|

시장보고서

상품코드

1850380

건설기계 렌탈 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Construction Equipment Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

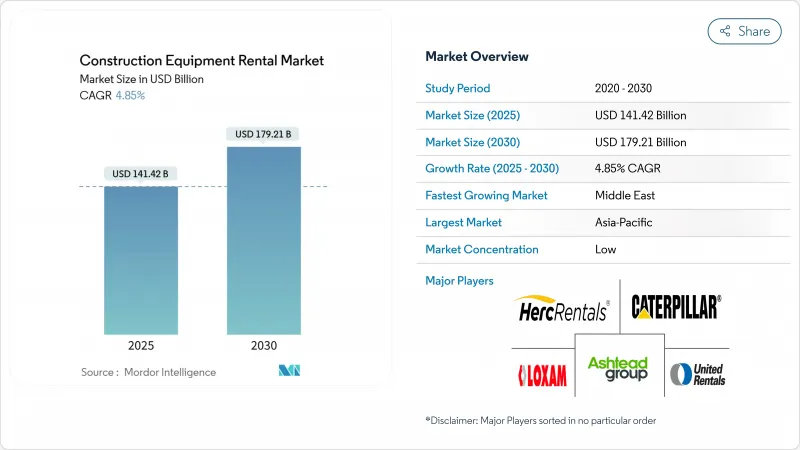

건설기계 렌탈 시장은 2025년 1,414억 2,000만 달러로 추정되고, CAGR 4.85%로 확대될 전망이며, 2030년에는 1,792억 1,000만 달러에 이를 것으로 예측됩니다.

이 기세는 기록적인 공공 부문의 인프라 파이프라인, 자산 라이트 모델을 선호하는 계약자 확대, 렌탈 거래의 급속한 디지털화로 인해 발생합니다. 전기기계 및 수소연료전지 기계의 채용이 증가하고, 성과 기반의 서비스 계약과 함께 플릿 전략이 재구축되어 프리미엄 가격의 틈새가 열리고 있습니다. 아시아태평양은 지속적인 고속도로, 철도, 도시 재개발 프로그램을 배경으로 규모의 주도권을 유지하고 있으며, 중동은 비전 2030의 메가 프로젝트에 힘입어 지역에서 가장 빠른 성장을 이루고 있습니다. 대기업이 지리적 밀도와 기술력을 얻기 위해 인수를 가속화하고 있기 때문에 경쟁의 치열성이 커지고 있습니다. 텔레매틱스를 활용한 플릿의 최적화는 가동률 향상과 고객 유지를 위한 중요한 테코로서 대두하고 있어 숙련 노동자 부족 및 복수 브랜드 유지관리의 복잡성에 의한 역풍을 일부 상쇄하고 있습니다.

세계의 건설기계 렌탈 시장 동향 및 인사이트

인프라 자극책의 대형 프로젝트 파이프라인

미국의 1조 2,000억 달러의 인프라 투자 및 고용 촉진법과 인도의 1조 4,000억 달러의 국가 인프라 파이프라인은 다년간의 장비 수요 사이클을 부추기고 있습니다. 유나이티드 렌탈에 따르면 메가 프로젝트는 이미 렌탈 주문에 차지하는 비율이 증가하고 있으며 프로젝트의 수명 주기 전반에 걸쳐 예측 가능한 사용을 지원합니다. 계약자는 유휴 자본을 피하기 위해 개별 단계에 특화된 기계 렌탈를 선호하고 있으며, 이러한 프로그램의 재생에너지 구성 요소는 수소 및 배터리 전기 접지 이동기의 조기 도입을 추진하고 있습니다. 아시아태평양과 북미는 물류 네트워크가 조밀하고 다양한 플릿 믹스를 공급할 수 있는 렌탈 지점이 확립되어 있기 때문에 가장 혜택을 받고 있습니다. 유틸리티의 규모는 또한 소규모 공급자가 디지털 거래소를 통해 장비를 신디케이트하도록 촉구하고 1급 도시 이외의 지역에 대한 접근을 확대하고 있습니다.

계약자 CAPEX에서 OPEX로 이동

높은 금리와 불안정한 수주 잔여로, 플릿 매니저는 현장 장비의 최대 80%를 렌탈하게 되어, 밸런스 시트의 레버리지가 대폭 저하하고 있습니다. 미국 계약자의 37%가 구매 연기를 보고했으며 운영 지출 모델의 매력이 높아지고 있음을 확인했습니다. 서비스로서의 설비 계약은 유지보수와 잔존 가치의 리스크를 렌탈 전문업자에게 이양하는 것으로, 계약자는 자본을 핵심적인 프로젝트 수행에 돌려줄 수 있습니다. 중소기업은 이전에는 예산 초과였던 고급 기계에 접근하여 경쟁력을 높일 수 있습니다. 한편, 렌탈 회사는 높은 장비의 회전 속도와 더 빠른 속도로 플릿을 업데이트하는 능력에서 이익을 얻어 엄격한 배출 규제에 대한 컴플라이언스를 보장합니다.

숙련된 운영자 부족으로 가동 중단 위험 증가

2026년까지 80,000명 이상의 중장비 운영자가 추가로 필요하지만, 현재 운영자의 41%가 정년 퇴직을 맞습니다. 인력 부족 현장에서는 렌탈 기계를 충분히 활용할 수 없어 프로젝트 일정을 팽창시켜 렌탈 수익률을 저하시킵니다. 또한 경험이 적은 운영자와 관련된 안전 사고도 보험료와 수리비를 늘리고 있습니다. 대기업 렌탈 회사는 현재 시뮬레이터를 사용한 교육을 제공하고 있으며, 이 교육은 신입 사원 연수가 6개월에서 7주로 단축되고 손해 배상 청구가 2자리 감소한 것으로 평가되고 있습니다. 그럼에도 불구하고 인력 격차는 추가 기술 숙련을 필요로 하는 첨단 전기자동차 및 수소 모델의 신속한 배치를 제한합니다.

부문 분석

2024년 세계 건설기계 렌탈 시장 매출의 40.98%는 토목 기계가 차지했습니다. 굴삭기와 백호 로더는 노반, 기초, 그루브 파업의 클래식이며, 바쁜 기간에는 가동률이 70%를 초과할 수 있습니다. 이 클래스에서는 전동 미니 굴삭기가 CAGR 8.81%로 성장을 지속하고, 있으며, 도시의 소음과 배기가스 규제에 의해 뒷받침되고 있습니다.

크레인 및 텔레핸들러와 같은 자재관리 유닛은 아시아 및 걸프 지역에서 고층 빌딩 확장으로 인해 2차적인 중요성을 제공합니다. 토목기계 함대 전체의 텔레매틱스 통합은 예지보전을 강화하여 자산 수명을 늘리고 고객 만족도 지수를 높이고 있습니다.

애프터마켓 서비스에도 비슷한 변화가 있었으며, 렌탈업체는 24시간 365일 현장 지원 계약을 번들로 제공하여 할인된 일당을 정당화할 수 있습니다. 대형 그레이더와 도저의 디지털 트윈은 마모 패턴을 시뮬레이션하고 최적의 교체 사이클을 알리기 위해 시험되었습니다. 불도저의 자율 통제 개조와 함께, 이러한 진보는 생산성을 더욱 향상시킬 것을 약속하지만, 규제 당국의 수용 태세는 관할 구역에 따라 다릅니다. 따라서 플릿 소유자는 농촌 지역 수요 탄력성을 모니터링하면서 가동률이 높은 지하철 프로젝트를 우선시하며 투자를 분산시키고 있습니다.

2024년 내연기관 점유율은 85.74%를 유지하며, 급유 인프라와 오퍼레이터의 익숙성이 정착하고 있음을 뒷받침하고 있습니다. 그러나 정부가 도시 지역의 밀집지대에서 제로 방출을 의무화함에 따라 건설 기계 렌탈 시장은 변모를 벌이고 있습니다. 수소 연료전지 프로토타입은 2030년까지의 예측 CAGR이 16.99%로 가장 높고, 빠른 연료 보급과 배터리 시스템에 비해 긴 듀티 사이클에 의해 지원되고 있습니다. 배터리 전기 모델은 항속 거리 불안이 제한되어 현장에서 하룻밤 동안 충전이 가능한 소형 굴삭기와 시저 리프트로 가장 빠르게 확대되고 있습니다.

하이브리드 파워 시스템은 브리지 기술로 작동합니다. 유나이티드 렌탈은 발전기와 배터리 축전 팩을 결합하면 연료를 최대 80% 절감하고 비용을 34% 절감할 수 있다고 보고했습니다. 그러나 도입에는 명확한 잔존 가치의 전망이 필요합니다. 대용량 리튬 배터리의 애프터마켓 가격이 불투명하기 때문에 적극적인 플릿 전개가 억제됩니다. 위험을 줄이기 위해 주요 임대 업체는 구독 기반 업그레이드를 채택하여 기술 및 규제가 변경되면 신속한 전환을 가능하게 합니다.

건설기계 렌탈 보고서는 장비 유형별(토목 기계(백호 로더 등), 기타), 구동 유형별(IC 엔진, 기타), 용도별(주택 건설, 기타), 렌탈 채널별(오프라인, 온라인), 서비스 유형별(단기 렌탈, 기타), 지역별(북미, 기타)로 구분됩니다. 시장 예측은 금액(달러)과 수량(단위)으로 제공됩니다.

지역별 분석

아시아태평양은 중국의 '일대일로(the Belt and Road)' 연장, 인도의 기록적인 자본 지출, 일본의 꾸준한 유틸리티 파이프라인에 지지되어 2024년 세계 렌탈 수입의 39.01%를 차지했습니다. 중국의 OEM은 2024년 세계 전동 건설기계 출하량의 75%를 차지하며 동남아시아에 적극적으로 수출하고 있습니다. 인도의 건설 부문은 2030년까지 GDP에 1조 달러를 올리는 추세이며, 대기업 렌탈 회사에 의한 전국적인 지점 확대에 활력을 주고 있습니다. 일본은 2분기에 걸친 기계 수주 축소에서 회복해 반도체 공장 투자가 확대됨에 따라 2025년 초에 성장으로 돌아섰습니다.

중동은 2030년까지 연평균 복합 성장률(CAGR)이 7.56%로 가장 빠르게 성장이 전망되는 지역입니다. 사우디아라비아에서는 리야드 지하철과 NEOM 도시 프로젝트를 포함한 비전 2030 파이프라인이 렌탈 수요를 연율 12% 이상의 성장으로 밀어 올리고 있습니다. 아랍에미리트(UAE)도 마찬가지로 80억 달러를 투자한 마사르 커뮤니티와 같은 대규모 회랑과 복합 용도 개발에서 혜택을 누리고 있습니다. 크레인과 텔레핸들러를 전문으로 하는 기업들은 높은 가동률과 매력적인 수익률을 활용하기 위해 장비를 걸프로 이전하고 있습니다.

북미는 건강한 CAGR 6.58%를 보여줍니다. 대규모 인프라 정비와 견조한 민간 산업 건설이 안정적인 가동률을 뒷받침하고 있습니다. 유럽의 성장률은 5.30%로 둔화하고 있지만, 엄격한 스테이지 V 디젤 규제와 지자체의 제로 카본 의무화에 의해 저배출 가스 렌탈 분야에서는 선도하고 있습니다. 남미는 운송 회랑의 현대화와 1차 제품 분야의 활성화로 CAGR 7.34%의 성장을 이루었습니다. 아프리카의 평균 성장률은 6.90%이지만, 자금조달에 대한 접근 및 규제의 명확화는 시장에 의해 여전히 변동이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 인프라 자극책의 대규모 프로젝트 파이프라인

- 계약자의 CAPEX에서 OPEX로의 전환

- 엄격한 ESG 목표가 전기 렌탈을 가속

- 종량 과금제 및 성과 베이스의 계약 모델

- 신흥 시장에서의 디지털 렌탈 플랫폼의 폭발적인 증가

- 데이터 구동형의 차량 최적화에 의해 고객의 ROI 향상

- 시장 성장 억제요인

- 여러 브랜드의 유지 보수 복잡성

- 숙련 오퍼레이터의 부족에 의해 다운타임 리스크 상승

- OEM에 의한 고객 직접 판매 렌탈의 카니발리제이션

- 리튬 전지 자산의 잔존 가치 변동성

- 밸류체인 및 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모 및 성장 예측(가치, 10억 달러)

- 기기별

- 토목기계

- 백호 로더

- 로더

- 굴삭기

- 불도저

- 스키드 스티어 로더

- 기타 토목 공사

- 자재관리 기기

- 크레인

- 지게차

- 덤프 트럭

- 텔레핸들러

- 기타 자재관리

- 콘크리트 및 도로 건설 기계

- 전력 및 에너지 기기

- 기타 기기

- 토목기계

- 드라이브 유형별

- IC 엔진

- 하이브리드

- 전기

- 수소 연료전지

- 용도별

- 주택 건설

- 상업 건설

- 공업 및 제조업

- 인프라(도로, 다리, 항구)

- 광업 및 채석업

- 석유 및 가스

- 렌탈 채널별

- 오프라인(지점 기준)

- 온라인 플랫폼

- 서비스 유형별

- 단기 렌탈(1개월 미만)

- 중기 임대(1-12개월)

- 장기 렌탈(1년 이상)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- United Rentals Inc.

- Ashtead Group plc(Sunbelt Rentals)

- Herc Rentals Inc.

- H&E Equipment Services Inc.

- Loxam

- Caterpillar Inc.(Cat Rental Store)

- Sumitomo Corp.

- Hitachi Construction Machinery Co. Ltd.

- Liebherr-International AG

- Kanamoto Co. Ltd.

- CNH Industrial NV

- HSS Hire Group plc

- Boels Rental

- Cramo Oyj

- Ahern Rentals

- Maxim Crane Works

- Ramirent

- Coates Hire

- Sarens nv/sa

- MyCrane

제7장 시장 기회 및 향후 전망

AJY 25.11.10The construction equipment rental market reached USD 141.42 billion in 2025 and is forecasted to expand at a 4.85% CAGR, lifting revenue to USD 179.21 billion by 2030.

Momentum stems from record public-sector infrastructure pipelines, widening contractor preference for asset-light models, and rapid digitalization of rental transactions. Rising adoption of electric and hydrogen fuel cell machinery, combined with outcome-based service contracts, is reshaping fleet strategies and opening premium pricing niches. Asia-Pacific maintains scale leadership on the back of sustained highway, rail, and urban-renewal programs, while the Middle East delivers the fastest regional growth supported by Vision 2030 mega-projects. Competitive intensity is increasing as larger players accelerate acquisitions to gain geographic density and technology capabilities. Telematics-enabled fleet optimization is emerging as a critical lever for utilization gains and customer retention, partly offsetting headwinds from skilled-labor shortages and multi-brand maintenance complexity.

Global Construction Equipment Rental Market Trends and Insights

Infrastructure-Stimulus Megaproject Pipeline

The USD 1.2 trillion U.S. Infrastructure Investment and Jobs Act and India's USD 1.4 trillion National Infrastructure Pipeline are fuelling multi-year equipment demand cycles. United Rentals reports that megaprojects already account for a rising share of rental orders, underpinning predictable utilisation across full project lifecycles. Contractors increasingly prefer renting specialised machines for discrete phases to avoid idle capital, while renewable-energy components of these programmes are driving early uptake of hydrogen and battery-electric earthmovers. Asia-Pacific and North America benefit most, given their dense logistics networks and established rental branches able to supply a diverse fleet mix. The scale of public works is also encouraging smaller providers to syndicate equipment via digital exchanges, widening access beyond tier-one cities.

Shift from CAPEX to OPEX Among Contractors

High interest rates and volatile backlogs are prompting fleet managers to rent up to 80% of site equipment, significantly reducing balance-sheet leverage. Deferred purchases, reported by 37% of U.S. contractors, underline the growing appeal of operational expenditure models. Equipment-as-a-Service agreements transfer maintenance and residual-value risks to rental specialists, enabling contractors to redeploy capital toward core project execution. Smaller firms gain competitive parity by accessing premium machines previously beyond their budget. Rental firms, in turn, profit from higher equipment rotation rates and the ability to refresh fleets faster, ensuring compliance with tightening emission norms.

Skilled-Operator Scarcity Elevates Downtime Risk

More than 80,000 additional heavy-equipment operators will be needed by 2026, while 41% of current operators approach retirement. Under-staffed sites struggle to utilise rented machinery fully, inflating project timelines and eroding rental yield. Safety incidents linked to inexperienced operators also raise insurance and repair costs. Leading renters now offer simulator-based training that compresses onboarding from six months to seven weeks, a move credited with reducing damage claims by double digits. Nevertheless, the talent gap limits rapid deployment of advanced electric and hydrogen models that require additional technical proficiency.

Other drivers and restraints analyzed in the detailed report include:

- Stringent ESG Targets Accelerating Electric Rentals

- Digital Rental-Platform Explosion in Emerging Markets

- High Multi-Brand Maintenance Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earthmoving machinery accounted for 40.98% of the global construction equipment rental market revenue in 2024. Excavators and backhoe loaders remain staple choices for roadbeds, foundations, and trenching, with utilisation rates often surpassing 70% during peak seasons. Within this class, electric mini-excavators are recording an 8.81% CAGR, propelled by urban noise and emission restrictions.

Material-handling units such as cranes and telehandlers are given secondary importance due to high-rise expansions in Asia and the Gulf states. Telematics integration across earthmoving fleets is bolstering predictive maintenance, thereby extending asset life and raising customer satisfaction indexes.

A parallel shift is visible in aftermarket services, where renters bundle operator training and 24/7 field support agreements to justify premium day rates. Digital twins of large graders and dozers are being trialled to simulate wear patterns, informing optimal replacement cycles. Coupled with autonomous control retrofits on bulldozers, these advancements promise step-change productivity, though regulatory acceptance varies by jurisdiction. Fleet owners are therefore staggering investments, prioritising high-utilisation metro projects while monitoring rural demand elasticity.

Internal-combustion units retained an 85.74% share in 2024, underscoring entrenched refuelling infrastructure and operator familiarity. Yet the construction equipment rental market is witnessing an inflection as governments roll out zero-emission mandates for dense urban zones. Hydrogen fuel cell prototypes log the highest forecast CAGR at 16.99% through 2030, buoyed by quick refuelling and extended duty cycles relative to battery systems. Battery-electric models are scaling fastest in compact excavators and scissor lifts, segments where range anxiety is limited and charging can occur overnight on-site.

Hybrid power systems act as a bridge technology. United Rentals reports up to 80% fuel savings and 34% cost reductions when pairing generators with battery energy-storage packs. Adoption, however, hinges on clear residual-value outlooks: uncertain aftermarket pricing for high-capacity lithium batteries dampens aggressive fleet rollouts. To mitigate risk, leading renters use subscription-based upgrades, allowing rapid turnover should technology or regulation shift.

The Construction Equipment Rental Report is Segmented by Equipment Type (Earthmoving Equipment (Backhoe Loaders and More), and More), Drive Type (IC Engine and More), Application (Residential Construction and More), Rental Channel (Offline and Online), Service Type (Short-Term Rental, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 39.01% of global rental revenue in 2024, underpinned by China's Belt and Road extensions, India's record capital-expenditure outlays, and Japan's steady public-works pipeline. Chinese OEMs captured 75% of global electric construction-equipment shipments in 2024, exporting aggressively to Southeast Asia. India's construction sector is on course to add USD 1 trillion to GDP by 2030, energising nationwide branch expansion by leading renters. Japan, recovering from two quarters of machinery order contraction, returned to growth in early 2025 as semiconductor-plant investments escalated.

The Middle East represents the fastest-growing territory at 7.56% CAGR through 2030. Saudi Arabia's Vision 2030 pipeline, including Riyadh Metro and NEOM city projects, is pushing rental demand beyond 12% annualised growth. The UAE likewise benefits from large corridors and mixed-use developments such as the AED 8 billion Masaar community. Companies with crane and telehandler specialities are relocating fleets to the Gulf to capitalise on strong utilisation rates and attractive yields.

North America shows a healthy 6.58% CAGR. Large infrastructure packages and robust private-sector industrial builds underpin stable fleet utilisation. Europe posts slower 5.30% growth, yet leads in low-emission rentals thanks to stringent Stage V diesel norms and municipal zero-carbon mandates. South America advances at 7.34% CAGR, fuelled by transport-corridor modernisation and commodity-sector revitalisation. Africa averages 6.90% growth, although access to financing and regulatory clarity remains uneven across markets.

- United Rentals Inc.

- Ashtead Group plc (Sunbelt Rentals)

- Herc Rentals Inc.

- H&E Equipment Services Inc.

- Loxam

- Caterpillar Inc. (Cat Rental Store)

- Sumitomo Corp.

- Hitachi Construction Machinery Co. Ltd.

- Liebherr-International AG

- Kanamoto Co. Ltd.

- CNH Industrial N.V.

- HSS Hire Group plc

- Boels Rental

- Cramo Oyj

- Ahern Rentals

- Maxim Crane Works

- Ramirent

- Coates Hire

- Sarens n.v./s.a.

- MyCrane

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-stimulus megaproject pipeline

- 4.2.2 Shift from CAPEX-to-OPEX among contractors

- 4.2.3 Stringent ESG targets accelerating electric rentals

- 4.2.4 Pay-per-use & outcome-based contracting models

- 4.2.5 Digital rental-platform explosion in emerging markets

- 4.2.6 Data-driven fleet optimisation boosts customer ROI

- 4.3 Market Restraints

- 4.3.1 High multi-brand maintenance complexity

- 4.3.2 Skilled-operator scarcity elevates downtime risk

- 4.3.3 OEMs' direct-to-customer rental cannibalisation

- 4.3.4 Residual-value volatility for lithium-battery assets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Equipment Type

- 5.1.1 Earthmoving Equipment

- 5.1.1.1 Backhoe Loaders

- 5.1.1.2 Loaders

- 5.1.1.3 Excavators

- 5.1.1.4 Bulldozers

- 5.1.1.5 Skid-Steer Loaders

- 5.1.1.6 Other Earthmoving

- 5.1.2 Material Handling Equipment

- 5.1.2.1 Cranes

- 5.1.2.2 Forklifts

- 5.1.2.3 Dump Trucks

- 5.1.2.4 Telehandlers

- 5.1.2.5 Other Material Handling

- 5.1.3 Concrete & Road Construction Equipment

- 5.1.4 Power & Energy Equipment

- 5.1.5 Other Equipment

- 5.1.1 Earthmoving Equipment

- 5.2 By Drive Type

- 5.2.1 IC Engine

- 5.2.2 Hybrid

- 5.2.3 Electric

- 5.2.4 Hydrogen Fuel Cell

- 5.3 By Application

- 5.3.1 Residential Construction

- 5.3.2 Commercial Construction

- 5.3.3 Industrial / Manufacturing

- 5.3.4 Infrastructure (Roads, Bridges, Ports)

- 5.3.5 Mining & Quarrying

- 5.3.6 Oil & Gas

- 5.4 By Rental Channel

- 5.4.1 Offline (Branch-based)

- 5.4.2 Online Platforms

- 5.5 By Service Type

- 5.5.1 Short-Term Rental (less than 1 Month)

- 5.5.2 Medium-Term Rental (1 - 12 Months)

- 5.5.3 Long-Term Rental (Over 1 Year)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of APAC

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Chile

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East & Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 United Rentals Inc.

- 6.4.2 Ashtead Group plc (Sunbelt Rentals)

- 6.4.3 Herc Rentals Inc.

- 6.4.4 H&E Equipment Services Inc.

- 6.4.5 Loxam

- 6.4.6 Caterpillar Inc. (Cat Rental Store)

- 6.4.7 Sumitomo Corp.

- 6.4.8 Hitachi Construction Machinery Co. Ltd.

- 6.4.9 Liebherr-International AG

- 6.4.10 Kanamoto Co. Ltd.

- 6.4.11 CNH Industrial N.V.

- 6.4.12 HSS Hire Group plc

- 6.4.13 Boels Rental

- 6.4.14 Cramo Oyj

- 6.4.15 Ahern Rentals

- 6.4.16 Maxim Crane Works

- 6.4.17 Ramirent

- 6.4.18 Coates Hire

- 6.4.19 Sarens n.v./s.a.

- 6.4.20 MyCrane