|

시장보고서

상품코드

1851264

의약품 첨가제 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Pharmaceutical Excipients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

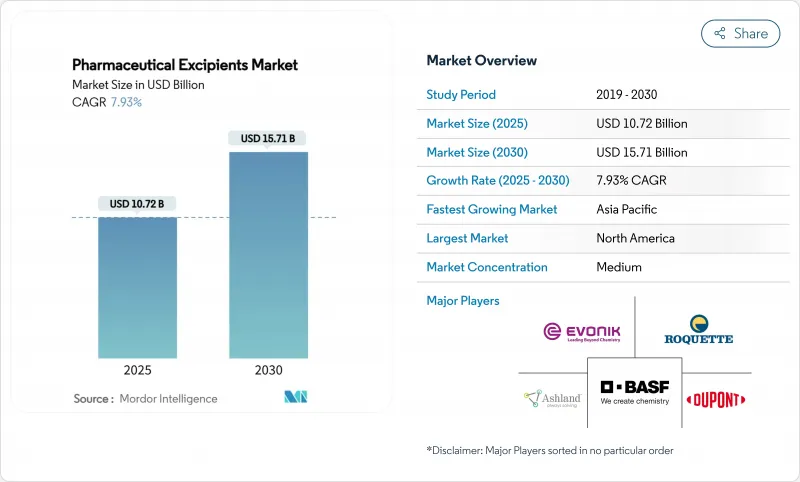

의약품 첨가제 시장 규모는 2025년에 107억 2,000만 달러에 이르고, 2030년에는 157억 1,000만 달러에 달할 것으로 예상되며, 2025년부터 2030년까지 7.93%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

견고한 확장은 고급 약물전달 플랫폼의 사용 증가, 연속 제조로의 이동, 고 역가의 활성 성분을 안정화시키는 첨가제에 대한 수요 증가로 인해 발생합니다. 2축 스크류 조립 및 핫멜트 압출 성형에 적합한 폴리머 기반 가공 보조제가 제제 효율을 지원하고 바이오시밀러 의약품의 보급이 단백질 친화적인 안정제의 필요성을 높이고 있습니다. 제조업체는 공급망의 위험을 줄이고 현지 조달의 우위를 활용하기 위해 비용 효율적인 지역으로의 생산 이전을 추진하고 있으며, 특히 아시아태평양은 공급업체 기반의 다양화와 경쟁력 있는 가격 설정을 지원하고 있습니다.

세계의 의약품 첨가제 시장 동향과 인사이트

고역가 원약용 다기능 신규 첨가제의 상승

강력한 암 치료제나 면역약에 종사하는 제제 제조업체는 현재 결합, 붕괴, 유동성 향상의 역할을 하나의 재료로 겸비한 첨가제를 요구하고 있습니다. 코프로세스 플랫폼은 단위 작업을 줄이고 분진 노출을 줄이고 균일한 함량을 제공하므로 연속 라인에 매력적입니다. 안전 데이터는 복합 기능을 다루어야 하며 승인주기가 길어지므로 규제 서류는 여전히 어렵습니다. 북미의 혁신가들이 조기 노하우를 잡고 있지만, 유럽 제조업체들은 수요를 캡처하기 위해 파일럿 플랜트를 빠르게 확장하고 있습니다. 중기적으로, 파이프라인 분자의 효능 임계치가 증가함에 따라 다기능 등급이 구매 결정의 중심에 계속 유지되는 것으로 보입니다.

바이오시밀러 의약품 확대를 지원하는 바이오 의약품 첨가제 수요 급증

단일클론항체 특허의 절벽에 이어 바이오시밀러 의약품의 상시는 가공중의 단백질 구조를 보호하는 고순도의 당, 아미노산, 계면활성제에 대한 세계적인 요구가 높아지고 있습니다. 공급자는 종종 다른 조성에서 생물학적 동등성을 보이는 동시에 참조 생물 제형프로파일에 적합한 안정제를 공동 개발합니다. 가정용 자동 주사기용 액체 제형은 안정성 요구를 더욱 증가시키고, 낮은 엔도톡신 및 저응집성 첨가제가 중요해집니다. 다중 컬럼 크로마토그래피와 무균 여과는 복잡성을 증가시켜 비용이 여전히 높지만, 아시아태평양의 대규모 생산 능력으로 인해 가격 차이가 줄어들고 있습니다. 장기적인 성장은 생산량이 증가함에 따라 엄격한 미생물 표준을 유지할 수 있는지 여부에 달려 있습니다.

세계 상시의 하모나이제이션을 제한하는 지역간의 규제의 변동

FDA, EMA, 인도, 브라질, 중국의 규제 당국 간에 신청 서류의 형식과 첨가제 목록의 규칙이 다르기 때문에 개발 일정이 장기화됩니다. 국제정합화위원회는 Q14와 Q2(R2) 가이드라인의 초안을 계속 만들고 있지만, 위험평가의 사고방식은 특히 다기능성 재료에 대해 다릅니다. 기업은 지역별로 마스터 파일을 관리하기 때문에 관리 오버헤드가 늘어나고 전 세계 배포가 지연됩니다. 규제 당국의 전문 팀이 없는 중견·중소의 이노베이터에게 있어서, 편차는 특히 큰 부담이 되고 있습니다. 하모나이제이션의 진전은 여전히 느리다.이 억제요인은 향후 10년간 남아 있음을 시사합니다.

부문 분석

유기화학제품은 2024년 의약품 첨가제 시장 점유율의 75.34%를 차지하고 타정 효율을 높이기 위해 셀룰로오스, 유당, 전분 유도체에 대한 의존이 계속되고 있는 것으로 밝혀졌습니다. 유기농 카테고리와 관련된 의약품 첨가제 시장 규모는 꾸준히 확대되고 있는데, 이는 셀룰로오스계 원료가 클린 라벨의 기호에 어울리고 강력한 컴펜디얼 서포트를 유지하고 있기 때문입니다. 연속 제조는 전단 및 수분 변동을 견디도록 고안된 고분자 등급 수요를 더욱 높여줍니다. 대조적으로, 염화나트륨 및 염화칼륨과 같은 무기 할로겐 염은 삼투압 펌프 및 개선된 방출 코어에서의 역할 때문에 2030년까지 연평균 복합 성장률(CAGR)이 가장 빠른 7.54%를 나타낼 전망입니다. 이 미네랄 염은 특수 복용 형태의 고부하 원료에 필수적인 안정한 이온 강도 프로파일을 제공합니다.

지방산으로부터 유래된 올레오케미컬은 저면역원성과 윤활성의 이점을 제공함으로써 비경구용과 경구용의 교량을 합니다. 단백질 기반 안정제는 양이 적고 생물 제제의 응집을 피하기 때문에 가격이 비쌉니다. 배합 담당자는 석유화학제품에 잔류하는 용매를 조사하고 동등한 유동특성을 가진 바이오기반 유사품으로 유도하고 있습니다. 연속 제형이 보급됨에 따라 PSD 관리가 엄격하고 endotoxin이 적은 첨가제가 조달 목록의 상위를 차지할 것으로 보입니다.

충전제는 2024년 의약품 첨가제 시장에서 32.45%의 점유율을 유지했지만, 이는 정제의 목표 중량과 기계적 강도를 달성하는데 있어서 필수적인 역할을 담당하고 있음을 반영했습니다. 유당 일수화물과 미결정 셀룰로오스는 여전히 기본 옵션이지만 DMF 등급의 만니톨과 이소말트는 수분 과민증이 계속되는 지역에서 지지를 받고 있습니다. 서방형 폴리머는 2030년까지 연평균 복합 성장률(CAGR) 7.34%를 나타낼 것으로 예측되며, 환자 중심의 어드히어런스 목표가 강조되고 있습니다. 이 친수성 매트릭스는 혈장의 피크를 완화하고 만성 질환의 처방을 지원합니다.

2축 스크류 습식 과립화를 위해 설계된 바인더는 높은 전단력 하에서도 안정된 점도를 제공하며 연속 처리 사양에 적합합니다. 초붕괴제는 간단한 팽윤제에서 빠른 용형의 중요한 성능 결정제로 진화하고 있습니다. 한편, 코팅제는 기본적인 보호 필름에서 장용성 저항성, 맛 마스킹, 브랜드 차별화를 제공하는 다기능 층으로 진화합니다. 공가공 첨가제는 결합과 붕괴를 융합시켜 기능성의 경계를 모호하게 하고, 재료 명세서를 단순화함과 동시에 규제적 변경 관리를 용이하게 합니다.

의약품 첨가제 보고서는 제품(유기화학 및 무기화학), 기능성(충전제 및 희석제, 기타), 제형(경구 고형제, 기타), 공급원(식물 유래, 기타), 지역(북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미)으로 구분됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

북미는 2024년에 의약품 첨가제 시장에서 42.45%의 점유율을 유지해, 혁신자의 밀집, 엄격한 규제 감독, 연속 처리의 조기 도입이 뒷받침되었습니다. 공급업체는 생물학적 제제에 사용되는 비경구용 폴리소르베이트, 시클로덱스트린 및 조절 셀룰로오스로 비싼 마진을 획득했습니다. 이러한 리더십에도 불구하고, 제조업체 각사는 최근 공급 충격으로 부각된 물류의 취약성에 직면하고 있으며, 예상치 못한 사태를 상정한 소싱 이니셔티브를 촉구하고 있습니다.

아시아태평양의 2030년까지의 CAGR은 6.52%를 나타낼 것으로 예측되어 인도의 제제 아웃소싱의 급증과 중국의 국내 생물 제제 라인의 스케일 업이 그 선두에 서 있습니다. 하이데라바드와 쑤저우의 개발·제조 수탁기업은 세계 품질기준 하에서 현지 첨가제 공급을 의무화하는 다국적 계약을 확보하고 있습니다. 분무 건조 만니톨, HPMC, 폴록 사머 공장에 대한 투자는 지역의 자율성을 지원합니다. 동시에 각국 정부는 컴플라이언스 향상을 위한 인센티브를 주고 역사적인 품질 격차를 시정하고 있습니다.

유럽은 성숙하면서도 혁신적인 지역이며 클린 라벨 정책과 생분해성 폴리머 연구의 선구자로서 세계 표준에 파급하고 있습니다. 규제의 명확화는 식물 유래의 담체와 비석유화학계 윤활유의 신속한 도입을 가능하게 합니다. 라틴아메리카와 중동, 아프리카는 각국의 약국방이 수입규제를 강화하고 전분과 인산칼슘의 현지생산 벤처를 촉매로 하여 수요 증가를 보여주고 있습니다. 외환위험의 경감과 리드타임의 단축이 국내 조달을 매력적으로 하고, 무역의 흐름을 서서히 바꾸고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고역가 원약을 위한 다기능 신규 첨가제의 대두

- 바이오시밀러 의약품의 확대를 지원하는 바이오 의약품 첨가제 수요 급증

- 구강내 붕괴정의 성장이 초붕괴제 소비를 촉진

- 폴리머계 가공 보조제를 필요로 하는 연속 제조로의 변화

- 인도로의 제제 아웃소싱의 지역 이전은 현지 첨가제 공급자에게 유리

- 클린 라벨 요건을 만족시키기 위한 식물 유래 첨가제의 선호

- 시장 성장 억제요인

- 세계 상시의 하모나이제이션을 막는 지역 간 규제 변동

- 신규 그레이드의 제조 비용을 상승시키는 고순도 요건

- 공급망의 농산물 가격 변동에 대한 익스포저(소르비톨 등)

- 석유화학첨가제 중 잔류용매에 대한 독성학적 우려

- 규제 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 유기 화학물질

- 탄수화물

- 석유화학제품

- 지방화학제품

- 단백질

- 기타 유기 화학물질

- 무기 화학물질

- 할라이트

- 금속 산화물

- 규산염

- 기타 무기 화학물질

- 유기 화학물질

- 기능성별

- 충전제 및 희석제

- 결합제

- 현탁제 및 점도 조절제

- 코팅제(필름 및 장용성)

- 향료

- 분해제

- 착색제

- 방부제

- 기타 기능

- 제형별

- 경구 고형제

- 비경구 제형

- 국소 및 경피용

- 폐/흡입용

- 안과용

- 기타(설하, 구강점막 등)

- 원료별

- 식물성

- 동물성

- 합성

- 광물성

- 해양성

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- BASF SE

- Ashland Global Holdings Inc.

- DuPont de Nemours Inc.

- Roquette Freres SA

- Evonik Industries AG

- Archer Daniels Midland Co.

- Kerry Group plc

- The Lubrizol Corporation

- Air Liquide SA

- Croda International plc

- Innophos Holdings Inc.

- Colorcon Inc.

- DFE Pharma GmbH & Co. KG

- JRS Pharma GmbH & Co. KG

- Eastman Chemical Company

- International Flavors & Fragrances

- Merck KGaA

- Dow Inc.

- Gattefosse SA

- Shin-Etsu Chemical Co. Ltd.

제7장 시장 기회와 향후 전망

KTH 25.11.12The pharmaceutical excipients market size reached USD 10.72 billion in 2025 and is projected to attain USD 15.71 billion by 2030, advancing at a 7.93% CAGR between 2025 and 2030.

Robust expansion stems from the growing use of sophisticated drug-delivery platforms, the shift toward continuous manufacturing, and rising demand for excipients that stabilize high-potency active ingredients. Polymer-based processing aids suited to twin-screw granulation and hot-melt extrusion underpin formulation efficiencies, while biosimilar proliferation elevates the need for protein-friendly stabilizers. Manufacturers are relocating production to cost-efficient regions to mitigate supply-chain risk and leverage local sourcing advantages, especially across Asia-Pacific, which supports a diversified supplier base and competitive pricing.

Global Pharmaceutical Excipients Market Trends and Insights

Rise of Multifunctional Novel Excipients for High-Potency APIs

Formulators working with potent oncology and immunology drugs now demand excipients that combine binding, disintegration, and flow-enhancing roles in one material. Co-processed platforms reduce unit operations, lower dust exposure, and deliver uniform content, making them attractive for continuous lines. Regulatory dossiers remain challenging because safety data must cover combined functionalities, which lengthens approval cycles. North American innovators hold early know-how, yet European manufacturers are rapidly scaling pilot plants to capture demand. Over the medium term, rising potency thresholds in pipeline molecules will keep multifunctional grades at the center of purchasing decisions.

Surging Demand for Biopharmaceutical Excipients Supporting Biosimilars Expansion

Biosimilar launches following monoclonal antibody patent cliffs have lifted global requirements for high-purity sugars, amino acids, and surfactants that guard protein structure during processing. Suppliers often co-develop stabilizers to match reference biologics' profiles while demonstrating bioequivalence with different compositions. Liquid formulations for at-home autoinjectors further magnify stability demands, making low-endotoxin and low-aggregate excipients critical. Costs remain high because multi-column chromatography and aseptic filtration add complexity, yet large-scale capacity in Asia-Pacific is narrowing price gaps. Long-term growth hinges on maintaining stringent microbial specs as volumes ramp.

Regulatory Variability Across Regions Limiting Global Launch Harmonization

Differing dossier formats and excipient listing rules among the FDA, EMA, and regulators in India, Brazil, and China prolong development timelines. The International Council for Harmonisation continues to draft Q14 and Q2(R2) guidelines, yet risk-assessment philosophies vary, especially for multifunctional materials. Companies maintain region-specific master files, inflating administrative overhead and delaying worldwide rollouts. Variability is especially burdensome for small and midsize innovators that lack dedicated regulatory teams. Harmonization progress remains slow, suggesting the restraint will linger into the next decade.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Orally Disintegrating Tablets Driving Superdisintegrants Consumption

- Shift Toward Continuous Manufacturing Requiring Polymer-Based Processing Aids

- Toxicological Concerns Over Residual Solvents in Petrochemical Excipients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic chemicals made up 75.34% of pharmaceutical excipients market share in 2024, underscoring continued reliance on cellulose, lactose, and starch derivatives for tableting efficiency. The pharmaceutical excipients market size linked to organic categories is expanding steadily because cellulosics match clean-label preferences and retain robust compendial support. Continuous manufacturing further elevates demand for polymer grades engineered to withstand shear and moisture variability. In contrast, inorganic halites such as sodium chloride and potassium chloride display the quickest 7.54% CAGR through 2030, owing to their role in osmotic pumps and modified-release cores. These mineral salts offer stable ionic strength profiles critical for high-load APIs in specialized dosage forms.

Innovation is creating cross-category synergies: oleochemicals derived from fatty acids bridge parenteral and oral use by offering low immunogenicity alongside lubricity advantages. Protein-based stabilizers, though smaller by volume, command premium pricing because they avert aggregation in biologics. Formulators scrutinize petrochemicals for solvent residues, nudging them toward bio-based analogs with equivalent flow properties. As continuous lines proliferate, excipients with tight PSD controls and low endotoxin profiles will dominate procurement lists.

Fillers retained 32.45% share of the pharmaceutical excipients market in 2024, reflective of their indispensable role in achieving target tablet weights and mechanical strength. Lactose monohydrate and microcrystalline cellulose remain default options, yet DMF-graded mannitol and isomalt gain traction where moisture sensitivity persists. The rise of controlled-release therapies elevates sustained-release polymers, which are forecast to grow at 7.34% CAGR to 2030, highlighting patient-centric adherence objectives. These hydrophilic matrices moderate plasma peaks, supporting chronic disease regimens.

Binders designed for twin-screw wet granulation deliver consistent viscosity under elevated shear, meeting continuous-processing specs. Superdisintegrants graduate from simple swelling agents to critical performance determinants in fast-dissolve formats. Meanwhile, coatings evolve from basic protective films to multifunctional layers providing enteric resistance, taste masking, and brand differentiation. Co-processed excipients blur functionality boundaries by merging binding and disintegration, simplifying bill-of-materials while easing regulatory change control.

The Pharmaceutical Excipients Report is Segmented by Product (Organic Chemicals and Inorganic Chemicals), Functionality (Fillers & Diluents, and More), Formulation (Oral Solid Dosage Forms, and More), Source (Plant-Based, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained 42.45% share of the pharmaceutical excipients market in 2024, boosted by a dense cluster of innovators, rigorous regulatory oversight, and early adoption of continuous processing. Suppliers capture premium margins on parenteral-grade polysorbates, cyclodextrins, and tailored celluloses used in biologics. Despite leadership, manufacturers face logistics vulnerabilities highlighted by recent supply shocks, prompting contingency sourcing initiatives.

Asia-Pacific is forecast to log a 6.52% CAGR through 2030, spearheaded by India's formulation outsourcing surge and China's scale-up of domestic biologic lines. Contract development and manufacturing organizations in Hyderabad and Suzhou secure multinational contracts that mandate local excipient supply under global quality standards. Investments in spray-dried mannitol, HPMC, and poloxamer plants support regional autonomy. Simultaneously, governments direct incentives toward compliance upgrades, closing historical quality gaps.

Europe represents a mature yet innovative territory, pioneering clean-label policies and biodegradable polymer research that ripple through global standards. Regulatory clarity enables swift uptake of plant-derived carriers and non-petrochemical lubricants. Latin America and the Middle East & Africa show incremental demand as national pharmacopeias toughen import regulations, catalyzing local production ventures for starches and calcium phosphates. Currency-risk mitigation and shorter lead times make domestic sourcing attractive, gradually reshaping trade flows.

- BASF

- Ashland Global

- DuPont

- Roquette Freres SA

- Evonik Industries

- Archer Daniels Midland Co.

- Kerry Group plc

- Lubrizol

- Air Liquide SA

- Croda International plc

- Innophos Holdings Inc.

- Colorcon

- DFE Pharma GmbH & Co. KG

- JRS Pharma GmbH & Co. KG

- Eastman Chemical Company

- International Flavors & Fragrances

- Merck

- Dow Inc.

- Gattefosse SA

- Shin-Etsu Chemical Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of Multifunctional Novel Excipients for High-Potency APIs

- 4.2.2 Surging Demand for Biopharmaceutical Excipients Supporting Biosimilars Expansion

- 4.2.3 Growth in Orally Disintegrating Tablets Driving Superdisintegrants Consumption

- 4.2.4 Shift Toward Continuous Manufacturing Requiring Polymer-Based Processing Aids

- 4.2.5 Regional Relocation of Formulation Outsourcing to India Favors Local Excipient Suppliers

- 4.2.6 Preference for Plant-Derived Excipients to Meet Clean-Label Requirements

- 4.3 Market Restraints

- 4.3.1 Regulatory Variability Across Regions Limiting Global Launch Harmonization

- 4.3.2 High Purity Requirements Escalating Production Costs for Novel Grades

- 4.3.3 Supply-Chain Exposure to Agricultural Commodity Price Volatility (e.g., Sorbitol)

- 4.3.4 Toxicological Concerns Over Residual Solvents in Petrochemical Excipients

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Organic Chemicals

- 5.1.1.1 Carbohydrates

- 5.1.1.2 Petrochemicals

- 5.1.1.3 Oleochemicals

- 5.1.1.4 Proteins

- 5.1.1.5 Other Organic Chemicals

- 5.1.2 Inorganic Chemicals

- 5.1.2.1 Halites

- 5.1.2.2 Metal Oxides

- 5.1.2.3 Silicates

- 5.1.2.4 Other Inorganic Chemicals

- 5.1.1 Organic Chemicals

- 5.2 By Functionality

- 5.2.1 Fillers & Diluents

- 5.2.2 Binders

- 5.2.3 Suspension and Viscosity Agents

- 5.2.4 Coatings (Film & Enteric)

- 5.2.5 Flavoring Agents

- 5.2.6 Disintegrants

- 5.2.7 Colorants

- 5.2.8 Preservatives

- 5.2.9 Other Functionalities

- 5.3 By Formulation

- 5.3.1 Oral Solid Dosage Forms

- 5.3.2 Parenteral Formulations

- 5.3.3 Topical & Transdermal

- 5.3.4 Pulmonary/Inhalation

- 5.3.5 Ophthalmic

- 5.3.6 Others (Sublingual, Buccal, etc.)

- 5.4 By Source

- 5.4.1 Plant-based

- 5.4.2 Animal-based

- 5.4.3 Synthetic

- 5.4.4 Mineral-based

- 5.4.5 Marine-based

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 BASF SE

- 6.3.2 Ashland Global Holdings Inc.

- 6.3.3 DuPont de Nemours Inc.

- 6.3.4 Roquette Freres SA

- 6.3.5 Evonik Industries AG

- 6.3.6 Archer Daniels Midland Co.

- 6.3.7 Kerry Group plc

- 6.3.8 The Lubrizol Corporation

- 6.3.9 Air Liquide SA

- 6.3.10 Croda International plc

- 6.3.11 Innophos Holdings Inc.

- 6.3.12 Colorcon Inc.

- 6.3.13 DFE Pharma GmbH & Co. KG

- 6.3.14 JRS Pharma GmbH & Co. KG

- 6.3.15 Eastman Chemical Company

- 6.3.16 International Flavors & Fragrances

- 6.3.17 Merck KGaA

- 6.3.18 Dow Inc.

- 6.3.19 Gattefosse SA

- 6.3.20 Shin-Etsu Chemical Co. Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment