|

시장보고서

상품코드

1430689

일본의 자동차용 윤활유 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2021-2026년)Japan Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2021 - 2026) |

||||||

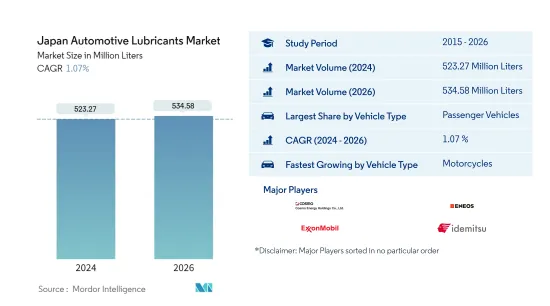

일본의 자동차용 윤활유 시장 규모는 2024년 5억 2,327만 리터로 추정 및 예측됩니다. 2026년에는 5억 3,458만 리터에 달할 것으로 예상되며, 예측 기간(2024-2026년) 동안 1.07%의 연평균 복합 성장률(CAGR)로 성장할 것으로 예상됩니다.

주요 하이라이트

- 차량 유형별 최대 부문 - 승용차: 일본은 승용차 보유 대수가 많습니다. 그 결과, 일본 자동차용 윤활유 산업에서 이 분야의 윤활유 소비가 가장 높은 점유율을 차지하고 있습니다.

- 자동차 유형별 가장 빠른 부문 - 이륜차: 2021년 이후 일본 내 이륜차 생산 및 판매 회복이 가속화될 것으로 예상됩니다. 이에 따라 윤활유 소비 증가율이 높아질 것으로 예상됩니다.

- 제품 유형별 최대 부문 - 엔진오일: 엔진오일은 고온, 고압 용도에 사용되기 때문에 필요량이 많고 배수 간격이 짧아 제품 유형별 1위입니다.

- 제품 유형별 가장 빠른 성장률 부문: 유압유압유: 2021년 이후 일본의 자동차 판매 및 생산 회복이 예상됨에 따라 예측 기간 동안 일본의 유압유압유 수요를 견인할 것으로 예상됩니다.

일본 자동차용 윤활유 시장 동향

차종별 최대 부문: 승용차

- 일본에서는 2020년 전체 온로드 차량 중 승용차(PV)의 점유율이 71.38%로 가장 높고, 상용차(CV)가 16.72%, 이륜차가 11.9%로 그 뒤를 잇습니다.

- 2020년 전체 윤활유 소비량에서 승용차가 차지하는 비중은 49.43%로 가장 높았고, 상용차(48.3%), 이륜차(2.27%)가 그 뒤를 이었으며, 2020년에는 코로나19 사태로 인해 윤활유 소비량이 눈에 띄게 감소하여 PV의 윤활유 소비량이 13.1%로 가장 높은 감소율을 기록하였습니다. 13.1%로 가장 높은 감소율을 기록했고, 상용차(12.28%)가 그 뒤를 이었습니다.

- 이륜차 부문은 2021-2026년 연평균 2.72%의 연평균 복합 성장률(CAGR)로 가장 빠르게 성장하는 윤활유 소비자가 될 것으로 예상됩니다. 이러한 성장은 국내 개인용 모빌리티 및 전기 자동차의 생산량 증가에 의해 주도될 것으로 예상됩니다.

일본 자동차용 윤활유 산업 개요

일본 자동차용 윤활유 산업 개요일본의 자동차용 윤활유 시장은 상위 5개 기업이 93.83%를 점유하는 등 상당히 통합되어 있습니다. 이 시장의 주요 기업은 Cosmo Energy Holdings Co. Ltd, ENEOS Corporation, ExxonMobil Corporation, Idemitsu Kosan Co. Ltd, Royal Dutch Shell Plc(알파벳순)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 자동차 업계 동향

- 규제 프레임워크

- 밸류체인과 유통 채널 분석

제4장 시장 세분화

- 자동차 유형별

- 상용차

- 이륜차

- 승용차

- 제품 유형별

- 엔진오일

- 그리스

- 유압작동유

- 변속기&기어 오일

제5장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 개요

- AKT Japan Co. Ltd(TAKUMI Motor Oil)

- BP PLC(Castrol)

- Cosmo Energy Holdings Co. Ltd

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS

- Idemitsu Kosan Co. Ltd

- Japan Sun Oil Company Ltd(SUNOCO Inc.)

- Motul

- Royal Dutch Shell Plc

제6장 부록

- 부록 1 참고 문헌

- 부록 2 도표

제7장 CEO에 대한 주요 전략적 질문

LSH 24.02.29The Japan Automotive Lubricants Market size is estimated at 523.27 Million Liters in 2024, and is expected to reach 534.58 Million Liters by 2026, growing at a CAGR of 1.07% during the forecast period (2024-2026).

Key Highlights

- Largest Segment by Vehicle Type - Passenger Vehicles : Japan has a large active passenger vehicle parc. As a result, the lubricant consumption of this sector occupies the highest share in Japan's automotive lubricant industry.

- Fastest Segment by Vehicle Type - Motorcycles : The recovery of motorcycle production and sales in Japan from 2021 is expected to be at a faster rate. As a result, its lubricant consumption growth rate is likely to be high.

- Largest Segment by Product Type - Engine Oils : Engine oil is the leading product type due to its high volume requirements and shorter drain intervals, as it is used for high-temperature and high-pressure applications.

- Fastest Segment by Product Type - Hydraulic Fluids : The expected recovery of automotive sales and production in Japan from 2021 is anticipated to drive the demand for hydraulic fluids in the country during the forecast period.

Japan Automotive Lubricants Market Trends

Largest Segment By Vehicle Type : Passenger Vehicles

- In Japan, passenger vehicles (PVs) accounted for the largest share, 71.38%, in the total number of on-road vehicles in 2020, followed by commercial vehicles (CVs) and motorcycles, with a share of 16.72% and 11.9%, respectively.

- Passenger vehicles accounted for the highest share of 49.43% in the total lubricant consumption in 2020, followed by commercial vehicles (48.3%) and motorcycles (2.27%), respectively. In 2020, the COVID-19 outbreak led to a notable dip in lubricant consumption, where PV lubricant consumption recorded the highest dip of 13.1%, followed by commercial vehicles (12.28%).

- The motorcycles segment is projected to be the fastest-growing lubricant consumer, with a CAGR of 2.72% during 2021-2026. The growth is projected to be driven by an expected rise in personal mobility and electric vehicle production in the country.

Japan Automotive Lubricants Industry Overview

The Japan Automotive Lubricants Market is fairly consolidated, with the top five companies occupying 93.83%. The major players in this market are Cosmo Energy Holdings Co. Ltd, ENEOS Corporation, ExxonMobil Corporation, Idemitsu Kosan Co. Ltd and Royal Dutch Shell Plc (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 Introduction

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 Key Industry Trends

- 3.1 Automotive Industry Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 Market Segmentation

- 4.1 By Vehicle Type

- 4.1.1 Commercial Vehicles

- 4.1.2 Motorcycles

- 4.1.3 Passenger Vehicles

- 4.2 By Product Type

- 4.2.1 Engine Oils

- 4.2.2 Greases

- 4.2.3 Hydraulic Fluids

- 4.2.4 Transmission & Gear Oils

5 Competitive Landscape

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Profiles

- 5.3.1 AKT Japan Co. Ltd (TAKUMI Motor Oil)

- 5.3.2 BP PLC (Castrol)

- 5.3.3 Cosmo Energy Holdings Co. Ltd

- 5.3.4 ENEOS Corporation

- 5.3.5 ExxonMobil Corporation

- 5.3.6 FUCHS

- 5.3.7 Idemitsu Kosan Co. Ltd

- 5.3.8 Japan Sun Oil Company Ltd (SUNOCO Inc.)

- 5.3.9 Motul

- 5.3.10 Royal Dutch Shell Plc

6 Appendix

- 6.1 Appendix-1 References

- 6.2 Appendix-2 List of Tables & Figures