|

시장보고서

상품코드

1850383

농업용 로봇 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Agricultural Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

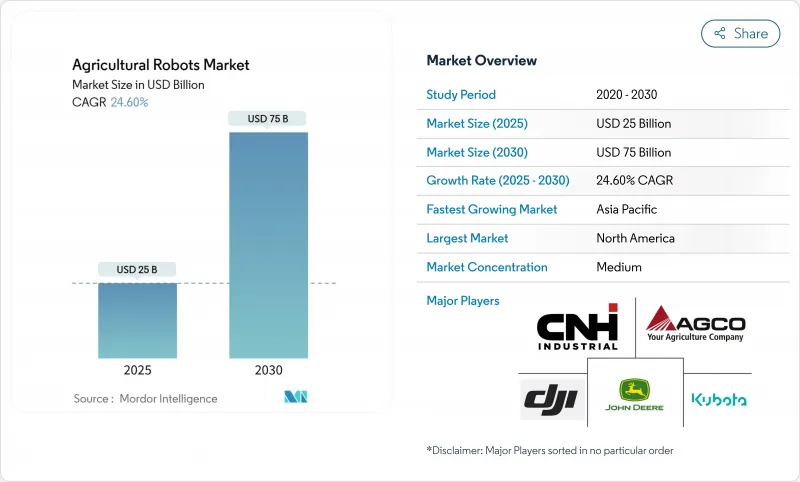

농업용 로봇 시장의 2025년 시장 규모는 250억 달러로 평가되었고 CAGR은 24.6%를 나타낼 것으로 예측되며, 2030년에 750억 달러로 성장할 전망입니다.

이러한 성장은 농민들이 인공지능, 컴퓨터 비전, 정밀 센서를 통합한 자율 기계로 노동력 부족을 상쇄하고 수확량을 높이며 투입물 낭비를 줄여야 하는 시급한 필요에서 비롯됩니다. 광활한 농지와 특수 작물에서 주야간 가동 가능한 유연한 장비에 대한 강력한 수요는 새로운 현장 적용 플랫폼으로 자본이 계속 유입되도록 하는 한편, 부품 가격 하락으로 한때 고가였던 기술이 중규모 생산자에게도 접근 가능해졌습니다. 하드웨어는 여전히 주요 수익원이지만, 농가들이 통합 의사 결정 지원, 예측 유지보수, 클라우드 기반 장비 군단 조정을 우선시함에 따라 반복적 소프트웨어 구독 및 서비스 계약이 급속히 확대되고 있습니다. 벤처 및 기업 투자자들은 농업용 로봇 시장을 광범위한 AgTech 생태계의 핵심 축으로 인식하며, 무농약 제초, 선택적 수확, 이질적인 농장 자산 간 데이터 융합 등 특정 문제점을 해결하는 스타트업에 대한 투자를 지속하고 있습니다. 마지막으로, 지속 가능한 관행을 장려하는 정부 보조금은 초기 비용 일부를 흡수하고 자율 기계에 대한 안전 규정을 명확히 함으로써 도입을 가속화합니다.

세계의 농업용 로봇 시장 동향 및 인사이트

만성 노동력 부족과 농가 인구의 고령화

경험 많은 노동자들이 은퇴하고 젊은 세대가 비농업 직업을 추구함에 따라 노동력 부족은 구조적 과제로 부상했습니다. 미국에서는 2024년 동안 계절별 인력을 확보하지 못해 농업 기업의 60%가 프로젝트를 연기했으며, 이미 캘리포니아의 고부가가치 농장에서 생산 비용의 40%를 노동비가 차지하고 있습니다. 자율 로봇은 초과근무 없이 24시간 운영되는 안정적인 인력을 제공하여 현장 작업의 연속성을 개선하고 임금 인플레이션 압력을 완화합니다. 공급업체들은 이제 재배자들이 최소한의 교육으로 로봇 장비를 통합할 수 있도록 배포 용이성을 강조하며 진입 장벽을 더욱 낮추고 있습니다.

농업용 로봇 분야 벤처 및 기업 투자 증가

광범위한 농업 기술(AgTech) 자금 조달이 감소했음에도 불구하고, 2024년 농업용 로봇 분야에 투입된 자본은 9% 증가하여 확장 가능한 자동화 솔루션에 대한 투자자들의 확신을 보여줍니다. 뉴홀랜드는 블루화이트와 협력해 특수 트랙터를 개조했으며, 이 협업으로 과수원 및 포도원 소유주의 운영 비용을 최대 85%까지 절감할 것으로 기대됩니다. 버던트 로보틱스, 필드워크 로보틱스 등 스타트업들은 수백만 달러 규모의 투자 라운드를 확보해 제품 개발 주기를 단축하고 글로벌 출시를 가속화하고 있습니다. 이로 인한 혁신 물결은 농업용 로봇 시장을 매우 역동적이고 경쟁적으로 유지하고 있습니다.

소규모 농가의 높은 초기 비용과 불확실한 투자 수익률

완전 자동화 착유실은 젖소 한 마리당 10,000달러의 비용이 발생하며, 180두 규모의 낙농장 기준 약 200만 달러에 달합니다. 많은 소규모 농가는 저렴한 금융 지원이나 리스 프로그램을 이용하기 어렵고, 변동하는 농산물 가격은 투자 회수 기간을 연장시킵니다. 자본 부담을 분산시키기 위해 모듈식 설계와 협동조합 소유 모델이 등장했으나, 가격에 민감한 지역에서는 여전히 경제적 타당성이 걸림돌로 작용합니다.

부문 분석

2024년 농업용 로봇 시장 점유율에서 무인항공기(UAV)는 35%를 유지했습니다. 농가들이 투입 효율성 제고를 위해 항공 촬영, 가변 속도 살포, 작물 스트레스 감지 기술에 의존했기 때문입니다. DJI는 전 세계적으로 40만 대 이상의 드론이 5억 헥타르를 처리하고 있다고 보고하며, 드론이 초기 단계 자동화의 관문 역할을 하고 있음을 확인했습니다. 무인항공기 하드웨어 및 관련 소프트웨어 구독과 연계된 농업용 로봇 시장 규모는 국가 항공 당국이 시야를 벗어난 임무를 허용하는 규정을 개선함에 따라 꾸준히 확대될 것으로 전망됩니다.

자동 수확기는 과일 및 채소 생산자들이 심각한 수확 인력 부족과 좁은 수확 기간에 직면함에 따라 가장 빠른 26%의 연평균 성장률(CAGR)을 기록하고 있습니다. 필드워크 로보틱스의 라즈베리 수확기는 시간당 150-300개의 열매를 수확하며 이미 인간의 작업량에 맞먹는 성능을 보이며 야간 교대 근무를 통한 연속 운영이 가능할 것으로 기대됩니다. 무인 트랙터 역시 OEM 업체들이 경운, 파종, 곡물 운반 작업을 관리하는 인식 키트로 기존 차량을 개조함에 따라 27% 성장률로 추진력을 얻고 있습니다.

지역 분석

북미는 대규모 농장 규모, 지원적인 규제 샌드박스, 풍부한 벤처 캐피털 풀 덕분에 2024년 농업용 로봇 시장의 37%를 차지했습니다. 카본 로보틱스(Carbon Robotics)는 2세대 레이저위더(LaserWeeder) 확장 위해 7,000만 달러를 조달하며, 화학 물질 없는 잡초 방제에 대한 투자자의 신뢰를 반영했습니다. 미국은 무인 트랙터 안전 규정을 검토하며 현장 자율운전의 주류화를 위한 길을 열었습니다. 캐나다와 멕시코는 각각 곡물 및 고부가가치 원예 작물을 통해 수요를 추가하며 해당 지역의 도입 기반을 확대하고 있습니다.

아시아태평양 지역은 중국이 국내 로봇 기업에 투자하고 식량 안보 목표를 관리하며 25.5%의 가장 빠른 연평균 성장률(CAGR)을 기록했습니다. 일본 정부는 고령화 농업 인구를 위한 자율 과수원 솔루션을 지원하며, 호주의 국가 로봇 전략은 광범위한 자동화를 통해 6,000억 호주 달러(4,200억 달러)의 GDP 증가를 목표로 합니다. 인도는 소규모 농가의 예산에 맞춘 저비용 제초 및 살포 로봇을 모색 중이지만, 연결성과 자금 조달은 여전히 장애물로 남아 있습니다.

유럽은 노동력 부족, 지속가능성 규제, 높은 작물 보호 기준에 힘입어 꾸준히 발전 중입니다. 유럽연합(EU)의 기계 규정에는 자율주행 이동 기계에 대한 신규 조항이 포함되어 제조업체에 명확한 규정 준수 로드맵을 제공합니다. 독일은 완전 전기식 펜트 e100 바리오 트랙터를 시범 운영하며, 100kWh 배터리 한 번 충전으로 4-7시간 동안 무공해 농장 작업을 입증했습니다. 영국의 보조금 프로그램은 로봇 구매 비용을 상쇄하며, 프랑스와 스페인은 포도밭과 올리브 농장에서 다중 로봇 제초기를 시험 중입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 만성적인 노동력 부족과 농가 고령화

- 농업용 로봇에 대한 벤처 투자와 기업 투자 증가

- 스마트 농업 자동화를 위한 정부 인센티브

- AI, 비전, LIDAR 기술의 급속한 진보

- 열 스트레스 회피를 위한 야간 자율 작업

- 무농약 레이저 제초 솔루션에 대한 수요

- 시장 성장 억제요인

- 소규모 농가의 높은 초기 비용 및 불확실한 투자 수익률

- 실시간 제어를 위한 농촌 지역 연결성 격차

- 동물-로봇 상호작용에 대한 윤리적 우려

- 자율 기계에 대한 분산된 인증 체계

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력/소비자

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- 무인 항공기(드론)

- 착유 로봇

- 무인 트랙터

- 자동 수확 시스템

- 다목적 필드 로봇

- 선별 및 포장 로봇

- 용도별

- 광역 농지 용도

- 필드 매핑

- 파종 및 식재

- 시비 및 관개

- 재배 관리 작업

- 수확 및 채취

- 낙농

- 착유

- 양치기 및 목축

- 항공 데이터 수집

- 기상 추적 및 예보

- 재고 관리

- 온실 자동화

- 과수원 운영

- 광역 농지 용도

- 제공별

- 하드웨어

- 자율 내비게이션 시스템

- 센서 및 비전 시스템

- 로봇 팔 및 엔드 이펙터

- 소프트웨어

- 로봇 운영체제

- 농장 관리 플랫폼

- 데이터 분석 및 AI 알고리즘

- 서비스

- 통합 및 전개

- 유지보수 및 업그레이드

- 서비스형 데이터(Data-as-a-Service)

- 하드웨어

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Agrobot

- Harvest Automation Inc.(Tertill)

- AGCO Corporation

- Lely International NV

- Naio Technologies SAS

- Deere & Company

- AgEagle Aerial Systems Inc.

- CNH Industrial NV

- Yanmar Holdings Co., Ltd.

- GEA Group AG

- Kubota Corporation

- SZ DJI Technology Co., Ltd.

- BouMatic LLC

- Topcon Corporation

- Yamaha Agriculture Inc.,(Yamaha Motor)

제7장 시장 기회와 장래의 전망

HBR 25.11.19The agricultural robots market is valued at USD 25 billion in 2025 and is forecast to climb to USD 75 billion by 2030, reflecting a 24.6% CAGR.

This growth stems from farmers' urgent need to offset labor shortages, raise yields, and cut input waste through autonomous machines that integrate artificial intelligence, computer vision, and precision sensors. Strong demand for flexible equipment that can operate day and night across broad-acre and specialty crops keeps capital flowing toward new field-ready platforms while falling component prices make once-premium technologies affordable to mid-sized producers. Hardware remains the revenue anchor today, yet recurring software subscriptions and service agreements expand rapidly as growers prioritize integrated decision support, predictive maintenance, and cloud-based fleet coordination. Venture and corporate investors view the agricultural robots market as a core pillar of the wider AgTech ecosystem and continue financing start-ups that solve specific pain points, such as chemical-free weeding, selective harvesting, and data fusion across disparate farm assets. Finally, government subsidies that reward sustainable practices accelerate adoption by absorbing part of the upfront cost and by clarifying safety rules for autonomous machines.

Global Agricultural Robots Market Trends and Insights

Chronic Labor Shortages and Aging Farmer Population

Labor scarcity has risen to a structural challenge as experienced workers retire and younger generations pursue non-farm careers. In the United States, 60% of agribusinesses postponed projects during 2024 because they could not secure seasonal crews, and labor already accounts for 40% of production costs on high-value California farms. Autonomous robots provide a consistent workforce that operates around the clock without overtime, improving field-work continuity and mitigating wage inflation pressures. Suppliers now emphasize ease of deployment to help growers integrate robotic units with minimal training, further lowering the barrier to entry.

Rising Venture and Corporate Investments in Ag-Robotics

Despite a dip in broader AgTech funding, capital committed to farm robotics rose 9% in 2024, underscoring investor conviction in scalable automation solutions. New Holland partnered with Bluewhite to retrofit specialty tractors, a collaboration expected to trim operating costs by up to 85% for orchard and vineyard owners. Verdant Robotics, Fieldwork Robotics, and other start-ups have secured multi-million-dollar rounds that shorten product-development cycles and accelerate international launches. The resulting innovation wave keeps the agricultural robot market highly dynamic and competitive.

High Upfront Cost and Uncertain ROI for Smallholders

A fully automated milking parlor can cost USD 10,000 per cow, translating into nearly USD 2 million for a 180-cow dairy. Many smallholders cannot access affordable finance or lease programs, and fluctuating commodity prices lengthen the payback horizon. Modular designs and cooperative ownership models have emerged to spread capital burdens, yet economic feasibility remains a hurdle in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Farming Automation

- Rapid Advances in AI, Vision, and LIDAR Technologies

- Fragmented Certification for Autonomous Machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UAVs retained 35% of the agricultural robots market share in 2024 as growers relied on aerial imagery, variable-rate spraying, and crop-stress detection to raise input efficiency. DJI reported more than 400,000 drones treating 500 million hectares worldwide, confirming drones' role as an early-stage automation gateway. The agricultural robots market size tied to UAV hardware and associated software subscriptions is forecast to expand steadily as national airspace authorities refine rules that permit beyond-visual-line-of-sight missions.

Automated harvesters log the fastest 26% CAGR because fruit and vegetable producers confront severe picker shortages and tight harvest windows. Fieldwork Robotics' raspberry unit already matches human throughput at 150 to 300 berries per hour and promises continuous operation through night shifts. Driverless tractors also gain momentum at a 27% growth clip as OEMs retrofit existing fleets with perception kits that manage tillage, seeding, and grain-cart duties.

The Agricultural Robots Market Report is Segmented by Type (Unmanned Aerial Vehicles (Drones), Milking Robots, Driverless Tractors, and More), Application (Broad Acre Applications, Dairy Farm Management, Aerial Data Collection, and More), Offering (Hardware, Software, and Services), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37% of the agricultural robots market in 2024 due to large farm sizes, supportive regulatory sandboxes, and deep venture capital pools. Carbon Robotics raised USD 70 million to scale its second-generation LaserWeeder, reflecting investor confidence in chemical-free weed control. The United States reviews safety rules for driverless tractors, signaling a path toward mainstream field autonomy. Canada and Mexico add demand through grains and high-value horticulture, respectively, broadening the region's adoption base.

Asia-Pacific posts the fastest 25.5% CAGR as China funds domestic robotics champions and monitors food-security objectives. The Japanese government subsidizes autonomous orchard solutions for an aging farming population, while Australia's National Robotics Strategy targets AUD 600 billion (USD 420 billion) in GDP gains from wider automation. India explores low-cost weeding and spraying robots tailored to smallholder budgets, though connectivity and financing remain obstacles.

Europe advances steadily, spurred by labor shortages, sustainability regulation, and high crop protection standards. The European Union's Machinery Regulation includes new provisions for autonomous mobile machines, giving manufacturers a clearer compliance roadmap. Germany pilots the fully electric Fendt e100 Vario tractor, proving zero-emission field work over four to seven hours of operation on a single 100 kWh battery. The United Kingdom's grant program offsets robotics purchases, and France and Spain test multi-robot weeders in vineyards and olive groves.

- Agrobot

- Harvest Automation Inc. (Tertill)

- AGCO Corporation

- Lely International N.V

- Naio Technologies SAS

- Deere & Company

- AgEagle Aerial Systems Inc.

- CNH Industrial N.V.

- Yanmar Holdings Co., Ltd.

- GEA Group AG

- Kubota Corporation

- SZ DJI Technology Co., Ltd.

- BouMatic LLC

- Topcon Corporation

- Yamaha Agriculture Inc., (Yamaha Motor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic labor shortages and an aging farmer population

- 4.2.2 Rising venture and corporate investments in ag-robotics

- 4.2.3 Government incentives for smart farming automation

- 4.2.4 Rapid advances in AI, vision, and LIDAR technologies

- 4.2.5 Night-time autonomous operations to avoid heat stress

- 4.2.6 Demand for pesticide-free laser weeding solutions

- 4.3 Market Restraints

- 4.3.1 High upfront cost and uncertain ROI for smallholders

- 4.3.2 Gaps in rural connectivity for real-time control

- 4.3.3 Ethical concerns over animal-robot interaction

- 4.3.4 Fragmented certification for autonomous machinery

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Unmanned Aerial Vehicles (Drones)

- 5.1.2 Milking Robots

- 5.1.3 Driverless Tractors

- 5.1.4 Automated Harvesting Systems

- 5.1.5 Multi-purpose Field Robots

- 5.1.6 Sorting and Packaging Robots

- 5.2 By Application

- 5.2.1 Broad Acre Applications

- 5.2.1.1 Field Mapping

- 5.2.1.2 Seeding and Planting

- 5.2.1.3 Fertilizing and Irrigation

- 5.2.1.4 Intercultural Operations

- 5.2.1.5 Picking and Harvesting

- 5.2.2 Dairy Farm Management

- 5.2.2.1 Milking

- 5.2.2.2 Shepherding and Herding

- 5.2.3 Aerial Data Collection

- 5.2.4 Weather Tracking and Forecasting

- 5.2.5 Inventory Management

- 5.2.6 Greenhouse Automation

- 5.2.7 Fruit Orchard Operations

- 5.2.1 Broad Acre Applications

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Autonomous Navigation Systems

- 5.3.1.2 Sensors and Vision Systems

- 5.3.1.3 Robotic Arms and End Effectors

- 5.3.2 Software

- 5.3.2.1 Robot Operating Systems

- 5.3.2.2 Farm Management Platforms

- 5.3.2.3 Data Analytics and AI Algorithms

- 5.3.3 Services

- 5.3.3.1 Integration and Deployment

- 5.3.3.2 Maintenance and Upgrades

- 5.3.3.3 Data-as-a-Service

- 5.3.1 Hardware

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Agrobot

- 6.4.2 Harvest Automation Inc. (Tertill)

- 6.4.3 AGCO Corporation

- 6.4.4 Lely International N.V

- 6.4.5 Naio Technologies SAS

- 6.4.6 Deere & Company

- 6.4.7 AgEagle Aerial Systems Inc.

- 6.4.8 CNH Industrial N.V.

- 6.4.9 Yanmar Holdings Co., Ltd.

- 6.4.10 GEA Group AG

- 6.4.11 Kubota Corporation

- 6.4.12 SZ DJI Technology Co., Ltd.

- 6.4.13 BouMatic LLC

- 6.4.14 Topcon Corporation

- 6.4.15 Yamaha Agriculture Inc., (Yamaha Motor)