|

시장보고서

상품코드

1850278

커넥티드 항공기 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Connected Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

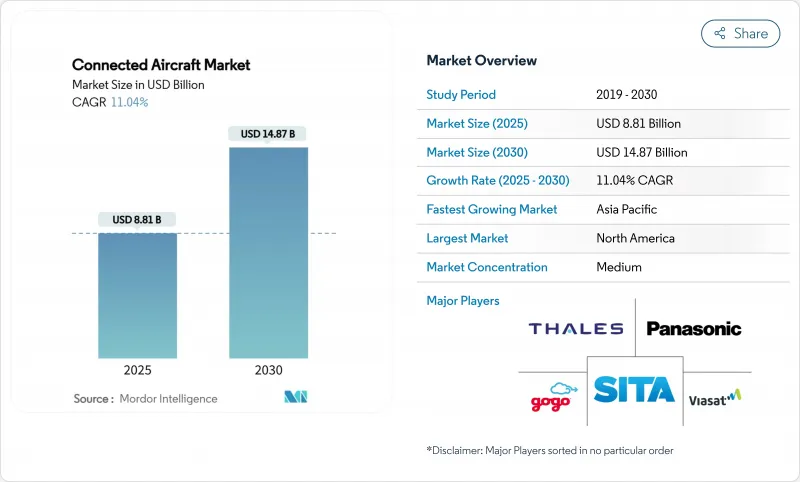

커넥티드 항공기 시장 규모는 2025년에 88억 1,000만 달러, 2030년에는 148억 7,000만 달러에 이르고, CAGR은 11.04%를 나타낼 전망입니다.

지속적인 성장은 게이트 간 광대역에 대한 승객의 기대가 증가하고 ICAO GADSS 규칙에 의한 실시간 추적의 의무화, 지연 및 대역폭 비용을 줄이는 다궤도 위성 배치에 기인합니다. 항공사는 기내 디지털화를 가속화하기 위한 리노베이션 프로그램을 확대했으며, 방위성은 4세대 전투기와 선진 센서를 연결하는 네트워크 중심 전쟁 프로젝트에 자금을 제공했습니다. 경쟁의 치열함은 기존 사업자가 장기 서비스 계약에 의해 그 지위를 지키면서도 스타링크나 다른 LEO 진입 사업자로부터의 가격 압력에 직면했기 때문에 완만한 것에 그쳤습니다. 사이버 보안 규칙, 주파수 대역 혼잡, 높은 리노베이션 비용은 단기 배포 계획을 완화했지만 연결 항공기 시장의 장기 디지털 궤도를 변경하지는 않습니다.

세계 커넥티드 항공기 시장 동향과 통찰

기내 커넥티비티에 대한 수요 증가

여객의 기대는 산발적인 이메일 액세스에서 스트리밍급 대역폭으로 바뀌었습니다. 2024년 업계 조사에 따르면 한국 여행자의 81%가 양질의 Wi-Fi를 제공하는 항공사를 재예약했으며, 80%가 비행 체험에서 연결성을 중요시하고 있습니다. 델타 항공과 같은 항공사는 빠르고 무료 Wi-Fi를 720대 이상의 항공기로 확장하여 유료 서비스에서 브랜드 차별화 요인으로의 전환을 시사합니다. 광대역을 이용한 부대 수입은 2035년까지 300억 달러에 달할 것으로 예상되며 연결이 전략적 수입원임을 뒷받침합니다. 그 결과 커넥티드 항공기 시장은 특히 북미와 아시아태평양에서 디지털 참여가 충성도를 높이는 승객을 위한 업그레이드를 우선시했습니다.

네트워크 중심 전쟁의 채택은 군사 연결성을 촉진

국방기구는 도메인 간 실시간 인텔리전스를 융합하는 공중 데이터 링크에 투자했습니다. 미국 공군의 배틀 네트워크 계획은 항공기를 통합 디지털 아키텍처에 통합하여 원활한 정보 교환을 실현했습니다. 록히드 마틴의 스나이퍼 네트워크 타겟팅 포드는 F-35와 4세대 전투기 사이에 안전한 메쉬 네트워크를 구축했습니다. 영국과 NATO의 동맹국에서도 같은 대처가 이루어져 국제적인 협조가 나타난 것으로, 커넥티드 항공기 시장 전체에서 안전한 접속 솔루션의 성장 전망이 확대되었습니다.

높은 리노베이션 및 인증 비용

오두막 개조에는 비싼 장비, 상세한 형식 증명서 보충, 항공기 가동 중지 시간이 필요했습니다. 미국 연방 항공국(FAA)은 미국의 이동성 함대를 위한 사이버 보안 연결에는 5억 달러의 비용이 소요될 것으로 예측됩니다. 항공사는 에어버스와 보잉의 납기 지연에 의해 신조기의 대체가 제한되는 가운데, 이러한 지출과 자본의 제약의 밸런스를 취하고 있었습니다.

부문 분석

2024년 커넥티드 항공기 시장 점유율은 서비스가 51.45%를 차지했으며, 2030년까지 연평균 복합 성장률(CAGR)은 12.80%를 보일 것으로 예측되어 항공사가 하드웨어 소유보다 턴키 솔루션을 선호하는 것으로 나타났습니다. 서비스의 커넥티드 항공기 시장 규모는 장비, 인증, 24시간 365일 네트워크 운영을 번들한 다년 계약에 따라 확대될 전망입니다. 항공사는 특히 급속한 기술 갱신 사이클이 자산의 진부화를 초래할 위험이 있는 경우 예측 가능한 운영 비용을 선호합니다.

서비스 제공업체는 지속적인 성능 분석, 사이버 보안 모니터링 및 유연한 대역폭 계획을 제공함으로써 가치 제안을 심화시켰습니다. 파나소닉이 리야드 항공과 연결한 10년간의 유지보수 계약은 엄청난 초기 비용을 들이지 않고 항공기를 최신 상태로 유지하는 수명 주기 모델을 보여줍니다. 정기 수입원은 공급업체의 자금 조달을 개선하는 반면 항공사는 고객 경험과 정시성에 집중할 수 있게 되었습니다.

승객의 디지털 라이프 스타일이 제품 로드맵에 영향을 미치는 동안 2024년 기내 연결성은 연결된 항공기 시장 점유율의 62.40%를 차지했습니다. 비행 빈도가 높고 브랜드 터치 포인트가 높기 때문에 항공사는 우선 내로우 바디기를 도입했습니다. CAGR 14.20%에서 가장 급성장하는 하위 부문으로 부상한 것은 공대지간의 링크이며, 게이트 접속을 상승 단계까지 확장하는 5G 지상 네트워크가 이를 지원하고 있습니다.

미래의 아키텍처는 위성, 셀룰러 및 항공기 간 경로를 융합시켜 중단되지 않는 커버리지를 실현합니다. Seamless Air Alliance는 3GPP의 5G 비 지상파 네트워크를 통합하는 표준을 진행하여 지상 및 궤도 영역에서 성능을 조정합니다. 이러한 진화로 인해 연결된 항공기 시장은 항공 디지털화의 최전선에 위치하고 있습니다.

지역 분석

북미는 2024년에 38.90%의 점유율로 연결된 항공기 시장을 선도하고 있으며, 이는 GADSS에 대한 조기 준수, 견고한 위성 인프라 및 항공기 전체의 무료 Wi-Fi에 대한 항공사의 헌신을 뒷받침하고 있습니다. 델타 항공, 유나이티드 항공 및 아메리칸 항공은 지역 제트기를 메인 라인의 예상 성능에 맞추기 위해 다중 궤도 개조를 실시했습니다. BACN과 F-22A 현대화와 같은 국방 프로그램도 미국 항공 자산 전체의 안전한 링크에 대한 수요를 높였습니다.

유럽에서는 EASA의 사이버 보안 규칙과 범 EU적인 항공 교통 근대화 협조에 의한 강력한 규제적 추진력이 이어졌습니다. 기함 항공사는 여객기의 연결성과 전자 비행 가방의 통합과 예지 보전 플랫폼 등의 운항상의 우선 사항과의 균형을 잡았습니다. 아시아태평양의 위성 통신 사업자는 LEO 신규 진입 사업자에 대항하여 시장에서의 지위를 지키기 위해 Ka 밴드 위성의 배치를 가속화했습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR) 전망에서 가장 빠른 12.65%를 기록했습니다. 중국 항공 서비스 수입은 2024년 230억 달러에서 2043년 610억 달러로 증가할 것으로 예측되었으며, 광범위한 디지털 서비스 믹스에 CAGR 5.6%로 연결이 통합되었습니다. 태국국제항공은 80대의 항공기 개보수로 네오스페이스 그룹과 제휴했고, 대한항공은 바이어사트의 Ka-band를 탑재한 B787의 상업운항을 시작했습니다. 항공 인프라에 대한 정부의 지원과 중산계급 여행자 수 증가가 지역의 순풍이 되었습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 승객의 기내 연결에 대한 수요 증가

- 군사적 연결성을 촉진하는 네트워크 중심 전쟁의 채택

- 실시간 비행 추적을 위한 ICAO GADSS 세계 의무

- 주요 항공사들의 전 기단 개조 프로그램

- LEO 위성군이 대역폭 비용을 삭감

- 데이터 수익화 주도의 보조 수익 모델

- 시장 성장 억제요인

- 고액의 리노베이션 및 인증 비용

- 극지 경로의 대역폭/커버리지 제한

- 사이버 보안 컴플라이언스 지연

- Ku/Ka 밴드의 스펙트럼의 혼잡

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제공별

- 솔루션(하드웨어, 소프트웨어)

- 서비스

- 접속 유형별

- 기내 연결

- 공대지 접속

- 공대공 접속

- 커넥티비티 테크놀로지별

- 위성-L 밴드

- 위성-Ku 밴드

- 위성-Ka 밴드

- ATG(공대지)

- 용도별

- 상용항공

- 내로우 바디

- 와이드 바디

- 지역 제트

- 상용 헬리콥터

- 군사항공

- 전투기

- 특수 임무 항공기

- 군용 수송기

- 군용 헬리콥터

- 일반항공

- 비즈니스 제트

- 기타

- 상용항공

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 멕시코

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 카타르

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Panasonic Avionics Corporation

- Viasat, Inc.

- Thales Group

- Gogo Inc.

- RTX Corporation

- SITA NV

- Honeywell International Inc.

- Kontron AG

- Anuvu Operations LLC,

- Burrana Pty Ltd.

- Intelsat SA

- Astronics Corporation

- OnOneWeb Holdings Ltd.

- SkyFive AG

- Telekom Deutschland GmbH

- AeroMobile Communications Ltd.

- Hughes Network Systems, LLC

제7장 시장 기회와 장래의 전망

SHW 25.11.11The connected aircraft market size reached USD 8.81 billion in 2025 and is forecasted to expand to USD 14.87 billion by 2030, reflecting an 11.04% CAGR.

Sustained growth stems from rising passenger expectations for gate-to-gate broadband, mandated real-time tracking under the ICAO GADSS rule, and multi-orbit satellite deployments that cut latency and bandwidth cost. Airlines broadened retrofit programs to speed digital cabin upgrades, while defense ministries funded network-centric warfare projects that link fourth-generation fighters with advanced sensors. Competitive intensity stayed moderate as incumbents defended positions through long-term service contracts, yet faced pricing pressure from Starlink and other LEO entrants. Cyber-security rules, spectrum congestion, and high retrofit costs moderated near-term rollout plans but did not alter the long-term digital trajectory of the connected aircraft market.

Global Connected Aircraft Market Trends and Insights

Rising Demand for Passenger Inflight Connectivity

Passenger expectations shifted from sporadic email access to streaming-grade bandwidth. An industry survey in 2024 found that 81% of South Korean travelers would rebook with airlines offering quality Wi-Fi, and 80% ranked connectivity important to the flight experience. Carriers like Delta expanded fast, free Wi-Fi to more than 720 aircraft, signaling a shift from paid service to a brand differentiator. Broadband-enabled ancillary revenue was projected to reach USD 30 billion by 2035, reinforcing connectivity as a strategic income stream. The connected aircraft market consequently prioritized passenger-facing upgrades, particularly in North America and Asia-Pacific, where digital engagement drives loyalty.

Adoption of Network-Centric Warfare Driving Military Connectivity

Defense agencies invested in airborne data links that fuse real-time intelligence across domains. The US Air Force Battle Network plan integrated aircraft into a unified digital architecture for seamless information exchange. Lockheed Martin's Sniper Networked Targeting Pod created secure mesh networks between F-35s and fourth-generation fighters. Similar initiatives in the United Kingdom and NATO allies indicated international alignment, extending growth prospects for secure connectivity solutions across the connected aircraft market.

High Retrofit and Certification Cost

Cabin retrofits required expensive equipment, detailed supplemental type certificates, and aircraft downtime. The FAA estimated that cyber-secure connectivity for the US mobility fleet would cost USD 500 million. Airlines balanced these outlays against constrained capital as delivery delays from Airbus and Boeing limited new-build replacements.

Other drivers and restraints analyzed in the detailed report include:

- Global ICAO GADSS Mandate for Real-Time Flight Tracking

- LEO Satellite Constellations Cutting Bandwidth Cost

- Cyber-Security Compliance Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services held 51.45% of the connected aircraft market share in 2024 and are projected to grow at 12.80% CAGR through 2030, underscoring airline preference for turnkey solutions over hardware ownership. The connected aircraft market size for services is expected to expand in line with multi-year agreements that bundle equipment, certification, and 24/7 network operations. Airlines favored predictable operating expenses, particularly when rapid technology refresh cycles risked asset obsolescence.

Service providers deepened value propositions by offering continuous performance analytics, cybersecurity monitoring, and flexible bandwidth plans. Panasonic's 10-year maintenance pact with Riyadh Air illustrated the lifecycle model that keeps fleets current without large upfront costs. Recurring revenue streams improved vendor cash visibility while enabling carriers to focus on customer experience and punctuality.

Inflight connectivity accounted for 62.40% of connected aircraft market share in 2024 as passenger digital lifestyles influenced product roadmaps. Given higher flight frequencies and brand touchpoints, airlines equipped narrowbody fleets first. Air-to-ground links emerged as the fastest-growing subsegment at 14.20% CAGR, supported by 5G surface networks that extend gate connectivity into the climb phase.

Future architectures will blend satellite, cellular, and aircraft-to-aircraft pathways for uninterrupted coverage. The Seamless Air Alliance advanced standards that integrate 3GPP 5G non-terrestrial networks, aligning performance across ground and orbit domains. This evolution keeps the connected aircraft market at the forefront of aviation digitalization.

The Connected Aircraft Market Report is Segmented by Offering (Solution and Services), Connectivity Type (Inflight Connectivity, and More), Connectivity Technology (L-Band, Ku-Band, and More), Application (Commercial Aviation, Military Aviation, and General Aviation), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the connected aircraft market in 2024 with a 38.90% share, supported by early compliance with GADSS, robust satellite infrastructure, and carrier commitments to fleet-wide free Wi-Fi. Delta, United, and American rolled out multi-orbit retrofits that aligned regional jets with mainline performance expectations. Defense programs like BACN and the F-22A modernization also lifted demand for secure links across US air assets.

Europe followed with strong regulatory impetus from EASA cybersecurity rules and pan-EU coordinated air traffic modernization. Flag carriers balanced passenger connectivity with operational priorities such as electronic flight bag integration and predictive maintenance platforms. The region's satellite operators accelerated Ka-band deployments to defend their market position against LEO newcomers.

Asia-Pacific posted the fastest 12.65% CAGR outlook through 2030. China's aviation services revenue was projected to rise from USD 23 billion in 2024 to USD 61 billion by 2043, embedding connectivity with a 5.6% CAGR within the broader digital services mix. Thai Airways partnered with Neo Space Group on 80 aircraft retrofits, and Korean Air began commercial B787 flights equipped with Viasat Ka-band. Government support for aviation infrastructure and rising middle-class travel sustained regional tailwinds.

- Panasonic Avionics Corporation

- Viasat, Inc.

- Thales Group

- Gogo Inc.

- RTX Corporation

- SITA N.V.

- Honeywell International Inc.

- Kontron AG

- Anuvu Operations LLC,

- Burrana Pty Ltd.

- Intelsat S.A.

- Astronics Corporation

- OnOneWeb Holdings Ltd.

- SkyFive AG

- Telekom Deutschland GmbH

- AeroMobile Communications Ltd.

- Hughes Network Systems, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for passenger inflight connectivity

- 4.2.2 Adoption of network-centric warfare driving military connectivity

- 4.2.3 Global ICAO GADSS mandate for real-time flight tracking

- 4.2.4 Fleet-wide retrofit programs by leading airlines

- 4.2.5 LEO satellite constellations cutting bandwidth cost

- 4.2.6 Data-monetization-led ancillary revenue models

- 4.3 Market Restraints

- 4.3.1 High retrofit and certification cost

- 4.3.2 Bandwidth/coverage limits on polar routes

- 4.3.3 Cyber-security compliance delays

- 4.3.4 Ku/Ka-band spectrum congestion

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Solution (Hardware, Software)

- 5.1.2 Services

- 5.2 By Connectivity Type

- 5.2.1 Inflight Connectivity

- 5.2.2 Air-to-Ground Connectivity

- 5.2.3 Air-to-Air Connectivity

- 5.3 By Connectivity Technology

- 5.3.1 Satellite - L-Band

- 5.3.2 Satellite - Ku-Band

- 5.3.3 Satellite - Ka-Band

- 5.3.4 ATG (Air-to-Ground)

- 5.4 By Application

- 5.4.1 Commercial Aviation

- 5.4.1.1 Narrowbody

- 5.4.1.2 Widebody

- 5.4.1.3 Regional Jets

- 5.4.1.4 Commercial Helicopters

- 5.4.2 Military Aviation

- 5.4.2.1 Combat Aircraft

- 5.4.2.2 Special Mission Aircraft

- 5.4.2.3 Military Transport Aircraft

- 5.4.2.4 Military Helicopters

- 5.4.3 General Aviation

- 5.4.3.1 Business Jets

- 5.4.3.2 Others

- 5.4.1 Commercial Aviation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Mexico

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Qatar

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Panasonic Avionics Corporation

- 6.4.2 Viasat, Inc.

- 6.4.3 Thales Group

- 6.4.4 Gogo Inc.

- 6.4.5 RTX Corporation

- 6.4.6 SITA N.V.

- 6.4.7 Honeywell International Inc.

- 6.4.8 Kontron AG

- 6.4.9 Anuvu Operations LLC,

- 6.4.10 Burrana Pty Ltd.

- 6.4.11 Intelsat S.A.

- 6.4.12 Astronics Corporation

- 6.4.13 OnOneWeb Holdings Ltd.

- 6.4.14 SkyFive AG

- 6.4.15 Telekom Deutschland GmbH

- 6.4.16 AeroMobile Communications Ltd.

- 6.4.17 Hughes Network Systems, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment