|

시장보고서

상품코드

1683756

독일의 건축용 코팅 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Germany Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

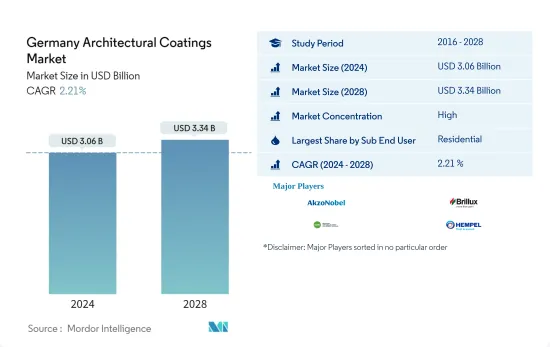

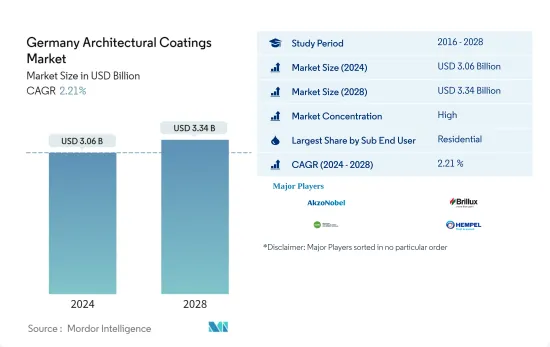

독일의 건축용 코팅 시장 규모는 2024년에 30억 6,000만 달러에 달했고, 2028년에는 33억 4,000만 달러에 이를 것으로 예측되며, 예측기간(2024-2028년)의 CAGR은 2.21%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 최종 사용자별 최대 부문 - 주택: 주택 건설 산업에서 비 페인트 건축자재의 높은 성장은 조사 기간 동안 주택용 페인트 소비에 영향을 미쳤습니다.

- 기술별 최대 부문 - 수성 : 독일에서 친환경 및 지속 가능한 재료의 인기가 높아짐에 따라 정부 규정과 함께 수성 기술의 성장을 지원하고 있습니다.

- 수지별 최대 부문 - 아크릴: 독일에서는 VOC 규제와 그린 빌딩 운동에 의해 수성 도료의 채용이 많아, 아크릴 수지 베이스의 성장을 견인하고 있습니다.

독일 건축용 코팅 시장 동향

서브 최종사용자별로는 주택이 최대 부문

- 독일의 건축용 도료 총 소비량은 2016-2019년 기간에 CAGR-1.14%를 기록했습니다. 조사 기간 동안 이 소비량의 축소는 플라스틱 시트나 프리빌드재 등, 도료 소비량이 적은 건축재료 증가 동향에 의한 것입니다.

- 상업용 도료의 점유율은 독일에서는 2016-2019년 사이에 약 26% 변동했지만, 주택용 도료 소비의 비정상적인 신장과 상업용 도료 소비의 감소에 의해 2020년에는 23% 감소합니다.

- 2020년에는 상업용 건축 및 리폼용 도료의 소비가 감소했지만, 도료 전체의 소비량은 특히 주택 부문에 있어서, COVID-19의 대유행으로 사람들이 집에 머무르면서 DIY용 도료의 소비가 대폭 증가했기 때문에 대폭적인 급증을 나타냈습니다.

독일 건축용 코팅 산업 개요

독일의 건축용 페인트 시장은 적당히 통합되어 상위 5개사에서 55.55%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. AkzoNobel NV, Brillux GmbH & Co. KG, DAW SE, Hempel A/S and PPG Industries, Inc.(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 바닥면적 동향

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제4장 시장 세분화

- 서브 최종 사용자

- 상업

- 주택

- 기술

- 용제계

- 수성

- 수지

- 아크릴

- 알키드

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형

제5장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AkzoNobel NV

- Beckers Group

- Brillux GmbH & Co. KG

- DAW SE

- Hempel A/S

- Jotun

- Meffert AG Farbwerke

- MIPA SE

- PPG Industries, Inc.

- Remmers GmbH

제6장 CEO에 대한 주요 전략적 질문

제7장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Germany Architectural Coatings Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 3.34 billion by 2028, growing at a CAGR of 2.21% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The high growth of the non-paintable building materials in the residential construction industry affected the residential paint consumption during the study period.

- Largest Segment by Technology - Waterborne : The increasing popularity of green and sustainable materials in the country is supporting the growth of waterborne technology, along with government regulations.

- Largest Segment by Resin - Acrylic : The high adoption of waterborne coatings in Germany due to VOC regulations and the green building movement is driving the growth of acrylic resin-based coatings.

Germany Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- Germany's total architectural coatings consumption recorded a CAGR of -1.14% during the 2016-2019 period. During the study period, this contraction in consumption was due to the growing trend of building materials that consume fewer paints, such as plastic sheets and pre-built materials.

- The commercial coatings' share fluctuated by around 26% in Germany during the 2016-2019 period while declining by 23% in 2020 due to abnormal growth in residential paint consumption and declining commercial paint consumption.

- In 2020, even though commercial construction and remodeling paint consumption declined, total paint consumption showed a huge spike due to a large increase in the consumption of the DIY paints, especially in the country's residential sector, as people stayed home due to the COVID-19 pandemic.

Germany Architectural Coatings Industry Overview

The Germany Architectural Coatings Market is moderately consolidated, with the top five companies occupying 55.55%. The major players in this market are AkzoNobel N.V., Brillux GmbH & Co. KG, DAW SE, Hempel A/S and PPG Industries, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Beckers Group

- 5.4.3 Brillux GmbH & Co. KG

- 5.4.4 DAW SE

- 5.4.5 Hempel A/S

- 5.4.6 Jotun

- 5.4.7 Meffert AG Farbwerke

- 5.4.8 MIPA SE

- 5.4.9 PPG Industries, Inc.

- 5.4.10 Remmers GmbH

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms