerospace industry comprises companies such as Airbus, Rolls-Royce, and Safran who been implementing ceramic matrix composites in jet engines, exhaust systems, and thermal protection systems, to enhance efficiency and capability under severe operational conditions. Also, automotive industries in the region, particularly Germany and Italy have adopted ceramic matrix composites in high-performance braking systems and lightweight structural components in achieving high standards of emissions and performance. Current research conducted by organizations like the Fraunhofer Institute of Germany is still further developing the ceramic matrix composite processing technologies that further enhance the growth of Europe in the global market. Thus, Europe's strong presence in these industries contributes significantly to the region's dominance in the ceramic matrix composites market.

This study has been validated through interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 35%, Tier 2- 25%, and Tier 3- 40%

- By Designation- C Level- 35%, Director Level- 30%, and Others- 35%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, Latin America- 10%, Middle East & Africa (MEA)-20%

The report provides a comprehensive analysis of company profiles:

Prominent companies include GE Aerospace (US), Rolls-Royce plc (UK), SGL Carbon (Germany), Coorstek Inc. (US), Lancer Systems (US), Axiom Materials (US), Ultramet (US), CFC CARBON CO., Ltd. (China), Spirit Aerosystems, Inc. (US), COIC (US), and Mitsubishi Chemical Group Corporation (Japan), among others.

Research Coverage

This research report categorizes the Ceramic Matrix Composites Market by Fiber Type (Continuous Fiber, Woven Fiber, Other Fibers), Fiber Material (Alumina Fiber, SiC Fiber, Other Fiber), Matrix Type (Oxide/Oxide Ceramic Matrix Composites, C/SIC Ceramic Matrix Composite, C/C Ceramic Matrix Composite, SIC/SIC Ceramic Matrix Composite), End-use Industry (Aerospace & Defense, Automotive, Energy & Power, Industrial, Other End-use Industries), and Region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the study includes thorough information on the important elements impacting the growth of the ceramic matrix composites market, such as drivers, restraints, challenges, and opportunities. A comprehensive review of the top industry participants has been conducted in order to provide insights into their business overviews, solutions, and services; important strategies; contracts, partnerships, and agreements. Product and service launches, mergers and acquisitions, and current developments in the ceramic matrix composites sector are all covered. The report includes a competitive study of the upcoming startups in the ceramic matrix composites industry ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall ceramic matrix composites market and their subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of Key Drivers (Increasing demand for ceramic matrix composites in emerging countries, Higher demand for lightweight and fuel-efficient vehicles), restraints (Higher costs as compared to other metals and alloys), opportunities (Growing use of lightweight components in various end-use industries), and challenges (Limited use due to reparability and recyclability) influencing the growth of the ceramic matrix composites market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the ceramic matrix composites market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the ceramic matrix composites market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ceramic matrix composites market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like GE Aerospace (US), Rolls-Royce plc (UK), SGL Carbon (Germany), Coorstek Inc. (US), Lancer Systems (US), Axiom Materials (US), Ultramet (US), CFCCarbon Co., Ltd. (China), Spirit Aerosystems, Inc. (US), COIC (US), and Mitsubishi Chemical Group Corporation (Japan), among others in the ceramic matrix composites market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with top ceramic matrix composite manufacturers

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CERAMIC MATRIX COMPOSITES MARKET

- 4.2 CERAMIC MATRIX COMPOSITES MARKET, BY END-USE INDUSTRY AND REGION, 2024

- 4.3 CERAMIC MATRIX COMPOSITES MARKET, BY FIBER TYPE

- 4.4 CERAMIC MATRIX COMPOSITES MARKET, BY MATRIX TYPE

- 4.5 CERAMIC MATRIX COMPOSITES MARKET, BY END-USE INDUSTRY

- 4.6 CERAMIC MATRIX COMPOSITES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for ceramic matrix composites in emerging countries

- 5.2.1.2 Higher demand for lightweight and fuel-efficient vehicles

- 5.2.1.3 Stringent regulations against carbon emissions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher cost than other metals and alloys

- 5.2.2.2 Limitations of ceramic matrix composites in various applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of lightweight components in various end-use industries

- 5.2.3.2 Mass manufacture and standardization of ceramic matrix composite production process

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited use due to reparability and recyclability

- 5.2.4.2 Scaling up manufacturing process while maintaining consistent quality and reducing costs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 RAW MATERIALS

- 5.4.2 PRODUCT MANUFACTURERS

- 5.4.3 END USERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING OF CERAMIC MATRIX COMPOSITES OFFERED BY KEY PLAYERS

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/KG)

- 5.8 MACROECONOMIC OUTLOOK

- 5.8.1 INTRODUCTION

- 5.8.2 GDP TRENDS AND FORECAST

- 5.8.3 TRENDS IN CERAMICS MATRIX COMPOSITES MARKET

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGY

- 5.9.1.1 Laser Additive Manufacturing (LAM)

- 5.9.1.2 Automated Fiber Placement (AFP)

- 5.9.2 COMPLEMENTARY TECHNOLOGY

- 5.9.2.1 Dipping fiber bundles, pressing, heating, and hot-pressing

- 5.9.1 KEY TECHNOLOGY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 TRADE DATA ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 681511)

- 5.11.2 EXPORT SCENARIO (HS CODE 681511)

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPES

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATIONS IN CERAMIC MATRIX COMPOSITES MARKET

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY 1: GENERAL ELECTRIC COMPANY SUCCESSFULLY TESTED NEW CERAMIC MATRIX COMPOSITE TURBINE BLADE

- 5.15.2 CASE STUDY 2: ROLLS-ROYCE PLC TO INVEST AND EXPAND RESEARCH & DEVELOPMENT ACTIVITIES

- 5.15.3 CASE STUDY 3: SGL CARBON EXPANDED PRODUCTION CAPACITY IN NORTH AMERICA

- 5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 IMPACT OF AI/GEN AI

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF 2025 US TARIFF ON CERAMIC MATRIX COMPOSITES MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 CERAMIC MATRIX COMPOSITES MARKET, BY MATRIX TYPE

- 6.1 INTRODUCTION

- 6.2 OXIDE/OXIDE CERAMIC MATRIX COMPOSITES

- 6.2.1 INCREASING DEMAND DUE TO LOW PRICE AND HIGH THERMAL STABILITY TO DRIVE MARKET

- 6.3 C/SIC CERAMIC MATRIX COMPOSITES

- 6.3.1 RISING DEMAND FROM AEROSPACE AND LUXURY AND SPORTS CARS INDUSTRIES TO BOOST MARKET

- 6.4 C/C CERAMIC MATRIX COMPOSITES

- 6.4.1 HIGH DEMAND FROM AEROSPACE & DEFENSE INDUSTRY TO FUEL MARKET

- 6.5 SIC/SIC CERAMIC MATRIX COMPOSITES

- 6.5.1 LOW THERMAL EXPANSION, EXCELLENT THERMAL SHOCK RESISTANCE, AND IMPROVED CHEMICAL INERTNESS TO PROPEL MARKET

7 CERAMIC MATRIX COMPOSITES MARKET, BY FIBER TYPE

- 7.1 INTRODUCTION

- 7.2 CONTINUOUS

- 7.2.1 RESISTANCE TO CRACK PROPAGATION AND OVERALL TOUGHNESS TO BOOST DEMAND

- 7.3 WOVEN

- 7.3.1 RISING DEMAND DUE TO HIGH STRENGTH AND OXIDATION RESISTANCE TO DRIVE MARKET

- 7.4 OTHER FIBER TYPES

- 7.4.1 FELT/MAT

- 7.4.2 CHOPPED

- 7.4.3 TWILL

- 7.4.4 BRAIDED

- 7.4.5 ROPES AND BELTS

8 CERAMIC MATRIX COMPOSITES MARKET, BY FIBER MATERIAL

- 8.1 INTRODUCTION

- 8.2 ALUMINA

- 8.2.1 COST-EFFECTIVENESS AND SUPERIOR THERMAL STABILITY TO BOOST MARKET

- 8.3 SIC

- 8.3.1 SIGNIFICANT MECHANICAL STRENGTH, THERMAL SHOCK RESISTANCE, AND STABILITY IN HARSH ENVIRONMENTS TO DRIVE MARKET

- 8.4 CARBON

- 8.4.1 GROWING DEMAND FOR LIGHTWEIGHT, HIGH-PERFORMANCE MATERIALS IN AEROSPACE AND AUTOMOTIVE SECTORS TO BOOST MARKET

- 8.5 OTHER FIBER MATERIALS

9 CERAMIC MATRIX COMPOSITES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AEROSPACE & DEFENSE

- 9.2.1 HIGH DAMAGE TOLERANCE, FRACTURE TOUGHNESS, TEMPERATURE, WEAR, AND CORROSION RESISTANCE TO DRIVE MARKET

- 9.3 AUTOMOTIVE

- 9.3.1 WEIGHT REDUCTION, IMPROVED SHOCK ABSORBANCE, ROAD-HOLDING COMFORT, AGILITY, AND FUEL ECONOMY TO BOOST MARKET

- 9.4 ENERGY & POWER

- 9.4.1 LOW THERMAL EXPANSION, RESISTANCE TO DEGRADATION FROM IRRADIATION, AND EXCELLENT RETENTION OF MECHANICAL PROPERTIES TO FUEL DEMAND

- 9.5 INDUSTRIAL

- 9.5.1 WEIGHT REDUCTION, INCREASED THERMAL/ENERGY EFFICIENCY, AND PROLONGED SERVICE LIFE TO PROPEL MARKET

- 9.6 OTHER END-USE INDUSTRIES

10 CERAMIC MATRIX COMPOSITES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Increased demand for aero-engine components, exhaust nozzles, and nose caps for aircraft to drive demand

- 10.2.2 CANADA

- 10.2.2.1 Growing aerospace & defense and industrial sectors to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 FRANCE

- 10.3.1.1 Presence of major aircraft manufacturers to drive market

- 10.3.2 GERMANY

- 10.3.2.1 Growth of automotive and aerospace sectors to boost market

- 10.3.3 UK

- 10.3.3.1 Demand for high-performance materials in luxury and sports cars to propel market

- 10.3.4 ITALY

- 10.3.4.1 Diversified industrial base to support market growth

- 10.3.5 SPAIN

- 10.3.5.1 Demand for lightweight materials in automotive industry to boost market

- 10.3.6 REST OF EUROPE

- 10.3.1 FRANCE

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Focus of OEMs on manufacturing cost-efficient and lightweight products to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Increasing focus on C/SiC and SiC/SiC for nuclear reactors to boost market

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Surging demand from automotive industry to fuel market

- 10.4.4 INDIA

- 10.4.4.1 Growth of aerospace & defense sector to fuel market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 LATIN AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Demand from aerospace & defense and automotive industries to boost market

- 10.5.2 MEXICO

- 10.5.2.1 Growth of aerospace sector to propel market

- 10.5.3 REST OF LATIN AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 UAE

- 10.6.1.1.1 Privatization initiatives and infrastructural developments to drive market

- 10.6.1.2 Saudi Arabia

- 10.6.1.2.1 Demand from industrial applications to boost market

- 10.6.1.3 Rest of GCC countries

- 10.6.1.1 UAE

- 10.6.2 ISRAEL

- 10.6.2.1 Significant investments in aerospace & defense sector to drive market

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Local and international investments to boost market

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.2.1 STRATEGIES ADOPTED BY CERAMIC MATRIX COMPOSITE MANUFACTURERS

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.5.1 CERAMIC MATRIX COMPOSITES MARKET: BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 PERVASIVE PLAYERS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Matrix type footprint

- 11.6.5.4 Fiber type footprint

- 11.6.5.5 Fiber material footprint

- 11.6.5.6 End-use industry footprint

- 11.7 STARTUP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.8 VALUATION AND FINANCIAL METRICS OF CERAMIC MATRIX COMPOSITE MANUFACTURERS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILE

- 12.1 KEY COMPANIES

- 12.1.1 GE AEROSPACE

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 ROLLS-ROYCE PLC

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SGL CARBON

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 COORSTEK INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 LANCER SYSTEMS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Right to win

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 AXIOM MATERIALS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 ULTRAMET

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 CFC CARBON CO., LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses and competitive threats

- 12.1.10 SPIRIT AEROSYSTEMS, INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.11 COIC

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 MnM view

- 12.1.11.3.1 Right to win

- 12.1.11.3.2 Strategic choices

- 12.1.11.3.3 Weaknesses and competitive threats

- 12.1.12 APPLIED THIN FILMS, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 MnM view

- 12.1.12.3.1 Right to win

- 12.1.12.3.2 Strategic choices

- 12.1.12.3.3 Weaknesses and competitive threats

- 12.1.1 GE AEROSPACE

- 12.2 OTHER PLAYERS

- 12.2.1 PRECISION CASTPARTS CORP.

- 12.2.2 STAR FIRE SYSTEMS INC.

- 12.2.3 PYROMERAL SYSTEMS

- 12.2.4 ZIRCAR ZIRCONIA, INC.

- 12.2.5 UNITED COMPOSITES B.V.

- 12.2.6 TOUCHSTONE ADVANCED COMPOSITES

- 12.2.7 BJS CERAMICS GMBH

- 12.2.8 WPX FASERKERAMIK GMBH

- 12.2.9 KERAMIKBLECH

- 12.2.10 MORGAN ADVANCED MATERIALS

- 12.2.11 KYOCERA CORPORATION

- 12.2.12 UBE CORPORATION

- 12.2.13 SCHUNK GROUP

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS