|

시장보고서

상품코드

1432327

건축용 코팅 시장 : 점유율 분석, 산업 동향, 성장 예측(2024-2029년)Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

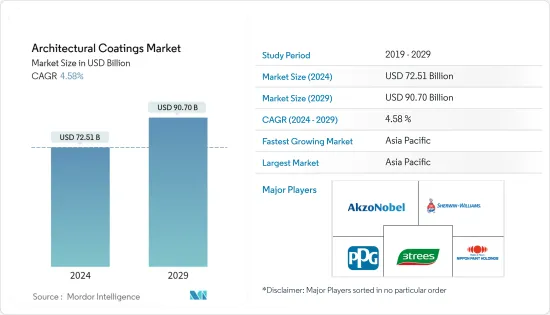

건축용 코팅(Architectural Coatings) 시장 규모는 2024년에 725억 1,000만 달러로 추정되고, 2029년에는 907억 달러에 이를 것으로 예측 되며, 예측 기간 중(2024-2029년)의 CAGR은 4.58%로 추이하며 성장할 것으로 예상됩니다.

건축 분야는 건축용 코팅 시장의 주요 촉진 요인입니다. 이러한 코팅은 내식성, 자외선 방지 등 몇 가지 장점이 있습니다. 비닐 아세테이트는 일반적으로 사용되는 건축용 코팅의 한 유형입니다. 건축용 인프라 수요 증가가 기대됩니다.

주요 하이라이트

- 저 VOC 코팅에 대한 수요 증가는 이 시장에서 다양한 기회를 창출하고 있습니다.

- 전 세계적으로 지구 온난화에 대한 우려가 증가함에 따라 사무실 건물, 주거용 주택 등에 안전하고 에너지 절약형 코팅이 요구되고 있습니다.

- 아시아 태평양 지역은 예측 기간 동안 세계 시장을 지배 할 것으로 예상됩니다.

건축용 코팅 시장 동향

주택 분야에서 수요 증가

- 최종 사용자 부문 중 주거 부문은 2021년 건설 부문을 지배하여 세계 시장에서 건축 코팅의 가장 높은 수요를 창출하고 있습니다.

- 중국에서는 최근 몇 년동안 주택 수요가 크게 증가하고 있습니다. 주택 가격이 과거 최저 수준이기 때문에 주택 수요가 크게 증가하고 건축용 코팅 수요가 증가하고 있습니다.

- 마찬가지로 미국에서도 주택용 페인트의 소비량은 2022년에 높은 성장을 보였습니다. United States Cnesus Board와 United States Department of Housing and Urban Development에 따르면 2022년 8월 개인 주택 건설 호수는 2022년 7월 165만 5,000호에서 1.1% 증가했습니다.

- 향후 1년간 러시아와 우크라이나의 최근 전쟁 발발로 인해 주택 및 상업용 건물에 대한 수요가 높아질 것으로 예측됩니다.

- 이상과 같은 요인이 예측기간 중 건축용 페인트 및 코팅 수요를 높일 것으로 예상됩니다.

아시아 태평양을 지배하는 중국

- 중국의 건축용 코팅 소비는 최근 몇 년동안 증가하는 경향이 있습니다. 주택의 바닥면적은 2022년 6월 6,642만 3,470㎡에서 2022년 7월에는 7,606만 6,760㎡로 증가하고 있습니다. 이는 국내에서 건축용 코팅의 소비 증가에 직접적인 영향을 미칩니다.

- 2022년 3월 이후, 수입 페인트 및 코팅의 신고 및 필수 테스트 요건을 폐지하는 등의 정부 이니셔티브로 인해 예측 기간 동안 소비 및 판매가 증가 할 것으로 예상되는 것은 국내 건축용 코팅의 긍정적인 미래에 대한 코팅 회사의 신뢰를 증가시킵니다.

- 수성 코팅은 중국 정부가 오랫동안 VOC 규제를 도입한 덕분에 중국에서 소비되는 전체 건축용 코팅 중 약 79%로 가장 큰 비중을 차지하고 있습니다. 또한 2050년까지 탄소 중립을 목표로 하는 중국의 노력은 중국 내 수성 코팅과 같은 친환경 제품을 더욱 촉진할 것입니다.

- 중국에서 아크릴 코팅은 외벽의 주요 부분을 코팅하는 데 사용되기 때문에 2016-2021년 건축용 코팅의 총 소비량 측면에서 수지 유형 중 가장 큰 점유율을 차지하고 있습니다.

- 아크릴 코팅은 이 기간 동안 소비된 전체 건축용 코팅의 약 절반 이상을 차지했습니다. 중국 정부의 규제로 인해 저 VOC 건축용 코팅의 채택이 크게 증가하고 있으며, 건축용 코팅 제조업체는 코팅의 VOC 함량을 줄이고 안전한 제품으로 마케팅해야 합니다.

건축용 코팅 산업 개요

건축용 코팅 시장은 세분화되어 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진 요인

- 동유럽 국가의 평균 바닥 면적 증가

- 주택 및 상업 인프라 증가

- 억제 요인

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 규제

제5장 시장 세분화

- 기술

- 수성

- 용제계

- 수지 유형

- 아크릴

- 알키드

- 폴리우레탄

- 에폭시

- 폴리에스테르

- 기타

- 최종 용도 부문

- 상업용

- 주택용

- 지역

- 아시아 태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 인도네시아

- 말레이시아

- 필리핀

- 싱가포르

- 베트남

- 호주 및 뉴질랜드

- 기타 아시아 태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 폴란드

- 북유럽 국가

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아 태평양

제6장 경쟁 구도

- M&A, 합작 사업, 제휴, 협정

- 시장 점유율 분석

- 주요 기업 채택 전략

- 기업 개요

- 3 Trees

- AkzoNobel NV

- Asian paints

- BASF SE

- Benjamin Moore

- Berger Paints India

- Brillux GmbH&Co. KG

- CIN, SA

- Cloverdale Paint Inc.

- DAW SE

- Flugger group AS

- Hempel A/S

- Kansai Paint Co.,Ltd.

- Masco Coporation

- Nippon Paint

- PPG

- RPM International

- Sniezka SA

- The Sherwin-Williams Company

제7장 시장 기회 및 향후 동향

LYJThe Architectural Coatings Market size is estimated at USD 72.51 billion in 2024, and is expected to reach USD 90.70 billion by 2029, growing at a CAGR of 4.58% during the forecast period (2024-2029).

The construction sector is a major driver of the Architecture Coatings Market. These coatings have several advantages including corrosion resistance, UV rays protection, etc. Vinyl Acetate is the common type of Architecture coating in use. Architecture Infrastructure is expected to see a rise in demand for Market Studied.

Key Highlights

- Increasing demand for Low VOC Coatings is creating various opportunities in this Market.

- Increasing Global Warming Concern across the globe is demanding safe and energy-saving coatings for office buildings, residential homes, etc.

- Asia-Pacific is expected to dominate the global market, during the forecast period.

Architectural Coatings Market Trends

Increasing Demand from Residential Sector

- Among the end-user segments, the residential segment dominated the construction sector in 2021, generating the highest demand for architectural coatings in the global market.

- In China, there has been a significant increase in demand for residential houses in the recent past. With the prices of the residential houses at an all time low when compared to the previous years the demand for the residential houses has increased to a greater extent there by increasing the demand for architectural coatings.

- Similarly, in the United States, residential paint consumption saw high growth in 2022. According to the United States Cnesus Board and United States Department of Housing and Urban Development the number of private houses construction increased by 1.1% in August 2022 compared to 1,655,000 houses in July 2022.

- In the coming year it is projected that there would be a high demand of residential and commercial buildings in Russia and Ukraine due to the recent outbreak of the war.

- All the above mentioned factors are expected to drive the demand for the architectural paints and coatings in the forecast period.

China to Dominate the Asia-Pacific Region

- Architectural coating consumption in China has been on rising in the recent past. There has been an increase in the floor space of the residential houses from 66,423.47 thousand Square metres in June 2022 to 76,066.76 thousand Square metres in July 2022. This has a direct impact on the increase in the consumption of Architectural coatings in the country.

- The increase in consumption and sales is expected to grow in the forecasted period due to the government initiatives such as revoking filing and mandatory testing requirements of imported paint and coatings in the country from march, 2022 grows the confidence of coating companies in the positive future of architectural coating in the country.

- The waterborne coating holds the largest share of around 79% of the total architectural coating consumed in the country due to the long adoption of VOC regulations set by the Chinese government. Furthermore, the country's commitment toward carbon neutrality by 2050, will further drive the eco-friendly product like waterborne coatings in the country.

- In China, acrylic coatings holds the major share amongst resin type, in terms of the total consumption volume of architectural coatings during 2016-2021, as it is used to coat the major part of the exterior walls.

- Acrylic coatings accounted for about ore than half of the total architectural coatings consumed during this period. The Chinese government regulations are majorly driving the adoption of low VOC architectural coatings and forces architectural coating manufacturers to reduce the VOC content in their coatings and market it as a safe product.

Architectural Coatings Industry Overview

The architectural coatings market is fragmented in nature. Some of the major players of the market studied include (not in particular order) Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., 3 Trees and Nippon Paint Holdings Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMEREY

4 MARKET DNAMICS

- 4.1 Drivers

- 4.1.1 Growth in Median Floor Area of Eastern European Countries

- 4.1.2 Increasing Residential and Commertial Infrastructure

- 4.2 Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Regulations

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Water-borne

- 5.1.2 Solvent-borne

- 5.2 Resin Type

- 5.2.1 Acrylic

- 5.2.2 Alkyd

- 5.2.3 Polyurethane

- 5.2.4 Epoxy

- 5.2.5 Polyester

- 5.2.6 Other Resin Types

- 5.3 End-use sub segment

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Indonesia

- 5.4.1.7 Malaysia

- 5.4.1.8 Philippines

- 5.4.1.9 Singapore

- 5.4.1.10 Vietnam

- 5.4.1.11 Australia & Newzealand

- 5.4.1.12 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Poland

- 5.4.3.7 Nordic Countries

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Stratergies Adopted by Leading players

- 6.4 Company Profiles

- 6.4.1 3 Trees

- 6.4.2 AkzoNobel N.V.

- 6.4.3 Asian paints

- 6.4.4 BASF SE

- 6.4.5 Benjamin Moore

- 6.4.6 Berger Paints India

- 6.4.7 Brillux GmbH & Co. KG

- 6.4.8 CIN, S.A.

- 6.4.9 Cloverdale Paint Inc.

- 6.4.10 DAW SE

- 6.4.11 Flugger group A S

- 6.4.12 Hempel A/S

- 6.4.13 Kansai Paint Co.,Ltd.

- 6.4.14 Masco Coporation

- 6.4.15 Nippon Paint

- 6.4.16 PPG

- 6.4.17 RPM International

- 6.4.18 Sniezka SA

- 6.4.19 The Sherwin-Williams Company