|

시장보고서

상품코드

1852077

실험실 정보 관리 시스템 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Global Laboratory Information System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

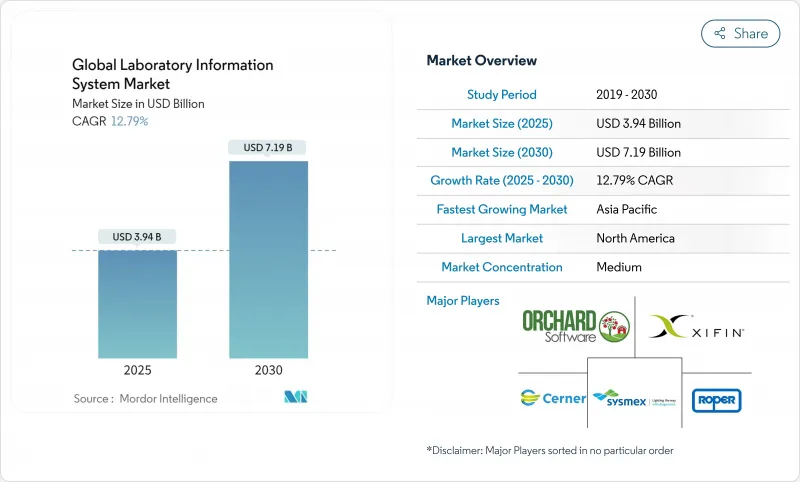

세계의 실험실 정보 관리 시스템 시장은 2025년 31억 9,000만 달러로, 2030년까지 71억 9,000만 달러에 이르고, CAGR 12.79%를 보일 것으로 예측됩니다.

고령화로 인한 검사량 증가, 자본 장벽을 줄이는 클라우드 아키텍처의 급속한 성숙, 검사실을 보다 광범위한 임상 데이터 네트워크로 끌어들이는 상호 운용성의 의무화 등이 성장의 요인입니다. 소프트웨어는 여전히 구매의 중심이지만, AI 모듈은 결과 검증, 재고 관리, 예지 보전에 있어서 파일럿에서 프로덕션으로 이행하는 한편, 수요는 가치 달성까지의 시간을 단축하는 전문가 서비스로 기울고 있습니다. 대부분의 대규모 시설은 여전히 On-Premise 시스템을 운영하고 있지만, 중소규모 시설은 서버에 투자하지 않고도 엔터프라이즈급 기능을 활용할 수 있는 SaaS 모델로 중심을 옮깁니다. 북미가 엄격한 컴플라이언스 룰과 조기 AI 도입을 통해 리드를 지키는 한편, 아시아태평양이 새로운 디지털 헬스 예산을 추가해 기존의 제약을 뛰어넘을수록 지리적 기세가 변화하고 있습니다. 격화하는 사이버 공격은 공급업체의 선택 기준을 강화하는 제로 트러스트 보안 계층의 필요성을 강조하고, 진단 대기업에서 클라우드 네이티브 진출기업에 이르기까지 합병의 물결은 규모, 인재, 규제의 깊이를 둘러싼 경쟁을 시사하고 있습니다.

세계 실험실 정보 관리 시스템 시장 동향과 통찰

고령화에 따른 세계 진단검사 건수 증가

세계의 의료시스템에서는 65세 이상의 인구동태가 가속되고 만성질환 패널과 정기적인 스크리닝 검사가 증가함에 따라 검사 건수가 급증하고 있습니다. 미국만으로도 2024년 검사실이 처리하는 검사 건수는 140억 건을 넘어 인구동태 예측은 지속적인 확대를 나타내고 있습니다. 수작업 워크플로우로는 따라잡지 못하기 때문에 실험실은 시료의 라벨링, 추적, 다층적 결과 검증을 자동화하는 최신 LIS 모듈을 도입하고 있습니다. AI 엔진은 용혈과 혈전 간섭에 몇 초 안에 플래그를 지정하여 검사 기술자를 복잡한 검사로 해방합니다. 헬스 키오스크 네트워크를 채용한 중국의 지방 진료소에서는 환자의 내원 수가 37.85%, 의료 수입이 54.03% 증가하고 디지털 프로세스가 지역 의료에 정착하면 승수 효과를 얻을 수 있음을 실증하고 있습니다.

바이오뱅크 네트워크의 신속한 스케일업

정밀 의학 프로젝트는 종단적인 인간 생물 자원 보관 시설을 요구하기 때문에 바이오뱅크 컨소시엄은 구성 가능한 LIS 플랫폼에 대한 투자를 추진하고 있습니다. 이러한 시스템은 시퀀싱 파이프라인과 통합하면서 분산된 냉동고 사이에서 동의, 혈통, CoC를 추적합니다. Guy's and St Thomas'BioResource는 Matrix Gemini를 도입하여 500,000개가 넘는 샘플을 자동화하고 최적화된 위치 매핑을 통해 20% 저장 공간을 되찾았습니다. 공급업체는 샘플 유도체를 매핑하고, ISO20387 컴플라이언스를 수행하며, 트랜스레이셔널 리서치 팀에 쿼리 가능한 데이터를 내보내는 바이오뱅크 가능 모듈로 대응합니다.

높은 총 소유 비용

종합적인 LIS의 도입은 종종 데이터 마이그레이션, 검증 및 사용자 교육이 표면화 될 때 초기 예산을 초과합니다. 본격적인 프로젝트에서는 소프트웨어 사용료가 6만 달러를 넘어 6-9개월에 이르기도 하며, 연간 라이선스료는 시트나 모듈에 따라 3,000-25만 달러에 이릅니다. 내부에 IT 팀이 없는 소규모 연구소에서는 통합 컨설팅 비용이 들고 헤드라인 가격이 두 배가 됩니다. 2025년 5월부터 미국 FDA의 새로운 실험실 개발 검사 규칙은 추가 문서화 및 품질 시스템 레이어를 도입하고 배포 일정을 부풀립니다.

부문 분석

2024년 검사실 정보시스템 시장은 시료의 수집, 분석장치와의 인터페이스, 컴플라이언스 문서화를 지휘하는 코어 모듈에 지지되어 소프트웨어가 65.15%의 점유율을 유지했습니다. 그러나 배포 팀은 성공적인 배포가 워크플로우 재설계에 달려 있으며 서비스 매출을 CAGR 13.14%로 밀어올릴 것으로 보입니다. 통합 지원 번들과 관련된 실험실 정보 시스템 시장 규모는 검사실이 검증 및 가동 후 최적화를 아웃소싱함에 따라 확대될 것으로 예측됩니다. SaaS의 코드베이스는 버전 업을 가속시키지만 분기별 릴리스로 스태프를 스킬업시키는 트레이닝 계약 수요에도 박차를 가합니다. 공급업체는 컨설팅 깊이, 상호 운용성 매핑, 규제 당국의 감사 대응 등을 통해 차별화를 도모하고 일회성 라이선스 계약을 정기적인 서비스 파이프라인으로 바꾸고 있습니다.

둘째로, 직원 수가 적은 소규모 시설에서는 서버 모니터링, 패치 적용 및 사이버 보안 강화를 위해 관리 서비스를 사용합니다. 프리미엄 지원은 24시간 365일 체제의 헬프 데스크와 지불자 규칙의 진화에 대응하는 신속한 인터페이스의 커스터마이즈를 제공해, 주기적인 라이선스 지출을 상쇄하는 연금 수입원을 만들어 냅니다. FDA의 2025년 LDT 규칙에 따라 문서화 업무가 강화되는 가운데, 검사시설은 미리 구축된 SOP 템플릿과 전자서명 워크플로우를 제공하고, 사내팀이 품질관리 업무에 집중하면서 지속적인 컴플라이언스를 확보할 수 있는 파트너를 요구하고 있습니다.

대형 병원이 데이터의 주권을 지키고 서버에 대한 투자를 효과적으로 활용하기 위해 2024년 실험실 정보 관리 시스템 시장 점유율은 On-Premise가 59.26%를 차지했습니다. 그러나 클라우드 도입의 CAGR은 13.85%를 기록하며 구매 패턴의 변화를 보여주고 있습니다. SaaS 계약으로 인한 실험실 정보 관리 시스템 시장 규모는 구독 모델이 하드웨어 사이클이 아닌 검사량에 따라 확대되므로 급증할 것으로 예측됩니다. 개인을 식별할 수 있는 민감한 정보는 현장에 있으며, 분석 대시보드와 장기 아카이브는 공급업체 클라우드로 마이그레이션하는 하이브리드 방식이 나타납니다.

팬데믹(세계적 유행병) 규제에서 태어난 원격 액세스 수요는 클라우드의 신뢰성에 대한 경영진의 감정을 기울이고, 실증 실험은 On-Premise 클러스터에 비해 가동 시간이 동등하거나 뛰어난 것으로 입증되었습니다. SOC 2 Type II 보고서, HIPAA 비즈니스 연관 보증 및 지역별 데이터 거주 영역은 규정 준수 팀의 우려를 해결합니다. 시간이 지남에 따라 감가 상각 일정과 전력 비용 상승으로 인해 로컬 데이터센터를 유지하는 경제성이 더욱 떨어지고 차세대 스마트 호스피탈 청사진을 계획하는 의료 기관의 전환 경로가 가속화되고 있습니다.

본 보고서에서는 세계 실험실 정보 관리 시스템 기업을 다루고 컴포넌트별(소프트웨어 및 서비스), 제공형태별(On-Premise, 클라우드 기반, 하이브리드), 실험실 유형별(임상병리실험실, 해부병리실험실 등), 최종사용자별(병원 및 클리닉 등), 지역별로 분류하고 있습니다. 시장 세분화는 위 부문의 금액(단위: 백만 달러)을 제공합니다.

지역별 분석

북미는 2024년 실험실 정보 관리 시스템 시장 점유율의 42.84%를 차지하며 계속 우위를 유지하고 있습니다. 미국은 엄격한 CLIA 감독과 디지털 품질 지표에 보답하는 견고한 지불자 인센티브를 통해 이 리드를 지원합니다. 캐나다의 단일 지불 구상은 지역 실험실 현대화에 자금을 주입하고 멕시코의 민간 병원 체인은 제한된 레거시 IT 직원을 피하기 위해 클라우드 플랫폼을 채택하고 있습니다. 2024 Change Healthcare의 정보 유출 사건에 의해 사이버 보안의 강화나 벤더의 SOC 2 인증에 경영진의 주목이 모아집니다. 2025년 5월에 시행되는 FDA의 실험실 개발 검사에 대한 새로운 의무화로 인해 구형 플랫폼에는 현재 필요한 전자 품질 관리 기능이 없기 때문에 교체 사이클이 견인됩니다.

아시아태평양은 정부의 e-헬스 로드맵과 중간층의 보험 가입률 확대로 CAGR 최고 속도의 14.38%를 기록했습니다. 인도의 국가 디지털 건강 계획(National Digital Health Blueprint)은 상호 운용가능한 데이터 플랫폼에 대한 투자를 촉진하고, 초기 파일럿은 2030년까지 250억 달러의 디지털 건강 경제가 실현될 것으로 예측됩니다. 중국의 농촌 의료용 키오스크는 원격 병리 진단 및 원격 결과 전달이 실제 상점의 제약을 뛰어넘을 수 있음을 증명하여 3층 현립 병원에서 클라우드 도입을 촉진합니다. 한국의 Samsung Medical Centre는 LIS, 방사선과, 약국의 각 플랫폼이 FHIR 교환을 통해 연계하는 스마트 호스피탈 오케스트레이션을 실증해 싱가포르와 호주가 모방한 지역 벤치마크를 설정했습니다.

유럽에서는 GDPR(EU 개인정보보호규정)에 의한 엄격한 데이터 주권 관리가 지역 밖의 클라우드 호스팅을 복잡하게 하기 때문에 진전은 완만하지만 꾸준히 진행되고 있습니다. 독일은 지역의 최고 점유율을 유지하고 프랑스는 국가적 유전체학 보조금의 혜택을 받아 암 영역에 특화된 시퀀싱 실험실을 가속화하고 있습니다. 중동에서는 'Vision 2030' 프로그램과 관련된 그린필드 병원의 건설이 시작되어 첫날부터 LIS를 통합해 조인트 위원회의 인정을 받습니다. 남미는 점차 전진하고 있습니다. 브라질의 민간 보험 시장은 실험실의 통합을 촉구하고 있지만, 통화 변동과 규제의 이질성이 다국간 전개를 억제하고 있습니다. 모든 지역에서 공여자로부터 자금 지원을 받는 공공 의료 기관은 WHO의 감시 보고를 준수하는 오픈소스 또는 저비용 SaaS 옵션을 추구하여 가치 지향 공급업체의 2차 계층을 형성합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고령화가 견인하는 세계의 진단 검사량 증가

- 바이오뱅크 네트워크의 급속한 확대

- 설비 투자를 억제하는 클라우드 및 SaaS의 급속한 보급

- AI를 활용한 워크플로우 자동화 모듈

- 상호 운용성에 관한 규제 강화

- 신흥 시장에서 클라우드 네이티브 LIS 스타트업 성장

- 시장 성장 억제요인

- 높은 총소유비용

- 확대되는 사이버 보안과 HIPASS 및 GDPR(EU 개인정보보호규정) 책임

- LIS 리터러시가 있는 검사 정보 기사 부족

- 세분화하고 진화하는 규제 요건

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측(금액, 백만 달러)

- 컴포넌트별

- 소프트웨어

- 독립형 LIS

- 통합 LIS 및 EHR 중심

- SaaS LIS 플랫폼

- 서비스

- 구현 및 통합

- 유지보수 및 지원

- 교육 및 컨설팅

- 소프트웨어

- 배송 형태별

- On-Premise

- 클라우드 기반

- 하이브리드

- 검사실 유형별

- 임상병리 실험실

- 해부병리 실험실

- 분자진단 실험실

- 혈액은행 및 바이오뱅크

- 기타 전문 실험실

- 최종 사용자별

- 병원 및 클리닉

- 실험실

- 학술기관 및 연구기관

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Clinisys(Roper)

- Oracle Health(Cerner Corporation)

- Epic Systems Corporation

- SCC Soft Computer, LLC

- Orchard Software Corporation

- Sysmex Corporation

- XIFIN, Inc.

- CompuGroup Medical SE & Co. KGaA

- Cirdan Ltd.

- Dedalus Group SpA

- Total Specific Solutions BV

- Comp Pro Med, Inc

- Margy Tech Pvt. Ltd.

- Biosero, Inc.

- Wavefront Software, Inc.

- LigoLab LLC

- Aspyra LLC

- LabWare, Inc.

- ClinLab, Inc.

- TELCOR, Inc.

- eLabNext BV

- CGM SCHUYLAB

- SoftTech Health LLC

제7장 시장 기회와 장래의 전망

JHS 25.11.19The laboratory information system market is valued at USD 3.19 billion in 2025 and is forecast to climb to USD 7.19 billion by 2030, advancing at a 12.79% CAGR.

Growth rests on larger test volumes generated by aging populations, fast-maturing cloud architectures that cut capital barriers, and tightening interoperability mandates that pull laboratories into broader clinical data networks. Software remains the anchor purchase, yet demand leans toward expert services that shorten time-to-value, while AI modules move from pilot to production in result validation, inventory control, and predictive maintenance. Laboratories also recalibrate deployment strategies: most large institutions still run on-premise systems, but small and midsize facilities pivot to software-as-a-service models that open enterprise-grade features without server investments. Geographic momentum shifts as Asia-Pacific adds new digital health budgets and leapfrogs legacy constraints, even while North America guards its lead through rigorous compliance rules and early AI adoption. Escalating cyberattacks underscore the need for zero-trust security layers that strengthen vendor selection criteria, and a wave of mergers-from diagnostics giants to cloud-native entrants-signals a race for scale, talent, and regulatory depth.

Global Laboratory Information System Market Trends and Insights

Rising Global Diagnostic Testing Volumes Driven by Aging Populations

World health systems process soaring test counts as the 65-plus demographic accelerates, lifting chronic disease panels and routine screenings. In the United States alone, laboratories handled more than 14 billion tests in 2024, and demographic projections indicate sustained expansion. Manual workflows cannot keep pace, so laboratories deploy modern LIS modules that automate specimen labeling, tracking, and multilayer result verification. AI engines now flag hemolysis or clot interference within seconds, releasing technologists for complex review. Rural clinics in China that adopted health kiosk networks saw patient visits jump 37.85% and medical revenue climb 54.03%, illustrating the multiplier effect once digital processes anchor community care .

Rapid Scale-up of Biobank Networks

Precision-medicine projects demand longitudinal biospecimen libraries, pushing biobank consortia to invest in configurable LIS platforms. These systems track consent, lineage, and chain-of-custody across distributed freezers while integrating with sequencing pipelines. Guy's and St Thomas' BioResource deployed Matrix Gemini to automate 500,000-plus samples and reclaimed 20% storage space through optimized location mapping. Vendors respond with biobank-ready modules that map sample derivatives, enforce ISO 20387 compliance, and export query-ready data to translational research teams.

High Total Cost of Ownership

Comprehensive LIS deployments frequently overrun initial budgets once data migration, validation, and user training surface. Full-scale projects can cross USD 60,000 in software fees and stretch 6-9 months, while annual licensing spans USD 3,000 to USD 250,000 depending on seats and modules. Smaller labs lacking internal IT teams bear integration consulting expenses that double headline price tags. New U.S. FDA rules for laboratory-developed tests from May 2025 introduce additional documentation and quality-system layers that inflate implementation timelines.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Cloud/SaaS LIS That Lower Capital Outlays

- AI-Powered Workflow Automation Modules

- Strengthening Regulatory Mandates for Interoperability

- Escalating Cybersecurity & HIPAA/GDPR Liabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software maintained a 65.15% stake of the laboratory information system market in 2024, anchored by core modules that orchestrate specimen intake, analyzer interfaces, and compliance documentation. Implementation teams, however, observe that successful rollouts hinge on workflow redesign, driving services revenue to a 13.14% CAGR. The laboratory information system market size associated with integrated support bundles is projected to widen as labs outsource validation and post-go-live optimization. SaaS code bases speed version upgrades, yet they also spur demand for training contracts that upskill staff on quarterly releases. Vendors differentiate through consulting depth, interoperability mapping, and regulatory audit readiness, converting one-time license deals into recurring service pipelines.

Second, smaller facilities with lean headcount lean on managed services for server monitoring, patching, and cybersecurity hardening. Premium support tiers bundle 24/7 help desks and rapid interface tailoring as payer rules evolve, creating annuity revenue streams that offset cyclical license spending. With the FDA's 2025 LDT rule intensifying documentation duties, laboratories look for partners that supply pre-built SOP templates and e-signature workflows, ensuring continuous compliance while internal teams remain focused on quality control tasks.

On-premise deployments held 59.26% of the laboratory information system market share in 2024 as large hospitals safeguarded data sovereignty and leveraged sunk server investments. Yet cloud implementations record a 13.85% CAGR, signaling an inflection in buying patterns. The laboratory information system market size attributable to SaaS contracts is forecast to rise sharply as subscription models scale with test volumes rather than hardware cycles. Hybrid approaches emerge where sensitive personally identifiable information resides on-site, while analytics dashboards and long-term archives shift to vendor clouds.

Remote access needs borne out of pandemic restrictions tipped executive sentiment toward cloud reliability, and proof-of-concept pilots now demonstrate parity or superiority in uptime compared with on-premise clusters. SOC 2 Type II reports, HIPAA business-associate assurances, and regional data-residency zones address compliance teams' concerns. Over time, depreciation schedules and power-cost spikes further erode the economics of maintaining local data centers, accelerating the transition path for institutions planning next-generation smart-hospital blueprints.

The Report Covers Global Laboratory Information System Companies and It is Segmented by Component (Software and Service), Mode of Delivery (On-Premise, Cloud-Based, and Hybrid), Laboratory Type (Clinical Pathology Labs, Anatomic Pathology Labs, and More), End User (Hospital and Clinics and More), and Geography. The Market Provides the Value (in USD Million) for the Above Segments.

Geography Analysis

North America continued to dominate with 42.84% of the laboratory information system market share in 2024. The United States anchors this lead through strict CLIA oversight and robust payer incentives that reward digital quality metrics. Canada's single-payer initiatives inject funding into provincial lab modernizations, while Mexico's private-hospital chains adopt cloud platforms to bypass limited legacy IT staffing. The fallout from the 2024 Change Healthcare breach draws executive attention to cybersecurity hardening and vendor SOC 2 credentials. New FDA mandates for laboratory-developed tests, effective May 2025, push replacement cycles as older platforms lack the e-quality-management functions now required.

Asia-Pacific registers the fastest 14.38% CAGR, underwritten by government e-health roadmaps and expanding middle-class insurance coverage. India's National Digital Health Blueprint funnels investment into interoperable data platforms, and early pilots forecast a USD 25 billion digital-health economy by 2030. China's rural health kiosks prove that tele-pathology and remote result delivery can leapfrog brick-and-mortar constraints, driving cloud adoption among tier-3 county hospitals. South Korea's Samsung Medical Centre demonstrates smart-hospital orchestration where LIS, radiology, and pharmacy platforms align through FHIR exchanges, setting a regional benchmark copied by Singapore and Australia.

Europe shows steady though slower progression as GDPR dictates tight data-sovereignty controls that complicate extra-regional cloud hosting. Germany retains top regional share, while France accelerates oncology-focused sequencing labs benefiting from national genomics funding. The Middle East opens green-field hospital builds tied to Vision 2030 programs, embedding LIS from day one to meet Joint Commission accreditation. South America advances gradually; Brazil's private insurance market encourages lab consolidation, yet currency volatility and regulatory heterogeneity temper multicountry deployments. Across all regions, donor-funded public-health labs seek open-source or low-cost SaaS options that comply with WHO surveillance reporting, creating a secondary tier for value-oriented vendors.

- Clinisys (Roper)

- Oracle Health (Cerner Corporation)

- Epic Systems

- SCC Soft Computer, LLC

- Orchard Software

- Sysmex

- XIFIN

- CompuGroup Medical SE & Co. KGaA

- Cirdan Ltd.

- Dedalus Group S.p.A.

- Total Specific Solutions B.V

- Comp Pro Med, Inc

- Margy Tech Pvt. Ltd.

- Biosero

- Wavefront Software, Inc.

- LigoLab LLC

- Aspyra LLC

- LabWare, Inc.

- ClinLab, Inc.

- TELCOR, Inc.

- eLabNext B.V.

- CGM SCHUYLAB

- SoftTech Health LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Diagnostic Testing Volumes Driven By Aging Populations

- 4.2.2 Rapid Scale-Up Of Biobank Networks

- 4.2.3 Rapid Uptake Of Cloud/SaaS Lis That Lower Capital Outlays

- 4.2.4 AI-Powered Workflow Automation Modules

- 4.2.5 Strengthening Regulatory Mandates For Interoperability

- 4.2.6 Growth Of Cloud-Native LIS Start-Ups In Emerging Markets

- 4.3 Market Restraints

- 4.3.1 High Total Cost Of Ownership

- 4.3.2 Escalating Cybersecurity & HIPASS/GDPR Liabilities

- 4.3.3 Shortage Of LIS-Literate Lab Informaticians

- 4.3.4 Fragmented And Evolving Regulatory Requirements

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Stand-alone LIS

- 5.1.1.2 Integrated LIS / EHR-centric

- 5.1.1.3 SaaS LIS Platforms

- 5.1.2 Services

- 5.1.2.1 Implementation & Integration

- 5.1.2.2 Maintenance & Support

- 5.1.2.3 Training & Consulting

- 5.1.1 Software

- 5.2 By Mode of Delivery

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.2.3 Hybrid

- 5.3 By Laboratory Type

- 5.3.1 Clinical Pathology Labs

- 5.3.2 Anatomic Pathology Labs

- 5.3.3 Molecular Diagnostics Labs

- 5.3.4 Blood Banks & Biobanks

- 5.3.5 Other Specialized Labs

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Laboratories

- 5.4.3 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Clinisys (Roper)

- 6.3.2 Oracle Health (Cerner Corporation)

- 6.3.3 Epic Systems Corporation

- 6.3.4 SCC Soft Computer, LLC

- 6.3.5 Orchard Software Corporation

- 6.3.6 Sysmex Corporation

- 6.3.7 XIFIN, Inc.

- 6.3.8 CompuGroup Medical SE & Co. KGaA

- 6.3.9 Cirdan Ltd.

- 6.3.10 Dedalus Group S.p.A.

- 6.3.11 Total Specific Solutions B.V

- 6.3.12 Comp Pro Med, Inc

- 6.3.13 Margy Tech Pvt. Ltd.

- 6.3.14 Biosero, Inc.

- 6.3.15 Wavefront Software, Inc.

- 6.3.16 LigoLab LLC

- 6.3.17 Aspyra LLC

- 6.3.18 LabWare, Inc.

- 6.3.19 ClinLab, Inc.

- 6.3.20 TELCOR, Inc.

- 6.3.21 eLabNext B.V.

- 6.3.22 CGM SCHUYLAB

- 6.3.23 SoftTech Health LLC

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment