|

시장보고서

상품코드

1435219

자동차용 촉매 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Automotive Catalyst - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

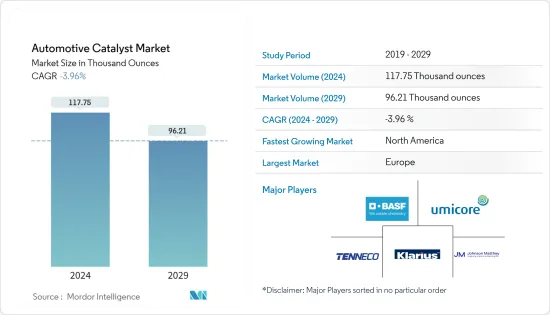

자동차용 촉매 시장 규모는 2024년 11만 7,750온스로 추정되며, 2029년에는 9만 6,210온스로 감소할 것으로 예상됩니다.

신종 코로나바이러스 감염증(COVID-19) 팬데믹으로 인해 제조 시설과 공장이 폐쇄되거나 제한적으로 폐쇄되면서 시장에 악영향을 미쳤습니다. 공급망과 운송의 혼란으로 인해 시장에 더 많은 장애가 발생했습니다. 그러나 2021년에는 업계가 회복세를 보이며 조사 대상 시장의 수요가 회복세를 보였습니다.

주요 하이라이트

- 단기적으로는 전 세계 정부가 시행하고 있는 엄격한 배출 기준과 자동차 생산량 증가가 조사 대상 시장의 성장을 촉진하는 주요 요인으로 작용할 것입니다.

- 한편, 전기자동차의 인기가 높아지면서 시장 성장에 걸림돌이 되고 있습니다.

- 그러나 개발도상국의 배기가스 배출 기준에 대한 관심이 높아짐에 따라 자동차용 촉매 시장에 미래 성장 기회를 가져올 것으로 예상됩니다.

- 유럽은 이 지역의 엄격한 배출 기준 채택으로 인해 시장을 독점하고 세계 최대 시장 점유율을 차지할 것으로 예상됩니다.

자동차용 촉매 시장 동향

승용차 부문이 시장을 독식

- 내연기관은 엔진 내부의 불완전 연소로 인해 독성 배출물을 생성합니다.

- CO가 인체에 유독하다는 사실과는 별개로, 도시 상공의 정체된 기단에는 오염물질이 장기간 잔류할 수 있습니다. 햇빛이 이러한 오염 물질과 상호 작용하면 HC, NOx 및 햇빛의 화학 반응으로 인해 지표면에서 오존이 형성됩니다.

- 자동차용 촉매는 탄화수소, 탄소 산화물, 질소 산화물과 같은 유해한 가스의 배출을 제어하기 위해 차량 배기 시스템에 사용됩니다. 이 촉매는 유해한 가스를 질소 및 이산화탄소와 같은 저독성 가스로 전환하는 데 도움이됩니다.

- 국제자동차산업기구(OICA)에 따르면 2022년 세계 승용차 총 생산량은 6,159만대로 2021년 대비 8%, 2020년 대비 10% 증가할 것으로 예상됩니다. 승용차 생산량 증가로 인해 예측 기간 동안 자동차용 촉매에 대한 수요가 증가할 것으로 예상됩니다.

- 인도의 자동차 산업에 대한 투자 증가와 발전은 자동차용 촉매 시장에 대한 수요를 증가시킬 것으로 예상됩니다. 예를 들어, 타타모터스는 2022년 4월 향후 5년간 승용차 사업에 30억 8,000만 달러를 투자할 계획을 발표했습니다. 이는 국내 자동차용 촉매 시장에 긍정적인 영향을 미칠 것으로 예상됩니다.

영국에서는 인플레이션 상승, 공급망 관리 문제, 지정학적 불안, 신종 코로나바이러스가 승용차 생산 감소의 주요 요인으로 작용했습니다. 예를 들어, OICA에 따르면 2022년 영국의 승용차 생산량은 총 7,75,014 대, 2021년 승용차 생산량은 8,59,575 대, 생산 감소율은 10 %로, Brexit과 긴장의 영향 미국과 중국 간의 갈등도 영국의 자동차 생산에 큰 영향을 미쳤으며, 영국 자동차 생산에 큰 영향을 미쳤습니다. 영향을 미치고 있습니다. 이러한 요인들은 국내 자동차용 촉매 시장에 부정적인 영향을 미칠 것입니다.

- 개발도상국 정부는 연비와 같은 새로운 배출가스 제어 기술에 많은 비용을 투자하여 배출가스 규제를 위해 노력하고 있으며, 이는 자동차용 촉매 시장의 성장을 촉진할 것으로 예상됩니다. 4원 촉매는 기존 촉매보다 효율이 우수합니다.

- 앞서 언급한 요인들은 예측 기간 동안 자동차용 촉매 시장에 큰 영향을 미칠 것으로 예상됩니다.

유럽이 시장을 독식

- 유럽 지역의 배출가스 기준이 점점 더 엄격해짐에 따라 자동차용 촉매 시장은 유럽이 독점할 것으로 예상됩니다.

- 오염을 억제하기 위한 정부의 엄격한 규제로 인해 최근 자동차용 촉매에 대한 수요가 급증하고 있습니다.

- OICA에 따르면 승용차 부문에서는 2022년 전체 생산량이 2021년에 비해 1 % 감소하여 자동차용 촉매 시장이 아직 회복기에 접어 들지 않았다고 밝혔습니다. 생산량이 크게 감소한 것은 정부 기관이 설정 한 환경 기준이 지속적으로 변경 되었기 때문입니다. 이는 이 지역의 승용차 부문에서 자동차용 촉매가 감소하는 데 중요한 역할을 했습니다. 슬로베니아, 우즈베키스탄과 같은 국가에서는 승용차 수요가 크게 감소한 반면 오스트리아, 포르투갈, 벨로루시 등의 국가에서는 자동차 생산이 급증하여 이 지역의 자동차용 촉매에 대한 수요가 증가했습니다.

- 또한 독일에서는 반도체 부족과 원자재 공급 제한으로 인해 자동차 산업이 타격을 받고 있습니다. 마찬가지로 새로운 세계조화 소형차 시험절차(WLTP)의 시행, 미중 무역 마찰로 인한 국제 자동차 수요 감소, 자동차 제조업체의 평균 CO2 배출량 달성을 의무화하는 EU-28의 새로운 배출 기준 등 다른 요인들도 영향을 미쳤을 수 있습니다. 새로 판매된 차량 전체가 1km당 95g의 오염을 발생시켜 승용차 생산에 악영향을 미쳤습니다. 그러나 2022년에는 반도체 부족으로 인해 국내 자동차 생산이 점차 회복되고 있습니다. 예를 들어, OICA에 따르면 2022년 독일에서는 약 3,480,357대의 승용차가 생산되어 2021년 대비 12% 증가했습니다. 따라서 승용차 부문의 생산 증가는 자동차 수요의 상승세를 가져올 것으로 예상됩니다. 촉매 시장.

- 반도체 부족이 지속되면서 유럽 지역의 소형 상용차 생산이 감소하고 있습니다. 예를 들어, OICA에 따르면 2022년에는 약 214만 8,379대의 소형 상용차가 생산되어 2021년에 비해 2% 감소할 것으로 예상됩니다. 이러한 부족은 국내 자동차용 촉매 시장의 수요 성장을 제한할 것으로 예상됩니다.

- 러시아의 소형 상용차 생산은 지난 3년간 온라인 쇼핑과 도시화의 증가로 인해 증가하고 있으며, 효율적인 물류가 필요한 새로운 소매 및 E-Commerce 플랫폼이 러시아에 등장했습니다. 반면 러시아-우크라이나 전쟁은 경제 제재, 1차 상품 가격 상승, 공급망 중단으로 국내 소형 상용차 생산에 영향을 미치고 국내 자동차용 촉매 시장에도 영향을 미치고 있습니다. 예를 들어, OICA에 따르면 2022년에는 약 83,813대의 소형 상용차가 생산될 것으로 예상되며, 이는 2021년 대비 35% 감소한 수치입니다.

- 프랑스에서는 반도체 부족과 공급망 부족이 계속되면서 국내 소형 상용차 생산에 약간의 영향을 미쳤습니다. 예를 들어, OICA에 따르면 2022년 국내 소형 상용차 생산량은 2021년 43만 3,401대에 비해 14% 감소한 37만 2,707대를 기록할 것으로 예상했습니다.

- 상기 요인들은 향후 몇 년 동안 시장에 큰 영향을 미칠 것으로 예상됩니다.

자동차용 촉매 산업 개요

자동차용 촉매 시장은 본질적으로 부분적으로 세분화되어 있습니다. 이 시장의 주요 기업으로는 BASF SE, Tenneco Inc., Johnson Matthey, Klarius Products Ltd, Umicore 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 자동차 생산 증가

- 자동차 배기가스에 관한 엄격한 규제

- 기타 촉진요인

- 성장 억제요인

- 전기자동차의 인기 상승

- 기타 저해요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화(금액 기준 시장 규모)

- 종류

- 플라티나

- 팔라듐

- 로듐

- 기타 유형

- 차종

- 승용차

- 소형 상용차

- 대형 상용차

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 상황

- M&A, 합작투자, 제휴, 협정

- 시장 점유율 분석**/순위 분석

- 주요 기업의 전략

- 기업 개요

- BASF SE

- CDTi Advanced Materials Inc.

- CLARIANT

- Cummins Inc.

- DCL International Inc.

- Ecocat India Pvt Ltd

- Johnson Matthey

- Klarius Products Ltd

- N.E. CHEMCAT CORPORATION

- Tenneco Inc.

- Umicore

제7장 시장 기회와 향후 동향

제8장 개발도상국의 배출 기준 중시 상승

제9장 기타 기회

ksm 24.03.06The Automotive Catalyst Market size is estimated at 117.75 Thousand ounces in 2024, and is expected to decline to 96.21 Thousand ounces by 2029.

The COVID-19 pandemic negatively impacted the market due to the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, stringent emission standards implemented by governments across the world and an increase in the production of automobiles are the major factors driving the growth of the market studied.

- On the flip side, the rise in the popularity of electric vehicles is hindering the growth of the market.

- However, surge in emphasis of developing nations towards the emission standards is anticipated to provide future growth opportunity to the automotive catalyst market.

- Europe is expected to dominate the market and have the largest market share globally, owing to the adoption of stringent emission standards in the region.

Automotive Catalyst Market Trends

The Passenger Cars Segment to Dominate the Market

- Internal combustion engines produce toxic emissions due to incomplete combustion in the engine.

- Apart from the fact that CO is poisonous to humans, the stagnant air masses over urban areas can hold the pollutants for long periods. When sunlight interacts with these pollutants, the formation of ground-level ozone occurs due to the chemical reaction between HC, NOx, and sunlight.

- The automotive catalyst is used in the exhaust system of vehicles to control the emission of harmful gases, such as hydrocarbons, carbon oxides, and nitrogen oxides, as these catalysts help in converting harmful gases into less toxic gases, such as nitrogen and carbon dioxide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for automotive catalysts in the forecast period.

- Increased investments and advancements in the automobile industry in India is expected to create an upside demand for automotive catalyst market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to have a positive impact on the automotive catalyst market in the country.

- In the United Kingdom, rising inflation, supply chain management issues, geopolitical unrest and COVID were the major contributors for the decrease in the production of passenger cars. For instance, according to OICA, in 2022, the country produced a total of 7,75,014 units of passenger vehicles at a 10% production decline rate as compared to 8,59,575 passenger vehicles produced in 2021. The fallout due to Brexit and the tensions between the United States and China have also significantly affected vehicle production in the country. These factors will negatively affect the market for automotive catalyst in the country.

- The governments of developing nations are taking initiatives in concern of emission control by spending hugely on new emission controlling technologies like fuel efficiency, which is expected to boost the growth of the automotive catalyst market. A four-way catalyst has better efficiency than older catalysts.

- The aforementioned factors are expected to show a significant impact on the automotive catalyst market during the forecast period.

Europe to Dominate the Market

- Europe is expected to dominate the automotive catalyst market due to the increasingly stringent emission standards in the region.

- Stringent government regulations to restrain pollution surged the demand for automotive catalysts in recent times.

- In the Passenger car segment, according to OICA, there was a decline in overall production in 2022. With a decrease of 1% compared to 2021, the automotive catalyst market is yet to see a recovery period. The major decrease in production was due to the constant change in the environmental standards set by the governing bodies. This played a vital role in the decrease of automotive catalysts from the passenger car segment in the region. Countries like Slovnia, and Uzbekistan have seen a major decrease in the demand for passenger cars while countries like Austria, Portugal, Belarus, and others have seen a surge in automotive production thereby increasing the demand for automotive catalysts in the region.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars. However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for automotive catalyst market.

- Due to the ongoing semiconductor shortages, the production of light commercial vehicles in the Europe region is declining. For instance, in 2022, according to OICA, around 21,48,379 units of light commercial vehicles were produced, which declined by 2% compared to 2021. These shortages are expected to restrict the growth of demand for automotive catalysts market in the country.

- Russia's production of light commercial vehicles has increased in the last three years due to an increase in online shopping and urbanization, which has created new retail and e-commerce platforms in the country that require efficient logistics. In contrast, the Russia-Ukraine war has resulted in economic sanctions, a jump in commodity prices, and supply chain interruptions, impacting the production of light commercial vehicles in the country, and affecting the automotive catalysts market in the country. For instance, according to OICA, in 2022, around 83,813 units of light commercial vehicles were produced, which shows a decrease of 35% compared to 2021.

- In France, due to the ongoing semiconductor shortage and supply chain shortages slightly affected the light commercial vehicles production in the country. For instance, according to OICA, in 2022 the country's light commercial vehicles production volume declined by 14% to 3,72,707 units as compared to 4,33,401 units produced in 2021.

- The abovementioned factors are expected to show a significant impact on the market in the coming years.

Automotive Catalyst Industry Overview

The Automotive Catalyst Market is partially fragmented in nature. The major players in this market (not in a particular order) include BASF SE, Tenneco Inc., Johnson Matthey, Klarius Products Ltd, and Umicore, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Automobile Production

- 4.1.2 Stringent Regulations Related to Automotive Emission

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rise in Popularity of Electric Vehicles

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Other Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CDTi Advanced Materials Inc.

- 6.4.3 CLARIANT

- 6.4.4 Cummins Inc.

- 6.4.5 DCL International Inc.

- 6.4.6 Ecocat India Pvt Ltd

- 6.4.7 Johnson Matthey

- 6.4.8 Klarius Products Ltd

- 6.4.9 N.E. CHEMCAT CORPORATION

- 6.4.10 Tenneco Inc.

- 6.4.11 Umicore